Crypto Exchange Launches ‘Shitcoin Futures Index,’ Offering New Way To Short Alts (#GotBitcoin)

Crypto derivatives platform FTX has perhaps the most speculative and oddly-named futures index fund on the market: SHIT-PERP, or the Shitcoin Index Perpetual Futures. Crypto Exchange Launches ‘Shitcoin Futures Index,’ Offering New Way to Short Alts (#GotBitcoin)

An index of 58 low market cap coins, SHIT-PERP includes projects like Waves, Grin, and Nano. It is flanked by two other low-cap indexes on the site, MID-PERP and ALT-PERP.

FTX’s connection to Alameda Research gives it deep liquidity, per FTX statements. Founded in October 2017, Alameda manages over $100 million in digital assets, trading between $600 million and $1.5 billion per day.

Related:

Ultimate Resource On Ledger Hardware Wallet (#GotBitcoin?)

Ultimate Resource On Trezor Hardware Wallets

Next Bitcoin Core Release To Finally Connect Hardware Wallets To Full Nodes

Ultimate Resource On Crypto Hardware (And Other) Wallets

Wallets Are Over. Your Phone Is Your Everything Now

Survey Shows Many BTC Holders Use Hardware Wallet, Have Backup Keys

What Are Lightning Wallets Doing To Help Onboard New Users?

Introducing BTCPay Vault – Use Any Hardware Wallet With BTCPay And Its Full Node

Inheritance Planning For Cryptocurrencies

How To Securely Transfer Crypto To Your Heirs

The quantitative trading firm operates the second-best performing account on BitMEX and helped onboard staff from Jane Street, Optiver, Susquehanna, Facebook, and Google to FTX, according to FTX.

Regardless of the index’s name, FTX stands by its product which it launched in June. Speaking to CoinDesk, FTX Chief Marking Office Darren Wong said the index allows traders and investors to interact with coins in an innovative way. Wong listed three examples:

If you want exposure to a particular initial coin offering, but not the general industry, you can short SHIT-PERP. By shorting the greater alt market, you hedge your bets and limit your downside.

If you want to short low market cap altcoins in general, you can use SHIT-PERP. The indexed future is one of few ways to short low cap alt markets.

Related:

JPMorgan Chase With It’s JPM ShitCoin Wants To Take On Bitcoin

Bitcoin Dominance Hits 70% As Keiser Warns Altcoins ‘Not Coming Back’

If you think bitcoin’s dominance is too high, you can buy all three of FTX’s altcoin futures indexes and sell BTC-PERP, the platforms Bitcoin futures index.

Surprisingly, Wong says the exchange trades a roughly on par with its other futures index, ALT-PERP, at roughly a few million dollars turnover. At the time of writing, the index was down 2.62%.

Updated: 9-10-2019

Nasdaq Lists New Decentralized Finance Index Including MakerDao, 0x, Augur

Nasdaq has added a new index that aims to offer the markets information on blockchain projects working in the decentralized finance (DeFi) space.

Called Defix, the index was launched by the London-based Exante brokerage – an early mover in the crypto industry that launched a bitcoin fund in 2012. Offered as a means for investors and traders to track “popular” defi-focused blockchain tokens, Defix lists projects including MakerDao, Augur, Gnosis, Numerai, 0x and Amoveo.

The index is listed by NASDAQ under the ticker DEFX, and can also be tracked on TradingView and Google, with a listing on Yahoo Finance planned in the future.

The news marks the latest index to be added by Nasdaq to inform its users. This year so far, the U.S. stock exchange has added dedicated indices for bitcoin, ether and XRP, as well as a wider crypto reference index from CryptoCompare.

This autumn, Exante is also to launch a fund based on the Defix index, saying it will be offered through a “secure, financially accredited agency.”

Updating: 9-13-2019

Tagomi Rollout Paves Way For Institutional Crypto Shorting

Crypto brokerage Tagomi released its borrowing and lending platform to the wider public, enabling investors to short cryptocurrencies like bitcoin and ethereum.

Tagomi’s COO Kevin Johnson told CoinDesk that its new platform addresses issues that stymie institutional crypto shorts.

Many large-scale investors could not short cryptocurrencies as rapidly as they might short an equity position because the existing borrowing process for crypto is too complex, Johnson said: “It’s multiple steps, it’s a lot of work.”

“First, you have to either find an exchange that’s able to lend, or talk to one of the centralized lending counterparties, negotiate rates, settle that, borrow, and then you could get to be in the process of actually selling the coin short.”

Johnson said this has been the biggest barrier for institutional investors.

CEO Marc Bharvaga said the service brings Tagomi closer to becoming a full-suite prime brokerage, which is how institutional investors prefer to manage their trading.

“Having a full prime brokerage functionality, which we now have through being able to do best execution, being able to custody, being able to lend, being able to short and there’s quite a few other things on the road map as we think about the [crypto] space,” Bharvaga said.

Tagomi completed a $12 million funding round in March, when co-founder Jennifer Campbell told CoinDesk then that it would expand its services to include lending and shorting.

Bitcoin Owners Are Giving Away Shitcoins To Support TOR Project

On the lighter side of things in the cryptosphere, some Bitcoin (BTC) owners have been donating altcoins to the TOR Project — a nonprofit organization primarily responsible for running “The Onion Router.”

For some Bitcoiners, the trend is a way of killing two birds with one stone — supporting the TOR Project and getting rid of “shitcoins.” As for the latter half of the equation, Bitcoiners appear keen to extend the running gag of altcoins being worthless.

“Donate Shitcoins, Stack Sats”

Earlier in September, Bitcoin maximalist and co-host of the “Tales from the Crypt” podcast Matt Odell posted a tweet urging people to support the TOR Project by way of donation. In a cheeky addendum, Odell added, “donate shitcoins. stack sats.”

