23 Dizzying Average American Savings Statistics (#GotBitcoin?)

Everyone wants to save more money, but figuring out how to do it is usually the hardest part. While the economy is continuing its slow recovery, many Americans still struggle with being able to set aside a little something for the future. Millennials, in particular, are facing a tougher uphill climb as they face a tougher job market and big student loan bills. 23 Dizzying Average American Savings Statistics (#GotBitcoin?)

Finding more money in your budget begins with cutting out unnecessary expenses. Sometimes, though, that still isn’t enough to put you in the black. CreditDonkey decided to dig a little deeper into how much people are actually saving in the U.S., and what we found was surprising, to say the least.

Measuring The Saving Habit

Some people are naturals when it comes to saving while others have to work a little harder to build the habit. The statistics we uncovered show that a shocking number of Americans have no savings at all, and that those who are saving are setting aside less money than they have in previous years.

1. How Many Americans Have Zero Savings?

The number of Americans who have no cash in the bank to fall back on is staggering. Approximately 26% of adults have no savings set aside for emergencies, while another 36% have yet to start socking away money for retirement.

2. What’s The Average Bank Account Balance?

While millions of Americans have no savings, many of them have managed to stash a few bucks in their checking account. As of 2013, the average bank account balance hovered around $4,436.

3. What Is The Personal Savings Rate In The U.S.?

The personal savings rate is the average amount of earnings people in the U.S. are putting away for rainy days. Through the end of 2014, the rate was 4.4%, which is a steep decline from the 10.5% rate in 2012.

4. How Many Adults Don’t Have A Bank Account?

Saving money is tough when you don’t have a place to park it. Approximately 7.7% of American households function without a bank account. That’s close to 10 million households altogether.

5. How Many Adults Live Paycheck To Paycheck?

An estimated 38 million households in the U.S. live hand to mouth, meaning they spend every penny of their paychecks. Surprisingly, two-thirds of them earn a median income of $41,000, which puts them well above the federal poverty level.

How Savers Compare Demographically

Aside from how much money you make and what your expenses are, there are a number of other factors that can determine whether you’re able to save money. Specifically, we considered how race, age and geographic location influence individual saving patterns.

6. Does Race Impact Savings Rates?

Research suggests that racial minorities face a tougher road when it comes to saving money. Around 75% of Latino and African American households have less than $10,000 saved for retirement, and nearly two-thirds of minority households don’t have anything set aside for the future.

7. Which Generation Is The Best At Saving?

Baby boomers tend to do better when it comes to hanging on to their extra money. Adults aged 55 and older have a positive personal savings rate of about 13%.

8. Which One Is The Worst?

Millennials, on the other hand, meaning adults who are 35 and under, have a personal savings rate of negative 2%. Between high student loan debt and stagnating wages, saving anything at all proves to be impossible for many of them.

9. Which Cities Are The Best For Savers?

Some cities make saving easier than others, thanks to higher wages and a lower cost of living. Through 2014, Baltimore made the top of the list, with a median household income of $73,816 and median expenses of $49,566.

10. Which Ones Are The Worst?

If you like the desert, you’ll want to move somewhere other than Phoenix if you’re trying to save money. Residents here face median expenses that are $1,136 higher than the median annual income.

Saving For Emergencies

Having an emergency cash buffer in place is a must if you want to safeguard yourself against potential financial disaster. While finance experts vary in their estimates of how much you need to save, they all agree that having that cushion is a necessity. Based on the numbers, however, it seems that far too many Americans don’t have adequate protection.

11. How Many Americans Have Less Than $100 In Emergency Savings?

Almost half of Americans would not be able to cover an unexpected expense of $500 or less. Almost a quarter would not be able to cover even $100. An estimated 22.9% of men and 22.7% of women say they don’t have at least a Benjamin in their emergency fund.

12. How Many Americans Have Less Than $500 Saved?

Having $500 in the bank for emergencies can give you a sense of financial security but for 41% of adults, it’s still a pipe dream.

13. What Percentage Of Americans Have A Three-Month Emergency Fund?

Saving three months’ worth of expenses is a lofty goal. In a survey when Americans were asked if they have a 3 to 5 month emergency fund, just 17% said they do.

14. How Many Have Six Months’ Worth Of Expenses Saved?

Twenty-three percent of adults surveyed acknowledge having an emergency fund that could last them at least six months.

15. Who’s More Likely To Have An Emergency Fund?

Age, income and race play a part in determining how Americans save for emergencies. For example, 36% of retirees have a 6-month emergency account compared to 16% of 18 to 29-year-olds. Ten percent of college grads lack any savings versus 36% of those with a high school diploma or less.

Planning For Retirement

With Social Security payouts expected to decrease to about 75% of their current limit over the next several decades, planning for a secure retirement has become more important than ever. Unfortunately, study after study shows that millions of workers are lagging behind on their savings goals.

16. How Many Americans Aren’t Saving For Retirement?

The sooner you start saving for retirement, the better – but that’s something 36% of adults haven’t gotten around to yet. More than a quarter of adults aged 50 to 64 aren’t saving anything for their golden years.

17. How Much Do Savers Expect To Need When They Retire?

How much cash you’ll need in retirement will vary based on your current income and expenses. Among middle-class workers, $250,000 is the median amount they’re aiming to save.

18. How Much Are They Saving Each Month?

Building up a quarter of a million dollars in savings takes time, and many adults may fall short. On average, workers aged 30 to 49 are saving $200 a month for retirement while those aged 50 to 59 are adding a mere $78 to their accounts.

19. What’s The Average 401(K) Balance?

At the end of 2013, the average 401(k) balance was a healthy $101,650. The median balance, however, was just $31,396, which means that half of the workers participating in their employer’s retirement had that much or more while the other half had less.

20. How Much Are People Contributing To Their 401(K)?

While 93% of middle-class workers are participating to a 401(k) plan, 67% of them are only saving enough to qualify for the company match. The median contribution amount for those between 30 and 59 years of age is 7% of their salary.

