Investors’ Dash For Cash Adds To Stock Market’s Vulnerability (#GotBitcoin?)

Investors are increasing their cash holdings at the fastest pace in a decade, highlighting doubts about the durability of the stock market’s early 2019 rebound. Investors’ Dash For Cash Adds To Stock Market’s Vulnerability

Cash holdings in investment portfolios are rising quickly, raising doubts about recent rebound.

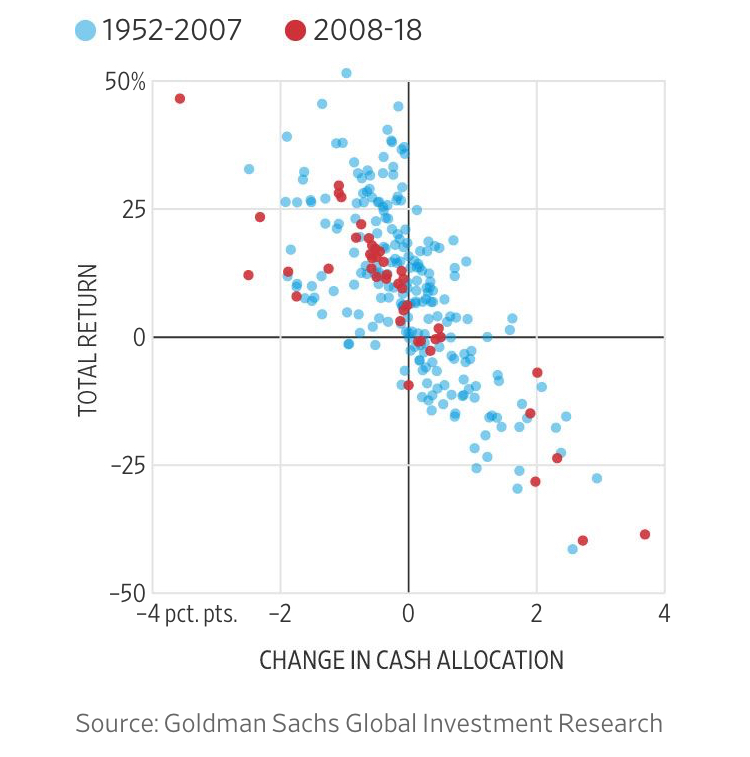

Money Drag

Stock returns tend to be negative when investors’ cash allocations rise.

