JPMorgan Chase With It’s JPM ShitCoin Wants To Take On Bitcoin (#GotBitcoin)

Payments is an extremely buzzy corner of the financial sector right now, and JPMorgan Chase wants to dominate it, Credit Suisse analyst Susan Roth Katzke told clients Friday following a meeting with the bank’s management. JPMorgan Chase With It’s JPM ShitCoin Wants To Take On Bitcoin (#GotBitcoin)

The back story. JPMorgan stock (ticker: JPM) is up almost 14% so far this year, just behind the S&P 500 index’s gain of 14.4%. The bank is the largest is the U.S. by assets and is looking to use that position to build a bigger, more profitable payments unit.

Related:

JPMorgan Will Pilot ‘JPM Coin’ Stablecoin By End of 2019: Report

JPMorgan Chase Settles Crypto Credit Card Lawsuit For $2.5M

JPMorgan Provides Banking Services To Crypto Exchanges Coinbase And Gemini

Bitcoin Is The Fraud? JPMorgan Metals Desk Fixed Gold Prices For Years

JPMorgan’s New App Service For Young People Fails

JPMorgan Scams Investors With Phantom Yields In EMBI Indexes

Citigroup, JPMorgan Chase And Others Fined $1.2 Billion Over FX Trading

In January, it combined the formerly separate business units that handled consumer-to-merchant payments and corporate transactions into a new wholesale-payments operation.

In February, the bank rolled out a prototype of a digital coin that will be tested out in transactions with institutional clients.

What’s new. Roth Katzke met with Takis Georgakopoulos, the global head of that new wholesale-payments group, and concluded that the bank’s “management has made it a strategic priority to dominate all aspects, both consumer and corporate.”

Payments, she said, is a business where scale is very important, noting that JPMorgan is making progress on that front with its integration of internal platforms—a process that is now more than halfway done. Additionally, she points out that business lines like Treasury Services are a fragmented market and that the bank can gain from consolidation.

Looking ahead. With revenue growth of between 4% and 5% and a high return on equity, Roth Katze says, JPMorgan’s wholesale payments business is “both strategically important and financially sound.”

Updated: 10-27-2020

JPMorgan’s Stablecoin Finally Sees Commercial Light Of Day

JPMorgan Chase now recognizes blockchain’s profitability and has created a new business dedicated to digital currency and blockchain work.

A year and a half after it was first announced, JPM Coin — JPMorgan Chase’s in-house stablecoin — is now live and in use by a major transnational tech firm for around-the-clock cross-border payments.

According to a report on Tuesday, this real-world proof that the technology is increasing efficiency and reducing costs has bolstered the megabank’s confidence in the technology’s promise and profitability. With the expectation that further commercial clients will sign up to use the stablecoin, JPMorgan Chase has created a dedicated business devoted to digital currency and blockchain work.

The new business unit, dubbed “Onyx,” has over 100 staffers and is being led by Umar Farooq as CEO. Takis Georgakopoulos, JPMorgan Chase’s global head of wholesale payments, told reporters:

“We are shifting to a period of commercialization […] moving from research and development to something that can become a real business.”

On the heels of PayPal’s recent embrace of crypto, incumbents’ confidence that blockchain can actually make them money appears to be on the rise. JPMorgan Chase’s experimentation and development with the technology thus far can be broken up into several key areas.

First, the megabank has been piloting a blockchain-based Interbank Information Network since 2017, involving over 400 participant banks and corporations. JPMorgan Chase believes that the network, now being rebranded as Liink, can bring significant efficiency savings for the complex interactions of corresponding banks in cross-border wholesale payments. JPMorgan Chase itself accounts for cross-border wholesale payment flows of over $6 trillion per day across over 100 different countries.

The bank has also identified blockchain’s usefulness to innovate the existing outdated system for processing “hundreds of millions” of paper checks. Blockchain and digitization can, securely, banish the physical aspects of this exchange altogether. Georgakopoulos said that a new blockchain system is months from commercial launch:

“Using a version of blockchain with the participants being the main issuers of checks and the main operators of lockboxes, it’s possible we can save 75% of the total cost for the industry today, and make checks available in a matter of minutes as opposed to days.”

