Even A Booming Job Market Can’t Fill Retirement Shortfall For Older Workers (#GotBitcoin?)

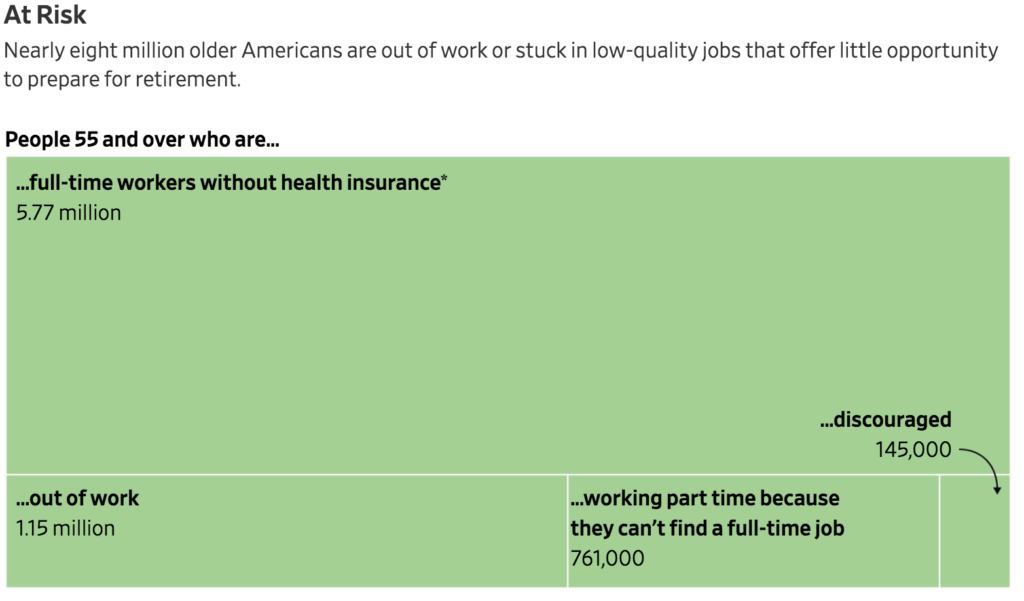

Nearly eight million older Americans are out of work or stuck in low-quality jobs, denying them a crucial time to accumulate savings. Even A Booming Job Market Can’t Fill Retirement Shortfall For Older Workers

For older Americans, the last few years of work can be a vital chance to patch up thin savings or pay down debt to ease their way into retirement. Many aren’t getting that opportunity.

Greg Miller, 65 years old, a former environmental engineer and contract administrator, was laid off in 2017. He recently gave up looking for full-time work after sending out more than 400 resumes.

https://www.youtube.com/watch?v=4Mtc3uETXv8&feature=share

“The heartbreak and the discouragement were just unbearable,” said Mr. Miller, who lives on Social Security and a part-time job. He shares a ranch house in Lansing, Mich., with three other men. “I am kind of working without a net here,” he said.

This kind of late-career employment woe is part of a paradox that is deepening the worst retirement shortfall in decades.

Even though the official unemployment rate is just 3% for older workers, the actual jobs environment is surprisingly bleak. Nearly 8 million older Americans are out of work or stuck in low-quality jobs that offer little opportunity to prepare for retirement, a Wall Street Journal analysis of government data shows.

*Doesn’t Include People Who Receive Health Insurance Through Another Family Member With Employee Coverage.

The figures include the nearly 2.1 million Americans who are out of work, working part time because they can’t find a full-time job or have stopped looking because they don’t think anyone will hire them.

Another 5.8 million Americans—or 23% of full-time, year-round workers ages 55 and older—are employed in what economists describe as “bad jobs” which offer no health benefits and typically pay poorly. A decade ago, about 20% held these jobs, according to census data compiled by the Minnesota Population Center.

James Walker, A 66-Year-Old Economist Who Lives In Pleasantville, N.Y., Was Laid Off When The Marketing Analytics Company He Worked For Was Acquired Two Years Ago. He Has Been Looking For A Full-Time Job Ever Since. Mr. Walker, Who Has A Doctorate From City University Of New York And Has Been Teaching Part-Time At A Local College, Says He And His Wife ‘Are Constantly Looking For Ways To Cut Back.’

“These jobs, which might be right for some, tend to offer low pay and little opportunity to save for retirement,” said Alicia Munnell, director of the Center for Retirement Research at Boston College.