21. What’s The Median Net Worth In America?

Among seniors aged 55 to 64, the median net worth is around $165,000. By comparison, those in the 35 to 44 range boast a net worth of about $50,000. The 18 to 34-year-old millennial set fare the worst, with a net worth of $11,000.

22. How Worried Are Americans About Their Financial Future?

Being prepared for retirement is a top financial concern for Americans; 59% say that running out of money is their number one fear.

23. How Many Americans Say They’ll Never Retire?

Working past retirement age has unfortunately become a reality for many seniors. In 2013, 7% of employees said they plan to stay on the job indefinitely. That’s a big jump from the 2% who made the same claim in 2011.

Conclusion:

Saving money should be a priority for everyone but as evidenced by the statistics we found, it’s not necessarily a cakewalk. Sometimes it’s as simple as cutting out that daily latte but for other Americans, their financial reality presents some much bigger obstacles.

Survey: Savings Statistics

Close to half have no cash savings and are living on the edge of financial disaster, according to a recent CreditDonkey.com survey. While 59% of respondents reported having more than $500 in savings, the other 41% do not have a cash safety net.

It’s not what you may think: this 41% is made up not only of people living at or below the poverty line. They are also dual-income earners with nice homes, nice cars, nice toys, a 401K retirement savings plan, big mortgages. and big credit card bills. But if they ever get into a bind and need some quick cash – say, because of a car breakdown or an unexpected doctor visit – they don’t have it.

While this group may be rich in home equity and other investments, their assets are not liquid. In other words, none of those items converts easily into cash in an emergency. People in this situation even have their own name – the “liquid asset poor” – a term coined by the Washington, D.C.-based advocacy group Corporation for Enterprise Development.

With no cash reserves, they are just one paycheck away from financial ruin should an emergency or a job loss happen because they cannot easily access cash on a moment’s notice.

It’s not what you may think: this 41% is made up not only of people living at or below the poverty line. They are also dual-income earners with nice homes, nice cars, nice toys, a 401K retirement savings plan, big mortgages. and big credit card bills. But if they ever get into a bind and need some quick cash – say, because of a car breakdown or an unexpected doctor visit – they don’t have it.

While this group may be rich in home equity and other investments, their assets are not liquid. In other words, none of those items converts easily into cash in an emergency. People in this situation even have their own name – the “liquid asset poor” – a term coined by the Washington, D.C.-based advocacy group Corporation for Enterprise Development.

With no cash reserves, they are just one paycheck away from financial ruin should an emergency or a job loss happen because they cannot easily access cash on a moment’s notice.

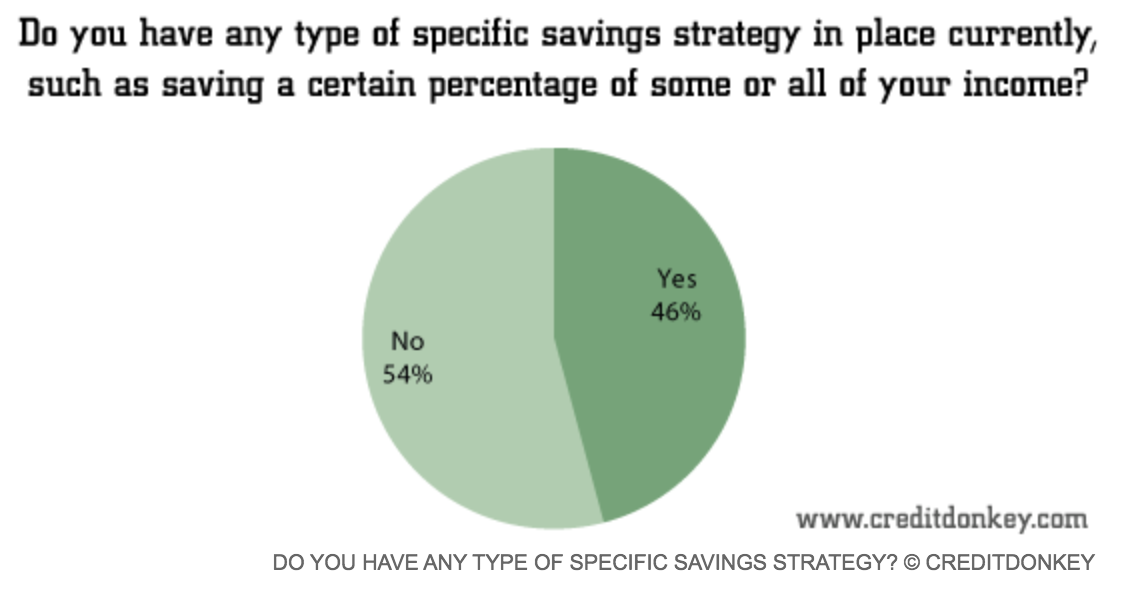

Sadly, the CreditDonkey.com survey also found that more than half of respondents (54%) said they may be stuck in this situation for the foreseeable future. They have not set up an emergency cash savings strategy.

