Goldman Sachs Gets Bullish On Bitcoin (#GotBitcoin)

In a note to customers, Goldman Sachs gave a bullish forecast for Bitcoin price. Shared on Twitter, Aug. 11, the note suggests a short-term target of $13,971. Goldman Sachs Gets Bullish On Bitcoin (#GotBitcoin)

Bullish Analysis Based On Elliott Waves

The target given is based on Elliott Wave Theory, which forecasts market trends by identifying extremes in investor psychology, along with price highs and lows.

According to the analyst, Bitcoin will rebound from support around $11,094, leaving room for at least one leg higher towards $12,916 and $13,971. This could complete a V wave count from July, producing a short-term top or consolidation.

The Bigger Picture, And Longer-Term Forecast

Potentially, the analyst suggests, this could be the first leg of a five wave count. This would mean that any retracement from $12,916-$13,971 levels presents a buying opportunity, as after the consolidation period, price could once again resume higher unless it goes below the previous recent low of $9,084.

The Note Suggests A Short-Term Stop At $10,791.00

Goldman Sachs increasingly interested in Bitcoin and cryptocurrency

Goldman Sachs has taken an increasing interest in the cryptocurrency market.

As Cointelegraph reported, in the last month it has gone from “looking at [the] potential” of launching its own virtual token, to making hires to accelerate the program.

Updated: 10-12-2020

Short The Dollar: How Goldman’s Bearish Stance Uplifts Bitcoin Q4 Sentiment

Analysts at Goldman Sachs are bearish on the U.S. dollar in the near term.

Goldman Sachs, the $71.4 billion investment bank, is reportedly bearish on the U.S. dollar. For Bitcoin (BTC), which has recently rallied above the dreaded $11,100 level, this could serve as a potential catalyst.

Bitcoin is heading into the last two months of the year with significant uncertainty. But if the dollar continues to slump, it could buoy the momentum of BTC and gold in the fourth quarter.

Why Goldman Sachs Is Not Optimistic On The Dollar

Zach Pandl, the co-head of Global FX, Rates, and EM Strategy at Goldman, predicts the dollar to hit 2018 lows.

In a note to clients obtained by CNBC, Pandl and his team of analysts pinpointed two major factors. First, Pandl said the potential “blue wave” election remains a significant risk to the U.S. Dollar Index (DXY). Second, the prospect around COVID-19 vaccines remains unclear.

On Sept. 30, Moderna CEO Stéphane Bancel told the FT that the vaccine would not likely be ready until after the election.

The lack of clarity on the production and distribution of vaccines, as well as the election risk, could hinder the dollar’s momentum. Pandl wrote:

“In our view, a ‘blue wave’ U.S. election and favorable news on the vaccine timeline could return the trade-weighted Dollar and DXY index to their 2018 lows.”

If the dollar drops, it would naturally benefit alternative stores of value like Bitcoin and gold. Since alternative assets are priced against the dollar, the decline of the DXY causes other stores of value to rise.

Atop the declining dollar, Pandl additionally noted that potential vaccine breakthroughs could boost risky assets. As such, if institutions view Bitcoin as a risk-on asset, it could further boost the sentiment around BTC. Pandl wrote:

“To be sure, there are important risks: we are most uncertain about the length of the vote count (especially for the Senate) and the equity market reaction to a ‘blue wave’. But the wide margin in current polls reduces the risk of a delayed election result, and the prospect for near-term vaccine breakthroughs may provide a backstop for risky assets.”

Bitcoin Technical Structure Remains Optimistic

A persistent narrative around the medium-term performance of Bitcoin has been its high time frame structure.

The weekly and monthly charts of Bitcoin remain highly positive due to BTC’s reaction from the $10,500 to $10,700 support range.

On Oct. 12, Bitcoin surged above $11,500 for the first time since September, demonstrating strong momentum.

The recovery of BTC above the $11,300 resistance level is critical because it follows a series of negative events in October.

From charges against BitMEX to U.S. President Donald Trump’s pushback on the stimulus, BTC faced numerous occurrences that could have led to a sharp pullback.

Following a prolonged period of stagnance throughout September, the recent price action of Bitcoin remains positive.

Updated: 1-12-2021

Goldman Sachs Says Bitcoin Is On The Path To Maturity

Analyst Jeff Currie believes more institutional money is needed to stabilize the market.

In an interview with CNBC, Currie said Bitcoin’s remarkable run has attracted greater institutional interest, but noted that smart-money investors are still a tiny fraction of the overall market. They will need to come in droves for Bitcoin to become a stable asset and avoid a flash crash like we saw earlier this week, he said.

“I think the market is beginning to become more mature,” Currie said of Bitcoin, adding that “volatility and those risks that are associated with it” are common for nascent assets.

He Continued:

“The key to creating some type of stability in the market is to see an increase in the participation of institutional investors and right now they’re small […] roughly 1% of it is institutional money.”

Some of Wall Street’s biggest names have thrown their weight behind Bitcoin over the past year. Legendary investors Paul Tudor Jones and Stanley Druckenmiller have already invested in the digital asset, and firms like MassMutual and Ruffer Investment Company have acquired sizable positions in BTC.

Last month, Anthony Scaramucci’s hedge fund, SkyBridge Capital, submitted an application with the Securities and Exchange Commission to launch a new Bitcoin fund.

That’s on top of the tens of billions invested by MicroStrategy, Grayscale, PayPal and Square combined.

Goldman Sachs has even changed its tune on Bitcoin and cryptocurrencies more generally. The firm has not only beefed up its human resources to include digital currency experts, but it has also issued guidance on the peaceful coexistence of Bitcoin and gold as macro hedges.

Coinbase, one of the world’s largest crypto exchanges, has also reportedly tapped Goldman for its forthcoming IPO.

After more than a decade of extreme price volatility, Bitcoin (BTC) is finally starting to mature as an asset class, according to Jeffrey R. Currie, Goldman Sachs’ global head of commodities research.

Updated: 3-9-2021

Bitcoin’s 2021 Returns Destroy Everything On Wall Street, Goldman Sachs Says

Bitcoin’s lead over assets from stocks to bonds, oil, banks, gold and tech stocks and the euro has widened.

Goldman Sachs, the storied Wall Street firm, didn’t start including bitcoin in its weekly ranking of global asset-class returns until late January, when the largest cryptocurrency quietly appeared atop the chart.

But since then, bitcoin’s lead over assets from stocks to bonds, oil, banks, gold and tech stocks and the euro has widened.

As of March 4, bitcoin’s year-to-date return, at about 70%, was roughly double that for the next-closest competitor, the energy sector, at about 35%, according to Goldman Sachs’ latest “U.S. Weekly Kickstart” report.

The comparisons could become even more flattering to bitcoin now that a recent bout of selling in U.S. stocks has taken the Standard & Poor’s 500 Index’s year-to-date return to roughly zero – flat on the year.

