Used-Car And Motorcycle Sales Boom, New Vehicles Get Too Pricey For Many

Price gap between new and preowned cars has widened to a near decade high. Used-Car And Motorcycle Sales Boom, New Vehicles Get Too Pricey For Many

The gap between the price of a new and used vehicle is as wide as it has been in years, pushing an increasing number of consumers to the used-car lot and putting pressure on auto makers to deepen discounts on new cars to keep them competitive.

Demand for used cars was unusually strong this summer and will remain at elevated levels through the year’s end as higher interest rates and rising prices on new cars continue to stretch buyers’ wallets, industry analysts said.

Used-car buyers are finding a growing selection of low-mileage vehicles that are only a few years old.

While used-car values have also increased in recent years, the gap between the price of a new and preowned car has also widened and is now at one of its largest points in more than a decade, according to car-shopping website Edmunds.com.

New-car prices have steadily climbed in the years following the recession as companies packed vehicles with more expensive technology and buyers shifted away from lower-priced cars to bigger and more expensive sport-utility vehicles and trucks. The average price paid for a car hit an all-time high of $36,848 in December of 2017 and remains at near-record levels, according to Edmunds.com.

“Customers forget a new car is now more than $30,000 and they expect it to be $20,000,” said Brian Allan, a senior director at Galpin Motors Inc., a Southern California dealership chain.

Including An Extended Warranty

“When people see the price has gone up, it is sticker shock, especially when people only buy a car every five to six years,” Mr. Allan said.

At the same time, the used-car market is being flooded with leased cars being returned to dealerships, increasing the supply and options for buyers looking for two- and three-year-old vehicles that are generally well maintained.

And unlike in recent years, where the selection on the used-car lot has tilted toward slow-selling sedans, dealers are offering more of the crossover and sport-utility vehicle models that are in hot demand now.

The customer who would never consider buying used before is now driving off the lot in a preowned vehicle, Mr. Allan said.

With nearly 40 million in sales last year, the used-car market is more than double the size of the new-car business.

The shift in demand is a troubling sign for auto makers, which will be under pressure to deepen discounts to keep customers from defecting to the used-car market. New-vehicle sales have started to cool this year following a seven-year growth streak.

As new car prices have climbed, auto lenders have kept monthly payments low by extending loan-repayment terms to five and six years and introducing 0% financing on loans that made buying new a more attractive deal.

But as interest rates rise and credit tightens, auto companies are pulling back on such sales incentives. The average monthly payment on a new car was $536 in August, up from $507 last year and $463 five years ago, according to Edmunds.com.

Justin Scholz, a 35-year-old banker, was stunned by the new-car sticker prices when he went shopping this spring for a new SUV for his growing family. He had been eyeing the Lexus RX hybrid but felt the $66,000 price tag was unusually high. He looked for 0% finance deals and couldn’t find many out there.

“In the past, I entertained new because you could get a 0% interest rate for 60 months,” he said. “New was a small premium compared to used. Now, the gap is much bigger.”

Rather than splurge, Mr. Scholz decided to try his luck in the used-car market, where he found a two-year-old version of the same vehicle that had recently been returned after a lease. It had fewer than 30,000 miles and was more than $20,000 cheaper than the new vehicle.

Mr. Scholz bought the vehicle in April for $44,000 and has no plans to return to the new-car market soon.

The Seven-Year Auto Loan: America’s Middle Class Can’t Afford Its Cars

Inexpensive and generous financing is putting consumers deep in debt.

Walk into an auto dealership these days and you might walk out with a seven-year car loan.

That means monthly payments that last well past when the brake pads give out and potentially beyond when the car gets traded in for a new one. About a third of auto loans for new vehicles taken in the first half of 2019 had terms of longer than six years, according to credit-reporting firm Experian PLC. A decade ago, that number was less than 10%.

Car loans that are increasingly stretched out are a pronounced sign that some American middle class buyers can’t afford a middle-class lifestyle.

Incomes have risen at a sluggish pace in the past decade, but car prices have grown rapidly. New technological and safety features, such as larger and more sophisticated multimedia displays, have made even the most basic cars more expensive. U.S. consumers have also veered toward pricier rides such as sport-utility vehicles that tend to dominate auto showrooms. The result is that consumers are seeking bigger loans than ever to purchase a car.

A lending machine has revved up in response, making it possible for more Americans to procure a vehicle by spreading the debt over longer periods. Wall Street investors snap up these loans, which are bundled into bonds. Dealers now make more money on the loans their customers take than on the cars they sell.

For many Americans, the availability of loans with longer terms has created an illusion of affordability. It has helped fuel car purchases that would have been out of reach with three-, five- or even six-year loans.

“People can get into very expensive cars,” said Bronson Argyle, a professor at Brigham Young University in Provo, Utah, whose research focuses on consumer credit. “Households are taking on, on average, more risk.”

Deven Jones walked into the Rolling Hills Honda dealership in St. Joseph, Mo., in early 2017 after a salesman emailed him and said he might be able to buy a new car for less than $400 a month.

Mr. Jones, now 22 years old, walked out with a gray Accord sedan with heated leather seats. He also took home a 72-month car loan that cost him and his then-girlfriend more than $500 a month. When they split last year and the monthly payment fell solely to him, it suddenly took up more than a quarter of his take-home pay.

He paid $27,000 for the car, less than the sticker price, but took out a $36,000 loan with an interest rate of 1.9% to cover the purchase price and unpaid debt on two vehicles he bought as a teenager. It was particularly burdensome when combined with his other debt, including credit cards, he said.

Just 18% of U.S. households had enough liquid assets to cover the cost of a new car, according to a Wall Street Journal analysis of 2016 data from the Fed’s triennial Survey of Consumer Finances, a proportion that hasn’t changed much in recent years.

Even a conservative car loan often won’t do it. The median-income U.S. household with a four-year loan, 20% down and a payment under 10% of gross income—a standard budget—could afford a car worth $18,390, excluding taxes, according to an analysis by personal-finance website Bankrate.com.

Stretched-out Debt

Auto loans are increasingly getting stretched out to keep payments manageable.

But the size of the average auto loan has grown by about a third over the past decade to $32,119 for a new car, according to Experian. To keep payments manageable, the car industry has taken to adding more months to the end of the loan.

The average loan stretches for roughly 69 months, a record. Some last much longer. In the first half of the year, 1.5% of auto loans for new vehicles had terms of 85 months or longer, according to Experian. Five years ago, these eight- and nine-year loans were practically nonexistent.

As a result, a growing share of car buyers won’t pay off the debt before they trade in their cars for new ones, either because the car is in need of repairs or because they want a newer model. A third of new-car buyers who trade in their cars roll debt from old vehicles into their new loans, according to car-shopping site Edmunds. That is up from about a quarter before the financial crisis.

Americans have been borrowing to buy their cars for decades, but auto debt has swelled since the financial crisis. U.S. consumers held a record $1.3 trillion of debt tied to their cars at the end of June, according to the Federal Reserve, up from about $740 billion a decade earlier.

As the global financial system flirted with disaster more than 10 years ago, two of the big three U.S. auto makers received government bailouts and restructured their debt in bankruptcy. The industry emerged into a battered economy when consumers hardly had the cash to go car shopping.

Yet for the auto industry, there was a silver lining: Interest rates had fallen to practically zero. Suddenly, it was much cheaper to finance a car. Loans made to buyers were snapped up by Wall Street investors looking for returns as income from supersafe Treasurys drifted toward zero.

The combination of rock-bottom rates and yield-hungry investors helped bring the U.S. auto industry back to life. By 2015, auto sales had reached records.

Low rates, in effect, served as a bailout for the entire auto industry. Last year, investors bought a record $107 billion of bonds backed by cars, according to the Securities Industry and Financial Markets Association, a trade group. That is the first issuance record since 2005 and nearly triple the amount two decades earlier. The outstanding pile of auto bonds swelled to a record $264 billion.

