The Weaponization of Bitcoin And Global Finance (#GotBitcoin)

U.S. tariffs intensify pressure on the Turkish lira, raising prospect of an open-ended cycle of protectionism and devaluation. The Weaponization of Bitcoin And Global Finance (#GotBitcoin)

Trade wars may be morphing into something more dangerous: financial wars.

Related:

Weaponizing Blockchain — Vast Potential, But Projects Are Kept Secret

Bitcoin Developer Amir Taaki, “We Can Crash National Economies”

Bitcoin Has Lost Its Way: Here’s How To Return To Crypto’s Subversive Roots

OnlyFans To Net $1.2 Billion This Year And $2.5 Billion In 2022 Off Sex Workers’ Hard Labor

In the hierarchy of things afflicting Turkey, this isn’t that high: The country’s problems are mostly self-inflicted, from its large current-account deficit and steep dollar debts to the politicization of its central bank.

But it is the latest example of how the U.S. and other countries are weaponizing international finance in ways that could destabilize the global economy and fray the intricate web of relationships that sustain it.

The origins of such crises usually lie in private-sector excess (lending too much to risky countries or home buyers), but the catalyst is often government policy somewhere: France’s hoarding of gold helped precipitate the Depression, while then-Federal Reserve Chairman Paul Volcker’s determination to slay inflation triggered the Latin American debt crisis of the 1980s.

The U.S. government has long seen it in the country’s long-term interest to tamp down crises abroad. It came to Mexico’s aid in 1982 and 1995, and worked with the International Monetary Fund in 1997 to contain the Asian financial crisis. In 2008, the Fed assisted foreign central banks in propping up banks in their countries that were hit by the mortgage crisis.

When the U.S. deliberately inflicts economic pain it is typically for geostrategic reasons and, where possible, it acts in concert with allies. In recent years, Washington has exacted enormous damage on North Korea and Iran by cutting them off from the dollar-based banking system. European and U.S. sanctions on Russia for invading Ukraine, interfering with U.S. elections and poisoning a former Russian spy and his daughter living in Britain have wrought havoc on the Russian economy.

Mr. Trump’s deployment of financial warfare against Turkey breaks with tradition in several key ways.

First, while relations between Turkey’s increasingly autocratic President Recep Tayyip Erdogan and the West have been deteriorating for years, his recent transgressions—such as detaining pastor Andrew Brunson—aren’t the sort of threat to the U.S. or its allies’ security that typically draws such a response.

“Geostrategically, it’s insanity” to react so harshly, said Benn Steil, an expert on sanctions at the Council on Foreign Relations. “Turkey has, since the end of the Second World War, been a vital U.S. interest because of its geographical position.” The country remains a member of the North Atlantic Treaty Organization and a key partner in managing the crisis in Syria and the flow of refugees to Europe.

Second, using tariffs to neutralize the Turkish lira’s decline, like Mr. Trump’s increasing tariffs on China because it let the yuan drop, could aggravate instead of mitigate financial turmoil. Currencies respond to the relative performance of economic growth, interest rates, inflation and trade balances.

The dollar is rising now because the U.S. economy is strong, capital is flowing in and interest rates are going up, which means the U.S. trade deficit should widen. The lira is falling because capital is fleeing, interest rates are too low and Turkey’s trade deficit needs to shrink. Mr. Trump is effectively trying to short-circuit this adjustment.

But by undermining Turkish and Chinese growth, his tariffs have intensified downward pressure on those countries’ currencies against the dollar. It raises the prospect of an open-ended cycle of protectionism and devaluation.

For now, a global meltdown looks unlikely. Few markets share Turkey’s vulnerabilities, and global banks are relatively insulated from foreign defaults. But Washington’s willingness to stand by or even pile on in a crisis is a new factor to consider for investors deciding whether to flee when another country gets into trouble.

Mr. Trump tends to see other countries’ economic suffering as an advantage for the U.S., boasting earlier this month that his tariffs had helped tank the Chinese stock market. Thus, he is likely to repeat the exercise, and others will follow suit. Last week, Saudi Arabia retaliated against Canadian criticism of its human-rights record by freezing trade and dumping Canadian bonds, a move the U.S. declined to criticize.

Just as the size of the U.S. market gives Mr. Trump the advantage in any trade dispute, America’s control over dollar-based banking and the depth of the Treasury market give it the advantage in any financial conflict. Any country, including China, that threatens to dump U.S. securities would hurt itself more than it hurts the U.S. Yet if relations deteriorate further, such tactics would no longer be off limits.

Updated: 11-9-2019

Weaponizing Blockchain — Vast Potential, but Projects Are Kept Secret

When Indian Defense Minister Rajnath Singh said that blockchain and artificial intelligence would “revolutionize war,” as Cointelegraph reported on Nov. 4, did he take things a bit too far? Jet engines have revolutionized warfare, and so have missiles and nuclear weapons — but shared digital ledgers?

Former NATO Secretary General Anders Fogh Rasmussen, for one, told Cointelegraph that he agrees with India’s minister when he was asked about blockchain’s possible military uses:

“Yes, potentially. Digital technologies have been transforming warfare since the 1990’s so emerging technologies such as blockchain have the potential to define the war industry over the coming decades. Data and data sharing will be critical for warfare in the future, particularly with the development of artificial intelligence.”

Rasmussen — former three-term prime minister of Denmark, current CEO of Rasmussen Global, and strategic advisor to the Swiss blockchain identity startup Concordium — added:

“Sharing data is fundamentally about transactions. Securing and sharing the right data in the right order between the right parties (computers, machines, defence agencies, and among allies) is critical in modern militaries and will only grow in importance in the future.”

Protecting Weapons From Hackers

Blockchain technology will be critical in defending key weapons systems as well as validating orders and battlefield information, among other uses. This is according to what Victoria Adams, the government practice lead for ConsenSys in Washington, D.C., told Cointelegraph. She added that the Indian minister’s remarks regarding blockchain “may have been a bit of a stretch,” but that AI, by comparison, is going to “revolutionize everything.”

Managing logistics and military supply chains will be a particular challenge, Adams said — especially as these become more privatized and complex with the addition of additive manufacturing (i.e., 3D printing). If the U.S. Marine Corps is going to put 3D printers in the field so that soldiers can manufacture spare parts on-site for F-35s, say, then it needs to protect these workstations from hackers — especially the digital specifications — Adams said.

“The Pentagon has said it doesn’t want a single point attack vector,” Joel Neidig — CEO of Simba Chain, a smart contract startup working with the U.S. Air Force to provide a blockchain-based platform to secure the supply chain — told Cointelegraph. And this is where blockchain technology, with its thousands of nodes, can indeed be of help.

If the supply chain is on a blockchain, one’s adversaries can no longer gain illicit entry through a single node or a single computer. According to Neidig, “They will have to take the whole network down, which isn’t so easy to do. Just think how resilient Bitcoin has been over the past 11 years. No one has been able to hack it.”

No Strategic Plan

The Department of Defense, and other U.S. security agencies, still doesn’t appear to have a clear, integrated strategy for incorporating blockchain into their operations, though use cases appear to be emerging piecemeal.

In September, for instance, the Department of Homeland Security awarded $143,478 to Vienna-based firm Danube Tech to develop blockchain security solutions, including digital documents like passports and green cards to be used at border crossings or in airports.

But according to what Markus Sabadello, the CEO of Danube Tech, told Cointelegraph, it isn’t far-fetched to see how a military organization could issue a digital identity for all its soldiers to establish their credentials, including their rank. Commanders could send orders through the decentralized digital network, and soldiers could verify who the message came from. The enemy would find it difficult to forge false identities, as all of them are registered on a blockchain, and there would be no one central server that the enemy could hack.

Blockchain technology could also be used in military-related areas like arms negotiations, Rasmussen suggested:

“One application that has been discussed is a so-called secure multi-party computation (MPC) which can be combined with blockchain so that a number of people can input information while keeping their individual inputs private. This is being discussed in the context of arms reduction and oversight agreements.”

It all isn’t happening fast enough, though, in Adams’ view. “You go to defense conferences, and you speak about this, and you get a lot of blank stares.” Yes, there are military blockchain initiatives in the works, “but they are all pilots, testing, getting the face wet — no energetic response.” Adams continued:

“I don’t see a strong vibe from the NATO countries. By comparison, Russia, and China’s People’s Liberation Army have shown that they get this.”

