China Seizes The Blockchain Opportunity. How Should The US Respond? (#GotBitcoin?)

The Chinese government is not in the habit of making speculative “what if” announcements. Typically, before anything about its plans goes public, a significant amount of preparation and thought has gone into it. China Seizes The Blockchain Opportunity. How Should The US Respond? (#GotBitcoin?)

So, although Xi Jinping’s passing statement about China needing to “seize the opportunity” posed by blockchain technology was thin on details, it’s unwise to assume nothing will come of it. In fact, as CoinDesk’s David Pan reported on Monday, there’s already a massive amount of blockchain development going on in China.

How Should The U.S. React To This? Definitely Not With Complacency.

The news out of China affirms Facebook CEO Mark Zuckerberg’s warning to Congress during last week’s contentious testimony over his company’s plans for the Libra cryptocurrency that the U.S. is at risk of falling behind the innovation curve. China is powering ahead, while the U.S. is bickering over a project that will be stalled in prototype testing phase for a long time and is throwing regulatory roadblocks in the way of countless other cryptocurrency ideas.

There Is Some There There

To be sure, many in the crypto community are dismissive of China’s blockchain strategy. That’s because it is most certainly based on a permissioned framework that implies significant centralization, with distributed ledgers managed by regulated trusted entities (if not directly controlled by the government, by consortia and other organizations subject to heavy oversight and Beijing’s intervention threats.

In that sense, China’s blockchain architecture will likely be a long way from the decentralized, trustless principles upon which bitcoin, ethereum and other public blockchains are based.

An exasperated Nic Carter took to Twitter Friday to state why he thought Xi’s “blockchain” reference was meaningless and why arguments attributing bitcoin’s massive rally to the Chinese leader’s comments were, in his mind, bunk.

But Xi’s comments did amount to “something.”

Just because China’s approach to distributed ledgers falls short of the ideals of cryptocurrency and likely involves use cases that could be just as well managed with a SQL database doesn’t mean we can walk away and ignore what’s happening there.

We must consider these moves in the context of other advances China is making in related fields. It is secretly developing a central bank digital currency, for one, and just passed a new cryptography law to enable the development of powerful new mathematical tools for managing information (potentially for the worse, if these tools are put in the hands of Beijing’s surveillance apparatus.)

Integrating a stablecoin and future cryptographic tools such as zero-knowledge proofs, and other forms of homomorphic encryption such as MPC wallets into China’s “Blockchain +” framework for related technologies could unlock efficiencies that give China’s economy real competitive advantages. Perhaps it enables the smart contract-based approach to foreign exchange risk that I flagged last month.

Or maybe it results in new compliance solutions for regulated entities such as banks to identify and onboard people and businesses. Or could it lead to more efficient Chinese customs procedures to speed up supply chains within China’s multinational Belt and Road project?

Response?

All these could give China a competitive economic advantage. And the more it develops them, the deeper its learning and capabilities will become.

Again, How Should The U.S. Respond?

Ideally, it would embrace the kind of approach to technological development that China simply can’t afford to take: the open, permissionless, decentralized one preferred by the crypto critics of closed, permissioned, centralized blockchain solutions.

Permissionlessness, as it pertains to blockchain technology, means an open architecture in which anyone can use or develop applications on a designated protocol and that there are no centralized gatekeepers saying yay or nay to actors or transactions on the network. And while that spooks the hell out of U.S. financial regulators who are used to monitoring payments for anti-money laundering and illicit finance enforcement, it’s more or less consistent with what long has been the U.S. stance on economic principles. It’s part of a long tradition in U.S. economic thinking that sees economic outcomes as positive-sum phenomena, where the more transactional activity that’s allowed, the more value and wealth is created.

Sadly, openness is much less of an American economic priority now, mostly in the international sphere, but also domestically. The Trump Administration’s protectionist approach to trade – marked by its brutal tariff war with China – and the President’s proclivity to reward or punish favorite industries and treat every negotiation as a winner-take-all “Art of the Deal” reflects the inward, closed mindset of zero-sum game thinking.

Yet the U.S. has a long history of beating its foes by being more open than them. That’s what the Cold War victory, largely engineered by a Republican president, Ronald Reagan, was all about. The same tradition continued under a Democrat administration during the post-Cold War era of Bill Clinton. Back then, amid a wave of free trade agreements and neoliberal reforms around the world, American diplomacy laid the foundation for the open Internet.

Having set the example of the Telecommunications Act of 1996, which forced the Baby Bells to accept competition, the U.S. used carrot and stick tactics to get other countries to follow suit. Creaking old government-owned telcos were privatized in developing countries, foreign competitors were allowed in, and investment flowed into the fiberoptic cable and switching technologies that would let the Internet grow.

A New Chance To Open Up

Those Were The Days. The Question Is: Can They Be Relived?

Well, the international to and fro that’s defining the regulatory and technical framework for cryptocurrency and blockchain technology may offer an opening. If the goal here is to ensure that Western models of business and government outcompete the state-led business titans of China, then a move to promote an open, permissionless approach to this vital technology may be the way to pressure Beijing.

China’s closed system of government simply can’t abide a permissionless structure over which it can have no control. But, in theory, the U.S., which its open innovation and competition model, can be more comfortable within it. It can take heart from the lesson of the 1990s, which was that open models of development will beat closed ones: the online world was won by the TCP/IP-founded open Internet, not by closed-loop intranet networks such as AOL and France’s Minitel. Ergo, an America that embraces permissionless innovation and open blockchain models has a chance to outcompete China.

I’m not holding my breath for such a policy stance in Washington, one that would mean removing roadblocks to bitcoin and other cryptocurrencies, including Libra and other stablecoins. For one, even tacitly encouraging their adoption could ultimately entail abandoning the dollar as the world’s reserve currency. Although that’s the right thing to do, it’s almost unfathomable as a policy decision.

And secondly, as I mentioned, Donald Trump is a closed-loop, zero-sum-game politician. He’s already made his disdain for bitcoin clear.

But America is still a democracy. The political environment could change. Let’s hope that whoever next leads it can see the opportunity to take on China with openness rather than tit-for-tat retribution.

China Has 700+ Blockchain Companies, According To Industry Study

China Electronic Information Industry Development (CCID) announced on Oct. 27 that there are over 700 blockchain enterprises in China, with over 500 relevant investments reported.

China Sees Aggressive Blockchain Development

According to a collective study conducted on Oct. 24 by the Central Committee of the Political Bureau of the Communist Party of China, of the aforementioned 700 blockchain enterprises, 83 are research institutions and 34 are banks.

Furthermore, over 500 investment and financing events took place in the domestic blockchain industry.

The data also reveals that 12 blockchain policies have been issued by the state and various ministries and commissions since the first half of 2019.

For example, in January the Cyberspace Administration of China introduced regulations for blockchain firms operating in the country, including anti-anonymity rules. The report also notes blockchain initiatives at the municipal level, such as those reported in Beijing, Shanghai and Guangzhou at the end of last year.

