California State Board of Equalization vs DPL-Surveillance-Equipment.com LLC

This is just another example of how this government will do anything and say anything to ruin small and medium size businesses. California State Board of Equalization vs DPL-Surveillance-Equipment.com LLC

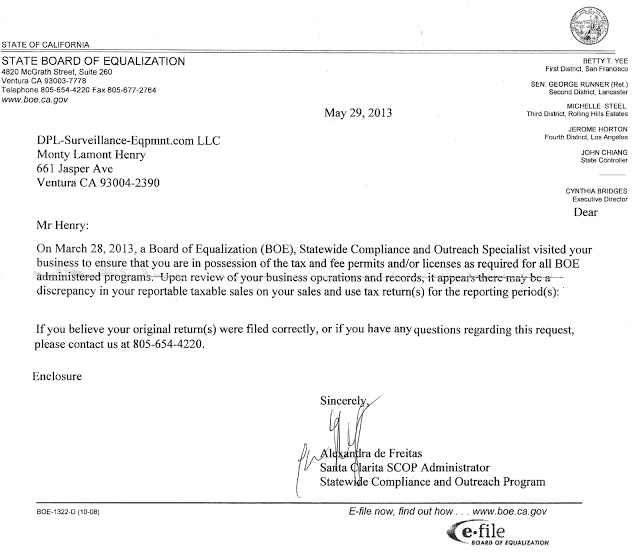

The visit as mentioned above actually never took place. When I called the Board of Equalization as mentioned in the graphic all I got was voice mail. I received this notice over the weekend (July 6,7 of 2013) I called first thing the following Monday morning. All I got was voicemail (numerous calls were made throughout the day). Monday and Tues. California State Board of Equalization vs DPL-Surveillance-Equipment.com LLC

Related:

Even The State Franchise Tax Board Is Trying To Scam Me

IRS Failed To Collect $2.4 Billion In Taxes From Millionaires

IRS Workers Who Failed To Pay Taxes Got Bonuses

Cyber Hack Got Access To Over 700,000 IRS Accounts

IRS Fails To Prevent $1.6 Billion In Tax Identity Theft

DOJ Declines To Charge Lois Lerner In IRS Scandal

IRS Uses Cellphone Location Data To Find Suspects

IRS Buying Spying Equipment: Covert Cameras In Coffee Trays, Plants

How A Lawsuit Against The IRS Is Trying To Expand Privacy For Crypto Users

Finally, I decided to call the main office in Sacramento, Ca. They told me that the letter was indeed a “mistake” on their part and shouldn’t have gone out. Also, I could never reach anyone dialing the numbers as mentioned in the letter because they were supposedly moving or changing offices. (I can’t believe that this is the best they could come up with!)

I wonder just how many businesses were under the impression that they were indeed visited by someone from the B.O.E. just to find out (or not) that no one ever came out and visited their premises and never even looked at one single record, license and/or permit?

This government is desperate to salvage this broken totalitarian/fascist system of corporate/government dominance no matter what it takes.

I’ve been blogging about how the supreme court and our constitution has said that the system of imposing an income-tax on it’s citizens is not consistent with the constitution as it’s written. Obviously, some people finally got fed-up with me shedding so much light on this issue.

Now it seems that I’m the target of their angst and this is their way of quieting me on this issue.

Well I’ll see if this is true, because this blog is dedicated to documenting exactly what I’m being put through so that each and every American citizen can and will see what tactics are being deployed against us.

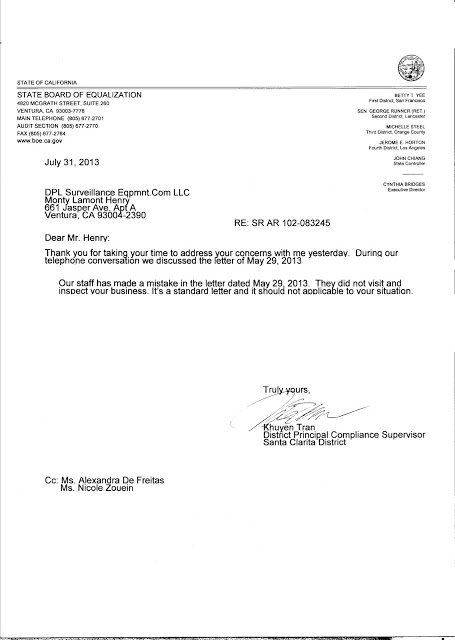

Presently, I’ll see what regulations the B.O.E. has in regards to my recording-keeping (I actually keep very good records) and also I need to have the contact person Alexandria De Freitas (now: Khuyen Tran: District Principal Compliance Supervisor,

Santa Claria District) provide me with any reference in the constitution that actually authorizes the States to impose and collect and income-tax on business such as mine.

