Black Wall Street: America’s Dirty Little Secrets (#GotBitcoin)

When Tulsa’s Black Wall Street Went Up In Flames, So Did Potential Inheritance. Black Wall Street: America’s Dirty Little Secrets (#GotBitcoin)

Destruction of hundreds of businesses in 1921 massacre had reverberations on family wealth for generations.

“Destroyed 1921, Not Reopened.”

That is how dozens of plaques commemorate the Black-owned businesses that once made up the city’s Greenwood neighborhood.

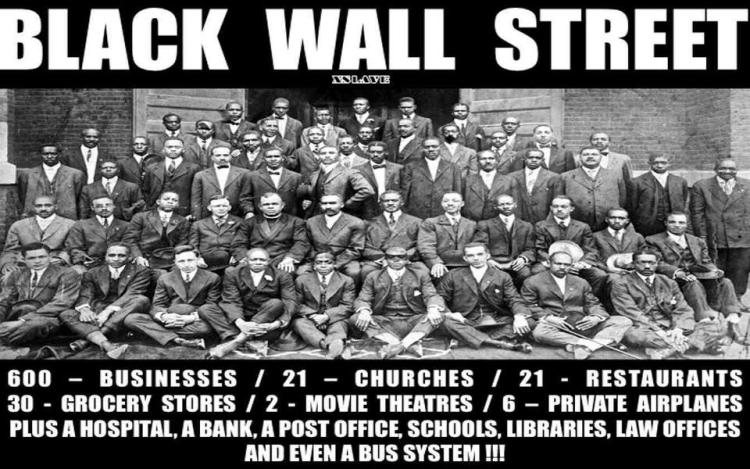

Before it was destroyed by mobs of white people during the 1921 Tulsa Race Massacre, the 35-block district had about 200 Black-owned registered businesses, including hotels, restaurants, grocery stores, beauty salons, movie theaters and a bank. Some local residents and business leaders estimate there may have been as many as 600 entities, including unlisted firms and sole proprietors.

Greenwood was among the few places in Tulsa where Black people could build wealth. They were able to buy land in their names and operate businesses in the area north of the railroad tracks that divided the segregated city. The neighborhood’s nearly 9,000 Black residents in 1920 primarily spent their money in their own community.

The majority of the businesses destroyed in the massacre were never rebuilt. Some that managed to rebuild didn’t last, at least partly because of the stresses of the massacre and the Great Depression that followed.

It has been four generations since the riot, and its effect on generational wealth for the descendants of those business owners lingers.

While Black residents before the massacre could bank with financial institutions, they also used alternative systems that they trusted such as secret societies or thrift clubs, said Shennette Garrett-Scott, an associate professor of history and African-American studies at the University of Mississippi who studies Black finance and banking before the Depression.

People also acted as informal bankers for their neighbors, holding on to money for community members, and those with a lot of wealth informally made loans, she said.

“What Black Wall Street was able to do was to create an ecosystem that fed customers to these businesses, and they were successful,” said Tiffany McGhee, founder of institutional investment advisory firm Pivotal Advisors LLC. “And when you destroy those businesses…then that ends the wealth.”

Descendants of Greenwood’s early Black entrepreneurs wonder what would have been different for them economically if their ancestors’ businesses hadn’t been destroyed. Despite income gains for Black families in the U.S., the median net worth of Black households is about one-eighth that of white households, according to government data.

In the years following the 1921 Tulsa Race Massacre, Greenwood’s business district rebounded with more businesses than before. However, decisions to demolish buildings in the name of blight removal, relocate businesses and run a highway through Greenwood contributed to the emptying out of the district, local historians and residents said.

Today, what remains of the historic district consist of a few blocks. The main block is home to 10 buildings that house about 30 small businesses, according to Freeman Culver, chairman of the historic Greenwood Chamber of Commerce.

Here are the accounts of three Tulsa families and the generational wealth they sought to build.

The Ross Family

J. Kavin Ross paused for a moment to stare at a black granite monument listing scores of businesses that were destroyed during the massacre. Once he spotted the name of his great-grandfather’s establishment, he slid his fingers across the engraved title, Isaac Evitt’s Zulu Lounge.

A few hundred feet away, a small plaque commemorates where the lounge once stood. It is tucked under an elevated section of Interstate 244, also known as the Martin Luther King Jr. Memorial Expressway, which now runs directly over where the lounge used to be.

“A freeway stands on top of my possible inheritance,” said Mr. Ross, a paraprofessional working with special-needs students. “Who is to say what Isaac Evitt’s Zulu Lounge would be today if it hadn’t been for a so-called riot.”

Mr. Ross said his great-grandfather never recovered financially from the loss of the Zulu Lounge, once at 501 E. Cameron St. His great-grandfather sold most of the family’s remaining land in the neighborhood. He couldn’t rebuild because white shop owners refused to sell him building materials, Mr. Ross said.

“Frustrated, he would leave my grandmother and the rest of the family here in Tulsa and go to California,” Mr. Ross said.

Mr. Ross’s father, former Oklahoma state Rep. Don Ross, advocated for the formation of the Tulsa Race Riot Commission to study the massacre and helped develop the Greenwood Cultural Center.

