Investors’ Flee From Stocks, Leaving Bot’s Free To Fuel Wild Market Swings (#GotBitcoin?)

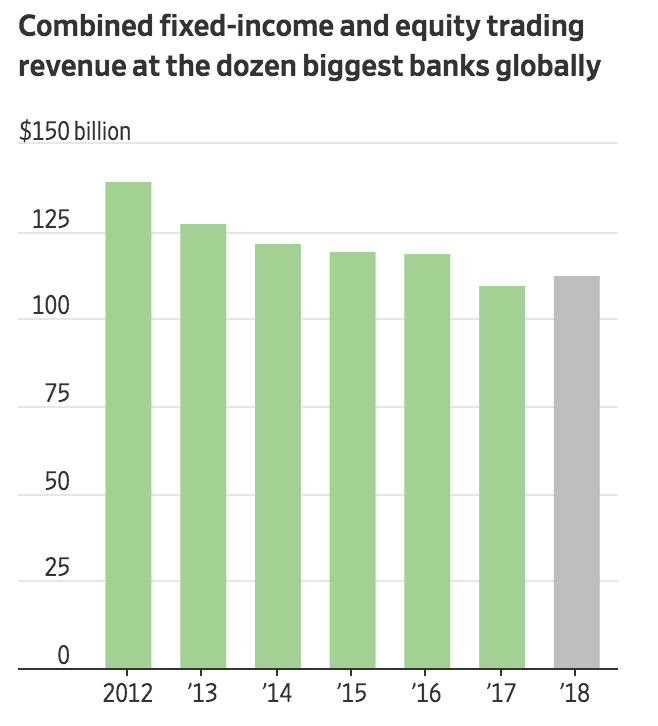

Financial markets’ wild and woolly fourth quarter likely won’t translate into strong trading results at the nation’s largest banks—the latest sign of the changes sweeping the business of buying and selling securities since the financial crisis. Investors’ Flee From Stocks, Leaving Bot’s Free To Fuel Wild Market Swings

Fourth-quarter trading revenue is expected to be roughly flat, collectively, with a year ago at Bank of America Corp., Citigroup Inc., Goldman Sachs Group Inc., JPMorgan Chase & Co., and Morgan Stanley, according to data from market-data firm Autonomous Research. Those banks were scheduled to report earnings the week of Jan 13.

The likely trading results underscore the tension between trading profits and safety at these firms in the years since the Dodd-Frank financial overhaul. Uncertainty and volatility can be a boon for Wall Street, as clients race to place big bets and firms collect significant fees—as was the case in early 2018. But market action in recent months has been marked instead by big funds and other traders scaling back activity in a bid to reduce risk, according to traders and analysts.