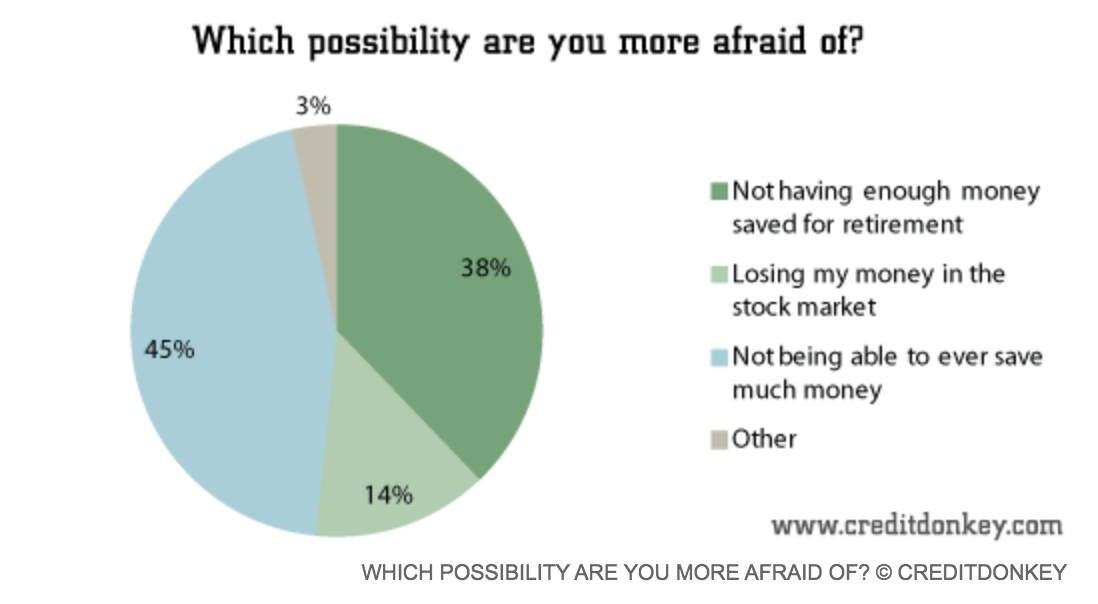

Interestingly, while these same respondents do not use a budget or an automatic savings plan (such as designating a specific portion of their income every paycheck to help them manage and save their money), almost half (45%) admitted they are most concerned about not being able to ever save much money.

Many families may be put off by the concept of having enough cash savings to cover 3-6 months worth of earnings in case of an emergency, such as a job loss or medical condition. But the truth is many families can tighten their belt and begin to save at least some cash for smaller emergencies. That way, they can cover unforeseen expenses that just “pop up,” like a car or household appliance breakdown.

It’s better to use cash for such emergencies, to keep debt at bay rather than make an unplanned strain on credit resources.

CreditDonkey.com polled 1,105 Americans between September 17 and September 25, 2012.

Sources and References

- Gallup

- Federal Reserve Bank of St. Louis

- Bankrate

- Interest.com

- Vanguard

- National Institute on Retirement Security

- The Washington Post

- FDIC

- Brookings Institute

- Wall Street Journal

- CreditDonkey

- Center for Economic and Policy Research

- Towers Watson

Updated: 11-16-2019

What Retirement Crisis? Number Of 401(K) And IRA Millionaires Hits Record High

Plus, expert advice on how you can hit the $1 million mark too.

There are more millionaires next door.

Despite that fact that most people are undersaved for retirement, a study released by Fidelity Thursday shows that the retirement savings picture isn’t quite as grim as you might think. Indeed, the number of 401(k) and IRA millionaires hit a record high at the end of the third quarter, Fidelity found.

“The number of people with $1 million or more in their 401(k) increased to a record 200,000, up from 196,000 at the end of Q2, while the number of IRA millionaires increased to 182,400, also a record high and an increase from 179,700 last quarter,” the report revealed.

What’s more, employee savings rates hit a record high: As of the 12-month period ending in the third quarter, 32.3% of workers increased their 401(k) contribution rate — a record high; by comparison, for the 12-month period ending in the third quarter of 2009, only 12% percent of workers increased their contribution rate.

(Interestingly, a recent Bankrate survey had a similar finding: that 29% of Americans had increased their retirement savings contributions from the year prior). Now, the average employee contribution rate is 8.8%, which is nearly a full percentage point higher than a decade ago, Fidelity reports.

But don’t pull out the confetti yet: Most of us still don’t have enough saved for retirement. Fidelity data show that the average 401(k) balance is still only $105,200, and the average IRA balance is $110,200, both down slightly from the previous quarter. And an analysis done by the Employee Benefit Research Institute found that more than four in 10 U.S. households where the head of household is between the ages of 35 and 64 will likely run short of money in retirement.

If you’re far from being a 401(k) or IRA millionaire, there may still be time for you to save more. Here are some expert tips on how to do it:

Up your savings motivation, says certified financial planner Bobbi Rebell, host of the Financial Grownup podcast. “The best way to do that is to simply look at your numbers. Run an online calculator and see where you are relative to your goals. Odds are that will motivate you to take action.”

What’s more, you should remember that “the money you contribute to your 401(k) is not taxed,” explains says certified financial planner Mitchell C. Hockenbury of 1440 Financial Partners in Kansas City, Mo. “But, it would be if it made its way to your paycheck. Therefore, just because you increase your contribution by $100 a month does not mean you have $100 less in your paycheck.” But remember, that money will be taxed upon withdrawal.

Make your savings automatic, advises Hockenbury. “Many 401(k) plans now have a cool feature that automatically raises your contribution to the plan by 1% each year. If you haven’t opted-in to this when you set up your plan, it is a great idea to do so today,” he says.

Increase your savings rate — even if you can only do it by a small amount. “Increasing your contribution rate, even by 1%, can make a big difference in your long-term retirement savings – what may seem like a small amount today can have a significant impact on your account balance in 10 or 20 years,” said Kevin Barry, president of Workplace Investing at Fidelity Investments, in a statement.

Use your raise towards retirement, says Hockenbury. “You know ahead of time you are going to receive a raise, before you get your next paycheck, go into the plan and increase your contribution amount,” he says.

Look for where you can free up extra money that you then sock away for retirement. “The big option right now could be taking a look at your mortgage, and seeing if the math works to refinance, and lower your monthly payments,” says Rebell. “The extra cash could then be put towards retirement savings.” Adds Hockenbury: “There are an awful lot of monthly memberships people sign up for and don’t use. Can you eliminate one or two and use the money to put towards an IRA, Roth IRA, or 401(k)?”

Updated: 12-3-2019

Germans Keep on Saving Their Money—Even When It Hurts

Thrift has a long tradition in Germany, but stockpiling cash might be damaging the country’s growth and eroding its wealth.