So far this year, dealerships made an average of $982 per new vehicle on finance and insurance versus $381 on the actual sale, according to J.D. Power, a data and analytics company. A decade earlier, financing brought in $516 per car and the sale made dealers $837.

To see these shifts up close, visit a dealership’s finance office. Dealers call it “the box,” a reference to the holding cell to which Paul Newman’s character was sent in the 1967 movie “Cool Hand Luke.” Since most buyers borrow to pay for their cars, it falls on the finance manager to figure out a manageable payment schedule.

The dealership commonly holds on to a portion of the interest rate, typically between 1 and 2 percentage points, or gets a one-time payment from the lender. The dealer also pitches high-margin add-on services, such as extended warranties and insurance for dings and dents, which are rolled into the loan.

When potential buyers enter Petrov Degand’s office at Earl Stewart Toyota in North Palm Beach, Fla., he walks them through each add-on, presenting the full menu of options, he said. He has seen finance managers quote a price in which the add-ons are already bundled into the loan amount to increase the bottom line, a tactic known as “packing the payment.”

Jose Mercado agreed to buy a series of add-ons, including an extended warranty, for his new RAV4 midway into his fifth hour at a Toyota dealership this spring. Mr. Mercado, 41, who lives in Blackwood, N.J., and works in a chocolate factory, had spent the previous six months reading reviews and figuring out how much he should pay for the car.

He found himself unprepared for the hard sell from the finance manager. The add-ons brought his payment to $448 a month, nearly $100 more than he had expected to pay when he walked in to buy his first new car in 18 years.

“I wish my research would have been deeper to be more ready,” he said.

Finance managers at dealerships typically use an electronic portal to hash out the terms of the loans. On the other end are various financial institutions that buy up the loan pretty much as soon as the dealer closes the deal.

Banks and credit unions are big lenders, as are the finance arms of major car makers. Some of these lenders shunned riskier subprime borrowers after the financial crisis, fueling the growth of independent nonbank auto lenders.

Westlake Services LLC is among the biggest. Its owner, billionaire Don Hankey, started lending four decades ago when, as a dealer, he realized subprime buyers needed somewhere to get their financing. Westlake is still focused on these borrowers, but it has pursued more creditworthy customers as it has grown in recent years.

Much like a dealership, the company is obsessed with results. An automated system sends emails to employees with an image of a winking robot when they are late to work, unproductive or exceed expectations. Workers get monthly bonuses based on how they stack up against their goals. Screens around the office display auto loan applications as they come in.

Westlake needs to make sure the monthly payments on its auto loans keep flowing. Late borrowers can expect calls from the company immediately. Roughly 40% of its employees focus exclusively on collecting.

In mid-April, a representative who handles the most-difficult cases called a past-due borrower to iron out payment on a 2018 Toyota RAV4. The borrower had struggled to keep up with a payment of more than $800. The car already had been repossessed from the borrower once.

The Westlake representative switched between English and Spanish. He offered an extension on the March payment, meaning it wouldn’t be due until the end of the loan in 2024. But he collected nearly $600 on a partial payment for April over the phone. Borrowers are less likely to resume payments if they stop altogether.

After hanging up, the representative rang a bell at his desk. “35K,” he called out, referring to the balance of the loan that was no longer considered seriously delinquent. “It took a while but I got ’em.”Across the industry, delinquencies have trended higher in the past few years, but they haven’t surged like mortgage delinquencies did during the financial crisis. Investors have been largely content to buy lenders’ auto bonds as they search for returns in a low-rate world. Losses are significantly higher when loan terms lengthen, according to S&P Global Ratings.

Mr. Jones, in Missouri, got his loan from Honda’s financing arm, which pools a large portion of its loans into bonds that it sells to investors. A $1.25 billion sale from late 2017 contained more than 7,000 loans tied to 2017 Accords like the one Mr. Jones owns, according to loan-level data.

The investors who hold Mr. Jones’s loan are still getting paid because he has remained current. Mr. Jones took on more overtime shifts at the plastic factory where he works as a machine operator. A raise and a bonus helped get him to stable ground. Still, he will be making payments for years to come.

Mr. Jones said he doesn’t plan to take out another auto loan soon. “Even just signing the paper, not even driving the car off the lot, suddenly I’m underwater,” he said.

Auto retailers sold 10.4 million used cars in the second quarter this year, according to Edmunds.com, the highest quarterly volume it has on record since the firm began tracking preowned sales in 2007.

Used-car prices are also up, defying expectations that the influx of off-lease cars would depress values. Prices have been rising in part due to a slowdown in repossessions and vehicles coming off rental-car fleets—two sources of used cars that are typically older and less expensive.

Buyers paid an average of $22,489 for a three-year-old used car in the second quarter of 2018, up $865 from the prior-year period, according to Edmunds.com. That is still well under the average $35,828 paid for a new car last quarter.

Dealers are also putting more resources and investment into promoting their used-car sales as a way to offset declining margins in the new-car business.

The profit margin on a used-car sale was nearly 7% last year, more than double the return on a new-vehicle sale, according to the National Automobile Dealers Association, giving dealers more incentive to steer buyers to their preowned selection.

AutoNation Inc., the U.S.’s largest dealership chain, opened its first used-car center last year, aiming to capture more of the preowned business as U.S. demand for new cars and trucks cools.

“We’re offering a more attractive product at a better price,” said AutoNation Chief Executive Officer Mike Jackson, referring to the chain’s used-car offerings.

Auto Lenders Ramp Up Risk to Win More Customers

Banks, other lenders making longer-term car loans to customers who must stretch to make payments.

New risks are lurking in auto loans.

As loan growth slows, banks and other lenders have been tinkering with loan terms in an effort to gain more consumers. They are originating a greater share of loans with repayment periods of more than five years and, in some cases, extending loans to consumers who are stretching further to afford their purchases. Banks such as TD Bank, Santander Consumer USA Holdings Inc. and BB&T Corp. , meanwhile, have said they are increasing their loans to riskier applicants.

Their moves come at an unsettled time for auto lending. Sales growth has been choppy and missed payments are up from a year ago. Also, used-car prices are under pressure, raising the risk of higher losses for lenders when vehicles are repossessed. Faced with these headwinds, many lenders shunned applicants with low credit scores and have been looking for ways to make up the lost volume.

The latest underwriting efforts show that lenders, faced with conflicting signals about the health of the U.S. consumer, are engaged in a delicate balancing act to boost lending and profit without taking on overly risky customers. Though unemployment has reached an 18-year low and wages are creeping higher, some households are sliding deeper into debt and falling behind on their credit cards and other debt payments.

“[If] you only took on the financing for the top echelon of the super prime… [it’s] very, very hard to make money in and of itself,” TD Bank Chief Executive Greg Braca said at an industry conference this year.

Many auto lenders, including banks, nonbanks and the finance arms of car manufacturers, have been offering more loans with longer terms. Generally, these terms allow borrowers to make lower monthly payments, but usually at a higher interest rate. That, combined with the longer payment period, means that borrowers can end up paying thousands more for their cars than if they opted for a shorter loan.

In the first quarter, the average loan term for a new car exceeded 69 months, the second consecutive quarter it had ever been above that level, according to credit-reporting firm Experian. Also in the first quarter, new car loans originated with repayment periods of between 73 and 84 months represented more than a third of total new car loans, up from 7% of loans in late 2009.

Lenders say borrowers need flexible terms because new vehicles are getting more expensive. Despite the longer repayment periods, average monthly loan payments continue to rise, hitting a record $523 for borrowers who bought new cars in the first quarter, according to Experian.

Zac Craft wanted a three-year loan when he bought his 2012 Chevy Cruze this year but opted for a five-year loan despite its slightly higher interest rate. Mr. Craft plans to pay off the loan in three years to cut down on interest but wanted the option to make lower monthly payments when money is tight.

“There’s some security in that,” said Mr. Craft, who lives in Hawaii.