Sarah Stevenson, fundraising director at the TOR Project, initially thought the donations were coming from members of the Stellar community, likely because of the influx of XLM tokens.

Bitcoiners swiftly corrected her conclusion, seemingly opposed to letting their attempted ribbing go unnoticed. They soon piled onto the thread, dropping Twitter soundbites like the “perfect destination for my airdropped shitcoins” and “sounds like a good place to dump my shitcoins.”

Some of the donations reportedly came from recipients of the Keybase XLM airdrop. As previously reported by Cointelegraph, encrypted messaging platform Keybase partnered with the Stellar Development Foundation to launch a $120 million airdrop.

The Bitcoiners did, however, advise Stevenson and the team to quickly convert the donations into fiat. Data from CoinMarketCap shows a 45% decline in the XLM price since the start of the year. Stellar tokens are also down more than 93% from their all-time high of $0.8755 in 2018.

On Wednesday, the XLM spot price saw a 52% rise in a little under two hours, leading to speculation about the arrival of another altseason. The upward surge was followed by a steep retrace, reducing the initial 24-hour trading gains by more than half.

For Stevenson, the TOR Project appreciates the donations regardless of the subtext. In a private correspondence with Cointelegraph, the TOR Project’s fundraising director offered her thoughts on the matter, stating:

“I am generally a peace, not war kind of person but I welcome any activity that draws attention to the importance of financially supporting the Tor Project. Everyone benefits from the privacy and anonymity technologies we develop and maintain. As for the tangible value proposition for altcoins, I’ll plead the fifth because I prefer to be friends with everyone.”

At the time of publication, the TOR Project has received more than 21,300 XLM tokens, valued at over $1,200.

The crypto-Philanthropy Angle

Apart from the TOR Project, other nonprofit organizations are also asking holders of spare altcoins to consider donating in support of worthy causes around the world. Via its Twitter account, Bitcoin Venezuela called on people to send their unwanted XLM to support its Bitcoin for Venezuela Initiative.

According to another Twitter account, “The Giving Block,” there are other nonprofit organizations that accept XLM donations. Recently, cryptocurrency has seemingly taken on increased prominence in philanthropic work across the globe.

As previously reported by Cointelegraph, Fidelity Charitable — an independent public charity organization — has received more than $100 million in cryptocurrency donations since 2015.

Global aid organizations such as the United Nations International Children’s Emergency Fund — or UNICEF — have encouraged PC gamers in the past to mine cryptocurrencies with their computers and donate the earnings to support humanitarian aid efforts for children in Syria.

There is also the Pineapple Fund from 2018, which donated more than $55 million in Bitcoin to numerous nonprofit organizations around the world.

Apart from using cryptocurrencies as an avenue for donating to charities, there is also talk of leveraging blockchain technology to improve the transparency of these organizations. An excerpt from Binance Academy’s post on the benefits of adopting crypto-philanthropy reads:

“Each cryptocurrency transaction is unique, which means that it is also easily tracked through the blockchain. The higher level of transparency and public accountability can ease donors’ minds and encourage them to give while also reinforcing the charity’s reputation for integrity. […] Funds can move directly from donors to charities, and the decentralized nature of blockchain makes it uniquely suitable for international transactions.”

Bitcoin Maximalism

According to Ethereum co-founder Joseph Lubin, there are observable elements of tribalism within the crypto space. Mati Greenspan, senior market analyst at eToro, quoted Lubin as saying:

“Ultimately we’re all on the same team. Yes, there’s a lot of tribalism but we’re all working towards similar goals.”

Lubin’s comments came during a session at the Ethereal Summit in Tel Aviv on Sunday. On the panel with Lubin were fellow Ethereum co-founder Vitalik Buterin and eToro CEO Yoni Assia.

The struggle for relevance among the major cryptocurrency projects formed a large part of the discussions at the event. The debate over whether any altcoin project can challenge Bitcoin’s dominance is one that often seems to draw myriad opinions.

As with any debate among groups holding strong opinions, the emergence of category-specific rhetoric — or, as Lubin puts it, “tribalism” — is likely. There are the Bitcoin maximalists whose position is that “Bitcoin is king” and all other altcoins are “shitcoins.”

To be fair, such a position might not seem extreme considering the many instances of exit scams among altcoin projects coupled with the poor price performance of the altcoin market.

This seemingly never-ending decline in altcoin prices becomes even more apparent when considered alongside Bitcoin. Bitcoiner and self-professed “toxic maximalist” Udi Wertheimer recently called out the leaders of altcoin projects like Bancor (BNT), writing:

“Shitcoin founders […] deserve all the fiery hate they receive from the community, and more. When you choose to sell your reputation for tens of millions, you don’t get to keep your reputation. Reputation can’t be double spent… not at scale.”

Another brand of Bitcoin maximalism, while agreeing that “Bitcoin is king,” says there is no harm in catching the frequent bounces in the altcoin scene and making money. Posting on Twitter earlier in September 2019, crypto analyst Josh Rager wrote:

“Bitcoin is king, I’m still Bitcoin maximalist, I like to make money though so I’ll invest in any tech that likely presents to give a solid ROI.”

If commentators like Matt Hougan of Bitwise Asset Management are correct, then 95% of all altcoins will die. Probable mass altcoin extinction aside, donating cryptos to charities while they still hold significant U.S. dollar value doesn’t seem like a bad idea.

Speaking Of Shitcoins….

Wells Fargo’s Stablecoin ‘Faster, Cheaper’ Than SWIFT, Says Exec

Banking giant Wells Fargo says its blockchain for internal cross-border money transfers is faster and more efficient than SWIFT, the global messaging system used by over 11,000 financial institutions.