The Rogers Family

John W. Rogers Jr. , founder of investment company Ariel Investments LLC, is the great-grandson of J.B. Stradford, who owned Greenwood’s Stradford Hotel. The three-story luxury hotel burned down and is counted among the businesses that were never rebuilt following the massacre.

“We did not have the benefit of building multigenerational wealth because his entire empire was destroyed,” Mr. Rogers said. “Many successful families continue to build on the dividends of prior generations’ business leadership.”

Before the massacre turned the 54-suite Stradford Hotel into a smoldering pile of bricks and debris, it was the crown jewel of Mr. Stradford’s real-estate empire, which included two dozen rental properties in Tulsa.

After the destruction ended, Mr. Stradford was detained and charged with inciting the massacre. Somehow, he escaped from a detention center and boarded a train for his brother’s home in Independence, Kan. He eventually headed to Chicago, where he successfully fought extradition to Tulsa with the help of his son, Mr. Rogers’s grandfather, who was a lawyer.

“There was real fear he could possibly be lynched,” said Mr. Rogers, who grew up in Chicago. “He was exonerated many years later when people realized what truly happened.”

In Chicago, Mr. Stradford tried and failed to open a hotel.

“He never remotely approached the success that he had in Tulsa,” Mr. Rogers said of his great-grandfather, who graduated from Oberlin College in Ohio and Indiana University’s School of Law. “And he was very disappointed and disillusioned to go from this giant business success in Tulsa to kind of a struggling lawyer and businessman in Chicago.”

Jewel Stradford, Mr. Stradford’s granddaughter and Mr. Rogers’s mother, became a prominent lawyer. She was the first Black woman to graduate from the University of Chicago Law School, the first female deputy solicitor general of the U.S. and the first Black woman to argue a case before the Supreme Court, among other achievements.

Still, she resented that she was never able to create the wealth she thought could come from having a law degree, and still worked every day, even when she was dying of breast cancer at age 75, Mr. Rogers said.

Mr. Rogers said his career path has been inspired by his hotelier great-grandfather. In 1983, Mr. Rogers made history as the first African-American founder of an asset-management firm, which urges companies to create a more diverse and inclusive corporate environment, he said. The firm, Ariel, had $16.2 billion in assets under management as of March 31, according to its website.

“I did not inherit wealth, but I inherited an education and early exposure to finance, which inspired my career path,” Mr. Rogers said.

The Nails Family

James Nails Sr. arrived in Tulsa from Honey Grove, Texas, after oil was found in the area and before Oklahoma became a state in 1907. In 1917, he got a college vocational degree in shoemaking. He wanted to own his own business.

He opened a combined shoe and record store with his brother on the main thoroughfare, Greenwood Avenue. Another brother operated a limousine-and-taxi service. A nearby park that the Nails family owned was home to the Nails Dance Pavilion and Recreation Rink.

The Nailses lost all their business assets, homes and money the night of the massacre.

Property deeds helped Brenda Nails-Alford, the granddaughter of James Nails Sr., piece together details about the three family businesses. Although each deed listed just one name, the business operated as a collective, giving each Nails brother a piece of the pie that was intended to build wealth for their families.

Nails Brothers Shoes is now commemorated by a plaque in the sidewalk on Greenwood Avenue. The weathered plaque stands apart from the others for one reason—it reads “reopened.”

Though the combined shoe and record store reopened after the massacre, it only survived until the early 1930s, when it succumbed to the Great Depression and the lingering stresses of the massacre.

One of the family’s other businesses, the park that housed the dance pavilion and recreation rink, was acquired for $1 by Henry Brady, the son of a local businessman and Ku Klux Klan member, Wyatt Tate Brady, the Tulsa World reported.

The stress of losing his businesses took a toll on James Nails Sr., and he no longer was able to support his family. His wife, Vasinora, raised their four children on her own and worked as a domestic helper in a white household.

“My grandfather did everything he was supposed to do and, still, it wasn’t enough,” Ms. Nails-Alford said.

Ms. Nails-Alford’s family still maintains the family home in the Greenwood district. The original family home was torn down and replaced as part of the city’s urban-renewal efforts. Ms. Alford said she gets offers for the property all the time from real-estate agents and individuals from in and out of the state, but when she was a little girl she remembers people saying, don’t sell your properties.

A generation later, James Nails Jr. tried to follow in the footsteps of his father, James Sr., by going to college for shoemaking, at Langston University in Tulsa, and opening a shoe store on North Greenwood Avenue in the 1970s.

He operated the store for only a brief period. Greenwood and other Black neighborhoods were losing businesses as dollars flooded out of the community after desegregation opened up more opportunities for Black people to spend their dollars elsewhere. Urban renewal and a new highway that cut right through Greenwood Avenue rearranged the geography of the business district.

James Nails Jr. shut down his store and spent the rest of his career working at other people’s businesses.

“He wanted to carry on the family legacy, and he couldn’t do that,” Ms. Nails-Alford said.

Black Land Ownership Primed Greenwood’s Rebound After Massacre

Property owners in Tulsa’s Greenwood district raised money by leveraging the land beneath the rubble, helping to bring businesses back.

After all the destruction and loss of life, what survived the 1921 attack in the Greenwood district proved the most valuable and enduring in the neighborhood’s midcentury recovery: the ambition of Black entrepreneurs and landowners.

