Ultimate Resource For A Spot And/or Futures Bitcoin ETF (#GotBitcoin)

Following another delay on Bitcoin exchange-traded funds (ETFs), asset managers VanEck and SolidX plan to offer a limited version of their Bitcoin ETF to institutional investors. Ultimate Resource For A Spot And/or Futures Bitcoin ETF (#GotBitcoin)

VanEck Securities and SolidX Management want to start selling shares in a limited version of a Bitcoin ETF, using a rule that exempts the shares from securities registration, under which shares can be sold only to certain institutional investors, The Wall Street Journal reported on Sept. 3.

Vaneck, Solidx Bitcoin ETF Launching Sept. 5

According to the report, the investment management firms are planning to start selling on Sept. 5 under the United States Securities and Exchange Commission’s (SEC) Rule 144A, which allows the sale of privately placed securities to “qualified institutional buyers.”

Related:

Ultimate Resource On Hong Kong Vying For World’s Crypto Hub

Petition Calling For Resignation Of U.S. Securities/Exchange Commission Chair Gary Gensler

What Crypto Users Need Know About Gary Gensler’s SEC

Ultimate Resource On Insider Trading (Congress, Senators, Corporate America)

Ultimate Resource On BlockFi, Celsius And Nexo (Including Regulatory Scrutiny From States And The SEC)

Ultimate Resource For Pro-Crypto Lobbying And Non-Profit Organizations

By using the SEC’s exemption, VanEck and Solid will be able to offer shares of their VanEck SolidX Bitcoin Trust to institutions such as banks and hedge funds, but not retail investors, the report notes.

Since VanEck and SolidX Partners requested the SEC to list a Bitcoin ETF in 2018, the regulator has delayed the decision on the matter multiple times, having approved zero Bitcoin ETFs to date.

Related:

Ultimate Resource For Your Crypto Hardware (And Other) Wallets

What Are Lightning Wallets Doing To Help Onboard New Users?

Ultimate Resource On Trezor Hardware Wallets

Next Bitcoin Core Release To Finally Connect Hardware Wallets To Full Nodes

Apple Announces CryptoKit, Achieve A Level of Security Similar To Hardware Wallets

Introducing BTCPay Vault – Use Any Hardware Wallet With BTCPay And Its Full Node

Bitcoin Dev Reveals Multisig UI Teaser For Hardware Wallets, Full Nodes

On Aug. 12, the SEC again delayed its decision on three Bitcoin ETFs, including VanEck SolidX, Bitwise Asset Management and Wilshire Phoenix.

VanEck’s New Bitcoin Trust Assets Total Just $41K In First Week

Investment management firm VanEck has issued just 4 Bitcoins (BTC) via its new trust focused on institutional investors.

VanEck: One Week, One Bitcoin Basket

Data from the company, spotted by economist and cryptocurrency commentator Alex Krüger on Sept. 10, showed that since its launch at the start of the month, VanEck SolidX Bitcoin Trust 144A Shares total net assets are only $41,400.

The product, which caused a buzz after VanEck described it as being akin to an exchange-traded fund (ETF), caters strictly to so-called qualified institutional buyers, or QIBs.

“VanEck SolidX Bitcoin Trust 144A Shares… looks and feels like a traditional ETF,” its official description reads.

Critics reacted coyly after news of the unveiling hit, with industry lawyer, Jake Chervinsky, arguing the product did not represent a legal ETF, something which remains outlawed by United States regulators.

“This is misleading. The VanEck SolidX Bitcoin Trust is *not* an ETF. It looks exactly like the Grayscale Bitcoin Trust, which was launched almost six years ago,” he warned Twitter followers at the time.

VanEck Had “A Bad Launch”

Now, the Trust’s slow progress at gaining traction has seen the lack of confidence continue. For Krüger, it has become proof that institutional investors do not want such limited Bitcoin-related instruments.

“This trust is just a bad launch of a product for which there’s not much demand,” he summarized.

October will see regulators deliver a final judgement on whether two ETFs can begin trading, one of which is sponsored by VanEck.

“I believe the Bitcoin ecosystem is slowly maturing toward supporting institutional quality products,” the company’s digital asset strategist and director, Gabor Gurbacs, said in comments on the events on Monday.

On Monday, institutional trading platform Bakkt announced its warehouse for physically-delivered Bitcoin futures was now active, having opened for deposits last week.

Updated: 10-9-2019

US SEC Rejects Bitwise Bitcoin ETF Proposal

The United States Securities and Exchange Commission (SEC) has rejected a proposal to list a Bitcoin (BTC) exchange-traded fund (ETF).

In an announcement on Oct. 9, the Commission stated that the ETF filing from Bitwise Asset Management and NYSE Arca did not meet the necessary requirements.

Specifically, regulators stated that the applicants did not meet the necessary requirements regarding possible market manipulation and illicit activities. The SEC wrote:

“Rather, theCommission is disapproving this proposed rule change because, as discussed below, NYSE Arcahas not met its burden under the Exchange Act and the Commission’s Rules of Practice to demonstrate that its proposal is consistent with the requirements of Exchange Act Section6(b)(5), and, in particular, the requirement that the rules of a national securities exchange be designed to prevent fraudulent and manipulative acts and practices.'”

Bitcoin ETF “closer than ever?”

Today’s decision by the SEC seems to fly in the face of recent comments from Matt Hougan, managing director and global head of research at Bitwise, who on CNBC on Oct. 7 said, “We’re closer than we’ve ever been before to getting a Bitcoin ETF approved.”

Hougan had been optimistic about the firm’s chances to land approval for a physically-held Bitcoin ETF. He noted the significant growth that has transpired in the crypto space in recent years, stating:

“Two years ago, there were no regulated, insured custodians in the Bitcoin market. Today, … there are big names like Fidelity and CoinBase [with] hundreds of millions of dollars of insurance from firms like Lloyd’s of London.”

The rejection of Bitwise’s proposal follows a circuitous series of delays and requests for comment from the SEC. In August, the regulator postponed its decision on the proposal — together with two other crypto ETF applications — until Oct. 13.

Bitwise initially filed its application for a rule change to U.S. securities laws in January.

Crypto Market Hardly Needs A Bitcoin ETF At This Time, Says BKCM CEO

Founder and CEO of crypto investment firm BKCM Brian Kelly has said that Bitcoin (BTC) exchange-traded funds (ETF) are hardly needed for the ecosystem’s development, given that the coin is already available on regulated platforms such as Fidelity and TD Ameritrade.

Kelly made his remarks during an interview with CNBC published on Oct. 11, explaining:

“You have companies like Fidelity and TD Ameritrade starting to push into this space.

So ultimately you’re going to be able to buy Bitcoin in a regular brokerage account, or it’s going to look like a regular brokerage account. So I’m less concerned that you need a bitcoin ETF at this point in time.”

He also pointed out that the United States Commodity Futures Trading Commission’s (CFTC) decision to define Ethereum as a commodity made a significant impact on the space, adding:

“The CFTC saying that Ethereum is a commodity is huge for the space. It gives us regulatory clarity. […] That opens the door for institutions to come in. […] Everybody is concerned, what if they ban it? […] The CFTC said ‘we’re not banning it yet, we’re gonna regulate it,’ and now investors can say ‘Put them in my commodity bucket.’”

General Hope For The Market

In May, Kelly has also said that the upcoming supply cut — brought by the next halving of the block reward — could help Bitcoin prices rise further in the coming months.

As Cointelegraph reported on Oct. 9, the United States Securities and Exchange Commission rejected Bitwise Asset Management’s proposal to list a Bitcoin ETF.

Updated: 10-23-2019

New Bitcoin ETF Proposal Filed With SEC by Gold Fund Veteran

Delaware-based asset manager Kryptoin Investment Advisors applied with the United States Securities and Exchange Commission (SEC) to launch a Bitcoin (BTC) Exchange Traded Fund (ETF) on Oct. 15.

A Bitcoin ETF On The New York Stock Exchange

According to the filing document published by the SEC, the Kryptoin Bitcoin ETF Trust is meant to be traded on the New York Stock Exchange Arca. Notably, the ETF product is designed:

“[…] To provide exposure to bitcoin at a price that is reflective of the actual bitcoin market where investors can purchase and sell Bitcoin, less the expenses of the Trust’s operations.”

The company plans to hold Bitcoin and value the shares of the trust according to the Chicago Mercantile Exchange Bitcoin Reference Rate. The cryptocurrency will be held at an unspecified third-party insured custodian that is also regulated under the Investment Advisers Act of 1940.

The SEC filing also details that the Trust will hold Bitcoin “in seeking to ensure that the price of the Trust’s shares is reflective of the actual bitcoin market.”

However, the Trust will not purchase or sell bitcoin directly but will acquire it via shares called “baskets.” The report continues:

“Instead, when it sells or redeems its Shares, it will do so in ‘in-kind’ transactions in blocks of 100,000 Shares called ‘Baskets’ at the Trust’s net asset value (‘NAV’). Only Authorized Purchasers may purchase or redeem Shares with the Trust, and they will do so by delivering bitcoin to the Trust in exchange for Shares when they purchase Shares.”