S&P 500 total return and change in cash allocation, quarterly 1952-2018

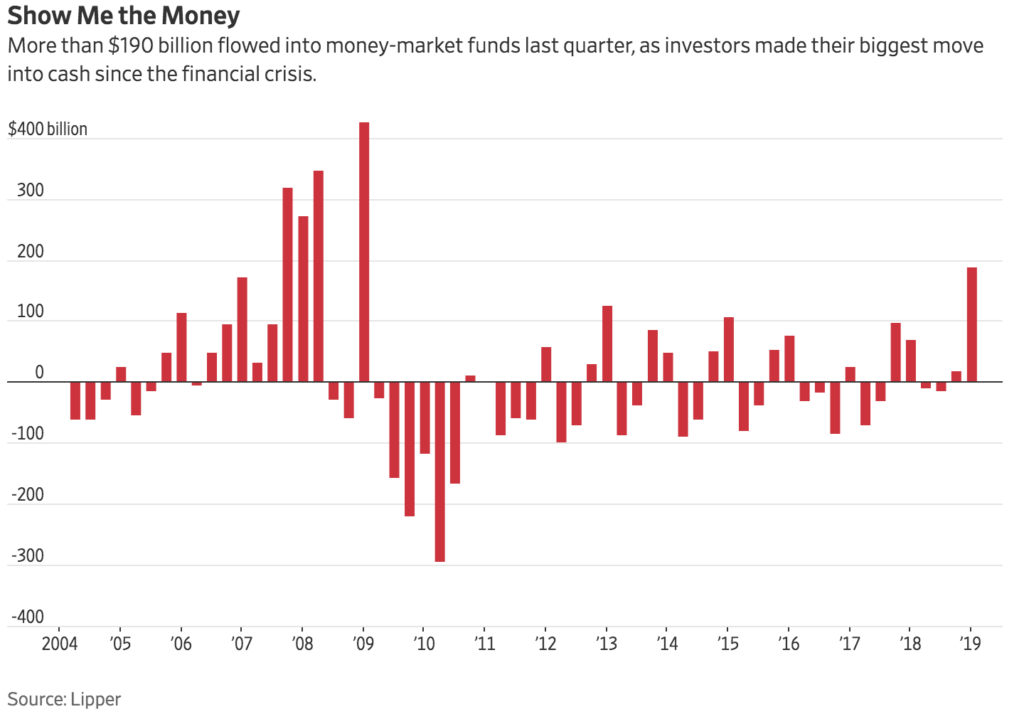

Assets in money-market funds, which are generally used as a proxy for net new cash flows, have grown by more than $2 billion this month, according to Lipper data through Thursday. That comes on top of the $190 billion investors added to the funds in the final three months of last year, their biggest deposit since 2008.

The moves are pushing up cash allocations in investment portfolios for the first time since 2011, with investors’ exposure rising off their lowest levels ever, according to a Goldman Sachs analysis. That could herald further volatility; the broad S&P 500 index tends to fall in years when cash allocations rise, according to Goldman data going back to 1952.

Investors, meanwhile, have added some $4 billion to stock funds this month, after withdrawing nearly $100 billion in the fourth quarter. Those inflows have helped the S&P 500 recover more than 13% since bottoming Christmas Eve, leaving the index nearly 8% below September’s record high. But some analysts and money managers say they fear the stock market recouped its losses too quickly.

Investors continue to grapple with many of the same issues that sparked the fourth-quarter selloff: slowing growth in Europe and Asia, the partial U.S. government shutdown, a lingering trade dispute with China, weaker corporate profit growth in the U.S. and a Federal Reserve that has waffled on its outlook for further interest-rate increases.

“A lot of people think the party will always go on, but they aren’t aware how bad it could get,” said Jerry Freund, an investor in Orange County, N.Y. He says he sold his entire portfolio of small-cap stocks and shares of bigger companies, such as software giant Microsoft Corp. , during one of the Dow Jones Industrial Average’s declines in October.

Mr. Freund has kept his assets in cash since then, he says, and doesn’t plan to buy more stocks until he sees some indication that volatility is subsiding. One such sign he pointed to would be a rally in transportation stocks, as that would suggest health in the crucial movement of goods across the U.S.