On a recent morning in the spa town of Baden-Baden, children clutching piggy banks and bags stuffed with coins flooded into the local savings bank, or Sparkasse, for a lesson in frugality.

The ritual has taken place across Germany every year since the International Savings Banks Institute launched World Thrift Day in 1924 to promote basic financial literacy, starting with the central tenet: Don’t ever spend more than you earn.

Today, saving is viewed in Germany as a tradition and a virtue. This goes for consumers, who are stashing cash in mattresses and checking accounts; for the state, which has run a budget surplus for five years; and for companies, which are hoarding profits.

The problem: In a world of negative interest rates, stockpiling cash has left German households poorer than their international peers in terms of wealth, hindered German companies from investing in their future and restrained economic growth across Europe.

Germany’s median household wealth is €61,000 ($67,000), lower than Greece’s, according to European Central Bank data. Germans are the least likely of all Europeans to own their own homes, an important source of wealth for many families, in part because they consider real estate risky.

So why are Germans hunkering down and saving more, even after years of policies designed by the ECB to encourage precisely the opposite?

Some economists think German frugality isn’t a behavior easily changed by policy, but rather it is part of an identity built over three centuries of revolution, hyperinflation, wars, depression and dictatorship.

Germany’s commitment to thrift has endured because of the stability of its savings banks and the acceptance by working-class people of thrift as a virtue, said Sandra Mass, professor of international history at the Ruhr University in Bochum.

In Baden-Baden, 10-year-old Maximilian Valasek said he saves all his pocket money, or €15 ($16.50) a month. Many children weren’t sure why they were doing it. “It’s for the future,” said Melissa Caraffa, 8.

Waldemar Schneider, who arrived with his two grandchildren, Sabine and John, said “interest rates go up and down, but we continue to save, man and wife.”

The ECB in September cut interest rates again, to minus 0.5%, in an effort to encourage Germans to borrow, consume or invest, in turn supporting growth in Europe’s largest economy, which is flirting with recession.

But households here continue to sock away 11% of their disposable income—compared with less than 7% in the U.S. and up from 9.3% in 2013, according to the Organization for Economic Cooperation and Development.

Last year, German households added €108.7 billion to their bank accounts, more than any time since the euro was introduced, according to Deutsche Bank research. Cash and bank deposits, at €2.5 trillion, make up 40% of Germans’ financial assets, according to Bundesbank data.

These deposits earn little or no return today. Indeed, many German banks are charging customers to park money. But 60% of Germans say they don’t plan to change how they save, according to a survey by the Association of German Savings Banks. Of those who did change their behavior, a quarter said they were saving more.

Crucially, Germans have been shunning those assets that have appreciated in the low-rate environment, like stocks and real estate, which are considered too risky. Only one in 10 households own stocks, while 70% have savings accounts, according to Bundesbank data. Some €140 billion in cash is being squirreled away in German mattresses or the like.

A man in northwest Germany lost half a million euros after a friend turned on the boiler in which the money was hidden, accidentally burning the entire stash, according to court documents.

Lars Feld, member of the Council of Economic Experts that advises the German government, says such behavior is more rational than it seems because of Germany’s aging society. As baby boomers near retirement, they shun risky investments. Saving cash—and saving more when interest rates fall—can make sense in this context.

Andreas Rademacher, owner of Hotel Der Kleine Prinz in Baden-Baden, said he and his wife recently discussed buying stocks but gave up over concerns about market volatility.

“A lot of people are waiting to see what happens,” he said.

Jessica Schreiber, a 23-year-old human-resource assistant, works full time for an IT company in Frankfurt and studies over weekends. She pays more than €300 a month into three savings accounts and has no debt.

“It’s partly for security, partly for future purchases,” she said.

For well over a century, a big agent of the thrift culture has been the country’s dense network of Sparkassen. Established in the 18th century, they were required to accept tiny deposits while other banks dealt exclusively with the rich. Part of the rationale was to help control the lower classes, since those with something to lose were less likely to revolt, said Robert Muschalla, an economic historian.

Today, the banks do outreach in schools, sponsor local events, provide bus services for old people, and produce a comic strip, Knax, which promotes thrift. They even run a university. Many children get their first account as a gift before their teens.

“Our mission is the same: To promote a sense of frugality among the people,” said Helmut Schleweis, president of the German association of savings banks.

The savings banks are also among the most strident critics of the ECB’s monetary policy, which they argue have defrauded German savers through negative interest rates. “We have a devastating interest-rate situation, and savers are the clear losers,” said Lothar Volle, chief executive of the Baden-Baden savings bank.

The state, too, is on the savers’ side. After clocking up a surplus every year since 2014, the federal government is on course to eliminate the national debt over the next two or three decades. Even though investors are paying it to borrow, Berlin expects to notch up a sixth straight surplus this year.

The country’s welfare state has tens of billions in reserves, and the nation’s gold reserves are the second-largest on the planet after the U.S.

“I spent much of my professional life outside Germany, and I’m still struck by this incredibly different thinking in Berlin and Germany more generally,” said Marcel Fratzscher, president of economic research institute DIW Berlin.

The biggest savers among German corporations are the midsize industrial companies that form the backbone of the economy. Known as the Mittelstand, these companies increased their ratios of equity to assets by more than 5 percentage points over the past decade, to above 30%, according to the German Association of Small and Medium-Sized Businesses.

Trumpf GmbH + Co. KG, a family-owned company based in a nondescript industrial estate in southwest Germany, is one of the world’s biggest providers of machine tools, with 2018 sales of €3.8 billion. Trumpf has no net debt and has hundreds of millions of euros in the bank. But it recently started cutting costs after a drop in orders.

The company has opted against seeking a credit rating, which would open access to bond markets, because it was “too laborious and too expensive,” said Stephen Schmid, Trumpf’s head of finance, noting that rating agencies might insist on a five-figure fee.

The International Monetary Fund warned in July that Germany’s high corporate savings were feeding inequality since few citizens owned stocks and business ownership was highly concentrated.