A Notable Executive

Another notable detail is that the head of exchange-traded product at Kryptoin is Jason Toussaint, former managing director at the World Gold Council and ex asset manager of SPDR Gold Shares, one of the largest Gold ETFs in the world.

Meanwhile, the race to launch the first regulated Bitcoin ETF is becoming increasingly competitive.

Earlier this month, documents revealed that the Wilshire Phoenix Fund has updated its own Bitcoin ETF proposal filed with the SEC. Also this month, asset manager Bitwise alongside NYSE Arca confirmed the intention to refile their application for a Bitcoin ETF after the latest SEC rejection.

Updated: 11-5-2019

The SEC Does Not Want Crypto ETFs — What Will It Take to Get Approval?

October has been a busy month in the race to register the first crypto exchange-traded fund compliant with the requirements of United States regulators. Following the Chicago Board Options Exchange withdrawing its proposal for VanEck/SolidX Bitcoin ETF earlier in September, the ETF filing from Bitwise Asset Management and NYSE Arca was turned down by the Securities and Exchange Commission on Oct. 9. The regulatory authority remained unconvinced of the applicants’ ability to prevent manipulative practices to the extent required by a national securities exchange.

For a brief moment, the only standing Bitcoin ETF application has been a bid by the investment management firm Wilshire Phoenix — a proposal that its sponsors amended in early October to include updated custody rules. It wasn’t too long, however, before a new contender entered the race.

Investment management firm Kryptoin Investment Advisors, with the former World Gold Council executive Jason Toussaint at the helm of the effort, turned in an initial registration statement to the SEC for a Bitcoin ETF. This latest submission may prove to be the latest in a series of fruitful attempts to convince the regulator to accept an ETF — or will it? What will it take for the commission to finally give the go-ahead for a crypto ETF, and is the new proposal up to par?

The New Gold

The new proposal’s sponsor, Kryptoin Investment Advisors LLC, is a Delaware-domiciled subsidiary of the fintech company Kryptoin ETF Systems, which is registered in the Cayman Islands. The firm specializes in developing AI-driven products for crypto financial markets.

Donnie Kim is the firm’s founder and CEO, while Toussaint — an industry veteran with more than 20 years of experience with exchange-traded instruments — holds the position of head of exchange-traded products at Kryptoin Investment Advisors.

As CEO of World Gold Trust Services, Toussaint was instrumental in the creation of one of the first commodity-based ETFs — the SPDR Gold Shares (GLD), which was first listed on the New York Stock Exchange in November 2004 and had once been the world’s largest ETF.

Toussaint’s involvement with gold-backed financial instruments is no coincidence as far as his new assignment goes. In serving as assets underlying ETFs, both Bitcoin (BTC) and gold differ from stocks of publicly traded companies, as they place additional regulatory scrutiny in terms of price discovery on the spot exchanges where they are traded. Indeed, the regulatory challenges faced by ETFs backed by gold and Bitcoin are in many ways similar: In both cases, the SEC first wants to get a solid grasp of what is going on in the underlying markets.

What The SEC Wants

One of the regulator’s major concerns when evaluating new commodity-based ETFs is establishing whether the underlying market is resistant to manipulation, in accordance with Section 6(b)(5) of the Securities Exchange Act. So far, no proposal filed with the SEC has been able to demonstrate such in regard to Bitcoin markets.

Yet, the act outlines an alternative route by which an ETF can win approval: Showing that the listing exchange has entered a “comprehensive surveillance-sharing agreement with a regulated market of significant size.”

Such agreements between exchanges and underlying markets — by facilitating the exchange of granular trading data — are supposed to provide additional transparency and enable regulators to investigate suspicious trading behavior should the need arise.

In the 122-page order disapproving the Bitwise application, the SEC commissioners deemed that the evidence brought by the proposal’s sponsor insufficiently supported the claim that the “real” spot market for Bitcoin, when “fake and/or non-economic data is removed,” is sufficiently resistant to manipulation.

Demonstrating that a “surveillance-sharing agreement with a regulated market of significant size” exists is a heavy burden as well. Even if there is an arrangement in place, the sponsor has to convince the regulator that the entity on the other side of it qualifies as a “significant, regulated market.”

In the Bitwise case, NYSE Arca — the proposal’s sponsor — tried to leverage the respectability of Bitcoin futures traded on the Chicago Mercantile Exchange, yet failed to show that the market was “significant.”

The Kryptoin Investment Advisors’ hope to clear this hurdle rests with using the CME CF Bitcoin Reference Rate, which captures transaction information from five major trading platforms: Bitstamp, Coinbase Pro, itBit, Kraken and Gemini. The applicants argue that this aggregated index “provides an accurate reference to the average spot price of Bitcoin,” and is more resistant to manipulation than other measurement strategies.

What Are The Odds?

Most of the crypto finance professionals who have spoken to Cointelegraph on the matter were skeptical that any of Bitcoin ETF’s short-term prospects would win the SEC’s approval. However, many sounded more optimistic when talking about medium to long-term prospects. Michael Ou, CEO of the fintech security firm CoolBitX, expects that the latest proposal will share the fate of its predecessors:

“It would seem that the cryptocurrency industry just doesn’t meet the SEC’s expectations of a well-behaved and well-regulated industry. This comes as no real surprise, as previously unregulated — and sometimes still unregulated —exchanges have been seen to be influential in manipulating market prices within the cryptocurrency sector.”

Charles Lu, CEO of the confidential ledger protocol Findora, also noted issues with price manipulation at the hands of exchange platforms:

“Though Bitwise is well known for analyzing ‘real’ exchange volume, the SEC noted that many of the exchanges used by the proposed Bitwise ETF are not regulated in the US. For instance, Binance, the largest platform identified by Bitwise as real, with 39% of the ‘real’ volume, is not registered with either FinCEN or NYSDFS.”

Christophe de Courson, co-founder and CEO of crypto investment firm Olymp Capital, mentioned unregulated exchanges as a major hurdle as well, adding insufficient liquidity to the list of concerns:

“Firstly, there is not enough liquidity on spot and derivative markets for institutional-grade investors to enter. This comes with a high level of volatility, making it difficult to manage in a portfolio. Secondly, operating in this market comes hand in hand with a lot of regulatory issues and unregulated cryptocurrency exchanges operating outside the US also play a crucial role in Bitcoin price movements.”

As such, it appears that there is no single most important component to ensuring a successful crypto ETF. In addition to the points already raised, experts note that custody is an important precursor for any of the regulated crypto-based financial instruments, as evidenced, for example, by the Bakkt futures saga. Tyler Gallagher, CEO of investment firm Regal Assets, observed that there are three key pieces that must be in place before the first ETF is approved:

“A regulated market for reliable pricing, proper market surveillance of exchanges to avoid market manipulation, and exceptional qualified custodians to ensure proper security and storage of the assets. The market has matured significantly over the past few years and is reaching a tipping point that should allow investors to see the approval of a Crypto ETF as early as next year.”

Others believe that the progress on the Bitcoin ETF front will be commensurate with general regulatory advancements of the crypto industry. Nick Cowan, Managing Director and Founder of the Gibraltar Stock Exchange Group, commented:

“Approval stems from a combination of two factors; time and understanding. Once the regulator has gotten to grips with the realities of this newly emerging asset class, only then will they become comfortable allowing such products into the market. This process will likely be a protracted one.”

Tara Bogard, senior vice president of business development at the independent qualified custodian Kingdom Trust, said that it can take some time for an ETF to be approved, since, “Before the SEC can or will approve a crypto ETF, the need to first focus on generalized cryptocurrency regulation is necessary.”

With regard to the realistic timeline for the first crypto ETF approval, Lu is doubtful that the process will be expeditious: “For a bitcoin ETF proposal to gain SEC approval, the sponsor will need to prove that real price discovery is happening as opposed to market manipulation.” Lu does not believe this will happen in the near future, adding:

“The SEC will require surveillance-sharing agreements with significant cryptocurrency exchanges — a requirement that few foreign-domiciled exchanges will agree to.”

The general sentiment among industry professionals seems to be that of reserved optimism: Hardly anyone expects a breakthrough to occur very soon, yet most admit that it is only a matter of time.

It could be the Kryptoin Investment Advisors’ proposal that will blaze the trail for crypto ETFs, or perhaps another one that is yet to be filed — at some point, the crypto industry will get its coveted prize, but not just yet.

Updated: 11-8-2019

The SEC Has Rejected Every Bitcoin ETF. This Firm Thinks It Has a Solution

One company thinks it knows how to get a bitcoin exchange-traded fund (ETF) approved by U.S. regulators.

Wilshire Phoenix, a relatively young financial firm in New York, filed to launch the United States Bitcoin & Treasury Investment Trust ETF in May with NYSE Arca. At that point, a dozen bitcoin ETF proposals had already been swatted down by the U.S. Securities and Exchange Commission (SEC) – including nine in one day. But unlike other ETF applications, Wilshire Phoenix’s ETF will invest in both bitcoin and U.S. Treasury securities, commonly referred to as T-bills.