The ability of property owners to raise money by leveraging the land beneath the rubble helped seed a local economy of Black-owned businesses for the next decades, according to interviews, court filings, newspaper articles and an analysis of Tulsa County real-estate records by The Wall Street Journal.

Rebuilding Greenwood after the massacre had seemed a long shot. There was little or no government assistance. Insurers largely denied claims from people who had lost their homes and didn’t compensate business owners for lost inventory. Many residents instead used their property as collateral to secure short-term mortgages from financial institutions, more affluent individuals and community lending pools, records show.

The loans helped the neighborhood flourish in the 1940s and 1950s, residents and historians said. In 1940, the homeownership rate among Black residents in Tulsa was 49%, surpassing the rate of 45% among white residents, U.S. Census data show.

In those decades, grocery stores lined the commercial spine of North Greenwood Avenue, and the district featured chili parlors, movie theaters, barbecue restaurants, drugstores, pool halls and doctors’ offices. By 1942, Greenwood was home to more than 240 businesses, according to Hannibal B. Johnson’s “Black Wall Street: From Riot to Renaissance in Tulsa’s Greenwood District.”

“All the odds were against us, and we survived anyway,” said James O. Goodwin, publisher of the Oklahoma Eagle, Greenwood’s century-old Black newspaper. Yet, this second renaissance would, too, meet its own calamity.

The story of Black property ownership in Oklahoma began well before the 1921 massacre. Many of the territory’s early Black residents were descendants of those formerly enslaved by Native Americans who had been pushed west by the U.S. government in the 19th century, according to Larry O’Dell, director of development and special projects at the Oklahoma Historical Society.

In later agreements with the U.S., these Native Americans and the more than 23,000 formerly enslaved Black men and women of the tribes—known as freedmen—became eligible for allotments of as much as 160 acres in Oklahoma, Mr. O’Dell said. Many formed all-black towns in Oklahoma, largely in the late 1800s and early 1900s.

The opportunity to own land drew Black migrants from other states to Tulsa. Many found work as skilled laborers and in service jobs in an economy buoyed by agriculture and, later, the oil industry. Some who settled in Greenwood started businesses and bought property.

P.S. Thompson was among the Greenwood residents who mortgaged property to rebuild after the massacre. He filed a claim against the city for failing to protect his house and drugstore from destruction, fires and looting, according to documents with the Tulsa Historical Society & Museum and research compiled by the Oklahoma Historical Society.

The following year, Mr. Thompson and his wife, E.B. Thompson, used their property as collateral to obtain a $750 loan from L.S. Cogswell Lumber Co., about $12,000 when adjusted for inflation. The loan was for 15 months at an annual interest rate of 10%, according to records from the Tulsa County Clerk. The average U.S. mortgage rate was around 6% at the time. The couple paid off the loan and obtained several more short-term mortgages in amounts from $500 to $1,500.

Well-to-do Greenwood residents made loans to other members of the community. In the 1920s and 1930s, James Henri Goodwin, a businessman and real-estate investor, extended mortgage loans to local residents, according to county clerk documents, and borrowed himself. Some Greenwood property owners were able to borrow from savings-and-loan associations.

Restrictive real-estate covenants limited the mobility of Black residents and property owners beyond Greenwood’s boundaries. Private-lending practices, common across the U.S., rated the presence of Blacks in a neighborhood as an elevated property risk, historians said, and blocked many Black home buyers from getting mortgages.

By 1958, the proportion of white home buyers had grown dramatically. Black residents made up 10% of Tulsa’s population but only 3% of buyers of new housing in the city, according to a Tulsa Urban League report issued that year.

Even with new homes being built, very few Black buyers could qualify for financing, according to the report, provided by the University of Tulsa’s Department of Special Collections. The passage of civil-rights legislation in the 1960s began to open up opportunities for some residents to move out of Greenwood amid efforts to desegregate communities, a move that cut into business owners’ clientele.

Greenwood’s second calamity was, in part, a consequence of broader urban renewal efforts in the 1960s.

Redevelopment plans and the clearing of blighted properties uprooted local businesses and residents, accelerating the neighborhood’s decline, residents and descendants of former business owners said. In some instances, businesses were forced to move because of redevelopment, they said, and some had to move several times while trying to stay close to longtime customers.

The construction of Interstate 244 through Greenwood in the late 1960s upended the local economy, piercing the heart of the business district and forever changing the neighborhood.

Here is a snapshot of some properties and entrepreneurs who contributed to Greenwood in its second heyday, the period of neighborhood revival after the 1921 massacre.

521 North Detroit Avenue

What Was There?

The home of P.S. and E.B. Thompson, husband and wife, survivors of the 1921 massacre, had 11 rooms, according to the damage claim filed against the city. The couple also had a drugstore listed in court documents at 23 North Cincinnati Street.

Who Owned It?

The Thompsons.

What Is There Now?

The Helmerich Research Center at Oklahoma State University-Tulsa takes up the block where the Thompsons’s home likely stood. The building, bordered by grass, backs onto Detroit Avenue, where the front of the Thompson home would have faced.

The I-244 Abuts The Southern End Of The Block.

122 and 123 North Greenwood Avenue

What Was There?

Goodwin family properties and former homes of the Oklahoma Eagle, a family-run newspaper. Various business ventures occupied the sites over the years, including a haberdashery, printing business and ice-cream shop.