Many experts, including a rising number of German economists, see excessive thrift as a dangerous trend. As trade cools, domestic demand is becoming the only way out of a slowdown that is hurting the entire continent.

Germany should use its budget surpluses to ramp up public investment and thereby help to rebalance the region’s economy, the ECB’s new president, Christine Lagarde, said in October.

Instead, Germany’s current-account surplus, a measure of excess savings in the economy, will be the world’s largest for the fourth straight year in 2019, at $276 billion, above those of Japan and China, according to the conservative-leaning Ifo economic think tank.

Thrift rarely affords protection against hardship. Twice in the past century—in the 1920s and in the 1940s—Germans lost most of their savings, only to start saving again.

For Mr. Muschalla, however, achieving wealth isn’t necessarily the point.

“It’s not even about the money you make,” he said. “It’s about the lifestyle, deeply built around the German work ethic, what you built yourself with your own hands.”

Updated: 10-25-2020

UPS To Offer Employees A Way To Save For Emergencies

Shipping giant joins other companies offering rainy day funds in 401(k) plans.

United Parcel Service Inc. UPS -0.63% is expected to announce Thursday a plan to offer nearly 100,000 of its workers a way to save for emergencies within its 401(k) plan, becoming one of the largest U.S. employers to join a trend that reflects concern over the impact of workers’ financial problems on their ability to retire.

The program gives UPS employees the option to divert a portion of their paychecks into rainy-day funds within their 401(k) plans.

In recent years, a growing number of employers have grown concerned that if employees are unable to cover unexpected expenses, they may resort to raiding their retirement savings early, said Timothy Flacke, executive director of Commonwealth, a nonprofit that builds tools to help low-income workers save.

With financial support from BlackRock Inc.’s BLK 0.34% foundation, Commonwealth and other nonprofits are working with companies including UPS, Etsy Inc. ETSY 1.40% . and MasterCard Inc. to develop emergency savings initiatives.

Amid the economic crisis caused by the coronavirus, Mr. Flacke said the 401(k) industry “is beginning to embrace short-term savings as part of their mandate.”

Some companies, including Truist Financial Corp. , are taking another approach to emergency savings, outside the 401(k), by encouraging employees to fund bank accounts, in some cases by offering cash and other incentives.

Under the program UPS unveiled in early October, it is allowing its 90,000 nonunionized U.S. workers to contribute to a 401(k) account and, using after-tax payroll deductions, to a linked emergency-savings option within the account. (The company employs more than 500,000 in total.)

Eligible employees can elect to contribute up to 5% of pay to the emergency account. Employees can invest the money in the same options the 401(k) offers.

Although UPS offers matching contributions to some of its employees, it doesn’t currently offer a match for money put into the after-tax emergency fund.

When an employee taps the emergency account, the contributions come out tax-free. Earnings on after-tax contributions are subject to income tax and, if the employee is younger than 59 ½, a 10% penalty.

Employees can avoid the 10% penalty by rolling over the earnings to an IRA, said Tom Armstrong, vice president at Voya Financial, UPS’s 401(k) record-keeper.

Voya data indicates that workers with emergency funds covering three or more months’ worth of expenses are 13 times less likely to take withdrawals from their 401(k) accounts due to financial hardship than are people with smaller or no emergency accounts.

Prudential Retirement, a 401(k) record-keeper, has offered a similar program since 2018. More than 20 companies currently offer the emergency fund option.

Updated: 11-16-2020

The American Consumer Is Flush With Cash After Paying Down Debt

Eight months into the pandemic, Americans’ household finances are in the best shape in decades.

It’s a seemingly incongruous thought, what with the widespread business lockdowns earlier in the year and coinciding surge in unemployment — and it certainly doesn’t apply to all families equally. But it points to just how strong the U.S. economy was going into the virus outbreak, and how powerful the combined monetary and fiscal response was from the Federal Reserve, Congress and the Trump administration.

Record-low mortgage rates, reflecting the ultra-easy Fed policy, have prompted a steady wave of refinancing and allowed homeowners to reduce monthly payments or tap equity. Americans are also holding more cash, helped in part by stimulus from the government.

Households’ debt service burdens have eased considerably, too, a complete departure from the 2007-2009 financial crisis that required years to mend. That in turn bodes well for consumer spending and its ability to power the economic recovery through a period marred by a violent spike in virus cases.

“The consumer here in the U.S. is relatively stable and, honestly, somewhat relatively better than we might have feared back in the height of the pandemic in the second quarter of 2020,” Marianne Lake, JPMorgan Chase & Co.’s chief executive officer for consumer lending, said Nov. 9 at a virtual investor conference. “The consumer’s willingness to carry on spending is a pretty positive sign for sort of a broader economic recovery.”

A government report Tuesday is expected to show retail sales posted another solid, yet more moderate, advance in October.

And despite the surge in Covid-19 cases, economists project a 4% annualized rate of U.S. economic growth this quarter, unchanged from the October forecast — though down from the prior period’s record gain, according to a Bloomberg survey.

While the pandemic has financially been harder on working-class families than the wealthy ones who have been stockpiling much of the cash, data shows that they too have more money in the bank now. That’s important because they are much more likely to spend that money — and give the economy an added jolt — than the rich are.

Checkable deposits were also improving for several quarters leading up to the pandemic and even before the government actions to provide financial assistance for the unemployed.

Ian Shepherdson, chief economist at Pantheon Macroeconomics, said it’s possible economic growth estimates for coming quarters are revised up even more “because there’s an awful lot of cash which is waiting to be spent.”

However, the virus resurgence means “people can’t spend until it’s safe to go back out again.”

To be sure, another reason savings remain elevated is that people are uneasy about their jobs and the outlook, particularly in industries such as travel, food services and leisure, where business activity is more at risk.

While “cash buffers” of those who benefited from fiscal stimulus are starting to weaken, their financial positions remain elevated compared with pre-pandemic levels, JPMorgan’s Lake said. “I think there’s enough juice to get people to year-end.”

