Budget Deficit Grows While Stocks And Bond Yields Fall, Negative Interest Rates Spread!

Yield on 10-year U.S. Treasury note slid to fresh low for the year.

Major stock indexes have managed to rally this year despite a slowdown in the global economy, in part because central banks have signaled they will back off plans to normalize monetary policy for the foreseeable future.

But signs that momentum continues to cool across major economies have challenged investors, raising questions about whether a soft patch of data could mark the start of a more persistent downturn.

A report Friday showed factory output in the eurozone fell in March at the fastest pace in six years, while a gauge of U.S. manufacturing activity slipped to its lowest level in nearly two years.

The data sent bond yields tumbling, with the German 10-year bond yield trading in negative territory for the first time since 2016 and the yield on the 10-year U.S. Treasury note at 2.453%, a fresh low for the year.

Meanwhile, stocks across the world retreated, with the S&P 500 losing 1.7% and benchmark indexes in France, the U.K. and Germany ending down more than 1% apiece.

“The global economy has clearly become an issue, with big headwinds there,” said Tim Anderson, managing director at broker-dealer TJM Investments, pointing to mounting worries particularly in Europe and China.

For much of 2019, stocks and bond yields had moved in opposite directions. That troubled fund managers, who noted bond yields typically rise—not fall—when investors are confident in future prospects for growth.

But they moved lower in lockstep Friday, as investors across markets bet on an environment in which growth across the world is expected to slow.

“This confirms the softening data tone the market has been observing and central banks have been forced to take note of,” said Matt Cairns, strategist at Rabobank.

Bank stocks slid again Friday, putting the KBW Nasdaq Bank Index of large lenders on track for its biggest one-week slide since December. The group has been hit particularly hard by recent stock declines, in part because lower interest rates and slowing growth bode poorly for lending profitability.

“The market is polarized: Half thinks we are in a bull-market recovery and the other half thinks we are in a bear-market rally” —Eoin Murray, head of investment at asset manager Hermes

Bank of America shed 4.5%, while Morgan Stanley declined 3.6% and Goldman Sachs fell 2.5%.

Commodities prices and stock sectors tied to them retreated, underscoring the dimming outlook for the global economy.

The S&P 500 energy and materials sectors lost nearly 3% apiece, while copper futures-—which tend to rise when investors expect growth to boost consumption of industrial materials-—retreated to a one-month low.

Part of investors’ anxiety, many say, stems from doubts about whether central banks’ wait-and-see approach to monetary policy will be enough to avert a global economic slowdown.

Earlier this week, Federal Reserve officials indicated they are unlikely to raise interest rates this year and may be nearly finished with the series of increases they began more than three years ago.

On Wednesday, Fed Chairman Jerome Powell suggested the central bank was likely to leave the policy rate unchanged for many months.

This change of tactic by the Fed has divided the market. For some, it is the latest sign that economic growth in the U.S. and around the world is slowing. For others, a more dovish Fed could prolong the bull market.

“The market is polarized: Half thinks we are in a bull market recovery and the other half thinks we are in a bear market rally,” said Eoin Murray, head of investment at asset manager Hermes.

To be sure, many believe that in the U.S., a recession isn’t imminent.

Corporate earnings, while cooling, are still expected to post single-digit percentage growth in 2019, according to FactSet. The labor market has added jobs for 101 consecutive months, its longest streak ever, and unemployment remains low.

Even weaker segments of the economy have appeared to stabilize in recent months, with data Friday showing sales of previously owned homes soared 12% in February—far more than economists had expected.

But the question investors say they are contending with is whether the slowdown in the eurozone could have a ripple effect, hitting profits at multinationals in the U.S.

In one warning sign, a closely watched yield curve inverted Friday for the first time since 2007.

The spread between 3-month and 10-year U.S. Treasurys fell to -0.03 percentage point. Investors and Fed officials closely watch the dispersion of short- and longer-term yields because the three-month yield has exceeded the 10-year yield ahead of every recession since 1975.

In another sign of pessimism, traders doubled down on bets that the Fed will go as far as lowering rates soon—something they haven’t done since the midst of the financial crisis in 2008.

Federal-funds futures, used by traders to place bets on the course of monetary, showed the market pricing in a more than 60% chance of the Fed lowering rates by the end of the year, according to CME Group. That marked the highest probability yet this year.