* The recovery in oil prices and real yields has boosted year-to-date returns for cyclical sectors such as energy and financials, which are nevertheless underperforming bitcoin.

* Crude oil and energy have a higher risk-adjusted return (Sharpe ratio) than bitcoin so far this year.

* Gold is the worst-performing asset class year-to-date, as rising yields have punished traditionally defensive sectors such as consumer staples and utilities.

* Based on prior CoinDesk reporting, bitcoin is viewed by many investors both in crypto and traditional markets as a potential inflation hedge, especially in an era where central banks around the world are pumping trillions of dollars of freshly created money into financial markets to stimulate coronavirus-racked economies. Even so, gold has lost about 10% on the year, prompting some market observers to argue that bitcoin is stealing market share from the yellow metal.

* According to a survey, some 40% of Goldman clients have exposure to cryptocurrencies.

* That’s the case even though, as recently as May 2020, Goldman’s money-management division argued in a presentation that cryptocurrencies were “not a suitable investments for our clients,” merely a beneficiary of a “mania” worse than the infamous run on Dutch tulips in the 1600s.

Updated: 5-6-2021

Reports Suggest Goldman Sachs Is Now Offering Bitcoin Derivatives

According to a new report, the investment firm is now offering trading with non-deliverable forwards.

Investment banking giant Goldman Sachs has reportedly opened up futures trading on Bitcoin to Wall Street executives.

According to Bloomberg Law, last month the investment firm began offering trading with non-deliverable forwards, a derivative tied to the price of Bitcoin (BTC) — roughly $56,000 at the time of publication — for which investors can get paid in fiat. Goldman Sachs reportedly lessens its risk to the crypto asset’s infamous volatility by buying and selling Bitcoin futures in block trades on the Chicago Mercantile Exchange, or CME, Group using the crypto trading unit of DRW Holdings, Cumberland.

Goldman has been seemingly increasing its exposure to the crypto market following price surges in tokens and institutional players like Tesla adopting cryptocurrencies. Rumors have persisted that the investment firm plans to set up a cryptocurrency trading desk after first announcing one during the 2017 bull run.

Updated: 5-19-2021

Bitcoin Proxy Stocks Tumble As BTC Tanks

Crash in the leading cryptocurrency hitting related companies.

Stocks of publicly traded companies tied closely to the fate of bitcoin are following the leading cryptocurrency into a sea of red Wednesday.

* With BTC down roughly 20% in the last 24 hours, leading bitcoin proxy stocks have followed suit.

* MicroStrategy, the business intelligence firm with billions in bitcoin reserves, is down 10% to $435 in the last 24 hours.

* Square, the owner of Cash App and another holder of bitcoin reserves, is down 3% to $197.

* Coinbase, the leading crypto exchange in the U.S., is down 7% and flirting with all-time lows at $222.

* Even furniture maker Ethan Allen, the shares of which have benefited from the rise in ether due to the company’s stock ticker being ETH, may now be paying the price for that association today, falling 5% to $27.

* The Bitwise Crypto Industry Innovators ETF, which tracks 30 prominent publicly listed crypto firms, is down 9.3% at press time.

Updated: 3-27-2021

Goldman Sachs Says Blockchain Stocks On Average Outperform S&P 500 (But Not Bitcoin)

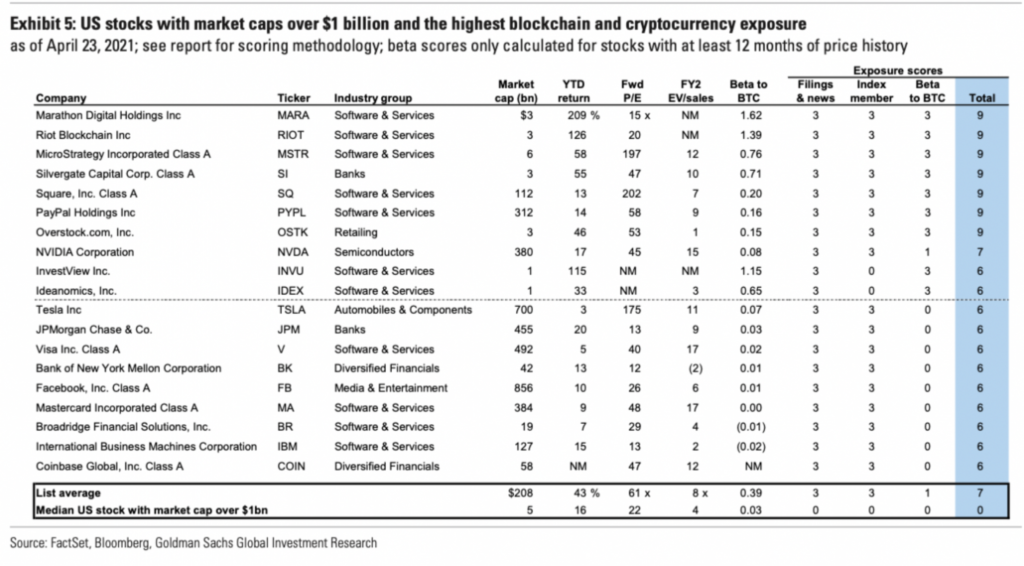

Goldman Sachs identified 19 blockchain and cryptocurrency related stocks that have outperformed the S&P 500 this year.

U.S. stocks exposed to blockchain and cryptocurrencies have outperformed the Standard & Poor’s 500 Index by about 34 percentage points for the year to date, according to Goldman Sachs. It is a reminder of how the fast-growing technologies’ appeal extends to investors in traditional markets.

The Wall Street firm identified 19 stocks with a market capitalization of at least $1 billion and high exposure to blockchain technology or cryptocurrencies.

On average, the stocks have climbed 46% year to date, versus 12% for the S&P 500, according to the Goldman report dated April 26. Notably, the average lagged behind a direct bet on bitcoin (BTC), which gained 89% over the period.

Marathon Digital Holdings (NASDAQ: MARA), Riot Blockchain (NASDAQ: RIOT), and Microstrategy (NASDAQ: MSTR) were included in Goldman’s blockchain exposed stock list. Also included were traditional financial companies like JPMorgan Chase (NYSE: JPM) and Visa (NYSE: V).

Goldman selected stocks included in blockchain indexes and ETFs, calculated the sensitivity of stock prices to bitcoin during the past 12 months and then scanned company filings to identify 19 stocks with blockchain exposure.

“An equal-weighted portfolio of the stocks has demonstrated roughly 60% correlations with bitcoin and the Bloomberg Galaxy Crypto Index during the last several months, compared with 20% correlations for the S&P 500,” according to Goldman.

11 of the 19 blockchain stocks are in the software and services industry and trade at twice the price-to-earnings valuation as the median U.S. stock.

