Trump Administration’s ‘Plunge Protection Team’ Convened Amid Wall Street Rout (#GotBitcoin?)

The president’s Working Group on Financial Markets is known colloquially as the “Plunge Protection Team.”Trump Administration’s ‘Plunge Protection Team’ Convened Amid Wall Street Rout

Here’s What To Know

The Trump administration is arranging a phone call on Monday with top regulators to discuss financial markets amid a rout on Wall Street.

Treasury Secretary Steven Mnuchin will host the call with the president’s Working Group on Financial Markets, known colloquially as the “Plunge Protection Team.”

Washington Has A Plunge Protection Team?

Yes, although it does not deal exclusively with Wall Street panic. The Working Group dates to March 1988 when Washington was still trying to figure out what was behind the “Black Monday” stock market crash of October 1987. Then-President Ronald Reagan created the group to find ways to keep financial markets operating smoothly. The group also met in 2008 during a profound financial crisis and issued recommendations for overhauling banking regulations and rules on mortgage lending. The group, however, does not always meet during a crisis. In 1999, the group issued a report asking Congress to change laws on derivatives markets.

Why Is The Group Meeting Now?

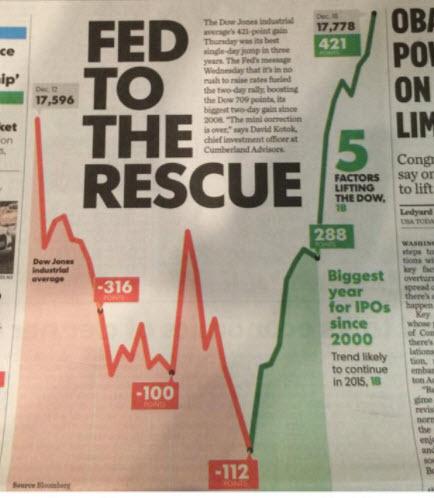

Financial markets are not in crisis but lately they have had a very bad run. The benchmark S&P 500 stock index is on pace for its biggest percentage decline in December since the Great Depression. The Treasury Department on Sunday said the Working Group will discuss “coordination efforts to assure normal market operations.” Financial turbulence is not always a sign of trouble in the economy, but Federal Reserve Chairman Jerome Powell, who is a member of the Working Group, said last week that tighter financial conditions were partly behind a downward shift in economic growth expectations.

Who Else Will Be At The Meeting?

As Treasury secretary, Mnuchin chairs the group. Besides Powell, it also includes the heads of the Securities and Exchange Commission and the Commodity Futures Trading Commission. Mnuchin has also invited representatives from the Comptroller of the Currency and the Federal Deposit Insurance Corporation to participate in the call.

Why Are Financial Markets So Choppy?

Investors are betting U.S. economic growth will slow as a tax cut stimulus fades and as three years of gradual interest rate hikes by the Federal Reserve cool purchases made by businesses and households. Slower growth in the global economy is also weighing on the United States.

Additionally, Wall Street is on edge over reports that U.S. President Donald Trump has privately discussed firing Powell, who was nominated by Trump to be Fed chairman and took the helm at the U.S. central bank in February. The Fed’s independence from politics is widely seen as vital for its mission of keeping inflation under control.

On top of these concerns, Washington is currently roiled by a partial government shutdown that began on Saturday due to a congressional impasse over Trump’s demand for more funds for a wall on the border with Mexico. Financing for about a quarter of federal government programs expired at midnight on Friday.

Plunge Protection Team

“Plunge Protection Team” was originally the headline for an article in The Washington Post on February 23, 1997,[ and has since been used by some as an informal term to refer to the Working Group. Initially, the term was used to express the opinion that the Working Group was being used to prop up the stock markets during downturns. Financial writers for British newspapers The Observer and The Daily Telegraph, along with U.S. Congressman Ron Paul, writers Kevin Phillips (who claims “no personal firsthand knowledge” ) and John Crudele, have charged the Working Group with going beyond their legal mandate. Charles Biderman, head of TrimTabs Investment Research, which tracks money flow in the equities market, suspected that following the 2008 financial crisis the Federal Reserve or U.S. government was supporting the stock market. He stated that “If the money to boost stock prices did not come from the traditional players, it had to have come from somewhere else” and “Why not support the stock market as well? Moreover, several officials have suggested the government should support stock prices.”

