Banks Lose Hundreds Of Billions As Depositors Seek Higher Deposit Yields #GotBitcoin

Updated: 3-9-2023: Banks big and small posted steep declines. PacWest Bancorp fell 25%, and First Republic Bank lost 17%. Charles Schwab Corp. fell 13%, while U.S. Bancorp lost 7%. America’s biggest bank, JPMorgan Chase & Co., fell 5.4%. Banks Lose Hundreds Of Billions As Depositors Seek Higher Deposit Yields #GotBitcoin

The four biggest U.S. banks lost $52 billion in market value Thursday. The KBW Nasdaq Bank Index notched its biggest decline since the pandemic roiled the markets nearly three years ago.

Related:

Fed Makes It Easier For Banks To Pass Stress Tests

Fed To Further Overhaul Stress-Testing Regime, Making It Easier For Banks To Pass

U.S. Market-Manipulation Cases Reach Record

Ultimate Resource On Insider Trading

Big (4) Audit Firms Blasted By PCAOB And Gary Gensler, Head Of SEC

Large declines in value aren’t necessarily a problem for banks unless they are forced to sell the assets to cover deposit withdrawals.

Related:

What Are Lightning Wallets Doing To Help Onboard New Users? (#GotBitcoin)

Ultimate Resource For Your Crypto Hardware (And Other) Wallets

Ultimate Resource On Trezor Hardware Wallets (#GotBitcoin)

Ultimate Resource On Ledger Hardware Wallet (#GotBitcoin)

Next Bitcoin Core Release To Finally Connect Hardware Wallets To Full Nodes (#GotBitcoin)

Apple Announces CryptoKit, Achieve A Level of Security Similar To Hardware Wallets (#GotBitcoin)

Introducing BTCPay Vault – Use Any Hardware Wallet With BTCPay And Its Full Node (#GotBitcoin)

Bitcoin Dev Reveals Multisig UI Teaser For Hardware Wallets, Full Nodes (#GotBitcoin)

Wells Fargo, and Citigroup each have over $1 trillion in deposits, per last quarter’s FDIC filings. Chase and BoA have over $2 trillion. The FDIC, by contrast, has only $128 billion in its deposit insurance fund. While not all of the big banks’ deposits are insured, it’s safe to say that if JPMorgan Chase failed tomorrow, the FDIC’s deposit insurance fund would be emptied very quickly. Realistically, there’d be a large-scale bailout as in 2008 to prevent further economic fallout, and expectation of those bailouts can and does lead these banks to act recklessly. They’re a true moral hazard.

Most banks aren’t doing so, even though their customers are starting to move their deposits into higher-yielding alternatives.

Yet a few banks have run into trouble this week, sparking fears that other banks could be forced to take losses to raise cash.

The collapse of Silvergate Capital Corp., one of the crypto market’s top banks, is a more extreme example of deposit flight. The California bank said Wednesday it would shut down after the crypto meltdown sparked a deposit run that forced it to sell billions of dollars of assets at a steep loss.

But They Didn’t Know Anything Right?

11:55 AM · Mar 10, 2023, 4.6M: Views

“This is the first sign there might be some kind of crack in the financial system,” said Bill Smead, chairman and chief investment officer of Smead Capital Management, a $5.5 billion firm that counts Bank of America Corp. and JPMorgan among its holdings. “People are waking up to the gravity that this was one of the biggest financial euphoria episodes.”

Index of banks posts biggest drop since pandemic roiled markets nearly three years ago.

Some investors got a nice payday in Thursday’s plunge. Some 5.4% of SVB’s available shares were sold short, according to FactSet data from last month. Short sellers aim to profit by borrowing and selling shares of companies they believe are overvalued, then buying them back later at a lower price.

Far fewer investors were betting against the tech-focused lender’s peers. Last month short interest was 2% at Fifth Third Bancorp, 1.4% at State Street Corp. and 1% at American Express Co.

Investors dumped shares of SVB Financial Group and a swath of U.S. banks after the tech-focused lender said it lost nearly $2 billion selling assets following a larger-than-expected decline in deposits.

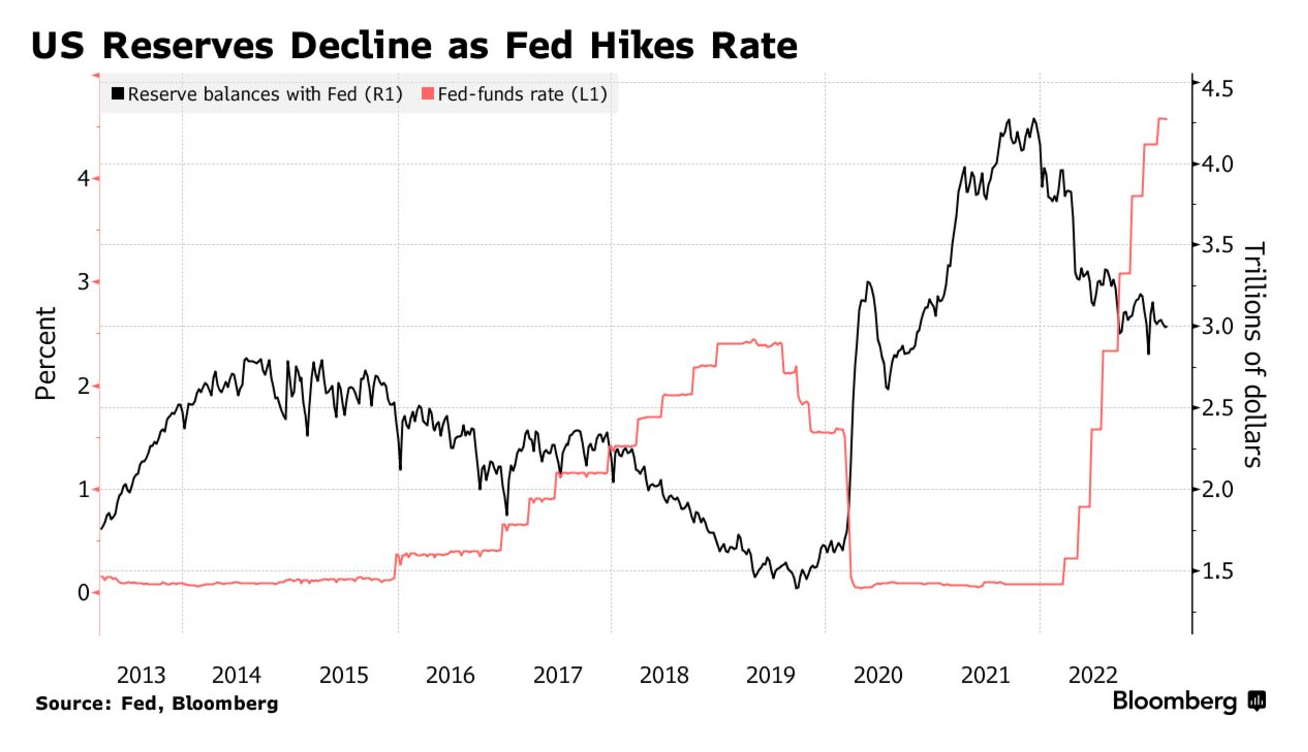

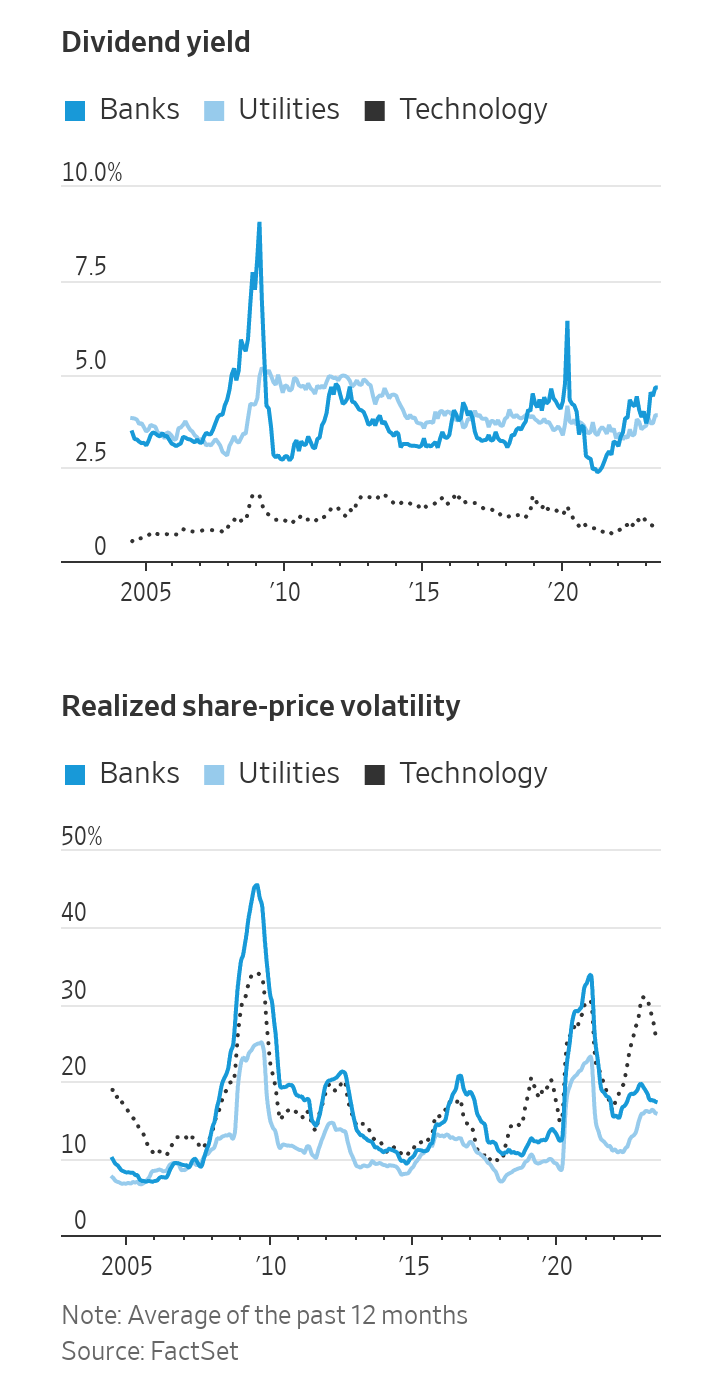

Thursday’s rout is another consequence of the Federal Reserve’s aggressive campaign to control inflation. Rising interest rates have caused the value of existing bonds with lower payouts to fall in value. Banks own a lot of those bonds, including Treasurys, and are now sitting on giant unrealized losses.

SVB said late Wednesday it would book a $1.8 billion after-tax loss on sales of investments and seek to raise $2.25 billion by selling a mix of common and preferred stock.

The bank’s assets and deposits almost doubled in 2021, large amounts of which SVB poured into U.S. Treasurys and other government-sponsored debt securities.

Soon after, the Fed began raising rates. That battered the tech startups and venture-capital firms Silicon Valley Bank serves, sparking a faster-than-expected decline in deposits that continues to gain steam.

Some venture-capital investors have advised startups to pull their money out of SVB, citing liquidity concerns, according to people familiar with the matter.

Garry Tan, president of the startup incubator Y Combinator, posted this internal message to founders in the program: “We have no specific knowledge of what’s happening at SVB.

But anytime you hear problems of solvency in any bank, and it can be deemed credible, you should take it seriously and prioritize the interests of your startup by not exposing yourself to more than $250K of exposure there. As always, your startup dies when you run out of money for whatever reason.”

SVB Chief Executive Greg Becker held a call Thursday trying to reassure customers about the bank’s financial health, according to people familiar with the matter. Mr. Becker urged them not to pull their deposits from the bank and not to spread fear or panic about its situation, the people said.

Banks don’t incur losses on their bond portfolios if they are able to hold on to them until maturity. But if they suddenly have to sell the bonds at a loss to raise cash, that is when accounting rules require them to show the realized losses in their earnings.

Those rules let companies exclude losses on their bonds from earnings if they classify the investments as “available for sale” or “held to maturity.”

Sometimes the losses catch investors by surprise, even if the problem has been slowly building and fully disclosed for a long time.

At SVB, unrealized losses had been piling up throughout last year and were visible to anyone reading its financial reports.

The Federal Deposit Insurance Corp. in February reported that U.S. banks’ unrealized losses on available-for-sale and held-to-maturity securities totaled $620 billion as of Dec. 31, up from $8 billion a year earlier before the Fed’s rate push began.