The SEC is currently reviewing the application.

“Our proposed bitcoin-related ETF is quite different from those that have previously been submitted to the Commission for approval,” Wilshire Phoenix founder and managing partner William Herrmann said in a phone interview. “To name just a few distinctions, the composition of the Trust is very different. Our Trust is a multi-asset trust (bitcoin and T-Bills), as opposed to just bitcoin.”

The SEC has long been hesitant to approve an ETF with exposure to digital assets, citing the market’s relatively young age and the possible risks to investors. The agency has rejected a number of proposals, while other applicants have proactively withdrawn their filings.

Herrmann says the Wilshire ETF has several mechanisms to address these concerns.

The Trust itself will automatically rebalance itself monthly to address possible concerns about bitcoin’s price volatility, Herrmann explained. Essentially, if bitcoin’s price volatility increases, the index will reduce its exposure to the cryptocurrency and instead increase its exposure to Treasury bills. As bitcoin’s volatility falls, the opposite occurs.

The weighting will be transparent, with the index being shown on Bloomberg and Thomson Reuters portals, he said.

The CME’s Bitcoin Reference Rate will provide the data for bitcoin’s price in the Trust, rather than use an in-house price method “or one from any related party,” he added.

Wilshire Phoenix is also hoping to address SEC concerns about market manipulation by using a surveillance sharing agreement, one component the regulator stressed was needed when rejecting a recent bitcoin ETF application. Herrmann said:

“The CME has surveillance sharing agreements with both the CME futures market as well as the relevant portion of the spot market that forms the basis for the Trust’s bitcoin values. This addresses the SEC concerns about the lack of surveillance sharing agreements with the relevant spot market, which is something previous applicants have not been able to address.”

Most recently, the SEC denied Bitwise Asset Management’s fund. In a whopping 112-page order published Oct. 9, the regulator said surveillance-sharing agreements were necessary and market manipulation remains a real concern.

As recently as September, SEC Chairman Jay Clayton said that while progress has been made in the space, the market manipulation question had not been resolved.

For Wilshire Phoenix’s proposal, the SEC began accepting comments on the proposal in June, though a final decision is still months away. The agency is currently accepting comments on the proposal through Nov. 12, 2019.

Herrmann is optimistic about the ETF proposal’s chances, saying “we developed the ETF consistent with investor protection as well as fair, orderly and efficient markets.”

Updated: 12-21-2019

SEC Punts Decision On Wilshire Phoenix’s Bitcoin ETF Proposal To February

The Securities and Exchange Commission (SEC) has postponed making a decision on a bitcoin and U.S. Treasury bond exchange-traded fund (ETF) proposal filed by Wilshire Phoenix.

According to a document published Friday, the SEC will continue evaluating the proposal, which was first filed earlier this summer, setting Feb. 26, 2020 as its next decision date to approve or reject the ETF proposal.

The securities regulator has been loathe to approve any bitcoin ETF, rejecting more than a dozen in the last two years. The agency has pointed to concerns about market manipulation and surveillance sharing as two areas it would like to see bolstered before it would approve an ETF.

Wilshire Phoenix believes it has found a way to address these concerns. In an interview with CoinDesk in November, Wilshire founder and managing partner William Herrmann said the fact that his company’s proposal, filed with NYSE Arca, is a multi-asset trust protects it against bitcoin’s price volatility.

Should volatility increase, the trust will automatically rebalance itself to decrease its bitcoin exposure and increase its exposure to the Treasury bills. As volatility falls, so too does the Treasury bill exposure.

The company filed a comment letter on Dec. 18 in an attempt to further assuage these concerns. Herrmann told CoinDesk Friday that the letter “addresses how the [exchange-traded product] is structurally and fundamentally different from prior bitcoin-related ETP applications.”

“The comment goes on to show how the two markets that are relevant to the Trust – referred to by the Commission as the ‘regulated markets of significant size’ – are the CME bitcoin futures market and the spot market composed of the five constituent exchanges from which pricing for the CME CF BRR is determined,” he said.

The five exchanges include Coinbase, Kraken, itBit, Bitstamp and Gemini, and they represent the majority of the bitcoin-U.S. dollar market, he said. The exchanges also have surveillance-sharing agreements with the CME and CF Benchmarks, the reference rate’s administrator.

It remains unclear whether the SEC will approve any bitcoin ETF in the near-term. The most recent rejection, when the SEC denied Bitwise Asset Management’s latest bid, reiterated the agency’s concerns.

The SEC Commissioners are reviewing that rejection, though it is unclear when they might reach a decision.

Updated: 12-30-2020

VanEck Proposes ETF For Bitcoin, Once Again

As 2020 draws to a close, one of the prior proponents for an exchange-traded fund (ETF) based on bitcoin is trying again: VanEck has submitted an application to the U.S. Securities and Exchange Commission (SEC) for a “VanEck Bitcoin Trust.”

An ETF is seen as advantageous because it trades on the stock market in much the same way as shares in popular companies such as Apple and Microsoft.

VanEck has previously proposed ETFs, withdrawing its most recent application in September 2019. At the time the company said it remained committed to an exchange-traded product.

As it has in previous applications, VanEck said this ETF would trade on the Cboe BZX Exchange.

So far the SEC has considered many applications for bitcoin-based ETFs and rejected them all. In August 2018, it rejected nine such proposals on the same day.

In October, SEC Chairman Jay Clayton said the agency was still open to considering ETF proposals.

Chairman Clayton stepped down officially last week. Dalia Blass, the director of the division of investment management, will also end her tenure in January, according to the agency. Blass was the author of a 2018 letter within the SEC expressing concerns the bitcoin (BTC, +3.36%) market was not large enough or liquid enough to be ready for an exchange-traded product.

According to the application, the number of the outstanding shares will depend on how much BTC is delivered to the Trust and held by an as yet undesignated custodian.

Updated: 1-22-2021

VanEck Files With SEC For ETF That Tracks Crypto Companies’ Performance

VanEck has filed with the SEC to launch the Digital Assets ETF related to the performance of top cryptocurrency companies.

VanEck, a major American investment management firm, is making another attempt to launch a digital asset-related exchange-traded fund, or ETF.

According to a Jan. 21 filing with the United States Securities and Exchange Commission, VanEck’s new ETF is called the Digital Assets ETF. The new fund would track the price and performance of the Global Digital Assets Equity Index run by its subsidiary MV Index Solutions.

According to the document, the new Digital Assets ETF “normally invests” at least 80% of its total assets in securities that comprise the Fund’s benchmark index. The index tracks the performance of the digital assets segment.

VanEck elaborated that digital asset companies refer to companies that operate digital asset exchanges, payment gateways, mining operations, software, equipment and technology or services to the digital asset industry, and others.

In order to be initially eligible for inclusion in the index, a company must generate at least 50% of its revenues from digital assets projects or projects having the potential to generate such revenues, the filing reads.

“Companies with less than 50% of their revenues from the global digital assets segment, including semiconductor and online money transfer companies, may be added to the Index to reach a minimum component number,” VanEck noted.

VanEck is famous for being the first company to file for a Bitcoin (BTC) ETF in the United States. After several failed attempts, VanEck filed a new Bitcoin ETF application on Dec. 31, 2020. As reported by Cointelegraph, VanEck is facing a lawsuit from blockchain firm and former-partner SolidX over its latest BTC ETF for alleged plagiarism.

Updated: 1-22-2021

Five Reasons The SEC Should Approve Bitcoin ETFs

The evidence shows that investors would prefer to invest in cryptocurrencies through an exchange-traded fund.

If President Joe Biden’s nomination of Gary Gensler to lead the Securities and Exchange Commission is confirmed, Gensler should act swiftly to get the agency’s staff moving toward approving a Bitcoin exchange-traded fund, showing that the U.S. not only understands cryptocurrencies but is looking to protect investors and put the country on a level playing field with the rest of the world. This move is long past due.

The SEC is seen as dragging its feet unnecessarily on the issue of approving ETFs that focus on cryptocurrencies. An informal Twitter poll I recently conducted found that almost 80% of the 2,192 people who responded believe the SEC should approve a bitcoin ETF. About 50% would invest in one. I’ve been doing these polls for years and this is the highest by far in favor of approval.

My poll lines up nicely with a Bitwise survey of financial advisors. In that one, 63% of respondents said an ETF was the preferred vehicle to invest in Bitcoin, compared with 16% for directly owning the digital coin and 10% for a mutual fund. People say this not as crypto advocates but as fans and users of the very durable and efficient ETF structure. They would feel the same way if the SEC denied a gold ETF or a China A-share ETF, both of which are great examples of ETFs breaking new ground and successfully democratizing a unique asset class.

Here Are Five Reasons The Sec Should Approve An ETF:

The Premium in Grayscale Bitcoin Investment Trust is Dangerous: Those seeking a U.S.-based investment vehicle for the digital currency are generally left with a bunch of OTC-traded trusts similar to closed-end funds but without the crucial share creation or redemption process offered by an ETF – a feature that allows for arbitrage.

