Jumbo Mortgages Are Slowing Down, Testing Banks’ Postcrisis Playbook (#GotBitcoin?)

High-end home buyers are turning cautious, a blow to banks that refocused their mortgage businesses around wealthy borrowers in the years after the financial crisis. Jumbo Mortgages Are Slowing Down, Testing Banks’ Postcrisis Playbook (#GotBitcoin?)

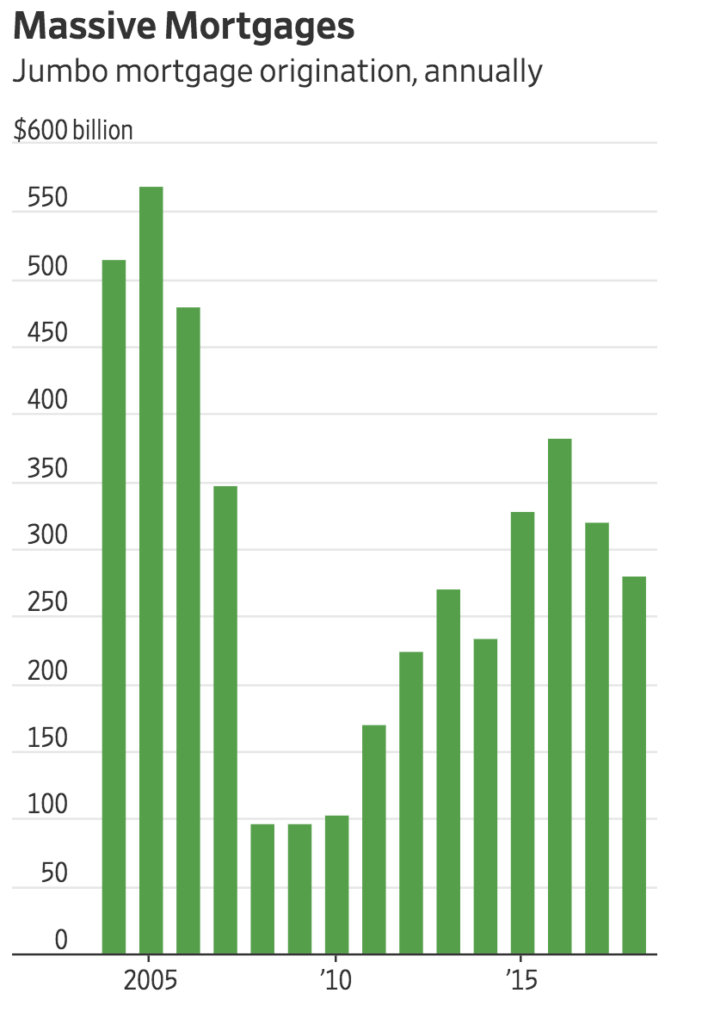

Loans too big for Fannie and Freddie dropped 12% last year by dollar volume

Originations for jumbo mortgages, which are loans too big to be sold to Fannie Mae and Freddie Mac , dropped 12% last year by dollar volume, outpacing the 7% decline in mortgages that meet the standards for Fannie and Freddie’s government backing. The $281 billion in jumbo originations was off 27% from its postcrisis peak two years earlier, according to Inside Mortgage Finance, an industry research group.

These high-dollar loans have been a bright spot for banks. Many financial institutions, stung during the housing crisis by mortgages made to buyers who ultimately couldn’t repay, pulled back from the market except for the portion that catered to high-end customers. Additionally, banks found that making and servicing the loans was a good entry point to sell more services to those customers.

But recent trends have hit the high end of the market disproportionately, testing the banks’ postcrisis strategy. Refinancings have cooled because many borrowers who were eligible to refinance have already done so, and rates would have to fall sharply to make it worthwhile for them to do so again. Home prices, while still rising annually, are cooling. A slowing U.S. economy and new tax laws that reduce the incentives to buy big homes are also hurting the jumbo market. The changes are weakening a key support for the housing industry and broader U.S. economy.

The high-end slowdown is bringing into sharp focus how hiccups in the housing industry can ripple throughout the economy. Baby boomers and retirees who want to downsize are having trouble selling their dream houses. In New York City, some wealthy homeowners are finding that their homes sit on the market for weeks or months longer than they expected.

The slowdown could also signal that would-be younger borrowers in expensive cities like New York City and San Francisco are no longer willing to stomach continually rising home prices.