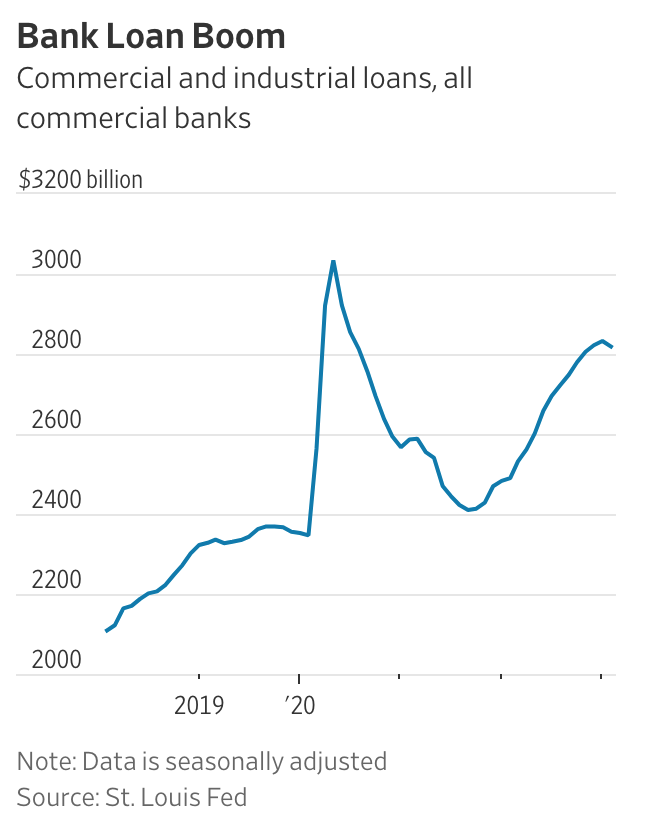

In part, U.S. banks are suffering the aftereffects of a Covid-era deposit boom that left them awash in cash that they needed to put to work. Domestic deposits at federally insured banks rose 38% from the end of 2019 to the end of 2021, FDIC data show.

Over the same period, total loans rose 7%, leaving many institutions with large amounts of cash to deploy in securities as interest rates were near record lows.

U.S. commercial banks’ holdings of U.S. government securities surged 53% over the same period, to $4.58 trillion, according to Fed data.

Most of the unrealized investment losses in the banking system are at the largest lenders. In its annual report, Bank of America said the fair-market value of its held-to-maturity debt securities was $524 billion as of Dec. 31, 2022, $109 billion less than the value it showed for them on its balance sheet.

Bank of America and its megabank peers can afford to part with a lot of deposits before they are forced to crystallize those losses.

Most of SVB’s liabilities—89% at the end of 2022—are deposits. Bank of America draws its funding from a much wider set of sources that includes more long-term borrowing; 69% of its liabilities are deposits.

And, unlike SVB and Silvergate, big banks hold a range of assets and serve companies across the economy, minimizing the risk that a downturn in any one industry will cause them serious harm.

“On the other hand, unrealized losses weaken a bank’s future ability to meet unexpected liquidity needs,” FDIC Chairman Martin Gruenberg said in a March 6 speech.

The risks are most acute for small lenders. Smaller banks must often pay higher deposit rates to attract customers than megabanks with flashy technology and extensive branch networks.

Bank of America paid an average rate of 0.96% on deposits in the fourth quarter, compared with 1.17% for the industry. SVB paid 2.33%.

SVB, based in Santa Clara, Calif., caters to tech, venture-capital and private-equity firms and grew rapidly along with those industries. Total deposits rose 86% in 2021 to $189 billion and peaked at $198 billion a quarter later.

They fell 13% during the final three quarters of 2022 and continued dropping in January and February “in part because of its concentration in investor-funded technology company deposits and the slowdown in public and private investments over the past year,” Standard & Poor’s credit analysts wrote in a note downgrading SVB to one notch above junk. They said they expect SVB’s deposits might decline further.

SVB’s debt securities declined in value substantially last year. As of Dec. 31, SVB’s balance sheet showed securities labeled “available for sale” that had a fair market value of $26.1 billion, $2.5 billion below their $28.6 billion cost.

Under accounting rules, the available-for-sale label allowed SVB to exclude the paper losses on those holdings from its earnings, although the losses did count in equity.

In a news release Wednesday, SVB said it had sold substantially all of its available-for-sale securities. The company said it decided to sell the holdings and raise fresh capital “because we expect continued higher interest rates, pressured public and private markets, and elevated cash-burn levels from our clients as they invest in their businesses.”

SVB’s year-end balance sheet also showed $91.3 billion of securities that it classified as “held to maturity.” That label allows SVB to exclude paper losses on those holdings from both its earnings and equity.

In a footnote to its latest financial statements, SVB said the fair-market value of those held-to-maturity securities was $76.2 billion, or $15.1 billion below their balance-sheet value. The fair-value gap at year-end was almost as large as SVB’s $16.3 billion of total equity.

SVB hasn’t wavered from its position that it intends to hold those bonds to maturity. Most of the held-to-maturity securities consisted of mortgage bonds issued by government-sponsored entities, such as Fannie Mae, which have no risk of default.

They do present market risk, including interest-rate risk, because bond values fall when rates rise. The yield on two-year Treasurys recently topped 5%, up from 4.43% at the end of 2022.

SVB Financial Explores Sale After Failing To Raise Capital

Silicon Valley bank is working with Centerview Partners, Sullivan & Cromwell.

SVB Financial Group is seeking a buyer after scrapping a plan to shore up its finances through a capital raise, according to people familiar with the matter.

Facing widespread customer withdrawals that have raised questions about the Silicon Valley lender’s ability to stay in business, the bank’s shares have declined sharply since Thursday, falling as much as 68% in premarket trading before the stock was halted.

That forced it to scrap the $2.25 billion sale of shares and other securities and to look for a buyer or other rescue instead, the people said.

Possibilities include a sale to a large financial institution and a stake sale, the people said. It’s conceivable there will be no deal and that the government will have to step in, the people said.

Advisory firm Centerview Partners and law firm Sullivan & Cromwell LLP were recently brought in to help SVB assess its options.

CNBC earlier reported on the scrapped share sale and bank talks.

SVB, based in Santa Clara, Calif., earlier this week surprised investors by announcing that it lost nearly $2 billion selling assets following a larger-than-expected decline in deposits.

The stock has lost more than 80% since then, and some tech clients have rushed to pull their deposits over concerns about the bank’s health.

The developments have badly destabilized the $212 billion asset firm, which operates tech-focused Silicon Valley Bank, and dragged down the entire industry.

The four largest U.S. banks lost some $52 billion in market value Thursday, and a broader index of bank stocks had its worst day in nearly three years. Bank stocks continue to plunge Friday morning, with a number halted for volatility.

On Thursday afternoon, bankers at Goldman Sachs Group Inc. had arranged for a share sale at $95 apiece, according to people familiar with the offering.

As the stock kept tumbling and more customers pulled their deposits from the bank, that deal fell apart, these people said. The share sale was canceled Friday morning.

On Friday morning, the bank told employees to “work from home today and until further notice,” according to a copy of the email viewed by The Wall Street Journal.

SVB caters mainly to startups and the investors that fund them, an insular ecosystem that has taken a big hit since the Federal Reserve began raising rates last year to curb inflation.

Startups, as a result, drained their deposits with SVB faster than the bank expected. And new investment has stalled, meaning fresh money isn’t coming into the bank.

Rising interest rates, meanwhile, dented the value of SVB’s bondholdings. The bank late Wednesday disclosed it had sold a big chunk of those holdings at a loss. Investors dumped the stock, spooking customers and sparking fears of a bank run.

Chief Executive Greg Becker held a call with jittery customers Thursday, telling them the bank was on solid financial footing despite the loss. But concerned SVB clients were already calling rival banks looking to move large balances in excess of Federal Deposit Insurance Corp. insurance caps.

Some venture-capital investors advised startups to pull their money out of the bank to avoid losses should the bank fail, The Wall Street Journal previously reported.

Alison Greenberg, co-founder of Los Angeles-based maternity care startup Ruth Health, was in a meeting Thursday when she got a frantic email from a seed investor.

“It basically just said ‘Things are imploding at SVB, it’s urgent that you get your money out,’” Ms. Greenberg said.

The meeting came to an abrupt halt. Ms. Greenberg called the investor, who answered the phone out of breath, she said.

The investor told her she should get as much money out of the bank as she possibly could, Ms. Greenberg said.

Audrey Wu, a Ruth Health co-founder, began making transfers out of the company’s account of different denominations, hoping not to trip up any automated systems that would flag the transactions and potentially delay them.

As she prepared to carry out the final transfer from the account, SVB’s website crashed and she couldn’t log back in, she said. The company still has some money in the account.

Others were sticking with SVB. Financial-technology venture-capital firm Restive Ventures said in an email early Friday morning that it was keeping its money at the bank and encouraging portfolio companies to do the same.

It urged people to calm down. “Moving corporate treasury under time pressure, on the internet, is a recipe for disaster,” the email said.

SVB’s deposits boomed alongside the tech industry, rising 86% in 2021 to $189 billion and peaking at $198 billion a quarter later. The bank poured large amounts of the deposits into U.S. Treasurys and other government-sponsored debt securities.

Soon after, the Fed began raising rates.

Rising rates and the tech downturn caused deposits to decline, spurring the bank to sell substantially all of its available-for-sale securities.

Updated: 3-9-2023

One Bank Folds, Another Wobbles And Wall Street Asks If It’s A Crisis

* More Lenders Are Struggling To Keep Deposits From Fleeing

* ‘Silicon Valley Bank Is Just The Tip Of The Iceberg’

Silvergate Capital Corp.’s abrupt shutdown and SVB Financial Group’s hasty fundraising have sent US bank stocks diving and tongues wagging across the industry: Could this be the start of a much bigger problem?

The issue at both of the once-highflying California lenders was an unusually fickle base of depositors who yanked money quickly. But below that is a crack reaching across finance:

Rising interest rates have left banks laden with low-interest bonds that can’t be sold in a hurry without losses. So if too many customers tap their deposits at once, it risks a vicious cycle.

Across the investing world, “people are asking who is the next one?” said Jens Nordvig, founder of market analytics and data intelligence companies Exante Data and Market Reader. “I am getting lots of questions about this from my clients.”

Indeed, amid deposit withdrawals at SVB, its chief executive officer urged customers on Thursday to “stay calm.”

The immediate risk for many banks may not be existential, according to analysts, but it could still be painful. Rather than facing a major run on deposits, banks will be forced to compete harder for them by offering higher interest payments to savers. That would erode what banks earn on lending, slashing earnings.

Small- and mid-sized banks, where funding is usually less diversified, may come under particular pressure, forcing them to sell more stock and dilute current investors.

‘Terrible Kicking’

“Silicon Valley Bank is just the tip of the iceberg,” said Christopher Whalen, chairman of Whalen Global Advisors, a financial consulting firm. “I’m not worried about the big guys but a lot of the small guys are going to take a terrible kicking,” he said. “Many of them will have to raise equity.”

Every bank in the S&P 500 Financials Index tracking major US firms slumped on Thursday, taking the benchmark down 4.1% — its worst day since mid-2020. Santa Clara-based SVB tumbled 60%, while First Republic Bank in San Francisco fell 17%.

Another S&P index tracking mid-size financials dropped 4.7%. The worse performer there was Beverly Hills-based PacWest Bancorp, down 25%.

Ironically, many equity investors had piled into financial stocks to ride out the Federal Reserve’s interest-rate hikes, betting it would pave the way for lenders to earn more. For them, this week has been a shock.

“The cost of deposits rising is old news, we’ve seen that pressure,” said Chris Marinac, an analyst at Janney Montgomery Scott. But suddenly “the market has really focused on it because there’s an obvious surprise with the capital raise from Silicon Valley Bank.”

SVB announced the stock offering as its clients — firms backed by venture capital — withdrew deposits after burning through their funding. The lender liquidated substantially all of the securities available for sale in its portfolio and updated a forecast for the year to include a sharper decline in net interest income.

Hours after CEO Greg Becker urged clients to “stay calm” on a conference call Thursday, news broke that a number of prominent venture capital firms, including Peter Thiel’s Founders Fund, were advising portfolio companies to pull money as a precaution.