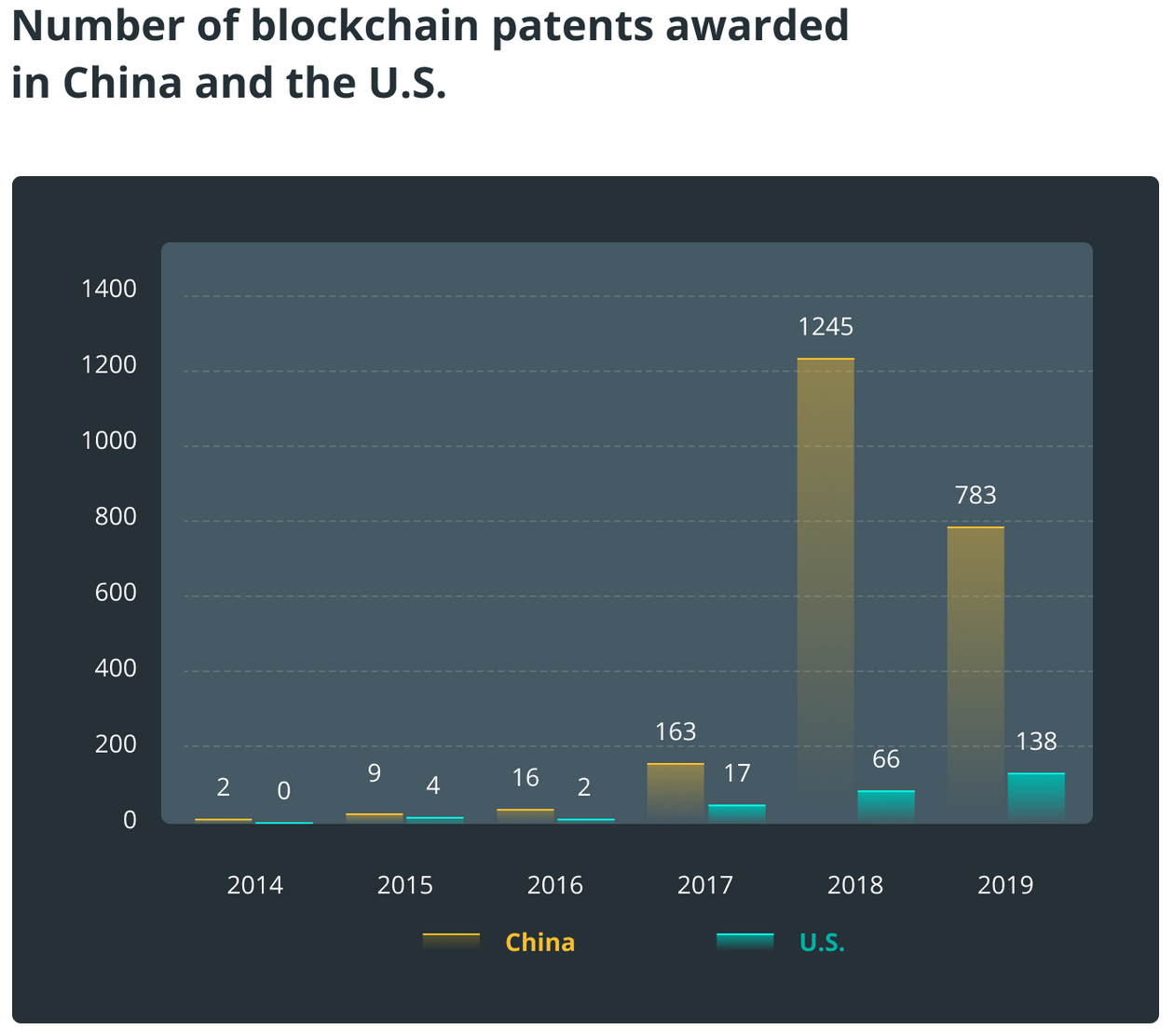

The CCID claims that local innovation in the industry is good, with internet giants, startups, research and financial institutions pushing for further development in the space. The agency says that the number of blockchain patents filed in China in the first half of 2019 was 3,547, while the total number of patents published in 2018 exceeded 2,435.

Lack Of Killer Apps And Third-Party Audits

According to the Blockchain Research Institute of CCID, China released 151 blockchain application cases in the first half of 2019. The applications are relevant to 28 fields including finance, e-government, medical care, intellectual property protection and traceability. That being said, the agency admits that Chinese blockchain applications are still lacking in multiple ways:

“At present, China’s blockchain industry applications still have problems such as large-scale application and promotion, lack of killer applications, and lack of authoritative third-party evaluation.”

CCID is a Chinese governmental organization that reports directly to the Ministry of Industry and Information Technology and is tasked with assisting the development of information industries in China.

President Xi Jinping’s Call For Blockchain Adoption Sparks Public Interest

Recently, Chinese President Xi called for the country to accelerate its adoption of blockchain technologies to drive innovation and industrial transformation. Xi told the Politburo:

“We must take blockchain as an important breakthrough for independent innovation of core technologies, clarify the main directions, increase investment, focus on a number of key technologies, and accelerate the development of blockchain and industrial innovation.”

Following Xi’s proclamations, stocks in Chinese blockchain A-share firms maxed out to their 10% daily limit, while the number of searches for blockchain technology on WeChat soared.

China Passes First-Ever ‘Crypto Law’ Going Into Effect January 2020

The Standing Committee of the 13th National People’s Congress in China has passed a new law regulating cryptography on Oct. 26 that will take effect on Jan. 1, 2020, reports local news outlet CCTV.

Per the report, the new regulatory framework aims to set standards for the application of cryptography and the management of passwords. The new regulatory framework establishes the role of a central cryptographic agency meant to lead public cryptographic work, creating guidelines and policies for the industry.

Implicit Cryptocurrency Regulation

The draft of the law was published on May 7 by a Chinese news outlet. The text is largely focused on government centralized password management and does not explicitly mention cryptocurrency, though it does focus on cryptography, a key component underpinning cryptocurrencies such as Bitcoin.

Wan Explained:

“The key take away is — the developing of new cryptography, hashing algo, even the usage of the tech, will be in the official legal realm. This means you need to follow the CCP standard for all ‘encrypted’ behaviors, which can be VERY broad, from mining to block propagation.”

Preparing For China’s National Crypto

She concluded that the law is building the foundation for the upcoming Chinese national cryptocurrency, though there is no official timetable for its launch, one Chinese official confirmed in September.

As Cointelegraph reported yesterday, China’s President Xi Jinping has called for the country to accelerate its adoption of blockchain technologies.

Meanwhile, this past week, Facebook’s Mark Zuckerberg warned that Chinese superiority in the digital currency space could put the U.S. dollar at risk in an attempt to sell lawmakers his plans for the Libra stablecoin.

“China is moving quickly to launch a similar idea in the coming months. We can’t sit here and assume that because America is today the leader that it will always get to be the leader if we don’t innovate,” he argued in an official statement.

