Bank Failure In New Jersey Is Nation’s Third In A Week And Counting (#GotBitcoin?)

Regulators have now closed three banks in the span of a week with the failure late Friday of City National Bank of New Jersey in Newark. Bank Failure In New Jersey Is Nation’s Third In A Week And Counting (#GotBitcoin?)

City National Bank of New Jersey was shuttered by the Office of the Comptroller of the Currency, which appointed the Federal Deposit Insurance Corp. as receiver. City National’s operations were sold to Industrial Bank in Washington, D.C. Industrial is a unit of IBW Financial.

City National, a minority depository institution, had about $120.6 million in assets and $111.2 million in deposits on Sept. 30, according to the FDIC.

Industrial, which is also a minority depository institution, agreed to buy essentially all of City National’s assets and assume all of the failed bank’s deposits.

Failed Bank List. The FDIC Is Often Appointed As Receiver For Failed Banks.

All three of City National’s existing branches will re-open Saturday under Industrial’s ownership. The FDIC estimates that the failure will cost the Deposit Insurance Fund about $2.5 million.

“The OCC acted after finding that the bank had experienced substantial dissipation of assets and earnings due to unsafe or unsound practices,” the regulator said in a statement. “The OCC also found that the bank was undercapitalized and failed to submit a capital restoration plan acceptable to the OCC.”

City National is the fourth bank to close in 2019, though two banks failed on Oct. 25 in Ohio and Kentucky. The last bank to fail in New Jersey was Harvest Community Bank in Pennsville, which closed on Jan. 13, 2017.

US Bank Fails For The First Time Since 2017

More than 10 years have passed since the collapse of Lehman Brothers, which burned almost $10 trillion in market capitalization in global equities within a month. Back then, it was determined that banks, large and small, had gotten themselves into trouble with mortgage-backed securities, the price of which turned out to be significantly overestimated.

Now, following waves of quantitative easing and huge bailouts for those deemed “too big to fail,” indications have emerged that the traditional banking system is heading towards its next big disaster. The main question that remains to be answered is what the trigger will be.

Analysts have warned it may be the record high level of global debt currently standing at well over $240 trillion, which is three times the size of the global economy. Others are pointing to China’s deeply indebted financial system. Europe’s banking sector, as deleveraged as it may seem, still has its unresolved issues, especially acute and chronic in some countries of its southern flank.

When America sneezes, however, the world usually catches cold, as the saying goes. This year, the U.S. registered its first bank failure since 2017. On the last day of May, the Texas Department of Banking closed Enloe State Bank. The Federal Deposit Insurance Corporation (FDIC) then took steps to arrange the assumption of the bank’s insured deposits by Legend Bank, N.A.