Who Owned It?

Members of the Goodwin family. Carlie and James H. Goodwin moved to Greenwood from Water Valley, Miss., with ambitions of giving their children a better education, their son Edward Goodwin Sr. said in a 1971 interview provided by the Columbia Center for Oral History.

James H. Goodwin co-owned an undertaking business and invested in real estate, passing an entrepreneurial tradition to his son. After the massacre, James and Carlie Goodwin listed losses of several houses and buildings totaling more than $27,000—about $410,000 when adjusted for inflation—according to an analysis by the Oklahoma Historical Society.

Hours before the start of the May 31 attack, Edward Goodwin was decorating the Stradford Hotel for the prom the following night, according to the Greenwood Cultural Center.

Edward Goodwin, who owned the printing business, haberdashery and ice-cream shop, brought home shows to Greenwood in the 1950s, putting on events at places like the Big 10 Ballroom. Black and white vendors and marketers brought in appliances and other housewares, and featured fashion shows.

Mr. Goodwin bought the Oklahoma Eagle newspaper, which he used to advocate for racial equity. He owned as many as 40 to 50 properties in Tulsa, he said in the 1971 interview. He is credited with helping save the last block of Greenwood from being razed for redevelopment by negotiating agreements with the city. His son James is the current publisher of the Oklahoma Eagle.

What Is There Now?

A section of I-244 rises close to where the Goodwin property at 123 North Greenwood once stood. The entrance to ONEOK Field, a minor-league baseball stadium that is home of the Tulsa Drillers, is near the former site of 122 North Greenwood.

749 and 751 North Greenwood Avenue

What Was There?

Lynn & Clark Cleaners opened around 1926 at 749 North Greenwood Avenue. Banner Grocery Market opened in 1937 at the neighboring address, according to the Tulsa Historical Society & Museum.

Who Owned It?

Clark C. and Lynn H. Holderness, brothers, and Jobie Holderness, Lynn’s wife. By Lynn Holderness’s death in 1966, the family’s properties encompassed about 50 lots in the city, according to estate documents filed with the county clerk’s office.

Mr. Holderness lived in Tulsa as early as 1916, and he worked as a porter at the Bohnefeld Cleaning & Hat Works and later as a cleaner for Lloyd-Richey Cleaners, according to the local historical society. Jobie Holderness continued to run Banner Market until 1982, according to Mr. Johnson’s “Black Wall Street” book.

What Is There Now?

Oklahoma State University Parking Lots And Buildings

1624 East Apache Street

What Was There?

The Big 10 Ballroom, which drew such top-tier musicians and performers as Ray Charles, James Brown and Otis Redding in the late 1940s and through the mid-1960s.

The large white building boasted a dining area, as well as a bar and lounge that opened to a ballroom with a dance floor and a stage, according to family members and a 1948 Tulsa Tribune feature story about its launch. The club, which sat at the outskirts of Greenwood, was among several neighborhood venues where world-class jazz and R&B musicians performed.

Who Owned It?

Lonnie Williams and Richard Thompson. Andranez Williams-Stephens, Lonnie Williams’s daughter, remembers her mother cooking spaghetti for musicians at their home. “It was huge and beautiful,” Ms. Williams-Stephens said of the Big 10. “On the front of the building was this huge window that you could see out on Apache and the parking lot.”

Her father, a Tulsa police officer, ran multiple businesses, including a local pool hall and liquor store.

Later, he opened up a bail-bond company. He eventually quit the police force, finding his enterprises were much more lucrative, Ms. Williams-Stephens said. Her father closed the pool hall and liquor store when redevelopment uprooted Greenwood businesses, she said. Urban renewal also forced him to find a new home in the district.

What Is There Now?

A nonprofit called A Pocket Full of Hope is renovating the building to serve as a venue for the organization’s theater productions and other events aimed at supporting local youth, said Lester Shaw, the nonprofit’s executive director. The project has been in the works for more than a decade and is expected to open later this year as the Historic Big 10 Ballroom.

Dr. Shaw turned down a donor who wanted to tear down the structure and build a new facility. “I knew the Big 10 Ballroom had a historical perspective,” he said, “and it’s hard to empower kids without a historical perspective.”

New Oklahoma Law Sparks Debate Over Teaching About Tulsa Massacre

Opponents say it stifles lessons about history of white mobs burning down the Black community of Greenwood in 1921.

For decades, Oklahoma students weren’t required to learn about the Tulsa Race Massacre in school, in what the city’s school superintendent called a “conspiracy of silence.”

Now some residents and educators worry that a new state law could derail progress in teaching about the tragedy, in which white mobs burned much of the Black community of Greenwood to the ground a century ago, leaving as many as 300 people dead.

The law, signed by Republican Gov. Kevin Stitt on May 7, restricts public-school teachers and employees from using lessons that make an individual “feel discomfort, guilt, anguish or any other form of psychological distress on account of his or her race or sex.”

Days later, Gov. Stitt was ousted from the 1921 Tulsa Race Massacre Centennial Commission, which said his action was contrary to the group’s mission. The commission called his approval of the legislation “a sad day and a stain on Oklahoma.”