Unveiled this week, Wells Fargo Digital Cash uses R3’s Corda Enterprise software to handle internal book transfers, when funds move from a payer’s account to a payee’s account at the same bank.

“When we move money across the world and we need to exchange currencies, we have to go through third parties such as SWIFT and other banks,” said Lisa Frazier, head of the Innovation Group at Wells Fargo. “That’s a long process and every time there’s a connection with external parties, it takes time and energy and effort.”

Using the digital cash would allow the bank to move funds 20 hours a day, up from only six to nine hours, five days a week when it relies on wire transfers and systems like SWIFT, Frazier said.

She Told CoinDesk:

“It’s faster than SWIFT, cheaper and definitely more efficient.”

Today, for internal book transfers between branches in different countries, the bank needs to use SWIFT. This is not the case for domestic internal book transfers.

The blockchain project, which will go into a pilot phase next year after a successful proof-of-concept, “will allow those locations to exchange digital cash among themselves,” Frazier said.

As with rival megabank JPMorgan’s JPM Coin, Wells Fargo’s digital cash will be backed 1-for-1 with the analog kind. “We will hold the fiat currency, so it’s a stablecoin, and we will issue digital cash tokens. These tokens are placed into digital wallets and then those tokens are able to be exchanged,” Frazier said.

Parallel Paths

Frazier said Wells Fargo has been avidly participating since 2016 in blockchain tests that she described as “external,” meaning other banks and financial institutions were involved. However, the bank has also been busy pursuing internal use cases for distributed ledger technology (DLT), she said.

“I think the surprise is, we have found a really solid internal application for DLT on our book transfers. By doing this we are streamlining the book transfer process and are reducing the use of intermediaries that can cause a delay in settlement. Therefore we are widening the operating window for clearing of FX wires cross-border,” she said.

The stablecoin project also happens to be the first project the bank has built using the paid-for version of R3’s DLT, which Wells Fargo has now licensed — with more to follow on the platform, the bank added.

SWIFT declined to comment, but the messaging system itself is collaborating with R3 on a number of projects, such as a proof of concept to connect the former’s gpi to the latter’s Corda to enable “off-ledger” payment settlement.

The results of this PoC will be revealed at Sibos 2019. Corda Settler, the Corda Network’s open-source payments engine, has also been tested with the cryptocurrency XRP.

However, Wells Fargo scotched any suggestion the bank would be connecting its digital coins to anything outside its own internal payments systems.

“R3’s Corda Enterprise was selected as the platform for our first enterprise DLT network, not CordaSettler,” said a spokesman for the bank. “Wells Fargo Digital Cash is an internal settlement service which will not be associated or connected to any other potential digital cash solutions emerging in the financial services markets today.”

Alex Lipton, a former bank executive, trader and quant, said Wells Fargo’s coin is potentially very useful for simplifying the “bank’s byzantine internal processes,” but not something that will see much usage outside the bank and a handful of close partners.

“Large banks are so bad that they have to use SWIFT like everyone else, so in effect, they don’t differentiate between inside and outside of banks. So, a coin can help. But it is a sign of desperation,” said Lipton, now co-founder and chief technical officer at fintech firm Sila.

Another JPM Coin?

At first blush, Well Fargo’s digital cash may appear to be another JPM Coin, the much-vaunted technology built using Quorum, the privacy-centric version of ethereum developed by JPMorgan.

Although initially intended for payments between clients, the coin will eventually be used to digitally fund enterprise blockchain projects such as on-chain debt issuances, JPMorgan executives have said.

JPM also boasts 344 banks on its Interbank Information Network (IIN), which uses Quorum to eradicate pain points in the way information circulates within foreign correspondent banking.

Frazier played down any similarities between JPM Coin and Wells Fargo Digital Cash. “I think they are very different,” she said.

Wells Fargo is not a member of IIN, but Frazier hinted at a long-term plan for interoperability.

She Concluded:

“Eventually in the future, there will be interoperable networks. As these emerging technologies come out of a nascent stage all kinds of things can happen.”

Updated: 8-8-2022

Bitcoin Core Contributor Urges Maximalists To Take A Different Route

Matt Corallo urged the Bitcoin community to drop the us-versus-them culture, which leads to attacking projects other than BTC.

There was once a time when Bitcoin was the only crypto project that was not a scam, and advocating for only BTC made perfect sense. According to a Bitcoin Core contributor, however, this has not been true for a while, as he urged the community to drop the us-versus-them culture.

In a Twitter thread, Matt Corallo, who contributed to the Bitcoin Core, pointed out to the community that at the moment, instead of BTC proponents advocating why Bitcoin is unique and remarkable, they are spending time attacking other projects.

According to Corallo, this situation is leading to what he described as a narrative war, where crypto projects bash each other. Corallo further explained that Bitcoiners coming after Ethereum for the upcoming Merge, saying that proof-of-stake (PoS) will not work, will, in turn, push Ethereum proponents to lobby with regulators against Bitcoin with the same environmental angle.

Lastly, the developer urged Bitcoiners to focus on talking about Bitcoin and its positive aspects and drop the culture of attacking other projects that are not BTC.

Despite the call for more respect and courtesy for other projects, some Bitcoiners still remain unfazed. In response to the thread, Twitter user BitcoinCEOh said that “anything other than Bitcoin is a scam.” They said that some projects look legit but are ultimately scams in the end.

In July, Bitcoin proponent Michael Saylor said in an interview that all PoS networks are securities and are very risky. He argued that Ethereum is a security because of its inherent features such as being issued through an initial coin offering. He noted that it’s up to regulators to decide if these projects should continue or not.