Recently, the National People’s Congress in China cleared a new law that will allow local authorities to start regulating all of the country’s cryptography-related activities starting from Jan. 1, 2020. By creating a new regulatory framework, the Chinese government is looking to establish a uniform standard for mainstream application of cryptographic techniques and the management of passwords and other sensitive data.

The initial proposal for the law was published all the way back in May. At the time, the rough draft focused quite strongly on government-centralized password management and did not mention crypto-related matters in detail, although, it is believed that this very law will be used by Chinese officials to govern their upcoming national CBDC (Central Bank Digital Currency) — even though there is no official timetable for the launch.

Additionally, on Oct. 24, President Xi Jinping called on his country’s tech community to accelerate their efforts in blockchain adoption as a core for digital innovation. These comments were made during a Politburo Committee session that was focused solely on blockchain technology and its utility across various industrial domains. A translation of Xi’s remarks during the session reads:

“We must take blockchain as an important breakthrough for independent innovation of core technologies, clarify the main directions, increase investment, focus on a number of key technologies, and accelerate the development of blockchain and industrial innovation.”

However, Xi’s apparent willingness to adopt blockchain comes against the backdrop of China’s long-standing aversion to cryptocurrencies — with the nation having banned initial coin offerings (ICOs) as well as all activities relating to digital currency trading a couple of years back.

What Does This Mean For The Global Crypto Community?

To get a better understanding of the fallout from these developments, Cointelegraph reached out to Daniel Popa, the founder and CEO of Anchor — a crypto-based platform that aims to solve transparency and liquidity issues. He told Cointelegraph:

“President Xi Jinping recognizes the inevitability of blockchain technology integration across industry verticals and wisely seeks to place China in a leadership position when it comes to the development, application, and regulation of cryptocurrencies and blockchain-based products.”

Similarly, Alexey Ermakov, the CEO of crypto-centric banking service Aximetria, believes that while the United States and Europe are actively resisting crypto-backed innovations, other countries have begun to realize the potential behind the technology. Ermakov told Cointelegraph:

“We reach a completely different geopolitical level when competition arises not between companies and state regulators, but between global leaders, as we see with the latest announcement by China’s President Xi Jinping who wants to take a leading position in the blockchain industry. The competition between political leaders in the fintech industry will sparkle with completely new colors, benefiting all those states that contribute to development, and not resist it.”

Further expounding his views on the subject, Ermakov believes that Switzerland, a country that has created the most hospitable framework for fintech startups and actively leads matters related to crypto regulation, will most likely be one of the first states to benefit as adoption continues to increase.

What Exactly Does The New Law Entail?

As mentioned previously, China’s newly passed law does not deal exclusively with cryptocurrencies but rather discusses a host of specialized concepts related to cryptography. Simply put, the law deals with three core tenets:

— Core and Common Cryptography: This relates to matters associated with cryptographic tools and systems that are designed to protect state secrets and other state-significant objects of informational interaction.

— Commercial Cryptography: This aspect covers matters related to cryptographic systems that are meant to be used for protecting commercial information.

— Legal Liability: This aspect of the new legislation seeks to determine and define the responsibility that arises in cases where an intentional or unintentional use of a commercial cryptographic product or service (that has not been verified) is discovered.

In regards to the matter, Ermakov pointed out to Cointelegraph that the Chinese government’s approach is basically that each crypto token or coin will have to rely on a cryptographic system that is certified by a sanctioned regulatory body.

He suggested that in the worst-case scenario, the setup might be a hierarchical one, where the highest certification authority will consist of preselected Chinese officials — which basically means that at any time, any token could be confiscated by the government.

Does China’s Upcoming CBDC Pose A Threat To The U.S. Dollar?

Over the past month, Facebook Founder and CEO Mark Zuckerberg has been reiterating that the launch of China’s much-talked-about CBDC will spur the country’s superiority across the digital currency landscape and put the United States dollar at risk. On the subject, Zuckerberg was quoted as saying:

“China is moving quickly to launch a similar idea in the coming months. We can’t sit here and assume that because America is today the leader that it will always get to be the leader if we don’t innovate.”

However, the Facebook CEO’s comments have largely been viewed by the global crypto community as being a ploy to push his company’s very own stable coin offering — Libra. Andrew Rossow, attorney and cybersecurity professor told Cointelegraph that Facebook already has a full plate of issues when it comes to security measures and data collection methods, and therefore assessing whether the allegations are supported by documented fact is extremely difficult.

“By not allowing one group to control or arbitrarily change the rules, decentralized cryptocurrencies and applications provide a powerful tool for checks and balances, to protect the system from malicious actions.”

Additionally, according to Ermakov, there are many groups currently vying to consolidate their control over blockchain — something that goes against the very essence of what the technology stands for.

Popa also feels that a Chinese cryptocurrency (or even Libra) would not have enough power to greatly affect the U.S. dollar or any other sovereign currency for the simple reason that neither are likely to offer any superior advantages in terms of stability, preservation of purchasing power, or as a hedge against volatility.

That said, Popa believes that China fully realizes that many of the world’s top economies are currently engaged in a “currency race” akin to the U.S. vs. Russia space race during the 1960s. In this regard, he added:

“The world power that succeeds in adopting a stable digital currency that is easy to exchange across borders and can be used as a value peg for other currencies will lead the 21st-century global economy.”

However, Brian Young, CEO of Cuvia Labs blockchain platform, is of the mindset that a Chinese cryptocurrency issued by its central bank could pose a credible threat to the reserve currency status currently enjoyed by the U.S. dollar.

He told Cointelegraph that this is a Sputnik moment for the Federal Reserve, since China seems to have a substantial lead and has the necessary governmental control to ensure widespread adoption. Edwards then added that the U.S. needs to fast-track the launch of Libra or the consequences will be catastrophic:

“This should be followed by the creation and issuance of sensible regulations and compliance requirements to allow US entrepreneurs and investors to engage with regulatory certainty. Finally, the Fed should layout a clear roadmap to the crypto-USD. A roadmap would create FUD in the market and slow down the competition.”

President Xi Is A Blockchain Advocate Now

After Xi made his pro-blockchain comments, the crypto market lit up as the price of Bitcoin soared by just over 25%, reaching close to the $10,000 mark.

Felix Shipkevich, an attorney and principal of Shipkevich PLLC, told Cointelegraph that Xi’s sudden support for blockchain technology is logical, given the imminent launch of the digital yuan:

“This statement is a positive one, as blockchain has the power to change how currency and even society functions, providing an anonymous, peer-to-peer, highly accountable transaction, while it is decidedly counterintuitive coming from China.”

However, the fact still stands that the crux of cryptocurrencies is the idea that they are free from government control. By creating a digital yuan and passing the new law, it seems as though China’s current goal involves further modernization and getting ahead of the blockchain/cryptocurrency curve while laying the groundwork for future economic success.