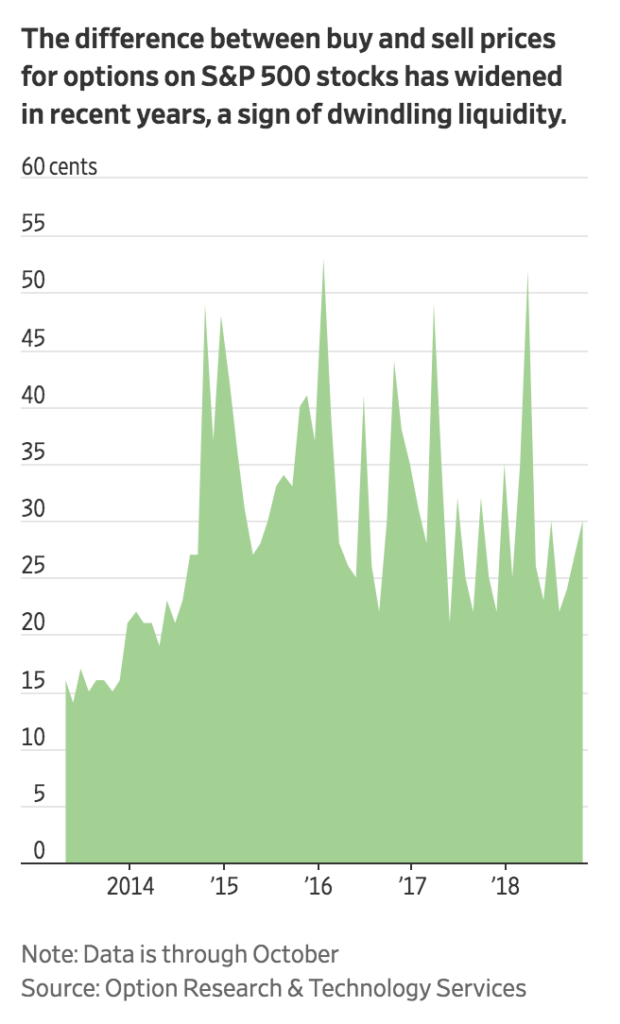

As a result, the fourth quarter was marked by a decline in liquidity, a measure of how long it takes to complete a trade without significantly affecting prices. The decline in liquidity was especially notable in the futures market, where many traders place or hedge big bets on the expected direction of shares.

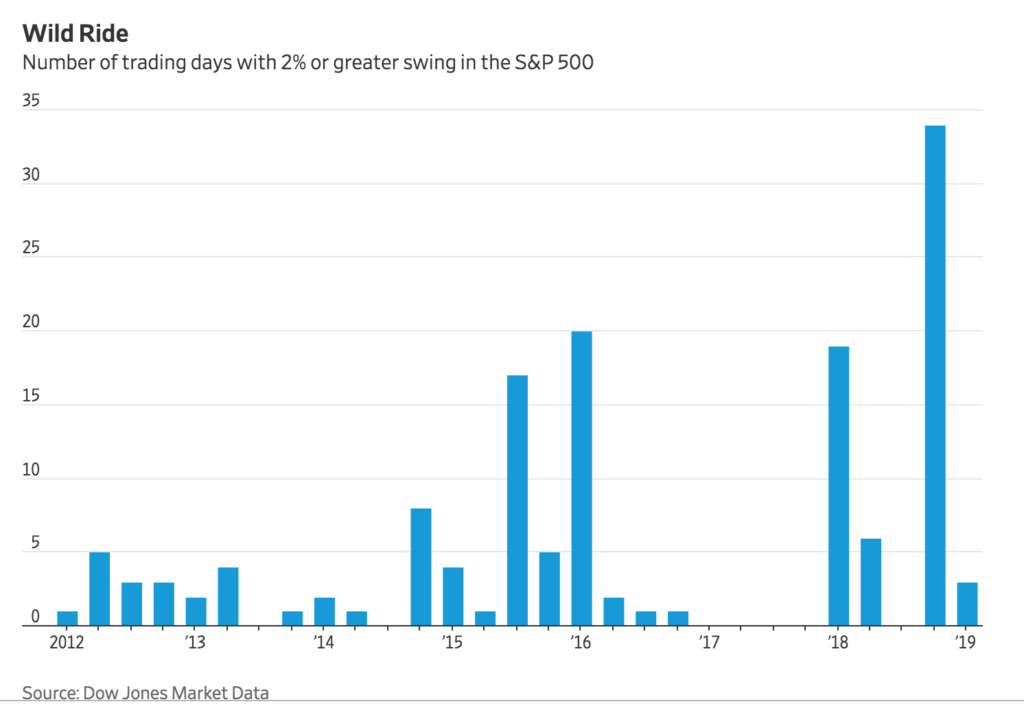

That, in turn, left automated programs free to run and drive prices up and down sharply, helping fuel the market’s wild swings. The S&P 500 posted its worst fourth quarter in seven years, dropping 14% in a period marked by repeated declines to lows the market hadn’t seen in months.

“There was a lot of volatility, but all to the downside,” said Brian Foran, a bank analyst at Autonomous. “That is bad volatility for the banks.”

Some Wall Street firms have already acknowledged the toll that investors’ retreat from risk has taken. Investment bank Jefferies Financial Group Inc. on Thursday attributed a decline in sales and trading revenue in its fourth quarter, which ended in November, to “investors’ risk appetite and activity levels [falling] during October and November.”

Clients’ retreat from risk made it particularly hard for Wall Street to make money in fixed-income markets, which include bonds, currencies, and commodities, wrote James Mitchell, a bank analyst at Buckingham Research Group, in a recent note.