Lenders pushed into subprime auto lending after the recession, which helped boost vehicle sales. Subprime auto lending peaked at $114.4 billion in 2015, according to Equifax, accounting for 19% of auto loans and leases that year. Higher loan losses followed, and lenders subsequently tightened underwriting standards. That resulted in a drop in new car sales and loan originations last year.

While subprime lending is declining, some banks are turning to consumers whose credit scores are neither high nor low. TD Bank, Santander Consumer USA and BB&T say they have been extending more loans to borrowers they define as “nonprime” or “near prime.” Santander and BB&T also originate subprime auto loans.

Skeptics say the term nonprime is another way to label less-than-ideal borrowers without alarming investors. Nonprime and subprime customers can generate better returns because they tend to pay higher interest rates.

“When you can kind of operate in the belly of credit and generate 7-plus-percent yields on new originations, that’s pretty attractive business,” Ally Financial Inc. Chief Executive Jeffrey Brown said at an industry conference this month. Ally, one of the largest U.S. auto lenders, does business with borrowers across the credit spectrum, including subprime.

Lenders say they typically make the longest loans to prime customers who can afford them and understand the risks. A report last month by Moody’s Investors Service, however, found that borrowers who sign up for loans that last six years or longer have lower credit scores and owe a larger share of the vehicle’s price than consumers with shorter loans. The loan payments also account for a larger share of their income, said Moody’s, which reviewed loans securitized since 2017 and that were mostly comprised of prime borrowers.

At Ally, for example, borrowers with loans stretching six years or longer owed on average around 100% of the car’s purchase price when those loans were originated, according to Moody’s. Borrowers with a shorter repayment period owed 83%. Credit scores for borrowers with the longer loans averaged roughly 725, compared with about 760 for borrowers with shorter-term loans.

Similar rifts exist with loans extended by auto makers’ in-house financing arms, including Ford Motor Credit Co. and American Honda Finance Corp.

A Ford Credit spokeswoman said the company’s lending standards haven’t changed and that longer-term loans are “a relatively small part of the business.” Honda Finance has kept its maximum repayment period at 72 months, a spokesman said.

Loans with longer repayment periods are more prone to default, according to Moody’s. Loans of five years or longer extended to borrowers in 2015 with high credit scores had a cumulative net loss rate of 1.29% as of spring 2017. For shorter-term loans, the loss rate was 0.28%.

Investors Rev Up the Risk in Subprime Auto Deals

Some analysts say that if the economy takes a turn delinquencies could lead to a wave of closures among auto lending firms.

Investors are gobbling up auto loans extended to the riskiest borrowers, looking past market warning signs as they reach further for returns.

This year, they have been buying subprime auto securitization deals that offer slices with single-B credit ratings, well into junk territory and the lowest grade offered when such bonds are sold. Auto lenders have issued $318 million worth of single-B debt in 2018, more than all prior years combined, according to data from Finsight.

Subprime auto deals, often bought by large money managers and other institutional investors, are typically backed by loans to borrowers with FICO scores below the mid-600s. Because these borrowers are at higher risk of default, the bonds tied to their loans can offer higher yields. Typically such bonds are subdivided into various layers, each with a different level of risk and return based on the order in which they receive payments.

The single-B tranches, sold in recent months by lenders including American Credit Acceptance and United Auto Credit, are the last rated bondholders in line. In exchange for rates of more than 6%, roughly twice what 10-year Treasurys pay, they are the first bondholders to suffer losses if the underlying loan payments aren’t sufficient to cover all that is owed. It is a trade-off not all investors are willing to make.

“It would be one thing if it was year two of the recovery and performance was rock solid and we were off to the races,” said Evan Shay, an asset-backed securities analyst at money manager T. Rowe Price, which hasn’t been buying single-B debt. The issuance late in the economic cycle appears to be “raising some eyebrows,” he said.

Still, issuers are finding willing buyers in investors hunting for returns. Sometimes, the single-B portions of these deals have later been upgraded. In essence, investors are wagering on the health of U.S. consumers, who have once again built up record stockpiles of household debt but haven’t shown much trouble repaying it.

For securities backed by subprime auto loans, the outlook is mixed. Borrowers are getting slightly more creditworthy, with average credit scores in this year’s securitization pools rising to 588 from 577 last year, according to a Fitch Ratings report from August. But more borrowers—roughly 80%—are taking out loans that have terms of more than five years, which are more prone to default. Delinquencies of greater than 90 days have been trending higher for all auto loans since 2012, according to the Federal Reserve Bank of New York.

There have been some recent signs of trouble in the subprime market. Auto lender Honor Finance LLC closed over the summer and a slug of bonds backed by the firm’s loans was downgraded to a bottom of the barrel double-C rating this month by S&P. The Evanston, Ill., company, owned by private-equity firm CIVC Partners, has since transferred its loans to another servicer. CIVC didn’t respond to requests for comment.

While investors are largely treating Honor as a one-off event, they are on high alert for signs the bonds issued by other auto lenders aren’t as solid as they appear. Auto lenders were criticized for lax underwriting on loans issued in 2015 and 2016.

At Honor, borrower delinquencies started rising last year. Because many received payment extensions, the loans weren’t immediately written off as losses.

After a series of executive departures that started late last year, cumulative net losses on the loans backing the bonds began rising. That has left bondholders in the double-C tranche bracing for losses. Westlake Financial Services, which took over servicing of the loans, hopes to avoid bondholder losses by aggressively pursuing borrowers who are in the early stage of delinquency, the firm’s president said.

Despite risks, bond buyers have grown comfortable with subprime auto bonds in recent years, partly because these deals performed well through the financial crisis. Borrowers largely continued to pay their loans because they needed vehicles to get to work, even as they defaulted on mortgages. Companies have issued about $29.7 billion of asset-backed securities made up of subprime auto loans this year, including single-B debt, already topping the full-year record of $24.5 billion from 2017, according to S&P.

The broad auto market has cooled in recent months. Interest rates are going up, which makes it more costly to borrow. Some analysts say that if the economy takes a turn for the worse and the unemployment rate rises, delinquencies on risky auto loans could lead to a wave of closures among auto lending firms.

“In some ways it feels like 2006, which was one year before the great recession started,” said Amy Martin, an analyst at S&P, on a webcast this fall.

Still, it is tough to call the end of the boom. In September of 2017, Aaron Greenspan, who runs a legal information website, personally bet against the stock of Credit Acceptance Corp , one of this year’s largest issuers of subprime auto asset-backed securities.

He posted dozens of pages of research online in which he alleged wide-ranging misconduct by the company. He believes the firm and the bonds backed by its loans will ultimately fall apart. Credit Acceptance declined to comment.

The stock has risen 35% in the last 12 months, far outpacing the S&P’s 4.3% rise. The options he used to bet against the stock have expired worthless.

“Trying to predict the demise of Credit Acceptance is like trying to predict the demise of the global economy,” Mr. Greenspan said.

A Glut of Used Hogs Is a Drag on Harley-Davidson

Harley-Davidson is facing a particularly tough competitor for new riders: its own used motorcycles. New-motorcycle sales in the U.S. are down by half from a 2006 peak, while used sales are up 13%..

For some younger riders, new motorcycles are too expensive, while well-maintained used ones offer good value.

Harley-Davidson Inc. is facing a particularly tough competitor for new riders: its own used motorcycles.

Three used Harleys are sold in the U.S. for every new one. A decade ago, it was the other way around. New motorcycle sales in the U.S. are down by half from a 2006 peak, while used sales are up 13%.

Milwaukee-based Harley in 2018 is heading for its fourth straight year of declining sales as the company’s core older customers scale back purchases while younger riders fail to pick up the slack. A glut of used Harley-Davidsons has emerged after years of strong sales growth and production volumes, and offers a variety of choices for those unwilling to splurge on pricey new models.

Rough Ride

Harley’s sales have fallen in the U.S., while sales of used motorcycles have climbed in the past decade.

“It comes down to price, always,” said Jim McMahan, co-owner of a Harley dealership in Greensburg, Pa. “There are people who just don’t want to spend $18,000 to $25,000 on a new motorcycle.” Used Harleys in good condition can cost less than $15,000, dealers say.

