Companies Betting on Pot May Be Worse Off When the Smoke Clears (#GotBitcoin)

Beer and liquor companies are investing in marijuana in case customers imbibe less as legalization spreads, but their cannabis push might be a lose-lose proposition. Companies Betting on Pot May Be Worse Off When the Smoke Clears

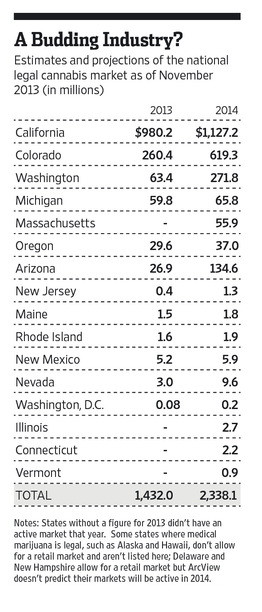

The cannabis investing frenzy has reached a fever pitch. With recreational marijuana use becoming legal in Canada next Wednesday and legalization efforts in the U.S. making steady progress, it seems like everyone from former Speaker of the House John Boehner to singer Jimmy Buffett wants a piece of the action. Shares of marijuana companies have soared, startups are proliferating and, while there may be a great deal of money to be made, there may also be a great deal of money to be lost.

It is, in other words, exactly the type of high-risk situation in which retail investors would be better off as spectators rather than participants. But for companies in the business of selling those other social lubricants—beer, wine and liquor—the calculus is very different. For them, not investing in cannabis could turn out to be even riskier than investing in it.

Corona brewer Constellation Brands has injected about $4 billion into Canadian cannabis company Canopy Growth, and has an option to invest another $3.4 billion to acquire a controlling stake. Molson Coors this month formed a joint venture with another Canadian cannabis producer, HEXO, to make nonalcoholic, cannabis-infused beverages for the Canadian market. European brewer Heineken NV’s Lagunitas brand is selling cannabis-infused sparkling water at California dispensaries.

Others have passed so far. Diageo chief executive Ivan Menezes said in July that his company is tracking developments “very closely.” Budweiser brewer Anheuser-Busch InBev noted in a statement that it is “closely following the legalization trends in the cannabis industry in North America.”

The big concern for the alcohol industry is that, if people consume more marijuana as legalization proliferates, they will imbibe less. Evercore ISI analyst Robert Ottenstein worries that AB InBev is making a mistake and that, if it doesn’t craft a plan to sell cannabis-infused beverages in Canada soon, it will miss an opportunity to make back the money it may lose on beer sales as legalization takes hold.

The problem would be compounded if legalization efforts in the far more populous U.S. continue to gain momentum. In a Gallup survey last year, 64% of respondents said that they favored making marijuana use legal. That compared to 46% in 2010 and 31% in 2000.

There is disagreement over whether increased marijuana spending among consumers actually does lead them to cut back on drinking. On Constellation’s earnings call earlier this month, chief executive Robert Sands said, “We see no evidence whatsoever, especially in the United States, in the legal states, of alcohol cannibalization.”

But a growing body of research suggests otherwise and that the drop in spending on alcohol could turn out to be quite large. A recent paper from economists Keaton Miller and Boyoung Seo found that the legalization of marijuana in Washington state in 2014 led to a 12% decline in alcohol demand. Similarly, when economists Michele Baggio, Alberto Chong, and Sungoh Kwon looked at store-level sales data across U.S. counties from 2006 to 2015, they found that, in states where medical marijuana was legalized, monthly alcohol sales were reduced by 12.4% relative to sales in other states.

Cowen analyst Vivien Azer surmises that Constellation may be better shielded from cannabis because of its exposure to Hispanic and female consumers—two groups for which cannabis adoption has been slower. But she also thinks cannabis ultimately poses a threat to Constellation’s beer sales and that the company’s investment in Canopy will shield it.

On the other hand, just because companies like Constellation and Molson Coors are hedging their bets doesn’t mean that their cannabis investments will pay off. Even if the U.S. does move toward full legalization, the industry faces a thicket of regulatory issues as jurisdictions across the country weigh everything from distribution laws to water rights. It also is literally selling a product that grows like a weed. How far pot prices might fall with legalization, and how compressed profit margins might become, is another unknown.

Nor does anybody know who the eventual winners will be. Marijuana isn’t especially complicated to grow. Neither new entrants nor do-it-yourselfers face significant barriers.

The ultimate risk to alcohol producers is that, regardless of whether they opt to put money into cannabis or stay away, they could end up losing money.

Go back

Leave a Reply

You must be logged in to post a comment.