Bitcoin Dissident Sees Dark Warnings in China’s Blockchain Push

China’s recent multi-front embrace of blockchain technology has divided the global cryptocurrency community. While some see it as helpful validation, others worry that crypto is diverging further from its anti-authoritarian roots.

Authorities in China have long discouraged investment in grassroots cryptocurrencies like bitcoin. But the world’s most populous country is making significant progress with plans for a national cryptocurrency that could increase the government’s surveillance powers over the economy.

CoinDesk spoke with one anonymous bitcoiner who grew up in China and has since moved elsewhere in East Asia. Far from seeing blockchain “adoption” as a march toward liberation, he expects the government to use such technologies to increase its control over the population. After all, the propaganda office for China’s Communist Party announced a blockchain-based application over the weekend that allows members to pledge their allegiance to the party.

Given China’s mass detention centers currently being used to “re-educate” over a million Chinese Muslims, this bitcoiner feared local minorities will face even harsher conditions under a fully integrated financial system controlled by the government.

What follows is a condensed transcript of the interview with this greybeard bitcoiner, a programmer who started following the project in 2014.

The text has been edited for clarity. We agreed to keep the identity of this person secret because he feared repercussions for his family.

Q: What Do You Think About The Recent “Pro-Blockchain” Announcements Coming Out Of China?

It terrifies the crap out of me.

Crypto is technology is just like nuclear fusion is just technology: You can use it to create nuclear generators that might benefit a lot of humanity, or you can use it to create atomic bombs. We do need to think about ethics when it comes to these things.

If the value is something a totalitarian state can take hold of and use to track every single person and what they’re doing, enforcing the strictest currency controls, then this is what they are going to do.

Q: Why Do You Think There Are So Many People Celebrating Such News This As A Positive Indicator For “Adoption” In The Crypto Community?

People in East Asia are very comfortable with the idea that the government is like our parents, that they’ll take care of us.

Even if they read novels like Brave New World or 1984, the world to them is OK for the most part. But the few people who want to act in a way that the government does not agree with will be persecuted.

My parents have been [Christian] missionaries for about 18 years now, and being a missionary is outlawed in China. Our phones were getting tapped, our computer was getting hacked. My parents’ names were on the Chinese police blacklist. People like my parents are called terrorists or Tibetan freedom fighters.

In China, there’s very strict capital controls. So when I read about bitcoin, it was like, “This is a great way to store money with real censorship resistance.”

Q: How Did You Guys Live Under Such Constant Surveillance?

We had very specific protocols for operational security. For example, when we’re talking over the phone or email, we switch out all sensitive words and make sure our servers are not located in China.

My parents once had their WePay and AliPay accounts cut off. But luckily they had cash, fiat currency and physical cash so they could live. If China had been 100 percent digital, there would have been no way for them to survive.

Q: How Does Your Family Use (Relatively) Decentralized Blockchain Technology Today?

I don’t send my parents money in crypto. But my biggest fear growing up was that my parents would be deported. In China, after they tell you that you need to leave the country, you need to liquidate all your assets in 48 hours. We used to practice this thing where we’d pack everything we have in less than 48 hours. It was kind of like our drill.

Right now, all my parents’ assets are in crypto. As long as there’s one of us, somewhere in the world with access to our private key, our wealth is OK. It’s still very difficult for my parents to access their crypto, though. They can’t do it by themselves. They definitely need my help. That’s why I hold most of their stuff. In that way, accessibility [with crypto] is still lacking, even if it provides a store of value. And my parents don’t really understand crypto the way they understand banking services.

At the end of the day, censorship resistance is not enough. We need a private way of transacting and a way to make it accessible, understandable to everyone. We’re not there yet.

Updated: 11-1-2019

Expert: US Should Cut Crypto Firms Some Slack To Compete With China

Fintech and regulation experts have said the United States needs to wake up to China’s proactive pursuit of a central bank digital currency.

A Fortune report published on Nov. 1 pointed to the fact that digital currency looks poised to play an increasingly important role in the standoff between the two superpowers.

China making “very large macros plays”

As Mike Wasyl — managing partner at DeerCreek, a fintech-focused corporate strategy firm that works across Asia-Pacific and the U.S. — told Fortune:

“China is making these very large macro plays. They want to maintain control and be seen as leaders and so adopting blockchain and being public about it, as we saw recently, is going to stir a lot of interest.”

Duncan Wong, chief executive of Hong Kong-based startup CryptoBLK, ventured that the recent endorsement of blockchain innovation by Chinese President Xi is likely to accelerate the rollout of the People’s Bank of China (PBoC)’s plan to launch a central bank digital currency (CBDC).

As Wasyl noted, China’s race to launch its CBDC first is likely to send a signal to global competitors that this is “the new paradigm.”

The country already has a vast digital payment ecosystem, with Tencent’s WeChat Pay counting over a billion users and Alibaba’s Alipay 1.2 billion.

U.S. Trying To Regulate Its Way To Innovation

Li Chen, a researcher at the Chinese University of Hong Kong whose work focuses on China’s financial development and government regulation, told Fortune underscored that the country’s approach to digital currency and blockchain bifurcates between encouragement and caution.

The country is notoriously opposed to decentralized cryptocurrencies such as Bitcoin and pursued a historic blanket criminalization of initial coin offerings (ICOs) alongside a crypto exchange crackdown back in 2017.

Yet when it comes to blockchain innovation in the industrial — and particularly financial — sectors, Li argued that advancements in CBDC development have taken place within the “relatively permissive attitude of China’s financial regulators and central bank”:

“I think it’s fair to say China’s fintech revolution […] would not achieve what it is now without the overall more permissive attitude of Chinese government regulations.”

Insofar as [developers] “remain in these parameters set by the state in terms of the direction of innovation,” he said he expected to see accelerated blockchain implementation in China.

Wasyl: U.S. Needs To Cut Blockchain Firms “A Little More Slack

But contrast, Wasyl argued that the U.S. is stuck trying to “regulate [its] way to innovation.”

A U.S. CBDC is “an inevitability,” he said, and the government should be capitalizing on the interest sparked by Facebook’s Libra to open up a larger conversation about the country’s currency future.

Once digital currency gains traction, he stressed, “it’ll be gradually, and then all at once.”

The experts remained unanimous in considering that for the time being, China’s CBDC is not likely to pose a threat to U.S. dollar hegemony, but warned that the U.S. needs to cut blockchain firms “a little more slack to allow some exploration” if it is to stay ahead in the game.

This summer, the former PBoC governor characterized Libra as being “inseparable from the global dollarization trend,” stressing the imperative for China to maintain a strong monetary status.

Updated: 11-1-2019

The Professor, The President And The Pep Talk That Kicked Off A Blockchain Rally

Chen Chun, who schooled China’s Xi Jinping on the technology underpinning digital currencies, is in the spotlight after this week’s spike in blockchain stocks.

China’s blockchain frenzy, which sparked rallies in an array of companies, has catapulted one academic into the limelight.