Several Countries Are Making Developments In This Area:

China

According to Deloitte’s 2019 Insight Global Blockchain Survey, China — more than any other country — will use blockchain “strategically instead of tactically,” according to Paul Sin, consulting partner at Deloitte Advisory. Moreover, 34% of Chinese respondents in the 2019 survey strongly believe in the disruptive potential of blockchain, more than most countries in the survey.

Elsewhere, statements from China’s People’s Liberation Army have caused some concern in the West. In a 2018 article, the PLA described how the technology behind Bitcoin could have military applications, including in its intelligence operations and in protecting weapon life-cycle data from cyberattacks.

According to Jahara W. Matisek, assistant professor of military and strategic studies at the U.S. Air Force Academy, the journal article was written specifically as a call to action. He quoted the PLA directly in his article in the journal National Interest, which said, “If we do not take precautions in keeping with the pace of the times, we will be subject to control everywhere.” Matisek commented on the quote:

“The PLA seems to recognize the importance of this emerging technological capability, but should China be allowed to control the future of information warfare?”

Russia

More than two years ago, the Russian news service Tass announced that blockchain technology might soon be introduced into the Russian military, but noted: “We should be cautious when approaching new technologies, study them in detail because they always carry not only new advantages but also new unknown risks and threats.”

In 2018, the Russian Defense Ministry announced it was launching a new research lab to study how blockchain could thwart cyberattacks. It hoped to build secure blockchain-based platforms to make it more difficult to hide traces of cyberattacks and track online intruders into its systems, according to Adams.

South Korea

In April, South Korea’s defense department announced a blockchain pilot program to prevent external tampering with its military supply chain. Kim Tae-gon, coordinator of the National Defense Agency, called blockchain technology “one of the core technologies of the 4th Industrial Revolution.” He added:

“The history of the entire process from bidding, evaluation, and results for defense improvement projects will be recorded on the blockchain, enabling more transparent management of the company selection process.”

India

India’s defense industry is undergoing “a churning to cope and employ these technologies, in order to safeguard the safety and security of critical infrastructure,” according to Defense Minister Rajnath Singh on Nov. 3, as reported by the Times of India.

Meanwhile, scholars in India are concerned about blockchain supporting the conduct of military operations.

According to Global Security Review, “With one author recognizing that as governments and individuals develop quantum computing abilities, blockchain will make it easy to hack into highly secure networks.”

United States

The U.S. Department of Defense — somewhat belatedly, perhaps — is recognizing the benefits of blockchain technology for national defense, noting in its July Digital Modernization Strategy 2019 report that its Defense Advanced Research Projects Agency, or DARPA, will study the technology. The report states:

“DARPA is starting to experiment with blockchain to create a more efficient, robust, and secure platform using a blockchain protocol that will allow personnel from anywhere to transmit secure messages or process transactions that can be traced through numerous channels of a decentralized ledger.”

The DoD referenced specific communications benefits, such as “facilitating communication between units and headquarters, and transmitting information between intelligence officers and the Pentagon.”

But many of the use cases noted above appear to be individual initiatives of departments or services sectors (e.g., the U.S. Air Force), and these are early in the developmental process. The U.S. DHS initiative with Danube Tech, for instance, is still in its pilot stage, and Simba Chain’s project with the U.S. Air Force only recently passed into phase two. It will be several years before a solution will be implemented at scale, Neidig told Cointelegraph.

NATO

NATO, as a political and military organization, needs to find ways of increasing investment across the alliance, as well as to cooperate more closely to develop new technologies like blockchain and AI, Rasmussen explained to Cointelegraph, adding:

“We often hear President Trump talk of the need for NATO allies to spend 2 percent of GNI on defense. This was a target agreed at my last NATO summit. But we also should focus on another target – 20 percent – which is the amount that NATO allies should spend on equipment and R&D. I believe we should raise this to 30 percent across the whole alliance.”

If Darpa Can’t Figure It Out, Who Can?

Not all concede that blockchain will revolutionize — or even impact — warfare in any meaningful way. DARPA, the DoD’s visionary agency, is supposed to anticipate the future, after all, whether it be the internet, driverless cars or the autonomous battlefield.

On Nov. 19, 2019, DARPA issued a request for information on distributed consensus protocols to see how this technology might improve security, storage and computing in the Defense Department. According to C4ISRNET:

Media for the Intelligence Age Military, such a request is “almost an indictment of the technology itself. If DARPA can’t figure out a responsible, value-generating use for blockchain, who can?”

It won’t be easy to introduce decentralization (i.e., blockchain) into top-down, heavily centralized military organizations. Some military minds may be hesitant to give up control, even if the U.S. military has been encouraging more bottom-up initiatives in recent years. “Yes, it’s a problem,” Adams said. “You gain control by giving up control. It’s hard to do. It requires a big cultural change.”

Higher Stakes

Overall, the development of blockchain technology is part of a wider picture about who cracks the next generation of technology — from applications like blockchain through to artificial intelligence — former NATO Secretary General Rasmussen told Cointelegraph:

“It is an area I’ve been working on in recent months as I firmly believe the world’s democracies must win this race.”

If that is to happen, a more robust and integrated stance from the U.S. and its allies might be in order.

Updated: 6-21-2021

Peter Thiel Says, “China “Weaponizing” Bitcoin To Hurt The U.S.

Thiel’s comments about China “weaponizing” bitcoin to hurt the U.S. are a warning about the cost of inaction.

The battle over bitcoin’s evolving role just became a piece in a complex game of political strategy.

Peter Thiel’s talk earlier this week at a Richard Nixon Foundation event thrust the cryptocurrency even further out onto the geopolitical stage and highlighted two important macro narratives that investors should keep an eye on and not just for their potential impact on crypto returns.

Here’s One Extract From His Comments:

“I do wonder whether bitcoin should be thought of as a Chinese financial weapon against the U.S. It threatens fiat money, but it especially threatens the U.S. dollar.”

As with most things in life, context is key, and this statement is crying out for it.

On the surface, it seems as if he is asking U.S. regulators to prevent bitcoin from becoming more of a threat to the U.S. dollar. This is the wrong interpretation.

The underlying intention is both more meaningful and more supportive of bitcoin and, ultimately, the U.S. than it may at first appear.

Others have pointed out that Thiel is probably playing 4D chess here, and I agree with that. But I believe his underlying message is about more than bitcoin and about more than trying to get the U.S. to sit up and take notice.

Bitcoin As A Weapon?

Before we unpack why Thiel might have said what he said, let’s look at what he might have meant.

Why Would Bitcoin Threaten The U.S. Dollar?

As early as 2013, Thiel was talking about bitcoin’s potential to “change the world,” and has on other occasions praised bitcoin’s reserve qualities.

Thiel seems to be suggesting that bitcoin’s stable supply and worldwide reach could one day put it in a position to rival the U.S. dollar as the world’s reserve currency. And his statement implies he believes China is supporting bitcoin, effectively “weaponizing it,” for this reason.

Does He Really Believe This?

He has access to several of the best minds in the crypto industry through some of the investments made by his funds, and is arguably a very smart individual himself. He has acknowledged that bitcoin is not the best payments system, and surely recognizes the dollar is a strong reserve currency precisely because it is an efficient payment method. Countries want to hold it because it is essential for global commerce.

And as for China “weaponizing” bitcoin to hurt the dollar, Thiel is no doubt aware of just how long China is on the dollar.

Chinese investment of U.S. Treasury bonds has been increasing since October of last year, and is now at almost $1.1 trillion.

What’s more, on the current macro landscape, bitcoin is probably well below central bank policies on the list of things that could hurt the U.S. currency.

And Thiel probably knows China has not exactly been “friendly” to bitcoin. On top of the years-old ban on crypto exchanges, authorities moved to shut down bitcoin miners in Inner Mongolia last month. Given the country’s constant battle with capital flight, it’s more likely it wishes bitcoin would just go away. And if it really wanted to weaken the dollar (which is debatable), it has methods within reach that would not also cause damage to the yuan.

So, Thiel may have said that China was trying to bring down the U.S. dollar by “weaponizing” bitcoin, but I doubt he really believes that. So why did he say so? What is he hoping to achieve?

The Real Issue

To dive into these questions, we need even more ladlefuls of context.