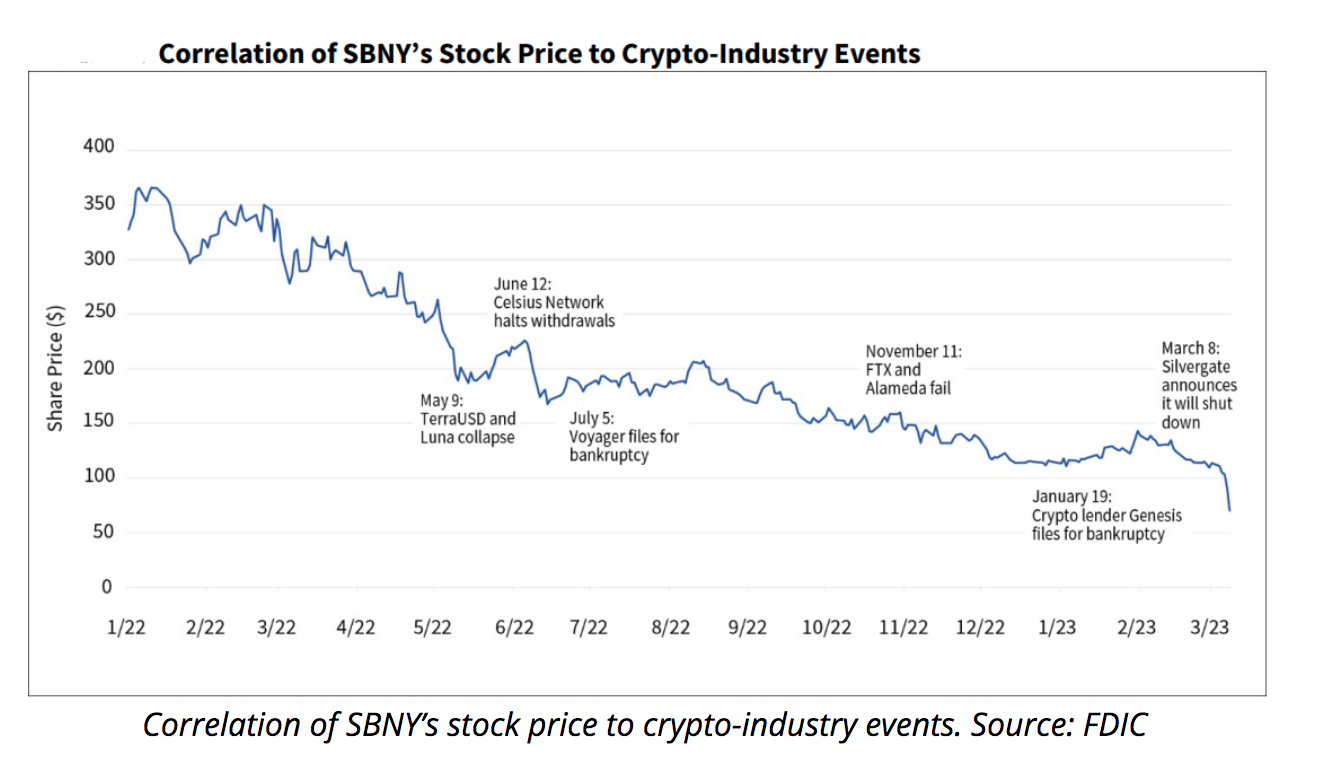

At Silvergate the problem was a run on deposits that began last year, when clients — cryptocurrency ventures — withdrew cash to weather the collapse of the FTX digital-asset exchange. After losses from rapidly selling securities, the firm announced plans Wednesday to wind down operations and liquidate.

US bank stocks also came under pressure this week after KeyCorp warned about the mounting pressure to reward savers. The regional lender lowered its forecast for growing net interest income in the current fiscal year to 1% to 4%, down from 6% to 9%, because of the “competitive pricing environment.” Its stock fell 7% on Thursday.

‘More Insulated’

Regulators talk openly about spending less time policing the balance sheets of small banks, giving them room to innovate, with some dabbling in financial-technology platforms or cryptocurrencies.

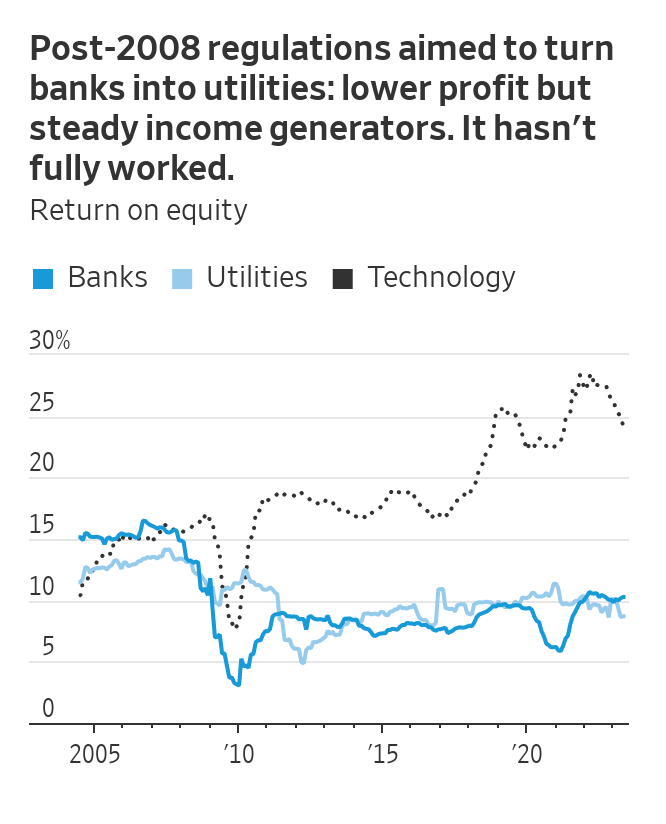

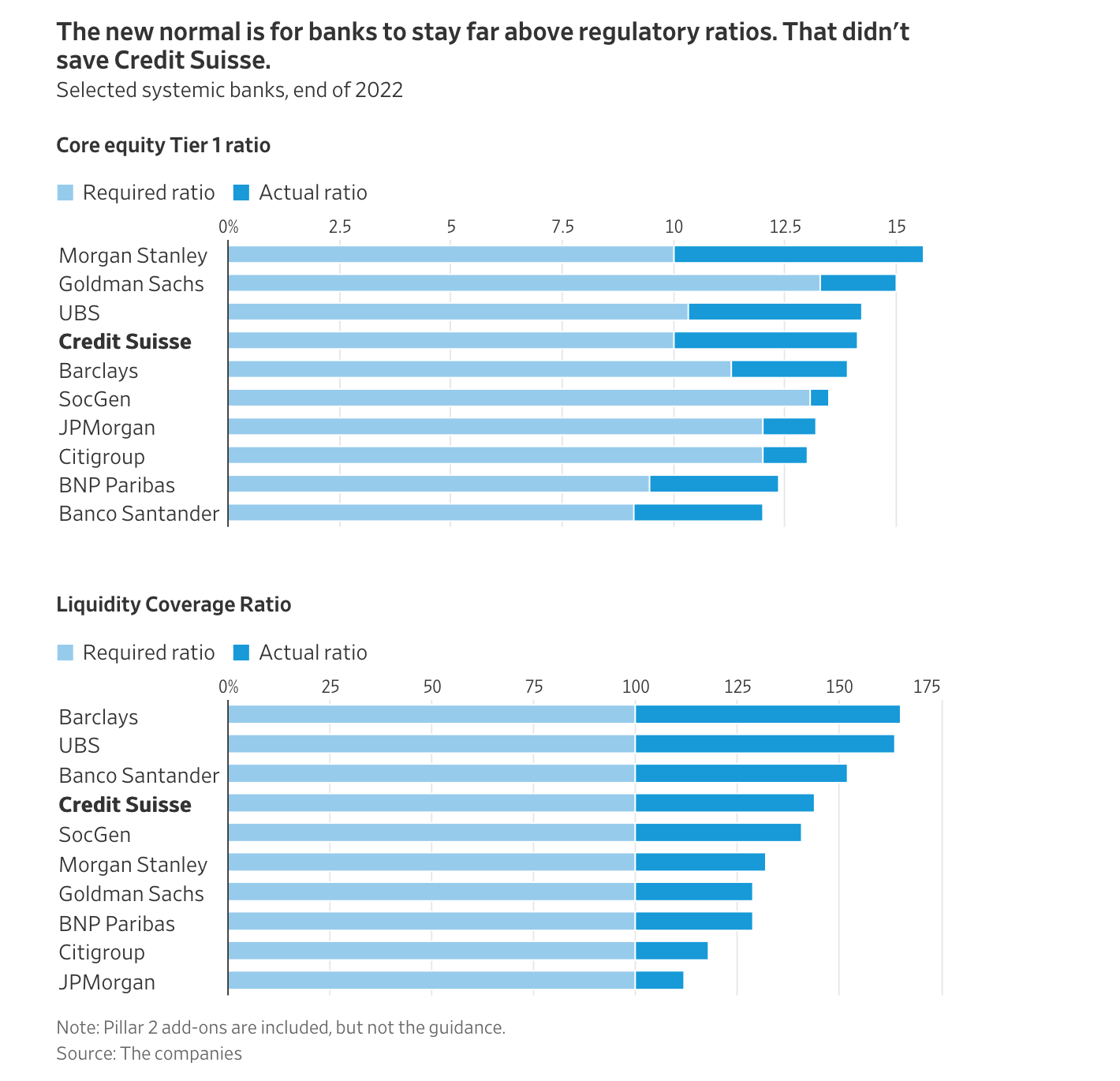

Authorities have instead devoted much of their time and attention since the 2008 financial crisis to ensuring the stability of large “systemically important” banks such as JPMorgan Chase & Co. and Bank of America Corp.

They’ve forced the biggest lenders to hold ever-larger amounts of capital aside — sometimes over the loud complaints of bankers — so that their health would be beyond reproach at moments like this.

Smaller lenders by contrast have been handled with “a very light-touch approach,” Michael Barr, the Fed’s vice chair for supervision, said during a speech Thursday.

“There are obviously larger institutions that are also exposed to these risks too, but the exposure tends to be a very small part of their balance sheet,” he said. “So even if they experience the same deposit outflows, they are more insulated.”

Silicon Valley Bank collapsed Friday in the second-biggest bank failure in U.S. history after a run on deposits doomed the tech-focused lender’s plans to raise fresh capital.

The Federal Deposit Insurance Corp. said it has taken control of the bank via a new entity it created called the Deposit Insurance National Bank of Santa Clara. All of the bank’s deposits have been transferred to the new bank, the regulator said.

Insured depositors will have access to their funds by Monday morning, the FDIC said. Depositors with funds exceeding insurance caps will get receivership certificates for their uninsured balances.

Once a darling of the banking business, Silicon Valley Bank collapsed at warp speed after it announced a big loss on its bondholdings and plans to shore up its balance sheet, tanking its stock and sparking widespread customer withdrawals.

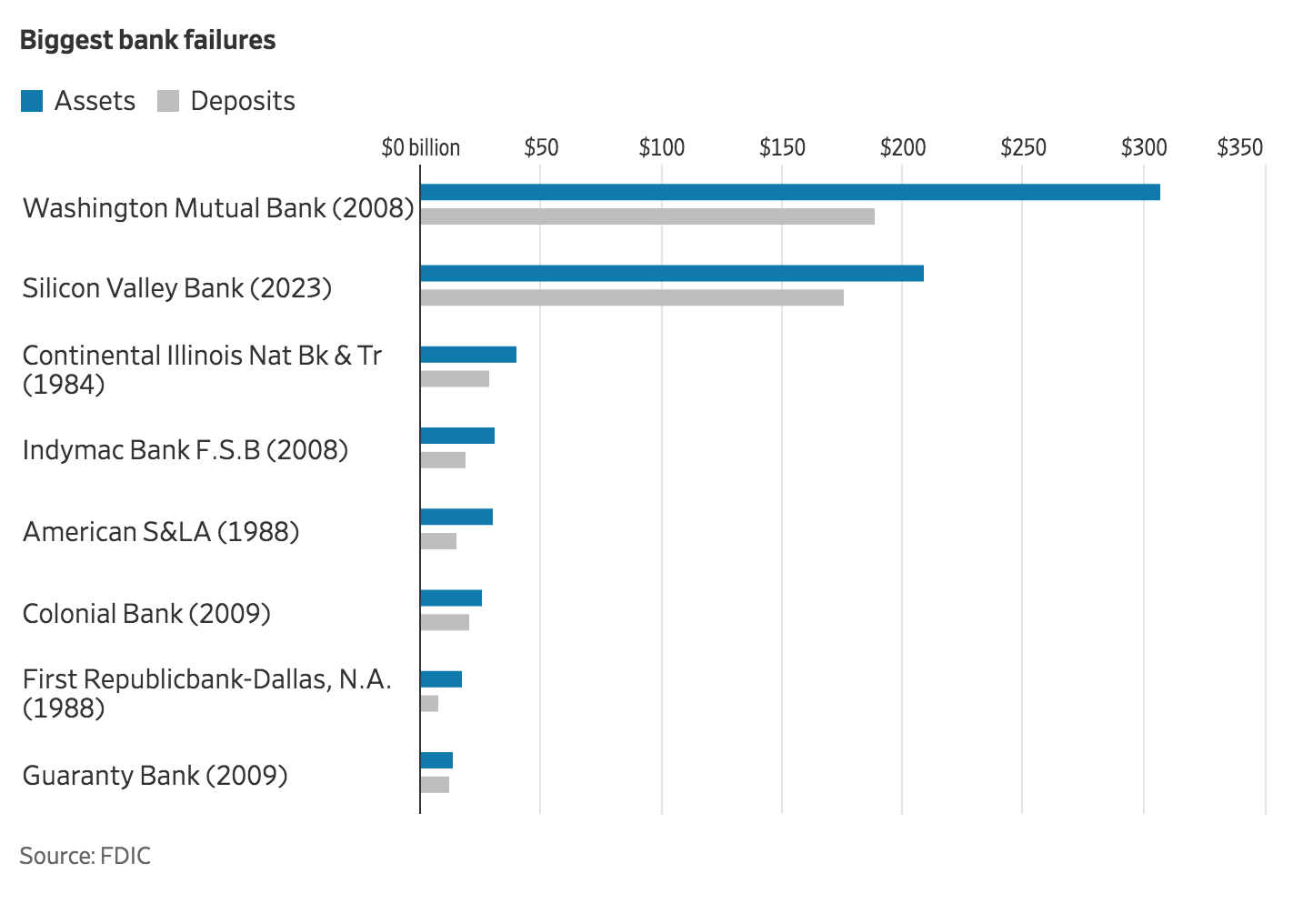

The bank is the 16th largest in the U.S., with some $209 billion in assets as of Dec. 31, according to the Federal Reserve. It is by far the biggest bank to fail since the near collapse of the financial system in 2008, second only to the crisis-era shutdown of Washington Mutual Inc.