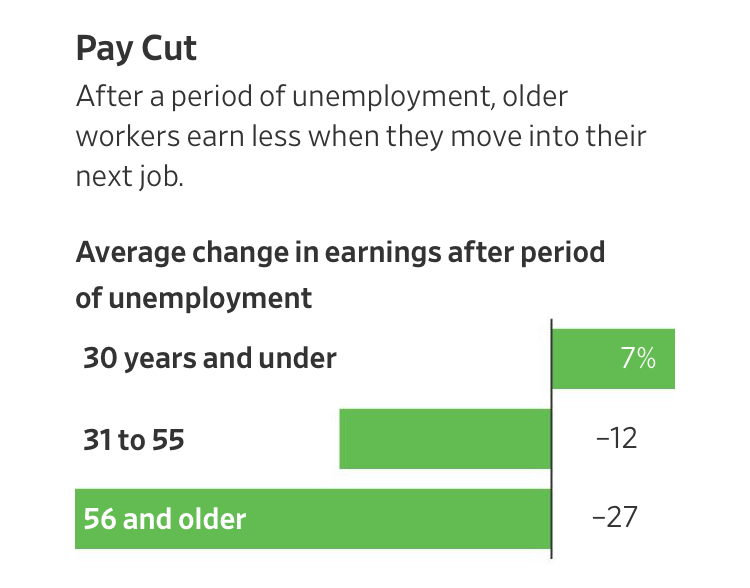

When older workers find themselves out of a job, it typically takes them a long time to find work and they end up worse off financially.

Workers 56 and older earn on average 27% less in their new job after they’ve been unemployed for at least a month, according to an analysis by Stony Brook University economist David Wiczer, compared with an average raise of 7% for people under age 30.

Note: Based On The 4-Month Period Before An Unemployment Spell And The 4 Months After It Ends. Does Not Include The Unemployment Period. Unemployment Defined As Anyone Who Leaves Employment Then Comes Back Within A Year.

For older workers, the earnings losses “come from moving down the occupational ladder” and being unemployed for longer, Mr. Wiczer said. The people who go through unemployment “and come out better on the other side, he added, “are almost exclusively under 35.”

Even just a few months out of work or living on a depressed salary without benefits can strain a senior’s finances as they struggle to cover mortgage payments, health care and other routine expenses. When a job is lost late in life and it takes a long time to find a new one, it can push back retirement by years or even erase the prospect of retirement completely.

“There is a model we are familiar with—work to 55 or 60, play golf for five or 10 years and then die,” said Paul Rupert, founder of Respectful Exits, a Chevy Chase, Md., nonprofit that advocates for improved employer practices with aging workers. “But now people are living to 80 or 90 and that model is completely broken.”

Staying on the job can have a significant impact on a retiree’s financial well-being. Working just three to six more months provides the same financial boost as saving an additional 1 percentage point of earnings annually for 30 years, says Stanford University economist John Shoven.

Working longer carries an outsize payoff because monthly Social Security payments increase by 8% plus inflation for every year retirees delay claiming benefits until age 70. Staying employed also allows more time to contribute to retirement savings and for those funds to compound before the first withdrawals.

The reasons companies aren’t hiring older workers are complex. Many have long directed recruiting and training at younger workers. Some older job seekers lack the right skills or are unable or unwilling to relocate, while others are disadvantaged by new ways of recruiting, such as online tools that use key words to identify candidates for interviews. Some job-placement specialists say age discrimination is a factor. Employers may consider older workers more expensive, even at the same pay, because of higher health care costs.

“I keep hearing that the economy is better, but we are not seeing that for our clients,” said Amanda Fox, director of career development and counseling at New Directions Career Center, which works with women in central Ohio.

One New Directions client, Jill Short, 59, of Columbus, has an M.B.A. and previously worked for the federal government, a local utility and a technology subcontractor. The financial crisis made it tough to re-enter the job market after she took time off for foot surgery in late 2007. She had a few seasonal positions, but didn’t find another full-time job until 2012 and was laid off in a restructuring 4 ½ years later.

“I probably should have declared bankruptcy, but I didn’t want to lose my house,” said Ms. Short, whose temporary position helping seniors select Medicare plans ended earlier this month. She receives $192 a month in food stamps and owes about $30,000 in credit card debt and loans from friends.

“I have depleted my savings. There really is none,” said Ms. Short, who has a four-inch thick folder detailing all the jobs she has applied for. Her goal is to work until 70 in a full-time job with benefits.