The basket of blockchain stocks underperformed the S&P 500 by roughly 10% over the past two weeks as cryptocurrency prices dipped but outperformed by about 2% on Monday as bitcoin retraced nearly 30% of the prior sell-off.

Coinbase Closes At A Record Low After Wild Bitcoin Session

Coinbase Global Inc. closed at a record low after a wild trading session that saw the price of Bitcoin swing by about $10,000.

The largest U.S. cryptocurrency exchange fell as much as 13% before paring the loss to close down 5.9% at $224.80 amid a broader rout in cryptocurrencies. Coinbase reported “intermittent downtime” on its platform, before saying it had identified and fixed the issue while Binance, the world’s biggest cryptocurrency exchange, temporarily disabled Ethereum withdrawals citing network congestion.

Bitcoin plunged as much as 31% and approached $30,000 before rebounding to about $40,000 at 4 p.m. New York time. The cryptocurrency has now erased nearly all the gains it made following Tesla Inc.’s Feb. 8 announcement that it would add the asset to its balance sheet. A statement from the People’s Bank of China Tuesday reiterating that digital tokens can’t be used as a form of payment added to the selloff. Ethereum lost more than 40%, while Dogecoin declined 45%, before joining in Bitcoin’s rebound.

The broader U.S. stock market also made up some ground with the S&P 500 Index closing down 0.3% and the Nasdaq 100 Index up 0.2% after both lost more than 1.6% earlier in the session.

MicroStrategy Inc. was down 6.6% after losing as much as 16% earlier. On Tuesday, the enterprise-software company known for its bullish bets on cryptocurrencies disclosed that it bought another 229 Bitcoin, bringing its total to over 92,000. It has now erased about two-thirds of its value from its February high.

Amid other crypto-connected stocks, Bit Digital Inc. was down 17%, Ebang International Holdings lost 9.8%, and Marathon Digital Holdings Inc. and Riot Blockchain Inc. both slid 5.6%.

Updated: 5-20-2021

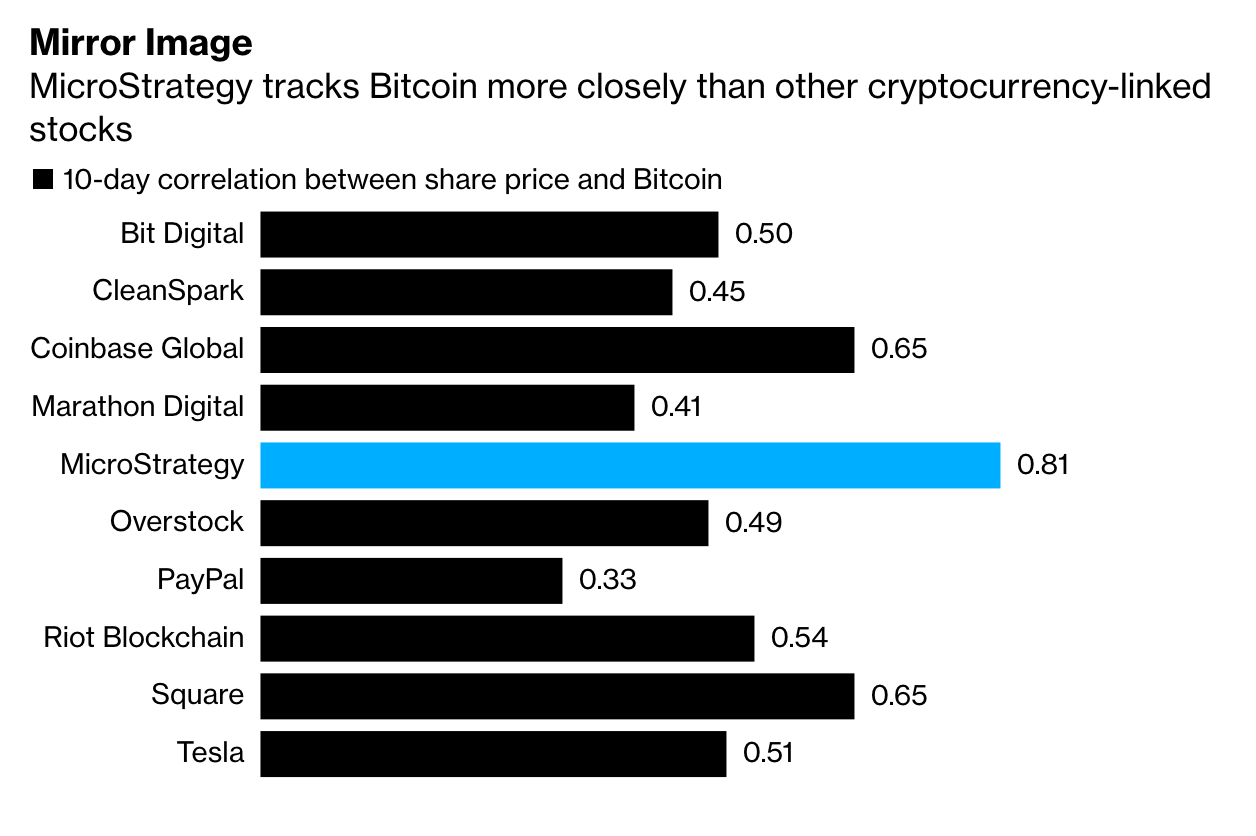

Scared of Bitcoin? MicroStrategy Is Just As Good

MicroStrategy Inc.’s shares may as well be Bitcoin, based on how closely they track each other. The business-intelligence software maker’s correlation with the cryptocurrrency amounted to 0.81 in the 10 trading days ended Wednesday, according to data compiled by Bloomberg. The figure was the highest among 10 U.S. stocks linked to Bitcoin and its peers, including Coinbase Global Inc., which runs a marketplace for trading the currencies. MicroStrategy’s ties reflect its investment in Bitcoin, which totaled about $2.25 billion as of Tuesday.

Updated: 5-25-2021

Crypto Stocks Solve Volatility Issue, Goldman Sachs Analysts Say

Coinbase stock is the best way for investors to gain exposure to the crypto industry and avoid volatility, according to Goldman Sachs analysts.

Wall Street megabank Goldman Sachs has initiated coverage of United States cryptocurrency exchange Coinbase with a buy rating following a major crash on crypto markets.

In a note to clients on Monday, Goldman Sachs analyst Will Nance stated that Coinbase stock is the best way for investors to gain exposure to the crypto industry, CNBC reported. According to the report, shares of crypto companies like Coinbase should be regarded as a hedge against the parabolic volatility of cryptocurrencies like Bitcoin (BTC).

“While we believe the core business today offers an attractive growth profile with the potential to drive new high levels of profitability, we see significant white space for new initiatives to drive more stable and recurring revenue streams to complement the core trading business over the longer term,” the analysts reportedly wrote.