Lastly, JPMorgan Chase has confidence in blockchain for the creation of new payment rails for global central banks and their evolving central bank digital currencies. Pointing to China and Singapore, Georgakopoulos expressed his confidence that the probability of CBDC adoption is “very high.”

Farooq, the new CEO of Onyx, gave his insights as to why developments have appeared “slow,” or at least equivocal, on the blockchain front at JPMorgan Chase until now:

“If you think about blockchain, we are either somewhere in the trough of disillusionment or just beyond that on the hype curve. That’s why at JPMorgan we’ve been relatively quiet about it until we were ready to scale it and commercialize it.”

Updated: 5-25-2021

JPMorgan Compares The Recent Crypto Plunge To 2017

I wrote on Sunday that the violent action in crypto bore some resemblance to the market peak in December 2017-January 2018. Since then we’ve seen a bit of a rebound, although the big coins are still well off their recent highs.

In a fresh note out last night, JPMorgan Chase’s head of interest-rate derivatives strategy Josh Younger (who has been writing a lot about crypto lately!) published a note getting at the same idea, that this market bears a resemblance to that peak.

Here are two charts showing that nicely. The second one, the seemingly parabolic rise of the non-blue chip cryptos, is particularly powerful in that it offers a very clear indication of the animal-spirits cycle. As the boom goes on, traders make bets on riskier and riskier stuff.

However, Younger notes differences as well. For one thing, the market volatility seems primarily to be a North America phenomenon this time around, with prices much more stable in Europe and Asia. He also notes that while market depth has fallen in the recent liquidations, the markets remain healthy overall.

His Conclusion:

We continue to see evidence of resilient microstructure in cryptocurrency markets: the volatility spike appears somewhat regionally localized, market depth is down but has not cratered despite these moves, and derivatives pricing has managed to adjust quickly enough to retain a decent fraction of the levered long base. This all argues against the view that we are in the midst self-reinforcing vicious cycle of price declines—a classic run scenario.

This is really the key question right here. As many people have pointed out, the crypto market is highly reflexive. Historically when prices go up, they go up fast because everyone wants in. And when prices then go down, they go down fast and stay down because people don’t want to hold the stuff or buy the stuff if the line isn’t going up.

It seems plausible that, with greater institutional ownership and perhaps a greater number of true believers, this bout of selling won’t beget selling the same way it did in the past. Plus we’ve seen crypto continue to not die, despite a million obituaries having been written.

Updated: 3-22-2021

Jamie Dimon May Soon Turn Away Deposits In Order To Comply With Simple Leverage Regulation, And He’s Not Happy

It’s a strange problem: JPMorgan Chase and other big banks are getting more assets than they even want.

You don’t need to feel too sorry for Jamie Dimon, the chief executive officer of JPMorgan Chase & Co., the largest bank in the U.S. by assets and the largest in the world by trading and fee revenue. But it’s easy to see why he might be miffed at the Federal Reserve at the moment.

On March 19, the Fed announced that a temporary regulatory break for banks will expire as scheduled on March 31. Dimon had told investment analysts in January that if the break went away, his bank would have a financial incentive to turn away deposits, as it has done in the past (for large institutional deposits, that is; the bank still likes retail deposits, which tend to be sticky and produce other banking business).

Here’s a snippet from the Jan. 15 earnings call as I transcribed it from Bloomberg’s recording:

Dimon:

Remember, we were able to reduce deposits $200 billion within like months last time.

Jennifer Piepszak, Chief Financial Officer:

Yeah.

Dimon:

But we don’t want to do it. It’s very customer unfriendly to say, “Please take your deposits elsewhere … .”

It’s common for Jamie Dimon to complain about “gold-plated” banking regulation, but in this case he seems to have a point. A Fed regulation that makes it unprofitable for banks to take in deposits—when taking in deposits has always been a key function of banks—is a bit hard to justify.

How we got to this point is complicated but interesting. The old style of bank regulation was to limit the leverage of banks. It was analogous to how banks themselves require homebuyers to have some skin in the game. Homebuyers have to put in some of their own money so the mortgage loan they get is smaller than the value of the house they’re purchasing.