The theme of the seminar was technology and national security. The comment flagged above was tucked into an answer to a question about China’s digital currency plans, and a discussion flowed about the potential control that would give the state over its citizens. The conversation also touched on AI, supply chains and much more, all with a sharp tinge of concern about ideological influence. Thiel even referred to the Chinese government as “omni malevolent.” Let that sink in.

Thiel’s remarks on bitcoin were most likely, as many have pointed out, an attempt to get the U.S. regulators to start taking bitcoin more seriously. But they were also about the broader threat to U.S. dominance that he sees coming from China.

The first point may seem risky – many are concerned the U.S. might decide to ban bitcoin if it starts to see it as a threat. But, as I’ve written elsewhere, this is unlikely to happen as authorities have been watching the social unrest triggered by attempts to curtail cryptocurrency activity in countries such as Nigeria. Plus, a U.S. attempt to ban bitcoin would be the best advertisement that something like bitcoin is needed, and the domestic fallout could shore up China’s soft power play.

It is more likely that greater attention to bitcoin regulation would support investment in crypto infrastructure, which would have extended effects throughout the industry.

This includes putting institutional investors’ minds more at ease with the concept, and possibly even removing the last barriers to approval of a bitcoin exchange-traded fund by the U.S. Securities and Exchange Commission.

The Arc of History

Now, let’s turn to the broader context. As a declared Republican who donated generously to Donald Trump’s first presidential campaign, Thiel was closer to the last administration than this one. He, and others, are concerned the new administration will take a more relaxed stance on relations with what many see as the greatest threat to U.S. power since the Cold War: China.

This almost nationalistic tone can also be heard in Kevin O’Leary’s insistence on CoinDesk TV last month that investors aren’t going to want “China coin.”

What’s more, the 2021 National People’s Congress held in February ratified the next five-year plan, which focuses on, among other things, shoring up China’s position on the global stage. The previous five-year plan described how a peaceful multilateral world would benefit China. This one highlights the danger of “hegemonism,” and describes a strong economic growth based on a vibrant domestic economy that is less dependent on others.

The crescendo in anti-American rhetoric and diplomatic actions point to escalating competition for not only trade but also hearts and minds on the international stage. The soft-power battle is being backed by loans and investment far beyond China’s borders in what appears to be a long game of influence.

I heard an interesting metaphor the other day: The U.S. favors chess, which is about capturing the opponent’s pieces in order to kill its king. The Chinese prefer Go, which is about a slow and stealthy occupation of territory.

Thiel seems to be saying the Chinese are playing Go with bitcoin as well as with blockchain, AI and other new technologies. He is effectively asking the U.S. to watch out for the territorial creep its inaction is facilitating.

Thiel’s talk is likely to have repercussions, slow and subtle but real and meaningful. Hopefully, U.S. regulators will recognize the real opportunity in supporting the use of bitcoin and the development of its infrastructure.

Hopefully, they will see that bitcoin is more representative of the American values of freedom and choice than many of the other new technologies making their mark on societal structures today. And hopefully they will understand that bitcoin will thrive no matter what they do, so they might as well start figuring out how to harness its innovation.

For those of us who love irony, there is much to appreciate in this emerging picture. Bitcoin is being thrust into a tussle between two world powers when it was created to live outside national boundaries.

It is being associated with political intent when its inbuilt ideology is supposed to flourish outside party lines. It is being used as a tool in a shift away from globalization and towards nationalism when its design is based on decentralization.

Here’s the thing: Bitcoin doesn’t care. It can be what anyone wants it to be. It’s going to continue functioning the way it does, regardless of how people see it. I’m pretty sure Peter Thiel knows that, and so if he wants to use bitcoin to make larger points that he believes are necessary for prosperity and freedom, then I say we leave him to it.

Updated: 7-21-2021

China Is Pumping Money Out Of The US With Bitcoin

Chinese authorities seem to be putting things in order rather than declaring war on crypto, aiming to further weaken the U.S. economy. China Is Pumping Money Out Of The US With Bitcoin

The ongoing United States-China trade war is in its fourth year. Former U.S. President Donald Trump saw different results from what he initially expected: America has taken a hit from higher tariffs and sanctions against Chinese companies and hasn’t benefited from it nearly to the same extent. It has cost the country up to 245,000 jobs. The U.S. Chamber of Commerce calculated that the situation puts the exports of each state at risk. For example, the damage to Florida’s exports alone has already reached $1.9 billion.

At the same time, China was taking a smarter approach: It not only imposed reciprocal sanctions and exported its products through intermediary countries (Vietnam, Taiwan and Mexico), but also made the U.S. pay for unsecured and poorly regulated assets — cryptocurrency.

Hidden Billions

The United States annually inject billions of dollars into the Chinese economy without even suspecting it. The reason is that the majority of Bitcoin (BTC), which is exchanged mainly for U.S. dollars worldwide, is mined in China. It hosts 65% of all mining farms.

To earn Bitcoin rewards, powerful computers solve complex math problems 24/7. Part of the newly mined coins goes directly to crypto exchanges, while the rest can be kept in the miners’ crypto wallets, but is eventually sold to dollars. On average, 900 BTC are mined every day, and the total daily revenue is about $31 million (as of the end of June). That means that in just a year, the miners have earned over $10 billion.

Taking into account China’s share of mining farms, the local miners have earned about $7 billion since last summer. If both the price of Bitcoin and its popularity keep increasing, the revenue will double or even triple each year. In one way or another, the money will circulate throughout the country’s economy: It will be spent, saved or invested.

Under the Party’s Control

The Chinese government is well aware of the volume and significance of U.S. dollar investments through cryptocurrencies.

Despite the heavily increasing regulation, the authorities are obviously not going to ban Bitcoin.

China restricted crypto transactions for banks and payment companies back in 2013. In 2017, the authorities also shut down local crypto exchanges and blocked access to foreign platforms. That said, locals could legally own cryptocurrency all this time.

What we see now is essentially a reminder of the previous restrictions imposed on financial institutions instead of the introduction of new ones.

On one hand, the Chinese authorities want to prevent the “transmission of individual risks to the social field,” and on the other hand, they leave the door wide open for foreign investors.

At the same time, the Chinese authorities have begun to restrict mining, which concerns many people on the market. The official reasons are excessive energy consumption and carbon dioxide emissions that prevent the country from achieving carbon neutrality by 2060. But the real situation is a bit different from official statements.

First, the Chinese miners already source cheaper hydroelectricity, which is highly developed in southern provinces, and only switch to fossil-based fuel during the dry winter season when they migrate to the north.

Secondly, the authorities have fully banned new mining projects and the existing ones in three regions: Qinghai, Inner Mongolia and Xinjiang. Other provinces that are rich in hydropower resources, like Yunnan or Sichuan, are in no hurry to impose a total ban. While Yunnan was planning to shut down only illegal BTC mining farms “with a campaign against misuse of electricity,” later in June it was reported that all mining farms in Yunnan Province were shutted down.

Chinese authorities seem to be putting things in order rather than declaring war on cryptocurrencies. The technological limitations of the Bitcoin supply are to work in China’s favor: It allows the country to influence the price of the crypto while keeping it in miners’ possession and without selling it on financial markets.

However, if the restrictions keep tightening, the mining power may be redistributed between other countries. The Chinese mining equipment manufacturers — BTC.TOP, Huobi and HashCow — announced that they are suspending domestic sales and expanding their international presence, including to North America.

Who Will Pick Up The Idea

At face value, the possibility of Chinese miners moving to North America seems beneficial to the United States. But experts pointed out that the continent doesn’t have a lot of idle energy capacity. Besides, moving countries takes time that competitors can take advantage of.

The idea of taking control over not only crypto transactions but also Bitcoin mining is quickly gaining traction in developing countries.

In Iran, mining has become one of the most accessible industries amid tough U.S. sanctions. The Iranian government is taking almost the same path as China: The authorities are to ban the use of cryptocurrencies generated abroad, but they allow paying for imported goods with domestically mined coins. Over the past year, Iran earned more than $400 million from cryptocurrency mining, with the United States’ revenue being only twice as much.

Another country planning the development of mining projects is El Salvador — the first country to adopt Bitcoin as a legal tender — that U.S. President Joe Biden refused to visit. El Salvador’s President Nayib Bukele is considering capitalizing on “very cheap, 100% clean, 100% renewable” energy from local volcanoes.