Twin Troubles Strike The Bond Market

Negative yields on German bunds and an unusual dynamic in the Treasury market are adding to investor nervousness.

The global bond market flashed two prominent warning signals on the economy Friday, spooking investors and feeding a selloff in stocks—particularly bank stocks.

The yield on 10-year German government bonds, the European benchmark, turned negative for the first time since 2016. Across the Atlantic, the 10-year Treasury yield fell below that of three-month Treasury bills. This “inversion,” which was last seen in August 2007, is considered to be a reliable predictor of recessions in the U.S.

The two signs emerged against the backdrop of cascading bond yields world-wide spurred in part by weak readings from the eurozone manufacturing sector. Disappointing data from purchasing-managers indexes, especially in Germany and France, exacerbated worries about the health of the region’s economy and possible knock-on effects in the U.S.

“You have a very clear signal here that the market is anticipating a notable slowdown on both sides of the Atlantic,” said Richard McGuire, head of rates strategy at Dutch group Rabobank.

Recent warnings from central banks about the state of developed economies have increased investor demand for safe government bonds, which pushes up prices and drives down yields.

Stock markets declined, with banks hit hard. Citigroup slid nearly 5%, Italy’s largest lender UniCredit fell 4.5% and Société Générale of France was down nearly 4%.

The yield on 10-year German debt, called bunds, touched -0.03% on Friday, the lowest level since October 2016. Germany’s export-driven economy is Europe’s powerhouse, but it is vulnerable to the global growth outlook.

Germany relies on China, but growth there is slowing, too, in part due to trade tensions with the U.S.

“The margin between stabilization and full-blown recession in Europe is becoming more and more thin,” said Maurice Harari, senior portfolio manager at SYZ Asset Management.

Downbeat growth predictions have prompted central banks in the U.S. and Europe to step back from their plans to reintroduce more-normal monetary policy—with higher interest rates and less quantitative easing.

The fall in European yields has put pressure on U.S. yields, as investors starved of returns in Europe are moving into Treasurys. Investors’ other option is to take more credit risk by buying lower-quality debt or longer-term bonds.

Investors are left confronted with a conundrum, according to James Athey, senior investment manager at Aberdeen Standard Investments: Either accept a definite small loss from a negative yield, or take risks that could lead to bigger losses.

“People say it’s a tax on banks, but it’s a tax on companies, it’s a tax on individuals, it’s a tax on the entire system because nobody can get a return on their investments without taking risk,” Mr. Athey said of negative yields.

Bunds’ slide has accelerated in recent weeks. The European Central Bank rattled markets this month by slashing forecasts for real economic growth this year to 1.1% from 1.7% predicted three months ago.

ECB President Mario Draghi added that the central bank’s benchmark rates, currently negative, would be held steady through 2019 rather than just through the summer.

Banks and insurers are on the front lines of dealing with subzero rates. Negative yields are destructive for profits at banks and insurers and painful for savers.

European bank stocks lost a third of their value in the first half of 2016, when the 10-year bund yield first went negative, and have suffered again in recent days.

The Stoxx Europe 600 Banks index has shed nearly 5% this week.

European banks themselves are part of the problem, said Alberto Gallo, portfolio manager at Algebris Investments. They have been slow to clear their balance sheets of problem loans and so are unable to help the economy grow, Mr. Gallo said.

Presidential candidate, Donald Trump, has been critical of fellow Replubicans including Sen. John McCain. Some voters are curious about his “daffy” behavior.

European companies, unlike those in the U.S., rely more heavily on bank lending than on the bond market.

“Bond markets allow you to recover from a balance-sheet recession more quickly because everything gets priced in immediately and is restructured in a few quarters,” Mr. Gallo said.

“But with bank loans you get extend and pretend,” he said, referring to banks rolling over loans to problem borrowers rather than writing them off or seizing borrowers’ assets. “In Europe, you end up still with hundreds of billions of bad loans on bank balance sheets more than 10 years after the crisis and that restricts growth.”

U.S. Budget Deficit Grew 39% in First Five Months of Fiscal 2019

Tax revenues little changed so far in fiscal 2019.

The U.S. budget gap widened 39% in the first five months of the fiscal year as tax revenues held steady and federal spending increased.