Update: See “retraction Letter above” dated: July 31, 2013: I finally got Khuyen Tran to admit that the State Board of Equalization never sent anyone out to my premises and that that event never actually took place (fabricated). I now wonder just how many other business received these letters and just started sending money to the BOE without considering that no one was actually visiting these businesses!

You would think a lawyer or even a paralegal would be interested in looking into this. It seems like grounds for a class action lawsuit if these letters are being arbitrarily sent out to businesses. I was told that the one sent to me was a one-off. However, something tells me that mine was not an isolated case.

I have to see if the BOE is going to honor the retracted letter or try to go back on their word.

Update: 8-13-2013 Approx: 10:30am

After finally deciding and agreeing to meet with Tran (who declined to have anything to do with me ever again) actually had me see Nicole Zouein and Kellen Olivier (her secretary). Well the meeting went about as well as expected. The police ended up being called (by me and Robert Kaudse: Audit Supervisor) in. I posed several simple questions to Nicole. For instance, I simply read the retraction letter to her and asked her how could she expect to enforce the terms of the letter when Khuyen Tran: (District Principal Compliance Supervisor) actually provided me with a complete retraction letter (see above) stating that that initial letter didn’t and shouldn’t be applicable. I guess the people at the State Board of Equalization have their own agenda and they simply will not even acknowledge the facts as presented by even their own peers. I’ll have to leave it up to these geniuses to figure-out amongst each other how to read plain English.

Anyway, I insisted on getting some straight answers and of course my voice may have gotten louder and louder. Unfortunately, if I feel that if someone is bullshitting me and waisting my time then yes the situation will get ugly and quickly.

So the police came and interviewed all parties and we agreed that this would have to be attempted again some time in the future. Actually, I really don’t think I can afford to play around with these people any longer considering I already gave them ample opportunity to make their case which they failed (miserably) to do.

Also, amazingly, Nicole probed my company’s records in an attempt to find something else to nail me on. She thought she found a period where I operated without a sellers permit. Then she had the nerve to ask me if I remembered this time frame or period (years ago). When I reminded her that this had absolutely nothing to do with our meeting today she had nothing further to say on the matter. It does seem that they (BOE) went on a fishing expedition through my files (company history) before the meeting to dig up anything they could (Ambush). No one bothered to give me the consideration so I could check into this prior to the meeting. As if I carry this stuff around with me in my pocket. I think they did this because of how stupid this present case was starting to look. Oh well.

That’s why we taxpayers are paying them or hard-earned dollars right?

I’ll keep you guys posted of this complete fiasco!

—————————————

Now I have to find out why I’m being compelled to play “tax collector” for at least twenty-four (24) tax jurisdictions in California even though I have no “tools, know-how and or resources” to actually implement this on my website.

Also, I really don’t think the people who are trying to compel my one-man, Internet-only business (which makes less the 1 million dollars per year) actually read this or even understand what it means:

The Marketplace Fairness Act of 2013: Who Gets To Be A Tax-Collector For The U.S. Government?

Meanwhile, I’m providing various informational resources that further explain why we should question the idea of being compelled to pay an income-tax.

Supreme Court Rulings Denying The I.R.S. The Authority To Collect An Income Tax: http://tinyurl.com/m33efj4 (There Are Numerous Other Supreme Court Rulings Stating The Same.