Harley wants to reverse its sales slump by drawing new riders with 16 middleweight bikes it plans to roll out by 2022. Among them will be the company’s first electric model, debuting next year.

Harley hasn’t released prices for the new bikes, but dealers expect many of the models will be cheaper than the big bikes that make up the core of the current lineup. Offering more motorcycle choices at lower prices could lure younger riders to the Harley brand for the first time and help offset slumping sales of traditional models.

Heather Malenshek, Harley’s vice president of marketing, said used Hogs aren’t the company’s biggest problem. “The greatest challenge is to bring younger people into the sport,” she said. “Our used motorcycle base is a great way to get them in.”

But some Harley fans—including one Harley salesman—say the price of a new Harley deterred them from buying one. John Call, 31 years old, has sold Harleys at a dealership outside of Cleveland since 2016. In buying his first Hog last year, he chose a used 2009 Dyna Fat Bob for just under $10,000.

“A new Harley isn’t really practical for me,” he said. “I’ve got a growing family.”

Harley-Davidson motorcycles tend to have long lives. They don’t wear out easily or go out of style quickly and owners tend to take care of them, making the bikes appealing in the used-motorcycle market.

Harley has struggled to lessen its reliance on baby boomers, whose growing discretionary income and passion for hobbies including motorcycle riding brought the company back from the brink of bankruptcy in the early 1980s. Now, those riders are aging and buying motorcycles less frequently. But younger riders often can’t afford as many bikes as their parents or don’t see themselves living the Harley free-spirit lifestyle.

In response, the company is pursuing younger people who don’t fit the profile of a typical Harley fan: male and clad in a black T-shirt and leather vest. On Monday, Harley said it would start selling its popular branded apparel through Amazon.com Inc. Currently, Harley apparel is sold through the company’s website or at dealerships.

Two of Harley’s new models will be dual-purpose bikes for riding on both paved and unpaved roads, a motorcycle category that is growing in popularity in the U.S. Nine will be sports bikes with racing-style body features and seating to reduce wind drag. Harley doesn’t currently compete in either of these categories.

Some dealers said they doubt customers for those kinds of bikes will one day trade up for a new, expensive Hog. Ms. Malenshek acknowledged some might not, but said Harley also needs to accommodate riders who aren’t interested in its traditional models.

“The point of all of this is bringing new customers into the brand that weren’t there before,” she said. “They don’t all want to be in the lifestyle. You can have Harley on your terms.”

The new models are also designed to attract riders overseas, where Harley wants to generate half its sales a decade from now, up from about 39% currently. Harley in June said it would shift production of motorcycles bound for Europe out of the U.S., after the European Union imposed what would have amounted to a roughly $2,200 tariff on each Hog imported from the U.S.

President Trump and unions representing Harley workers said Harley was using the trade fight to justify existing plans to move production overseas. Harley said that assertion was false.

Many foreign markets are dominated by Harley’s competitors. Japan’s Kawasaki Heavy Industries , Suzuki Motor Co. and Honda Motor Co. make popular utilitarian bikes, while Germany’s BMW AG and Italy’s Ducati, owned by Volkswagen AG , make higher-priced models.

Harley faces those same competitors in the U.S., too, along with a resurgent U.S-based competitor in Indian Motorcycles, owned by Polaris Industries Inc.

Harley still accounts for about half of sales of U.S. motorcycles built for riding on highways. That share has held steady in recent years even as its own sales stalled because the market for new motorcycles overall has shrunk since the 2008-2009 recession.

And some riders of used Harleys do eventually buy a new one. Sarah Pellatiro of New Kensington, Pa., bought a new Harley Sportster this year for just under $12,000 after riding a used version for three years. Ms. Pellatiro said she chose the middleweight bike over a larger, more expensive model because she was confident she could handle it in traffic after gaining experience with a used Sportster.

“I got that bike right when I was still learning how to ride,” said the 32-year-old photographer and silversmith. “I don’t think I’ll ever ride any brand other than Harley from here on.”

Updated: 5-22-2019

Harley-Davidson Tries Revving Up Sales with Loans

Hog maker’s strategy comes with risks as it looks to broaden appeal beyond baby boomers.

Harley expects buyers of electric Hogs—such as the LiveWire, pictured, at the 2019 Consumer Electronics Show in Las Vegas—to be younger and less wealthy than the baby boomers who drove its sales in recent decades.

Harley-Davidson Inc. is using loans to reach new riders.

The motorcycle maker is introducing 100 new models through 2027, including its first electric bike, to find new customers outside a pack of aging riders in the U.S. Harley expects buyers of those Hogs to be younger and less wealthy than the baby boomers who drove its sales in recent decades, the company has said in recent years, making financing more important to securing their business.

“We are an enabler of Harley-Davidson’s plan for growing new riders,” Larry Hund, president of Harley’s financing arm, said in an interview.

The strategy presents new risks as Harley draws more of its revenue from lending. The company’s financing unit generated more than 40% of operating income last year, up from 28% in 2012. Profit in the unit has held steady as overall operating income declined in each of the past four years. Harley’s shares are down 16% over the past year.

Credit Cycle

Harley is financing more motorcycle purchases as it struggles to generate sales. Delinquency rates on those loans are rising.

Harley said in its most recent annual report that credit losses could increase as the company lends to more customers with lower creditworthiness. The percentage of customers who are late on their loans rose to 3.7% in the first quarter from 3.3% a year earlier in the U.S. despite strong economic growth and low unemployment.

Other vehicle makers, including Caterpillar Inc. and Deere & Co., also make loans through in-house financing units. Honda Motor Co.’s write-offs on loans for cars and motorcycles have increased over the past three years. Deere on May 17 raised its provision for credit losses from loans to 0.23% of its total portfolio from 0.17% in the previous quarter. Caterpillar said earlier this year that issues in its boat-engine business had increased the percentage of late loans to 3.55% in 2018 from 2.78% at the end of 2017.

Harley’s increase was the result of temporary problems with a new loan-management system that made reaching customers with late payments more difficult, Mr. Hund said. Delinquency rates for Harley’s customers remain well below rates of around 6% reached during the financial crisis.

“We have a very disciplined process in the way we set our credit criteria,” Mr. Hund said.

But rising delinquency and repossession rates could threaten Harley’s finances if they aren’t monitored carefully, said Jaime Katz, an analyst at Morningstar. Harley owned $20 million in repossessed bikes at the end of 2018, up from $12 million in 2012.

Those repossessions are adding to a glut of used motorcycles at Harley dealerships that is weighing on demand for the company’s new bikes.

The company wants to make more loans to customers purchasing those used bikes as well, generating some revenue from customers the company hopes will one day buy a new model, Mr. Hund said.

Ryan Smith, general manager at Greeley Harley-Davidson in Greeley, Colo., said Harley’s increased loan options have helped him close sales a customer might have walked away from in the past.

“Harley-Davidson Financial has really been a huge tool in helping us move motorcycles,” Mr. Smith said.

About 40% of Harley’s outstanding loans in 2016 were for used bikes, up from less than a quarter in 2006, and that share has continued to grow, Mr. Hund said.

But when financing goes bad, it can turn Harley from a beloved bike brand into a debt collector.

Alex Anker bought a used Harley for $15,800 in 2015, while he was in the Navy. He liked the look of Harley models that his roommates owned.

Harley gave Mr. Anker a six-year loan at a 6.49% annual interest rate, lower than the rate a credit union offered him. Harley didn’t require him to make a down payment.

Three years later, after leaving the Navy and college, Mr. Anker’s income dropped, and he missed a payment on his motorcycle in October.

“It was, honestly, wants versus needs,” he said. “I had to pick which bills I needed to pay.”

Harley started calling his cellphone repeatedly, Mr. Anker said. He filed a lawsuit in May claiming Harley broke federal and state laws by continuing to call him after he told them to stop.

Harley declined to comment on the lawsuit.