The bank’s parent company, SVB Financial Group, was racing to find a buyer after scrapping a planned $2.25 billion share sale Friday morning. Regulators weren’t willing to wait.

The California Department of Financial Protection and Innovation closed the bank Friday within hours and put it under the control of the FDIC.

SVB, based in Santa Clara, Calif., earlier this week surprised investors by announcing that it lost nearly $2 billion selling assets following a larger-than-expected decline in deposits.

The stock has lost more than 80% since then, and tech clients rushed to pull their deposits over concerns about the bank’s health.

The bank’s troubles have dragged down the entire industry. The four largest U.S. banks lost some $52 billion in market value Thursday, and a broader index of bank stocks had its worst day in nearly three years. Bank stocks continue to plunge Friday morning, with a number halted for volatility.

Bankers at Goldman Sachs Group Inc. had arranged for SVB to sell shares at $95 apiece on Thursday afternoon, according to people familiar with the offering.

As the stock kept tumbling and more customers pulled their deposits from the bank, that deal fell apart, these people said. The share sale was canceled Friday morning.

On Friday morning, the bank told employees to “work from home today and until further notice,” according to a copy of the email viewed by The Wall Street Journal.

SVB catered mainly to startups and the investors that fund them, an insular ecosystem that has taken a big hit since the Fed began raising rates last year to curb inflation.

Startups, as a result, drained their deposits with SVB faster than the bank expected. And new investment had stalled, meaning fresh money wasn’t coming into the bank.

Rising interest rates, meanwhile, dented the value of SVB’s bondholdings. The bank late Wednesday disclosed it had sold a big chunk of those holdings at a loss. Investors dumped the stock, spooking customers and sparking a bank run.

Chief Executive Greg Becker held a call with jittery customers Thursday, telling them the bank was on solid financial footing despite the loss. But concerned SVB clients were already calling rival banks looking to move large balances in excess of FDIC insurance caps.

Some venture-capital investors advised startups to pull their money out of the bank to avoid losses should the bank fail, the Journal previously reported.

Alison Greenberg, co-founder of Los Angeles-based maternity care startup Ruth Health, was in a meeting Thursday when she got a frantic email from a seed investor.

“It basically just said ‘Things are imploding at SVB, it’s urgent that you get your money out,’” Ms. Greenberg said.

The meeting came to an abrupt halt. Ms. Greenberg called the investor, who answered the phone out of breath, she said.

The investor told her she should get as much money out of the bank as she possibly could, Ms. Greenberg said.

Audrey Wu, a Ruth Health co-founder, began making transfers out of the company’s account of different denominations, hoping not to trip up any automated systems that would flag the transactions and potentially delay them.

As she prepared to carry out the final transfer from the account, SVB’s website crashed and she couldn’t log back in, she said. The company still has some money in the account.

Others stuck with SVB. Financial-technology investor Restive Ventures said in an email early Friday morning that it was keeping its money at the bank and encouraging portfolio companies to do the same. It urged people to calm down.

“Moving corporate treasury under time pressure, on the internet, is a recipe for disaster,” the email said.

SVB’s deposits boomed alongside the tech industry, rising 86% in 2021 to $189 billion and peaking at $198 billion a quarter later.

The bank poured large amounts of the deposits into U.S. Treasurys and other government-sponsored debt securities. Soon after, the Fed began increasing rates.

Rising rates and the tech downturn caused deposits to decline, spurring the bank to sell substantially all of its available-for-sale securities.

Updated: 3-6-2023

US Banks Are Finally Being Forced To Raise Rates On Deposits

* Deposits Declined Last Year For First Time Since 1948

* Rising Funding Costs For Banks Seen Weighing On Profit Growth

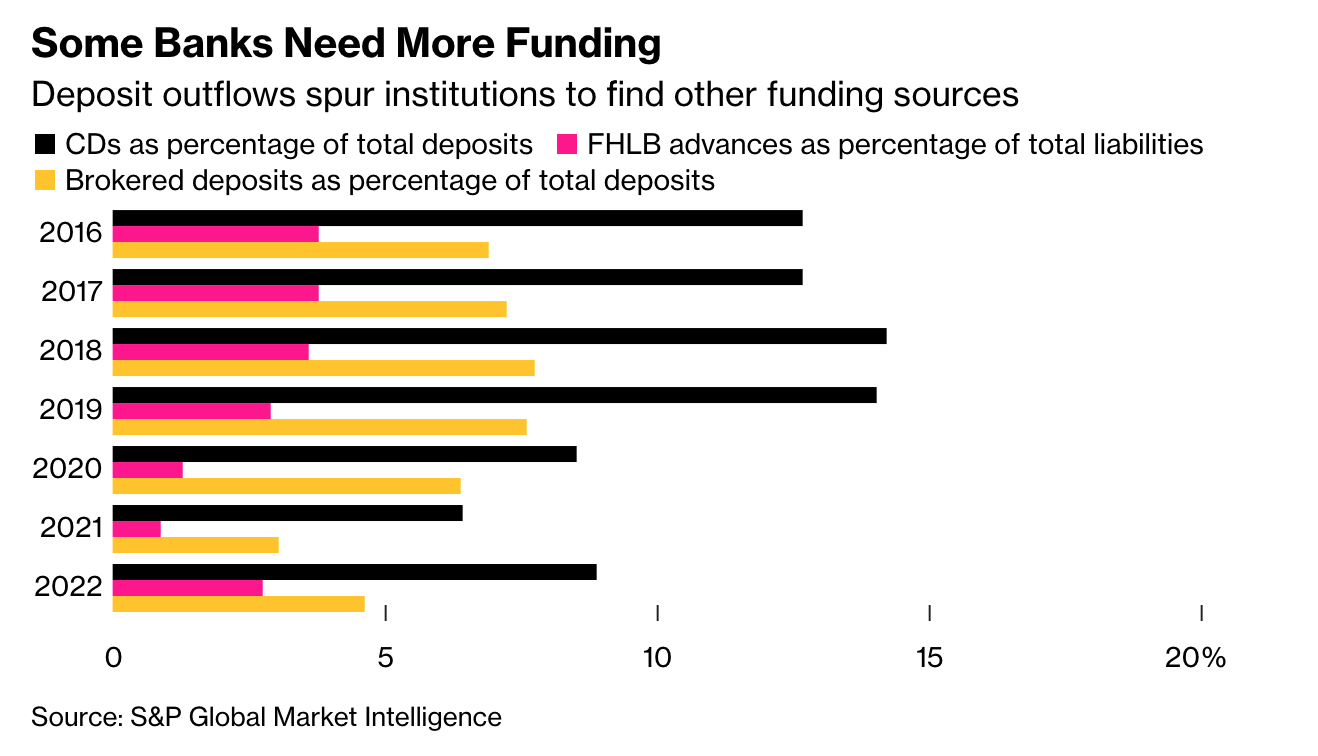

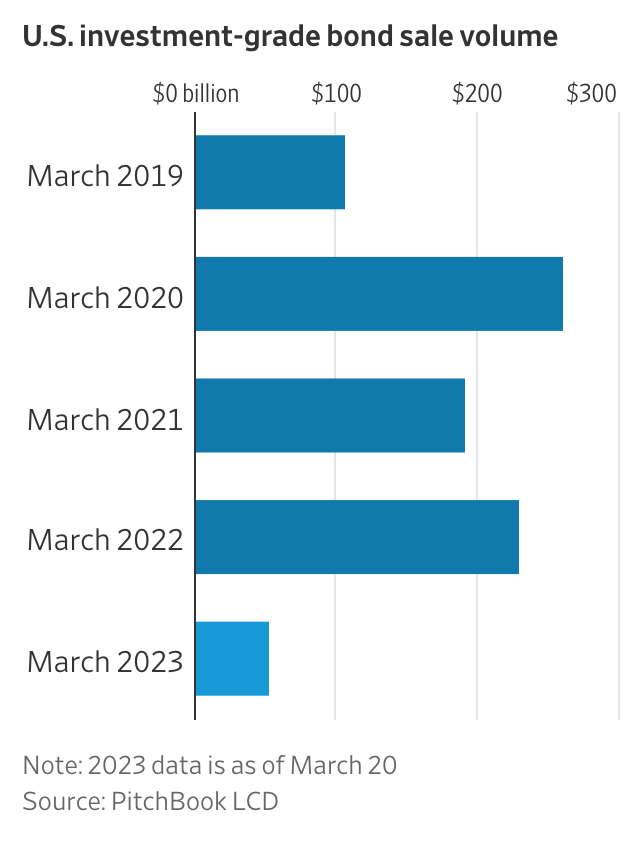

US banks are being forced to do something they haven’t done for 15 years: fight for deposits.

After years of earning next to nothing, depositors are discovering a trove of higher-yielding options like Treasury bills and money market funds as the Federal Reserve ratchets up benchmark interest rates.

The shift has been so pronounced that commercial bank deposits fell last year for the first time since 1948 as net withdrawals hit $278 billion, according to Federal Deposit Insurance Corp. data.

To stem the outflows, banks are finally starting to lift their own rates from rock-bottom levels, particularly on certificates of deposit, or CDs.

More than dozen US lenders including Capital One Financial Inc. are now offering an annual percentage yield of 5% on CDs maturing in around a year, a rate that would have been unspeakably high two years ago. Even the big banks are feeling the heat. At Wells Fargo & Co., 11-month CDs now pay 4%.

The jump in rates on CDs and other bank deposits has been a boon for consumers and businesses, but it’s a costly development for the US banking industry, which is bracing for a slowdown in lending and more writedowns, says Barclays Plc analyst Jason Goldberg. And for smaller regional and community banks, losing deposits can be serious and weigh heavily on profitability.

“There are challenges ahead for banks,” Goldberg said. “Banks reflect the economy they operate in, and most forecasts call for slowing GDP growth and increasing unemployment.”

The very biggest banks can afford to slow-walk their rate increases, simply because they still have relatively high deposit levels. Overall, the average rate on a one-year CD is roughly 1.5%.

That’s up from 0.25% a week before the Fed began raising rates a year ago, but still well below inflation. After a year of record profits, the foot-dragging has earned banks plenty of ire from politicians globally.

Nevertheless, banks are feeling more pressure to boost rates, which will raise funding costs and crimp profit margins. According to Barclays, the median large-cap bank can expect growth in net interest income, a measure of lending profits, to slow to 11% this year, from 22% last year.

JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon made clear that some institutions will feel pressure on the firm’s earnings call in January: “Banks are competing for the capital, money, now. We’ve never had rates go up this fast.”

For depositors, CDs have been popular because they tend to offer the highest rates. For banks, they’re a way to lock up funding for a set period of time, unlike checking or savings accounts.

Rising CD rates have led to huge growth in sales of the product: CDs outstanding totaled $1.7 trillion in the US banking industry in the fourth quarter, up from $1.49 trillion in the third. That’s the biggest quarterly jump in at least two decades, according to S&P.

“The money really woke up in the late summer — banks felt pressure to really catch up on funding in a big way,” said S&P Global analyst Nathan Stovall. Boosting rates on CDs is one key way to do so, he said.

CDs are just one piece of how banks fund themselves, but funding costs are broadly rising as the Federal Reserve hikes rates.

The pressure is also evident in the fed funds market, where banks lend to one another for short periods.

Rates there have risen to the highest since November 2007, and trading volume has reached seven-year highs. The three-month London interbank offered rate for dollar, a major global lending benchmark, surpassed 5% for the first time in more than 15 years on Monday.

When the Fed boosts rates, banks usually get higher lending income quickly, as the rates on the loans they’ve made reset to higher levels. They can be slower to boost payments to depositors.

The rising income and lagging growth in expenses mean that banks can see their net interest income soar, as happened last year.

Net interest income last year for the US banking system was $632.9 billion, up 20% from the year before, according to the Federal Deposit Insurance Corp.

The lenders getting hit hardest by rising funding costs are community and smaller regional banks, said Arnold Kakuda, a bank credit strategist at Bloomberg Intelligence.

The largest US banks, and major regional lenders, can often borrow more in bond markets globally when they lose deposits. But smaller regional banks and community lenders have fewer options, and often have to win more deposits or get more funding from the Federal Home Loan Banking System.

The biggest banks probably won’t need to change their bond issuance plans, but bigger regional banks, like USBancorp and Truist Financial Corp., may need to borrow more in bond markets, according to BI. Kakuda estimates they may have to sell as much as $10 billion to $15 billion for each of the next few years, but that funding should be manageable for them.

On the asset side of bank balance sheets, loan growth has continued as the US economy manages to avoid a meaningful slowdown. Those loans need to be funded, and deposits are a key source of financing for banks.