“We are of opinion, however, that the confusion is not inherent, but rather arises from the conclusion that the 16th Amendment provides for a hitherto unknown power of taxation; that is, a power to levy an income tax which, although direct, should not be subject to the regulation of apportionment applicable to all other direct taxes. And the far-reaching effect of this erroneous assumption will be made clear…” Brushaber v. Union Pacific R.R., 240 U.S. 1, 11 (1916)

* America From Freedom To Fascism (Video):

See Video Section 25:00 Minutes To 30:00 To See Actual Proof Demonstrating That The I.R.S. Has No Legal Authority For The Collection Of Income Taxes, Seizure of Property For Non-Payment, Audits Of Citizens Tax Filings, etc.: http://youtu.be/gKToYTOE128

The I.R.S. Also Fails To Actually Define Income: See Video Section 32:41

No Balance Updates For Taxpayers On BOE Website

Why is it that you guys are so adamant about taxpayers paying on time and being accountable when you guys are the total opposite!

My account that I set-up on your website shows absolutely no record of my payments! However, you didn’t hesitate to send out a letter to me demanding that I pay you interest on a balance that should have been reduced to zero.

I paid you guys (my balance was: $1,524.00) $300.00 2-5-2015 (Citibank ref# *00021340882*) as evidenced by the debit in my citibank account (online) and then I paid $1,224.00 2-2-2015 10:26am (I have a printed statement from “Official Payments”) and that should equal $1,524.00 on most any calculator!

However, I just received a billing (past due notice) stating that I only paid $1,224.00 and that I owed and additional $152.40 in interest charges. I received this later 2-27-2015 and it stated that I had until 2-28-2015 to fix this issue.

Why would you send out a notice that would take 2-3 days to reach me knowing full well that by the time I received it I would only have 1 day to make a timely payment?

That’s almost as stupid as you guys (the BOE) expecting us to pay our taxes due (for example):

A “REMINDER TO FILE” Notice

Period: 1/1/2014 – 12/31/2014 Due Date: 2/2/2015

Most merchant (Credit Card) processors don’t and will not even have their annual statements (showing our gross sales numbers) ready for us merchants until approx. the 2nd or 3rd. week in February! Yet we’re told by the BOE that the due date is 2/2/2015

I’m not even sure of why the BOE should even have my taxpayer dollars at all. I never utilize any of their useless services and their response times are completely unacceptable!

By the way, 2-28-2015 actually falls on a Saturday!

I’m going to call these idiots first thing Monday morning (3-2-2015) to remind them that I paid them a total of $1,524.00 which is exactly what I owed them.

What really pisses me off is that when I make payments the BOE will not update my account on their website nor will they send my a statement showing or confirming said payments. However, if you owe them a dime they will send out a letter demanding your payment like yesterday. Then even cite IRS publications and references just to make sure that you know your violating Federal gov. rules and regulations!

Why is it that I can’t get an email, text message or something indicating that I made a payment immediately? There should be no reason why I should not see my balances on there website update within a few days of making said payments.

Also, I would like to see exactly where my tax dollars are going considering that there is no accountability that I can see at the BOE. We need to see a breakdown of each dollar that we send in and what portion of that dollar is used and for what purpose. I know for sure they (BOE) are not spending any of our tax dollars on that website where our accounts are set-up. I think they (the BOE) is doing this on purpose so that they can avoid the responsibility of accounting for the money that we are paying to them.

We (taxpayers) should at least get an invoice, receipt or something immediately when we make a payment. This applies to consumer purchases with most companies and should not be any different with the BOE.

Finally, why don’t you at least make a reference to the “REMINDER TO FILE” Notice when I sign in to pay the current tax bill? You should pre-populate certain fields so that the tax “period” and “due” dates, etc. are already chosen! This would probably lessen the likely-hood of taxpayers sending in a payment for the wrong period.

I know you guys would love to get and hang-to this money for as long as possible. However, it is not yours to just do with whatever you like! You’re supposed to make sure you get the correct amount for the correct tax period and apply that payment asap and then send out a notice, invoice, receipt, text message, etc (immediately). stating what has been paid and how much and when, etc.

You guys need to get it together and stop monkeying around with our time and money!

Updated 3-4-2015

Hi Michelle,

Maybe your boss “Jerome Horton” should have addressed my concerns in the first place. That’s what he gets paid to do correct?

Or is he too busy making sure that we have BOE websites that are safe and secure or maybe he’s making sure that we get to see timely payment confirmation via email, fax, text message, etc.

“You also asked why your payment is not posted on our website. I indicated because that information is confidential and should not be available for the public to see.”

The public should not be seeing ANY of my information on a properly secured site!