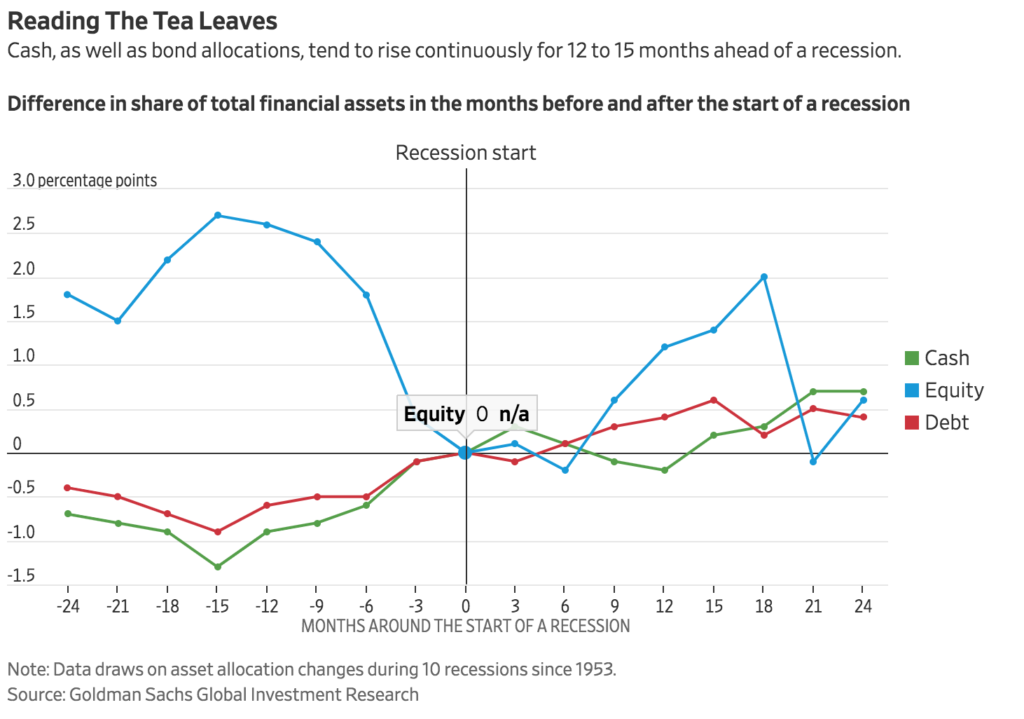

An estimated 13% of investment portfolios now include cash, up from 12% for 2018, which was one of the lowest figures in the Goldman data. Besides pressuring stock returns, a rush toward cash could also signal a looming economic downturn, Goldman data show, as allocations tend to rise continuously in the 12 to 15 months preceding a recession.

Reading The Tea Leaves

Cash, as well as bond allocations, tend to rise continuously for 12 to 15 months ahead of a recession.

Difference in share of total financial assets in the months before and after the start of a recession

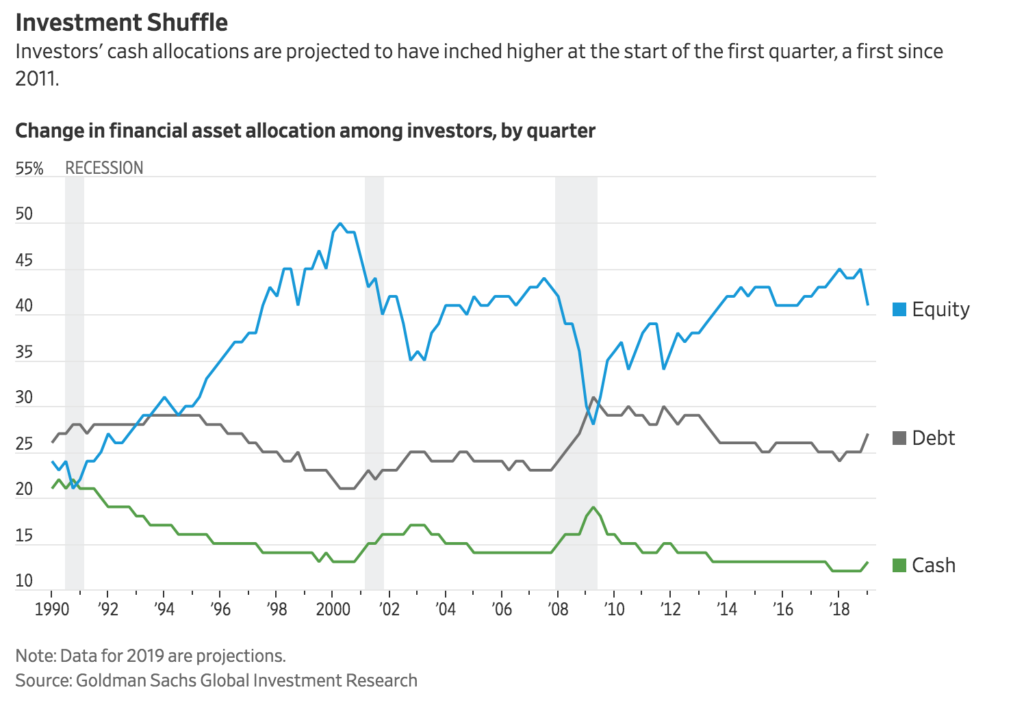

Stock allocations, meanwhile, fell to 41% in January from October’s 45%, which was one of the highest levels in the data.

Cash allocations had been trending downward throughout most of the decade since the financial crisis, reflecting negative “real” interest rates that meant holders lost money after inflation. Now, cash is competitive again following rate increases that have pushed real, inflation-adjusted rates into positive territory, and have brought bond yields into line with stock-dividend yields.

Some Wall Street strategists say investors should consider holding more cash, in case trade tensions resurface or the market hits another rough patch as the Fed continues winding down its easy-money policies. But they warn not to get carried away.

“Cash is a great short-term way to mitigate volatility and defer purchasing power, but as you lengthen the horizon you’re going to erode your purchasing power,” said Matthew McLennan, a portfolio manager with First Eagle Asset Management, whose cash level has come down lately but remains above its historical average.