Similar legislation designed to counter moves by school districts to focus lessons on race or systemic racism has been passed in Idaho and Tennessee and is being considered in at least a dozen other states. Some of the Republican-backed legislation specifically bans a decades-old teaching method called “critical race theory,” which addresses the way racism is embedded in laws and society.

Educators have been more focused on race and racial inequities after a year of civil unrest following police killings of Black people. In April, the U.S. Department of Education outlined its proposed priorities for grants for American history and civics education, with applicants asked in part to indicate how they would take into account “systemic marginalization, biases, inequities, and discriminatory policy and practice in American history.”

Some Oklahomans criticized Mr. Stitt’s timing in signing the bill into law just weeks before the 100-year anniversary of the massacre on Monday. Opponents say that while the law doesn’t forbid teaching students about the massacre, it is an attempt to stifle lessons that deal with unpleasant aspects of history.

“This is a way to keep the history of Tulsa in the dark, in the closet,” said Jennettie Marshall of the Tulsa school board. “It has been a dirty little secret.”

The Oklahoma Council of Public Affairs, a conservative think tank, applauded the legislation. “From a government perspective, should taxpayers be required to pay the salaries of government employees to teach that whites are inherently racist or inherently privileged? I think the answer would be no,” said Jonathan Small, president of the group.

Some educators said that teaching about the massacre in Oklahoma schools has gotten better in recent years. In 2019, state academic standards required for the first time that Oklahoma history classes include in-depth lessons on the massacre, including the “emergence of ‘Black Wall Street’ in the Greenwood District” and the “causes of the Tulsa Race Riot and its continued social and economic impact.” The standards also include an opportunity to introduce the massacre in broader terms to second-grade students, but it isn’t required.

“I did not learn about the Tulsa race massacre until I was an adult,” said Joy Hofmeister, Oklahoma’s education chief, who grew up in Tulsa. She supports more detailed lessons about the massacre: “We have to face the historic events of that time and learn critical lessons from that.”

Oklahoma Sen. Rob Standridge, a Republican and co-author of his state’s bill, warned parents about school lessons in a statement. “I encourage every parent to make certain their schools aren’t making some students feel that, solely based on the color of their skin, they are naturally racist, they are inferior or superior,” said Mr. Standridge.

James Taylor teaches seventh grade in Oklahoma City and said the new law addresses those who cross the line. “It doesn’t say you can’t talk about racism; you just can’t say all white people are racist,” said Dr. Taylor.

Some teacher groups are concerned that the law puts their members in a difficult position. “Our teachers are mostly worried about what will happen to them legally with their job, or legally with themselves, in a civil lawsuit if they teach anything related to diversity or race,” said Torie Shoecraft, president of the Oklahoma City American Federation of Teachers, which has about 1,500 members.

Stefanie Wager, president of the National Council for the Social Studies, an association of about 10,000 teachers and other social studies professionals, questioned how states will monitor educators for compliance with the new laws focused on race, especially as interest grows in teaching on the subject.

Todd Gragg is a teacher for Seminole Public Schools, a small district about an hour from Oklahoma City. He said that while he has concerns about how the law might affect teaching about the massacre and racism in his Advanced Placement U.S. history and government classes starting in the fall, he plans to do so anyway.

“Are we going to run from the truth or be willing to teach it openly in the classroom?” said Mr. Gragg. “The reality is there is structural racism. We can’t deny that it exists.”

Research shows that U.S. history classes from kindergarten to 12th grade devoted about 9% of their time to Black history in 2015—and not much has changed since then, said LaGarrett King, an associate professor of social studies education at the University of Missouri.

Part of the issue is that while teachers have been willing to teach Black history, some don’t know it themselves. “The average teacher means well,” Dr. King said. “But there is a lack of knowledge. A lot of these teachers were educated in the same system they are educating in.”

Oklahoma school districts are weighing in on the new state law. The school board of Oklahoma City Public Schools, the state’s largest district, approved a resolution denouncing the legislation. Tulsa Public Schools, the state’s second-largest district, said the law has no implications for how it teaches about the massacre. Tulsa officials rolled out a new curriculum on the massacre this month for grades three through 12.

“This is history that is painful, but our approach is firmly grounded in the belief that one human being isn’t ‘worth’ more than another,” the Tulsa district said in a statement.

Mr. Stitt has said the Tulsa Race Massacre can be taught under the new law, which he noted doesn’t prohibit teaching concepts aligned with state academic standards. The law also forbids state colleges and universities from requiring students to engage in any form of mandatory “gender or sexual diversity training or counseling.”

But the centennial commission, which removed Mr. Stitt as a member, said in a statement that while the law doesn’t preclude teaching about the Tulsa Race Massacre, it clearly intends to limit teaching the racial implications of America’s history.

After the legislation was signed, the commission invited the governor to attend a special meeting to discuss the bill. Mr. Stitt didn’t show up or reply to the invitation, the commission noted in a May 11 letter to the governor.

The letter said he could contact the group for discussion, but not doing so would indicate further disavowal of its goals and an official resignation. On May 12, the commission met and decided to part ways with Mr. Stitt, according to a statement from the group.

Mr. Stitt said in a statement that his role on the commission was ceremonial and accused the group of sowing division based on falsehoods.