Jill Short, 59, Has Had A Hard Time Finding A Full-Time Job In Recent Years Despite Her M.B.A., And Has Resorted To Food Stamps. ‘I Have Depleted My Savings,’ She Said. ‘There Really Is None.’

Such difficulties come at a time when companies around the country are struggling to find workers. In Minnesota, the unemployment rate is 2.8%. For the past two years, the state Chamber of Commerce has held an annual event hoping to entice employers to hire categories of people being ignored by companies: the disabled, ex-offenders—and anyone over 55.

“This is a long-term challenge,” said Bill Blazar, until recently the group’s senior vice president. “Employers for decades have had certain strategies for hiring their staff.”

Ultra Machining Co. in Monticello, Minn., is working hard to retain veteran employees by offering shorter hours, and is launching a training program for candidates with little or no manufacturing experience that it hopes will attract older workers. But the 200-person company has long focused on recruiting the young, creating feeder programs and apprenticeships aimed at middle- and high-school students.

“Kids hang out at schools and we can just plug in,” said Jaci Dukowitz, director of human resources. “Where do older people hang out? What do they do when they are looking for jobs? Those programs aren’t in our community or, if they are, we are not aware of them.”

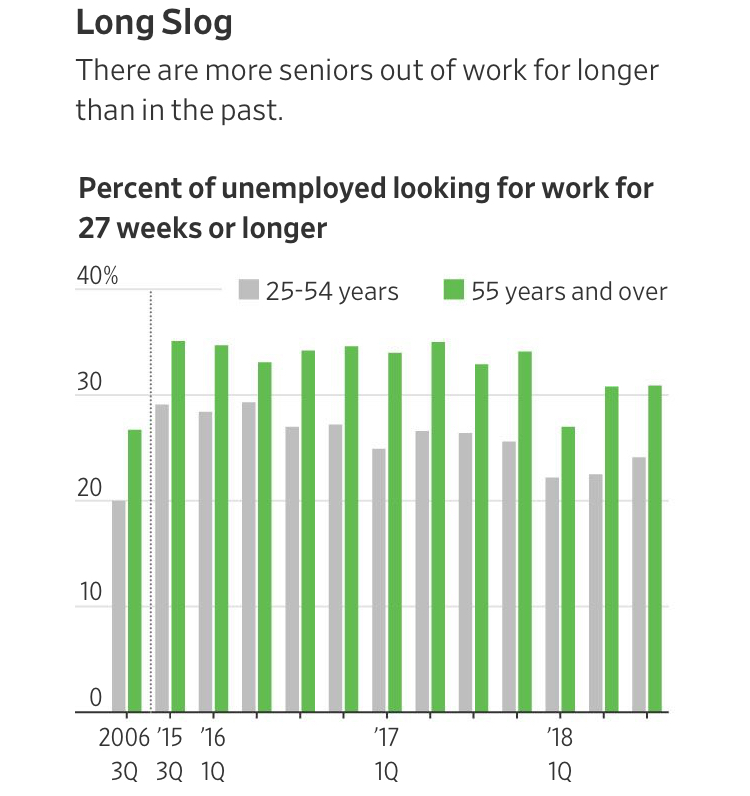

Compounding the financial hit is a long period of unemployment that drains what had been stored up.

Overall, 31% of job seekers aged 55 and older report they have been looking for work for 27 weeks or longer, according to the BLS, compared with just 24% of younger job seekers. Older job seekers report looking for work, on average, 34.6 weeks. That is nearly three months longer than the average of 23.4 weeks reported by unemployed 25- to 54-year-olds.

What had been the largest safety net for someone this age is also evaporating. Seventeen percent of workers ages 55 to 64 had a pension plan in 2016, down from 33% in 1992, according to the Boston College Center for Retirement Research.

Lisa Borthwick, currently age 60, was working as a graphic designer for a group of real-estate magazines when the financial crisis hit. She lost her job, then her Hernando, Fla., home, then her savings. She has no pension. She took on student loans to pay for her degree.

A decade later, she is still struggling to recover.

“When I was sitting for interviews, they offered me $10 an hour,” she recalled. “They said most people your age only need supplemental income.”

Now living in the Midwest, she recently landed two part-time jobs—as an operations manager for a nonprofit and an administrator for a real-estate company. She said both jobs are fabulous, but she can’t afford her own apartment in a neighborhood where she would feel safe and doesn’t receive health insurance or other benefits.