Zero-Percent Financing Deals Fade From the New-Car Lot As Interest Rates Rise

Auto lenders are backing away from no-interest loans as they become more expensive to offer to buyers of new vehicles.

Car buyers on the hunt for a 0% financing deal are going to have to look harder.

Auto lenders are pulling back on the no-interest financing offers that had become widespread in new-car ads and dealer showrooms for much of this decade. Cheap financing reinvigorated the U.S. auto industry’s sales following the recession, helping to keep monthly payments affordable and draw buyers from the used-car market, where lending rates are usually higher.

But as interest rates rose, the cost of such deals has increased, pinching profits for car makers that finance vehicles through their lending arms and must pay the difference to keep the rate at zero for the customer. With U.S. auto industry sales slowing, car companies are turning to other types of sale incentives, such as cash rebates and discount lease rates, to lure buyers to showrooms, dealers and industry analysts say.

“For a long time, everything was 0%,” said Adam Lee, chairman of Lee Auto Malls, a dealership chain in Maine. At first, buyers could find 0% finance deals on 48-month car loans, and then auto lenders started extending those deals to 60-month loans and eventually 72-month loans, he said. “There are fewer and fewer of those deals now,” Mr. Lee added.

In September, the percentage of new cars financed with an interest rate of 1% or less fell to 5.3% for the month, down from 8.2% in September 2017 and 11.7% in September 2016, the year U.S. auto sales peaked, according to market research firm J.D. Power.

No-interest loans have become even scarcer, accounting for 3.4% of all new-car financing in September, down from 9.1% two years ago, J.D. Power said.

Overall financing rates on new-car loans have also crept up over the last couple of years, although they remain well below 2008 levels. The average financing rate for a new-car purchase was 5.75% in the second quarter, up from 4.82% two years ago when auto sales were at their strongest, according to Experian Automotive.

“You’re definitely seeing the entire industry pulling back,” said Jack Hollis, general manager of Toyota North America, of the scaling back of interest-free auto loans. “Obviously, interest rates rising is a reality in the marketplace, and we’re going to react.”

In the years following the recession, auto makers took advantage of rock-bottom interest rates to make these deals more prevalent, mostly extending them to customers with higher credit scores and on specific loan lengths. For many car buyers, these promotions became a reason to buy a new car over a used vehicle, because the financing was cheaper.

General Motors Co. , which helped pioneer the 0% financing deal with its “Keep America Rolling” campaign in the early 2000s, still offers no-interest loans on select models, such as the Chevy Trax and Chevy Equinox.

While the promotions are becoming more expensive to maintain, it is “not so much that we would drop it from our quiver,” GM spokesman Jim Cain said. As interest rates continue to rise, GM will become more selective in how they are used and on which models, Mr. Cain said.

Mr. Lee, of Lee Auto Malls, said the pullback on 0% financing and uptick in interest rates are making cars more expensive at a time when buyers are already paying near-record prices for new vehicles. For instance, a customer who may have paid $476 a month for a $26,500 Toyota Camry purchased with a 0% loan for 60 months will now have to pay at least $50 more a month at 4%, he said.

“The higher payments are making it harder for people to afford a new car,” Mr. Lee said. “Some are going to used [vehicles], some are holding off [on purchases], and some are going to leases.”

Updated: 4-23-2019

Harley Sales Fall, But Motorcycle Shipments Exceed Forecast

Higher-than-expected shipments reflect output at an expanded factory in Thailand that has helped the company make more sales in Southeast Asia.

Harley-Davidson Inc. sold more motorcycles than expected in the first quarter, but sales fell due in part to lower prices on models sold abroad, underscoring the challenge facing the company as it seeks new riders around the world.

The Milwaukee-based manufacturer on Tuesday reported first-quarter sales of $1.19 billion, down from $1.36 billion a year earlier. Harley also shipped 58,891 motorcycles in the quarter, down from 63,944 a year ago but more than the 58,000 the company had predicted.

Harley said its higher-than-expected shipments reflected output at an expanded factory in Thailand that has helped the company make more sales in Southeast Asia, a fast-growing market for motorcycles.

Harley said last June that it would move manufacturing of more motorcycles destined for foreign markets to factories outside the U.S., drawing a rebuke from President Trump.

Mr. Trump called European Union tariffs on U.S.-made motorcycles unfair in a tweet early Tuesday and said the U.S. would reciprocate.

Harley said that the Thailand factory has helped double sales in Southeast Asia and that the company plans to begin shipping bikes from that factory to China this year.

“We saw proof in the wisdom of our Thailand manufacturing investment,”

Chief Executive Matt Levatich said on a call with analysts. “The tariffs mitigation realized allowed more competitive pricing and access to more customers.”

Harley said it has spent more on marketing and sales incentives as it strives to reach new riders. Harley is pushing to revive sales by releasing 16 new models over the coming years, including electric motorcycles and racing-style sport bikes. Last month, the company purchased a company that makes electric bikes designed for children, a signal of how it is targeting younger customers. The company in the quarter also hired Neil Grimmer, a former Campbell Soup Co. executive, as its first-ever global brand president.

Harley said first-quarter profit dropped to $127.9 million, or 80 cents a share, from $174.8 million, or $1.03 a share, a year earlier.

Excluding restructuring expenses and the impact of tariffs, the company reported earnings of 98 cents a share, more than the 82 cents a share analysts predicted.

Retail motorcycle sales dropped 4% in the U.S., the company’s largest market. Those sales were off 0.6% in the region that includes Europe and the Middle East.

Harley also reiterated that it expects to ship between 217,000 and 222,000 motorcycles this year. The second quarter, encompassing the spring season when Harley often makes more than a third of its annual sales, will be an important gauge of progress toward that goal.

Updated: 1-3-2020

Car Sales Boom Hit the Brakes in 2019

GM, Toyota, Fiat Chrysler report softer U.S. sales last year as buyer demand cools after streak of robust results.

Several major car companies reported softer U.S. sales for 2019, as the auto market shows signs of easing after posting a multiyear streak of near-record results.

General Motors Co.’s sales fell 2.3% for the year, dented largely by a 40-day strike last fall that brought more than 30 U.S. factories to a standstill, the company said Friday.

In the fourth-quarter alone, the Detroit auto maker’s sales fell 6% over the prior-year period, illustrating the impact of the United Auto Workers strike, which depleted new-vehicle supply on dealership lots, GM said.

Fiat Chrysler Automobiles NV’s sales in the U.S. fell 1% last year, while Toyota Motor Corp. reported a nearly 2% decline in U.S. sales. Honda Motor Co.’s 2019 U.S. sales were flat, while Nissan Motor Co.’s sales fell nearly 10%.

Major auto makers reported their year-end sales tallies for the U.S. throughout the day Friday, with the exception of Ford Motor Co. Its full-year U.S. sales will be released publicly on Monday, a spokesman said.

GM shares fell nearly 2% in Friday afternoon trading, more sharply than the broader market decline. Fiat Chrysler shares fell 3%, while Ford’s declined 1%.

Once final numbers are complied, analysts expect the industry to post a decrease of 1% to 2% in U.S. auto sales for the year, to around 17 million vehicle sales.

While cooling, auto makers are still selling new vehicles near the record levels posted in 2016. A final tally of 17 million would be the fifth straight year industry sales topped that mark, defying earlier predictions of a sharper decline and extending a remarkably long period of lofty U.S. results.

“Ten years ago it was like, ‘Can we ever get to 17 million?’ said Jack Hollis, group vice president of Toyota’s North American subsidiary. “And now we’re there every year.”

The industry’s resilience in the U.S. caps a tumultuous 2019 for the global car business, which has confronted trade pressures, tighter environmental regulations and slowing sales in key markets.

Car companies are leaning more on the U.S. market to fuel profits amid troubles overseas. Analysts expect the auto industry in China, the world’s largest auto market, to report later this month a decline in sales in 2019 for the second straight year, after decades of consistent growth.