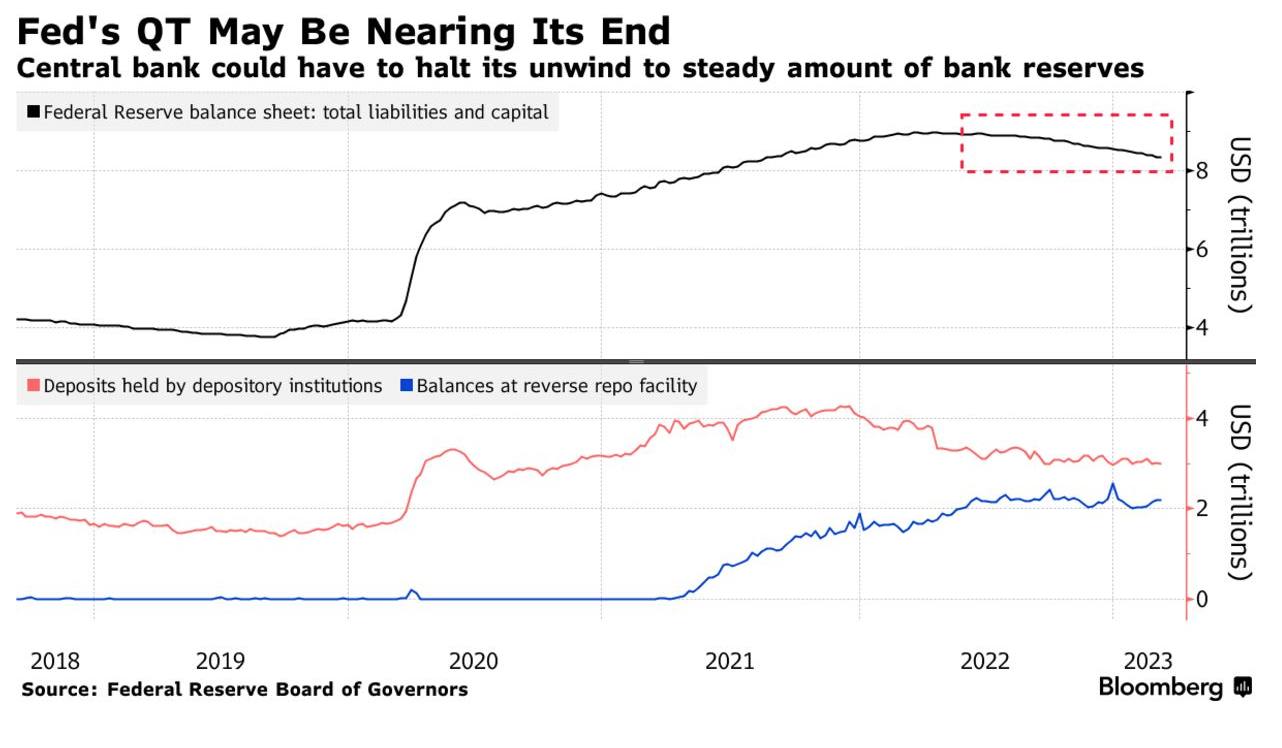

A recent Fed survey hinted at strategies banks may be using to recoup lost funds as financing pressures increase. In the questionnaire, financial institutions reported that they would borrow in unsecured funding markets, raise brokered deposits or issue CDs if reserves were to fall to uncomfortable levels.

A large majority of domestic banks also cited borrowing advances from Federal Home Loan Banks as “very likely” or “likely.”

Ultimately, banks will probably have to continue raising deposit rates as they compete with other kinds of investments that provide more yield, according to Jan Bellens, a global banking and capital markets sector leader with Ernst & Young.

“Banks will just have to pay more for deposits,” he said. “Customers will start to gradually move deposits if they are no longer happy with the rates they get, and that’s why the banks are very keen to lock in consumers with CD products.”

Updated: 3-2-2023

We Are All Gamblers Now, From Sports To Crypto

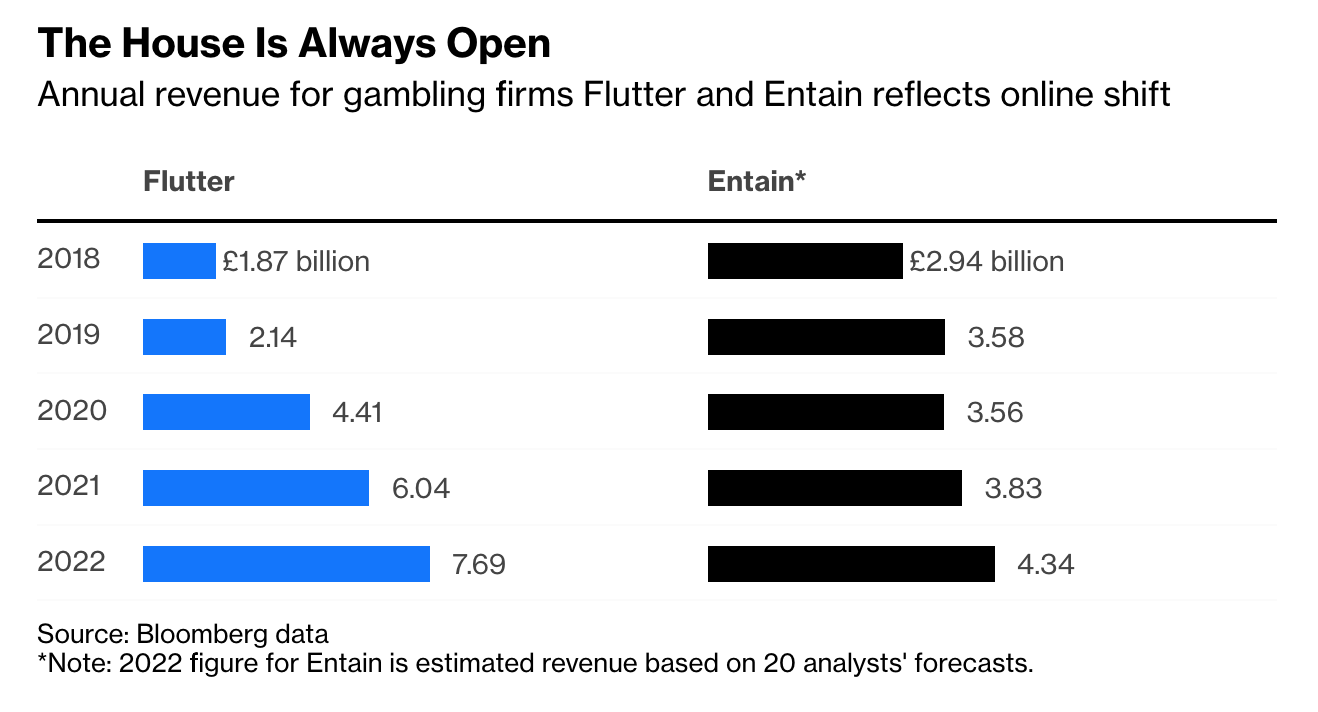

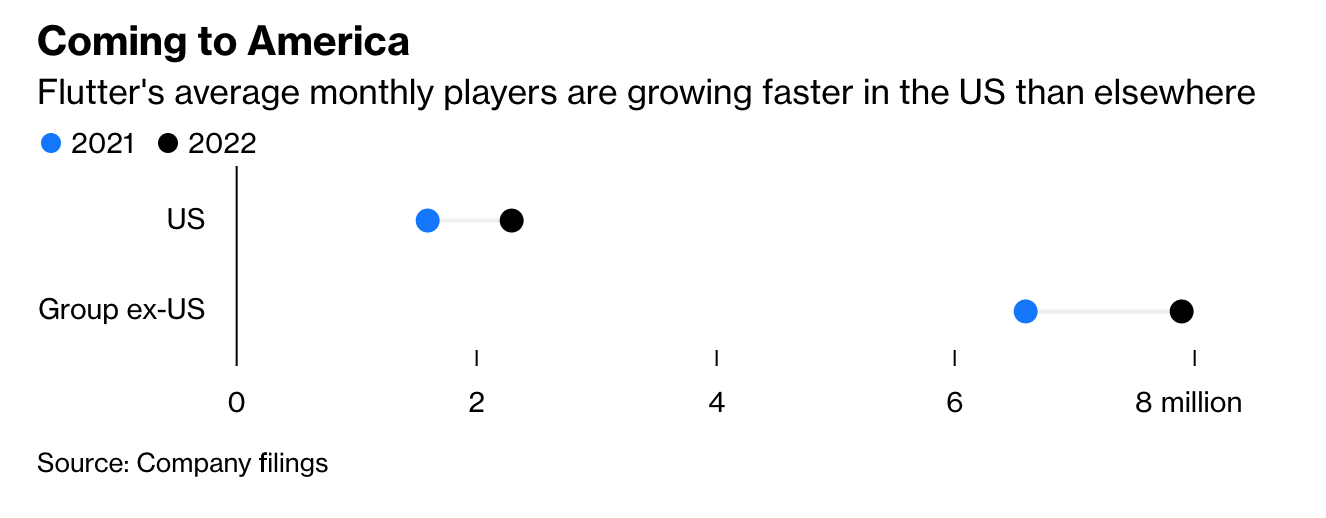

FanDuel owner Flutter shows how our smartphone is a 24/7 betting shop, broker and casino combined. Can regulators keep up?

Congratulations to whoever won a bet on the World Cup via Paddy Power or FanDuel last year: You weren’t alone. Parent group Flutter Entertainment Plc took a £40 million ($47.7 million) hit from so-called “customer-friendly” sports results in December.

Chief Executive Officer Peter Jackson said he watched the spectacular six-goal final through his hands — “it was a very expensive event for us.”

There were other customer-friendly developments in Flutter’s 2022 financial results, which triggered an investor-unfriendly fall in its shares.

The company estimates it spent £150 million worth of annualized sales on safer gambling measures in the UK and Ireland, where the company imposed a £500 deposit limit for players under 25. The unwinding of the Covid-19 boom also hurt performance in Australia.

So: The house doesn’t always win. But the sobering truth is that it’s not losing the bigger battle of global domination.

Gambling has become an estimated $350 billion industry powered by the ability to bet online 24/7, a huge increase in the broadcasting of sports events, and governments looking for new tax revenues to fill a pandemic hole.

Regulators need more resources if they’re going to keep up with the attendant risks of addiction, money laundering and corruption.

Betting is becoming more mass-market, more normalized and more recreational. If the World Cup was last year’s “big one,” with 20.5 million Americans expected to have bet $1.8 billion, the Super Bowl was this year’s white whale, with more than 50 million Americans expected to have bet around $16 billion.

These tentpole events might lead to expensive results for firms like Flutter, but they’re very lucrative for market share in the long run. Americans bet about $450 million on sports every day, highlights Timothy L. O’Brien.

As the image of working-class gamblers counting out banknotes in betting shops gives way to glamorized ad campaigns targeting young men with smartphones and digital cash, a huge variety of apps are competing to tap into our psychological risk-on impulses.

Go to a wedding, a concert or a friend’s apartment, and chances are at least someone will be standing a little to the side, nervously checking their phone for the latest cryptocurrency price, memestock news or sports outcome.

Competition for consumers’ speculative dollars is intensifying as a result. The US is the El Dorado where gambling firms are converging, encouraged by the Supreme Court’s lifting of a ban on sports betting in 2018.

On Thursday, Flutter reported a 49% jump in average monthly players there, to 2.3 million; it expects the US online market will be worth $40 billion by 2030, up from $9 billion in mid-2022. Bloomberg Intelligence expects FanDuel, which competes against DraftKings Inc., will be the first of its kind to generate underlying Ebitda this year.

Flutter now wants to be listed in the US — partly so that it can tap into its own customer base for retail investors. It’s punts all the way down.

Now, it may certainly be the case that most of the wagers made on sports are harmless fun, and that problem gambling affects a tiny minority. A survey in New York (which expects to generate $615 million in tax revenues from sports betting this year) estimated that more than two-thirds of adults don’t gamble at all, around 4% are at risk and less than 1% are problem gamblers.

But the super-charged power of technology and the pressure on governments to compete amongst themselves for more tax revenue may end up making the problem worse, with reports of gambling helplines ringing off the hook and haphazard enforcement of new rules designed to keep players safe.

Gambling firms seem to want a more sustainable mass-market model: Flutter talks about its “flywheel” effect, whereby its dominant market share in US sports betting allows it to invest in better products and keep gamblers coming back for more.

But old habits like turning a blind eye to high-spending “VIPs” might die hard: Rival 888 Holdings Plc was fined £9.4 million last year over social responsibility and money-laundering failures, and its CEO has stepped down amid a probe into its Middle East operations.

In this kind of market, regulators need serious resources and staff to keep up. On crypto, the record of financial regulators has been quite good: The collapse of FTX and troubles at Silvergate Capital Corp. haven’t tanked the broader economy.

But gambling in the UK, whose social costs run to about £1.3 billion annually, is a cautionary tale. Politicians have repeatedly delayed a white paper promising to reform the industry, though that’s now due later this month.