In this context, Kazakhstan seems to be the most politically neutral country. Here, a huge mining center by Enegix with a capacity of 180 MW, and up to 50,000 mining rigs will start operating in September. What’s more, Chinese manufacturer of mining equipment Canaan has set up a new service center in Kazakhstan.

China might exploit the export of their crypto farms as a means to further weaken the U.S. economy, while the U.S. government has no significant leverage to stop the dollar outflow caused by crypto transactions. Imposing a crypto ban for Americans would simply be undemocratic.

The only option for the U.S. government is to weaken the appeal of Bitcoin through every possible means. This would explain why Elon Musk, the owner of some of the largest American companies, Tesla and SpaceX, suddenly switched from supporting Bitcoin to criticizing its environmental impact.

The same thing happened to Greenpeace, which no longer accepts crypto donations, even though it had been doing so for the past seven years. It seems that the escalating campaign against Bitcoin has more to do with politics rather than the environment.

Updated: 12-8-2021

Bitcoin Adoption Among Far-Right Extremists Leaves Its Mark On The Blockchain

Blockchain sleuthing firm Elliptic has been tracking numerical hate signals left by alt-right groups.

Bitcoin as a means of payment among far-right extremists is growing in popularity, according to cryptocurrency analytics firm Elliptic, which is tracking traces left on the blockchain by such groups.

A flight to censorship-resistant crypto by far-right actors has been driven in recent years by large internet platforms like PayPal blocking extremists, with deplatforming efforts starting in earnest following Charlottesville’s bloody “Unite the Right” rally in August 2017.

Some prominent far-right extremists have even gone as far as declaring that bitcoin is now the currency of the alt-right. This matters because domestic terrorism in the U.S. associated with such groups is on the rise.

It turns out many right-wing extremists actually want to leave their mark on the blockchain. No doubt beguiled by the immutability of bitcoin transactions, wallets belonging to alt-right enthusiasts can often be identified by amounts including hate symbol “1488″ – 0.001488 BTC is about $50 at today’s prices.

It’s like leaving a swastika on the blockchain, explains Elliptic co-founder Tom Robinson, since the number “14″ is numerical shorthand for the white supremacist slogan known as the “14 Words” and “88″ maps to “H,” the eighth letter of the alphabet, signaling “Heil Hitler.”

The proportion of bitcoin transactions that contain the number 1488 was about 30,000 times larger than for your average wallet, Elliptic said in a blog post published today.

“We looked into whether we can use that model to proactively identify new far-right extremist wallets,” Robinson told CoinDesk in an interview. “We were able to identify about 100 new wallets that were then found to be linked to far-right extremist activity.”

The payments and fundraising activity that Elliptic has mapped amounts to some $8.9 million. In the case of one extremist, 47% of all payments received were for amounts containing “1488,” Robinson said.

“I’m not sure whether alt-right groups realized that they were allowing this activity to be monitored and identified in the blockchain to the extent that we’re now doing,” Robinson said of the public nature of the Bitcoin blockchain. “But I do think there’s a sort of, ‘Look at me, look what I’m doing’ kind of aspect of this that they like.”

Updated: 12-10-2021

SPLC Report Examines Use Of Bitcoin And Monero By Right Wing Extremists

Several political extremists have derived a great deal of wealth from cryptocurrency donations since their supporters can remain anonymous and transactions can’t be censored.

The Southern Poverty Law Center (SPLC) has released a report examining the extensive ties between Bitcoin and the far right, many of whom have built fortunes in the cryptocurrency.

In a Thursday Hatewatch report, the SPLC shared its findings on how right-wing extremists and white supremacists, discuss and use cryptocurrencies, claiming that many have amassed “tens of millions of dollars” from crypto donations.

The report, How Cryptocurrency Revolutionized the White Supremacist Movement, identified and compiled over 600 cryptocurrency addresses associated with white supremacists and other prominent far-right extremists” to reach its conclusions.

One Of The Main Claims It Makes Is That Although Less Than One Quarter Of Americans Own Cryptocurrency:

“Hatewatch struggled to find any prominent player in the global far right who hasn’t yet embraced cryptocurrency to at least some degree.”

Of the reasons these individuals used cryptocurrency, the most common was because they were debanked and they wanted to hide their transactions.

Stefan Molyneaux, who is described by Wikipedia as a far-right white nationalist and white supremacist, has been accepting donations in Bitcoin for eight years. The SPLC noted that the first Bitcoin wallet to be linked to Molyneaux dates back to Jan. 25, 2013, and that his followers have donated a total of 1250 Bitcoin since 2013.

Molyneaux has realized an estimated $3.28 million from $1.28 million in crypto donations. This is more than any other extremist studied for the SPLC report.

Greg Johnson, who goes by the pseudonym Karl Thorburn, has gained over $800,000 from crypto. Johnson is the founder of the controversial website CounterCurrents.

The site requests donations from his followers to be paid in 12 different cryptocurrencies and is currently trying to raise $200,000 goal to further its political ambitions.

Crypto critic and author David Gerard told the SPLC in an email that although at first glance the amount of money these extremists are making from crypto is alarming, it is not a reason to associate all cryptocurrency with their actions. He claimed:

“Bitcoin started in right-wing libertarianism… This is not at all the same as being a neo-Nazi subculture. That said, there’s a greater proportion of Nazis there than you’d expect just by chance, and the Bitcoin subculture really doesn’t bother kicking its Nazis out.”

While extensive, the SPLC report relies heavily on historical events and incidents that have been reported previously, such as extremist publication Daily Stormer citing in 2017 a Bitcoiner TV host’s views on the use of the cryptocurrency as a way to liberate its readers from what it sees as the Jewish control of centralized banks.

It tied extremist Andrew “Weev” Auernheimer to the privacy coin Monero, which facilitates private, untraceable transactions better than Bitcoin, with a 2017 podcast when he said: “I hold a lot of Monero though. That’s my big thing now. I’m way into Monero. I hold a significant amount.”

Updated: 12-19-2021

In Today’s Wars, Everything Is A Weapon

It’s not just gray zones and Putin’s little green men: Conflict is now carried out in banks, courts and even movie theaters.

On Sept. 3, 1939, Britain declared war on Nazi Germany. On Dec. 11, 1941, Germany declared war on the U.S. On Aug. 8, 1945, Russia declared war on Japan. The point here is that for the best part of a thousand years, a convention prevailed that before one state waged war against another, it formally announced its intention to do so.

Belligerents’ diplomats were permitted to return unimpeded to their respective homelands — even the wartime Japanese and Germans went along with this, although they had launched surprise attacks such as that on the Day of Infamy.

The rights of prisoners under international law were sometimes respected, albeit sometimes not. Red Cross workers received at least intermittent protection. Combatants wore the uniforms of their respective nations, and it was tacitly if not always officially conceded that armies — yes, including that of Hitler — had a right to shoot prisoners who were captured using guns while wearing civilian clothes without identifying marks.

It would be absurd to suggest that the “laws of war” commanded universal respect or obedience, even sometimes by democracies, and least of all in conflicts with guerrillas. But there was a recognition that the worst effects might be tempered if some rules and conventions existed.

Today, almost all the above is out the window. If China invades Taiwan or Russia seeks to attack Ukraine, the only near-certainty is that their forces will attack without any prior declaration of intent. Moreover, if or when the shooting stops, it is unlikely that there will follow a treaty signed by both belligerents.

Instead, there will merely be a unilateral announcement of whatever new reality Beijing, or Moscow, or the rulers of any other state which has committed a successful act of aggression, deems to be appropriate.

The old explicit delineation between war and peace has been abolished. It is replaced by a new dispensation that seems almost certain to be permanent, wherein rival states compete fiercely and perilously, at a level designed to remain just below the threshold of full-blown armed conflict.

Three years ago, Andrei Kortunov, director general of the Russian International Affairs Council, said in a speech: “It seems that we all, East and West, are beginning to live according to the rules of wartime, when all means are good, and a reputation becomes an unaffordable luxury or, at the very least, an easily spent resource.

And as a result, for example, a very important red line between politics and a special operation” — an intelligence agency mission — “is practically erased.”

Kortunov’s own country, of course, has done as much as any to create this state of affairs. Not — as was the case with the Soviet Union — for ideological reasons, but because President Vladimir Putin’s overwhelming objective is the preservation of his own power, the gangster culture over which he presides.