That way, if the homeowner stops making payments, the bank can seize the house, sell it, and get back what it lent. Similarly, under simple leverage regulation, banks had to show that the value of their assets (such as the loans they make and cash in the vault) was substantially greater than their liabilities (such as the deposits they take in, which is money they owe to the depositors). Roughly speaking, the excess of assets over liabilities was called capital.

But that simple system failed. Banks can make more money by going big on risky assets like high-interest loans than by investing in safe, low-yielding stuff like Treasury securities.

And as long as regulators treated all assets alike, it made sense to load up on risky ones.

But risky assets are more likely to go bust, so regulators wisely started taking the safety of different assets into account.

It was a big improvement, but not perfect: Some banks understated the riskiness of their assets, which became a problem in the global financial crisis of 2008-09. For instance, some loaded up on the debt of their national governments because it was given a zero risk-weighting, when in fact it was highly risky.

The new system is belt and suspenders. The belt is risk-weighted capital regulation, under which riskier assets require a bank to have more capital against them, while very safe assets require little or none. There’s also a backup system—the suspenders—where all assets are treated alike, just as in the old days.

This is called the supplementary leverage ratio. It was agreed to by a wide range of nations under the auspices of the Bank for International Settlements and took effect in 2018. The SLR is meant to deal with situations where a bank has loads of assets that aren’t as safe as they’re said to be.

The suspenders are supposed to hang loose most of the time while the belt does the real work of holding up the pants, so to speak. In last year’s Covid-19 recession, though, banks suddenly got flooded with more assets than they could handle.

The Fed bought Treasuries to drive down interest rates and paid for them by creating reserves, which show up as assets on banks’ balance sheets. Businesses drew down lines of credit and deposited the proceeds in banks. Consumers’ bank accounts were swollen by government relief checks.

Demand for consumer and business loans was weak, so banks stashed most of the incoming money in Treasury securities or left it in cash. (Funds from customers are both an asset to the bank, because they can invest the money, and a liability, because they have to return it someday.)

Suddenly the suspenders weren’t so loose anymore. Without even trying, banks had acquired a lot more assets on their balance sheets. Most were supersafe, but the SLR applied equally to every dollar of them, regardless of their safety.

Realizing there was a problem, the Federal Reserve and other federal bank regulators in May 2020 exempted Treasuries and reserves at the Fed from the calculation of the supplementary leverage ratio.

Not permanently, but through March 31, 2021. It said the exemption “will provide flexibility to certain depository institutions to expand their balance sheets in order to provide credit to households and businesses in light of the challenges arising from the coronavirus response.”

This year banks lobbied vigorously for the exemption to be extended or even made permanent, but, as mentioned above, on March 19 the Fed said without explanation that the exemption would end at the end of the month.

What happens now? Nothing right away. Banks have more capital than they need, so they won’t have to shed assets starting April 1. Zoltan Pozsar, an analyst at Credit Suisse Group AG, wrote in a note to clients on March 16, ahead of the Fed announcement, that “Neither the Fed nor the market should fear mayhem if the exemption expires.”

One key reason, he said, is that the major banks won’t be affected by the expiring exemption because they never opted into it in the first place for their operating subsidiaries. And, he wrote, 90% of the currently exempt Treasuries and Fed reserves are being held at the operating subsidiary level.

In the longer run, though, there could be problems. Pozsar wasn’t quite as blithe when he discussed the SLR on the Odd Lots podcast aired by Bloomberg on March 3. If banks such as JPMorgan Chase push away institutional deposits by charging fees or putting on negative interest rates, the money will spill into money-market funds, he predicted. But these funds won’t have any good place to put the money either, he said.

If they pour into Treasury bills, they could push the bill yields negative. But money-market funds can’t afford to earn negative returns because they promise to pay back investors 100 cents on the dollar.