There also needs to be more recognition of the other pressures that push the young to make all sorts of high-stakes bets on everything from crypto to sports, such as indebtedness and helplessness in the face of high house prices and stagnant wages.

Companies will howl, of course. But they’ll also appreciate that more regulation increases the barriers to entry. It may even drive mergers in the sector, such as a possible takeover of Entain Plc by MGM Resorts International.

The industry wants to justify investors’ own high-stakes bets on future growth. But that shouldn’t come at the expense of society: We aren’t all cut out to be gamblers.

Updated: 3-10-2023

SVB’s 44-Hour Collapse Was Rooted In Treasury Bets During Pandemic

* Largest Bank Failure Since 2008 Rooted In Bad Bets On Rates

* Leaders Who Recently Showed Confidence Now Seeking Quick Deal

Greg Becker sat in a red armchair at an invite-only conference in Los Angeles last week, legs crossed, one hand cutting through air.

“We pride ourselves on being the best financial partner in the most challenging times,” SVB Financial Group’s chief executive officer told the Upfront Summit on March 1, a day before his firm was up for Bank of the Year honors at a London gala.

Just a week later, it all fell apart.

SVB’s collapse into Federal Deposit Insurance Corp. receivership came suddenly on Friday, following a frenetic 44 hours in which its long-established customer base of tech startups yanked deposits.

But its fate was sealed years ago — during the height of the financial mania that swept across America when the pandemic hit.

US venture capital-backed companies raised $330 billion in 2021 — almost doubling the previous record a year before. Cathie Wood’s ETFs were surging and retail traders on Reddit were bullying hedge funds.

Crucially, the Federal Reserve pinned interest rates at unprecedented lows. And, in a radical shakeup of its framework, it promised to keep them there until it saw sustained inflation well above 2% — an outcome that no official forecast.

SVB took in tens of billions of dollars from its venture capital clients and then, confident that rates would stay steady, plowed that cash into longer-term bonds.

In doing so, it created — and walked straight into — a trap.

Becker and other leaders of the Santa Clara-based institution, the second-largest US bank failure in history behind Washington Mutual in 2008, will have to reckon with why they didn’t protect it from the risks of gorging on young tech ventures’ unstable deposits and from interest-rate increases on the asset side.

Outstanding questions also remain about how SVB went about navigating its precarious position in recent months, and whether it erred by waiting and failing to lock down a $2.25 billion capital injection before publicly announcing losses that alarmed its customers.

Investors and depositors tried to pull $42 billion on Thursday, leaving the firm with a negative cash balance of almost $1 billion, regulators said.

Still, decades of declining interest rates that started in the early 1980s — when SVB was founded over a poker game — made it heresy among market pros to suggest bond yields could climb without roiling the economy. As it turns out, American consumers are doing just fine, with jobs aplenty.

It’s banks, especially smaller ones that are flying below the Fed’s radar, that are now looking like the weakest links. SVB stands as the most extreme example yet of how Wall Street has been blindsided by the dynamics of the global economy after the Covid-induced shock.

Investors aren’t waiting to find out which institution might be next, with the KBW Bank Index dropping the most in a week since March 2020.

At SVB, “there was a lot of risk they were taking on that other banks wouldn’t,” said Sarah Kunst, a managing director at venture capital fund Cleo Capital. “That ultimately was part of their demise.”

Cash Rich

In March 2021, SVB had what might be considered an enviable problem: Its clients were flush with cash in a big way.

The bank’s total deposits exploded higher over the prior 12 months, to about $124 billion from $62 billion, according to data compiled by Bloomberg.

That 100% surge far outpaced a 24% increase at JPMorgan Chase & Co. and a 36.5% jump at First Republic Bank, another California institution.

“I always tell people I’m confident I’ve got the best bank CEO job in the world, and maybe one of the best CEO jobs,” Becker said in a May 2021 Bloomberg TV interview.

When asked if the bank’s recent run of growing revenue was sustainable, Becker, who joined SVB in 1993, smiled and spoke the lingo of tech visionaries.

“The innovation economy is the best place to be,” he said. “We’re very fortunate to be right in the middle of it.”

Still, the FDIC only insures bank deposits of up to $250,000 — and SVB’s clients had much more. That meant a large share of the money stashed at SVB was uninsured: more than 93% of domestic deposits as of Dec. 31, according to a regulatory filing.

For a while, that exposure didn’t raise any red flags. SVB easily cleared regulatory hurdles assessing its financial health.

But beneath the surface were severe losses on long-term bonds, snapped up during that period of rapid deposit growth, that had been largely shielded from view thanks to accounting rules.

It had mark-to-market losses in excess of $15 billion at the end of 2022 for securities held to maturity, almost equivalent to its entire equity base of $16.2 billion.

Still, after the bank’s posted fourth-quarter results in January, investors were sanguine, with a Bank of America Corp. analyst writing that it “may have passed the point of maximum pressure.”

It soon became clear that wasn’t the case.

Tough Spot

In a meeting late last week, Moody’s Investors Service had bad news for SVB: the bank’s unrealized losses meant it was at serious risk of a credit downgrade, potentially of more than one level, according to a person familiar with the matter.

That put SVB in a tough spot. To shore up its balance sheet, it would need to offload a large portion of its bond investments at a loss to increase its liquidity — potentially spooking depositors. But standing pat and getting hit with a multi-notch downgrade could trigger a similar exodus.

SVB, along with its adviser, Goldman Sachs Group Inc., ultimately decided to sell the portfolio and announce a $2.25 billion equity deal, said the person, who requested anonymity to discuss internal deliberations. It was downgraded by Moody’s on Wednesday anyway.

At the time, large mutual funds and hedge funds indicated interest in taking sizable positions in the shares, the person said.

That is, until they realized how quickly the bank was hemorrhaging deposits, which only got worse on Thursday after a number of prominent venture capital firms, including Peter Thiel’s Founders Fund, were advising portfolio companies to pull money as a precaution.

“Stay Calm”

Around that same time, on Thursday afternoon, SVB was reaching out to its biggest clients, stressing that it was well-capitalized, had a high-quality balance sheet and “ample liquidity and flexibility,” according to a memo viewed by Bloomberg. Becker had a conference call in which he urged people to “stay calm.”

But they were already too late.

SVB “should have paid attention to the basics of banking: that similar depositors will walk in similar ways all at the same time,” said Daniel Cohen, former chairman of The Bancorp. “Bankers always overestimate the loyalty of their customers.”

A vice president, in one call with a public company client, seemed to stick to a script and gave no new information, according to a person on the call.

That client decided to move a portion of their cash to JPMorgan to diversify assets Thursday; the transaction took two hours to navigate on SVB’s website and is still marked as “processing.”

The same client tried to move a larger amount on Friday morning, but no attempts to wire the money worked, the person said.

Quick Collapse

The collapse on Friday happened in the span of hours. SVB abandoned the planned equity raise after shares tumbled more than 60% on Thursday. By that point, US regulators had descended upon the bank’s California offices.

SVB “didn’t have nearly as much capital as an institution that risky should have had,” William Isaac, the former chairman of the FDIC from 1981 to 1985, said in a telephone interview Friday. “Once it started, there was no stopping it. And that’s why they just had to shut it down.”

Before noon in New York, the California Department of Financial Protection and Innovation closed SVB and appointed the FDIC as receiver. It said the main office and all branches would reopen on Monday.

By then, it’s SVB’s goal to find a buyer and complete a deal, even if it requires selling the company’s assets piecemeal, according to a person familiar with the matter.

Startup founders, meantime, are worrying about whether they’ll be able to make payroll. The FDIC said that insured depositors would have access to their funds by no later than Monday morning.

The amount of SVB deposits in excess of the $250,000 insurance cap: “undetermined.”

Updated: 3-11-2023

What’s Going On With Silicon Valley Bank?

Here Are Some Questions And Answers To Help Explain What Happened:

SVB Financial Group bought some of the safest assets in the world of finance. How could it possibly have failed in two days?

How Did We Get Here?

SVB Financial is the parent company of Silicon Valley Bank, which counts many startups and venture-capital firms as clients.

During the pandemic, those clients generated a ton of cash that led to a surge in deposits.

SVB ended the first quarter of 2020 with just over $60 billion in total deposits. That skyrocketed to just shy of $200 billion by the end of the first quarter of 2022.

What Did The Bank Do?

SVB Financial bought tens of billions of dollars of seemingly safe assets, primarily longer-term U.S. Treasurys and government-backed mortgage securities.

SVB’s securities portfolio rose from about $27 billion in the first quarter of 2020 to around $128 billion by the end of 2021.

Why Is That A Problem?

These securities are at virtually no risk of defaulting. But they pay fixed interest rates for many years. That isn’t necessarily a problem, unless the bank suddenly needs to sell the securities.

Because market interest rates have moved so much higher, those securities are suddenly worth less on the open market than they are valued at on the bank’s books. As a result, they could only be sold at a loss.

SVB’s unrealized losses on its securities portfolio at the end of 2022—or the gap between the cost of the investments and their fair value—jumped to more than $17 billion.

What Else Went Wrong?

At the same time, SVB’s deposit inflows turned to outflows as its clients burned cash and stopped getting new funds from public offerings or fundraisings.

Attracting new deposits also became far more expensive, with the rates demanded by savers increasing along with the Fed’s hikes.

Deposits fell from nearly $200 billion at the end of March 2022 to $173 billion at year-end 2022.

And that is accelerating this year: As of Jan. 19, SVB was forecasting its deposits would decline by a midsingle-digit percentage in 2023. But their expectation as of March 8 was for a low-double-digit percentage decline.

How Did This Come To A Head?

On Wednesday SVB said it had sold a large chunk of its securities, worth $21 billion at the time of sale, at a loss of about $1.8 billion after tax.

The bank’s aim was to help it reset its interest earnings at today’s higher yields, and provide it with the balance-sheet flexibility to meet potential outflows and still fund new lending. It also set out to raise about $2.25 billion in capital.

Why Didn’t It Work?

Following that announcement on Wednesday evening, things seemed to get even worse for the bank. The share-sale announcement led the stock to crater in price, making it harder to raise capital and leading the bank to scuttle its share-sale plans, The Wall Street Journal has reported.

And venture-capital firms reportedly began advising their portfolio companies to withdraw deposits from SVB.

On Thursday, customers tried to withdraw $42 billion of deposits—about a quarter of the bank’s total—according to a filing by California regulators. It ran out of cash.

What Will Happen To Customer Deposits?

Many of the bank’s deposits are sizable enough that they don’t carry Federal Deposit Insurance Corp. protection. SVB said it estimates that at the end of 2022 the amount of deposits in its U.S. offices that exceed the FDIC insurance limit was $151.5 billion.

The FDIC said in a statement on Friday that customers will have full access to their insured deposits no later than Monday morning. The FDIC said it hadn’t yet determined the current amount of uninsured deposits.

But it said that uninsured depositors will get an advance dividend within the next week. For the remaining amounts of uninsured funds, those depositors will get something called a “receivership certificate,” and as the FDIC sells off the assets of SVB, they may get future dividend payments.

Why Are Other Bank Stocks Getting Hit?

Already rattled by the failure of Silvergate Capital, whose own problems started with crypto but also reflected a portfolio of government debt whose value was depressed by higher rates, investors are selling bank stocks across the board.

Stocks of other midsize lenders such as First Republic Bank and Signature Bank were halted on Friday morning.

The impact of higher rates on banks’ securities isn’t limited to SVB. Across all FDIC banks, there were about $620 billion worth of unrealized losses in securities portfolios as of the fourth quarter.

Why Is The Circle Stablecoin USDC Getting Hit?

Circle Internet Financial Ltd., which issues the USD Coin stablecoin, said Friday it had $3.3 billion stuck in Silicon Valley Bank. USDC is supposed to mimic a dollar, but its price fell below 87 cents Saturday morning.

Stablecoins such as USDC hold their $1 value by assuring coin holders that the coin’s issuer has $1 in real dollars or other assets for every coin in circulation—and that users can always swap their coins for $1.

Like a bank, a stablecoin is subject to a run: If holders are worried that they might not get their $1 back, they’ll race to get rid of their coins however they can—including by selling them. Buyers on Friday and Saturday, though, were evidently only willing to take them at a discount to $1.

What Have We Learned?

One of the big questions coming out of this will be which banks misjudged the match between the cost and lifespan of their deposits and the yield and duration of their assets.

This is very different from the questions about bad lending that haunted the 2008 financial crisis.

As money flowed into banks during the pandemic, buying the shortest-term Treasurys or keeping the money in cash would have insulated them from the risk of rising interest rates.

But it also would have depressed their income. Banks’ reach for “safe” yield may be what haunts them this time around.

Updated: 3-11-2023

Banks Down? That Is Why Bitcoin Was Created, Crypto Community Says

The Silicon Valley Bank collapse on March 10 has sparked fear, uncertainty and doubt across the crypto community.

The Silicon Valley Bank (SVB) collapse on March 10 has sparked fear, uncertainty and doubt (FUD) across the crypto community, leading many to return to crypto roots — reviving the Bitcoin white paper published just weeks after the Lehman Brothers meltdown in 2008.