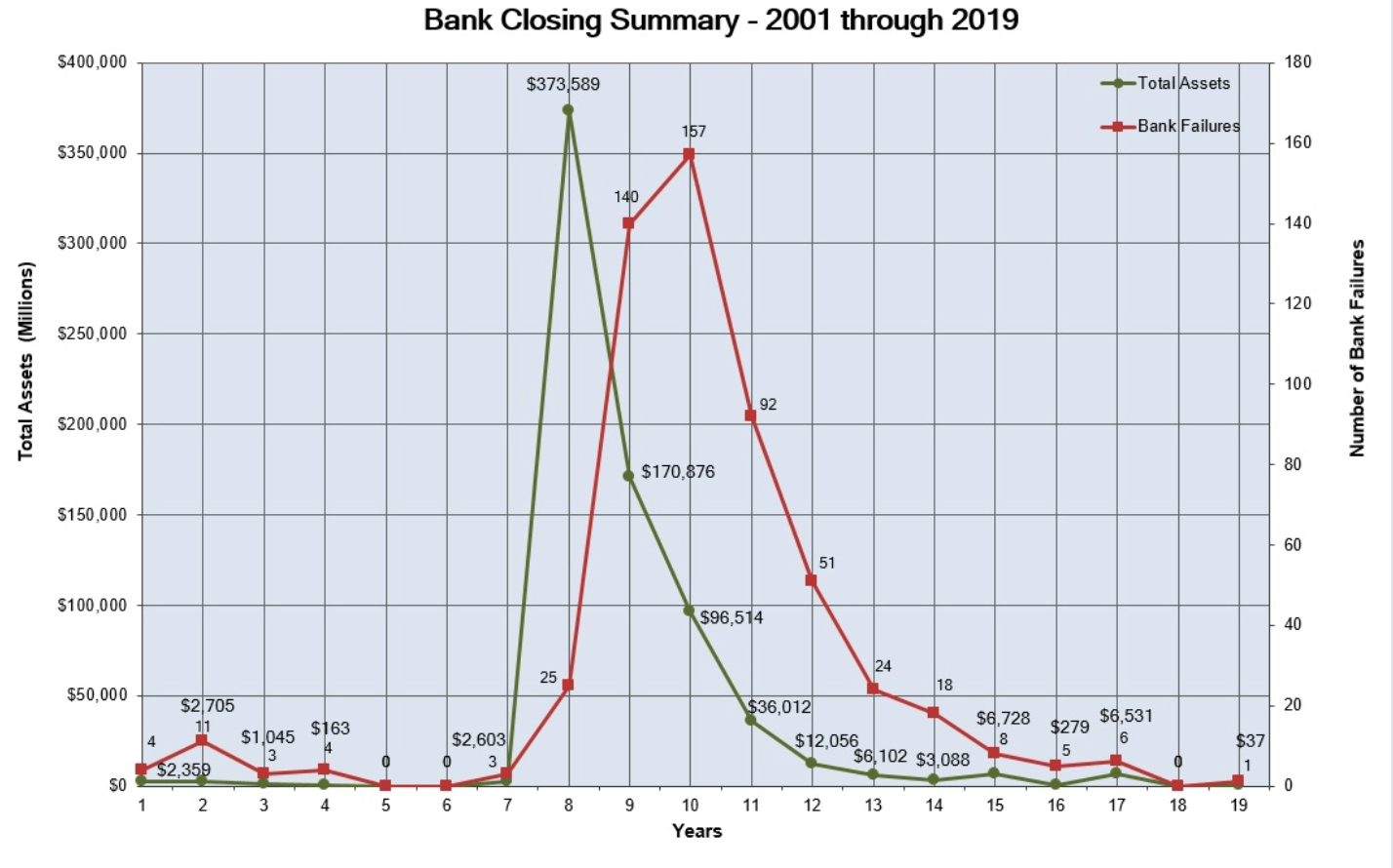

The Enloe State Bank is a small institution with only one branch. It controlled a little over $36 million in assets and only about $31 million in deposits. Nevertheless, its demise is an event that deserves a mention. Bank failures in the U.S. peaked in 2010, according to FDIC data, when 157 banks closed. Since then, the number of failing financial institutions has been decreasing – 92 in 2011, 51 in 2012, 24 in 2013, 18 in 2014, eight in 2015, five in 2016, six in 2017, and most notably – zero in 2018.

The FDIC maintains a database of all U.S. banks that failed since Oct. 1, 2000. It’s a terrifying list to go through as it has 23 pages of institutions that for various reasons were forced to abandon their business and seek rescue. The table contains the name of the troubled bank, the city and state it’s based in, its certification number, closing date, and the acquiring institution. The list already has a staggering 556 entries added since the beginning of the millennium.

Undoubtedly, the fact that in 2018 no bank failed indicates that the banking sector in the Untitled States has strengthened since what’s now often called the Great Recession. But the fact that a bank went down this year shows there are still underlying problems and weaknesses in the market that have to be addressed.

The industry has been consolidating as most troubled banks have been bought by bigger institutions. On the backdrop of economic expansion, corporate tax cuts and new safety measures, it’s been reported that the six largest of them are expected to reach a record profit of more than $100 billion. The question is, will bigger be better when the next crisis hits?