The government ran a $544 billion deficit from October through February, the Treasury Department said Friday, compared with $391 billion during the same period a year earlier. Federal outlays rose 9%, to $1.8 trillion, while revenues declined less than 1%, to $1.28 trillion.

Part of the increase in the deficit was attributable to a shift in the timing of certain payments, which made the deficit appear larger. If not for those timing shifts, the deficit would have risen 25% from the same period in fiscal year 2018.

Higher spending on health care, the military and tariff-assistance programs for farmers pushed the deficit to a record $234 billion in February, 9% higher than the same period a year earlier, as federal spending outpace tax collections.

The government typically runs a deficit in the month of February, as the Treasury begins to send out tax refunds to individuals, and businesses aren’t due to make any scheduled tax payments.

Last month, federal tax receipts rose 7%, due in part to a 5% increase in individual income-tax collection compared with February 2018. The rise is significant, a senior Treasury official said, because employers were withholding income from individual taxpayers at a higher rate for part of February 2018, before the Tax Cuts and Job Act took effect midmonth.

The tax code overhaul enacted in 2017 had constrained federal revenues over the past year. Going forward, Treasury expects revenue collection to stabilize or increase as rising wages boost workers’ paychecks.

Another source of rising revenues last month was tariff collections, which rose $3 billion, a 93% increase from February 2018. That was partially offset by higher spending by the Agriculture Department, which a senior Treasury official attributed to assistance programs for farmers facing retaliatory tariffs.

On a 12-month basis, revenues declined 0.7% and outlays rose 5%. For the 12 months ended February, the deficit totaled $932.2 billion, or 4.5% as a share of gross domestic product, the highest since May 2013.

Updated 5-30-2019

Low Yields Might Mean This Is as Good as It Gets

A realization is growing that a stubborn shift lower is the new way of the world.

In October, investors were worried that higher bond yields would hurt stocks. In January—after the Federal Reserve backtracked on rate rises—they thought lower yields would help stocks. Now, falling government-bond yields world-wide are spooking shareholders, with some on Wall Street again talking about recession.

What’s going on? We saw something similar in 2016; then as now, the concerns were in large part made in China. But look deeper, and there is something else afoot: A rising sense not of imminent trouble but of a realization that central banks might not be able to spark growth and inflation, and that a stubborn shift lower is the new way of the world.

In 2016, bond markets freaked out and yields reached record lows. This week, the German 10-year bond, the benchmark for the eurozone, came within a hair’s breadth of that 2016 trough. In the U.S., the level of yield is much higher, but the scale of the fall since October is virtually identical to the fall to the lows over the same time frame in 2015-2016.

There are other similarities. Investors are worrying that future inflation will be subdued. In the U.S., the probability of inflation above 3% over the next five years has fallen below 7% for the first time, aside from the recession panic of December, since 2016, according to the Minneapolis Federal Reserve.

In both the U.S. and Europe, future inflation expectations priced into markets have fallen, in Europe’s case a lot. The eurozone inflation swap for the five years starting in five years’ time, a gauge closely watched by the European Central Bank, is back below 1.3% and close to the 2016 low.

Traders are betting that the Fed will cut rates more than once by January. Meanwhile, the ECB isn’t expected to push rates back above zero for seven years, twice as long as was expected at the start of the year.

In 2016, investors feared that China’s economy was slowing, and there was a hangover from the previous year’s devaluation of the yuan. Today the danger is that the trade fight with China badly hurts global manufacturing, already struggling with a tepid world economy.

In some ways, a repeat of 2016 might be welcome. The rapid decline in bond yields in the summer of 2016 was ignored by equities, which were on the rebound from the oil slump at the start of that year. Bond yields snapped back up again fast, then soared when Donald Trump was elected president.

Yet, there are significant differences. The 2016 low in yields came amid serious concerns about Britain’s vote to leave the European Union. It didn’t take long for investors to conclude that this was a problem mainly for the British, as it has stayed since then.

“It feels more like a slow burn this time as opposed to the shock of the Brexit event,” says Andrew Bosomworth, Pimco’s head of portfolio management in Germany. “Trade has been more of a drip-feed process.”

Inflation was a more obvious problem in 2016, too. The big drop in oil prices had left Europe and Japan with headline deflation once again, encouraging talk of a deflationary spiral. Inflation options implied a 40% chance of price rises averaging less than 1% over five years.