Meanwhile, Ethereum co-founder Vitalik Buterin has been actively defending Ethereum from critics. Buterin called out arguments against Ethereum voting and described one as an “unmitigated bare-faced lie,” saying that Ethereum doesn’t conduct voting on protocol parameters.

Updated: 1-12-2023

From Bernie Madoff To Bankman-Fried: Bitcoin Maximalists Have Been Validated

The parallels between Sam Bankman-Fried and Bernie Madoff are ample. On the bright side, both men highlighted the fact that Bitcoin maximalists are immune to Ponzi schemes.

Bernie Madoff sat atop the longest-running, largest fraud in history. The rise and real-time fall of Sam “SBF” Bankman-Fried, former CEO of crypto exchange FTX, were expedited in comparison.

While the similarities are profound, the storyline is not: Create organizations under false pretenses, develop relationships with people in authority positions, defraud clients, survive as long as possible, and try not to get caught.

Madoff advisers experienced a “liquidity” problem in 2008, around late November into early December, where the fund was unable to meet client redemption requests. On its surface, the fourth-quarter timing of the Madoff collapse more than a decade ago appears eerily similar to FTX’s 2022 implosion.

Bitcoiners who hold their keys will never experience a “liquidity problem,” as their Bitcoin isn’t being used to leverage anything else. It is the hardest money around as long as it stays in the custody of its rightful owner.

Even near the collapse, Madoff had planned to pay out $173 million in early bonuses to family and friends. When questioned by his sons on Dec. 9, 2008, Madoff confessed to the massive fraud.

The numbers, in many instances, are fractions of the fraud FTX is accused of. Bitcoin maximalists continue to remind their communities that yield, third-party custodians and humans cannot be trusted. Satoshi Nakamoto’s white paper endures.

Madoff’s sons communicated, almost immediately, with an attorney, who advised them to contact federal authorities. Madoff was arrested on Dec. 11, one day after federal agencies were made aware of the fraud.

On Nov. 8, Binance CEO Changpeng Zhao announced on Twitter that he tentatively intended to purchase FTX, but he quickly reversed the decision, and a “liquidity” problem ensued at FTX. Bitcoin maximalists either watched idly, shaking their heads in disbelief — knowing it was a matter of time — or simply went on with their lives.

Many maximalists might very well have been a part of Mt. Gox, which held approximately 80% of all BTC in circulation at the time it was breached. The “wake-up call” is an unfortunate initiation ritual for some Bitcoiners. FTX will mint many new Bitcoin maximalists.

In December, SBF was arrested in the Bahamas. As authors and researchers, we’re confident that correlations will be immediately identified and explored in regard to the timing of Madoff’s arrest on Dec. 11, 2008.

As SBF Faces Extradition To The United States, Based Upon The “Treaty Between The United States And The Bahamas,” He Faces Sentence Terms That May Mirror Madoff’s, Who Faced A 150-Year Prison Sentence For An Arsenal Of Convictions.

Those Convictions Included:

* 40 Years For Two Counts Of International Money Laundering

* 20 Years For One Count Of Securities Fraud

* 20 Years For One Count Of Mail Fraud

* 20 Years For One Count Of Wire Fraud

* 20 Years For One Count Of False Filings With The Securities And Exchange Commission

* 10 Years For One Count Of Money Laundering

* Five Years For One Count Of Investment Adviser Fraud

* Five Years For One Count Of False Statements

* Five Years For One Count Of Perjury

* Five Years For One Count Of Theft From An Employee Benefit Plan

To Provide Some Perspective, The Longest Sentences For Recent Financial Fraud Include, In Order:

* Shalom Weiss (845 Years)

* Norman Schmidt (330 Years)

* Bernie Madoff (150 Years)

* Frederick Brandau (55 Years)

A tie for fifth place between Charles Lewis, Eduardo Masferrer, Chalana McFarland and Lance Poulsen, who received 30-year sentences.

Based on the limited release documents at the time of publication, SBF may have his name included on the top five listed above — even potentially at or near the top. That would be fair considering that, among other allegations, his political donations may have impacted or influenced U.S. political elections.

Madoff’s prisoner number was 61727-054. Note that these oddly hyphenated eight digits weren’t representative of an account number, an SEC filing record or some secretive financial code; the numbers were Madoff’s former inmate number at Federal Correctional Complex, Butner.

If and/or when the time comes, SBF may be remembered by a similar numeric value instead of a cheeky three-letter moniker (“SBF”). Time will tell. Remember, Madoff pleaded guilty and still received 150 years, eventually dying while in custody.

Bitcoin > Bribes

Let’s be clear: Not your keys, not your coins.

Stop giving your hard-earned money and Bitcoin to “trusted” third parties. Whether or not SBF spends a day in prison, or multiple lifetimes, the future of SBF means nothing to Bitcoin maximalists. In truth, if SBF walks free, the event will only confirm a greater Ponzi scheme that Bitcoiners are well aware of.

Bitcoin maximalists continue to preach, and events such as the collapse of FTX (among numerous other exchanges) are dire reminders of Nakamoto’s words that kicked off the introduction of Bitcoin’s white paper: “Commerce on the Internet has come to rely almost exclusively on financial institutions serving as trusted third parties. […] While the system works well enough for most transactions, it still suffers from the inherent weaknesses of the trust based model.”

There were and continue to be many lessons to be learned when examining the greed, lack of empathy and overall corruption humans have witnessed throughout history; and as events of this magnitude unfold, at the heart of every failure is trust — or a lack thereof.

Bitcoin’s proof-of-work model — including but not limited to how transactions occur, timestamps are recorded, hash rates adjust, the network broadcasts nodes, incentives are rewarded, verification occurs and privacy is encoded — is the solution many Bitcoiners have come to take comfort in.