We should not pretend that this is entirely new. Strong states have always sought to use economic power, especially, to bully or cajole weaker ones. But every day the non-kinetic means of assault available to governments, including soft-power lawyers, bankers and cultural assets as well as the more familiar cyber-arms, become more potent and promiscuously used.

“War without warfare,” writes British academic Mark Galeotti in a new book, “non-military conflicts fought with all kinds of other means, from subversion to sanctions, memes to murder, may be becoming the new normal.”

Galeotti, author of several works related to this theme, calls his new one “The Weaponization of Everything.” Globalization has proved great for bad guys, whether states or individuals, because it has dramatically increased the range of tools available to befuddle or crush enemies.

Economic sanctions are an increasingly popular weapon against rogue states’ excesses. While these can hurt governments, however, they seldom cause them to change their ways — think Iran. By one estimate, European Union trade sanctions imposed on Russia in the wake of the Crimea seizure cost that country around $15 billion — a price Putin thinks cheap. Meanwhile, the measures are reckoned to have cost EU economies … $40 billion.

Then there is law. Chinese lawyers seek to lay a smokescreen of legitimacy upon Beijing’s expansionism in the South China Sea. London has become libel capital of the world, regularly exploited by Russian oligarchs and Middle Eastern potentates to silence critics, exploiting their almost limitless funds to pay for top counsel against publishers and media outlets.

It is frightening to behold the power that Russian billions exert in Britain, whether in gaining access to top politicians or in acquiring a facade of social respectability.

More than a decade ago, I was shocked to hear Mervyn King, then governor of the Bank of England, remark as if stating the obvious that “London has become the money-laundering capital of the world.” Scarcely any of these vast Russian fortunes have been made through what we would call honest toil.

Yet many billions that have been, in effect, stolen from the Russian people are today comfortably housed in the venerable City of London.

Successive British governments know that this mocks probity. Yet none dares to move effectively against ill-gotten wealth and its owners, because Britain’s bankers, hedge-fund managers and lawyers prosper too mightily for ministers to take the moral high road.

Though our leaders make defiant statements challenging Russian military aggression or threats of it, they are too frightened to resist invasions by Russian cash. Britain likes to claim — in the past, rightly — that it has a less politically corrupt culture than the U.S. or Italy. This has become less true.

Meanwhile, Western public-relations companies and lobbyists earn large sums promoting the images and reputations of disreputable nations as well as individuals. In the wake of the 2018 murder of Saudi journalist Jamal Khashoggi, almost certainly on the orders of Crown Prince Mohammed Bin Salman, the regime spent an estimated $20 million on reputation management abroad.

Former British Prime Minister David Cameron was photographed showing that he is among the shameless hosts who find nothing embarrassing about hanging out with the Saudis.

Meanwhile, great global media companies bow to the demands of Beijing, because the Chinese market is deemed too important to be expelled from.

Chinese filmmakers have joined the patriot games played for so long by Hollywood through John Wayne and Rambo, and by their British counterparts through the James Bond franchise, now to produce a stream of super-nationalistic war movies, designed to condition their people for conflict with the West.

Ever-more state violence is contracted out to mercenaries, to shroud ugly action in a gossamer cloak of deniability. Russian intelligence agencies headed by the Federal Security Service, or FSB, reportedly use criminal organizations as cut-outs in assassinations, such as that of a Chechen leader in Berlin in 2019. (Germany last week expelled two Russian “diplomats” after a court ruled the Kremlin had ordered the killing.)

Mercenaries of the Wagner Group are fighting in several countries, most prominently Libya and Syria, at the behest of the Kremlin. Russia’s “little green men” — non-uniformed special forces — spearheaded the 2014 seizure of Crimea and eastern Ukraine.

Meanwhile, the U.S. has also been paying billions to military contractors, in the past for providing support services, today ever nearer to the “sharp end.” An estimated 70% of America’s intelligence budget goes to private contracts.

Until recently, Chinese civilians were prohibited from carrying arms abroad, but today such companies as China Security & Protection, Shandong Huawei Security Group and Genghis Security Services play an increasingly active role in implementing Beijing’s policies abroad, and some of their employees have been spotted with weapons.

In September 2014, Estonian security officer Eston Kohver was on his way to a meet with an informer when he was kidnapped and bundled across the Russian border. (The Russians insist he was on their side of the frontier).

In Moscow, he was charged with espionage and only released when exchanged for a jailed Russian spy. His misfortune, it later emerged, was to have incurred the anger of border smugglers who had reportedly become spies for the Russian state.

Galeotti describes North Korea’s Committee Bureau 19 as, “in effect the Hermit Kingdom’s organized crime office.” It is responsible for large-scale smuggling, the manufacture and trafficking of amphetamines and forgery of foreign banknotes. As is well known, the country organizes multimillion-dollar online frauds.

The North Koreans and Russians can claim that there is nothing new in this way of doing dirty business: Six decades ago, the Central Intelligence Agency sought to subcontract the killing of Fidel Castro to the mafia. But the links between espionage and crime have expanded exponentially, much to the advantage of big crooks.

Cyber is the towering, revolutionary instrument of conflict. A new breed of professional, the cyber-mercenary, sells his skills to any nation or criminal gang willing to pay for them.

We can all understand the peril posed by attacks that paralyze banks, expose data, steal commercial and scientific secrets, shut down hospitals, stop trains. Few of even the biggest Western businesses are effectively protected against the sophistication of Chinese and Russian hackers.

Galeotti suggests, however, that cyberattacks may not be as decisive as sensationalists claim. He cites the example of the U.S.-Israeli Stuxnet assault on Iran’s nuclear program. This certainly inflicted substantial damage on centrifuges and much else, set back the Iranian bomb schedule by many months.

Yet the author says that if this was the best the most advanced cyberwarriors in the world could achieve, he is unconvinced that electronic assault is as conclusive a game-changer as doomsayers suggest.

I am unsure whether he is right about this. True, military systems can recover from even successful cyberattacks within hours or less. In a shootout in the South China Sea, however, a Chinese ability to disarm even for minutes U.S. Navy carrier catapults or radar systems could prove critical.

All of us have become aware of the pernicious impact of fake news, not least upon an astonishingly credulous American readership. Yet Galeotti is not entirely a pessimist about social media. This can be a force for good, he argues, especially in fingering perpetrators of wickedness, and state promoters of it.

The brilliant Netherlands-based, pro bono website Bellingcat mobilized the public in Ukraine and around the world to pin responsibility for the 2014 shootdown of Malaysian Airlines Flight 17, with the loss of 283 lives, onto the Russians who provided the deadly Buk missile.

Social media users identified images of the launcher being trundled from Russia into eastern Ukraine, and found emails sent by triumphant separatists boasting about their achievement. No reasonable person could thereafter doubt Putin’s culpability.

Likewise, the citizen-journalists of Bellingcat named the Russian intelligence officers who attempted to murder the defector Sergei Skripal and his daughter in Salisbury, U.K., in 2018. They also “named and shamed” the Kremlin undercover agents who, in August 2020, sought to murder opposition leader Alexei Navalny with the same Novichok nerve agent.

Deniability is a key objective of many state attacks carried out below the threshold of war. Thus, the tools of freedom — not least exercising a right to vote in favor of sensible leaders — can be used to resist and spotlight wrongdoing.

Galeotti concludes his book with the assertion that “we are heading into an age when everyone may be in at least some kind of a state of ‘war’ with everyone else, all the time, and it is just a matter of degree.”

As I read such accounts, the phrase that echoes in my mind, though not used by Galeotti himself, is “the Great Game.” This was what the British dubbed their century-long struggle with Russia for dominance of the region bordering the North-West frontier of India, conducted through bribes to local rulers, spies, adventurers, occasional assassinations and spasmodic shootouts.

There were many absurdities about the Great Game, just as there are about its modern version. These beg the question: Does it all matter? Are not today’s conflicts in law courts, online, through the banking system, or killings of rival mercenaries whose fates need not trouble us, preferable to mass slaughters such as the 20th century’s world wars?

I submit that we would be mistaken to shrug our shoulders. All the activities sketched above impair the order and stability that are critical forces in preserving the world from self-harm. The peril posed by weapons of mass destruction has never gone away, and almost certainly never will.

In the dark days of the Cold War, we were daily reminded by politicians and the media of the threat from nuclear weapons — the balance of terror. Today, we scarcely hear such words mentioned. Yet the bombs are still there, and they are held by ever-more nations.