The most popular is the Grayscale Bitcoin Investment Trust, which has grown from $2 billion to more than $20 billion in assets over the last year. If Grayscale was an ETF, it would rank about 50th in size, putting it in the top 2% of all ETFs.

Those that bought shares of the trust over the last year paid an average premium of about 18% more than the value of Bitcoin — and that’s on the low side of where it has traded historically. The premium has been as high as 132% and as low as 3% in recent years.

In an ETF, investors know they are getting a price that is going to be very close to the underlying asset.

Of course, a Bitcoin ETF would also likely trade at premium, but it would be microscopic compared with where Grayscale trades. It also would not be subject to artificial forces that tend to push the price of Grayscale’s shares lower even if the price of Bitcoin is rising and vice-versa. History shows us that the premium in an ETF would steadily shrink as more and more professional market-makers get involved.

They’ve Worked Fine in Europe: More than 20 cryptocurrency ETFs already exist outside the U.S., mostly in Europe. Exchange-traded notes such as the Bitcoin Tracker EUR introduced in Sweden over five years ago have typically trade at miniscule premiums thanks to the arbitrage allowed by the share creation/redemption process.

Although a U.S. Bitcoin ETF would be a much bigger deal in terms of volume and assets, it would effectively work the same.

And although the premiums and discounts to net asset values are wider than most equity ETFs, they are pretty tight all around and much tighter than Grayscale and the like.

The steep run up – and then down – in Bitcoin prices provided a case study in how a U.S. Bitcoin ETF would react to such sharp moves. Looking at the lot of ETFs and ETNs in Europe, most ended Jan. 11 (following a two-day 17.6% plunge in Bitcoin) at a 3% to 4% discount to net asset value. Clearly, the “arbitrage band” was stretched but it didn’t break. Those who wanted to exit, could. Put that in the U.S. with the biggest and best market makers and my guess is that the discount would have been half as much.

There Are Plenty More Volatile ETFs: Although there’s no precedent for an ETF tracking a digital asset, the SEC has approved vehicles that are arguably more dangerous in terms of volatility. There are about 70 ETFs that are more volatile than Bitcoin.

For example, an ETF approved and launched less than a year ago, the Direxion Daily S&P 500 High Beta Bear 3X Shares ETF, has a 60-day standard deviation between 100% and 200% – depending on the month – while the Swedish Bitcoin ETN is between 25% and 100%.

It Would Be Obvious What It Is: The risks of a Bitcoin ETF are obvious to average investors, as most have at least some knowledge of cryptocurrencies as being new, alternative and volatile. That suggests it would be less apt to result in a nasty surprise for unknowing investors, which has happened in the past with certain ETFs.

One example is the United States Oil ETF, which is akin to a wolf in sheep’s clothing: It has a vanilla name and looks pretty innocent, but it holds futures contracts and most don’t understand how big the costs of “rolling” those contracts can get.

Second, the broader Bitcoin market, which the SEC has said is prone to manipulation and fraud, is becoming more efficient with bigger institutions participating. If anything, having an ETF will speed this along and further help transparency and foster better surveillance of crypto exchanges as they’d compete to attract professional market makers.

No Worries About Remembering Password : One reason why investors love ETFs is because they are convenient. Any individual investor could replicate any ETF — they literally tell you what they hold every day – and save the expense ratio, but most investors want the convenience.

As an added bonus, investors don’t have to worry about losing passwords to digital wallets; they just need to be able to log into a brokerage account.

And please don’t ask me about the 4.6% that don’t think the SEC should approve a bitcoin ETF but would invest in one if they did. That’s a special kind of person.

Updated: 1-23-2021

The Race Is On Yet Again For Crypto ETFS As Valkyrie Files Registration

Multiple institutions are yet again lining up to offer crypto ETFs, but will the SEC overcome its historical reticence?

In a move that may give seasoned investors flashbacks to 2018, Valkyrie Digital Assets is the latest asset management firm to file a registration with the SEC to form a Bitcoin ETF — a bid that joins a crowded field of prospective fund managers looking to capitalize on renewed retail interest in cryptocurrencies.

Filed on Friday, the Texas-based family investment fund proposed listing the Valkyrie Bitcoin Trust on the New York Stock Exchange. The application did not include a possible trading ticker.

If history is any indication, however, the filing’s chances of leading to a tradable fund are slim. During the last Bitcoin bull run, multiple firms attempted to throw their hat into the ring as at least nine entities filed proposals for a Bitcoin ETF with the SEC, including ETF giants VanEck and Direxion, as well as Gemini, the crypto services firm formed by Cameron and Tyler Winklevoss.

In a previous interview with Cointelegraph, Kryptoin CEO Donnie Kim, whose firm filed for an ETF in October of 2019, says that the SEC has long been hesitant to move forward with proposals.

“At this moment in time the commission is listening and learning about this new asset class and they are in a holding pattern, partly to understand the consequences of the existing products on the market and partly to look for further guidance under the current political landscape,” said Kim.

Despite the commission’s historical reticence, as retail interest in cryptocurrency booms fund managers are once again clamoring to be the first to offer an ETF product.

On Thursday, Jan. 21 gold ETF giant VanEck — which was the first company to ever file for a Bitcoin fund — filed to form a Digital Assets ETF, which would track the performance of the Global Digital Assets Equity Index made up of crypto service companies.

While American ETFs have been hard to come by, other exchange-traded products are flourishing. Options for traders include a Swiss Bitcoin ETP, a bevvy of Grayscale products that may be expanding to include Chainlink in the coming months, and an Ethereum ETF in Canada that proved so popular trading had to be halted in its debut.

Updated: 2-3-2021

Crypto Hedge Fund Refutes JPMorgan’s Claim That Bitcoin ETF Is Short-Term Negative For BTC

Research from Tyr Capital Arbitrage SP refutes JPMorgan’s claim that a Bitcoin ETF holds negative connotations for BTC’s price.

Strategists at JPMorgan Chase caused quite the stir in January when they informed clients that the approval of a Bitcoin (BTC) exchange-traded fund, or ETF, would be a short-term headwind for the digital asset. A United Kingdom-based cryptocurrency hedge fund manager is attempting to pour cold water on those claims, asserting that JPMorgan’s analysis isn’t based on quantitative analysis or in-depth research.

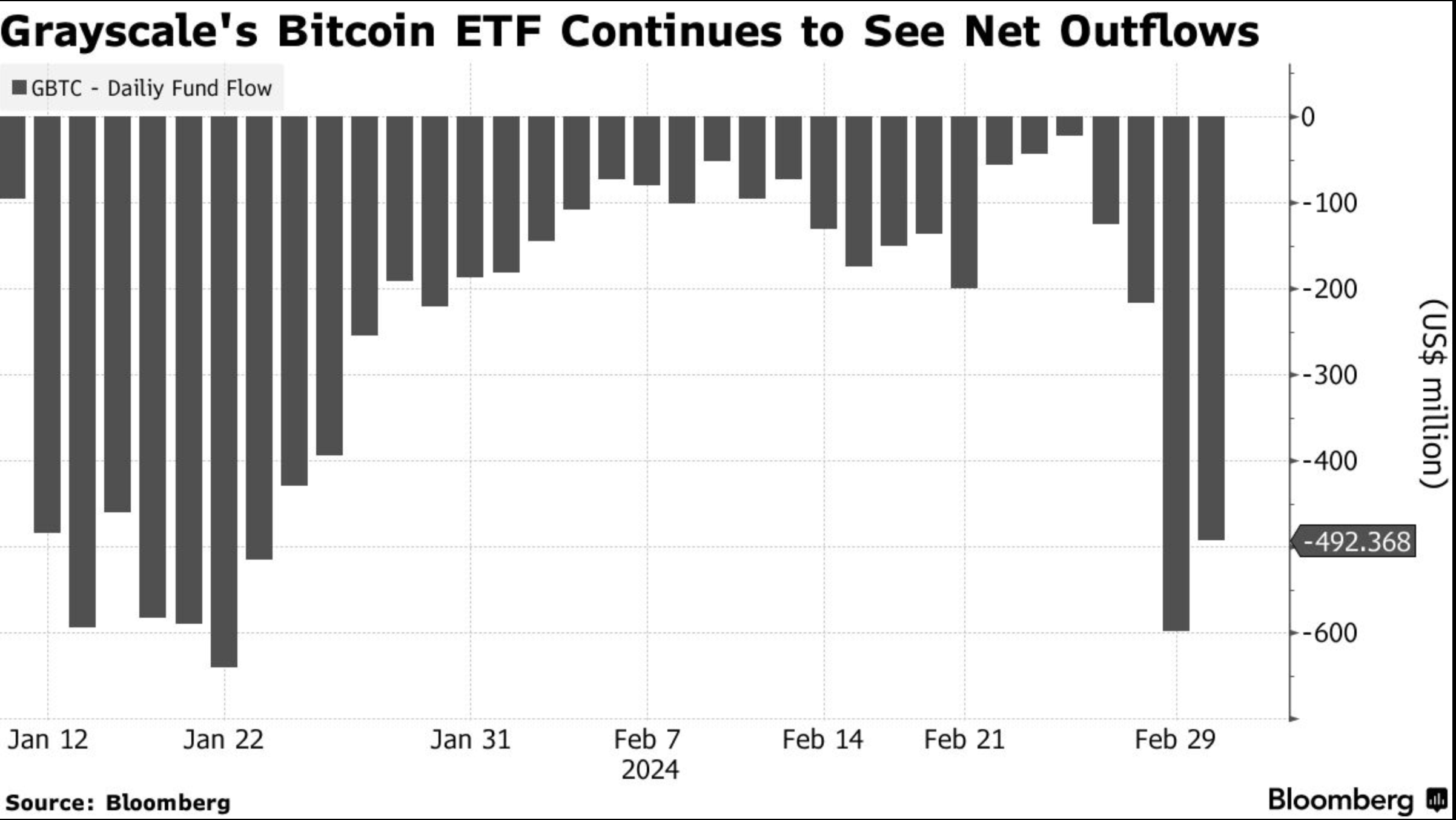

The crux of JPMorgan’s argument is that a new institutional-grade ETF would introduce competition for Grayscale Bitcoin Trust, or GBTC, which has amassed over $22 billion in assets under management. The bank’s strategists say that the new ETF could lead to a cascade of GBTC outflows and cut into the premium.