In the buy rating for Coinbase shares, Goldman Sachs analysts set a 12-month price target of $306, implying a share price increase of 36%. However, Coinbase’s longer-term fate will depend on the continued success or failure of cryptocurrencies as an asset class, the client note reportedly reads.

Following the newly initiated buy rating, shares of COIN rose nearly 3.5% to over $235 in premarket trading. The stock debuted on Nasdaq on April 14 at a price of $381. The price rebound comes in line with a notable uptick on crypto markets, with Bitcoin surging more than 4% over the past 24 hours to trade above $37,400.

The latest buy rating is not the first time that Goldman Sachs mentioned Coinbase as a successful stock. In late April, Goldman Sachs mentioned Coinbase as one of 19 U.S. stocks performing significantly better than the S&P 500.

Previous reports in December 2020 suggested that Coinbase was looking to Goldman Sachs to handle its public filing.

The latest news comes shortly after Goldman Sachs reportedly launched Bitcoin derivatives trading to Wall Street executives in early May.

Wall Street Aims To Make Sense of Confounding Bitcoin Swings

Wall Street strategists face an almost impossible task in trying to analyze the outlook for Bitcoin and other tokens after a volatile rout. Even so, they are still trying, and some see the risk of more trouble ahead.

At JPMorgan Chase & Co., a team led by Nikolaos Panigirtzoglou reckons it’s premature to call the end of the Bitcoin selloff. Meanwhile, in a wide-ranging report, Goldman Sachs Group Inc. signaled that extreme swings hamper crypto’s appeal for institutional investors. And Medley Global Advisors LLC warned of the threat of spillovers if Bitcoin drops well below $20,000.

“It is too early to call the end of the recent Bitcoin downtrend,” the JPMorgan strategists wrote Friday, citing in part momentum signals and a lack of buying in Bitcoin funds and regulated futures.

The largest cryptocurrency rebounded on Monday, climbing 9% to $36,800 as of 8:42 a.m. in London after another weekend of big gyrations. Bitcoin’s drop of more than 40% from a mid-April record headlines a cryptocurrency crash that’s become emblematic of waning speculative zeal.

Cryptos have suffered a range of blows in recent days, from Elon Musk’s criticism of Bitcoin’s energy use and about face on accepting it for payments, to heightened regulatory rhetoric from China.

High-profile figures like Mark Cuban have also flagged the risk that some leveraged investors have to unwind their positions, something he described on Twitter as the “Great Unwind.”

In a multi-part report, Goldman Sachs authors including Allison Nathan, Jeffrey Currie, Zach Pandl and Christian Mueller-Glissmann flagged a variety of trends. That included Ether’s potential to overtake Bitcoin as a store of value and crypto volatility that may pose a challenge for institutional buyers.

Mathew McDermott, global head of digital assets at Goldman Sachs, also wrote that the company is looking at crypto-related offerings, such as “fund or structured note-like products.”

Aside from the sheer scale of the slump in virtual currencies last week — the Bloomberg Galaxy Crypto Index fell almost 40%, the most since the pandemic turmoil in March last year — massive intraday price swings have also captivated investor attention.

Risk-Adjusted Returns

Still, RBC derivatives strategist Amy Wu Silverman argued in a note Sunday that based on a measure of risk-adjusted returns known as the Sharpe ratio, Bitcoin has done better than shares in Tesla Inc., the SPDR S&P 500 ETF Trust or Invesco QQQ Trust Series 1.

Bitcoin, Ether and meme virtual currencies like Dogecoin are still sitting on major gains over longer time-frames, such as the past year — about 12,000%, in the case of Dogecoin.

For Ben Emons, managing director of global macro strategy at Medley Global Advisors in New York, Bitcoin is “firming its grip on markets through volatility, liquidity and correlation.”

Crypto-Exposed Stocks Slide As BTC-Bolstered Treasuries Shed Value

Many stocks of publicly traded firms that are exposed to Bitcoin have suffered significant drawdowns this month.

The fallout from this month’s violent crypto market meltdown appears to have flowed into the stock markets, with publicly listed firms with exposure to crypto assets seeing significant losses during May.

The month saw Bitcoin (BTC) and other leading cryptocurrencies crash by at least 50%, with BTC plummeting from roughly $60,000 on May 10 to bounce off support at $30,000 last week.

The largest publicly traded firm by number of BTC held in its reserves, MicroStrategy saw its share price slump from $657 at the end of April to roughly $450 as of May 21 — a 31.5% drawdown in three weeks. However, MSTR appears to have benefited from Bitcoin’s 50% bounce from the weekend’s lows, having gained nearly 5% in the last 24 hours to last change hands for $472.45.

According to Bitcoin Treasuries, MicroStrategy’s 92,000 Bitcoin have appreciated in value by roughly $1 billion in total despite the crypto crash.

Tesla also took a beating this month, with its shares tanking 18%, from $709 at the end of April to $581 on May 21. TSLA has rallied 4.4% in the past day to last trade for $606.44.

Despite Tesla suspending Bitcoin as an accepted method of payment for its vehicle fleet on May 12, the firm has yet to announce that it has sold any of the 43,200 BTC from its reserves. Bitcoin Treasuries estimates that Tesla’s BTC stash has increased in value by 10% since the vehicle manufacturer invested $1.5 billion into Bitcoin.

However, not every firm that purchased Bitcoin in recent months is sitting in profit, with Chinese smartphone manufacturer and app developer Meitu having invested $49.5 million near BTC’s all-time highs during March and April. While the firm’s BTC holdings are now worth $35.9 million, Meitu has also seen its share price plummet 19% from roughly $0.31 to $0.26 since the end of April.

Japanese online gaming firm Nexon also announced an ill-timed $100 million BTC purchase on April 28, with the firm’s Bitcoin stash now valued at just $67 million. Nexon’s share price has since tanked 29.5% from $33.35 at the end of April to $23.49 on Tuesday.

However, some analysts believe the sell-off in the tech and crypto sectors may be exacerbated by concerns regarding inflation.

Speaking to Reuters, David Mazza, managing director of leverage exchange-traded funder issuer Direxion, speculated that “Higher-risk assets, whether in the form […] of cryptocurrencies or the more speculative growth stocks, are seeing their multiples taken down markedly as investors begin to reassess what impact the potential for inflation will have.”

Updated: 6-3-2021

Bitcoin Is Risky Digital ‘Copper,’ It’s Not Gold — Goldman Sachs Commodities Boss

Jeff Currie, the global head of commodities research at Goldman Sachs, described Bitcoin as a “risk-on” asset that is similar to copper as a hedge against inflation.

Jeff Currie, the global head of commodities research at Goldman Sachs, has dismissed comparisons between Bitcoin (BTC) and gold as an inflation hedge, and described BTC as more akin to a “risk-on” asset like copper.