Our leaders need to go on being afraid, because only prudent fear can deter them from gambling recklessly upon extending the borders of conflict, as Putin and President Xi Jinping of China risk every day. The mortal peril posed by undeclared war — cyberconflict, clashes on the electronic frontiers of our societies and of our defenses — is that it can very suddenly get very hot.

Updated: 1-23-2022

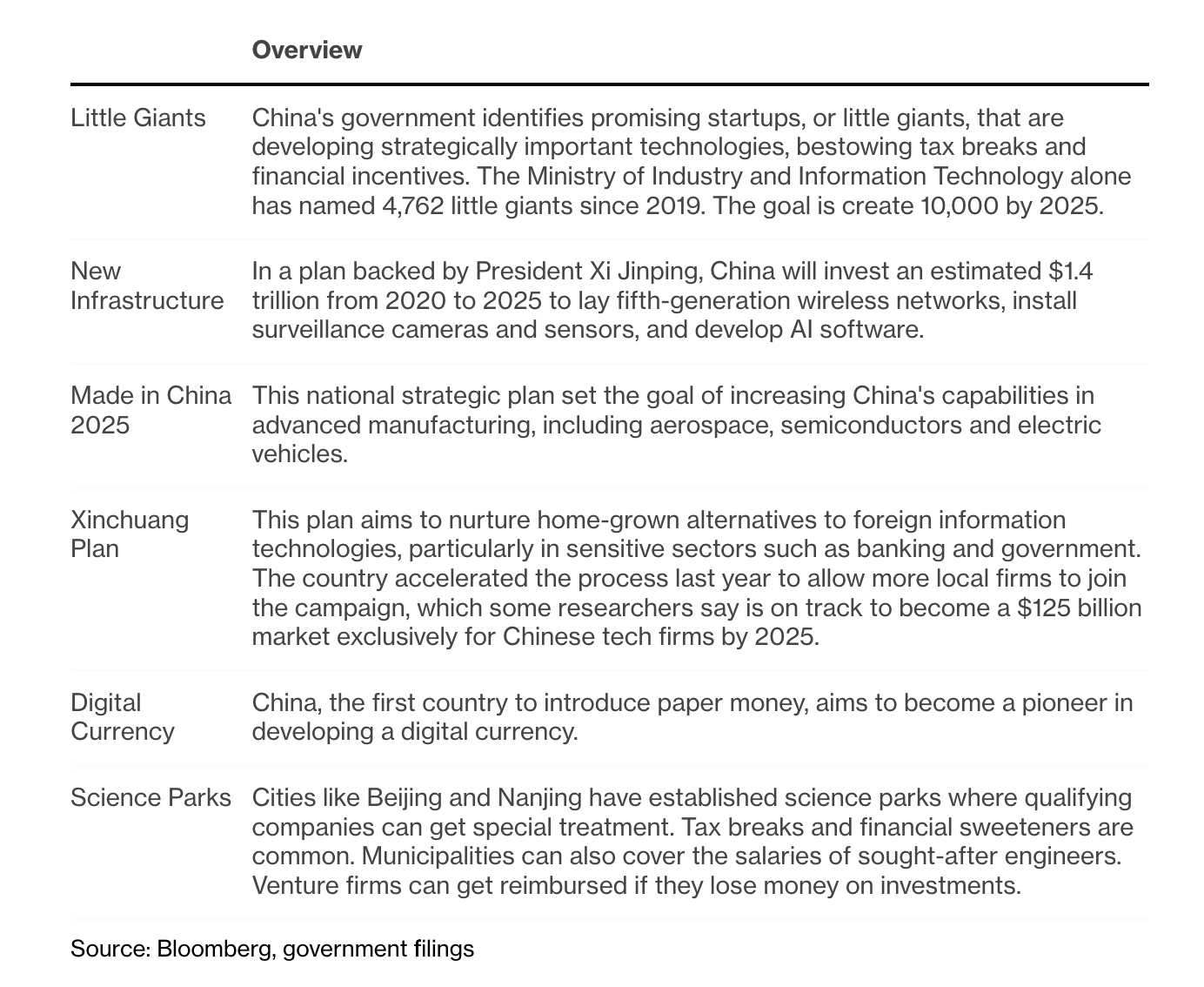

China’s ‘Little Giants’ Are Its Latest Weapon In The U.S. Tech War

Beijing is giving special government support to thousands of startups working on strategically important sectors.

In today’s China, behemoths like Alibaba Group Holding Ltd. and Tencent Holdings Ltd. are out of favor, but “little giants” are on the rise.

That’s the designation for a new generation of startups that have been selected under an ambitious government program aimed at fostering a technology industry that can compete with Silicon Valley.

These often-obscure companies have demonstrated they’re doing something innovative and unique, and they’re targeting strategically important sectors like robotics, quantum computing and semiconductors.

Wu Gansha won the little giants title for his autonomous driving startup after a government review of his technology. That gave the Beijing company, Uisee, an extra dose of credibility and financial benefits. Last year, it raised more than 1 billion yuan ($157 million), including money from a state-owned fund. It’s also become a unicorn, with a valuation of at least $1 billion.

“It’s an honor to wear the little giant label,” Wu said. “The essence of the project is that the companies must possess some specialty that others don’t have.”

The program has been around for more than a decade, but it has taken on new prominence after Beijing launched a sweeping crackdown against leading companies like Alibaba and Tencent. The little giants label has become a valued measure of government endorsement, a signal for investors and employees that the companies are insulated from regulatory punishment.

President Xi Jinping has given his personal blessing to the program.

“This is helpful to startups in many ways: It’s a subsidy. It’s a grant. It’s an honor. It’s a stamp of approval,” said Lee Kai-Fu, founding managing director of the venture firm Sinovation.

The program is key to the Communist Party’s ambitious strategy to reposition the country’s technology industry. For two decades, China largely followed the Silicon Valley model, allowing entrepreneurs to pursue their ambitions with little government oversight. That led to enormous successes, including e-commerce pioneer Alibaba, social media giant Tencent and ByteDance Ltd., creator of the hit TikTok short-video app.

But in a series of regulatory moves over the past year, Beijing made clear the technology industry must realign to conform with government priorities. Alibaba and Tencent were quickly forced to eliminate anti-competitive practices, while games companies had to limit minors to three hours of online play per week. More broadly, the government has signaled softer internet services are out of favor.

Instead, Beijing aims to shift resources to strategically important technologies like chips and enterprise software. The Ministry of Industry and Information Technology has named 4,762 little giants since 2019, many in semiconductors, machinery and pharmaceutical industries.

The designation typically comes with lucrative incentives from the central government or provincial authorities, including tax cuts, generous loans and favorable talent acquisition policies.

“What the country is trying to promote is more hardcore technology,” said Yipin Ng, founding partner of Yunqi Partners, a venture fund that is investing in little giants. “In that sense, this is more in line with what they are trying to promote — things that makes China more competitive.”

Governments from the U.S. to Africa have established programs to support smaller enterprises, but China’s efforts dwarf those in terms of scale, resources and ambition. Xi, the country’s most powerful leader since Mao, has instituted a half dozen programs that will collectively disburse trillions of dollars in pursuit of economic might, social stability and technological independence.

The U.S. trade war has stiffened the Communist Party’s resolve to build a self-sufficient industry. The country’s vulnerability was exposed when Donald Trump’s administration blacklisted national champions like Huawei Technologies Co. and Semiconductor Manufacturing International Corp. That prevented them from buying U.S. components such as chipsets and industrial software, crippling operations.

The little giants concept dates back to at least 2005, when the local government in Hunan province instituted policies to support small enterprises. The central government’s powerful MIIT endorsed the Hunan campaign, which included land grants and financial support, as a model for developing the private sector. Local governments in places like Tianjin began their own initiatives.

It was in 2018, with the trade war, that the central government began to seriously push the program. MIIT announced a plan to create about 600 little giants that would develop core technologies. The procedure for winning the designation was designed to foster competition and identify the most promising companies.

Candidates apply with a six-page form detailing financial status, number of patents and research accomplishments. In the first round of selection, each province could nominate no more than a dozen companies. The country’s top three tech hubs — Beijing, Shenzhen and Shanghai — had a combined quota of only 17 candidates.