GBTC boasts a large premium over Bitcoin largely because of its dominant position in the market. Institutional investors that want exposure to the digital asset without having to buy it outright have few options outside of GBTC.

Tyr Capital Arbitrage SP has completed a detailed refutation to JPMorgan’s claims. The fund manager told Cointelegraph: “We disagree with the JPM assessment” on grounds that there is no evidence suggesting that a decrease in the GBTC premium will lead to negative short-term returns for BTC.

“Instead we found evidence of the opposite, namely a decrease in the GBTC Premium tends to be followed by short term gains in Bitcoin,” Tyr says in its yet-to-be-released report.

The Report Continues:

“We found no evidence that supply originating from the ‘new’ shareholders affects the premium in any meaningful way. […] We found, instead, evidence that supply originating from existing or ‘old’ shareholders is negatively affecting the premium (effectively ‘front running’ or discounting the effect the ‘new’ shareholders will eventually have).”

Nick Metzidakis, Tyr Capital’s research lead, told Cointelegraph that his analysis of GBTC’s premium history over the past five years suggests that a “decrease in the premium has a positive impact on Bitcoin.”

As for Grayscale Bitcoin Trust, Metzidakis said that increased competition may affect its market share but that its assets under management will likely continue to rise as more investors allocate to Bitcoin.

Despite rumblings to the contrary, Metzidakis doesn’t believe the United States Securities and Exchange Commission will greenlight a Bitcoin ETF this year. That being said, the growth of crypto as an asset class “may encourage regulators to fast track their acceptance of a Bitcoin ETF as they are motivated to provide a safe and controlled point of access” to the new asset class.

He Continued:

“Institutional adoption of Bitcoin can only be positive for the price of Bitcoin in the long run yet it may increase its correlation to other asset classes. That would especially be the case in times of crisis.”

Updated: 2-8-2021

Bitwise Files Intent With SEC To Launch ‘Crypto Innovators ETF’

A recent SEC filing by Bitwise reveals plans to launch a new crypto innovators fund.

Bitwise, one of the world’s largest cryptocurrency fund managers, has filed a new prospectus with the United States Securities and Exchange Commission, or SEC, to launch an exchange-traded fund for so-called “crypto innovators.”

The fund manager filed Form N-1A with the securities regulator on Feb. 5, where it outlined its intent to offer the Bitwise Crypto Innovators ETF. The proposed ETF will track the performance of the Bitwise Crypto Innovators Index.

The proposed Index will be comprised primarily of companies that derive more than 75% of their revenue from the crypto sector or that have more than 75% of their net assets held in cryptocurrency. The remainder includes large-cap companies that have a “dedicated business initiative” focused on crypto.

According to the prospectus, crypto innovators include digital trading platforms, custodians and wallets; financial service providers leveraging crypto assets or blockchain technology; financial institutions serving clients involved in the digital asset space; and blockchain infrastructure service providers.

The Document States:

“The term “Crypto Innovators” generally refers to companies that service and transact in the segment of the economy dealing with crypto assets and distributed ledger technology.”

Notably, the proposed ETF will not invest in crypto assets directly or through derivatives. The fund will also avoid any dealings with initial coin offerings.

For years, Bitwise has been at the forefront of the crypto ETF debate. In Jan 2020, the fund manager shelved its long-standing Bitcoin ETF application, following a similar move from VanEck. At the time, Bitwise told Cointelegraph that it plans to re-file the application “at an appropriate time.”

That time could be approaching as more institutions hop on board the Bitcoin bandwagon. The digital asset has been in rally mode for months thanks to a new wave of corporate and institutional buyers. On Monday, Tesla confirmed that it had allocated a large portion of its balance sheet to BTC, becoming perhaps the most high-profile buyer in history.

Updated: 2-10-2021

Why A U.S. Bitcoin ETF Could Be A Real Thing In 2021

Looking for the adrenaline rush of investing in Bitcoin but without the bother of crypto-exchanges and digital wallets? An exchange-traded fund might appeal, except an investor won’t find one tracking Bitcoin in the $5.8 trillion U.S. ETF universe — at least not yet.

While exchange-traded crypto-tracking products exist in Europe, U.S. regulators have repeatedly batted down attempts to introduce them citing concerns about potential manipulation and thin liquidity. Yet with the world’s largest digital coin rallying to new heights and a change of leadership at the Securities and Exchange Commission, the prospect of a first U.S. Bitcoin ETF appears to be rising.

1. What Would A Bitcoin ETF Look Like?

ETFs are part of a broader family known as exchange-traded products, though people frequently use “ETFs” to refer to all of them since they are by far the largest and most popular contingent. ETPs trade like stocks and can track (almost) any asset class by directly acquiring the securities or replicating the performance through derivatives. Niche ETPs track everything from cannabis stocks and uranium miners to space-related investments and regular currencies.

The largest Bitcoin ETP — the $1.7 billion Bitcoin Tracker EUR, listed on the Stockholm Stock Exchange — invests in swap contracts to mirror the cryptocurrency’s returns. Meanwhile, several U.S. investment trusts follow Bitcoin and are similar to ETFs but with certain restrictions. The Grayscale Bitcoin Trust (ticker GBTC) is physically backed, meaning that it holds Bitcoin. An ETF planned by VanEck Associates Corp. also intends to physically hold the cryptocurrency.

2. Is There Demand For An ETF?

There’s good reason to think so. GBTC has swelled in size during Bitcoin’s bull run into early 2021, with total assets soaring to more than $27 billion from $2.8 billion a year earlier. Demand for crypto-related products has been so relentless that investors piled into the trust even as its market value soared to 40% more than the value of Bitcoin it held. The recently launched Bitwise 10 Crypto Index Fund (ticker BITW) swelled to a valuation of more than $700 million in early February following its December debut, meaning it was valued 63% above its net asset value.

3. Why Would Investors Pay Such Premiums?

Because buying investment trusts is easier than purchasing the coins themselves. Shares can be bought and sold on brokerage platforms, without the need to set up digital wallets or move money to a crypto exchange. Industry experts argue that the premiums on trust products would dwindle if a Bitcoin ETF were approved. The problem with trusts is, unlike ETFs, new shares can’t be quickly created. For example, only accredited investors can create BITW shares with a minimum initial stake of $25,000. A lockup period bars the sale of new shares for 12 months. The supply constraints helped contribute to those soaring premiums.

4. Why Have Regulators Shunned A Bitcoin ETF?

As well as worries that prices can be manipulated and liquidity is insufficient, there’s also concern that Bitcoin’s famous volatility may be too much for regular investors. Bitcoin’s last three full-year returns were a 74% loss followed by gains of 95% and 306%. The regulator also questioned whether funds would have the information necessary to adequately value cryptocurrencies or related products. There have also been questions about validating ownership of the coins held by funds and the threat from hackers.

5. Who Is Interested In Launching One?

As of early February, the only active filing with the SEC was the request for the VanEck Bitcoin Trust made in December. That fund would value its shares based on prices contributed by what the index provider judges to be the top five exchanges for the cryptocurrency. Bitwise Asset Management is also seeking to launch a broader cryptocurrency ETF. It’s one of numerous issuers who have already tried to start a Bitcoin ETF, beginning with the Winklevoss twins in 2013. Other attempts were made by Direxion, ProShares, First Trust, Grayscale, WisdomTree and GraniteShares, all without success.

6. What Are The Current Hurdles To Approval?

The wild price swings — in the early weeks of 2021 Bitcoin rose more than 40% then fell 24% before surging more than 50% — have reignited worries about exposing ETF investors to such volatility. Furthermore, Treasury Secretary Janet Yellen noted that Bitcoin is an area of concern for terrorist and criminal financing. Critics also say the issues involving industry manipulation have yet to be effectively addressed. Because the amount of Bitcoin is finite, the fear is large holders would be able to move the market.