For its part, residential real estate has played a huge role in driving both the recovery and improvement in household finances. Cheaper borrowing costs have not only sparked a flurry of demand for homes, mortgage refinancing has strengthened. While cash-out refinancing only makes up a little more than a third of all activity, a larger share of rate-term refinancing means lower monthly mortgage payments.

“It’s highly likely that households have at least had the ability to spend more, and probably are spending more and continue to spend more, because they refinance and their payments are so low relative to their income,” said David Berson, chief economist at the insurance and financial services company Nationwide.

“The consumer came into this crisis in a pretty strong position in terms of household balance sheets and household liquidity and debt service burdens,” JPMorgan’s Lake said.

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

Blockchain Can And Will Replace The IRS

China Seizes The Blockchain Opportunity. How Should The US Respond? (#GotBitcoin?)

Jack Dorsey: You Can Buy A Fraction Of Berkshire Stock Or ‘Stack Sats’

Bitcoin Price Skyrockets $500 In Minutes As Bakkt BTC Contracts Hit Highs

Bitcoin’s Irreversibility Challenges International Private Law: Legal Scholar

Bitcoin Has Already Reached 40% Of Average Fiat Currency Lifespan

Yes, Even Bitcoin HODLers Can Lose Money In The Long-Term: Here’s How (#GotBitcoin?)

Unicef To Accept Donations In Bitcoin (#GotBitcoin?)

Former Prosecutor Asked To “Shut Down Bitcoin” And Is Now Face Of Crypto VC Investing (#GotBitcoin?)

Switzerland’s ‘Crypto Valley’ Is Bringing Blockchain To Zurich

Next Bitcoin Halving May Not Lead To Bull Market, Says Bitmain CEO

Bitcoin Developer Amir Taaki, “We Can Crash National Economies” (#GotBitcoin?)

Veteran Crypto And Stocks Trader Shares 6 Ways To Invest And Get Rich

Is Chainlink Blazing A Trail Independent Of Bitcoin?

Nearly $10 Billion In BTC Is Held In Wallets Of 8 Crypto Exchanges (#GotBitcoin?)

SEC Enters Settlement Talks With Alleged Fraudulent Firm Veritaseum (#GotBitcoin?)

Blockstream’s Samson Mow: Bitcoin’s Block Size Already ‘Too Big’

Attorneys Seek Bank Of Ireland Execs’ Testimony Against OneCoin Scammer (#GotBitcoin?)

OpenLibra Plans To Launch Permissionless Fork Of Facebook’s Stablecoin (#GotBitcoin?)

Tiny $217 Options Trade On Bitcoin Blockchain Could Be Wall Street’s Death Knell (#GotBitcoin?)

Class Action Accuses Tether And Bitfinex Of Market Manipulation (#GotBitcoin?)

Sharia Goldbugs: How ISIS Created A Currency For World Domination (#GotBitcoin?)

Bitcoin Eyes Demand As Hong Kong Protestors Announce Bank Run (#GotBitcoin?)

How To Securely Transfer Crypto To Your Heirs

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

Crypto News From The Spanish-Speaking World (#GotBitcoin?)

Financial Services Giant Morningstar To Offer Ratings For Crypto Assets (#GotBitcoin?)

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

The Original Sins Of Cryptocurrencies (#GotBitcoin?)

Bitcoin Is The Fraud? JPMorgan Metals Desk Fixed Gold Prices For Years (#GotBitcoin?)

Israeli Startup That Allows Offline Crypto Transactions Secures $4M (#GotBitcoin?)

[PSA] Non-genuine Trezor One Devices Spotted (#GotBitcoin?)

Bitcoin Stronger Than Ever But No One Seems To Care: Google Trends (#GotBitcoin?)

First-Ever SEC-Qualified Token Offering In US Raises $23 Million (#GotBitcoin?)

You Can Now Prove A Whole Blockchain With One Math Problem – Really

Crypto Mining Supply Fails To Meet Market Demand In Q2: TokenInsight

$2 Billion Lost In Mt. Gox Bitcoin Hack Can Be Recovered, Lawyer Claims (#GotBitcoin?)

Fed Chair Says Agency Monitoring Crypto But Not Developing Its Own (#GotBitcoin?)

Wesley Snipes Is Launching A Tokenized $25 Million Movie Fund (#GotBitcoin?)

Mystery 94K BTC Transaction Becomes Richest Non-Exchange Address (#GotBitcoin?)

A Crypto Fix For A Broken International Monetary System (#GotBitcoin?)

Four Out Of Five Top Bitcoin QR Code Generators Are Scams: Report (#GotBitcoin?)

Waves Platform And The Abyss To Jointly Launch Blockchain-Based Games Marketplace (#GotBitcoin?)

Bitmain Ramps Up Power And Efficiency With New Bitcoin Mining Machine (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Miss Finland: Bitcoin’s Risk Keeps Most Women Away From Cryptocurrency (#GotBitcoin?)

Artist Akon Loves BTC And Says, “It’s Controlled By The People” (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Co-Founder Of LinkedIn Presents Crypto Rap Video: Hamilton Vs. Satoshi (#GotBitcoin?)

Crypto Insurance Market To Grow, Lloyd’s Of London And Aon To Lead (#GotBitcoin?)

No ‘AltSeason’ Until Bitcoin Breaks $20K, Says Hedge Fund Manager (#GotBitcoin?)

NSA Working To Develop Quantum-Resistant Cryptocurrency: Report (#GotBitcoin?)

Custody Provider Legacy Trust Launches Crypto Pension Plan (#GotBitcoin?)

Vaneck, SolidX To Offer Limited Bitcoin ETF For Institutions Via Exemption (#GotBitcoin?)

Russell Okung: From NFL Superstar To Bitcoin Educator In 2 Years (#GotBitcoin?)

Bitcoin Miners Made $14 Billion To Date Securing The Network (#GotBitcoin?)

Why Does Amazon Want To Hire Blockchain Experts For Its Ads Division?