The trust lies in the protocol rather than in individuals. Time and time again, a broken world and unscrupulous actors make the case for a trustless system.

No matter how well-regulated, designed or engineered future financial systems, exchanges or “cryptocurrencies” claim to be, they all have the same failure point: human nature and greed.

Bitcoiners realize this, and as many more become aware of financial fraud — whether impacted directly or indirectly — Bitcoin continues to emerge as the most obvious solution. SBF may teach a new generation of “investors” the same hard lesson learned by their parents: When something is too good to be true, it often is.

The failure of FTX is not a surprise, nor are the potential connections between SBF and high-ranking officials. The fact that punishments may not fit the crime(s) shouldn’t come as a surprise, either.

In truth, maximalists realize that Bitcoin will be around long after the SBF dust has settled. Bring on the next Ponzi scheme — Bitcoin maximalists appear immune.

Updated: 6-22-2023

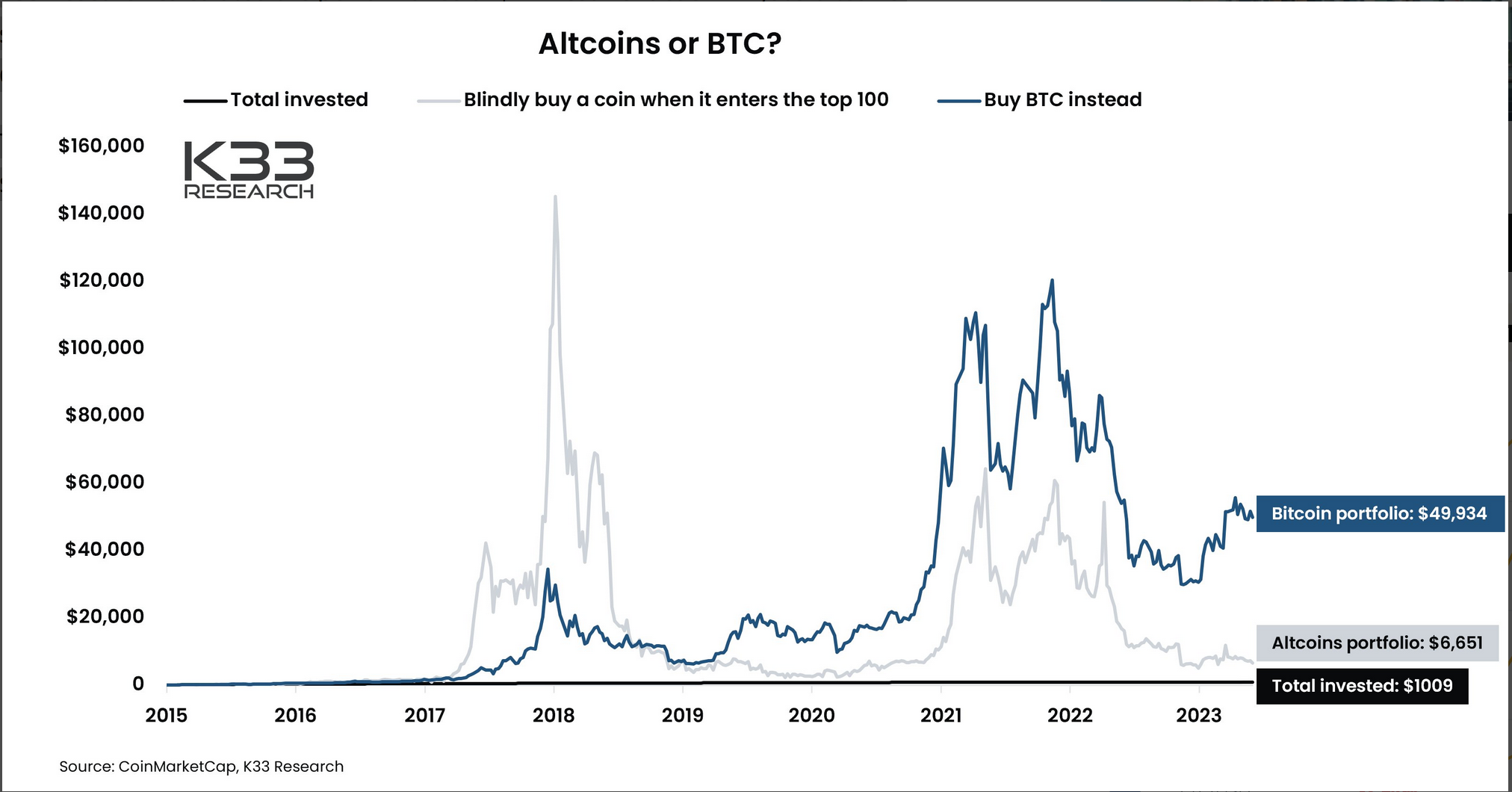

‘Bitcoin Only’ Buy-And-Hold Investment Strategy Outperforms Altcoins Over The Long Term

Historical data shows that apart from a few times since 2015 when altcoins outperformed BTC, a ‘Bitcoin only’ investment strategy has fared considerably well.

Altcoins offer diverse, innovative features, promising technological advancements, and potentially lucrative investment opportunities.

Many-a-time specific altcoins post handsome gains that surpass Bitcoin, popularly known as altcoin season. However, K33 Research analysis shows over the long-term, ‘Bitcoin only’ has been a better investment strategy than an altcoin portfolio.

Altcoin portfolio underperformed Bitcoin over the long run

Bitcoin has had three consecutive bull and bear market cycles, starting in 2013 with the latest one coming in 2021. In each cycle, Bitcoin’s price rose parabolically in a very short span, usually a few months, after surpassing the peak of its previous cycle.