7. So What Are The Chances Of An ETF This Year?

Market watchers say they’re improving as Wall Street heavyweights such as Paul Tudor Jones and Stan Druckenmiller adopt the cryptocurrency and the likes of Robinhood and PayPal make it it easier to use and trade Bitcoin. Some crypto fans were encouraged by President Joe Biden’s nomination of Gary Gensler as SEC chairman; Gensler once taught a class at MIT’s Sloan School of Management called “Blockchain and Money.” But he has also acknowledged industry issues with fraud and light regulation. Don’t expect a decision until the new chairman is in place between now and July.

Updated: 2-11-2021

First Bitcoin ETF Approved In Canada

The approval makes it the first North American Bitcoin ETF.

A Bitcoin exchange traded fund for investment firm Accelerate Financial has been approved in Canada.

This makes it the first officially approved Bitcoin ETF in North America after the Ontario Securities Commission gave the green light for the institutional product.

The decision document was approved on Thursday, Feb. 11, and covers the following territories; British Columbia, Alberta, Saskatchewan, Manitoba, Quebec, New Brunswick, Nova Scotia, Prince Edward Island, Newfoundland and Labrador, Northwest Territories, Yukon and Nunavut.

Accelerate Financial Technologies had filed and obtained a receipt for a preliminary prospectus with Canadian securities regulators for the Accelerate Bitcoin ETF (ABTC) on Feb. 2.

It stated that the fund will offer units denominated in both United States and Canadian dollars with a 0.7% management fee, adding that it had applied to list ABTC units on the Toronto Stock Exchange.

At the time, founder and CEO of Accelerate, Julian Klymochko, said;

“Bitcoin has been one of the best performing asset classes on a 1-year, 3-year, 5-year and 10-year basis, both absolute and risk-adjusted. Given Bitcoin’s historical track record and future potential, along with its portfolio diversification properties, we are looking forward to offering investors exposure to the asset class in an easy-to-use, low-cost ETF.”

The firm offers a suite of other ETFs, including the recently launched OneChoice Alternative Portfolio ETF which is the country’s first fund to provide single-ticket exposure to multiple alternative asset classes and investment strategies including Bitcoin, gold, arbitrage, and private credit.

In mid-January, Canadian investment fund manager Arxnovum also filed a prospectus for a Bitcoin ETF with the Ontario Securities Commission.

Updated: 2-12-2021

Australian Regulators Open To Bitcoin ETF With ‘Rules In Place’

Securities regulators’ down under said that they are open to a Bitcoin ETF, so long as investors are protected by the proper rules.

The Australian Securities and Investments Commission has clarified its position regarding Bitcoin (BTC)-linked exchange-traded funds.

According to a Feb. 12 report by the Australian Financial Review, the commission addressed the subject after previously rejecting a Bitcoin ETF initiative by local company Cosmos Capital.

Per the report, Cosmos CEO James Manning claimed that ASIC “have a policy — which they have not released — which says they do not want an exchange traded product, an MIS, listed on an exchange.”

However, ASIC commissioner Cathie Armour told the Senate select committee on financial technology Friday that a Bitcoin ETF is possible, so long as there are appropriate rules in place in the market on which it is traded:

“For any products to be quoted on exchange markets in Australia, the particular market needs to have in place rules that facilitate the quoting of products […] Not all markets have rules in place that do that. […] These products can be made available to Australians through a managed investment scheme regime and Australians can invest in these products in that way.”

Armour said that a Bitcoin ETF could fall under Australian Securities Exchange’s AQUA Rules, which are specifically designed for investment schemes like managed funds, ETFs and other products.

Armour noted that the National Stock Exchange of Australia, on which Cosmos attempted to list its product, does not have such rules.

Australian Securities Exchange CEO Dominic Stevens said that the ASX has taken a cautious approach toward cryptocurrency-related products, but is considering them. “The world of bitcoin has changed since the last run, and my gut feel is this dominated by more corporate activity and institutions,” he said.

Steve Vallas, head of the Blockchain Association of Australia, told Cointelegraph that the shift in regulators’ attitudes represents a major signal for the crypto adoption in the country:

“The first step towards the adoption […] is open communication and a willingness by Government to discuss the opportunity, implications and risks associated with the listing of products like an ETF. The message being conveyed from ASIC is a very important signal to the sector and is welcome news for all involved in the sector.”

Cosmos Capital is now reportedly planning to list its Bitcoin ETF on ASX, which could potentially become Australia’s first ETF linked to Bitcoin. Cosmos did not immediately respond to Cointelegraph’s request for comment.

Updated: 2-16-2021

NYDIG Files For US-based Bitcoin ETF, With Morgan Stanley On Board

The crypto-focused financial services company has filed S-1 paperwork with the SEC, reigniting the debate over a Bitcoin ETF.

New York Digital Investment Group, or NYDIG, has submitted paperwork with the United States Securities and Exchange Commission to launch a new Bitcoin (BTC) exchange-traded fund.

NYDIG filed a Form S-1 registration statement for a Bitcoin ETF with the SEC on Tuesday. The submission lists NYDIG Trust Company LLC as the fund’s Bitcoin custodian and Morgan Stanley as an authorized participant.

As an authorized participant, Morgan Stanley is expected to sell shares to the public at prices that reflect the fund’s assets, supply and demand, and underlying market conditions. The shares will trade on the NYSE Arca exchange under a yet-to-be-determined ticker symbol.

According To The Prospectus Summary:

“The Trust’s investment objective is to reflect the performance of the price of bitcoin less the expenses of the Trust’s operations. The Trust will not seek to reflect the performance of any benchmark or index.”

It Continues:

“In seeking to achieve its investment objective, the Trust will hold bitcoin.”

NYDIG has been highly active in the crypto space, as it seeks to provide more institutional exposure to digital assets like Bitcoin. In November and December 2020, the company raised $150 million through two separate cryptocurrency investment funds. NYDIG was granted a BitLicense by the New York State Department of Financial Services in 2018.

Stone Ridge, NYDIG’s parent company, is one of the largest institutional holders of Bitcoin.

The quest for a Bitcoin ETF has been elusive, at least in the United States, where several fund issuers have tried unsuccessfully to get regulatory approval.

Canada recently approved the first publicly traded Bitcoin ETF in North America, allowing institutional investors to access BTC investments directly without derivatives.

Updated: 2-16-2021

Evolve Wins Second Canadian Bitcoin ETF As Ontario Regulator Approves Application

Evolve Funds Group Inc has received approval to list its Bitcoin ETF. The new asset will trade under the ticker symbols “EBIT” and “EBIT.U” and provide direct exposure to BTC.

North America’s second Bitcoin (BTC) exchange-traded fund received regulatory approval on Tuesday, offering another potential entry point for institutional investors to access digital assets.

Less than three weeks after filing a preliminary prospectus for a Bitcoin ETF, Evolve Funds Group Inc announced Tuesday that its fund has been approved by the Ontario Securities Commission, or OSC.

The ETF has two ticker symbols: EBIT for Canadian-denominated units and EBIT.U for U.S.-denominated units. EBIT is said to provide “unhedged exposure to the daily price movement” of Bitcoin in Canadian dollars, whereas EBIT.U provides exposure to the daily price movements in U.S. dollars.

Notably, the fund will track price data using CF Benchmarks’ Bitcoin Reference Rate, which aggregates data from several BTC/USD markets into a one-a-day benchmark index.

An Updated Prospectus Submitted To The OSC On Frida Outlines The Fund’s Investment Objective:

“The Evolve Fund’s investment objective is to provide holders of Units with exposure to the daily price movements of the U.S. dollar price of bitcoin while experiencing minimal tracking error by utilizing the benefits of the creation and redemption processes.”

To achieve this goal, the Evolve fund will invest in long-term holdings of BTC purchased through Gemini NuSTAR LLC and other platforms.

The prospectus was filed under a passport system, which allows the fund to be accessed in all of Canada’s 10 provinces and three territories.

Sui Chung, CEO of CF Benchmarks, told Cointelegraph that the Evolve ETF has “developed a true first — giving investors an easy-to-understand product that is available through their existing brokers and advisors that gives ownership of Bitcoin.”

Chung Continued:

“By using the regulated Bitcoin Reference Rate from CF Benchmarks, the ETF tracks the value of the Bitcoin and because its structure allows daily creation and redemption of ETF shares investors aren’t forced to pay soaring premiums in the secondary market.”

The Evolve fund is the second Bitcoin ETF to be approved by Canadian securities regulators this month. The Purpose Bitcoin ETF received approval last week, becoming the first physically settled North American ETF.

An ETF-style product from 3iQ was approved in Canada last year and is currently listed on the Toronto Stock Exchange. However, unlike the Evolve ETF, the EiQ fund doesn’t continually issue new shares.

Updated: 2-17-2021

Bitcoin ETF Approval More Likely Under New SEC leadership, Says Ark Invest CEO

“I think the probability of an ETF has gone up,” said Cathie Wood.