Sales in the European Union were steady last year, but the cost of complying with stricter limits on tailpipe emissions threaten to pinch car makers’ profits, industry analysts and executives say.

Trade tensions have eased since a year ago, when the auto industry braced for impact from a U.S.-China clash over auto tariffs and an amended North American trade pact was still unsettled. With earnings under pressure, GM, Ford, Volkswagen and other auto giants embarked last year on restructurings that included tens of thousands of layoffs and factory closings.

The car industry is making costly bets on new technologies, such as electric vehicles, leading to more consolidation and alliances among auto makers. Fiat Chrysler heads into 2020 with a merger agreement in hand with France’s PSA Group, creating a $50 billion company that would rank among the world’s largest auto makers by sales.

U.S. sales, while down slightly, outpaced most analysts’ forecasts.

The strong U.S. economy has kept the good times rolling for many auto makers, while low gas prices and a proliferation of new sport-utility vehicles have helped steer consumers toward more expensive models, analysts and industry executives say. Cheap leases, low interest rates and longer loan terms have helped buyers fit pricier cars into manageable monthly payments, while taking on more financial risk in the process.

U.S. buyers continued to shell out more for new vehicles, drawn by new technology and safety features as well as a growing affinity for pricier SUVs and pickup trucks.

The average price of a new vehicle reached an estimated record of $33,656 in 2019, nearly 4% higher than a year earlier, research firm J.D. Power said.

U.S. vehicle sales rose steadily from the depths of the financial crisis a decade ago, when they bottomed out at 10.4 million sales in 2009. Sales hit a record 17.6 million in 2016 and have bobbed along around the 17-million mark over the last several years, providing an unusually steady environment for an industry accustomed to sharp cyclical swings.

Still, analysts and car executives are monitoring factors that could curb demand for new vehicles in 2020, analysts say. Industry forecasters expect a steeper sales drop this year, into a range of 16.5 million to 16.8 million vehicles.

Car dealers started 2019 with unusually large stockpiles of unsold vehicles, stoking concerns that demand for new cars was slowing. Dealers also had trouble ridding their lots of past-year models as newer vehicles were released this summer, forcing steeper discounts.

Auto makers are spending more on discounts and other sales promotions to draw buyers’ interest, another sign that demand is weakening and slower sales could be around the corner, analysts say. The industry’s spending on sales incentives in recent months hovered around 11% of the sticker price of a car, the highest level since 2008, according to J.D. Power.

“There is still too much supply relative to overall demand,” said Thomas King, head of analytics at J.D. Power.

New-car buyers increasingly are stretching to afford monthly payments as the prices of new vehicles continued to hit record highs last year, analysts say.

With sticker prices on the rise, more buyers are gravitating to the used-car lot, where prices have fallen in recent months, making them a better bargain, analysts and dealers say. There is also a wider selection of popular preowned SUV models now than in the past, giving shoppers more-appealing options, said Ryan Gremore, president of O’Brien Auto Team, which has stores in Illinois, Florida, Kentucky and Washington.

“A lot of people can’t afford” new vehicles, Mr. Gremore said. “We tried to capitalize on the used-car market [in 2019], and it will be an important focus in 2020.”

Updated: 2-18-2020

High Car Prices Are Locking Out Younger Shoppers

As auto makers shift away from cheaper models, dealers lament losing first-time buyers.

Auto dealers want to lure young buyers back to new-car lots.

Auto makers have in recent years turned away from cheaper models, such as hatchbacks and small sedans, to focus their lineups on the higher-priced SUVs and trucks that have surged in popularity with the drop in fuel prices.

The shift has helped lift new-vehicle prices to record levels and boost profitability for the auto sector.

But dealers, gathering at a conference in Las Vegas this past weekend, warned that the trend is also pricing many buyers out of the new-car market.

The main casualty, they said, are younger adults. “We really do need the younger buyers in these new vehicles,” said Charlie Gilchrist, the 2019 chairman of the National Automobile Dealers Association, in an interview.

Used-car shoppers typically aren’t loyal to one brand, and auto retailers count on drawing first-time buyers to build repeat business, he said.

“That first vehicle they have is an impression that they will keep the rest of their lives,” said Mr. Gilchrist, who is also a dealer in Texas.

The number of new vehicles purchased by buyers between the ages of 16 and 35 fell nearly 4.5% last year, according to J.D. Power. That is a more dramatic decrease than the overall U.S. market saw in 2019.

By comparison, purchases by customers older than 56 increased nearly 1% in 2019, J.D. Power found.

“The financial challenges that young consumers face are multifaceted and well-documented,” said Tyson Jominy, vice president of data and analytics for J.D. Power, referring to high student-loan and rent payments already plaguing young consumers. “But we can’t discount the role that higher monthly new car payments and insurance play on lower sales.”

He also cited the availability of ride hailing as a factor delaying the purchase of a car for some young people.

U.S. auto sales are cooling, down roughly 1% last year, after more than a half-decade of growth and hitting a record of 17.6 million in 2016. In that time, new-vehicle prices have steadily increased, in part because of the industry’s shift to larger, more expensive vehicles, but also owing to more advanced technology and safety features and rising material prices, dealers and analysts said.

The average price paid for a new vehicle last year was $33,600, up $1,100 from 2018, according to J.D. Power. Prices are expected to keep rising this year, supported by expensive tech features and bolstered by steady demand, dealers and analysts said. Auto executives and industry experts are forecasting new vehicle sales of just under 17 million this year, which is still considered a healthy level.

To make vehicles more affordable, car companies are spending more on discounts while many lenders are stretching out repayment terms. Dealers said interest rates, while a concern in years past, have come back down again, giving customers some cost relief this year.

Fiat Chrysler Automobiles NV’s head of U.S. sales, Reid Bigland, who met with dealers in Las Vegas over the weekend, said he doesn’t see higher car prices affecting demand this year.

“It’s always a concern, affordability, but it doesn’t seem to be showing its face,” Mr. Bigland said.

Still, the average monthly payment for a new vehicle was $566 last year, about $150 more than the average payment of a used vehicle, according to Cox Automotive. Analysts expect used-car sales to hit a record this year.

Cheaper sedans and hatchbacks have traditionally served as the affordable option for first-time car buyers. Companies such as Toyota Motor Corp. and Nissan Motor Co. have said they are sticking with these models, even as demand has dropped off significantly, in part to preserve that gateway into the brand.

The U.S. auto makers have taken a different tack. Ford Motor Co. no longer sells in the U.S. the Focus and Fiesta, two small-car models that have long served as a more affordable option for budget-minded buyers, to plow more resources into expanding its SUV lineup. General Motors Co. has stopped building the Chevy Cruze. Fiat Chrysler turned away from the sedan market in 2016, dropping the compact Dodge Dart and scaling back its Chrysler sedan offerings.

That has left fewer options for buyers on a budget. Sales of cars priced at $20,000 or less plummeted 20% last year, according to J.D. Power, while sales of more expensive cars—going for more than $40,000—increased 7%.

The migration to used vehicles for younger buyers is unavoidable as sticker prices on new cars keep rising, said Mike Maroone, a former president of AutoNation Inc. who owns dealerships in Colorado and Florida. But he is taking the change in stride, he said, leveraging new-car discounts when he can while looking for ways to build loyalty among used-car buyers.

“A lot of customers come in with a payment in mind, not a product,” Mr. Maroone said. “Affordability is a big issue, so we need to be building up our used-car business.”

Hertz Accuses Thousands of Car Renters of Theft, Court Papers Show

* Tally Of Criminal Reports Disclosed Amid Suit On False Arrests

* Car Rental Company Faces More Than 200 False Arrest Claims

Hertz Corp., facing lawsuits from hundreds of car renters who say they were falsely arrested for auto theft, files thousands of related criminal complaints each year against customers, according to claims in newly released court documents.

In one four-year period, the company filed nearly 8,000 theft reports annually, advocates for the falsely arrested customers said in a federal court filing in Wilmington, Delaware Thursday. The advocates cited internal data from Hertz that a judge ordered the company to release.