Despite the tension over the law, some parents are looking forward to their children learning about the massacre. Tulsa parent Michelle Lamb gave her 10-year-old daughter, Annette, a lesson on the massacre a few days before she was to start learning about it in school.

The mother and daughter spent time earlier this month reading placards embedded in sidewalks on Greenwood Avenue, which show where businesses stood before the massacre, whether the owner died and if the business reopened.

“I can try to teach her, but it’s best to show her,” Ms. Lamb said.

The night’s carnage left some 3,000 African Americans dead, and over 600 successful businesses lost. Among these were 21 churches, 21 restaurants, 30 grocery stores and two movie theaters, plus a hospital, a bank, a post office, libraries, schools, law offices, a half dozen private airplanes and even a bus system. As could have been expected the impetus behind it all was the infamous Ku Klux Klan, working in consort with ranking city officials, and many other sympathizers. Black Wall Street: America’s Dirty Little Secrets

In their self-published book, Black Wall Street: A Lost Dream, and its companion video documentary, Black Wall Street: A Black Holocaust in America!, the authors have chronicled for the very first time in the words of area historians and elderly survivors what really happened there on that fateful summer day in 1921 and why it happened. Wallace similarly explained to me why this bloody event from the turn of the century seems to have had a recurring effect that is being felt in predominately Black neighborhoods even to this day.

The best description of Black Wall Street, or Little Africa as it was also known, would be liken it to a mini-Beverly Hills. It was the golden door of the Black community during the early 1900s, and it proved that African Americans had successful infrastructure. That’s what Black Wall Street was all about.

The dollar circulated 36 to 100 times, sometimes taking a year for currency to leave the community. Now in 1995, a dollar leaves the Black community in 15-minutes. As far as resources, there were Ph.D.’s residing in Little Africa, Black attorneys and doctors. One doctor was Dr. Berry who owned the bus system. His average income was $500 a day, a hefty pocket change in 1910.

During that era, physicians owned medical schools. There were also pawn shops everywhere, brothels, jewelry stores, 21 churches, 21 restaurants and two movie theaters. It was a time when the entire state of Oklahoma had only two airports, yet six Blacks owned their own planes. It was a very fascinating community.

The area encompassed over 600 businesses and 36 square blocks with a population of 15,000 African Americans. And when the lower-economic Europeans looked over and saw what the Black community created, many of them were jealous. When the average student went to school on Black Wall Street, he wore a suit and tie because of the morals and respect they were taught at a young age.

The mainstay of the community was to educate every child. Nepotism was the one word they believed in. And that’s what we need to get back to in 1995. The main thoroughfare was Greenwood Avenue, and it was intersected by Archer and Pine Streets. From the first letters in each of those three names, you get G.A.P., and that’s where the renowned R and B music group the Gap Band got its name. They’re from Tulsa.

Black Wall Street was a prime example of the typical Black community in America that did businesses, but it was in an unusual location. You see, at the time, Oklahoma was set aside to be a Black and Indian state. There were over 28 Black townships there. One third of the people who traveled in the terrifying “Trail of Tears” along side the Indians between 1830 to 1842 were Black people.

The citizens of this proposed Indian and Black state chose a Black governor, a treasurer from Kansas named McDade. But the Ku Klux Klan said that if he assumed office that they would kill him within 48 hours. A lot of Blacks owned farmland, and many of them had gone into the oil business. The community was so tight and wealthy because they traded dollars hand-to-hand, and because they were dependent upon one another as a result of the Jim Crow laws.

It was not unusual that if a resident’s home accidentally burned down, it could be rebuilt within a few weeks by neighbors. This was the type of scenario that was going on day- to-day on Black Wall Street. When Blacks intermarried into the Indian culture, some of them received their promised ’40 acres and a mule’ and with that came whatever oil was later found on the properties.

Just to show you how wealthy a lot of Black people were, there was a banker in the neighboring town who had a wife named California Taylor. Her father owned the largest cotton gin west of the Mississippi [River]. When California shopped, she would take a cruise to Paris every three months to have her clothes made.

There was also a man named Mason in nearby Wagner County who had the largest potato farm west of the Mississippi. When he harvested, he would fill 100 boxcars a day. Another brother not far away had the same thing with a spinach farm. The typical family then was five children or more, though the typical farm family would have 10 kids or more who made up the nucleus of the labor.

On Black Wall Street, a lot of global business was conducted. The community flourished from the early 1900s until June 1, 1921. That’s when the largest massacre of non-military Americans in the history of this country took place, and it was lead by the Ku Klux Klan. Imagine walking out of your front door and seeing 1,500 homes being burned. It must have been amazing.

Survivors we interviewed think that the whole thing was planned because during the time that all of this was going on, white families with their children stood around the borders of their community and watched the massacre, the looting and everything–much in the same manner they would watch a lynching.

In my lectures I ask people if they understand where the word “picnic” comes from. It was typical to have a picnic on a Friday evening in Oklahoma. The word was short for “pick a nigger” to lynch. They would lynch a Black male and cut off body parts as souvenirs. This went on every weekend in this country, and it was all across the county. That’s where the term really came from.

Updated: 6-19-2020

Former ‘Black Wall Street’ Aims to Rebuild as Tulsa Comes Into National Spotlight

Historic and entrepreneurial efforts seek to transform Greenwood district nearly 100 years after race massacre.