In 2013, BTC peaked around $1,175 and after that followed a downtrend for two years. At the time, the altcoin market was in its nascent stage. The fiat onramps to Bitcoin were limited and exchanges to convert them to altcoins were rare.

However, by the end of 2015, a number of altcoins, including the invention of Ethereum had occurred. A few exchanges had also propped up that supported conversion of Bitcoin to other cryptocurrencies, paving the way for an altcoin market.

It was not until April 2017 when Bitcoin’s price broke above the 2013 top, that a bullish run in altcoins took place. During the second half of 2017, the ICO boom on Ethereum and retail investment hype around Ripple’s XRP led the altcoin season as many tokens outperformed Bitcoin until January 2018.

Nevertheless, in the aftermath of the bull market, altcoins suffered relatively larger losses than Bitcoin. It suggested that altcoins surged primarily as users bought them during Bitcoin bull markets with the hope of capturing higher returns.

The chart for Bitcoin and altcoin market capitalization shows that during the bear market of 2018-2019, Bitcoin found support around $6,500 after recovering from lows of $3,250 in late 2018. However, altcoins continued to hover around the lows for most of the duration of the bear market and only reversed their trend after Bitcoin broke above its previous peak of $20,000.

K33 Research calculated the performance of $1 investment each in 1,009 altcoins since 2015 as they entered the top 100 ranks by market capitalization on CoinMarketCap versus the same amount invested in Bitcoin simultaneously.

The altcoin portfolio would be worth approximately $7,000 today compared to $50,000 from the Bitcoin-only strategy.

Altcoins are usually narrative driven and many narratives die with the evolution of the market. For instance, privacy-based tokens were quite popular in 2017, however, due to regulatory scrutiny, these have dropped out of the top 100 rank by market capitalization.

Similarly, many DeFi tokens like Compound that populated the market in 2020 have dropped out of the top cryptocurrency list due to decline in DeFi usage and along with it the demand of holding non-yielding governance tokens.

Altcoins are also subject to volatility and unpredictable shifts with regulatory uncertainty hovering over most tokens. Different altcoins may experience their individual seasons at different times, and the duration of an altcoin season can vary significantly, requiring perfect timing on investor’s part to churn a profit.

K33 analysts found that since 2015 over two-thirds of the 1,009 altcoin projects that managed to creep into the top 100 rank by market capitalization have become inactive. Only 9.11% of these altcoins yielded positive returns, with only around 1.5% outpacing Bitcoin’s 50X returns.

The reported added that altcoins investments were profitable only two times since 2015—in 2017, when the altcoin strategy gained a significant edge due to the outperformance of ether hype.

Notably, during the second half of 2021 when Bitcoin regained the $60,000 level from March 2023 to make new all-time highs at $69,000, altcoins, except ETH, posted relatively dull gains.

Positive Breakout In Bitcoin’s Dominance

Besides a breakout in Bitcoin’s all-time high, another potent indicator that helps identify long term trend reversals in altcoins are breakouts in Bitcoin’s dominance levels from cricual levels.

Altcoin seasons in the previous two cycles were marked by a breakdown in Bitcoin’s dominance below 60%. After the bullish trend reversal, the bottom in Bitcoin’s dominance also coincided with the top in the total market capitalization of altcoins.

If history repeats itself, Bitcoin’s dominance could rise further while altcoin performance remains subdued.

A breakout in Bitcoin’s dominance above the 50% level on June 19, 2023, thanks to BlackRock’s Bitcoin ETF filling, has opened room for further altcoin losses as it marked a crucial historic resistance point.

In the latter half of the previous bear market that ran between 2018 and 2020, Bitcoin’s dominance increased to over 70%. On the other hand, Bitcoin’s performance was relatively better as its price held above the 2018 lows of around $3,250. K33 Research also shows that this period marked significantly poor altcoin performances, making new lows toward the end.

K33 Research analysts added in the report that altcoin portfolios have shown the potential for extra profits on Bitcoin, however, that requires “timing the market or picking the altcoin winners.” Anders Helseth, VP of research at K33 Research, told Cointelegraph regarding DCA that,

“You can create higher returns by trading market sentiment more aggressively, but it requires a lot of attention, and it is obviously more risky.”

Given that Bitcoin outperformed altcoins over the long run, an effective investment strategy for crypto investors can be dollar cost averaging (DCA) into Bitcoin.

DCA means regularly investing a fixed amount of money into a particular asset over a specific period, regardless of the investment’s price, to average the principal amount and remove the need to time the markets. Helseth of K33 Research commented on Bitcoin DCA strategy that “it’s a sensible, quite safe, and simple crypto investment strategy.”

Updated: 11-10-2023

Sam Bankman-Fried Has Fallen. Long Live Bitcoin?

Despite ongoing legal scrutiny, the performance of the asset class this year has defied and dismayed skeptics.

Financial markets have alarmingly short memories. Dreaming about the future is a much more powerful force than dwelling on the past.

Just look at what transpired in the cryptocurrency market as the US government successfully prosecuted FTX exchange co-founder Sam Bankman-Fried for one of the biggest financial crimes in history.

Rather than selling off amid the powerful reminders of how much everyone got wrong during the digital-asset bubble in general—and the ascendancy of Bankman-Fried’s empire in particular—crypto prices continued their vigorous rebound from last year’s face-plant.

In fact, as the traditional bond market heads for what may be an unprecedented third year of losses and broad stock market indexes cling to mostly ho-hum returns following last year’s bear market, crypto is poised to be the best-performing asset class of 2023.

The price of Bitcoin has more than doubled this year, and some smaller coins such as Solana are doing even better. Fund flows are returning, with investors adding $807 million to crypto-focused exchange-traded products over the past year to bring their total assets to almost $10 billion, according to data compiled by Bloomberg.