“Prices have gotten so expensive in some of these coastal markets, there are fewer buyers that can afford these prices,” said Daryl Fairweather, chief economist at real-estate brokerage Redfin.

Home sales for the top 5% of the market fell 10% in February from a year earlier, while sales overall stayed essentially flat, according to Redfin.

In most parts of the country, a jumbo is any loan above $484,350, though in the most expensive areas a jumbo is above $726,525.

These high-cost mortgages dominate the market in expensive cities. In Manhattan, for example, 61% of purchase mortgages last year qualified as jumbo per that year’s loan limits, according to housing-research firm Attom Data Solutions.

The banks’ postcrisis push toward wealthier borrowers contrasts with nonbank lenders that have grown rapidly since the crisis, often by focusing on first-time or moderate-income borrowers. Jumbos made up almost one-fifth of the mortgage originations at banks with more than $10 billion in assets in 2017, versus about 7% of business for nonbanks, according to ComplianceTech’s LendingPatterns.com.

Banks that did more than half their U.S. mortgage business in jumbo loans last year include First Republic Bank , MUFG Union Bank, Toronto-Dominion Bank and Bank of America Corp. , according to Inside Mortgage Finance.

Executives at Bank of America and Union Bank, which is a subsidiary of Tokyo-based Mitsubishi UFJ Financial Group Inc., say their companies’ businesses skew naturally toward jumbo borrowers because of where their client bases are concentrated, such as in expensive parts of the West Coast. Recently, both banks have sought to focus more on borrowers taking out smaller loans, they say.

The jumbo loan business tends to be heavy on refinancing because a small drop in rates can make a big difference on large mortgage payments. “It doesn’t take much of a rate move on larger loans to make the cost to transact make sense,” said Rick Bechtel, the head of U.S. residential lending at TD Bank.

But as rates rose last year, the refinance market effectively shut down.

Prices for higher-end homes are still rising, but at a slower pace than less expensive ones. On the most expensive third of U.S. homes, list prices rose about 6% since the end of 2017, while the middle third grew about 9% and the bottom third jumped 16%, according to online real-estate company Zillow Group Inc.

During an otherwise upbeat 2018 for financial earnings, mortgage-banking profitability among the top 24 banks that report it dropped 19% from a year earlier, according to Inside Mortgage Finance.

Still, there are few signs banks are changing tack. If anything, industry watchers say, they are becoming more competitive. Banks tend to keep jumbo loans on their balance sheets rather than selling them to investors, which means they can offer lower rates without worrying about whether that will make the loans less attractive to investors.

Kevin Leibowitz, the founder of Brooklyn, N.Y.-based Grayton Mortgage Inc., a nonbank lender and broker, said that it is tough to outmaneuver banks in the jumbo market. This month, he was asked to price a roughly $900,000 mortgage for a second home in California. He offered a rate of 4.375%, but couldn’t beat Bank of America’s 4%, which included the potential to drop it to 3.875% if the borrower also deposited $250,000 at the bank.

“I can’t compete with crazy,” Mr. Leibowitz said.

Had Eric Nadler and his wife chosen to purchase an apartment in Manhattan when they moved to the city from the suburbs last year, they likely would have taken out a jumbo loan. But instead, the empty-nesters decided to rent. Mr. Nadler, an angel investor, said a series of quick tallies on a mortgage calculator showed renting to be a more reasonable option given the length of time they were willing to commit to living in New York City.

The new tax law reinforced their decision because it would have cut the size of their deduction, effectively increasing the cost to own. “There was no reason to take on more tax liability,” Mr. Nadler said.

Related Articles:

Home Prices Continue To Lose Momentum (#GotBitcoin?)

Freddie Mac Joins Rental-Home Boom (#GotBitcoin?)

Retreat of Smaller Lenders Adds to Pressure on Housing (#GotBitcoin?)

OK, Computer: How Much Is My House Worth? (#GotBitcoin?)

Borrowers Are Tapping Their Homes for Cash, Even As Rates Rise (#GotBitcoin?)

‘I Can Be the Bank’: Individual Investors Buy Busted Mortgages (#GotBitcoin?)

Why The Home May Be The Assisted-Living Facility of The Future (#GotBitcoin?)

Your Questions And Comments Are Greatly Appreciated.

Monty H. & Carolyn A.

Go back

Leave a Reply

You must be logged in to post a comment.