Some analysts say they expect to see further gains in the stock market if the companies in the S&P 500 post double-digit profit growth for the fourth quarter. FactSet projects a 10% jump in profits for the period, down from expected growth of 16% back in September.

Investment Shuffle

Investors’ cash allocations are projected to have inched higher at the start of the first quarter, a first since2011

For now, analysts expect rising yields on cash to continue to compete with stocks.

PagnatoKarp, a $3.8 billion wealth-management firm, for example, is rolling out a new offering in the next several weeks that pays individuals a 2.3% interest rate on deposits of up to $1.5 million, or $3 million for a couple. PagnatoKarp will spread the cash across several banks to make sure total sum is insured by the Federal Deposit Insurance Corp., and no minimum is needed to open the account.

“We never did this before, but we noticed and recognized a need,” said the firm’s founder Paul Pagnato. “Cash is a real asset class, and that’s something we’re taking advantage of.”

Betterment LLC, an automated investment manager that relies on algorithms to make investor recommendations, now offers a so-called Smart Saver account that puts clients’ cash into a mix of short-term U.S. Treasurys and investment-grade bonds for a yield of more than 2%, net of fees. Launched last year, the accounts are currently available to about half of Betterment’s more than 400,000 users.

“In the past, you had no other opportunity but to take risk,” said Phil Blancato, chief executive of Ladenburg Thalmann Asset Management, of the impact of low interest rates on investors’ options. “The recent volatility gave investors an opportunity to de-risk, shore up portfolios and get ready for 2019, assuming it’s a lot like 2018.”

Meanwhile…

U.S. Firms Repatriate Less Profits As Global Slow-down Accelerates

The United Nations expects foreign direct investment to rebound in 2019 but remain subdued by precrisis standards.

Corporate overseas investment will likely rebound this year as U.S. companies repatriate less profits, but will nonetheless continue to be weak by pre-crisis standards in the face of a darkening economic outlook and uncertainties about trade rules, the United Nations said Monday.

The U.N. Conference on Trade and Development said global business investment flows fell sharply in 2018, to $1.2 trillion from $1.47 trillion in 2017. But it said most of that decline was due to U.S. companies sending profits back home in response to changes in the country’s tax law.

With U.S. repatriations easing, the agency expects to see total foreign direct investment rebound in 2019, while remaining subdued compared with the years before the global financial crisis. It counts profits made overseas and not repatriated as foreign investment, in addition to the establishment of new operations and the acquisition of existing businesses.

“The underlying trend since the crisis has been weak,” said James Zhan, director of Unctad’s investment and enterprise division, attributing this to increasing protectionism, the rise of the digital economy and weaker returns on overseas investments.

“Furthermore, the global economic growth prospect is getting gloomy,” he said.

Many economists believe higher foreign investment, as part of the globalization process, has aided economic growth by helping locate production where it is most efficient and spreading new technologies and know-how. Critics say the benefits haven’t been shared equally, with low-skilled workers in developed economies seeing their incomes stagnate even as large numbers of people in developing economies have enjoyed incomes raises.

As a result of profit repatriation, Europe saw a 73% drop in foreign investment to $100 billion in 2018, a low not seen since the 1990s. There was a $121 billion outflow of foreign investment from Ireland, and a $141 billion outflow from Switzerland.

Excluding repatriations, foreign investment flows were slightly up on the previous year, boosted by a 19% rise in cross-border mergers and acquisitions and a 29% increase in announcements of new factories and other greenfield projects.

The U.S. remained the top destination for foreign investment, despite an 19% drop from 2017 that Unctad attributed to uncertainty about American economic policy, increased scrutiny of foreign investment for security reasons, and the Chinese government’s discouragement of large overseas investments in real estate and the entertainment industry.

China continued to be the second largest recipient of foreign investment at levels that were little changed from 2017. The big surprise was the U.K., which was the third-largest recipient, despite high levels of uncertainty about the way in which it will leave the European Union this year.

Unctad said foreign investment in the U.K. rose by 20% to $122 billion as overseas businesses kept more of their profits in the country, and bought their British rivals.

“Despite the huge uncertainty related to Brexit, the U.K. government has intensified its effort to promote and facilitate new investment,” said Mr. Zhan.

Related Articles:

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Your questions and comments are greatly appreciated.

Monty H. & Carolyn A.

Go back

Leave a Reply

You must be logged in to post a comment.