Trading around the end of a calendar year can be tricky in the best of times, as banks clean up their books ahead of regulatory exams that base certain capital requirements on big banks’ year-end holdings. But the size of the 2018 moves—stocks falling more than in any December since 1931, with the most 2%-plus declines in any month since November 2008—was unusual.

Under tighter capital requirements, big banks have been focusing more on large trading clients, such as giant asset managers like BlackRock Inc. BLK -0.40% and Pacific Investment Management Co., and less on providing cheap credit to smaller, more aggressive hedge funds.

“You’re losing market participants from the bottom up, especially the less sophisticated, who sometimes trade against the market,” said Gil Mandelzis, chief executive of Capitolis, a startup technology firm that works with banks to find third parties to fund trades the banks no longer facilitate on their own.

Traders and analysts said that compared with past market swoons, this time it has been unusually difficult to find corresponding buyers or sellers in many markets.

There was an “abrupt deterioration” of liquidity in the market for government-bond futures in December, said Nikolaos Panigirtzoglou, global market strategist at JPMorgan. The ability to trade futures on everything from stocks to currencies also fell toward the end of the year, he said, though the move was most pronounced in bonds.

The ease of trading single stocks within the Russell 3000 index has dwindled and hovered near its lowest levels over the past decade, according to data from Goldman Sachs as of Dec. 18. Liquidity in options and futures also has deteriorated, according to data and interviews with market participants.

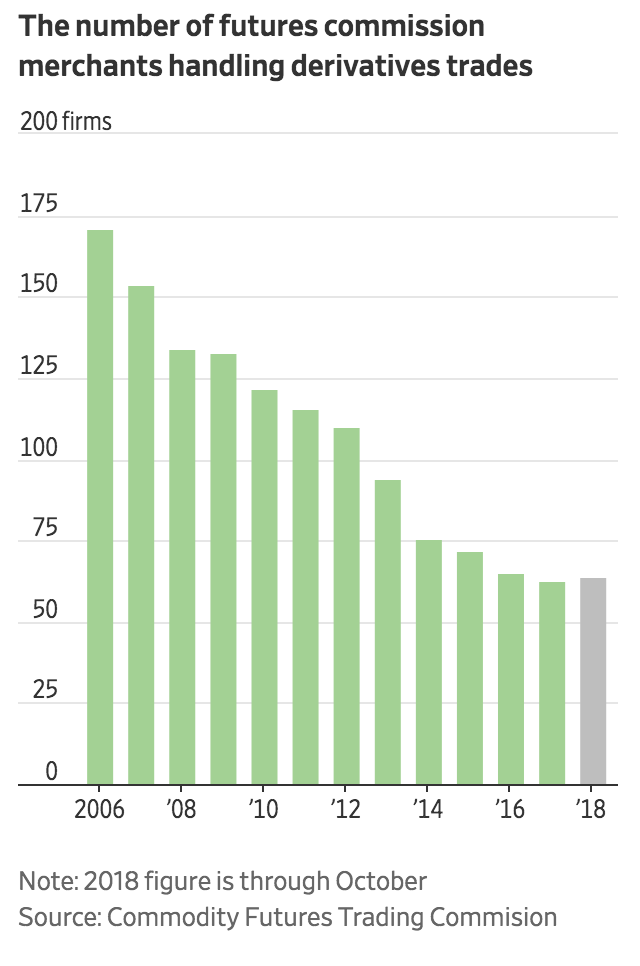

Stiffer capital rules for banks have led some to pull away from providing clearing services—or act as a go-between for trading shops and central clearinghouses—in the futures and options markets. This leads to less support for trading services overall.

The number of firms clearing both options and futures has shrunk in recent years. There were just 64 futures commission merchants in the U.S. toward the end of 2018, compared with more than 170 in 2006, according to Commodity Futures Trading Commission figures.

“As we’ve seen the ability of clearing capital become tighter, there are trades that we otherwise would have done that either happened at worse prices for the market or they didn’t happen at all,” said Steve Crutchfield, head of market structure at Chicago Trading Company, which specializes in trading derivatives.

Traders Wished for Volatility. The Fourth Quarter Wasn’t What They Had in Mind.