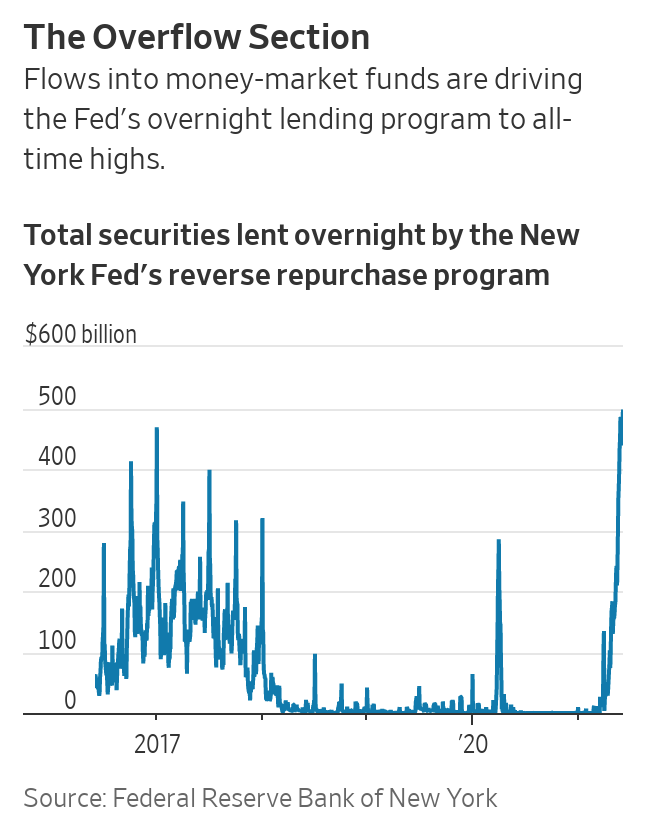

Pozsar said the Fed system could assist by allowing money-market funds to stash more money with it through overnight reverse repurchase agreements. The Federal Reserve Bank of New York did just that two weeks later, announcing on March 17 that it would allow each of its counterparties to do overnight reverse repos of $80 billion a day, up from $30 billion previously.

Pozsar, who used to work for the New York Fed, called that “foaming the runway” for the March 31 expiration of the SLR exemption.

In 2014, when the supplementary leverage ratio was under discussion, Fed staff predicted [PDF] that the impact of the enhanced version of the ratio on the biggest banks would be modest because, after all, the Fed was about to start shrinking its balance sheet. In reality, the balance sheet is bigger than ever now and still growing.

As the Fed continues to buy Treasuries and mortgage bonds and pays for them with reserves, banks’ assets will continue to swell, and eventually the supplementary leverage ratio could become the “binding constraint” on the banks’ behavior; the suspenders will become tight. That would be a return to the bad old days.

Some of the resistance to keeping the leverage exemption in place past March 31 is based on concerns that banks need bigger safety buffers. That’s a legitimate concern. But the question of how much capital banks need is separate from the question of how those capital levels should be determined.

There area actually four ways of setting capital: risk-weighted capital, supplementary leverage ratio, post-stress estimate of risk-weighted capital, and post-stress estimate of supplementary leverage ratio. That ends up causing confusion and treating banks differently when they’re engaged in the same activities.

It’s “not clear you can fix the gaming of one rule by adding more rules,” says a 2017 presentation [PDF] by Robin Greenwood, Sam Hanson, Jeremy Stein, and Adi Sunderam of Harvard University and the National Bureau of Economic Research for a Brookings Papers on Economic Activity conference.

Their preference: a single standard that takes into account stressful scenarios and is “generally more sensitive to the kinds of data that you wouldn’t want to bake into a hard rule.”

The Fed may end up having more to say about this.

Updated: 6-9-2021

Banks To Customers: No More Deposits, Please #GotBitcoin

Some banks have warned the growing deposits could force them to raise more capital, or say no to deposits.

“Raising capital against deposits and/or turning away deposits are unnatural actions for banks and cannot be good for the system in the long run,” Jennifer Piepszak, then-CFO of JPMorgan Chase & Co., said on a call with analysts in April.

Flows into U.S. money-market funds have surged in recent months, pushing the total assets held in such funds to $4.61 trillion, just shy of the record set in May 2020, according to the Investment Company Institute.