Ark Investment Management founder and CEO Cathie Wood said the likelihood that U.S. regulators will approve a Bitcoin exchange-traded fund has gone up under the Biden administration.

In an interview with CNBC’s Bob Pisani today, Wood said there were two signs that the Securities and Exchange Commission might be more open to greenlighting a Bitcoin (BTC) exchange-traded fund, or ETF. Under previous administrations, the regulatory body did not approve any Bitcoin ETFs, to the industry’s chagrin.

Specifically, the Ark Invest CEO said she was encouraged by Joe Biden’s pick for SEC chair, Gary Gensler. Gensler is known as someone who understands the underlying technology of digital assets and BTC itself. In addition, Wood saw FinHub leader Valerie Szczepanik, known as the “Crypto Czar,” reporting directly to the next chair as a bullish sign.

“I think the probability of an ETF has gone up,” said Wood. “[Gensler] understands the technology, and I think he understands the currency itself. […] I think we have individuals now involved who really understand the space.”

Wood recognized that institutional interest in the crypto space has surged recently but said she did not expect it to be driven by “broad-based substitution of Bitcoin for cash on corporate balance sheets.” She said this widescale investment may happen slowly as the market matures, but she was encouraged by the examples already set by Square and Tesla.

The payment company added 4,709 BTC to its balance sheet in October 2020, while the car manufacturer announced a $1.5-billion Bitcoin purchase earlier this month.

“If all corporations in the United States were to put 10% of their cash into Bitcoin, that alone would add $200,000 to the Bitcoin price,” she said.

Perhaps recognizing the potential opportunity in the new regulatory environment, some firms have already applied for a Bitcoin ETF with the SEC following Biden’s inauguration. Yesterday, New York Digital Investment Group filed the paperwork for a BTC exchange-traded fund, and on Jan. 22, Valkyrie Digital Assets proposed listing its Bitcoin trust on the New York Stock Exchange.

Updated: 2-19-2021

Bitcoin ETF Roars In Debut With $165 Million of Trading Volume

North America’s first Bitcoin ETF got off to a stellar start in its debut, with investors exchanging $165 million worth of shares.

After a relentless surge in the world’s largest digital currency, the first Bitcoin product that’s officially labeled an exchange-traded fund debuted Thursday in Toronto. It’s worth noting, though, that Europe has several crypto-tracking products that function like an ETF.

The new fund, called Purpose Bitcoin ETF (ticker BTCC), invests directly in “physical/digital Bitcoin,” issuer Purpose Investments Inc. said in a statement.

The cryptocurrency has captivated investors from billionaire Elon Musk to hedge-fund moguls including Alan Howard and Paul Tudor Jones. It may well be “the stimulus asset,” DoubleLine Capital LP chief Jeffrey Gundlach tweeted, in a reference to Bitcoin’s rally amid a wave of cash pumped into the financial system during the pandemic.

While the digital asset has already surged fivefold in the past year — spurring concern about a speculative froth in global markets –it’s grabbing more mainstream attention, especially after Tesla Inc.’s recent $1.5 billion purchase.

It’s unclear how much of the activity in BTCC will result in inflows for the fund, but the trading volumes were well above an ETF’s typical first day in Canada, according to Bloomberg Intelligence analyst James Seyffart. Although too early to tell, ETF proponents argue that such a fund will trade without the massive premiums plaguing many current Bitcoin trusts in the U.S.

“There’s sizable untapped interest for a Bitcoin investment that has the benefits of an ETF,” said Todd Rosenbluth, CFRA Research’s director of ETF research, adding it’s unlikely the fund will trade at a significant premium-to-net-asset-value. “While most ETFs come to market globally with an educational hurdle to overcome, many investors are familiar with what is inside BTCC,” he noted.

The U.S. currently has several active filings for a Bitcoin ETF, including the ones from VanEck Associates Corp. and Bitwise Asset Management, but the price swings notorious in cryptocurrenies and allegations of industry manipulation remain hurdles to regulator approval.

Still, with the world’s largest digital trading near all-time highs and a change of leadership at the Securities and Exchange Commission, analysts say the prospect of a first American Bitcoin ETF appears to be rising.

North America’s First Bitcoin ETF Hits $165M Trade Volume in First Day

The Canadian fund has experienced a flurry of demand but in the U.S. a bitcoin ETF is an unrealized desire.

North America’s First Bitcoin ETF Hits $165M Trade Volume in First Day: Report

The Canadian fund has experienced a flurry of demand but in the U.S. a bitcoin ETF is an unrealized desire.

A bitcoin ETF in the U.S. has been highly prized by the likes of VanEck and Valkyrie but is yet to make its debut stateside due to concerns from regulators over the nascent asset class’ volatility and industry manipulation.

Multiple close-ended bitcoin funds have been listed on the Toronto Stock Exchange, such as the ones listed by Canadian investment manager 3iQ. However, they differ from an ETF.

The fund seeks to replicate the performance of the price of the bellwether cryptocurrency while units of its shares are currently changing hands for around CAD$10.17 (US$8.00).

Updated: 2-21-2021

Canadian Bitcoin ETF Predicted To Hit $1B AUM By Friday: Bloomberg Analyst

Eric Balchunas said the Purpose Bitcoin fund could surpasses all other ETFs in Canada within two months, “barring a nasty selloff.”

With only two full days of trading under its belt, the first Bitcoin (BTC) exchange-traded fund in North America reached more than $400 million in volume and is expected to go even higher.

According to a tweet from Bloomberg analyst Eric Balchunas, the Bitcoin exchange-traded fund, or ETF, recently debuted by Canadian firm Purpose Investments is likely to hit $1 billion in assets under management by Feb. 26.

His prediction came prior to Purpose reporting its Bitcoin ETF traded $421.8 million between the time when it was first listed on the Toronto Stock Exchange, or TSX, on Feb. 18 and when markets closed Friday. The ETF is listed under the ticker BTCC.

Balchunas compared the impressive debut of the Purpose Bitcoin fund to other ETFs currently trading on the TSX. At more than $4.6 billion in total assets, the JPMorgan BetaBuilders Canada ETF is one of the biggest in the country. The Bloomberg analyst said he “wouldn’t be surprised” if the Purpose Bitcoin ETF surpasses all others in Canada within two months, “barring a nasty selloff.”

The Purpose ETF is not the only Bitcoin exchange-traded fund in North America to share the wealth. Last week, Evolve Funds Group received approval from the Ontario Securities Commission to launch its own Bitcoin ETF, which started trading on Friday under the ticker EBIT. As of the close of markets on Friday, EBIT.U had traded 103,595 units priced at $21.54.

Though some investment managers have hinted that the Securities and Exchange Commission under U.S. President Joe Biden might be more open to approving a Bitcoin ETF, regulators in the United States have not yet given them the green light. Both New York Digital Investment Group applied and Dallas-based Valkyrie Digital Assets have filed the paperwork for a Bitcoin ETF since the new president took office.

According to the TSX, BTCC.B had traded 9,270,111 units priced at $10.55, and BTCC.U 2,065,855 units at $10.57 as of Friday.

Raging Success of First Bitcoin Fund Shows Who Leads ETF Market

The roaring success of the first-ever Bitcoin exchange-traded fund will have been no surprise to cryptocurrency fans. But if they don’t know about ETFs, the venue might have been startling.

The explosive debut of the Purpose Bitcoin ETF (ticker BTCC), whose trading volume approached $400 million worth of shares in two days, didn’t happen in the largest ETF market. Nor was it in Europe, where similar exchange-traded products have already garnered about $6.5 billion in assets, according to data compiled by Bloomberg.

It was actually in Canada — where the equity market is just 8% of the size of the U.S. and assets in ETFs total about $215 billion — less than the SPDR S&P 500 ETF Trust (SPY) on its own. It doesn’t register much beyond the ETF industry, but Canada has quietly built a reputation for this kind of coup.

“Canada has long been out in front with respect to ETF product development,” said Ben Johnson, Morningstar Inc.’s global director of ETF research. “From listing the first-ever ETF to more recently becoming home to the first-ever psychedelics ETF.”

BTCC launched on the Toronto Stock Exchange on Thursday, the first fund of its kind in North America and the first anywhere to carry the ETF label. A day later, Evolve Fund Group’s Bitcoin ETF (EBIT) debuted, but with a less impressive trading volume of about $14.5 million worth of shares.

As with many areas of innovation, deciding who or what was first in the financial world can come down to definition, but most agree that the Toronto 35 Index Participation fund, or TIPs, was the first iteration of a modern ETF in 1990. While it hasn’t enjoyed the astronomical growth of the U.S. industry — which kicked off with SPY’s launch in 1993 — Canada’s ETF market has frequently introduced products not tried anywhere else.

The reason comes down to a more nimble and liberal regulatory environment and a focus on innovation. The Evolve fund, for example, was approved less than a month after an application was initially filed.

“Canada has proven that it has a process that leads to innovation and the systems to allow for it,” said Som Seif, chief executive officer of Purpose Investments.