“Black Wall Street” T-shirts were on display alongside local art and images of Angela Davis, Spike Lee and Toni Morrison at Ricco Wright’s art gallery Thursday, as jazz music played on a set of turntables.

It is a far cry from what the bustling black community of Greenwood, once known as Black Wall Street, was a century ago, before white mobs burned it to the ground and killed hundreds. But the neighborhood, just north of downtown Tulsa, has become part of the new wave of revitalization there as several entities work to reconcile a violent past and build new opportunities.

“For me it was about just bringing art, music and culture here,” said Mr. Wright, whose gallery moved to a new Greenwood location in March. “People are coming to pay their respects to the Black Wall Street pioneers, and those who lost their lives, and those who stayed, in an attempt to rebuild Black Wall Street.”

Tulsa and its violent history have entered the national spotlight. Protesters plan to take to the streets in Tulsa and in cities across the U.S. on Friday to mark Juneteenth, a holiday celebrating the end of slavery, and to demand reform to the American justice system after several killings of African-Americans by police. On Saturday, President Trump is hosting a rally here that officials expect will draw 100,000 people—supporters of the president and those coming to protest him—to this city of 400,000.

Mr. Trump tweeted on Friday: “Any protesters, anarchists, agitators, looters or lowlifes who are going to Oklahoma please understand, you will not be treated like you have been in New York, Seattle, or Minneapolis. It will be a much different scene!” He has previously criticized authorities in those cities for not taking a harder line against the violence and looting that has sometimes accompanied protests since the May 25 killing of George Floyd while in the custody of Minneapolis police.

The details of the 1921 massacre that destroyed Greenwood lay dormant for decades. Now, as the 100th anniversary approaches, the city is finally reckoning with its history of racial violence. A bipartisan contingent of state lawmakers created the 1921 Commission, which is building a history center commemorating the community that once existed and the massacre that destroyed it. It is financially supporting black artists and entrepreneurs and training teachers in how to tell students about its blighted past.

Greenwood, on the north side of Tulsa’s downtown, was once a thriving black business district, nationally known after World War I for its affluent African-American community, according to the Tulsa Historical Society. But in 1921, a young black man was accused of assaulting a white woman in an elevator, sparking a confrontation at the courthouse over his fate.

In response, white mobs destroyed the black neighborhood’s 35 blocks and killed as many as 300 people, historians believe. The rampage was dubbed a riot, which kept insurance companies from having to pay for any of the destroyed buildings, according to the historical society. For decades, even most Tulsa natives knew nothing about what had happened.

“There was always this idea in the back of the black community’s mind that this could happen again, so they didn’t talk about it,” said Phil Armstrong, project director for the 1921 Commission. “And in the white community it was such a black eye, such a stain on Tulsa, that they didn’t acknowledge it.”

Black business owners in Greenwood rebuilt—for a time—until many lost their land again in the 1950s and ’60s to government seizures for interstate construction and other “urban renewal” projects, historians said. The community shifted farther north and its businesses faded away.

A major goal of the 1921 Commission is to promote black homeownership and business ownership in a newly economically charged area, Mr. Armstrong said. “These people were able to rebuild,” he said. “That’s an amazing story. It’s the American story. A story of resilience.”

Dirt has begun moving at the site of the 11,000-square-foot history center, which the commission expects to be finished in time for events next year marking the centennial of the June 1 massacre.

“We wanted it to be unifying for Tulsa,” said state Sen. Kevin Matthews, who spearheaded the commission’s creation in 2015.

When Venita Cooper decided to step away from a career as a school administrator and pursue selling sneakers, which had always been her passion, she found help from all over the place, she said. She attended a Tulsa Economic Development Corp. business-planning course, and was able to receive a low-interest loan. She got training from Black UpStart, which helps develop black entrepreneurs, and she won a pitch contest that granted her $17,500 in startup funding. She met a landlord eager for a concept like hers.

“It was like all these supports came from across the community,” Ms. Cooper said. “The mayor was my first customer.”

Ms. Cooper opened Silhouette Sneakers & Art in Greenwood last year, where it is doing well, despite being only months old when Covid-19 lockdowns forced it to close, she said. A non-native Tulsan, she said learning about the area’s history has been eye-opening.

“But we’re not going to be Black Wall Street as we knew it, 36 blocks of tight black businesses,“ she said. ”There are black entrepreneurs building businesses all across Tulsa.”

Each classroom at the Greenwood Leadership Academy, a nonprofit elementary school in North Tulsa, is named after one of the businesses that once existed on Black Wall Street. The aim is to “drill into students that they come from excellence,” said Jabar Schumate, director of the Met Cares Foundation, which opened the school in 2014.

Brenda Alford, a Tulsa career-safety coordinator, overheard enough conversations as a child to grow up with the vague knowledge that her grandmother once had to hide in a church for her life. But she didn’t find out about the massacre until she was an adult, when a law firm contacted her about a possible lawsuit for reparations.

Her grandparents had been successful African-American entrepreneurs, owners of multiple homes and businesses, including a shoe shop, record shop and chauffeur service. All were burned to the ground as they fled for their lives. Afterward, the family rebuilt and restarted the shoe business, but they never reached the same level of affluence, Ms. Alford said.