Guan Yaxin, chief operating officer of Beijing-based ForwardX Robotics, said the process was relatively smooth for her company because it has proven innovations, with 121 patents globally, including 25 in the U.S.

“This government endorsement is very helpful when I expand the business because the clients will understand we are not just a random startup,” she said.

Innovation Under The CCP

China has built the world’s second-most successful tech industry with an unusual level of government involvement. A few of the key programs:

MIIT has since expanded the program to thousands of companies, with about 1,000 “priority little giants” at the top of the hierarchy. Members of this rarefied club, which includes Wu’s Uisee, receive direct funding from the central government. In January, the Finance Ministry set aside at least 10 billion yuan to fund small and mid-sized enterprises until 2025, with the lion’s share directly financing the priority startups’ research. The goal is to create 10,000 little giants by 2025.

“It’s quite clear that this is a selection of companies very much subordinate to China’s specific industrial policy and needs,” said Barry Naughton, a professor and China economist at the University of California, San Diego. “They were partially picked because they are good firms, but an equally important criteria is they fit the urgent policy needs of the government right now.”

There are substantial risks. The success of China’s technology industry over the past 10 years came from giving entrepreneurs like Alibaba’s Jack Ma and ByteDance’s Zhang Yiming free rein to build their businesses. Flipping the model to focus on the government’s priorities risks leading to waste and failure, Naughton said.

“These are small companies that are being nurtured because they can potentially be alternative suppliers. How do you nurture them? You throw money at them,” he said.

The little giants have become popular targets for venture capitalists, many of whom lost money on portfolio companies during Beijing’s crackdown. One VC said that some startups in the program have been able to raise capital in the last six months while boosting their valuations by 50% to 75%. Another VC reportedly invests only in companies identified as little giants by the government.

Zhang Hui, co-founder of Guizhou Changtong Electric Ltd., applied for the program in Guizhou province in 2020 and received the award last year, based on his company’s power equipment technology. The startup soon landed more than 100 million yuan from state-backed funds, and other investors have been knocking on his door to offer additional capital.

“Of course, venture investors will chase little giants for investment,” he said. “It would be a surprise if they didn’t.”

Venture investments in China hit a record last year despite the crackdown. The value of deals rose about 50% in 2021 to $130.6 billion, according to the research firm Preqin.

EcoFlow Inc., a portable battery startup in Shenzhen, announced a 100 million yuan fundraising led by Sequoia as the company won the little giant label from MIIT. The four-year-old firm now plans an initial public offering in its hometown city within three years.

The government is also making it easier for these startups to go public, another incentive for entrepreneurs and venture investors. China set up a dedicated stock exchange in Beijing last year to help small enterprises raise capital.

Guan of ForwardX Robotics pointed out that founders retain control over their companies even if they participate in such government programs. Her company, which makes mobile robots used in manufacturing and logistics, has about 300 employees and plans to expand into Japan and the U.S. She sees the government’s support as a big benefit as little giants try to grow.

“Many of them are very small now compared with multinationals,” she said. “But the government sees the potential for them to become real giants one day.”

Updated: 2-22-2022

Oil, Gas And Commodities Aren’t Being Weaponized — For Now

The West each day continues to buy hundreds of millions of dollars worth of resources from Russia, indirectly financing the Ukrainian crisis.

In the 24 hours after Vladimir Putin signed a decree recognizing two breakaway Ukrainian territories, the European Union, the U.K., and the U.S. bought a combined 3.5 million barrels of Russian oil and refined products, worth more than $350 million at current prices.

On top of that, the West probably bought another $250 million worth of Russian natural gas, plus tens of millions dollars of aluminum, coal, nickel, titanium, gold and other commodities. In total, the bill likely topped $700 million.

And that’s the way it’s going to be — at least for now. The U.S. and its European allies will continue buying Russian natural resources and Moscow will continue shipping them, despite the biggest political crisis between the former Cold War warriors since the collapse of the Soviet Union in 1991.

Both sides are aware of the contradictions. The West knows that commodities are a cash cow for Putin, fueling his imperial ambitions thanks, in great part, to ultra-high oil and gas prices, but the allies are also aware of the economic self-harm of cutting imports to zero.

For its part, the Kremlin may be tempted to weaponize its natural resources — which could trigger blackouts in Europe. But it also knows commodity exports are its own economic lifeline.

It’s the commodities market version of the Cold War doctrine of mutual assured destruction, or MAD.

With other adversaries — say Iran or Venezuela — the White House has been quicker to use oil as a geopolitical tool. As a result, both Tehran and Caracas cannot sell oil legally in world markets, not just into the U.S. However, Russia remains free to ship its oil into America; and the U.K. continues to buy Russian diesel, too.

At this point, neither Moscow nor the U.S. and its allies have an economic, political or military interest in weaponizing oil, gas and other natural resources. However, I must emphasize “for now.” The initial round of Western sanctions — and the reaction from the Kremlin — was a reflection of that current posture.

The European Union and the U.K. targeted five medium-sized Russian banks, accusing them of helping the Kremlin’s campaign. But they left untouched the three state-owned giant lenders that are key for the commodities trade: VTB Bank PJSC, Sberbank of Russia PJSC and Gazprombank JSC.

Putin did the same, telling an industry conference — the day after recognizing the breakaway republics — that Russia was planning “uninterrupted supplies” of natural gas to world markets.

The fears of the Kremlin cutting the gas supply remain simply that: fears. Any military trouble remains confined to the two breakaway territories, which are far away from the mighty Russian oil and gas pipelines that crisscross Ukraine from East to West: Druzbha, Soyuz, Progress and Brotherhood. The company that operates the gas pipeline network of Ukraine tweeted: “Keep Calm & Transit Gas.”

The biggest casualty has been NordStream 2, the Kremlin-backed gas pipeline connecting Russia directly with Germany under the Baltic Sea. Berlin halted the administrative approval process for the pipeline, in effect putting the project on ice. Tellingly, however, it did not impose sanctions on the pipeline itself.

In any event, NS2 — which hasn’t started operations — was unlikely to be approved before the summer. Berlin did not take any action on NS2’s sister pipeline, NordStream 1, which follows exactly the same route, and has been pumping gas for several years. Why not? NS2 is empty; NS1 is full.

While NS2 is a cause célèbre for many politicians, its importance lies in diplomacy rather than the energy market. For Berlin, halting the project sends a signal to the Kremlin without affecting current German natural gas supply. For its part, Moscow doesn’t need NS2 if its sister is at full capacity.

Indeed, Gazprom, the Russian state-owned gas giant, hasn’t sent a single molecule of gas through its other pipeline — the Yamal-Europe, which traverses Belarus and Poland — since late December.

We may soon see Gazprom boosting its gas supplies to Germany and the rest of Europe. Current spot gas prices are higher than the average of February-to-date, a situation that may prompt European utilities to maximize their Gazprom supply contracts from March 1st. If that’s the case, Europe may see an ironic situation: simultaneously higher political tension and higher flows of Russian gas.

It’s another sign that both sides have an interest in keeping commodities out of the battle — for now.

Updated: 3-3-2022

Monetary Weapons: 4 Lessons From Canada And Russia

The traditional financial system is a tool that can be used both against fellow citizens and despicable enemies.

Just when fear of the latest COVID-19 variant was waning and long-term planning was starting to seem possible again, February brought unsettling episodes that shattered dreams of lasting peace and normality. Money played a crucial part in these episodes.

In Canada, we saw a Liberal government invoking for the first time the federal Emergencies Act, enacted in 1988, to end disruptions caused by protestors blocking borders and streets with trucks.

Among other measures, the government ordered banks, financial institutions and even crypto exchanges to freeze personal and corporate accounts suspected of sending contributions to protestors, eliminating the need to obtain a court order and the risk of later being sued for abuse.

It didn’t matter whether you were transferring C$10 (US$7.89) or C$100,000 or paying for legitimate services provided a week ago: Send money to a targeted account and yours might end up frozen, too.

A democratic government indiscriminately depriving its citizens of money as a sanction for supporting a protest shouldn’t be taken lightly – even after the emergency declaration was revoked. But this action paled in comparison to what was about to happen.

In the last weekend of February, reacting to a dreadful invasion of Ukraine, the U.S. and the European Union, among others, decided to impose sanctions on Russia. By executive order, political leaders decided to prevent the Russian central bank from using hundreds of billions of dollars of its international reserves – an unprecedented move in its breadth and intensity.