Despite big price swings in stocks and other assets, trading revenue was down 6% among the five largest banks

Wall Street traders for years complained that they couldn’t make money in calm markets. They haven’t fared any better in wild ones.

Bank traders stumbled in the fourth quarter of 2018, when the stock market lurched and strange things happened in the bond market. The five largest Wall Street firms reported this week that combined quarterly trading revenue was down 6% from a year earlier, further draining a once-reliable stream of profits.

Rising interest rates, trade tensions and signs of China’s slowing economy stoked investor fears. Exacerbating the swings: the widespread use of algorithms, which sold stocks in tandem and bought when pummeled shares looked cheap enough. The S&P 500 swung at least 2% on more than half of the trading days during the fourth quarter, the most in any three-month period since 2011, when the U.S. credit rating was downgraded.

“When things move a little bit up or down every day, that’s good,” Morgan Stanley Chief Financial Officer Jon Pruzan said in an interview. “When they go up 600 points one day and down 600 points the next, that’s bad.”

Bank traders serve a key function, matching buyers and sellers in relatively opaque markets. They can make money predicting steady price moves in either direction, like a baseball outfielder shifting into position for batters who reliably hit the same spot. Scattered moves are harder to defend.

“It’s not necessarily whether interest rates are moving up or down. You can certainly [make money] in either of those cases,” said Michael Corbat, chief executive at Citigroup Inc., where revenue from currency and rates trading tumbled 26% in the quarter.

“It’s where the market appears somewhat directionless or people aren’t quite sure exactly how far something is going….Bad volatility, that’s what we saw in the fourth quarter,” he said.

Wall Street banks used to be more resilient. Years ago, banks were permitted to hold a large number of securities for months at a time. That allowed traders to ride out price swings.

Since the financial crisis, banks have shrunk their portfolios and put strict time limits on certain positions. Holdings of the riskiest and most illiquid assets are down 85% since 2008, according to the Office of the Comptroller of the Currency. In some situations, traders must flip their inventory by day’s end, which left them exposed to the market’s stunning intraday swings last month.

“Banks act much more like market makers, and less like large proprietary position takers, than they did pre-crisis,” said James Masserio, head of Americas equity-derivatives trading at Société Générale SA .

The volatility changed how clients acted, too. Some retreated altogether. “People didn’t know when to jump in,” Mr. Corbat said, “so everybody just stayed on the sidelines.”

Some money managers shifted away from products that generate big fees for banks into less lucrative ones. Mildly concerned investors often use derivatives to guard against losses, but the truly scared tend to sell outright, traders said. That generates commissions, typically a fraction of a penny, instead of bigger fees associated with derivative instruments.

Indeed, while equity derivatives were a bright spot early in 2018, when volatility briefly spiked, they were weaker in the fourth quarter.

The result was a December slump that turned a mediocre quarter into a bad one.

At Goldman Sachs Group Inc., executives between Christmas and New Year’s pulled tens of millions of dollars out of the bonus pool that had been set aside a month earlier for fixed-income traders, according to people familiar with the matter. In stock trading, where revenue rose in the quarter and for the year, pay was up as much as 15%, traders said.

To some executives, the chance to squeeze out a few pennies didn’t justify the risk of getting stuck on the wrong side of a market move. Citigroup trimmed $26 billion worth of risky assets, the bulk of which came from its trading business, in the fourth quarter, CFO John Gerspach said.

Further confounding traders, many long-held market truths crumbled. Investments that have historically moved in different directions traded in lockstep. Treasurys maturing in five years were briefly yielding less than two-year notes. The Japanese yen, which often rises significantly in times of market stress, appreciated only modestly for most of the late-year turmoil.

That meant that the bets traders used to hedge their risk were less effective. “Historical relationships broke down,” Mr. Pruzan said, though they are coming back this year.

Related Articles:

Trump Administration’s ‘Plunge Protection Team’ Convened Amid Wall Street Rout (#GotBitcoin?)

Tech Stocks Down $800 Billion While Asian Stocks Erase $5.6 Trillion In Market Value (#Gotbitcoin?)

Trump Policies Cause Chinese Stocks To Out-perform Those of US. (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Your questions and comments are greatly appreciated.

Monty H. & Carolyn A.

Go back

Leave a Reply

You must be logged in to post a comment.