Speaking on CNBC’s Squawk Box Europe on Tuesday, Currie noted that copper and Bitcoin both work as “risk-on assets” for hedging due to their volatility, while describing gold as a more stable “risk-off” hedge:

“Digital currencies are not substitutes for gold. If anything, they would be a substitute for copper, they are pro-risk, risk-on assets. They are a substitute for risk-on inflation hedges, not risk-off inflation hedges”

“You look at the correlation between Bitcoin and copper, or a measure of risk appetite and Bitcoin, and we’ve got 10 years of trading history on Bitcoin — it is definitely a risk-on asset,” he added.

Currie’s comments come after the recent crypto downturn, which has seen Bitcoin’s price fall by 37% in over a few weeks according to CoinGecko, declining from around $57,000 on May 12, to roughly $36,000 today.

Ethereum has also taken a similar hit, dipping 39.58% and moving from around $4,300 on May 12 to around $2,598 as of writing.

Copper has seen a lot of volatility in 2021. On Jan. 3, it was priced at $3.56 and rose to $4.30 by Feb. 24. The price then fluctuated between $3.50 to $4.00 from March, until it broke out to $4.80 on May 10. The price now sits at $4.65.

Currie noted that “there is good inflation and there is bad inflation,” against which different assets hedge, and explained that, “Good inflation is when demand pulls it.” He said that Bitcoin, copper and oil are hedges against this type of inflation.

However:

“Gold hedges bad inflation, where supply is being curtailed, which is … focused on the shortages on chips, commodities and other types of input raw materials. And you would want to use gold as that hedge.”

The Goldman Sachs boss previously argued in an April note that Bitcoin cannot yet be seen as digital gold, as it’s “vulnerable to losing store-of-value demand to another, better-designed cryptocurrency,” adding that: “We think it is too early for Bitcoin to compete with gold for safe-haven demand — and the two can coexist.”

According to TradingView, since April 1 gold has been on an upward trend, increasing from $1686 up to $1900 as of writin.

In a note from Monday, Currie stated that he believes commodities with real-world use are the best hedge against inflation, because they ultimately rely on demand and not growth rates:

“Commodities are spot-assets that do not depend on forward growth rates, but on the level of demand relative to the level of supply today.”

“As a result, they hedge short-term unanticipated inflation, created when the level of aggregate demand is exceeding supply in the late stages of the business cycle,” the note added.

Goldman Close To Offering Bitcoin To Wealth Management Clients

Goldman Sachs Group Inc. is close to offering investment vehicles for Bitcoin and other digital assets to clients of its private wealth management unit.

″We are working closely with teams across the firm to explore ways to offer thoughtful and appropriate access to the ecosystem for private wealth clients, and that is something we expect to offer in the near-term,” Mary Rich, who was recently named global head of digital assets for the unit, said in an interview with CNBC.

Wall Street banks have largely shied away from cryptocurrencies. While Bitcoin is now more than 11 years old, there are very few things it can actually buy, and volatility is a major risk. Three years ago, Goldman hired a crypto trader to help lead digital-asset markets, with a goal of familiarizing people in the company as well as clients with cryptocurrencies, but the firm has more recently played down the idea of Bitcoin as an asset class.

Bitcoin’s rally over the past few months has intrigued wealthy investors in a new way. During the cryptocurrency’s 2017 surge, they largely remained on the sidelines. Many compared the cryptocurrency to tulip mania. Warren Buffett called Bitcoin a “mirage” and JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon said it was a “fraud” (although he later expressed regret for that remark).

This time, they are coming on board, along with a broad swath of retail investors. Data compiled by JPMorgan showed that retail investors have purchased over 187,000 Bitcoins this quarter as of mid-March, compared with roughly 205,000 last quarter. Institutions have bought about 173,000 of the world’s largest cryptocurrency over that period, down from nearly 307,000 in the final three months of 2020.

And big banks are floating the idea that clients could use Bitcoin to diversify their portfolios. JPMorgan strategists have recently touted cryptocurrency as a way to hedge against significant fluctuations in traditional asset classes. And Bank of New York Mellon Corp. BNY Mellon has announced plans to hold, transfer and issue the digital currency for its clients.

In a memo to staff on Wednesday announcing Rich’s appointment, Goldman said that Rich “will leverage the firm’s capabilities to ensure we can best meet client interest across digital asset classes and technologies,” it said. “As a firm, we believe in the possibility of blockchain technologies, and it is imperative that we continue.”

Goldman plans to begin offering investments in digital assets in the second quarter, and is looking at eventually offering a “full spectrum” of such investments “whether that’s through the physical Bitcoin, derivatives or traditional investment vehicles,” Rich told CNBC.

Analysts Seek Alternatives To Low-Return S&P 500, But Is Bitcoin The Place To Be?

“Gold is seen as a safe-haven, sleepy asset while bitcoin is viewed as a risk-on, growth asset.” one analyst noted.

Investors’ hunt for yield may soon intensify as inflation-adjusted earnings from the S&P 500, Wall Street’s benchmark index, fall into negative territory. However, that may not bode well for bitcoin (BTC, +3.96%) in the short term.

The index’s real earnings yield – inflation-adjusted return for every dollar invested – was minus-0.81% last week, according to Barron’s, having turned negative in early May.

“The hunt for alternatives could escalate in the wake of negative real returns in the stock market,” Charlie Morris, chief investment officer at ByteTree Asset Management, told CoinDesk. “However, bitcoin is not exactly in the sweet spot right now.”

Bitcoin has been pitched as an inflation hedge by some cryptocurrency analysts, since the pace of its supply expansion is reduced by 50% every four years via a process known as a mining reward halving.

The cryptocurrency charted a near sixfold rally from October 2020 through March 2021, outperforming traditional assets by a wide margin, as the rising stockpile of negative-yielding global bonds drove investors further out on the risk spectrum.

With the S&P 500 Index of large U.S. stocks offering a negative earnings yield on an inflation-adjusted basis, one theoretically might expect more money to flow into crypto markets and propel bitcoin to fresh record highs.

However, big gains may remain elusive for some time because the bitcoin market sentiment has weakened in recent weeks due to an increased focus on the potential environmental damage from cryptocurrency mining, and the greater regulatory scrutiny of the industry in China.

“Bitcoin is being weighed down by regulatory fears,” Morris said, adding that the dour mood is reflected in on-chain activity.

Fears the U.S. Federal Reserve may soon scale back liquidity-boosting stimulus to contain inflation may keep investors from pouring money into bitcoin. Minutes of the April Fed meeting released last month showed policymakers were beginning to consider thinking about tapering and reduce the U.S. central bank’s $120 billion-a-month of bond purchases, a way of injecting extra liquidity into financial markets.