A breakdown of the theft reports isn’t public, so it’s not yet possible to know how many complaints were against customers and how many were for other types of theft. Under certain circumstances, Hertz will tell police that a customer may have stolen a car. Many of those people turn out to have valid contracts and allegedly have been falsely arrested, according to the lawsuits.

Messages left for Hertz representatives weren’t immediately returned. CBS, which hired lawyers to help get the documents unsealed, previously reported Hertz said the “vast majority” of cases involve renters who were weeks or months overdue on returns and authorities are brought in only after “exhaustive attempts” to reach a customer.

Court Order

In a court hearing Wednesday, U.S. Bankruptcy Judge Mary Walrath ordered the annual theft numbers to be made public, siding with advocates for 220 people suing Hertz who argued that more details about Hertz’s internal anti-theft program should be public.

Court documents show that some of the customers who rented cars were jailed, some years after they rented and returned the cars. At least one allegedly was held at gunpoint just hours after paying for a rental.

“Hertz now admits that it reports thousands of its own customers for auto theft each year,” lawyers for the people suing said in court papers. The problem can be traced to company-wide, systemic problems, they allege.

Bankruptcy Claims

The false arrest claims often involve long-term rentals, some set up directly by the customer, others through an auto insurance company, according to court documents.

Those who claim Hertz had them wrongly arrested have filed claims in bankruptcy court demanding to be paid like other creditors of the company. Walrath oversaw Hertz’s Chapter 11 reorganization, which ended last year with a plan to pay creditors in full.

The case is Hertz Corp. 20-11218, U.S. Bankruptcy Court, District of Delaware (Wilmington).

Updated: 2-11-2022

The 10 Used Cars Surging The Most In Price: Here’s The List

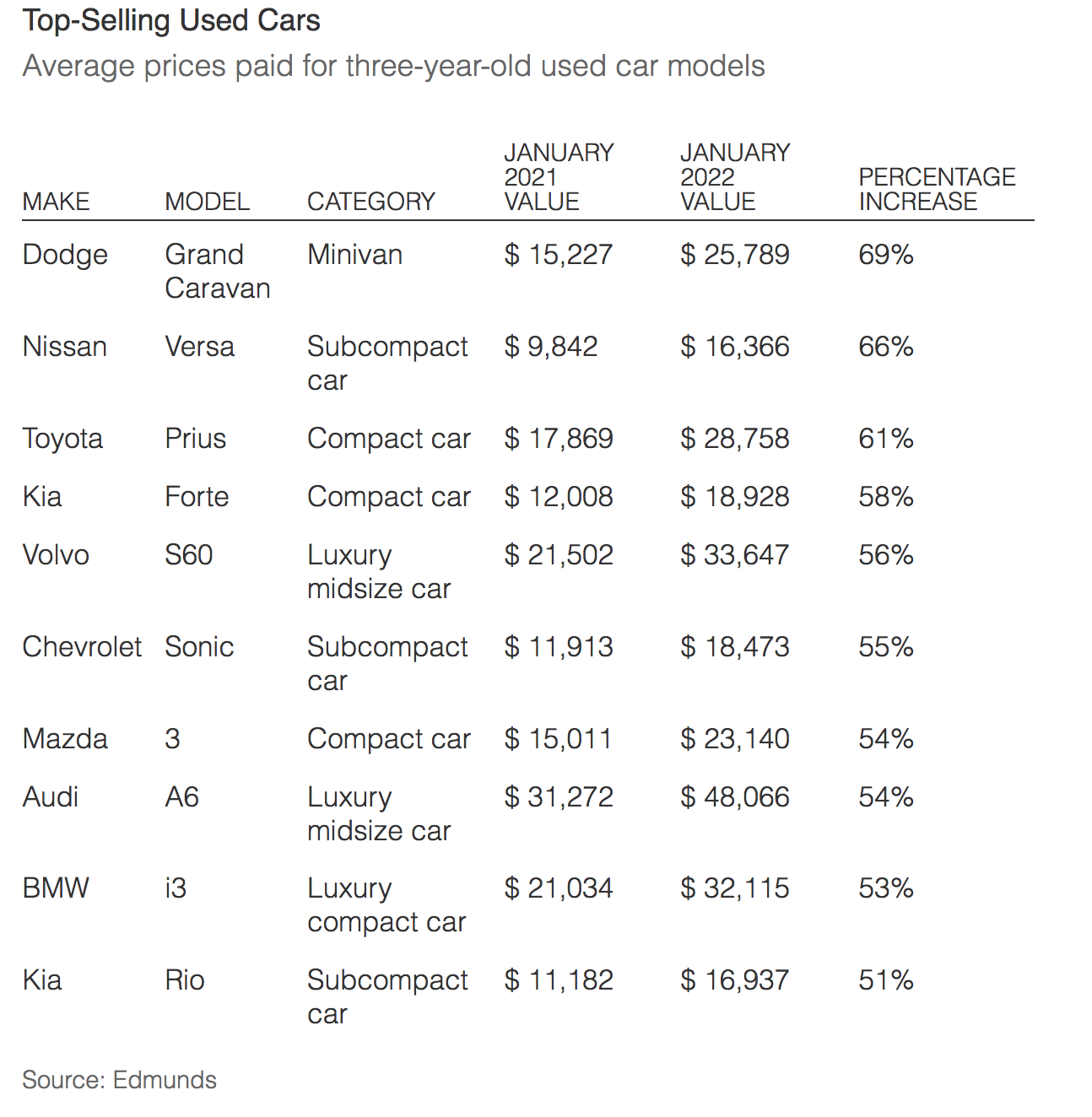

Dodge Grand Caravan, Nissan Versa and Toyota Prius have seen biggest increases in average prices paid for three-year-old models.

Surging used-car prices and an inventory crunch across auto dealerships mean there could be cash to be had in that old clunker.

Prices for used cars have risen by 40.5% over the past year, according to the latest Labor Department data. That jump helped accelerate U.S. inflation to an annual rate of 7.5% last month, a new four-decade high.

Cars are traditionally depreciating assets. But a slowdown in new car production among auto manufacturers has created high demand for used vehicles—and led to sticker shock for buyers expecting to find deals on second-hand models.

The average transaction price for a three-year-old used Dodge Grand Caravan, for example, surged by 69%, according to data from automotive research company Edmunds, rising from just over $15,000 in January 2021 to nearly $26,000 last month.

The firm provided a list of three-year-old used cars that have seen the biggest percentage increases in average transaction prices over the past year. It says average prices paid for three-year-old Nissan Versas and Toyota Priuses are up more than 60% from a year ago.

Ivan Drury, senior insights manager for Edmunds, said bargain hunters are seeking the most affordable options, rather than looking for the newest or flashiest car. That’s giving car owners looking to unload older models some surprising selling power in this upside-down market, he said.

Here’s the Edmunds list of three-year-old used cars that have surged the most in price on average over the past year.