This time, there is much less concern about deflation. Options markets suggest only a 12% chance of such “lowflation” on the way, and current headline inflation isn’t far below central banks’ 2% target in the U.S. and Europe; Japan is still failing to reach its goal, but at 0.9% in April was some way from deflation.

Instead, the concern this time is that the economic models central banks and investors rely on to forecast inflation no longer work. Perhaps the internet, trade and manufacturing technology will cap price rises even with full employment?

“It’s this growing sense that there might be little mini [economic] cycles but the long-term outlook is a rather depressing grind lower in potential growth and inflation prospects,” says Sebastian Mackay, a multi-asset fund manager at Invesco. “It just seems that central banks’ direct influence on inflation is quite limited.”

This view is one reason stocks and corporate bonds have fallen much less than the drop in bond yields might suggest. Sure, the S&P 500 is down 5.5% from its peak. And corporate-bond yields are up, although nowhere near as much as in 2016. But the general rush for safety that took place in 2016 hasn’t been repeated this year in classic havens such as gold and the yen.

Investors who fear specific events—higher tariffs, Brexit—can quickly change their minds if the events don’t pan out as expected. It takes a lot longer to shift entrenched views about what counts as normal for inflation or for the power of central banks, or a long-running confrontation with China.

The danger is that unlike in 2016, this time around low yields are caused as much by a shift in mind-set as they are by the impact of trade barriers on the economy.

Updated: 8-12-2019

U.S. Budget Gap Widens 27% in First 10 Months of Fiscal Year

The government collected $2.9 trillion in receipts, a 3% increase, while spending climbed 8% so far this fiscal year.

The U.S. budget gap widened further in July as federal spending outpaced revenue collection, bringing the deficit to $867 billion so far this fiscal year, a 27% increase from the same period a year earlier.

The Treasury Department said Monday federal receipts rose 3% from October through July, totaling $2.9 trillion, while outlays climbed 8%, to $3.7 trillion. A senior Treasury official said federal revenue collection has picked up significantly since April compared with a year earlier, when lower tax rates implemented under the 2017 tax overhaul weighed on receipts.

At the same time, rising enrollment in Medicare and higher interest rates have led to higher government costs on benefits and interest payments, pushing the deficit even higher despite robust economic growth that usually shrinks budget shortfalls.

Part of the increase in the deficit so far this fiscal year, which began Oct. 1, can be attributed to calendar quirks, which made the gap appear slightly larger. If not for a shift in the timing of certain payments, the deficit would have been 20% higher during the first 10 months of the fiscal year, the Treasury said.

Higher deficits have forced the government to ramp up borrowing since early 2018, due in part to slumping revenue following the tax cut and a 2018 budget deal that lifted domestic and military spending for two years.

Over the 12 months that ended in July, the deficit totaled $961.8 billion, or 4.5% as a share of gross domestic product. Revenues over the previous 12 months rose 2.4%, while federal spending was up 6.3%.

Much of the increase in revenue collection so far this fiscal year has occurred in the past few months, the senior Treasury official said, thanks in part to a sturdy economy that has boosted tax receipts. Net individual taxes are up 7% since April, or $42 billion, and net corporate taxes have grown 30% since then, the official said.

Revenue from tariffs, or customs duties, also increased 75% through July, a significant boost from the same period a year earlier but just 2% of total receipts collected during that time.

The Treasury said last month it expects to borrow more than $1 trillion this calendar year for the second year in a row, as the annual budget gap is on track to exceed $1 trillion for fiscal year 2019, which ends Sept. 30.

A recently enacted budget deal, which President Trump signed earlier this month, will maintain the current government spending trajectory and add further to federal deficits over the next two years.

More broadly, deficits are projected to continue rising over the coming decades as a wave of retiring baby boomers pushes up government outlays on Social Security and Medicare.

Updated: 9-5-2019

Precious Metals Enjoy Resurgence in Negative-Yield World

Investors seek assets that can hold their value in troubled times.

Investors are piling into precious metals at the fastest clip in years, driven by a plunge in global bond yields that has fueled a search for assets that can hold their value during troubled times.