Top of mind for many big banks is a rule requiring them to hold capital equivalent to at least 3% of all assets. Worried about the rule’s impact during the pandemic, the Fed changed the calculation in 2020 to ignore deposits the banks held at the central bank, but ended that break this March.

Banks have several options for unloading client deposits, though they try not to offend their customers in the process.

One strategy is reverse tiering, giving clients lower yields for additional deposits. Asking customers to move some funds to another, smaller bank also is an option, said Pete Gilchrist, an executive vice president at Novantas Inc., which advises banks.

In recent months, banks including BNY Mellon have focused on moving clients from deposits into money-market funds, which are common cash-like investments. Assets in money-market accounts, even ones run by the same bank, are treated differently under bank capital rules, alleviating some of the regulatory pressure.

Some banks, awash in deposits, are encouraging corporate clients to spend the cash on their businesses or move it elsewhere.

U.S. companies are holding on to billions of dollars in cash. Their banks aren’t sure what to do with it.

When the coronavirus pandemic hit last year, corporate executives rushed to raise money. Banks have been holding that cash ever since, and because companies are reluctant to borrow from them, they can’t turn it into income-generating loans.

That has weighed on banks’ profit margins, and some have started pushing corporate customers to spend the cash on their businesses or move it elsewhere.

Bankers say they thought the improving economy would reduce companies’ desire for holding cash, but deposit inflows have continued in recent weeks.

Chief financial officers and treasurers, many still wary of the pandemic’s impact, say they aren’t ready for big changes, even if they earn little or nothing on their deposits.

“We have been operating with a higher cash balance for about 12 months now,” said Matthew Ellis, the chief financial officer of telecommunications company Verizon Communications Inc. “There’s been no decision yet if and when to bring it down.”

Verizon held $10.2 billion in cash and cash equivalents at the end of the first quarter, up 45% from a year earlier.

Pascal Desroches, who manages the finances of rival AT&T Inc., said the company doesn’t plan to move its cash holdings into other investments to generate a higher return. “We are not looking to optimize the yield,” he said.

Companies flooded U.S. banks with deposits at the start of the pandemic. In March 2020, the Federal Reserve lowered interest rates to near zero and launched bond-buying programs, which enabled many companies to raise funds at low costs. The Treasury Department also made loans, including to airlines.

Bank deposits have continued to surge this year. Between late March and May 26, they rose by $411 billion to $17.09 trillion, according to the latest available data from the Federal Reserve.

That is slower than the pace last spring, but still nearly four times the average of the past 20 years, according to the Fed data.

High deposits usually aren’t a bad thing for banks, as long as they can use the money to make loans. But bank lending has been slow as many companies prefer to borrow money from investors. For banks, total loans equaled 61% of all deposits as of May 26, down from 75% in February 2020, according to the Fed data.

The industry net-interest margin, a key measure of lending profitability, fell to a record low in the first quarter, according to the Federal Deposit Insurance Corp.

Some banks are encouraging corporate customers to consider alternatives. “Banks would certainly like to do different things, obviously,” said Peter Mariani, CFO of Axogen Inc., a company specializing in nerve-repair research. “But we’re going to maintain our…conservative investment strategy with our cash.”

“We’ve been very successfully working with our clients to basically explore and move some of those nonoperational deposits,” said Emily Portney, CFO at Bank of New York Mellon Corp.

The money-market funds, in turn, need new places to park all that new cash and earn some interest. But rock-bottom interest rates have pushed them into storing it back at the Federal Reserve overnight, in a facility that pays them zero return and had been largely ignored for the past three years.

Funds stored overnight with the Federal Reserve Bank of New York surged in May and hit a record of $497.4 billion on Tuesday.

Finance chiefs say holding on to cash is sensible, for now.

“Having a bit more cash than you normally would still makes good business sense now as we aren’t really out of the pandemic yet,” said Jeff Shepherd, the CFO of Advance Auto Parts Inc., which is based in Raleigh, N.C.

Updated: 3-14-2024

JPMorgan Hit With Nearly $350 Million Fine For Compliance Failures In Trading

Federal regulators allege that JPMorgan didn’t properly oversee and monitor trades that the bank and clients carried out through its systems.