Updated: 1-27-2023

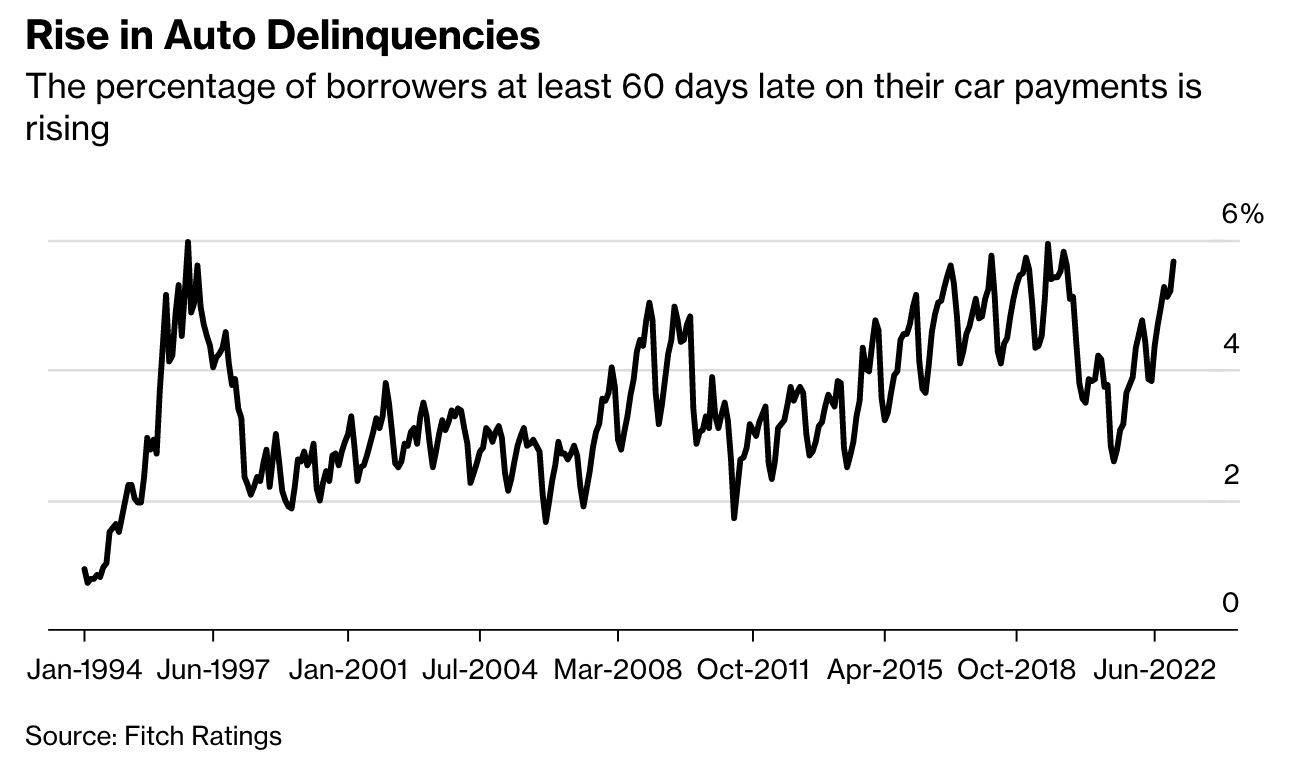

Americans Fall Behind On Car Payments At Higher Rate Than In 2009

Automobile repossessions are climbing as inflation forces struggling consumers to make tough choices.

Losing his car was just the beginning.

When 21-year-old Kobe Hatch walked outside his Chicago home in December and couldn’t find his 2013 Dodge Journey, he knew it had been repossessed. He’d been falling behind on payments for months.

Without a car, he couldn’t do his job as a delivery driver for Amazon and got fired. Now, he’s struggling to make his rent payments and can’t afford groceries, even with food stamps.

“It’s been very stressful for the past few months,” he said. “Inflation has really taken a toll on people.”

Hatch is part of a growing cohort of Americans facing auto repossessions, an ominous sign for the US economy. During the pandemic, a surge in used car prices forced buyers to take out bigger loans for their vehicles.

The monthly payments seemed doable in an era of stimulus checks, a tight labor market and surging stocks, but that’s changed for many people as inflation eats into their budgets and the job market cools.

Now, more Americans are falling behind on their car payments than during the financial crisis. In December, the percentage of subprime auto borrowers who were at least 60 days late on their bills rose to 5.67%, up from a seven-year low of 2.58% in April 2021, according to Fitch Ratings.

That compares to 5.04% in January 2009, the peak during the Great Recession.

Higher interest rates are making it even more difficult to make the monthly payments. The average new auto loan rate was 8.02% in December, up from 5.15% a year earlier, according to Cox Automotive. The rate can be much higher for subprime borrowers.

For Hatch, the total monthly bill for his car reached about $1,000, including the cost of insurance, thanks to a whopping 26% interest rate.

Even if he can manage to save up enough to get the car back — about $1,100 for the repossession fee — there’s a strong chance he won’t be able to make the payments in subsequent months, especially now that he’s unemployed.

Affordability Struggles

While the number of vehicle repossessions is rising, it’s still below pre-pandemic levels.

At Manheim, an auto auction company, the number of repossessed cars increased 11% in 2022 compared to the prior year, but that was still down 26% from 2019.

When exactly a lender can repossess a car varies by state, but it can happen in many cases as soon as a borrower is in default — often when a payment is not made on time, according to the Federal Trade Commission.

Usually, though, it takes two or three consecutive missed payments for a repossession to happen.

Once the vehicle is seized, the repossession can affect the borrower’s credit score for as long as it stays on the credit report — usually about seven years, according to Experian.

Credit Hit

Josef Fields in Forth Worth, Texas, fell behind on his car payments and now faces a hit to his credit score.

With his monthly bill at $556 for his 2021 Subaru WRX, the 25-year-old was having a hard time figuring out which costs to prioritize.

He tried to apply for a hardship program through his bank, but it was too late. He woke up to an empty driveway a week before Christmas.

Now, the repossession and tow fee will cost him $1,600 — about the total sum he owes in back payments as well.

He’s trying to save up for another car but it will likely take a while.

One positive is that he can walk to his job at the local post office. But whenever he needs to go to the grocery store, he has to ask a friend or take an Uber, which adds even more costs.

Fields is worried about how this will affect his financial future, especially his dream to buy a house one day. He estimates that the repossession shaved about 40 points off his credit score.

“When it comes to people my age and younger our credit is still new, so it’s more difficult, and then when stuff like this happens, it screws us over for the long run,” he said.

Ominous Signal

Zhea Zarecor in San Antonio is currently trying to negotiate with her lender so her 2013 Honda Fit won’t get repossessed. In the meantime, she’s hiding it.

The 53-year-old, who is currently in school for her bachelor’s in information technology, splits the monthly bill for the car — about $178 — with her roommate.

But then the roommate lost his job, and with prices for groceries and everyday items increasing, there just wasn’t enough for the car payments.

Zarecor is trying to make extra money with odd jobs like contract secretarial work and participation in medical studies, but it often feels hopeless, she said.

“Our money doesn’t go as far as it used to,” she said. “I don’t see prices going down, so the only relief I see is when I get my degree.”

Updated: 4-27-2023

Harley-Davidson Says Repo Shortage Is Fueling Credit Losses

There are not enough people to repossess all the motorcycles.

That was the message from Harley-Davidson Inc., which said Thursday its credit losses in the first quarter were due in part to a shortage of repossession agents.

The repossession industry is seeing an uptick in demand as more Americans struggle to afford their car payments.

And companies that specialize in seizing vehicles are having trouble hiring enough agents, after many decamped for other jobs during the pandemic when business largely dried up due to stimulus measures.

For Milwaukee-based Harley, the repo shortage combined with a decline in retail bike values.

That contributed to realized credit losses of about $52.6 million in the first quarter for the company’s financial arm, vice president and treasurer David Viney said on a conference call Thursday.

“A lot of people left the repossession industry during Covid,” Viney said.

He added that Harley has accelerated efforts to reach customers in cases of late-stage delinquencies, and that the company is “making a lot of enhancements” to its repossession strategy.

Those changes, combined with an expected seasonal recovery in credit losses, should help reduce the loss rate in the coming quarters, he said.

At the North American Repossessors Summit in Orlando earlier this month, many attendees reported staffing shortages and said they’re gearing up for boom times.

In March, the percentage of subprime auto borrowers who were at least 60 days late on their bills was 5.3%, up from a seven-year low of 2.58% in May 2021 and higher than in 2009, the peak of the financial crisis, according to data from Fitch Ratings.

Related Articles:

Auto Dealers Found Guilty of Odometer Fraud, Deceptive Advertising And Other Charges (#GotBitcoin?)

Americans’ Love Affair With The Automobile Headed For Divorce (#GotBitcoin?)

The First Flying-Car Review (#GotBitcoin?)

Cargo Ship Fire Sends 2k Luxury Autos To The Sea Bottom (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.