World’s Oldest Bank Bailed Out Against Europe’s Rules

Despite some positive changes implemented in the past decade, the traditional banking system is still facing numerous challenges that are mounting once again. Europe, where a more conservative approach to dealing with the 2008 troubles created a generally safer environment, is still struggling to overcome the problems that have dogged banks in many of the southern member states of the European Union which took a hard blow from the global financial bust 10 years ago.

After governments commissioned huge bailouts and introduced stricter regulations, the capital balances of many European banks improved. Countries such as Greece and Italy, however, continue to register a high proportion of bad loans. At the same time, unlike the United States, larger banks in these and more stable economies are experiencing low profits due to not only the large share of non-performing loans, but also the unprecedented low interest rates across the Eurozone and the larger EU.

Between 2007 and 2009, financial institutions, from Ireland to Austria, had to be saved by governments or acquired by banks in better financial condition. The heightened standards players in the industry were obliged to meet and the new rules they now have to comply with improved the stability of surviving banks, increased their capital ratios and reduced the share of bad loans in subsequent years. Still, when the European Central Bank conducted a health check in 2014, 25 out of the 130 largest Eurozone banks failed the stress test. The capital shortfall estimated by the ECB amounted to €25 billion.

Again, unlike the U.S., 2018 was not a very good year for banks on the Old Continent. Towards the end of the summer and during the last quarter they turned out to have some of the worst performing stocks. The losses reported by mainstream media were remarkable. In just four months, the price of Dankse Bank shares declined by almost 32%, Commerzbank over 31%, Deutsche Bank close to 30%, Unicredit and BNP Paribas around 24%.

However, it’s not so much about the suffering banks, which can survive, but about those financial institutions that could not make it on their own and had to be saved with taxpayer money. The case with the Italian Banca Monte dei Paschi di Siena SpA is a symbolic one. Two years ago, the oldest operating bank in the world, founded in 1472, needed almost $6.2 billion to avoid bankruptcy. The government in Rome granted it state aid to avoid triggering a nationwide banking crisis. The bailout was executed despite a report by a team of ECB inspectors, quoted recently by Bloomberg, who doubted the bank’s solvency even back in 2015.

The financial institution was funded regardless of the experts’ concerns that the attempt to keep it running might not succeed. The rescue also breached the European Union’s own rules on bailout eligibility. Monte Paschi’s resurrection, considering its bad shape, is a move that undermines ECB’s credibility as a banking regulator and raises questions about accountability and transparency, when it comes to spending public funds on saving failed private enterprises. Are we going to see more rule-violating bailouts? That’s an important question to ponder if a new financial crisis is on its way.

Small Bank Collapse Triggers Credit Crunch In China

A growing number of analysts believe the next financial crisis is likely to start from China and its indebted banking system. A recent incident substantiates these fears. Baoshang, a small lender based in the Inner Mongolia Autonomous Region, collapsed in the end of May, despite its numbers from a few weeks having given no indication that this was going to happen. According to its most recent report filed with financial authorities, the bank registered a $600 million profit in 2017. It also had approximately $90 billion in assets, while its bad loans were under 2%.

But then Baoshang suddenly failed and Chinese regulators seized the bank – the first act of this kind in the People’s Republic this century – quickly blaming its owner of misappropriation of funds. Observers note, however, that the significance of Baoshang’s collapse stems from the fact that it was caused by the country’s first default on interbank obligations. It has since become very hard for smaller institutions to access the interbank lending market, on which they are heavily reliant.

And while the collapse of an Inner Mongolian bank may not sound like a Lehman-size event, in China quantity has a quality all of its own. Numerous small and medium-sized Chinese banks combined are in fact as large as the big players. All of them are now facing difficulties when trying to convince larger financial institutions they are stable enough to receive new loans.

