Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

Early indicators signal concerns, though more credible ones still look good. But the economy can turn quickly. Recession Is Looming, or Not. Here’s How To Know

The plummeting stock market is signaling a serious slowdown, if not a recession. But shopping malls were packed into Christmas Eve.

Only one of those trends will continue into 2019. Picking the winner will be profitable but won’t be easy.

The crux of the problem: The early indicators of trouble, such as stock-market selloffs and surveys of sentiment, are imperfect forecasters of a recession. But the hard economic numbers that more accurately predict a slowdown are lagging indicators, so they often just confirm what everyone already knows. This matters a lot right now.

Early indicators have more credibility when several of them are flashing warning lights, which is true now. Besides the stock-market turmoil, short-term Treasury yields are almost as high as long-term yields, closing in on a yield curve “inversion” that in the past has portended recession. Corporate bond yield spreads over comparable Treasurys are climbing. Business sentiment is slipping, with nearly half of chief financial officers in a recent Duke University survey forecasting a recession by the end of next year.

True, one or more of these may turn out to be wrong. The flattening yield curve, for example, could be a result of bond buying by central banks. But these indicators tend to reinforce one another, so if markets get worse, investors should be more nervous.

The next thing to watch are the most real-time of the lagging indicators. Among them, economists at Bank of America Merrill Lynch point to initial jobless claims, auto sales, industrial production and aggregate hours worked. Of these, only auto sales, which have leveled off lately, provide any concern. The others are sending an all clear, with jobless claims near multidecade lows, industrial production at a record high and aggregate hours—the combined amount of time Americans are spending on the job—growing steadily.

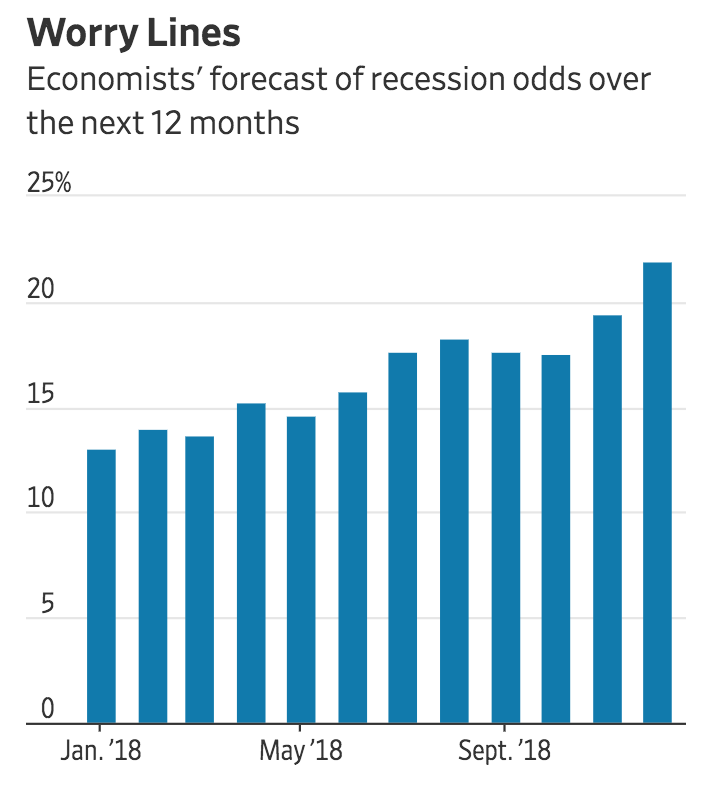

Another good recession indicator, according to Goldman Sachs, is economists’ recession forecasts. This isn’t as silly as it sounds. Economists as a group may never correctly predict a recession, but the odds they place on one coming tend to rise in advance of a downturn.

This is what has happened: This month, economists surveyed by The Wall Street Journal put a 22% chance of a recession occurring over the next 12 months, compared with 14% a year earlier. Those odds would need to go higher before they amounted to a danger sign. In September 2007, three months before the last downturn began, economists’ recession odds were at 36%.

Before relaxing too much, the other thing to know about recessions is that they can start fast. Before the fall of 2007, recession indicators like jobless claims suggested nothing was seriously amiss, and then suddenly, they did. With the boost from last year’s tax-cut stimulus about to fade, the lagged effects of the Federal Reserve’s rate increases starting to take hold and fractious geopolitical environment, investors should acknowledge the blue skies overhead but also keep an eye on the horizon.

Related Articles:

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Your questions and comments are greatly appreciated.

Monty H. & Carolyn A.

Go back

Leave a Reply

You must be logged in to post a comment.