Argentina’s Economy Is In A Technical Default (#GotBitcoin?)

Blockchain-Based Fractional Ownership Used To Sell High-End Art (#GotBitcoin?)

Portugal Tax Authority: Bitcoin Trading And Payments Are Tax-Free (#GotBitcoin?)

Bitcoin ‘Failed Safe Haven Test’ After 7% Drop, Peter Schiff Gloats (#GotBitcoin?)

Bitcoin Dev Reveals Multisig UI Teaser For Hardware Wallets, Full Nodes (#GotBitcoin?)

Bitcoin Price: $10K Holds For Now As 50% Of CME Futures Set To Expire (#GotBitcoin?)

Bitcoin Realized Market Cap Hits $100 Billion For The First Time (#GotBitcoin?)

Stablecoins Begin To Look Beyond The Dollar (#GotBitcoin?)

Bank Of England Governor: Libra-Like Currency Could Replace US Dollar (#GotBitcoin?)

Binance Reveals ‘Venus’ — Its Own Project To Rival Facebook’s Libra (#GotBitcoin?)

The Real Benefits Of Blockchain Are Here. They’re Being Ignored (#GotBitcoin?)

CommBank Develops Blockchain Market To Boost Biodiversity (#GotBitcoin?)

SEC Approves Blockchain Tech Startup Securitize To Record Stock Transfers (#GotBitcoin?)

SegWit Creator Introduces New Language For Bitcoin Smart Contracts (#GotBitcoin?)

You Can Now Earn Bitcoin Rewards For Postmates Purchases (#GotBitcoin?)

Bitcoin Price ‘Will Struggle’ In Big Financial Crisis, Says Investor (#GotBitcoin?)

Fidelity Charitable Received Over $100M In Crypto Donations Since 2015 (#GotBitcoin?)

Would Blockchain Better Protect User Data Than FaceApp? Experts Answer (#GotBitcoin?)

Just The Existence Of Bitcoin Impacts Monetary Policy (#GotBitcoin?)

What Are The Biggest Alleged Crypto Heists And How Much Was Stolen? (#GotBitcoin?)

IRS To Cryptocurrency Owners: Come Clean, Or Else!

Coinbase Accidentally Saves Unencrypted Passwords Of 3,420 Customers (#GotBitcoin?)

Bitcoin Is A ‘Chaos Hedge, Or Schmuck Insurance‘ (#GotBitcoin?)

Bakkt Announces September 23 Launch Of Futures And Custody

Coinbase CEO: Institutions Depositing $200-400M Into Crypto Per Week (#GotBitcoin?)

Researchers Find Monero Mining Malware That Hides From Task Manager (#GotBitcoin?)

Crypto Dusting Attack Affects Nearly 300,000 Addresses (#GotBitcoin?)

A Case For Bitcoin As Recession Hedge In A Diversified Investment Portfolio (#GotBitcoin?)

SEC Guidance Gives Ammo To Lawsuit Claiming XRP Is Unregistered Security (#GotBitcoin?)

15 Countries To Develop Crypto Transaction Tracking System: Report (#GotBitcoin?)

US Department Of Commerce Offering 6-Figure Salary To Crypto Expert (#GotBitcoin?)

Mastercard Is Building A Team To Develop Crypto, Wallet Projects (#GotBitcoin?)

Canadian Bitcoin Educator Scams The Scammer And Donates Proceeds (#GotBitcoin?)

Amazon Wants To Build A Blockchain For Ads, New Job Listing Shows (#GotBitcoin?)

Shield Bitcoin Wallets From Theft Via Time Delay (#GotBitcoin?)

Blockstream Launches Bitcoin Mining Farm With Fidelity As Early Customer (#GotBitcoin?)

Commerzbank Tests Blockchain Machine To Machine Payments With Daimler (#GotBitcoin?)

Man Takes Bitcoin Miner Seller To Tribunal Over Electricity Bill And Wins (#GotBitcoin?)

Bitcoin’s Computing Power Sets Record As Over 100K New Miners Go Online (#GotBitcoin?)

Walmart Coin And Libra Perform Major Public Relations For Bitcoin (#GotBitcoin?)

Judge Says Buying Bitcoin Via Credit Card Not Necessarily A Cash Advance (#GotBitcoin?)

Poll: If You’re A Stockowner Or Crypto-Currency Holder. What Will You Do When The Recession Comes?

1 In 5 Crypto Holders Are Women, New Report Reveals (#GotBitcoin?)

Beating Bakkt, Ledgerx Is First To Launch ‘Physical’ Bitcoin Futures In Us (#GotBitcoin?)

Facebook Warns Investors That Libra Stablecoin May Never Launch (#GotBitcoin?)

Government Money Printing Is ‘Rocket Fuel’ For Bitcoin (#GotBitcoin?)

Bitcoin-Friendly Square Cash App Stock Price Up 56% In 2019 (#GotBitcoin?)

Safeway Shoppers Can Now Get Bitcoin Back As Change At 894 US Stores (#GotBitcoin?)

TD Ameritrade CEO: There’s ‘Heightened Interest Again’ With Bitcoin (#GotBitcoin?)

Venezuela Sets New Bitcoin Volume Record Thanks To 10,000,000% Inflation (#GotBitcoin?)

Newegg Adds Bitcoin Payment Option To 73 More Countries (#GotBitcoin?)

China’s Schizophrenic Relationship With Bitcoin (#GotBitcoin?)

More Companies Build Products Around Crypto Hardware Wallets (#GotBitcoin?)

Bakkt Is Scheduled To Start Testing Its Bitcoin Futures Contracts Today (#GotBitcoin?)

Bitcoin Network Now 8 Times More Powerful Than It Was At $20K Price (#GotBitcoin?)

Crypto Exchange BitMEX Under Investigation By CFTC: Bloomberg (#GotBitcoin?)

“Bitcoin An ‘Unstoppable Force,” Says US Congressman At Crypto Hearing (#GotBitcoin?)