These reserves are safe and liquid assets denominated in foreign currencies, usually U.S. Treasury bonds, that a central bank keeps deposited around the world to support its country’s international transactions.

Without international reserves, neither the government nor the private sector can import goods or services, from software and clothing to much-needed medicine and consumer goods that aren’t produced locally.

Cutting a country’s access to its international reserves amounts to unplugging it from the rest of the world: The longer the sanction lasts, the more isolated the country becomes and the scarcer essential goods and services get. It’s an extreme measure that affects all citizens, no matter their political preferences.

Not Your Money

It’s still early to understand all the implications of these episodes, but some lessons can start to be drawn. First, and perhaps most sobering, money is a weapon that can be used both against fellow citizens and despicable enemies.

As a weapon, money needs better governance. We have to think harder about the powers a money issuer, public or private, has. Should money issuers, from states to stablecoin creators, be able to restrict access to the money we legitimately hold? Under which circumstances?

This concern grows stronger when we realize digital money is the money that matters most. The long lines outside ATMs in Russia and Ukraine are a reminder that banknotes and coins aren’t always available. Unless you have your mattress permanently stuffed with cash, you’ll run out of it in no time when times are tough.

In the end, we don’t really “hold” the bulk of our money. It’s held for us, somewhere in a computer that can be blocked, hacked or stolen. The technological and institutional protections around this computer represent the thin line that separates monetary order from chaos – and this is true for all digital currencies, from bank deposits and central bank digital currencies (CBDC) to stablecoins and crypto.

Privacy

Second Lesson: Monetary anonymity is a fallacy, not a solution. Against the Canadian background, it’s easy to argue that anonymous money would be the way to go. Wrong. Anonymous money in these circumstances would only give authorities more reasons to broaden their intervention and issue blanket bans.

That doesn’t mean we need fully transparent money to satiate the desires of a surveillance state. It means money transactions should run on a system of partial identification and protected identity, following David Birch’s ideas.

If a decentralized pseudonymous bitcoin (BTC) type of coin seems too far-fetched for any sovereign currency, a decentralized pseudonymous identity should be allowed in money transactions.

Instead of providing your tax identification number and your personal details to open a bank account, for example, you’d digitally send the bank a code generated by a decentralized database holding the details of your identity.

Every time you needed to prove your identity or a personal detail (like your age, nationality or monthly income), the decentralized database would authenticate your access and release the required information.

But only under certain conditions (say, a court order) would the database disclose your full identity.

A Better Alternative

Third, cryptocurrencies can offer a way out for those being attacked and also for regular people who disagree with the actions taken by their tyrannical government. Think about a Russian family who doesn’t feel safe in Russia anymore or simply doesn’t want to pay the price for the government’s lunacy. If they hold at least part of their savings in crypto, they have a chance of escape.

Sure, crypto can be volatile and isn’t widely accepted or easily used for everyday payments. But try fleeing a country at war with gold in a suitcase or making payments with rubles in a couple of weeks if this tragedy lingers. In these cases, crypto has only to be better than the alternatives – and it is.

Money For Enemies

Finally, cryptocurrencies proved they can be valuable also for sovereign governments. The Ukrainian government asked for – and received – financial support via crypto donations. If crypto can provide some relief to a country being brutally attacked by a powerful neighbor, its social value becomes indisputable: it can be used against criminals.

More than that. As the freezing of the Russian international reserves raises doubts about how safe and liquid these reserves ultimately are, central banks might have started pondering if the time to add cryptocurrencies to their reserves’ portfolio has arrived.

Between securities controlled by foreign governments and cumbersome gold bars, crypto could end up offering a reasonable option.

Updated: 3-7-2022

Food Is Just As Vital As Oil To National Security

Amid all the talk about U.S. energy independence, few have fretted over the vulnerability of agriculture imports needed to feed Americans.

While Putin’s war in Ukraine is delivering shocks to the energy market and driving up fertilizer prices, the bigger problem has become the soaring cost of wheat. Russia is steering the world toward an increasingly severe food security crisis — compounding the shortages already caused by the pandemic and climate change.

More than 70% of Ukraine is prime agricultural land that produces a major share of the world’s wheat, as well as its corn, barley, rye, sunflower oil and potatoes.

Ukraine’s crop exports to the European Union, China, India and throughout Northern Africa and the Middle East are plummeting as Russian forces paralyze Ukrainian ports. They could soon cease altogether. Meanwhile, heavy Western sanctions are disrupting the flow of crop exports from Russia, the world’s top wheat producer.

Food security organizations are already hard pressed to deal with spreading hunger. Expanding shortages “will be hell on earth,” the United Nations World Food Program director David Beasley predicted last week. The threat is greatest in countries already teetering on the edge of famine, and in those that rely heavily on Ukrainian and Russian imports.

Beasley said his organization will “have no choice but to take food from the hungry to feed the starving,” and unless more funding pours in immediately, “we risk not even being able to feed the starving.”

The Ukraine war is teaching international leaders a lesson they should have learned already: Long-term agricultural strategy must be built into national security plans.

That means starting now to invest in more sustainable farming practices, climate-resilient crops and new growing technologies, as well as agile supply chains that can pivot around disruptions when needed. Food security must also become a central focus of international trade agreements.

Hunger fuels civil unrest and a vicious cycle of disruptions. It adds burdens, distractions and enormous costs to already strained governments as they scramble to import food at higher prices. Eventually, it can lead to mass exodus: hungry civilians fleeing their homeland in search of food.

For millennia, robust food systems have conferred political power. Civilizations from the Mayans of Mesoamerica to the Vikings of Scandinavia rose as their food supplies flourished and fell as they declined. Even today, the nations with the least-reliable food supplies tend to have the least-diverse economies and the most conflict-prone governments.

In 2012, hunger helped foment the Arab Spring after droughts crippled wheat fields in Russia and the U.S., causing grain prices to spike worldwide. Food riots broke out in dozens of cities worldwide.

That global food crisis a decade ago forced Group of Eight nations to begin to focus on food security. They pledged significant funding for food relief. The Obama administration, for its part, set up Feed the Future, a program that deployed USAID and other agencies in targeted countries to help improve access to food. These were important efforts — but not enough.

Today, both wealthy and developing nations need to double down on this issue. Wheat prices already are at the levels they were in the 2008 food crisis — and climbing. “We can only imagine how much more devastating this is going to get,” said Catherine Bertini, a food security expert with the Chicago Council on Global Affairs and former director of the UN’s World Food Program.

“The risk we’re facing is unprecedented.”

The Ukraine invasion has three tiers of negative influence on food security: first, on the people of Ukraine and Russia who are experiencing supply disruptions; second, on countries relying heavily on their exports; and third, on broader populations that already are feeling the shock of higher food prices.

Worldwide today, 283 million people are acutely food insecure and 45 million are on the edge of famine. Famine-stricken countries such as Yemen stand to suffer most from dwindling Ukranian food exports, but also vulnerable are Egypt, Turkey and Bangladesh, which import billions of dollars of Ukrainian wheat annually.

Many other nations already struggling with food supplies depend on Ukrainian exports. Take Kenya, for instance: It derives 34% of its wheat from Russia and Ukraine, and 70% of its population lacks money for food. Or Morocco: 31% of its wheat comes from Russia and Ukraine, and 56% of its population can’t afford a stable food supply. No less than half of the wheat purchased by the United Nations for food assistance worldwide comes from Ukraine.

But no country is insulated from food disruptions going forward — including and especially the United States.

With all the calls we’ve been hearing for greater energy independence, few have fretted over the fact that while the U.S. exports about $150 billion annually in food products, it imports nearly as much – about $145 billion.

Why isn’t food security a key topic at major global conferences? It was barely discussed last year at the World Economic Forum in Davos, nor was it a priority at the COP 26 climate conference or at the United Nations Conference on Trade and Development.

The European Union, World Trade Organization and other international trade groups must prioritize stable food-trade relationships — especially for the poorest and most food-vulnerable countries.

Even if Russia’s war against Ukraine is resolved soon and their exports continue to flow, climate impacts on food production and supply chain disruptions will become increasingly severe.

According to the Intergovernmental Panel on Climate Change report released last week, hotter, dryer and more volatile growing conditions are already hobbling food systems globally, and as much as 30 percent of the world’s currently productive farm and pastureland will no longer support food production by the end of this century, if current trends continue.