For the past two years Ms. Borthwick has rented a bedroom from a couple she met when, on the verge of homelessness, she put her dog up for foster care.

“Am I asking too much to be compensated for my experience?” Ms. Borthwick asked. “I am fairly tenacious, determined and resilient, but it doesn’t pay the bills.”

Lisa Borthwick, 60, Was A Graphic Designer For A Group Of Real-Estate Magazines When The Financial Crisis Hit. She Lost Her Job, Then Her Hernando, Fla., Home, Then Her Savings. These Days She Is Working Two Part-Time Jobs, As An Operations Manager For A Nonprofit And An Administrator For A Real-Estate Company.

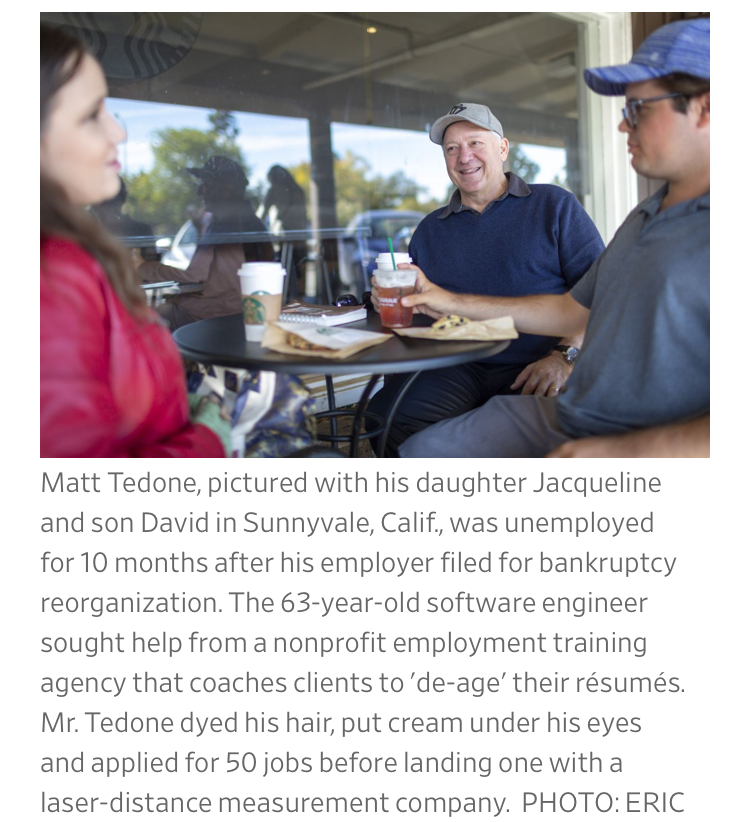

At nonprofit employment training agency Nova Workforce Development Board in Silicon Valley, more than three-quarters of dislocated workers are 45 or older and nearly one-third have advanced degrees.

“The older you are, the longer you are unemployed,” said Nova executive director Kris Stadelman. “The longer you are unemployed, the less attractive you are to any employer.”

Nova coaches clients to “de-age” their résumés by focusing on the past 10 to 20 years of experience, and highlighting recent training and credentials. It teaches how to interview with someone half their age and subsidizes training so they can reframe their education with, say, a certificate in another computer language.

Paul Millman, chief executive of Chroma Technology Corp., which recently won a state award for supporting mature workers, said he doesn’t understand companies “that turn up their noses up at experience.” The Bellows Falls, Vt., optical-filters manufacturer offers training to workers of all ages and opportunities for sabbaticals. Forty-four percent of its 124 employees are 53 and older.

Newer ways of recruiting via online application processes can disadvantage older workers, especially if their skills don’t fit the precise requirements but may be transferable.

In Her Columbus, Ohio, Home, Ms. Short Goes Through A Folder Of Jobs She Didn’t Get.

Some studies have found what appears to be direct evidence of age bias. David Neumark, a University of California, Irvine economist, created fictional resumes for comparable job candidates around age 30, 50 and 65 and then submitted their applications to more than 13,000 different job postings. Callback rates declined by age, with bigger drops for female applicants.

Some states are experimenting with ways to connect experienced job seekers with willing employers.

The Southeast Michigan Community Alliance in Taylor, Mich., held its first 50+ job fair this spring with AARP Michigan. Job seekers’ qualifications were reviewed before the event to make sure they had the needed skills; 31 of them received job offers on the spot.