Federal regulators fined JPMorgan Chase roughly $350 million on Thursday for failing to properly monitor billions of trades that the bank has executed since 2019.

The Federal Reserve said JPMorgan didn’t adequately surveil trading and order activity through the firm’s corporate and investment bank across 30 exchanges and other trading venues. The trades were for the firm and for clients.

Regulators and law enforcement require banks to watch and record clients and trades as a front line in market policing and to ensure their own risks are under control. Banks are required to flag suspicious activity and hand over documents to investigators when asked.

JPMorgan agreed to pay a combined $348.2 million penalty to its regulators at the Fed and the Office of the Comptroller of the Currency, without admitting or denying the allegations.

“Certain remedial actions are complete and others are under way, and we have not found any employee misconduct or harm to clients or the market in our review,” a spokesman for JPMorgan said.

JPMorgan also said that it is in discussions to resolve claims with a third regulator over its collection of client data related to trading.

In the settlements, JPMorgan agreed to review the old trading data to ensure that no market misconduct had taken place and to take appropriate action if needed.

The bank isn’t allowed to trade on new exchanges or trading venues without permission from the Federal Reserve.

Additionally, JPMorgan agreed to appoint a compliance committee that would ensure the bank is better overseeing its trading business.

In February, JPMorgan disclosed that the bank had received inquiries from the U.S. government regarding the surveillance of trades that the bank executed. It said then that the bank had subsequently identified some failures in JPMorgan’s commercial and investment bank.

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

Bitcoin To Be Exposed To Millions With Upcoming “60 Minutes” Segment (#GotBitcoin?)

Grayscale To Investors: Drop Gold (#GotBitcoin?)

Tether Ordered To Freeze Transfers To Bitfinex By New York Supreme Court, Bitcoin Flash Crashes

HTC Smartphone Will Run A Full Bitcoin Node (#GotBitcoin?)

Send Bitcoin Transactions Without Internet Connection

Bitcoin’s Lightning Comes To Apple Smartwatches With New App (#GotBitcoin?)

E-Trade To Offer Crypto Trading (#GotBitcoin)

Bitfinex Used Tether Reserves To Mask Missing $850 Million, Probe Finds (#GotBitcoin?)

21-Year-Old Jailed For 10 Years After Stealing $7.5M In Crypto By Hacking Cell Phones (#GotBitcoin?)

You Can Now Shop With Bitcoin On Amazon Using Lightning (#GotBitcoin?)

Afghanistan, Tunisia To Issue Sovereign Bonds In Bitcoin, Bright Future Ahead (#GotBitcoin?)

Crypto Faithful Say Blockchain Can Remake Securities Market Machinery (#GotBitcoin?)

Disney In Talks To Acquire The Owner Of Crypto Exchanges Bitstamp And Korbit (#GotBitcoin?)

Crypto Exchange Gemini Rolls Out Native Wallet Support For SegWit Bitcoin Addresses (#GotBitcoin?)

Binance Delists Bitcoin SV, CEO Calls Craig Wright A ‘Fraud’ (#GotBitcoin?)

Bitcoin Outperforms Nasdaq 100, S&P 500, Grows Whopping 37% In 2019 (#GotBitcoin?)

Bitcoin Passes A Milestone 400 Million Transactions (#GotBitcoin?)

Future Returns: Why Investors May Want To Consider Bitcoin Now (#GotBitcoin?)

Next Bitcoin Core Release To Finally Connect Hardware Wallets To Full Nodes (#GotBitcoin?)

Major Crypto-Currency Exchanges Use Lloyd’s Of London, A Registered Insurance Broker (#GotBitcoin?)

How Bitcoin Can Prevent Fraud And Chargebacks (#GotBitcoin?)

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Zebpay Becomes First Exchange To Add Lightning Payments For All Users (#GotBitcoin?)

Coinbase’s New Customer Incentive: Interest Payments, With A Crypto Twist (#GotBitcoin?)

The Best Bitcoin Debit (Cashback) Cards Of 2019 (#GotBitcoin?)

Real Estate Brokerages Now Accepting Bitcoin (#GotBitcoin?)

Ernst & Young Introduces Tax Tool For Reporting Cryptocurrencies (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.