This situation forced the People’s Bank of China to intervene and inject 600 billion yuan to sustain liquidity while introducing full guarantees for all retail deposits. Nevertheless, credit has already become harder to get and much more expensive for small banks in a time of worsening economic prospects amid an ongoing trade dispute with the U.S.

Under these circumstances, one thing is sure: trust in the global financial system, based on constantly inflated fiat currencies, will continue to diminish. And while new barriers are being raised to free economic interaction, often out of geopolitical considerations, the need for an independent vehicle for global money flows will continue to grow. Whether cryptocurrencies can fulfill that role remains an open question, the answer to which may arrive sooner than many think.

What do you think about the collapse of these banks and the measures taken by governments and central banks to deal with the financial crisis? Share your thoughts on the subject in the comments section.

Updated: 1-6-2020

Bank Failures Could Be A Warning Sign For U.S. Financial System

Hidden risks may be masked by a strong economy, some analysts say.

Times are good for U.S. banks.

The industry is highly profitable, lending is up and the number of problem institutions—those found to have deficiencies in their businesses—is the lowest since early 2007, according to the Federal Deposit Insurance Corp.

Unusually, not a single bank failed in 2018, and just four small lenders have gone under since the end of May 2019. Yet some bank analysts and former regulators say the very paucity of failures may be a sign that hidden risks are building.

“It’s in the good times, when things seem very calm and when there are no bank failures, that the bad loans are made,” former FDIC Vice Chairman Thomas Hoenig said in a recent interview.

Apart from 2018, the only years on record with no failures were 2005 and 2006, when home prices soared and banks feasted on subprime mortgage debt in the run-up to the financial crisis.

Regulators say the current calm is a sign of strength in the economy, which is in its 11th year of expansion. Even banks that do run into trouble can easily raise fresh capital or find a merger partner.

All four banks that failed in 2019 were small, and one of them, the Enloe State Bank, with a single branch near Dallas, collapsed as a result of what Texas banking authorities said was “insider abuse and fraud by former officers.”

Failures “have been small in number and nothing that gives us concern that there is a systemic problem,” said FDIC Chairman Jelena McWilliams in November. Some of the failures would have occurred sooner in a weaker economy, she said.

In a country with some 5,000 banks, ranging from tiny, one-branch operations to behemoths like JPMorgan Chase & Co. and Bank of America Corp. , a handful can be expected to go bust each year. Failures averaged about seven a year during the 1970s and from 1994 to 2004, periods that didn’t witness major banking crises, according to FDIC data.

“The mark of a healthy industry is one in which some banks are trying new things and failing,” said Aaron Klein, a fellow at the Brookings Institution who served in the Treasury Department during the Obama administration. “When herd behavior becomes pervasive throughout the system, risks brew or bubble up.”

A prolonged period of low interest rates has encouraged businesses and consumers to take on more debt, which may be hard to repay if the economy sours. Banks, meanwhile, may be tempted to loosen lending standards.

Officials at the Federal Reserve say overall risks in the financial system are moderate, but they are keeping a close watch on debt among nonfinancial firms, which is close to a record high relative to gross domestic product. What is more, that debt is rising fastest among riskier companies with lower credit ratings.

“A highly leveraged business sector could amplify any economic downturn as companies are forced to lay off workers and cut back on investments,” Fed Chairman Jerome Powell said in a May speech. “Investors, financial institutions and regulators need to focus on this risk today, while times are good.”

Household debt, at $15.8 trillion, is similar to precrisis levels as a proportion of GDP and has been growing fastest among higher-rated borrowers. But some segments are showing signs of froth: Auto debt has soared by about 56% in the past decade, according to Fed data. Among people who traded in cars to buy new ones in the first nine months of 2019, 33% owed more than the car was worth.

To be sure, banks have thicker capital buffers and are supervised more tightly than before the crisis. “You don’t go through a crisis like we did without learning lessons,” said Preston Kennedy, chairman of the Independent Community Bankers of America and president and chief executive of Zachary Bancshares Inc. in Zachary, La.