“A number of participants suggested that if the economy continued to make rapid progress toward the committee’s goals, it might be appropriate at some point in upcoming meetings to begin discussing a plan for adjusting the pace of asset purchases,” according to the minutes.

Tapering is a risk for bitcoin, according to Messari research analyst Mira Christanto.

“Bitcoin is considered by fiat-based institutional investors at the extreme end of the risk spectrum,” Christanto said in a recently published note. “It thrives in quantitative easing (QE), irresponsible fiscal and monetary policy, and doesn’t quite like quantitative tightening (QT).”

While Christanto doesn’t foresee the Fed pulling the plug anytime soon, she expects taper fears to persist for some time.

“Crypto investors still need to pay special attention to upcoming data prints, as capital to this new asset class is still mercenary and tends to overreact on the bull and bear side,” Christanto noted.

Stock markets might look overdue for a pullback, with the negative earnings yield signaling overstretched valuations. With bitcoin sometimes trading in line with stocks, that might create downside risk.

Historically, negative real earnings yields have paved the way for stock market corrections, based on data shared by Jeroen Blokland, portfolio manager for the Robeco Multi-Asset funds, on LinkedIn.

So a potential risk-off mood in stock markets could have an immediate bearish impact on the cryptocurrency. That goes against the popular narrative of bitcoin being a safe haven like gold – an asset preferred during times of stress.

“While bitcoin is sometimes referred to as ‘digital gold,’ gold is seen as a safe-haven, sleepy asset, while bitcoin is viewed as a risk-on, growth asset,” Messari’s Mira Christanto said.

Jeff Currie, head of commodities at Goldman Sachs, voiced a similar opinion during a CNBC interview on Tuesday.

“Digital currencies are not substitutes for gold,” Currie said. “If anything, they would be a substitute for copper; they are pro-risk, risk-on assets.”

“They are a substitute for risk-on inflation hedges, not risk-off inflation hedges,” Currie added.

Bitcoin fell sharply during the March 2020 crash and pretty much moved in tandem with the S&P 500 until the end of April 2021. The cryptocurrency fell last month on environmental concerns, decoupling from the rising stock market.

While the cryptocurrency may have tough time in the short run, Morris is confident that it will eventually bounce back with a vengeance.

Updated: 6-18-2021

Goldman Sachs To Offer Bitcoin Futures Trading In Partnership With Galaxy Digital

Mike Novogratz’s Galaxy Digital will serve as the counterparty entity for Goldman Sachs’s Bitcoin futures trading product.

Goldman Sachs has debuted a Bitcoin (BTC) futures trading product for its client in collaboration with crypto investment giant Galaxy Digital.

According to CNBC, the move marks the first time the Wall Street bank has partnered with a digital asset-based liquidity provider. Galaxy Digital co-president Damien Vanderwilt said the company offered a gateway to the crypto space allowing a tightly regulated entity like Goldman to offer crypto-related investment products.

Goldman will reportedly be offering CME Group Bitcoin futures for its clients, marking another expansion of its recently established crypto trading desk. The move follows swiftly on the heels of an earlier announcement by the bank about debuting Ether (ETH) futures and options.

For Vanderwilt, Goldman offering BTC futures trading will help to onboard more institutional investors into the crypto investment space which the Galaxy executive argued will help to reduce price volatility.

Vanderwilt also remarked that the move would serve as an example to other Wall Street banks that crypto exposure is possible.

Indeed, as previously reported by Cointelegraph, the demand for crypto exposure appears to be growing on Wall Street with some banks recently announcing plans to establish trading desks for the novel asset class.

Max Minton, Goldman Sachs head of digital assets for the Asia-Pacific region stated that offering Bitcoin futures trading was part of the banks’ goal of providing access to its clients’ preferred assets, adding:

“In 2021, this now includes crypto, and we are pleased to have found a partner with a broad range of liquidity venues and differentiated derivatives capabilities spanning the cryptocurrency ecosystem.”

Despite the impending announcement from the bank, several Goldman figures are still reportedly not sold on Bitcoin as an “investable asset class.” Earlier in June, the bank’s commodities chief argued that BTC was more similar to a “risk-on” asset like copper rather than an inflation hedge like gold.

Updated: 7-21-2021

60% Of Uber-Rich Family Offices Considering Crypto Or Own It: Goldman Sachs

15% of Goldman Sachs’ family office clients have already purchased digital assets.

A survey conducted by major investment bank Goldman Sachs has found that close to half of its family office clients want to add cryptocurrency to their portfolios, signaling the ultra-wealthy are becoming increasingly bullish on digital assets.

The survey, reported by Bloomberg, queried more than 150 family offices worldwide and found that 15% are already exposed to crypto assets.

A further 45% of offices expressed interest in investing in the asset class as a hedge against “higher inflation, prolonged low rates, and other macroeconomic developments following a year of unprecedented global monetary and fiscal stimulus.”

However other respondents cited concerns regarding the volatility and long-term uncertainty surrounding the price of cryptocurrencies as reasoning for their aversion to the asset class.

Approximately 67% of the firms surveyed manage more than $1 billion worth of assets, with 22% of respondents boasting assets under management exceeding $5 billion.

Bloomberg describes the business of family offices as managing “the wealth and personal affairs of rich people,” including the likes of Microsoft co-founder Bill Gates, former Google CEO Eric Schmidt, and Chanel owners Alain and Gerard Wertheimer.

Professional services firm Ernst & Young estimates there are more than 10,000 family offices that each manages the financial affairs of only a single family, half of which were launched during the 21st century. The family office sector is estimated to manage more than $6 trillion globally, overshadowing the hedge fund industry.

Goldman Sachs’ Meena Flynn asserts that most of the firm’s family office clients have expressed an interest in the “digital asset ecosystem,” adding that many customers believe blockchain technology “is going to be as impactful as the internet has been from an efficiency and productivity perspective.”

Updated: 7-22-2021

The Ultra-Rich Are Turning To Crypto After Driving The SPAC Boom

A Goldman Sachs survey found that nearly half the family offices the bank does business with want to add digital currencies to their stable of investments.

Firms that manage the wealth and personal affairs of rich people are increasingly looking to make bets on crypto.

That’s according to Goldman Sachs Group Inc., which found that nearly half the family offices it does business with want to add digital currencies to their stable of investments.

The bank reported that 15% of respondents in a recent survey — which included responses from more than 150 family offices worldwide — are already invested in cryptocurrencies. Another 45% would be interested in diving into the space as a hedge for “higher inflation, prolonged low rates, and other macroeconomic developments following a year of unprecedented global monetary and fiscal stimulus.”

The interest from family offices shows how these sometimes secretive companies that manage the affairs of the rich are turning into a force across multiple markets. Of the firms that participated in the survey, 22% had assets under management of $5 billion or more, and 45% oversaw $1 billion to $4.9 billion.