“Our families would have liked to promote generational wealth in our families, but we never had that opportunity,” she said. “We lost our economic base.”

The current Greenwood efforts are important for both recognition of the past and the future, Ms. Alford said.

“It’s not a sense of ‘Let’s do it.’ It is ‘Let’s bring it back, because our ancestors did it so well,’ ” she said.

Updated: 6-2-2021

Black Wall Street 3.0

A new crypto wallet, named for a Tulsa neighborhood destroyed by fire 100 years ago, shows how communities of color can build wealth.

One hundred years after a devastating massacre desecrated a thriving black community in Tulsa, Okla.’s Greenwood neighborhood, Hill Harper and his team are reviving the vision of “Black Wall Street” in digital form by creating a Black-owned cryptocurrency exchange and digital wallet.

The initiative aims to increase access to financial education in Black and other communities of color. In the words of Harper, “When we talk about financial literacy, to me it’s about an ecosystem of problems that requires an ecosystem of systemic solutions. We start with financial literacy, we move to financial capacity building, ultimately getting to financial empowerment.”

We are entering a phase of increased collective consciousness but not without a wide wealth gap, institutional racism and proud racists surfacing. We have moved from a place of “racial paranoia” to being jaded by the widespread evidence of prejudice due to the proliferation of social media and other consequences of the Information Age.

This prejudice can be noted in practices of predatory capitalism that target minority communities. “When you really, actually peel back the onion, 90% to 95% of the financial products and services that have historically been offered to Black, brown and marginalized communities have been either predatory on their face or hidden predatory,” Harper told CoinDesk’s Consensus 2021 event last week.

As a community, Black folks have always strived to own and operate both infrastructure and the means of production but have been continually held back by structural inequality and attacks from extremists and the government alike. The Greenwood District, which was burned down 100 years ago this week, was densely populated with Black business owners, which enabled the community to keep money in local circulation.

“There were three pillars in my mind,” said Harper. “Number one was institutional ownership. Pillar number two [was] institutional trust. Pillar number three was the movement of money or capital within the ecosystem.”

At present, a dollar circulates within the Black community for six hours on average before exiting. “I believe,” Hill argues, “if we don’t own our own digital wallets and don’t onboard and educate folks about digital currency and cryptocurrency concurrently, then that dollar will be leaving within six to seven seconds.”

Today, African Americans are among the biggest consumers in the U.S. but are primarily not the owners of infrastructure or rights to intellectual property. Despite being the frontrunners of cultural capital, the arts and innovation, Black folks don’t often participate in ownership or distribution.

The Black Wall Street app hopes to be a safe and trusted place for the Black community to exchange and hold value developed from the ground up. As we enter the Web 3.0 era, the unbanked and underbanked must not be left behind as society moves away from fiat currency.

Hill Harper, an actor who has appeared in “CSI: NY“, “Limitless” and “The Good Doctor,” is a Harvard-educated lawyer who sat in a class with Barack Obama during his time at Harvard Law. The app was engineered by CTO Brian Griffin, while Najah Roberts is the startup’s blockchain expert and chief visionary officer.

As the “great wealth transfer” shifts capital from boomers to their children, the Black community needs to be a part of it. The Black Wall Street App seeks to increase financial literacy among members of the Black community.

The Black Wall Street app is not a get-rich-quick scheme nor will it be exclusive to the Black and brown communities. It will be available to everyone with all getting the added value of using the platform.

“Number one, we’re going to be cheaper than Coinbase, cheaper than Cash App and we’re going to give folks more for their money,” Harper said.

Hill Harper and Najah Roberts are currently on a 30-city financial literacy tour to engage members in the Black community across the country. “We don’t want to set our people up to fail because they’ve been burned so many times,” Harper said.

Cryptocurrencies such as bitcoin can be an effective hedge against inflation given the finite supply of Satoshis and increasing demand. We don’t want a wider wealth gap because underserved communities are not engaged in diversified investments, especially investments that result in increased spending power over time.

Multiplication works better than addition. Strategic investments that compound interest or favorable annual percentage yield (APY) are more effective than saving paper fiat under the mattress or paying the bank to invest your money for their benefit.

Minority groups need to own and curate wealth within their communities. “For too long, particularly in tech, we’ve allowed tech companies to monetize our community,” said Harper. “And our communities are the community that’s made apps like Clubhouse billion-dollar apps [and] apps like Twitter billion-dollar apps, yet we have never owned them. This is an opportunity for us to monetize culture and keep the money circulating within our culture.”

Related Articles:

Annual January 3rd “Proof Of Keys” Celebration Of The Genesis Block! (#GotBitcoin?)

ETFs, Mutual Funds See Sudden And Dramatic Drop In Money Flowing In (#GotBitcoin?)

Trump Administration’s ‘Plunge Protection Team’ Convened Amid Wall Street Rout (#GotBitcoin?)

Crypto Craze Drew Them In; Fraud, In Many Cases, Emptied Their Pockets (#GotBitcoin?)

Meet The Watchdog Called CryptoMom (#GotBitcoin?)

Bitcoin On Facebook, Lite.IM Adds BTC Support For Leading Social Networks (#GotBitcoin?)

Your Questions And Comments Are Greatly Appreciated.

Monty H. & Carolyn A.

Go back

Leave a Reply

You must be logged in to post a comment.