Gold purchases by everyone from central banks to retail buyers have boosted the metal to its highest level in six years, with a coterie of famous investors now touting its role as a haven from market turmoil. Silver and platinum have outpaced all other major asset classes so far in the third quarter, while palladium is up about 30% this year.

The sudden interest in precious metals follows years of sideways trading as investors bet that steady growth would allow the world’s central banks to raise interest rates and end an era of miserly debt yields.

Summer Surge

Several precious metals have rallied sharply in recent days with trade worries rocking stocks.

Performance Since End of June

Instead, a deepening trade war between the U.S. and China has weighed on the outlook of nearly every major economy, adding pressure on many central banks to further cut rates—even those that already stand below zero.

That has raised the allure of gold and other precious metals. While these nonyield-bearing assets struggle to compete with bonds when the outlook for the world economy is stable, their appeal has risen as negative rates have proliferated in Europe and Japan. It also has boosted interest in stocks that are expected to pay high dividends even when growth slows, such as shares of utilities and makers of consumer products.

“There is so much flight to safety right now and metals is where a lot of that money is going,” said Bob Haberkorn, senior commodities broker with RJO Futures in Chicago.

“Traders that had been out of the metals market are coming back…and there’s been a lot of buying from new accounts,” Mr. Haberkorn said. “It’s been great, great for business.”

Key Catalyst

The yield on the benchmark 10-year U.S.Treasury note has fallen steadily, makingassets that offer no yield for holding themmore attractive to investors.

10-year U.S. Treasury yields

Precious metals fell sharply Thursday as stocks and other risky investments rallied on hopes that upcoming trade talks will relieve some pressure on the world economy. Gold, silver and platinum each dipped 2% or more, trimming some of their sizable quarter-to-date gains.

Another factor boosting them this summer: falling yields and growth fears have dragged a long list of currencies, from the euro and British pound to the Chinese yuan, to their lowest levels in years. Unlike currencies, gold and other precious metals aren’t under the sway of any global central bank, further heightening their appeal.

Additionally, while stocks remain near records, a recent burst of market volatility has unsettled many investors. So has a steady world-wide decline in bond yields that many believe is a harbinger of weaker growth.

Although they rebounded Thursday, yields on the U.S. 10-year Treasury note dropped near a record low earlier in the week as disappointing manufacturing data and trade tensions pushed investors into government bonds and other safe assets. Yields fall as bond prices rise.

In Europe and Japan, some bond yields have been negative for years, and investors expect they will fall further as the European Central Bank and Bank of Japan unleash more monetary stimulus. More than $15 trillion in government debt around the world now has a negative yield, meaning essentially that savers holding these bonds are paying the government to store their money.

“Gold yields zero, but zero is still much better than negative,” said Bart Melek, head of commodity strategy at TD Securities.

Hedge funds and other speculative investors are wagering on further gains. They have pushed net bullish bets on gold to their highest level since 2006, as far back as Commodity Futures Trading Commission figures go. They also have lifted bullish wagers on platinum and silver, which both are on track for their best quarter in several years, according to Dow Jones Market Data.

Their advance comes after years of tepid investor interest, particularly in platinum, which is used as a component in auto exhaust filters for diesel engines. Platinum prices had previously tumbled as environmental concerns cut demand for diesel vehicles across the world.

Liftoff

Shares of smaller precious metals miners have also advanced in recent sessions.

But the precious-metals rally spread to platinum in July, and prices logged their biggest weekly gain in eight years last week, advancing nearly 9%.

The gains have rippled to shares of companies that mine the metals, in part because mining stocks offer individual investors easier exposure to the sector than trading metals futures contracts. The NYSE Arca Gold Miners Index is up about 40% this year, and shares of some smaller precious-metals producers have risen even more than that. Royal Gold Inc. is up 57% for the year, while First Majestic Silver Corp. has climbed 69%.

After an extended stretch of rangebound trading, the combination of falling rates and sluggish economic activity set up the sector’s rally this quarter, said Rhona O’Connell, head of market analysis for Europe, the Middle East, Africa and Asia at INTL FCStone.

“It was looking a bit like a pressure cooker,” she said. “It’s a sharp move that becomes self-fulfilling because you get the momentum traders involved.”

Updated: 5-4-2020

US Treasury Seeks To Borrow A Record $3 Trillion This Quarter

Massive stimulus to support the U.S. economy through the coronavirus crisis will cause the Treasury to borrow a record $3 trillion this quarter.