Some family offices have long been investors in private equity and real estate, but have recently been one of the biggest drivers of the boom in special purpose acquisition companies, or SPACs. Just like that phenomenon, the past year’s crypto-market frenzy has lured mainstream financial institutions, athletes and celebrities.

As family offices grow in size and influence, critics are also pushing for more regulation, especially after the implosion of Bill Hwang’s Archegos Capital Management hit banks with billions of dollars in losses.

Respondents in the survey also indicated interest investing in the “digital asset ecosystem.” The majority of families want to talk to us “about blockchain and digital ledger technology,” said Meena Flynn, who helps lead private wealth management for Goldman. There are many who think that “this technology is going to be as impactful as the internet has been from an efficiency and productivity perspective.”

Other survey respondents, however, indicated they still had underlying concerns about the long-term value of digital currencies, despite the financial industry’s more recent embrace of crypto and emerging blockchain technologies. Bitcoin — the largest cryptocurrency — is now more than 50% below its record high levels near $65,000 in mid-April. Prices, which on Tuesday slid below $30,000 for the first time in a month, are still up more than 230% from a year earlier.

Family offices have proliferated this century, partly due to the boom in tech billionaires. More than 10,000 family offices globally manage the wealth of a single family, with at least half having started this century, according to EY. A 2019 estimate by researcher Campden Wealth valued family office assets at almost $6 trillion globally, larger than the entire hedge fund industry.

The firms vary markedly in size. Some manage hundreds of millions of dollars, while others oversee the fortunes of multi-billionaires such as Sergey Brin and Jeff Bezos. Many choose obscure names to operate out of the public eye. Alphabet Inc. founder Brin’s family office, Bayshore Global Management, gets its name from the location of the company’s headquarters. Charles and David Koch named theirs after the year their grandfather emigrated to America: 1888.

They’ve also surged in number across Asia following booming fortunes of the region’s ultra-wealthy, with China’s Jack Ma and real estate billionaire Wu Yajun both establishing their own family offices in the past decade. Meantime, members of the ultra-wealthy based outside Asia including Bridgewater Associates founder Ray Dalio are increasingly setting up branches of their family offices in the area.

Updated: 3-21-2022

Goldman Sachs: The First American Bank To Offer Over-The-Counter Crypto Trading

Key Takeaways:

* Goldman Sachs To Become The First Bank To Deal With Over-The-Counter Crypto Trading.

* The Bank Is Ready To Take Risks Involved In This Step For Future Development.

The crypto market is evolving every day. All crypto supporters are trying to draw the crowd towards the market. In an attempt to do so, large organizations offer facilities to make it more available to people.

One such step has been taken by the US Bank, Goldman Sachs. It will soon announce the launch of its trade of over-the-counter crypto transactions. It will be the first of its kind. To take its development of digital assets into the market, the bank has partnered with Galaxy Digital and has sold a bitcoin-linked instrument, a new non-deliverable option.

The OTC (Over-the-counter) crypto trading means an exchange of cryptocurrencies and Bitcoin between two parties without the involvement of a mediator. The trading for one type of digital currency for another is also allowed.

This colossal step will bring in massive growth for investors. It will also reveal the bank’s Bitcoin trade into the market instead of its customers. However, there are significant risks involved as well.

The Co-president of Goldman, Vanderwilt, finds this step as relevant for growth into the market and exchange-based products despite the uncertainties involved. It will open the path for other financial institutions to enter the crypto world and will replace the conventional trading process that was slow and inconvenient.

Updated: 12-6-2022

Goldman Sachs Looking To Buy Crypto Firms After FTX Collapse

Goldman Sachs executive Mathew McDermott said that their firm is already doing its due diligence on some crypto firms.

As crypto company valuations are affected by the recent FTX debacle, financial services firm Goldman Sachs is looking to swoop in and invest millions to purchase or invest in crypto firms while the prices are low.

In an interview with mainstream media outlet Reuters, Mathew McDermott, an executive at Goldman Sachs, reportedly said that big banks are seeing opportunities in the space as the FTX collapse highlighted a need for more regulation within the industry.

The executive added that the firm is currently seeing opportunities that are “priced more sensibly” and are already doing its due diligence on some crypto companies.

Commenting on the FTX debacle, McDermott also noted that in terms of sentiment, the market encountered setbacks.

However, the traditional finance executive highlighted that though FTX became a “poster child” of the space, the underlying tech behind the industry “continues to perform.”

The FTX liquidation crisis and bankruptcy saga have turned the crypto space upside down since the beginning of November. The collapse of FTX continues to have a domino effect, affecting crypto-focused companies that have some exposure to the embattled firm.

Because of this, institutional investors like Goldman are looking for opportunities to buy and invest at lower prices while the effects of FTX are lowering valuations.

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

US Department Of Commerce Offering 6-Figure Salary To Crypto Expert (#GotBitcoin?)

Mastercard Is Building A Team To Develop Crypto, Wallet Projects (#GotBitcoin?)

Canadian Bitcoin Educator Scams The Scammer And Donates Proceeds (#GotBitcoin?)

Amazon Wants To Build A Blockchain For Ads, New Job Listing Shows (#GotBitcoin?)

Shield Bitcoin Wallets From Theft Via Time Delay (#GotBitcoin?)

Blockstream Launches Bitcoin Mining Farm With Fidelity As Early Customer (#GotBitcoin?)

Commerzbank Tests Blockchain Machine To Machine Payments With Daimler (#GotBitcoin?)

Man Takes Bitcoin Miner Seller To Tribunal Over Electricity Bill And Wins (#GotBitcoin?)

Bitcoin’s Computing Power Sets Record As Over 100K New Miners Go Online (#GotBitcoin?)

Walmart Coin And Libra Perform Major Public Relations For Bitcoin (#GotBitcoin?)

Judge Says Buying Bitcoin Via Credit Card Not Necessarily A Cash Advance (#GotBitcoin?)

Poll: If You’re A Stockowner Or Crypto-Currency Holder. What Will You Do When The Recession Comes?

1 In 5 Crypto Holders Are Women, New Report Reveals (#GotBitcoin?)

Beating Bakkt, Ledgerx Is First To Launch ‘Physical’ Bitcoin Futures In Us (#GotBitcoin?)

Facebook Warns Investors That Libra Stablecoin May Never Launch (#GotBitcoin?)

Government Money Printing Is ‘Rocket Fuel’ For Bitcoin (#GotBitcoin?)

Bitcoin-Friendly Square Cash App Stock Price Up 56% In 2019 (#GotBitcoin?)

Safeway Shoppers Can Now Get Bitcoin Back As Change At 894 US Stores (#GotBitcoin?)

TD Ameritrade CEO: There’s ‘Heightened Interest Again’ With Bitcoin (#GotBitcoin?)