Still, a trend toward easing postcrisis rules for the financial industry has some former regulators worried that risks could be overlooked. Smaller firms are now allowed to file shorter financial reports with regulators, are examined less often and are exempt from some capital rules if they maintain a relatively high ratio of equity to assets.

“The momentum is going in the direction of softening rules, generally,” said Sheila Bair, who headed the FDIC from 2006 and 2011, when more than 400 banks failed. “It’s the wrong mind-set.”

Bank Failure In New,Bank Failure In New,Bank Failure In New,Bank Failure In New,Bank Failure In New,Bank Failure In New,Bank Failure In New,Bank Failure In New,Bank Failure In New

Related Articles:

Trump To Tell Federal Agencies To Cut New York Times And Washington Post Subscriptions

Donald Trump Boards Air Force One With Toilet Paper On Shoe

Major Donor To Trump Pleads Guilty In Campaign-Finance Case

Morgan Stanley Says An ‘Earnings Recession’ Has Arrived (#GotBitcoin?)

Stock-Market Trading Volumes Decline As Liquidity Concerns Rise (#GotBitcoin?)

The Downside To Charles Schwab And TD Ameritrade Eliminating Trading Fees (Yes, Really)

Insiders Profiting From Advanced Knowledge Of Donald Trump Tariff Announcements

Trump Outstripping Obama On Pace Of Executive Orders

White House Condemns Anti-Media Video Shown At Pro-Trump Conference

If E-Commerce Doesn’t Kill Your Store, Sky-High Rents Will (#GotBitcoin?)

$381 Billion Annual Gap Between Taxes Owed And Taxes Collected (#GotRecession?)

When Sales At Struggling Chains Fall Faster Then Commercial Rents (#GotRecession?)

Parts of America Are Already In Recession (#GotBitcoin?)

A Manufacturing Recession Is Here. Now What? (#GotBitcoin?)

Trump Blames Business Setbacks On Incompetency vs Recession He’s Causing (#GotBitcoin?)

What Are YOU Doing NOW To Prepare For The Incoming Recession? (#GotBitcoin?)

Trump And Republicans Will Have Zero Chance of Re-election During Coming Recession

Investors Ponder Negative Bond Yields In The U.S. (#GotBitcoin?)

As Global Order Crumbles, Risks of Recession Grows (#GotBitcoin?)

Lower Mortgage Rates Aren’t Likely To Reverse Sagging Home Sales (#GotBitcoin?)

Financial Crisis Yields A Generation Of Renters (#GotBitcoin?)

Global Manufacturing Recession Weighs On US Economy (#GotBitcoin?)

Falling Real Yields (0.241% ) Signal Worry Over U.S. Economy (#GotBitcoin?)

Donald Trump’s WH Projects $1 Trillion Deficit For 2019 (#GotBitcoin?)

U.S. Home Sales Stumble, As Pricey West Coast Markets Suffer Declines (#DumpTrump)

Lower Rates Have A Downside For Bank’s Mortgage-Servicing Rights (#GotBitcoin?)

Central Banks Are In Sync On Need For Fresh Stimulus (#GotBitcoin?)

Weak Corporate Earnings Signal A Weak Economy (#GotBitcoin?)

Price of Gold, Indicator Of Inflation And Recession Surges (#GotBitcoin?)

Recession Set To Materialize In Approximately In (9) Months (#GotBitcoin?)

A Whiff Of U.S. Recession Is In The Air Again. Credit Trumponomics

Trump Calls On Fed To Cut Interest Rates, Resume Bond-Buying To Stimulate Growth (#GotBitcoin?)

Fake News: A Perfectly Good Retail Sales Report (#GotBitcoin?)

Anticipating A Recession, Trump Points Fingers At Fed Chairman Powell (#GotBitcoin?)

Affordable Housing Crisis Spreads Throughout World (#GotBitcoin?) (#GotBitcoin?)

Los Angeles And Other Cities Stash Money To Prepare For A Recession (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.