The department on Monday announced the total, which is actually $2.999 trillion.

“The increase in privately-held net marketable borrowing is primarily driven by the impact of the COVID-19 outbreak, including expenditures from new legislation to assist individuals and businesses, changes to tax receipts including the deferral of individual and business taxes from April – June until July, and an increase in the assumed end-of-June Treasury cash balance,” the department said in a statement.

On top of that borrowing, the Treasury also said it anticipates another $677 billion in the third quarter. First-quarter borrowing totaled $477 billion.

The red ink comes thanks to multiple stimulus efforts Congress has passed to resuscitate an economy brought to a standstill amid social distancing efforts to halt the virus spread.

Allocations thus far have totaled more than $2 trillion, and at last one more package is expected to help the more than 30 million Americans who have hit the unemployment line as well as thousands of other businesses that have seen their revenue streams evaporate.

The Treasury Department also is backstopping several lending programs for the Federal Reserve, which is leveraging Treasury guarantees in programs aimed at providing another $2.2 trillion in funding to businesses and households.

Just since March 1, the national debt has grown by $1.5 trillion to $24.9 trillion, a 6.4% increase. The budget deficit through March, or the first six months of the fiscal year, totaled $744 billion, on pace to easily eclipse the biggest shortfall in U.S. history.

Updated: 12-12-2022

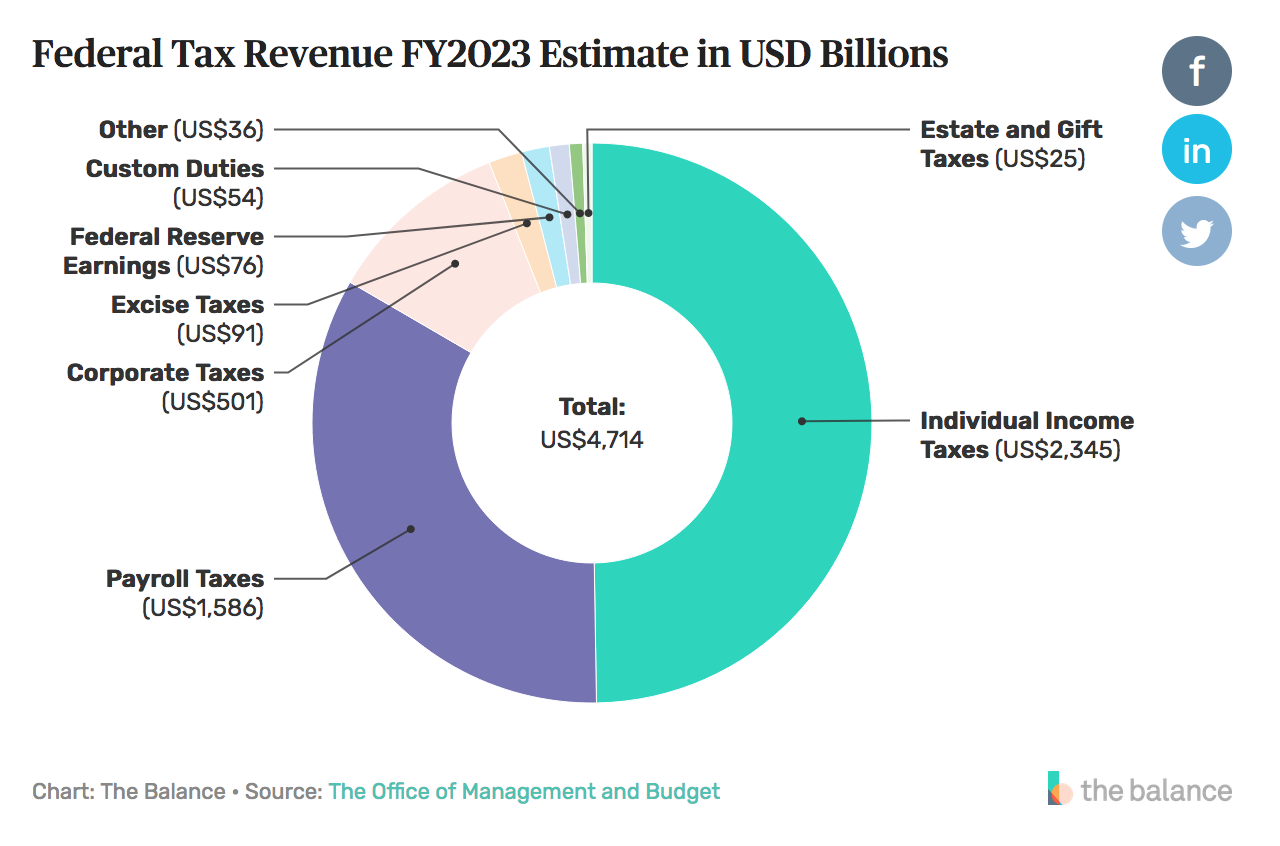

U.S. Federal Government Tax Revenue

Who Really Pays The Bills?

U.S. federal tax revenue is made up of the total tax receipts received by the government each year. Most of it is paid either through income taxes or payroll taxes. The rest is made up of estate taxes, excise and custom duties, and interest on the Federal Reserve’s holdings of U.S. Treasurys.

Key Takeaways

* The Bulk Of Federal Tax Revenue Comes From Income Taxes, Payroll Taxes, And Corporate Taxes.