In August 2005, Sprott Asset Management released a report that argued that there is little doubt that the PPT intervened to protect the stock market. However, these articles usually refer to the Working Group using moral suasion to attempt to convince banks to buy stock index futures.

Former Federal Reserve Board member Robert Heller, in the Wall Street Journal, opined that “Instead of flooding the entire economy with liquidity, and thereby increasing the danger of inflation, the Fed could support the stock market directly by buying market averages in the futures market, thereby stabilizing the market as a whole.” His statement has been used to claim that the Fed actually did act in that way.[ Some mainstream analysts call those claims a conspiracy theory, explaining that such claims are simplistic and unworkable. Author Kevin Phillips wrote in his 2008 book Bad Money that while he had no interest “in becoming a conspiracy investigator”, he nevertheless drew the conclusion that “some kind of high-level decision seems to have been reached in Washington to loosely institutionalize a rescue mechanism for the stock market akin to that pursued…to safeguard major U.S. banks from exposure to domestic and foreign loan and currency crises.” Phillips infers that the simplest way for the Working Group to intervene in market plunges would be through buying stock market index futures contracts, either in cooperation with major banks or through trading desks at the U.S. Treasury or Federal Reserve.

Market Crisis of 2008

On October 6, 2008, the working group issued a statement indicating that it was taking multiple actions available to it in order to attempt to stabilize the financial system, although purchase of stock shares was not part of the statement.[ The government may wind up owning shares in the firms to which it provided loans, as they will receive warrants as collateral for these loans.

References

- ^ Jump up to:a b “Executive Orders” (published August 15, 2016). March 18, 1988. Retrieved August 10, 2018., which appears and purports to be a copy of the original: National Archives And Records Administration (March 18, 1988). “Executive Order 12631 of March 18 1988: Working Group on Financial Markets”. Federal Register. Library of Congress (published March 22, 1988). 53 (55): 9421. FR Doc. 88-6380. Retrieved August 10, 2018.

- ^ “Plunge Protection Team”. The Washington Post. February 23, 1997.

- ^ Evans-Pritchard, Ambrose (October 30, 2006). “Monday view: Paulson re-activates secretive support team to prevent markets meltdown”. London: Telegraph UK. Retrieved September 15, 2008.

- ^ Wachman, Richard; Jamie Doward Observer (2001-09-16). “Fed to prop up Wall St”. London: Guardian Unlimited. Retrieved September 15, 2008.

- ^ Fromson, Brett. D. (February 23, 1997). “Plunge Protection Team”. Washington Post. Retrieved September 15, 2008.

- ^ Baum, Carolyn (July 31, 2007). “Rubin Should Teach Paulson Secret PPT Handshake”. Bloomberg. Retrieved September 15, 2008.

- ^ Gross, Daniel (August 3, 2008). “Riches to Rags”. The New York Times.

- ^ Bennett, Drake (September 21, 2008). “The Operators Behind a seductive Wall Street conspiracy theory”. The Boston Globe. Retrieved September 21,2008.

- ^ Crawshaw, Julie (2010-01-10). “Biderman: Fed, Gov’t Likely Rigging Market Rally”. Money News. Retrieved April 24, 2012.

- ^ “Sprott Asset Management” (PDF). Retrieved November 13, 2016.

- ^ Federal Government Manipulating Equities Market?

- ^ Bennett, The Boston Globe.

- ^ Jump up to:a b Phillips, K. (2008). Bad Money: Reckless Finance, Failed Politics, and the Global Crisis of American Capitalism. Viking. ISBN 978-0-670-01907-6.

- ^ “Statement by the President’s Working Group on Financial Markets”. United States Department of the Treasury. Retrieved October 6, 2008.

Related Articles:

Probes Reveal Central, US-Based, International Banks All Have Sticky Fingers (#GotBitcoin?)

Major Banks Suspected Of Collusion In Bond-Rigging Probe (#GotBitcoin?)

Some Merrill Brokers Say Pay Plan Urges More Customer Debt (#GotBitcoin?)

Deutsche Bank Handled $150 Billion of Potentially Suspicious Flows Tied To Danske (#GotBitcoin?)

Wall Street Fines Rose in 2018, Boosted By Foreign Bribery Cases (#GotBitcoin?)

U.S. Market-Manipulation Cases Reach Record (#GotBitcoin?)

Poll: We Should Get Rid of The Federal Reserve And Central Banks Because:

Your questions and comments are greatly appreciated.

Monty H. & Carolyn A.

Go back

Leave a Reply

You must be logged in to post a comment.