It’s truly amazing how many people are scared that a couple banks went down. Someone tell these people WHY BITCOIN WAS CREATED.

— Toby Cunningham (@sircryptotips) March 11, 2023

“There’s an entire generation of builders who only read about Lehman and the financial crisis and scoffed at Bitcoin. Now, their eyes are wide open. Welcome new friends,” stated Ryan Selkis, founder and CEO of Messari.

in shock

that is all

the SPEED at which all of this is happening is unbelievable

— Meltem Demirors (@Melt_Dem) March 10, 2023

Approximately six weeks after the dramatic collapse of Lehman Brothers — the fourth-largest investment bank in the United States at the time — Satoshi Nakamoto released the now-famous white paper, paving the way for the emergence of the Bitcoin network.

Some people blame the SVB failure on the rising interest rates in the United States. The Federal Reserve increased its benchmark rate over the past year to more than 4.5% — the highest rate since 2007. In January, the inflation rate in the U.S. was 6.4%.

Add “interest rate driven bank run” to the increasingly long list of “things I did not think I’d see in 2023”

— Sheila Warren (@sheila_warren) March 10, 2023

Many crypto and tech companies are affected by the collapse of Silicon Valley Bank. SVB, a Federal Deposit Insurance Corporation-insured bank, was about to shut down operations when USD Coin issuer Circle initiated a wire transfer to remove its funds.

Circle revealed it could not withdraw $3.3 billion of its $40 billion reserves from SVB, leading to a sell-off and the stablecoin’s price dropping below its $1 peg.

Less than 24 hours old and already experienced his first bank run. pic.twitter.com/PjqGh1UAXg

— Michael Bentley (@euler_mab) March 11, 2023

The stablecoin ecosystem felt an immediate effect as USDC depegged from the U.S. dollar. USDC’s collateral influence prompted other stablecoins to depeg from the dollar.

Dai, a stablecoin issued by MakerDAO, lost 7.4% of its value due to USDC’s depegging, Cointelegraph reported.

Stablecoins

Stablecoins

Stablecoins

Stablecoins

Stablecoins

Stablecoins

Unstablecoins— Cope (@Timccopeland) March 11, 2023

Other popular stablecoins, such as Tether, continue to maintain a 1:1 peg with the U.S. dollar.

Circle said it is now joining other customers and depositors in calling for the continuity of SVB, which the company alleged is important for the United States economy. Circle stated on Twitter that it would follow state and federal regulators’ guidance.

SVB was shut down by the California Department of Financial Protection and Innovation for undisclosed reasons on March 10. The California watchdog appointed the Federal Deposit Insurance Corporation (FDIC) as the receiver to protect insured deposits.

However, the FDIC only insures deposits up to $250,000 per depositor, institution and ownership category.

US Discusses Fund To Backstop Deposits If More Banks Fail

* FDIC, Fed Weigh Special Vehicle After SVB Swiftly Collapses

* Regulators Are Racing To Stem The Fallout For Other Banks

The Federal Deposit Insurance Corp. and the Federal Reserve are weighing creating a fund that would allow regulators to backstop more deposits at banks that run into trouble following Silicon Valley Bank’s collapse.

Regulators discussed the new special vehicle in conversations with banking executives, according to people familiar with the matter. The hope is that setting up such a vehicle would reassure depositors and help contain any panic, said the people. They asked not to be identified because the talks weren’t public.

A representative for the Federal Reserve declined to comment. Representatives at the FDIC didn’t immediately respond to a request for comment.

The vehicle is part of the agency’s contingency planning as concern spreads about the health of smaller banks focused on the venture capital and startup communities.

Separately, the FDIC on Saturday queried officials from multiple small- and mid-sized lenders, including First Republic Bank, about their financial situations, according to people with knowledge of the conversations who asked not to be identified because the discussions were private.

Fears Spread

First Republic’s stock had tumbled 15% on Friday, extending the bank’s slide to 34% for the week. The firm told investors in a statement that its liquidity remained strong and that its deposit base was very diversified.

Representatives for San Francisco-based First Republic and the FDIC didn’t immediately respond to requests for comment on the interactions.

A number of other regional lenders also saw their stock plunge on SVB’s collapse, prompting their own assurances of financial stability.

Phoenix-based Western Alliance Bancorp pointed to its strong deposits and robust liquidity after its stock sank to its lowest since November 2020 on Friday.

That same day, when PacWest Bancorp shares dropped 38%, Chief Executive Officer Paul Taylor said that the firm is a “well-performing, well-diversified” commercial bank.

Representatives for Western Alliance and PacWest didn’t immediately respond to requests for comment.

SVB became the biggest US lender to fail in more than a decade on Friday, after a tumultuous week that saw an unsuccessful attempt to raise capital and a cash exodus from the startups that fueled its rise.

California state watchdogs took possession of the bank, which was valued at more than $40 billion as recently as last year.

FDIC Races To Return Some Uninsured SVB Deposits Monday

* Initial Payout Depends On Efforts To Sell Assets Over Weekend

* Figures Floated Behind Scenes Range From 30% To 50% Or More

US regulators overseeing the emergency breakup of SVB Financial Group are racing to sell assets and make a portion of clients’ uninsured deposits available as soon as Monday, according to people with knowledge of the situation.

The initial payout — the amount of which is still being determined — would aim to tide over the firm’s distressed customers, many of them Silicon Valley entrepreneurs and their companies, with more cash to follow as the bank’s assets are sold.

The amount will depend in part on the Federal Deposit Insurance Corp.’s progress in turning assets to cash by Sunday night.

Figures being floated behind the scenes for an initial payment range from 30% to 50% or more of uninsured deposits, the people said, asking not to be identified discussing private talks.

A spokesperson for the FDIC didn’t respond to requests for comment on its plans.

Silicon Valley Bank’s business clients are desperate to access their money to keep operations running and employees paid. On Friday, the bank became the biggest US lender to fail in more than a decade, unraveling in less than 48 hours after announcing plans to raise capital.

The firm, which swelled in recent years as it soaked up deposits from tech startups, began losing money as those clients burned through their funding and drew down balances.

At the end of last year, Silicon Valley Bank had more than $175 billion in deposits and $209 billion in total assets — but selling those holdings to meet demands for cash proved costly.

That’s because SVB had loaded up on bonds and Treasuries that lost value as the Federal Reserve raised interest rates.

While the FDIC insures deposits of up to $250,000, the vast majority of funds held in at SVB far exceeded that. The agency has said it will make 100% of protected deposits available on Monday.

The amount of uninsured deposits was still being determined, the FDIC said on Friday.

The watchdog said it will issue an advance dividend to uninsured depositors soon, with future payments later. Wall Street executives expect there will be a market for selling the rights to recoup deposits.

Easing ‘Pain’

Behind the scenes, senior Wall Street executives have been gaming out the value of the bank’s holdings, and how much cash could be extracted quickly, absent some sort of bailout or deal to sell all or part of the bank to a stronger institution.

In those circles, paying less than half, such as 30%, is seen as too little to avoid severe fallout in the technology sector and potentially beyond.

A partial up-front payment could at least provide some relief, William Isaac, a former FDIC chairman, said in a phone interview Saturday.

“It doesn’t completely eliminate the problem or the pain, but it makes it a lot easier for customers of the bank to deal with their losses,” said Isaac, who held the role from 1981 to 1985.

Deposits aren’t the only way SVB clients have been left in the lurch. The bank also had $62.5 billion of credit commitments at the end of 2022, a figure nearly as large as its loan book.

The firm didn’t provide a detailed breakdown of those commitments, but a majority of its lending was in capital call lines of credit.

Those facilities give venture capital and private equity firms the ability to tap cash to immediately invest in a startup, which then gets repaid once the money arrives from pensions and other investors that previously committed to the funds.

If those lines of credit were to disappear, it would likely limit funds’ ability to invest quickly.

As young tech companies pondered over the weekend how they will navigate SVB’s demise, a number of fintechs stepped into the void.

Brex, a platform offering financing to startups, rolled out emergency bridge loans for ventures that need help keeping lights on, according to an offer seen by Bloomberg. In another offer, New York-based credit provider Capchase offered emergency payroll financing.

The FDIC has been laying groundwork for a potentially drawn-out sale process, according to senior executives at two investment banking firms that recently spoke with the regulator.

An official told one firm that, despite efforts to reach a resolution quickly, a piecemeal sale spanning weeks or months looked more probable, one of the people said.

The agency informally invited the other firm to pitch proposals for certain assets, a second person said, prompting dealmakers to review prospects for a variety of publicly disclosed holdings, such as a desirable portfolio of loans to California wineries and vineyards.

Updated: 3-12-2023

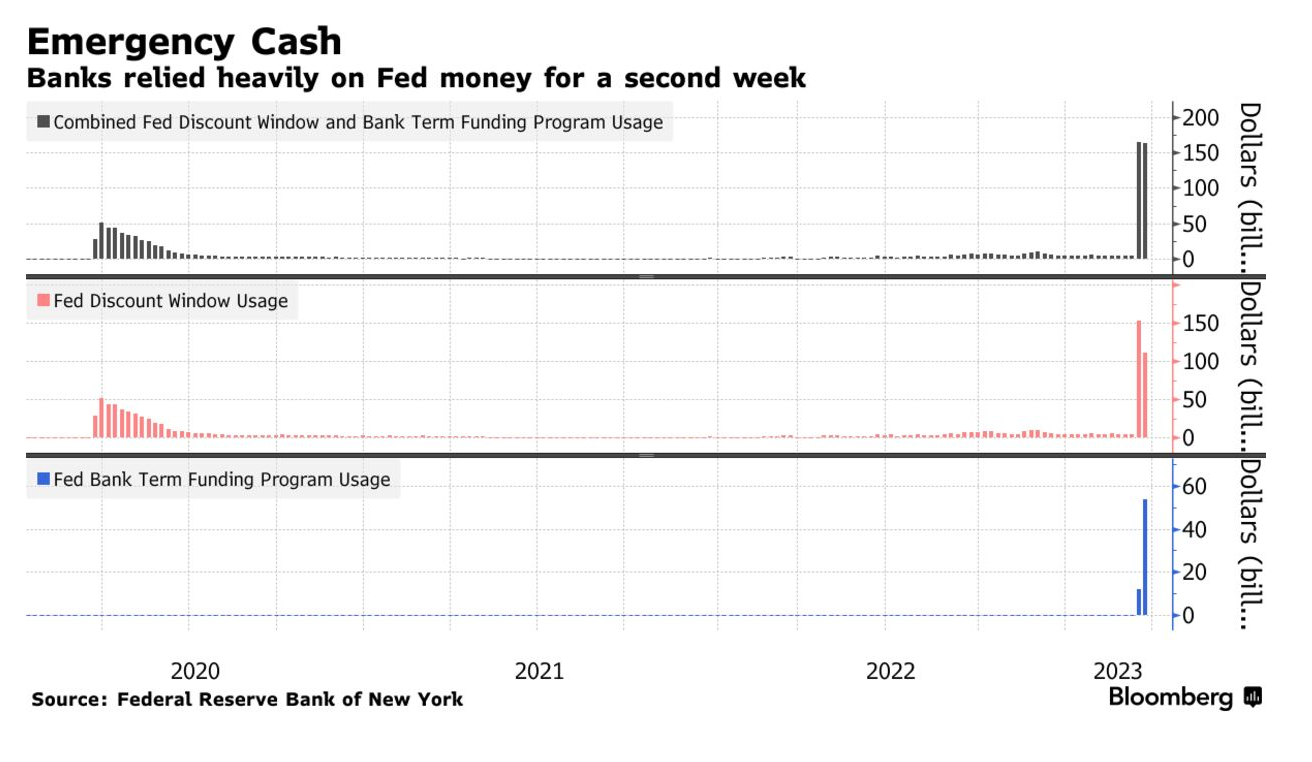

US Fed Announces $25B In Funding To Backstop Banks

Hot on the heels of several United States bank collapses, the Federal Reserve Board has announced $25 billion worth of funding aimed at backstopping banks and other depository firms.

The funds would ensure that eligible banks would have enough liquidity to cover the needs of their customers during times of turmoil.

@federalreserve announces Bank Term Funding Program (BTFP) to support American businesses and households, assure banks have ability to meet needs of all their depositors: https://t.co/JIMjkooIDV

— Federal Reserve (@federalreserve) March 12, 2023

In a Mar. 12 statement, the Federal Reserve Board said it created a $25 billion Bank Term Funding Program (BTFP) offering loans of up to one year to “banks, savings associations, credit unions, and other eligible depository institutions.”

Eligible firms must pledge U.S. Treasurys, agency debt and mortgage-backed securities or other “qualifying assets” as collateral, which will be valued “at par” — the price at which the assets were issued.

The Fed added it would be an “additional source of liquidity against high-quality securities, eliminating an institution’s need to quickly sell those securities in times of stress.”

Excellent, in my opinion.

Funding is at 1-year OIS (basically 1-year market-implied Fed Funds) plus a meagre 10 bps spread on top.