Meet Chen Chun, a 63-year-old computer-science professor and an expert at a government-backed think tank. At a meeting last week, it was his job to brief Chinese President Xi Jinping and other senior officials at the Communist Party’s Politburo on the merits of blockchain—the open-ledger technology underpinning cryptocurrencies like bitcoin.

After Mr. Chen’s briefing, Mr. Xi announced that China should speed up research into blockchain, according to a report released late last week by the country’s official Xinhua News Agency.

While Beijing has previously been skeptical about cryptocurrencies, some investors and experts had expected cautious support for blockchain technology as part of a broader competition with the U.S. over financial firepower. China’s central bank is also in the midst of developing its own digital currency. Yet the fact that such an endorsement for blockchain came from Mr. Xi himself took the market by surprise.

On Monday, stocks that had even a tangential connection to blockchain soared. The share prices of more than 150 blockchain-related listed companies were forced to suspend trading because they hit the upper 10% daily limit allowed in China’s stock market, according to data provider Wind.

The price of bitcoin also jumped by about a third and briefly topped $10,000 after Mr. Xi’s comments were publicized, before falling back in recent days. The world’s most popular cryptocurrency recently traded around $9,100, according to research site CoinDesk.

For many of those companies, their rallies lost steam throughout the week. An index that tracks blockchain-linked stocks in mainland China rose just 3.1% for the week, after initially rising nearly 9% on Monday alone.

“This is classic speculation among retail investors,” said Tony Gu, founding partner at NGC Ventures, a blockchain investment fund. “When you see rallies like this, the trend almost always dies off because there’s no substance to it.” He said the vast majority of companies claiming to have blockchain exposure don’t actually make any money off the technology.

Among companies that maintained their share gains were some with ties to Mr. Chen or companies he has had stakes in.

One of them is Insigma Technology Co., whose shares rose 26% over the past week. Mr. Chen co-founded the company in Hangzhou in eastern China decades ago; he left it in 2014. Insigma announced on Wednesday it holds a 2.8% stake in a private company Mr. Chen established two years later, Hangzhou Qulian Technology Co.; it didn’t disclose whether Mr. Chen still holds stakes in Insigma.

Another winner in this week’s rally is property developer Xinhu Zhongbao Co., which said in a Thursday filing with the Shanghai Stock Exchange that it owns nearly half of Qulian. It surged by the daily 10% limit all five days. Its market cap is currently $5.7 billion, according to FactSet, up from $3.4 billion a week ago.

There is no indication Mr. Chen directly profited from the market’s sharp rally. He couldn’t be reached for comment.

Mr. Chen’s connection with these companies is well-known in the industry, four blockchain and cryptocurrency investors told The Wall Street Journal.

Mr. Chen was listed in 2017 by China’s Ministry of Science and Technology as a member of an artificial-intelligence-strategy advisory committee, which was designated to support the country’s megaplan for high-end manufacturing development, dubbed “Made in China 2025.”

Investments are intricate in this knowledge-intensive industry, and often involve scholars and experts. According to public filings, Mr. Chen is a shareholder of at least four private companies and chairs the board of another two besides Qulian.

Qulian partnered with several state-owned enterprises including the Shanghai Stock Exchange and the power giant State Grid to develop blockchain platforms. It also runs research projects with Zhejiang University, where Mr. Chen directs a blockchain research center.

Chinese state media have warned about the risks of speculation in the blockchain business. Investors, meanwhile, worry that speculators might use the blockchain push to step up practices such as shadow lending or cross-border transfers that could eventually trigger a regulatory crackdown and hurt the industry as a whole.

The multiple stock-exchange filings this week by Insigma and Xinhu Zhongbao, in which they clarified their associations with Mr. Chen’s company, were an indication of their desire to stay ahead of speculation around their dramatic market-cap gains.

Updated: 11-4-2019

China: Blockchain Is the Future But Keep it Rational — Avoid ‘Aircoins’

China’s official state-owned media has endorsed “orderly” blockchain innovation but cautioned the public to “keep it rational” and avoid the hype around “aircoins.”

On Oct. 4, Dovey Wan — founding partner of blockchain-based investment company Primitive Ventures — tweeted two screenshots showing a rough translation of the new report from the CPC-owned English-language news portal China Daily.

China Needs “Inclusive And Prudent” Regulation

The People’s Daily article opens with the bullish statement that with blockchain “the future is here” — yet swiftly goes on to draw a sharp distinction between bonafide innovation in the sector and what it deems to be undesirable virtual currency speculation:

“Innovation in blockchain is not equivalent to speculation in virtual currency. The use of blockchain to hype up aircoins […] should be prevented.”

The report continues to caution that blockchain remains in its early stages of development and still demands improvements in terms of security, standardization and regulatory oversight:

“The use of blockchain to store and spread illegal information, to enable illegal transactions, money laundering and similar activities should be severely punished.”

To conclude, the report advocates for “inclusive and prudent regulation” that allows for experimentation but prohibits transgressions.

Only by avoiding a frenzied rush can China foster the development of the blockchain sector with “orderly competition, it states.

As the People’s Daily notes, China already has a solid foundation for implementing blockchain development with the participation of major internet firms in the sector as well as with over 20 of the country’s provinces already introducing policies to promote the industry.

Blockchain-based ID System Launching In China’s Smart Cities

Earlier today, the Global Times reported that a new, independently-developed blockchain-based smart city identification system has been jointly launched by three institutes based in the city of Shijiazhuang in North China’s Hebei Province. The system has been made available for cities nationwide as of Nov. 3.

This week, over 10 million blockchain-based invoices were successfully issued in China’s tech capital Shenzhen, according to the city’s tax authorities.

Notably, Chinese President Xi Jinping has recently called on the country to accelerate blockchain adoption, endorsing the technology “an important breakthrough.”

Updated: 11-4-2019

Huawei Signs Deal With Digital Currency Research Unit of China’s Central Bank

Multinational telecommunications and consumer electronics giant Huawei has signed a strategic cooperation agreement with China’s central bank, the People’s Bank of China (PBoC).

According to a statement from Huawei’s WeChat channel on Nov. 4, PBoC deputy governor Fan Yifei attended the signing of a fintech research cooperation agreement between Huawei and PBoC’s Digital Currency Research Institute at Huawei’s headquarters in Shenzhen.

The announcement did not mention details regarding the agreement, or whether it includes joint research on blockchain technology or digital currencies. Huawei has not responded to Cointelegraph’s request for comment as of press time.

Huawei Is Active In The Blockchain Space

Huawei has been actively developing its blockchain capabilities over the past few years. In April 2018, the firm launched its Hyperledger-based blockchain-as-a-service platform — Blockchain Service — one month after the release of Huawei and Hyperledger’s joint project Caliper.

In June, the firm was considering launching blockchain services in Latin America.

Speaking to Cointelegraph Brasil, an anonymous Huawei executive said at the CIAB Febraban conference on June 11 that its blockchain-enabled products and services may be available on the continent in the near future.