Venezuela Sets New Bitcoin Volume Record Thanks To 10,000,000% Inflation (#GotBitcoin?)

Newegg Adds Bitcoin Payment Option To 73 More Countries (#GotBitcoin?)

China’s Schizophrenic Relationship With Bitcoin (#GotBitcoin?)

More Companies Build Products Around Crypto Hardware Wallets (#GotBitcoin?)

Bakkt Is Scheduled To Start Testing Its Bitcoin Futures Contracts Today (#GotBitcoin?)

Bitcoin Network Now 8 Times More Powerful Than It Was At $20K Price (#GotBitcoin?)

Crypto Exchange BitMEX Under Investigation By CFTC: Bloomberg (#GotBitcoin?)

“Bitcoin An ‘Unstoppable Force,” Says US Congressman At Crypto Hearing (#GotBitcoin?)

Bitcoin Network Is Moving $3 Billion Daily, Up 210% Since April (#GotBitcoin?)

Cryptocurrency Startups Get Partial Green Light From Washington

Fundstrat’s Tom Lee: Bitcoin Pullback Is Healthy, Fewer Searches Аre Good (#GotBitcoin?)

Bitcoin Lightning Nodes Are Snatching Funds From Bad Actors (#GotBitcoin?)

The Provident Bank Now Offers Deposit Services For Crypto-Related Entities (#GotBitcoin?)

Bitcoin Could Help Stop News Censorship From Space (#GotBitcoin?)

US Sanctions On Iran Crypto Mining — Inevitable Or Impossible? (#GotBitcoin?)

US Lawmaker Reintroduces ‘Safe Harbor’ Crypto Tax Bill In Congress (#GotBitcoin?)

EU Central Bank Won’t Add Bitcoin To Reserves — Says It’s Not A Currency (#GotBitcoin?)

The Miami Dolphins Now Accept Bitcoin And Litecoin Crypt-Currency Payments (#GotBitcoin?)

Trump Bashes Bitcoin And Alt-Right Is Mad As Hell (#GotBitcoin?)

Goldman Sachs Ramps Up Development Of New Secret Crypto Project (#GotBitcoin?)

Blockchain And AI Bond, Explained (#GotBitcoin?)

Grayscale Bitcoin Trust Outperformed Indexes In First Half Of 2019 (#GotBitcoin?)

XRP Is The Worst Performing Major Crypto Of 2019 (GotBitcoin?)

Bitcoin Back Near $12K As BTC Shorters Lose $44 Million In One Morning (#GotBitcoin?)

As Deutsche Bank Axes 18K Jobs, Bitcoin Offers A ‘Plan ฿”: VanEck Exec (#GotBitcoin?)

Argentina Drives Global LocalBitcoins Volume To Highest Since November (#GotBitcoin?)

‘I Would Buy’ Bitcoin If Growth Continues — Investment Legend Mobius (#GotBitcoin?)

Lawmakers Push For New Bitcoin Rules (#GotBitcoin?)

Facebook’s Libra Is Bad For African Americans (#GotBitcoin?)

Crypto Firm Charity Announces Alliance To Support Feminine Health (#GotBitcoin?)

Canadian Startup Wants To Upgrade Millions Of ATMs To Sell Bitcoin (#GotBitcoin?)

Trump Says US ‘Should Match’ China’s Money Printing Game (#GotBitcoin?)

Casa Launches Lightning Node Mobile App For Bitcoin Newbies (#GotBitcoin?)

Bitcoin Rally Fuels Market In Crypto Derivatives (#GotBitcoin?)

World’s First Zero-Fiat ‘Bitcoin Bond’ Now Available On Bloomberg Terminal (#GotBitcoin?)

Buying Bitcoin Has Been Profitable 98.2% Of The Days Since Creation (#GotBitcoin?)

Another Crypto Exchange Receives License For Crypto Futures

From ‘Ponzi’ To ‘We’re Working On It’ — BIS Chief Reverses Stance On Crypto (#GotBitcoin?)

These Are The Cities Googling ‘Bitcoin’ As Interest Hits 17-Month High (#GotBitcoin?)

Venezuelan Explains How Bitcoin Saves His Family (#GotBitcoin?)

Quantum Computing Vs. Blockchain: Impact On Cryptography

This Fund Is Riding Bitcoin To Top (#GotBitcoin?)

Bitcoin’s Surge Leaves Smaller Digital Currencies In The Dust (#GotBitcoin?)

Bitcoin Exchange Hits $1 Trillion In Trading Volume (#GotBitcoin?)

Bitcoin Breaks $200 Billion Market Cap For The First Time In 17 Months (#GotBitcoin?)

You Can Now Make State Tax Payments In Bitcoin (#GotBitcoin?)

Religious Organizations Make Ideal Places To Mine Bitcoin (#GotBitcoin?)

Goldman Sacs And JP Morgan Chase Finally Concede To Crypto-Currencies (#GotBitcoin?)

Bitcoin Heading For Fifth Month Of Gains Despite Price Correction (#GotBitcoin?)

Breez Reveals Lightning-Powered Bitcoin Payments App For IPhone (#GotBitcoin?)

Big Four Auditing Firm PwC Releases Cryptocurrency Auditing Software (#GotBitcoin?)

Amazon-Owned Twitch Quietly Brings Back Bitcoin Payments (#GotBitcoin?)

JPMorgan Will Pilot ‘JPM Coin’ Stablecoin By End Of 2019: Report (#GotBitcoin?)

Is There A Big Short In Bitcoin? (#GotBitcoin?)

Coinbase Hit With Outage As Bitcoin Price Drops $1.8K In 15 Minutes

Samourai Wallet Releases Privacy-Enhancing CoinJoin Feature (#GotBitcoin?)

There Are Now More Than 5,000 Bitcoin ATMs Around The World (#GotBitcoin?)

You Can Now Get Bitcoin Rewards When Booking At Hotels.Com (#GotBitcoin?)

North America’s Largest Solar Bitcoin Mining Farm Coming To California (#GotBitcoin?)

Bitcoin On Track For Best Second Quarter Price Gain On Record (#GotBitcoin?)

Bitcoin Hash Rate Climbs To New Record High Boosting Network Security (#GotBitcoin?)

Bitcoin Exceeds 1Million Active Addresses While Coinbase Custodies $1.3B In Assets

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Zebpay Becomes First Exchange To Add Lightning Payments For All Users (#GotBitcoin?)

Coinbase’s New Customer Incentive: Interest Payments, With A Crypto Twist (#GotBitcoin?)

The Best Bitcoin Debit (Cashback) Cards Of 2019 (#GotBitcoin?)

Real Estate Brokerages Now Accepting Bitcoin (#GotBitcoin?)

Ernst & Young Introduces Tax Tool For Reporting Cryptocurrencies (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.