* FY 2023 Federal Revenues Aren’t Enough To Pay For Spending. That Creates A Projected $918 Billion Budget Deficit.

* Tax Cuts Implemented By Presidents Bush, Obama, And Trump To Drive Economic Growth Further Reduced Revenues.

* Tax Revenue Has Grown Steadily Over The Past 60 Years. It Eclipsed $1 Trillion For The First Time In 1990.

Current Revenue

The U.S. government’s total revenue is estimated to be $4.71 trillion for FY 2023.

Per the White House’s projections, income taxes are slated to contribute $2.35 trillion. Another $1.59 trillion will come from payroll taxes.

This includes $1.10 trillion for Social Security, $342 billion for Medicare, and $55 billion for unemployment insurance.

Corporate taxes will add another $284 billion.

The White House also predicts the Federal Reserve, whose revenue comes from a variety of sources, will contribute $76 billion in 2023. The Fed is the bank for federal government agencies, and it pays interest on the billions of dollars in operating funds deposited by these agencies.

The remainder of federal revenue comes from excise taxes, tariffs on imports, miscellaneous receipts, and estate taxes.

How Revenue Relates To The Deficit, Debt, And GDP

The government’s annual income doesn’t cover its spending, which is projected to create a $918 billion budget deficit in 2023.

Deficits Add To The National Debt

Many argue that Congress should only spend what it earns, but that depends on where the economy is in the business cycle. For example, Congress should use deficit spending to expand economic growth in a recession and stimulus spending to create jobs.

Once the recession is over, the government should switch from expansionary to contractionary fiscal policy because it’s the best time to raise taxes and reduce the deficit and national debt. It also keeps the economy from overheating and forming dangerous bubbles.

Note:

The government’s 2023 tax revenue projection is 18.1% of gross domestic product (GDP), which is a measurement of a nation’s economic output.