China Aggressively Pursues Blockchain And Digital Currency Development

Over the last few years, the Chinese government has lost no time in pursuing blockchain development and innovation within the country as it jockeys to be the global leader in emerging distributed ledger technologies.

China’s central bank founded the Digital Currency Research Institute in June 2017, concentrating its efforts on blockchain technology and fintech.

In June 2019, Cointelegraph reported that China is running neck-and-neck with the United States regarding the number of blockchain patents filed in each country.

President Xi Jinping himself recently called on his country to accelerate the adoption of blockchain technology at a Politburo Committee session. He said:

“We must take blockchain as an important breakthrough for independent innovation of core technologies, clarify the main directions, increase investment, focus on a number of key technologies, and accelerate the development of blockchain and industrial innovation.”

Updated: 11-5-2019

Peter Schiff: China’s Gold-Backed Crypto Would Be Bearish for Bitcoin

China launching a digital counterpart of the yuan backed by gold puts Bitcoin (BTC) at a disadvantage, veteran gold bug Peter Schiff claims. In a tweet on Nov. 2, Schiff, notorious for his cynicism when it comes to Bitcoin, attempted to counter criticism of his stance by Keiser report host, Max Keiser.

Schiff Tells Keiser: Gold Backing Beats BTC

“According to @maxkeiser I’m an idiot because I think #gold is better money than #Bitcoin,” he wrote.

Schiff also repeated his oft-quoted idea that Bitcoin has no intrinsic value:

“He also claims China is about to launch a crypto currency backed by gold. This is bullish for gold and bearish for Bitcoin. A crypto backed by gold is much better than one backed by nothing!”

Keiser did not respond publicly, having kept a markedly low profile on social media throughout October.

Official Hints At Gold Role

As Cointelegraph reported, China appears to be advancing efforts to issue a digital currency in the wake of Facebook’s own token, Libra.

Its backing remains uncertain, with an ex-Congress official last month suggesting it would come in the form of a peg to China’s gold reserve among other factors.

China’s recent endorsement of blockchain technology meanwhile appeared to have an instant positive impact on Bitcoin markets. Nonetheless, local media subsequently tempered the hype, advising citizens not to take the support as proof of a change of stance regarding cryptocurrency.

Beijing outlawed cryptocurrency trading in September 2017, a situation which officially remains the same despite rumors that investors are using different on-ramps to gain access.

Updated: 11-6-2019

China Signs Agreement With Hong Kong Central Bank For Blockchain Push

Blockchain has received fresh endorsement from China in the form of a development pact with the de facto central bank of Hong Kong.

In a news post on Nov. 6, the Hong Kong Monetary Authority (HKMA) confirmed it had signed a Memorandum of Understanding (MoU) with a subsidiary of the People’s Bank of China (PBoC).

Central Banks Want “More Convenient Trade Finance”

The deal aims to create a Proof-of-Concept for a trade finance platform from Q1 2020, linking two existing projects: the HKMA’s eTradeConnect and the PBoC’s Trade Finance Platform.

The two central banks will be represented by subsidiaries of Hong Kong Interbank Clearing Limited and the Institute of Digital Currency of the PBoC.

“Once the connection has successfully been established, it will provide firms in both places with more convenient trade finance services and enable banks in Hong Kong to expedite the expansion of their trade finance business,” the post adds.

China Blockchain Funds Approach $6 Billion

The news follows sudden endorsement of blockchain technology from Beijing, with president Xi Jinping personally appealing for its use to expand across the domestic economy.

As a direct response to the events, Chinese regional governments and other entities have pledged blockchain funds worth $5.7 billion to further support, local financial media outlet China Money Network reported on Wednesday.

Among them is a 100 million yuan ($14.3 million) fund from 1911 Group, the publication wrote citing another outlet, PE Daily.

“To lift Hong Kong’s fintech development to a new height, we must take a holistic ‘HK Inc.’ approach,” HKMA chief executive Eddie Yue commented as part of the MoU signing.

‘Bullish For Bitcoin’ — China Scraps Plans To Ban Cryptocurrency Mining

Bitcoin (BTC) mining will not face a state crackdown in China, authorities have confirmed in new official documents. As noted by Blockstream CSO Samson Mow and others on Nov. 6, mining no longer features on a list of industries Beijing considers undesirable.

“Bullish For Bitcoin”

The change came via a new edition of China’s Industrial Structure Adjustment Guidance Catalog, which will take effect from the start of 2020.

“China’s National Development and Reform Commission has removed #cryptocurrency mining from the list of industries they want to eliminate. Bullish for #Bitcoin,” Mow commented.

A previous incarnation of the document earlier this year had conversely included Bitcoin mining as one of the government’s targets.

The news marks a rare boon for Bitcoin-related activities in China, a country where cryptocurrency outside the control of the central bank remains all but banned.

BTC Markets Calm

The recent endorsement of blockchain technology from president Xi Jinping coincided with a dramatic rise in BTC/USD, after which local media cautioned on misinterpreting the remarks as supportive of crypto.

Following the most recent announcement, however, little appeared to change on Bitcoin markets.

Mining has long formed a profitable industry in China, with cheap electricity meaning major participants still reside there. Canaan Creative, one of the biggest Bitcoin mining rig manufacturers, will reportedly undergo a $400 million initial public offering, or IPO, later this month.

Updated: 11-6-2019

How Will China Pursue Xi Jinping’s Blockchain Adoption Plan?

After President Xi Jinping called to speed up the development of blockchain technology in the country on Oct. 24, blockchain-related news from China just keeps on coming as the country is seemingly eager to beat the United States (or any other country) in the race to implement blockchain initiatives. For this purpose, a special regulatory body has been created to monitor over 700 local decentralized projects, and any articles containing anti-blockchain statements are now banned.

Talking About Blockchain Is Good!

The country’s authorities have studied the possibilities of distributed ledger technology for some time. However, at the beginning of last week, the blockchain policy in China took a more aggressive course.

During a Politburo Standing Committee session, the head of state called on government institutions to immediately begin implementing a program to integrate blockchain into the country’s economy and its IT sector.

The ambitious program’s implementation began with restoring blockchain’s reputation. Any anti-blockchain statements are now banned in the country, with existing publications criticizing or calling the technology a scam being removed en masse last week.

Not long ago, the Chinese government’s stance on blockchain and cryptocurrencies wasn’t so positive.

“Who still remember the days when posts promoting blockchain getting deleted real fast?” tweeted local blockchain and cryptocurrency news outlet cnLedger on Oct. 28. Additionally, the country’s most downloaded educational mobile app, Xuexi Qiangguo, has recently introduced a new course that is completely dedicated to blockchain and cryptocurrencies.

As reported by local news outlet Storm Media, the technology is being discussed in Chin

a mainly due to the government’s motive. As a result, the number of articles and TV programs promoting decentralized technology is growing rapidly. Over the past 30 days, the number of pages containing publications about “區塊鏈” (blockchain) in the Baidu search engine has more than doubled, from 34 to 76.