In the U.S., the Securities and Exchange Commission has rejected multiple applications for a Bitcoin ETF, citing concerns that prices can be manipulated and liquidity is insufficient. That has left investors plowing cash into the Grayscale Bitcoin Trust (GBTC), a riskier and more costly structure that often trades at huge premiums to the value of its underlying assets.

“Canadian regulators seem much more willing to embrace innovation,” said Nate Geraci, president of the ETF Store, an advisory firm.

None of this is to say the ultra-rich, highly liquid U.S. market doesn’t innovate. The first of a new ETF format that hides its holdings against front-funning — called active non-transparent funds — debuted in the U.S. in April 2020.

“Canada has been ahead of us in certain instances, but there are instances where the U.S. is ahead,” said Ben Slavin, head of ETFs for BNY Mellon Asset Servicing. “I wouldn’t necessarily generalize the U.S. is always behind, it’s just Bitcoin is an incredibly hot topic and it might be a special case.”

Meanwhile, there are plenty of industry watchers who would argue Canada isn’t truly first to the Bitcoin ETF. In Europe, several ETPs exist that behave in almost exactly the same way, the biggest of which has been trading for more than five years. Regulatory differences just result in a different label.

While other markets have outpaced the U.S. in innovation, none can compete with the size and scale of the American market when it does finally enter the fray.

Canada may have launched the first-ever ETF, but the market in the U.S. is now about 27 times bigger. There is around $70 billion in Canadian bond ETFs — south of the border it’s $1.1 trillion and counting.

If and when a Bitcoin ETF finally arrives in the U.S., growth could be explosive. The closest alternative, the Grayscale Bitcoin Trust, has about $34 billion in assets. Investors are even willing to pay 7.5% premium currently to get in, and its average premium in its lifetime is 37%.

That’s yet another reason to approve an ETF, according to proponents.

“It boggles my mind we still don’t have a Bitcoin ETF in the U.S.,” said Geraci at the ETF Store. “It’s understandable that there can be a difficult balance between embracing innovation and ensuring proper investor protections. However, given the existing Bitcoin products available to U.S. investors, a Bitcoin ETF would seem to strike that balance.”

CI Global Files To Issue North America’s Third Bitcoin ETF

A subsidiary of a firm overseeing more than $230 billion in assets will work with Galaxy Digital on what could be the third bitcoin ETF in Canada.

There could soon be a third Canadian bitcoin exchange-traded fund (ETF). CI Global Asset Management, a subsidiary of a firm overseeing more than $230 billion in assets, filed a preliminary prospectus for the financial instrument, the company announced Friday.

* The so-called CI Galaxy Bitcoin ETF (BTCX) would be managed by CI and advised by merchant bank Galaxy Digital. The two firms have previously partnered on the CI Galaxy Bitcoin Fund, a closed-end investment product.

* Two bitcoin (BTC, +1.69%) ETFs went live this week, offering investors a way to gain exposure to bitcoin by buying stock, rather than the asset itself. ETF managers purchase an underlying asset on behalf of investors trading on the stock market, for a fee.

* The first bitcoin ETF in North America hoovered up $421.8 million worth of assets in its first two days trading, including over 6,000 BTC. BTCX will invest directly in bitcoin, with Galaxy handling that end of the trade and Gemini acting as custodian.

* Canadian firm 3iQ also filed a preliminary prospectus for a bitcoin ETF last week.

Novogratz Positions Firm At Center Of Hoped-for Crypto ETF Boom

Mike Novogratz is seeking to position his Galaxy Digital Holdings at the center of what could turn out to be a boom in cryptocurrency exchange-traded funds.

Galaxy’s trading desk is one of several that are providing Bitcoins for the Purpose Bitcoin ETF, the first-ever approved. The Toronto Stock Exchange-listed fund debuted Thursday. CI Global Asset Management filed this week in Canada to offer the CI Galaxy Bitcoin ETF. Galaxy Digital will act as the Bitcoin sub-advisor, and execute trades on behalf of the proposed ETF. None have been approved in the U.S.

“Crypto is being institutionalized at an accelerating rate,” Novogratz said in an interview. “And now an ETF product is showing up in Canada first, it will show up in the U.S. next. It’s all part of this accelerating evolution of being a store of value.”

While high-profile Bitcoin purchases by Tesla Inc. and MicroStrategy Corp. are generating headlines, many more companies and pension funds are seeking to follow suit, Novogratz said.

“All of these stories — and there’s a story every day — really point to a sustainable bull market in crypto,” the billionaire former hedge fund manager said. Galaxy Digital is registered in Canada, though Novogratz is based in New York.

Bitcoin rose to a record of more than $56,000 Friday, increasing the cryptocurrency’s market value to more than $1 trillion for the first time.

ETFs have long been seen by many crypto advocates as a path toward greater mainstream acceptance. There are already a number of ETF-like products in Europe and exchange-traded trusts in the U.S.

The U.S. Securities and Exchange Commission has repeatedly shot down attempts to offer crypto ETFs in America, citing concerns such as market concentration and manipulation. The approval of the Purpose fund is seen as beneficial for the pending funds, said James Seyffart, an analyst at Bloomberg Intelligence.

“Its been wildly successful as far as volume goes,” Seyffart said. “And we expect to see that show up in flows in the coming days. If you look at it compared to other Canadian ETFs, it is by far the most traded fund. It is already more liquid than every Bitcoin ETP in Europe.”

The U.S. currently has several active filings for a Bitcoin ETF as well, including from VanEck Associates Corp. and Bitwise Asset Management. Recently imposed regulations and the new Biden administration are “potentially adding momentum to similar efforts in the U.S.,” according to Bloomberg Intelligence. A U.S. Bitcoin ETF would likely dwarf any ETF from Canada, Seyffart said.

“We want Galaxy to be seen as the smartest guys in the room when it comes to crypto,” Novogratz said. “We want to be in the center of the action.”

Updated: 2-23-2021

The First Canadian Bitcoin ETF Is Absolutely Soaring

Canada’s CI Global Files For What Would Be World’s First Ether ETF

If approved, the ETF would trade on the Toronto Stock Exchange under the ticker “ETHX.”

The world’s first ether exchange-traded fund (ETF) may be on the way, after CI Global Asset Management filed a preliminary prospectus in Canada on Thursday.

* In an announcement, the firm said its proposed “CI Galaxy Ethereum ETF” would be the first ETF in the world to invest directly in ether (ETH, -3.34%), the native cryptocurrency of the Ethereum network.

* If approved, the ETF would trade on the Toronto Stock Exchange (TSX) under the ticker “ETHX.”

* Galaxy Digital Capital Management LP will act as the ether sub-adviser and execute trading on behalf of the ETF.

* ETHX will invest directly in ether with its holdings priced using the Bloomberg Galaxy Ethereum Index, owned by Bloomberg Index Services.

* “Ethereum is the leading candidate to be the base layer of Web 3.0, and ether is a growth asset that provides investors exposure to the explosion of decentralized applications,” said Mike Novogratz, chairman and CEO of Galaxy Digital, in the announcement.

* The ether ETF may have a reasonable chance of being approved. Last week, two bitcoin ETFs were listed in Canada.

* CI Global also recently filed a preliminary prospectus for a bitcoin (BTC, -0.57%) ETF, which would also be in in partnership with Galaxy Digital.

Bitcoin’s Second North American ETF Just Started A Price War

Just a week after the first Bitcoin exchange-traded funds in North American started trading, the underdog firm just kicked off a fee war.

Evolve Fund Group in Canada lowered the price on its Bitcoin ETF, ticker EBIT, to O.75% from 1%, according to a statement. That’s now cheaper than the 1% expense ratio of its competitor the Purpose Bitcoin ETF (BTCC), which starting trading just a day before Evolve’s offering but has already attracted far greater interest.

The rapid price cut underscores the benefits of being first to market in the ETF space, especially amid the fervent demand for products tracking anything related to crypto. As U.S. regulators continue to deny approval for a Bitcoin ETF, the Canadian products are capturing investor attention.

“BTCC illustrates the importance of first mover advantage in ETFs,” said Ben Slavin, head of ETFs for BNY Mellon Asset Servicing. “A one-day head start was all that was required to establish a clear lead for Bitcoin ETFs in Canada.”

Since its debut on Feb. 18, BTCC has gained $448 million in assets compared to only $28 million for EBIT, according to the firms. In its first day of trading alone, more than $165 million worth of shares in the Purpose product changed hands. Only a day later, that number for EBIT was just $14.6 million.

The fee is still relatively expensive in the ETF space, even among the more complicated products. The median fee for passive equity products is 0.49%, while their active counterparts charge an average 0.72%, according to data from Bloomberg Intelligence.

Bitcoin’s sharp climb on Wednesday, following support from Ark Investment Management’s Cathie Wood and news that Square Inc. has boosted its stake in the cryptocurrency, could generate even more interest in the ETFs.

Huge demand for the Canadian funds also ramps up the battle in the U.S. for issuers to gain first approval in launching a Bitcoin ETF, although the Securities and Exchange Commission has so far rejected applications due to concerns about price manipulation and insufficient liquidity.