There are signs that leverage in the market is ramping up, with demand for crypto borrowing sending interest rates above 10% for some stablecoins designed to track the value of the US dollar.

Bankman-Fried’s conviction by no means clears the crypto industry’s court docket, however. Terraform Labs co-founder Do Kwon has been charged by the same US prosecutors with orchestrating an alleged fraud that last year wiped out at least $60 billion in market value from the TerraUSD and Luna cryptocurrencies, one of the triggers of the crisis at FTX.

Alex Mashinsky, the former chief executive officer of Celsius Network LLC, was arrested in July and charged in connection with what prosecutors allege was a scheme to mislead customers before the crypto lender collapsed with more than $1 billion in debt.

He’s pleaded not guilty to the charges. Su Zhu, co-founder of the bankrupt Three Arrows Capital hedge fund, was jailed in September in Singapore, as liquidators applied maximum pressure after months of sparring over locating the failed company’s assets.

Meanwhile, the Winklevoss twins’ Gemini Trust Co. and Digital Currency Group’s Genesis Global Holdco are mired in lawsuits with each other as well as legal actions from regulators over their borrowing and lending partnership.

Which Raises The Question: What could be so bright about this market’s future that it overshadows all these negatives? Well, the very fact that all these criminal cases, bankruptcies and regulatory actions are taking place at once has led many in the industry to hope that these courthouse climaxes will mark the end of the Wild West era of crypto and usher in a more mature, less-chaotic phase.

Nowhere are expectations of that hoped-for transition more on display than in the exchange-traded fund industry, which this year saw investment giant BlackRock Inc. enter the crowded race for a spot Bitcoin ETF.

It’s widely believed that approval of one or more Bitcoin ETFs is imminent after a court in August overturned the Securities and Exchange Commission’s rejection of Grayscale Investments LLC’s proposal to convert its trust into an ETF.

Much of this year’s rally in Bitcoin, at least, has been attributed to hopes that an ETF will open up a new source of demand from the type of investors (and their financial advisers) who previously were reluctant to engage with crypto-native investment platforms. Although skeptics abound, crypto’s claim to fame as the year’s best-performing asset class means that FOMO is already percolating.

Only time will tell if this transformation to a more mature, mainstream post-FTX era for crypto is wishful thinking or not. There are signs it won’t occur without friction. PayPal Holdings Inc.’s plan to develop a stablecoin was swiftly met with an SEC subpoena.

Coinbase Global Inc. is mired in an almost-existential fight with the SEC, which sued the largest US exchange in June for allegedly failing to register with the agency as a broker, an exchange or a clearing firm.

Any hopes that lawmakers in the US will pass bills to provide much-needed legal clarity to the crypto industry are slim, given the dysfunction on display in Congress.

Even if that happens, there isn’t a long list of examples of governments preventing financial asset bubbles or the painful busts that inevitably follow.

For better or worse, that’s a job typically done by the market itself—and on its own timeline, including the $2 trillion crypto wipeout last year that destroyed Bankman-Fried’s FTX empire.

“Let’s remember that he operated ‘the safe and regulated’ exchange, and not a single regulator caught him,” Erik Voorhees, an early crypto advocate, posted to X after the jury returned Bankman-Fried’s guilty verdict.

“It was, instead, the market, which is not only a great fountain of innovation, but also the best arbiter of discipline and justice.”

As Bankman-Fried sits in a cell in a correctional facility in Brooklyn, New York, waiting to learn how many years he’ll spend behind bars, he has time to lament failures in his long-held ambition to pursue effective altruism—a philosophy that motivated him to earn billions of dollars in crypto so he could one day give it all away to causes that would make the world a better place.

He shouldn’t be too hard on himself: Perhaps blowing up the Wild West era of crypto was the most effective altruism he could’ve ever performed.

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

1 In 5 Crypto Holders Are Women, New Report Reveals (#GotBitcoin?)

Beating Bakkt, Ledgerx Is First To Launch ‘Physical’ Bitcoin Futures In Us (#GotBitcoin?)

Facebook Warns Investors That Libra Stablecoin May Never Launch (#GotBitcoin?)

Government Money Printing Is ‘Rocket Fuel’ For Bitcoin (#GotBitcoin?)

Bitcoin-Friendly Square Cash App Stock Price Up 56% In 2019 (#GotBitcoin?)

Safeway Shoppers Can Now Get Bitcoin Back As Change At 894 US Stores (#GotBitcoin?)

TD Ameritrade CEO: There’s ‘Heightened Interest Again’ With Bitcoin (#GotBitcoin?)

Venezuela Sets New Bitcoin Volume Record Thanks To 10,000,000% Inflation (#GotBitcoin?)

Newegg Adds Bitcoin Payment Option To 73 More Countries (#GotBitcoin?)

China’s Schizophrenic Relationship With Bitcoin (#GotBitcoin?)

More Companies Build Products Around Crypto Hardware Wallets (#GotBitcoin?)

Bakkt Is Scheduled To Start Testing Its Bitcoin Futures Contracts Today (#GotBitcoin?)

Bitcoin Network Now 8 Times More Powerful Than It Was At $20K Price (#GotBitcoin?)

Crypto Exchange BitMEX Under Investigation By CFTC: Bloomberg (#GotBitcoin?)

“Bitcoin An ‘Unstoppable Force,” Says US Congressman At Crypto Hearing (#GotBitcoin?)

Bitcoin Network Is Moving $3 Billion Daily, Up 210% Since April (#GotBitcoin?)

Cryptocurrency Startups Get Partial Green Light From Washington

Fundstrat’s Tom Lee: Bitcoin Pullback Is Healthy, Fewer Searches Аre Good (#GotBitcoin?)