Since Oct. 25, WeChat users have been searching for blockchain 11.8 times more often. In just two days, the number of relevant searches increased from 777,000 to 9.2 million.

Research

The People’s Bank of China began exploring the possibilities of digital currencies and DLT back in 2014.

Three years later, in 2017, its representatives announced that they would pay special attention to blockchain as part of a five-year development plan. Musheer Ahmed, managing director at FinStep Asia — an advisory firm assisting fintech startups — told Cointelegraph:

“The development of innovative technologies has been an important part of Chinese Government Policy to take the country forward into industry 4.0 era. We saw the same when it came to the development of mobile internet and, in particular, Artificial Intelligence and IoT.”

A week ago, during a meeting with Communist Party of China officials, President Xi urged the country’s ministries and companies to allocate even more resources to the study of blockchain technology. He emphasized, “Greater effort should be made to strengthen basic research and boost innovation capacity to help China gain an edge in the theoretical, innovative and industrial aspects of this emerging field.”

The ambitious plans are supported by existing programs: In October last year, China launched the first pilot blockchain development zone. Based in the Hainan Resort Software Community, the zone was created in collaboration with the Oxford University Blockchain Research Center. Wang Jing, head of Hainan’s provincial department of industry and information technology, said at the time:

“The pilot zone will commit to attracting blockchain talent around the world and exploring the application of blockchain in areas such as cross-border trade, inclusive finance and credit rating.”

She added that the pilot zone will cooperate with the world’s leading research institutes and major players in the blockchain industry. According to the Communist Party of China Central Committee, there are presently 83 blockchain research institutes in the country.

Overall, research across Chinese universities in blockchain is at a prolific level, according to professor Olinga Taeed, council member and expert advisor at China E-Commerce Blockchain Committee. He told Cointelegraph:

“CCEG has a 5 year agreement with then Centre for Cyber Security at the University of Electronic Science and Technology of China in Chengdu (UESTC). When I visited them in September 2017 they already had over 40 PhD students working on blockchain; you have to compare this to the rest of the world where you will be lucky at most to have 3–5 at a university more than two years later.”

Investments

China is seeking to introduce blockchain in a variety of areas, doubling the volume of investments to $3 billion since the second quarter of 2018.

Last year, various funds were allocated to the blockchain industry by Chinese government agencies, totaling 40 billion yuan ($5.8 billion). Funds financed by individual cities and provinces such as Hangzhou, Nanjing, Beijing, Shanghai, Shenzhen, Xi’an and others are especially active. On Oct. 30, Cointelegraph reported on the Guangzhou government’s plans to launch a $140 million subsidy fund to encourage the development of blockchain initiatives.

Regulation

The ambitious goals set by Beijing to create a blockchain industry ecosystem in the country require strengthening leadership and the work of regulatory bodies, as stated by the Secretary General of the CPC. Meanwhile, an entity to meet this requirement is already actively functioning in the country.

To date, the Chinese Cyberspace Administration — the structure governing the activities of local blockchain projects — has checked and approved over 506 organizations. This list includes the largest Chinese state-owned banks, IT corporations as well as many state and commercial projects that determine the face of today’s Chinese economy.

It should go without saying that the face should be impeccable, according to the CPC, which calls on blockchain companies to “remain rational.” The orders from above are being successfully carried out, as the Shanghai Stock Exchange asked blockchain-related projects at the end of October to make statements based on facts and refrain from creating hype.

Meanwhile, the creation of these standards is entrusted to the Research Institute of Electronic Industry Standards under the Chinese Ministry of Industry and Information Technology.

The widespread adoption of these standards is expected to occur before the end of the year and will allegedly include basic and business standards for processes and methods, compatibility and information security.

At the same time, ready-made fintech products will undergo mandatory certification. For this purpose, the People’s Bank of China has created a special department called Certification of Fintech Products.

Cointelegraph reported that China plans to certify 11 types of equipment and software for financial technology that facilitate digital payments and blockchain services. According to the bank’s representatives, the issued certificates will be reviewed and updated every three years.

Development

When it comes to the development of blockchain solutions, China’s plans are wide and varied. The work is in full swing, especially after the recent speech made by the president. Everybody is busy — from the administration itself, in a hurry to issue a central bank national digital currency while checking the loyalty of officials through a new decentralized application, to large corporations.

According to the China Electronic Information Industry Development report, the number of blockchain patents filed in the country reached 3,547 in the first half of 2019, exceeding the total number of patents for the full year of 2018.

One of these companies, FUZAMEI Technology, told Cointelegraph it has applied for more than 300 blockchain patents, 295 of which have been published, and eight have been authorized. Danruo Huang, the company’s overseas market development manager, said, “From our perspective, intellectual property protection and continuous innovation of technology are fundamental to future development.”

Meanwhile, the total number of blockchain projects in the country counts over 700. The list includes representatives from various industries, including tourism, education, e-commerce, law, healthcare and supply chains. Among the latter are blockchain solutions HiCloud and AliCloud developed by technology corporations Huawei and Alibaba, respectively.

Baidu, the Chinese online search giant, has also made its appearance by patenting its own “Super Chain” blockchain for developing the fundamental infrastructure for the provision of blockchain services.

The list also includes financial sector giants such as Industrial and Commercial Bank of China and Ping An Bank, both of which have registered as many as two blockchain projects each. Another major state-owned bank, China Merchants Bank International, is using the public blockchain Nervos to create fintech applications for retail and institutional clients.

Along with commercial enterprises, government agencies are also represented, including the State Currency Office with its cross-border blockchain platform for business representatives and the Hangzhou Internet Notary Service.

Beijing is actively attracting IT companies to integrate blockchain technology into the administrative sphere and the public sector. It is known, for example, that the American company ConsenSys is creating an application for renting real estate in Xiongan New Area.

Meanwhile, the administration of Shenzhen city has entered into an agreement with Tencent, a Chinese tech company, to open an entire Intellect Tax laboratory. Its employees will use blockchain to track how citizens pay taxes.

Add to that the recent investment of Wanxiang, one of China’s largest automotive giants, of almost $30 billion in a new blockchain startup involved in creating a blockchain-powered “smart city” that is able to track citizens’ data. “Innova City” is set to become China’s “largest, most interconnected, blockchain-powered smart city.”

Real-world Use?

Does China demonstrate the same level of efficiency when it comes to functional blockchain solutions? It seems that the country is succeeding here too. It’s not just mining corporations and cryptocurrency exchanges where China is an undisputed global leader, but also in the practical application of decentralized technology within institutional structures.

The most vivid example is the Beijing Internet court, which was created in 2018 and has since examined 14,904 cases with the help of blockchain. The organization’s president, Zhang Wen, said that in 40 out of 41 cases, the parties preferred to settle the matter in court using evidence validated by blockchain.

Zhang also noted that the court has used blockchain in 58 cases to collect and provide evidence during trials. In another city, Hangzhou, the internet court uses blockchain to combat plagiarism, and the country’s Supreme Court has even recognized the legal force of evidence based on blockchain.