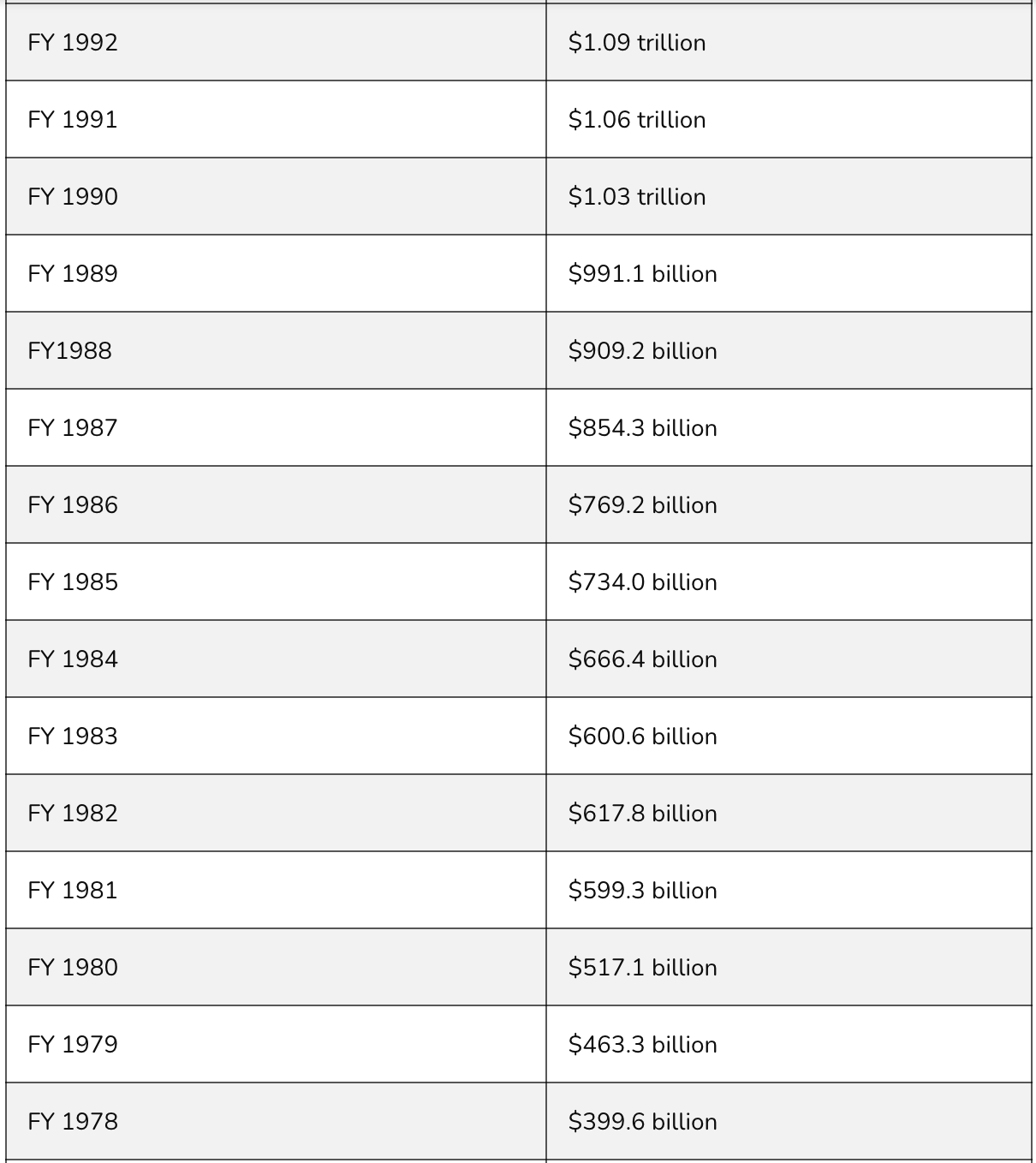

U.S. Tax Revenue by Year

Here’s a record of income for each fiscal year since 1962. Tax receipts fell off during the recession but started setting new records by FY 2013.

![]()

Frequently Asked Questions (FAQs)

What Is The Main Source Of Tax Revenue For Local Governments?

Unlike the federal government, most local governments earn the majority of their revenue from property or sales taxes. Income taxes are less common at the local level, but localities in 11 states collect some portion of their revenue in those ways.

How Does The Government Raise Revenue?

One way for the federal government to increase revenue is to boost taxes. It has several options for exactly how to do this, though, and economists and policymakers frequently debate the effectiveness of each.

Some examples of ways to increase federal tax revenues include directly increasing tax rates, raising rates on wealthier taxpayers, reducing tax exemptions and deductions, and boosting economic activity.

How Much Are Federal Taxes?

Federal income taxes are structured in graduated brackets ranging from 10% to 37% of your adjusted gross income. Long-term capital gains are taxed at a different rate, ranging from 0% to 20%.

Related Articles:

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Your Questions And Comments Are Greatly Appreciated.

Monty H. & Carolyn A.

Budget Deficit Grows While,Budget Deficit Grows While,Budget Deficit Grows While,Budget Deficit Grows While,Budget Deficit Grows While,Budget Deficit Grows While,Budget Deficit Grows While,Budget Deficit Grows While,Budget Deficit Grows While,Budget Deficit Grows While,Budget Deficit Grows While,Budget Deficit Grows While,Budget Deficit Grows While,Budget Deficit Grows While,

Go back

Leave a Reply

You must be logged in to post a comment.