1 year guaranteed liquidity at Fed Funds plus 10 bps posting collateral deep in the mud but valued at par.

Quite the deal.

— Alf (@MacroAlf) March 12, 2023

It comes as Silicon Valley Bank (SVB) announced on Mar. 8 a significant sale of assets and stocks aimed at raising additional capital, which panicked depositors and triggered a run on the bank.

The bank run contaminated the crypto space as stablecoin issuer Circle disclosed it had $3.3 billion in SVB, causing further panic and resulting in its stablecoin USD Coin losing its peg to the U.S. dollar.

The new program comes on the same day the Fed announced that U.S. Treasury Secretary Janet Yellen approved actions for the Federal Deposit Insurance Corporation (FDIC) to make SVB depositors whole and that regulators closed New York-based Signature Bank, citing systemic risk.

US Backstops Bank Deposits To Avert Crisis After SVB Failure

* Fed Says New Lending Program To Protect The Nation’s Deposits

* US Stocks Rally, Yields Drop As Traders Unwind Fed Hike Bets

US authorities took extraordinary measures to shore up confidence in the financial system after the collapse of Silicon Valley Bank, introducing a new backstop for banks that Federal Reserve officials said was big enough to protect the entire nation’s deposits.

The Sunday announcement by the Treasury Department, Federal Reserve and Federal Deposit Insurance Corp. followed a frantic weekend that saw the surprise closure of New York’s Signature Bank along with mounting concerns about spillover effects to other regional lenders and the wider economy.

Regulators Acted On A Number Of Fronts To Contain The Potential Fallout:

The FDIC said it will resolve SVB in a way that “fully protects all depositors.” Similarly, “all depositors” at Signature will be made whole.

The Fed also announced a new “Bank Term Funding Program” that offers one-year loans to banks under easier terms than it typically provides. $25 billion is available.

The central bank relaxed terms for lending through its discount window, its main direct lending facility.

The response helped soothe investors worried about additional bank runs or the risk a fresh financial crisis would trigger a recession. US stock futures climbed on Monday after bank shares plunged last week by the most since the March 2020 pandemic shock.

In the UK, HSBC Holdings Plc began Monday by announcing it was acquiring the UK arm of Silicon Valley Bank, the culmination of a weekend where ministers and bankers explored various ways to avert the SVB unit’s collapse.

Under the new US program, which provides loans of up to one year, collateral will be valued at par, or 100 cents on the dollar.

That means banks can get bigger loans than usual for bonds, reducing the pressure to generate cash by selling securities whose prices have tumbled.

There were some concerns that the taxpayer could now be on the hook for covering losses suffered by banks and that questionable management and investments were now being protected by the government.

Banks, for example, now can limit accepting losses or selling assets given they have access to easier funding. US banks were sitting on more than $300 billion of losses on securities they planned to hold to maturity at the end of 2022.

On March 8, SVB’s parent company, SVB Financial Group, revealed it had sold $21 billion of securities from its portfolio at a loss of $1.8 billion. The Fed’s new safety net may have helped it avoid doing so.

“If the Fed is now backstopping anyone facing asset/rates pain, then they are de facto allowing a massive easing of financial conditions as well as soaring moral hazard,” said Michael Every and Ben Picton, strategists at Rabobank.

SVB’s meltdown offered an illustration of the costs of the Fed’s most aggressive monetary tightening campaign since the early 1980s.

The lender had plowed money into longer-term bonds during the pandemic, the market values of which dropped as yields then soared. Meantime, SVB’s funding costs surged as the Fed kept jacking up its benchmark.

Fed officials said on a briefing call that their new facility was invoked under its emergency authority allowing for the establishment of a broad-based program under “unusual and exigent circumstances,” which requires Treasury approval.

It was unanimously approved by the Fed board.

The Treasury will “make available up to $25 billion from the Exchange Stabilization Fund as a backstop” for the bank funding program but the Fed doesn’t expect to draw on the funds, officials said.

With a senior Treasury official cautioning there were other banks that appeared to be in similar situations to SVB and Signature, regulators’ top concern was assuring businesses and households they were made whole on their deposits.

US Treasury Secretary Janet Yellen said the actions taken Sunday will protect “all depositors,” signaling aid to those whose accounts exceed the typical $250,000 threshold for FDIC insurance.

Normally, under the Fed’s main lending program, known as the discount window, the Fed typically lends money at a discount against the assets provided as collateral, a practice known as haircuts.

The central bank said the loans under the discount window, which are up to 90 days, will now be subject to the same collateral margins as the new bank funding facility.

The Fed’s emergency lending program is “an admission not only of systemic risk but that the risks are so unusual and exigent that failure to invoke this liquidity could create a financial crisis,” said Peter Conti-Brown, associate professor at the University of Pennsylvania’s Wharton School.

US regulators emphasized that taxpayers won’t be on the hook for protecting SVB and Signature deposits, and Treasury and Fed officials rejected the idea that the banks are being bailed out — showcasing the potential political sensitivities of the weekend moves.

The regulators said shareholders and certain unsecured debtholders will be wiped out, while management was fired.

President Joe Biden, in a statement Sunday night, said the solution “protects American workers and small businesses, and keeps our financial system safe.”

For the Fed, the collapse of two powerhouse regional banks will test their resolve as they decide their next move on rates. Chair Jerome Powell just last week opened the door to a re-acceleration to a 50 basis-point hike at the Fed’s March 21-22 meeting.

Financial ructions may raise the bar for such a move, however.

While economists at JPMorgan Chase & Co. retained their forecast for a quarter-point rate hike by the Fed next week, their counterparts at Goldman Sachs Group Inc. said they no longer expect the Fed to raise rates.

“While the Fed wants tighter financial conditions to restrain aggregate demand, they don’t want that to occur in a non-linear fashion that can quickly spiral out of control,” Michael Feroli, chief US economist at JPMorgan Chase, wrote in a note to clients.

“If they indeed have used the right tool to address financial contagion risks (time will tell), then they can also use the right tool to continue to address inflation risks — higher interest rates.”

Updated: 3-12-2023

Where Were The Regulators As SVB Crashed?

Silicon Valley Bank grew too fast using borrowed money—and the risks were lurking in plain sight.

Silicon Valley Bank’s failure boils down to a simple misstep: It grew too fast using borrowed short-term money from depositors who could ask to be repaid at any time, and invested it in long-term assets that it was unable, or unwilling, to sell.

When interest rates rose quickly, it was saddled with losses that ultimately forced it to try to raise fresh capital, spooking depositors who yanked their funds in two days.

The question following the bank’s takeover Friday: How could regulators have allowed it to grow so quickly and take on so much interest-rate risk?

And it wasn’t the only problem bank last week. Just days before SVB collapsed, Silvergate Capital Corp., one of the crypto industry’s biggest banks, said it would shut down.

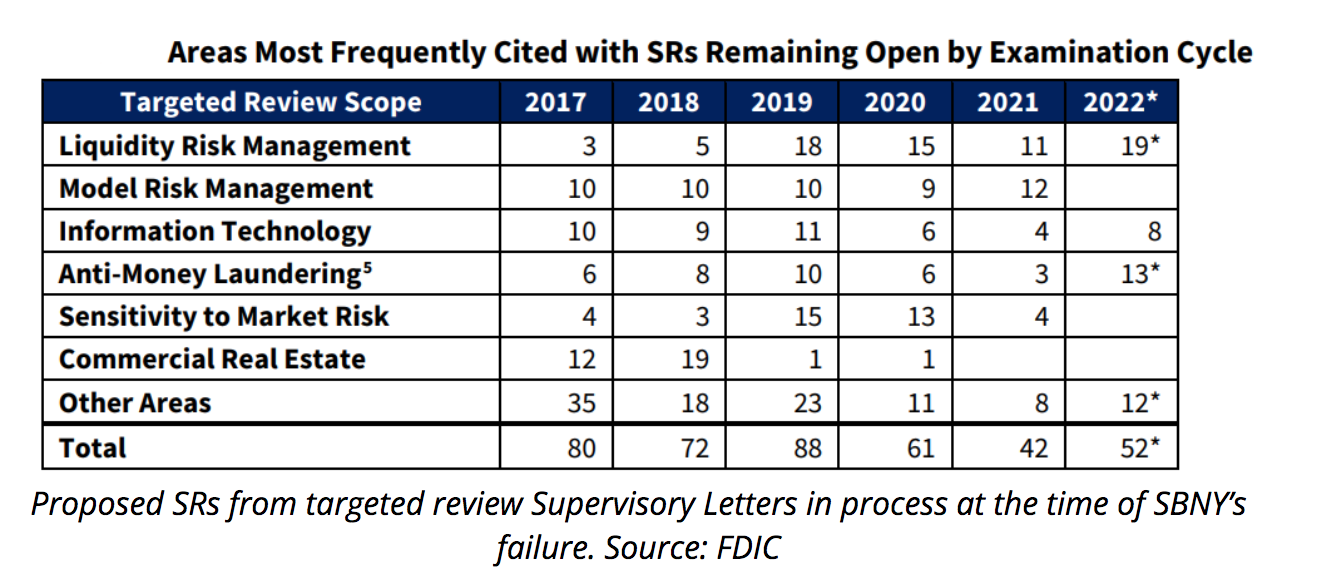

“The aftermath of these two cases is evidence of a significant supervisory problem,” said Karen Petrou, managing partner of Federal Financial Analytics, a regulatory advisory firm for the banking industry.

“That’s why we have fleets of bank examiners, and that’s what they’re supposed to be doing.”

The Federal Reserve was the primary federal regulator for both banks.

Notably, the risks at the two firms were lurking in plain sight. A rapid rise in assets and deposits was recorded on their balance sheets, and mounting losses on bond holdings were evident in notes to their financial statements.

SVB grew at a breakneck pace, nearly doubling deposits in just a year. Total assets at its parent, SVB Financial Group, grew to $211 billion at the end of 2021, versus $116 billion a year earlier. By the end of 2022, SVB was the 16th largest lender in the U.S.

Its implosion was the second-biggest bank failure in American history and marks the biggest test to date of the post-financial crisis regulatory architecture designed to force banks to curtail risk and monitor it more closely.

“Rapid growth should always be at least a yellow flag for supervisors,” said Daniel Tarullo, a former Federal Reserve governor who was the central bank’s point person on regulation following the financial crisis.

That’s because risk controls and buffers against potential losses often don’t grow in line with new risks being taken by fast-growing banks.

In addition, nearly 90% of SVB’s deposits were uninsured, making them more prone to flight in times of trouble since the Federal Deposit Insurance Corp. doesn’t stand behind them.

“A $200 billion bank should not fail because of liquidity,” said Eric Rosengren, who served as president of the Federal Reserve Bank of Boston from 2007 to 2021 and was its top bank regulator before that.

“They should have known their portfolio was heavily weighted toward venture capital, and venture-capital firms don’t want to be taking risk with their deposits. So there was a good chance if venture-capital portfolio companies started pulling out funds, they’d do it en masse.”

SVB and Silvergate both had less onerous liquidity rules than the biggest banks. In the wake of the failures, regulators may take a fresh look at liquidity rules, with an eye toward adjusting the requirements for holding high-quality liquid assets for banks whose funding sources go far beyond retail deposits, said Jaret Seiberg, an analyst at TD Cowen Washington Research Group, in a note.

To be sure, banks regularly borrow short-term to lend for longer periods of time. But SVB concentrated its balance sheet in long-dated assets, essentially reaching for yield to bolster results, at the worst possible time, just ahead of the Federal Reserve’s rate-hiking campaign. That left it sitting on big unrealized losses, making it more susceptible to customers pulling funds.

Timothy Coffey, associate director of depository research at Janney Montgomery Scott LLC, said regulators were aware that unrealized losses in banks’ securities portfolios could lead to trouble, but didn’t take specific steps to address the issue.

“This is something that’s been rolling through the industry for several months,” he said. “They did nothing to help this bank,” he added, referring to SVB.

Indeed, the two firms aren’t the only ones facing the risk posed by unrealized losses. The banking industry as a whole had some $620 billion in unrealized losses on securities at the end of last year, according to the Federal Deposit Insurance Corp., which began highlighting those late last year.

Another regulatory issue: accounting and capital rules that allow banks to ignore mark-to-market losses on some securities if they intend to hold them to maturity. At SVB, the bucket holding these securities—consisting largely of mortgage bonds issued by government-sponsored entities—is where the biggest capital hole is.

The idea behind such a bucket is that it insulates an institution from short-term price volatility. The problem this poses is two-fold.

First, a bank may not be able to hold such securities to maturity if it faces a cash crunch, as happened at SVB. Yet selling the securities would force the bank to recognize potentially massive losses.

Second, the treatment of the securities means banks like SVB are discouraged from selling when losses emerge, potentially causing problems to fester and grow. That appears to have been the case at SVB and many other banks as rising interest rates in 2022 caused large losses in bond markets.

Banks have an additional incentive to pile into Treasurys. They have to hold less capital against such holdings, supposedly because they are risk-free. However, this means banks are holding less capital to absorb losses, and Treasurys can lose value due to changes in interest rates.