Bitcoin Lightning Nodes Are Snatching Funds From Bad Actors (#GotBitcoin?)

The Provident Bank Now Offers Deposit Services For Crypto-Related Entities (#GotBitcoin?)

Bitcoin Could Help Stop News Censorship From Space (#GotBitcoin?)

US Sanctions On Iran Crypto Mining — Inevitable Or Impossible? (#GotBitcoin?)

US Lawmaker Reintroduces ‘Safe Harbor’ Crypto Tax Bill In Congress (#GotBitcoin?)

EU Central Bank Won’t Add Bitcoin To Reserves — Says It’s Not A Currency (#GotBitcoin?)

The Miami Dolphins Now Accept Bitcoin And Litecoin Crypt-Currency Payments (#GotBitcoin?)

Trump Bashes Bitcoin And Alt-Right Is Mad As Hell (#GotBitcoin?)

Goldman Sachs Ramps Up Development Of New Secret Crypto Project (#GotBitcoin?)

Blockchain And AI Bond, Explained (#GotBitcoin?)

Grayscale Bitcoin Trust Outperformed Indexes In First Half Of 2019 (#GotBitcoin?)

XRP Is The Worst Performing Major Crypto Of 2019 (GotBitcoin?)

Bitcoin Back Near $12K As BTC Shorters Lose $44 Million In One Morning (#GotBitcoin?)

As Deutsche Bank Axes 18K Jobs, Bitcoin Offers A ‘Plan ฿”: VanEck Exec (#GotBitcoin?)

Argentina Drives Global LocalBitcoins Volume To Highest Since November (#GotBitcoin?)

‘I Would Buy’ Bitcoin If Growth Continues — Investment Legend Mobius (#GotBitcoin?)

Lawmakers Push For New Bitcoin Rules (#GotBitcoin?)

Facebook’s Libra Is Bad For African Americans (#GotBitcoin?)

Crypto Firm Charity Announces Alliance To Support Feminine Health (#GotBitcoin?)

Canadian Startup Wants To Upgrade Millions Of ATMs To Sell Bitcoin (#GotBitcoin?)

Trump Says US ‘Should Match’ China’s Money Printing Game (#GotBitcoin?)

Casa Launches Lightning Node Mobile App For Bitcoin Newbies (#GotBitcoin?)

Bitcoin Rally Fuels Market In Crypto Derivatives (#GotBitcoin?)

World’s First Zero-Fiat ‘Bitcoin Bond’ Now Available On Bloomberg Terminal (#GotBitcoin?)

Buying Bitcoin Has Been Profitable 98.2% Of The Days Since Creation (#GotBitcoin?)

Another Crypto Exchange Receives License For Crypto Futures

From ‘Ponzi’ To ‘We’re Working On It’ — BIS Chief Reverses Stance On Crypto (#GotBitcoin?)

These Are The Cities Googling ‘Bitcoin’ As Interest Hits 17-Month High (#GotBitcoin?)

Venezuelan Explains How Bitcoin Saves His Family (#GotBitcoin?)

Quantum Computing Vs. Blockchain: Impact On Cryptography

This Fund Is Riding Bitcoin To Top (#GotBitcoin?)

Bitcoin’s Surge Leaves Smaller Digital Currencies In The Dust (#GotBitcoin?)

Bitcoin Exchange Hits $1 Trillion In Trading Volume (#GotBitcoin?)

Bitcoin Breaks $200 Billion Market Cap For The First Time In 17 Months (#GotBitcoin?)

You Can Now Make State Tax Payments In Bitcoin (#GotBitcoin?)

Religious Organizations Make Ideal Places To Mine Bitcoin (#GotBitcoin?)

Goldman Sacs And JP Morgan Chase Finally Concede To Crypto-Currencies (#GotBitcoin?)

Bitcoin Heading For Fifth Month Of Gains Despite Price Correction (#GotBitcoin?)

Breez Reveals Lightning-Powered Bitcoin Payments App For IPhone (#GotBitcoin?)

Big Four Auditing Firm PwC Releases Cryptocurrency Auditing Software (#GotBitcoin?)

Amazon-Owned Twitch Quietly Brings Back Bitcoin Payments (#GotBitcoin?)

JPMorgan Will Pilot ‘JPM Coin’ Stablecoin By End Of 2019: Report (#GotBitcoin?)

Is There A Big Short In Bitcoin? (#GotBitcoin?)

Coinbase Hit With Outage As Bitcoin Price Drops $1.8K In 15 Minutes

Samourai Wallet Releases Privacy-Enhancing CoinJoin Feature (#GotBitcoin?)

There Are Now More Than 5,000 Bitcoin ATMs Around The World (#GotBitcoin?)

You Can Now Get Bitcoin Rewards When Booking At Hotels.Com (#GotBitcoin?)

North America’s Largest Solar Bitcoin Mining Farm Coming To California (#GotBitcoin?)

Bitcoin On Track For Best Second Quarter Price Gain On Record (#GotBitcoin?)

Bitcoin Hash Rate Climbs To New Record High Boosting Network Security (#GotBitcoin?)

Bitcoin Exceeds 1Million Active Addresses While Coinbase Custodies $1.3B In Assets

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Zebpay Becomes First Exchange To Add Lightning Payments For All Users (#GotBitcoin?)

Coinbase’s New Customer Incentive: Interest Payments, With A Crypto Twist (#GotBitcoin?)

The Best Bitcoin Debit (Cashback) Cards Of 2019 (#GotBitcoin?)

Real Estate Brokerages Now Accepting Bitcoin (#GotBitcoin?)

Ernst & Young Introduces Tax Tool For Reporting Cryptocurrencies (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.