Bitcoin Network Is Moving $3 Billion Daily, Up 210% Since April (#GotBitcoin?)

Cryptocurrency Startups Get Partial Green Light From Washington

Fundstrat’s Tom Lee: Bitcoin Pullback Is Healthy, Fewer Searches Аre Good (#GotBitcoin?)

Bitcoin Lightning Nodes Are Snatching Funds From Bad Actors (#GotBitcoin?)

The Provident Bank Now Offers Deposit Services For Crypto-Related Entities (#GotBitcoin?)

Bitcoin Could Help Stop News Censorship From Space (#GotBitcoin?)

US Sanctions On Iran Crypto Mining — Inevitable Or Impossible? (#GotBitcoin?)

US Lawmaker Reintroduces ‘Safe Harbor’ Crypto Tax Bill In Congress (#GotBitcoin?)

EU Central Bank Won’t Add Bitcoin To Reserves — Says It’s Not A Currency (#GotBitcoin?)

The Miami Dolphins Now Accept Bitcoin And Litecoin Crypt-Currency Payments (#GotBitcoin?)

Trump Bashes Bitcoin And Alt-Right Is Mad As Hell (#GotBitcoin?)

Goldman Sachs Ramps Up Development Of New Secret Crypto Project (#GotBitcoin?)

Blockchain And AI Bond, Explained (#GotBitcoin?)

Grayscale Bitcoin Trust Outperformed Indexes In First Half Of 2019 (#GotBitcoin?)

XRP Is The Worst Performing Major Crypto Of 2019 (GotBitcoin?)

Bitcoin Back Near $12K As BTC Shorters Lose $44 Million In One Morning (#GotBitcoin?)

As Deutsche Bank Axes 18K Jobs, Bitcoin Offers A ‘Plan ฿”: VanEck Exec (#GotBitcoin?)

Argentina Drives Global LocalBitcoins Volume To Highest Since November (#GotBitcoin?)

‘I Would Buy’ Bitcoin If Growth Continues — Investment Legend Mobius (#GotBitcoin?)

Lawmakers Push For New Bitcoin Rules (#GotBitcoin?)

Facebook’s Libra Is Bad For African Americans (#GotBitcoin?)

Crypto Firm Charity Announces Alliance To Support Feminine Health (#GotBitcoin?)

Canadian Startup Wants To Upgrade Millions Of ATMs To Sell Bitcoin (#GotBitcoin?)

Trump Says US ‘Should Match’ China’s Money Printing Game (#GotBitcoin?)

Casa Launches Lightning Node Mobile App For Bitcoin Newbies (#GotBitcoin?)

Bitcoin Rally Fuels Market In Crypto Derivatives (#GotBitcoin?)

World’s First Zero-Fiat ‘Bitcoin Bond’ Now Available On Bloomberg Terminal (#GotBitcoin?)

Buying Bitcoin Has Been Profitable 98.2% Of The Days Since Creation (#GotBitcoin?)

Another Crypto Exchange Receives License For Crypto Futures

From ‘Ponzi’ To ‘We’re Working On It’ — BIS Chief Reverses Stance On Crypto (#GotBitcoin?)

These Are The Cities Googling ‘Bitcoin’ As Interest Hits 17-Month High (#GotBitcoin?)

Venezuelan Explains How Bitcoin Saves His Family (#GotBitcoin?)

Quantum Computing Vs. Blockchain: Impact On Cryptography

This Fund Is Riding Bitcoin To Top (#GotBitcoin?)

Bitcoin’s Surge Leaves Smaller Digital Currencies In The Dust (#GotBitcoin?)

Bitcoin Exchange Hits $1 Trillion In Trading Volume (#GotBitcoin?)

Bitcoin Breaks $200 Billion Market Cap For The First Time In 17 Months (#GotBitcoin?)

You Can Now Make State Tax Payments In Bitcoin (#GotBitcoin?)

Religious Organizations Make Ideal Places To Mine Bitcoin (#GotBitcoin?)

Goldman Sacs And JP Morgan Chase Finally Concede To Crypto-Currencies (#GotBitcoin?)

Bitcoin Heading For Fifth Month Of Gains Despite Price Correction (#GotBitcoin?)

Breez Reveals Lightning-Powered Bitcoin Payments App For IPhone (#GotBitcoin?)

Big Four Auditing Firm PwC Releases Cryptocurrency Auditing Software (#GotBitcoin?)

Amazon-Owned Twitch Quietly Brings Back Bitcoin Payments (#GotBitcoin?)

JPMorgan Will Pilot ‘JPM Coin’ Stablecoin By End Of 2019: Report (#GotBitcoin?)

Is There A Big Short In Bitcoin? (#GotBitcoin?)

Coinbase Hit With Outage As Bitcoin Price Drops $1.8K In 15 Minutes

Samourai Wallet Releases Privacy-Enhancing CoinJoin Feature (#GotBitcoin?)

There Are Now More Than 5,000 Bitcoin ATMs Around The World (#GotBitcoin?)

You Can Now Get Bitcoin Rewards When Booking At Hotels.Com (#GotBitcoin?)

North America’s Largest Solar Bitcoin Mining Farm Coming To California (#GotBitcoin?)

Bitcoin On Track For Best Second Quarter Price Gain On Record (#GotBitcoin?)

Bitcoin Hash Rate Climbs To New Record High Boosting Network Security (#GotBitcoin?)

Bitcoin Exceeds 1Million Active Addresses While Coinbase Custodies $1.3B In Assets

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Zebpay Becomes First Exchange To Add Lightning Payments For All Users (#GotBitcoin?)

Coinbase’s New Customer Incentive: Interest Payments, With A Crypto Twist (#GotBitcoin?)

The Best Bitcoin Debit (Cashback) Cards Of 2019 (#GotBitcoin?)

Real Estate Brokerages Now Accepting Bitcoin (#GotBitcoin?)

Ernst & Young Introduces Tax Tool For Reporting Cryptocurrencies (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.