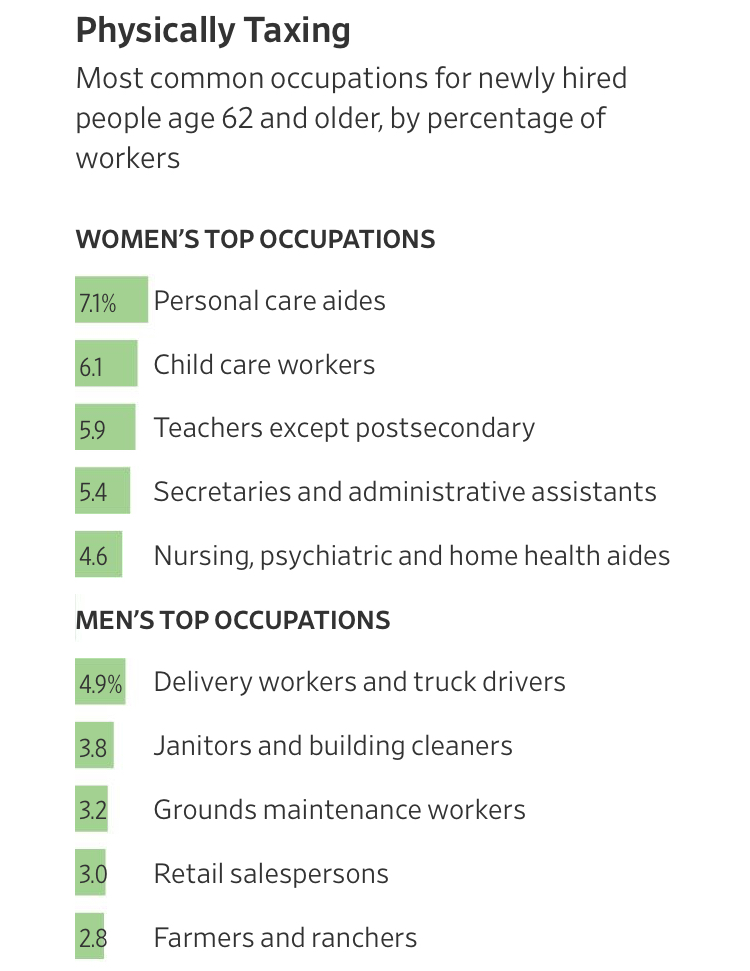

Most participating companies were in the retail, hospitality and home health care industries, and offered hourly positions that require applicants to spend the workday on their feet. That was disappointing for attendees seeking “more professional work,” said workforce programs administrator Ana Salazar.

A tight job market “makes you look at your openings quite differently,” said Julie Haak, corporate director of human resources at Neogen Corp., a Lansing, Mich.-based food and animal safety company with about 1,600 employees. Neogen has hired several older workers through Michigan AARP and is looking to partner with the group on a 50+ job fair.

Michele Langdon, 55, had worked for several startups and was employed by Hewlett Packard for nearly 20 years. In 2016, she was let go after H-P sold the unit she worked for.

Divorced and with two children, Ms. Langdon ran up $50,000 in credit-card debt. She relied on unemployment insurance, food stamps and a state program that helps the unemployed pay their mortgages during her 18-month job search.

Ms. Langdon figures she applied for roughly 500 jobs and eventually had to settle for a short-term contract position. A few months later, she was offered a full-time job as a program manager for a new data-center business at a different company.

But the lengthy time out of work means she now expects to work until at least age 70.

“My job now is to keep my job” and make my employer successful, she said, “so I can retire and not be a burden to my children.”

Even A Booming Job,Even A Booming Job,Even A Booming Job,Even A Booming Job,Even A Booming Job,Even A Booming Job,Even A Booming Job

Related Articles:

Even A Booming Job Market Can’t Fill Retirement Shortfall For Older Workers (#GotBitcoin?)

The New Retirement Plan: Save Almost Everything, Spend Virtually Nothing (#GotBitcoin?)

Three Steps To Take If You’re Behind In Retirement Savings (#GotBitcoin?)

A Retirement Wealth Gap Adds A New Indignity To Old Age (#GotBitcoin?)

401(k) or ATM? Automated Retirement Savings Prove Easy to Pluck Prematurely

Your Questions And Comments Are Greatly Appreciated.

Monty H. & Carolyn A.

Go back

Leave a Reply

You must be logged in to post a comment.