If you’re telling me that it’s perfectly ok for you guys to post my full name, account#, express login code, the total amount of sales make including my accountants name,etc. on a website that’s not secure then someone over there needs to be fired like yesterday!

Also, “old” accounts that are “closed” with no balance owed should not be allowed to have payments posted to them at all!

Also, when tax payers login to our accounts on your website we should see certain fields “pre-populated” with the current tax period, due dates, etc.

There is no excuse for asking us to manually input this same information when you guys already know that for the most part this is the main reason why we are going to this site in the first place. When we go to the website you ask for the information listed below from the “Reminder To File” so why not use it to identify exactly and accurately make the payment on YOUR website?

Express Login Code:

Account number:

Period: 1/1/2014 – 12/31/2014

Due Date: 2/2/2015

When anyone insults my intelligence AND wastes my money I usually will get upset.

Dear Mr. Monty Henry,

Thank you for your time in speaking with me today. However, I had to terminate the conversation as I could not have you call me “stupid” and make inappropriate remarks. I understand your frustration and please be assured the reason for my phone call was to assist you.

The Sales and Use Tax Return for Year 2014 (covering 1/1/14 through 12/31/14) was due on 2/2/15, as 1/31/15 and 2/1/15 fell on a weekend. As indicated, you filed your return on time, however, you paid it late. I asked you when you made your payment, you indicated you made the payment on 2/20/15, which was 18 days after the due date.

You also mentioned that you spoke with several individuals with the Board of Equalization (Chelsea, David, Maurice, Carol) who confirmed that the payment was applied to your old account. You indicated that Carol of Return Analysis moved the payment to the correct acct. (They also reassured me that I would not have to pay the interest charges) I explained that this is not uncommon that sometimes payments are applied to the wrong account, however, when the account is corrected and payment is moved to the correct account, the system will honor the date the payment was made, not when the account was corrected. I gave you the example if a payment was made today 3/4/15 and was applied to the wrong account, and was corrected on 4/4/15, the system will honor 3/4/15 as the date of payment, not when it was corrected.

You also asked why your payment is not posted on our website. I indicated because that information is confidential and should not be available for the public to see. However, all your payments are posted in our internal system where we may view the date of filing and payment.

I also mentioned on our conversation that you have the option to request for penalty to be waived if you don’t believe it’s due. If you wish to pursue this, here’s the link to make the request:

http://www.boe.ca.gov/elecsrv/esrvcont.htm#Request_Relief

For your reference, I am also attaching Publication 75, Interest, Penalties, and Fees. I would direct you to page 3 of the publication which explains when do interest, penalty apply:

http://www.boe.ca.gov/pdf/pub75.pdf

I will also reach out to the Ventura District Office, which is the district of control to further assist you.

Thank you for your time, patience, and understanding.

From: Horton, Jerome

Sent: Wednesday, March 04, 2015 8:09 AM

To: ‘Monty@DPL-Surveillance-Equipment.com‘

Cc: Creencia, Michelle

Subject: : Re: : Lack of Accountability

Thanks for sharing your concerns. A member of my team will contact you soon.

Jerome Horton

Board Member, 4th Equalization District

Jerome.Horton@boe.ca.gov

(310) 297-5201 office

(310) 536-4460 fax

—————–

Updated: Wed, 25 Mar 2015 20:38:31 -0700

To: Lim, Linden “Chip”<Linden.Lim@boe.ca.gov>

From: Monty Henry

Subject: Re: Statistical Information for the BOE

Bcc:

Hi Chip,

Considering that the BOE.org website isn’t considered secure enough to warrant posting taxpayer payments there, (this is what I’ve been told) it’s seems out of all the taxpayer revenue that you guys collect you would think that that would be one of the first places (IT or Informational Technology) you guys would commit some of our funds towards.

It would be nice if you guys spent some of our money also on technology that would quickly text us, email us payment confirmations or just quickly post payments from “Official Payments” company to our accounts.

Please advise.

Monty Henry, taxpayer

California State Board of,California State Board of,California State Board of,California State Board of,California State Board of,California State Board of,California State Board of,California State Board of,California State Board of

Related Articles:

Even The State Franchise Tax Board Is Trying To Scam Me

Leave a Reply

You must be logged in to post a comment.