In the logistics field, the VeChain blockchain system is actively used to validate the quality of goods. In mid-October 2019, it began to be used for tracking beef imported from Australia and identifying counterfeit meat products.

Through the new service, each piece of beef is placed in a vacuum-sealed package marked with a unique QR code, which allows the transportation process to be tracked from the slaughterhouse in Australia to stores in China. Suppliers, sellers and consumers can check the origin of the meat by scanning the code using a smartphone at any time. The code works with VeChain Pro, WeChat and Alipay applications, and makes it impossible to fake or forge any records in the blockchain system.

Blockchain has also seen widespread use in the field of mobile payments in China. This is not surprising, given that 425 million Chinese people use phones as electronic wallets, and the mobile payment market has already reached $5.5 trillion. One can now pay for a product with a smartphone at almost any vegetable market by simply scanning the QR code marked on an electronic scale. Tencent’s messenger, used by 500 million Chinese people, has its own TrustSQL blockchain platform to make mobile payments safer. Regarding this, Ahmed told Cointelegraph:

“The technology has been in use to varying degrees in Mainland China for the last few years. We have seen the big TechFins/Tech giants using blockchain for payments, like Alipay for remittance, as well as for their operations. In some instances, blockchain has been used by tax bureau to issue tax invoices in Shenzhen.”

The Forecast For The Next Two Years

Meng Liu, an analyst at Forrester, believes that there will be a significant increase in enterprise blockchain projects in the next year or two, most of which will be owned or financed by government organizations. At the same time, according to Meng, banking will stand at the forefront of China’s blockchain industry:

“In his speech, President Xi has highlighted a few use cases for blockchain such as small-to-medium enterprise (SME) lending, banking risk management, and compliance. The instructions from China’s top leadership will push the digital transformation process of megabanks’ back-office operations and improve their operational efficiency.”

Speaking about the role of financial entities involved in China’s blockchain adoption plan, many experts referred to the country’s national cryptocurrency planned for issue by the People’s Bank of China as part of its Digital Currency Electronic Payment system intended for use in the near future.

Xin Wang, CTO at Huaxin Blockchain, told Cointelegraph that the DCEP system can be publicly released within a year. He also added that Alipay and WeChat pay have already set up an infrastructure for the project. Xin went on:

“Blockchain will act as a complementary strategy for data safety and audit. The government will start to adopt this technology in the government IT system to provide better service to public. The areas may include: digital certificate, copyright, proof of asset, etc…”

As for a key region where the blockchain is likely to flourish, Meng named Shenzhen, explaining that China’s government is seeking to turn the city into a “hub of innovation, entrepreneurship, and creativity with international influence. It also fosters plenty of leading tech and fintech giants such as Ping An Group, China Merchants Bank, WeBank, Tencent and Huawei,” the analyst added.

Further development of blockchain technology in the country will most likely be facilitated through state-controlled chains. Dr. Paul Sin, leader of FinTech Practice and Asia Pacific Blockchain Lab, said in a conversation with Cointelegraph:

“DLT or permissioned blockchain has a key difference from public blockchains used by cryptocurrency, i.e. only permissioned named users can join the network (vs. crypto users are often anonymous). While crypto allows money laundry, breaches of currency control, illegal fund raising, etc., DLT enables traceability and auditability. Hence China government has been and will continue to support DLT.”

Updated: 11-11-2019

China’s State-Run Media: Bitcoin Is Blockchain’s First Success

The official Chinese state-run Xinhua News Agency has published a report recognizing Bitcoin (BTC) as “the first successful application of blockchain technology.”

Published today, Nov. 11, the coverage is exceptional given China’s abiding hardline stance against decentralized cryptocurrencies, as epitomized by Beijing’s historic September 2017 blanket ban on crypto exchanges and initial coin offerings.

Even-handed Exposure

The Xinhua article is broadly positive and detailed in its coverage of Bitcoin and the history of its development and evolution.

It opens by posing the question of whether the coin represents the “inevitable trend of future currency development or just another ‘tulip’ hype?” Given this formulation reproduces a long-standing industry platitude, it arguably leans more toward rhetorical convention than polemic.

The article continues to describe the core principles of blockchain as a decentralized, immutable and trustless system for the peer-to-peer transfer of value, covering aspects such as mining, digital scarcity and pseudonymity.

It is in regard to this latter — again, similarly to much Western mainstream media coverage of cryptocurrencies — that the article flags up the potential risks of Bitcoin, arguing that purportedly “the most important uses of Bitcoin payments are black market transactions and ‘dark net’ transactions.”

Xinhua also emphasizes the volatility of Bitcoin as a currency that is not backed by a centralized sovereign power — as distinct from national fiat currencies.

However, the article is notably free of hyperbole or demonization, prompting some readers to propose that the coverage represents the “first time Bitcoin got such positive exposure” from the Chinese government.

A turning tide?

As reported, President Xi’s recent high-profile endorsement of blockchain innovation in recent weeks was accompanied by the signing of the first national law regulating cryptography, governing various aspects of blockchain, due to come into effect this January.

The country’s central bank, the People’s Bank of China, is also expected to become the first major global economy to launch a central bank digital currency as other countries, such as Tunisia, are already getting a head start.

While state media has recently reiterated a cautious stance against speculative excesses in cryptocurrency trading, the country is nonetheless appearing to tone down its erstwhile stringent opposition to activities such as Bitcoin mining.

Updated: 11-12-2019

China Digital Currency ‘Not Seeking Full Data Control’ — Central Bank

China is not launching a war on cash by introducing its own digital currency, a senior official from the central bank has said.

As Reuters reported on Nov. 12 quoting Mu Changchun, head of the digital currency research institute at the People’s Bank of China (PBoC), Beijing still intends for the new currency to complement the paper yuan.

PBoC “Knows” Public Wants Notes And Coins

Mu was speaking at a conference in Singapore, as speculation swirls the digital currency could appear within the next three months. China would be one of the first countries in the world to issue a domestic digital currency, along with Tunisia.

“We know the demand from the general public is to keep anonymity by using paper money and coins… we will give those people who demand it anonymity in their transactions,” Mu explained. He continued:

“But at the same time we will keep the balance between the ‘controllable anonymity’ and anti-money laundering, CTF (counter terrorist financing), and also tax issues, online gambling and any electronic criminal activities. That is a balance we have to keep, and that is our goal.”

No War On Cash?

China already employs strict monitoring of the financial sphere. The use of popular mobile payment operators such as WeChat Pay and Alipay requires extensive personal information, and until recently was only available to those with a Chinese bank account.

Mu’s comments build on previous moves from the PBoC to protect cash. In July, it announced a crackdown on merchants refusing to accept paper fiat.

Nonetheless, Mu appeared keen to state that digital currency did not imply increased control of user data, despite the ease of aggregation of such data with digital transactions.

“We are not seeking full control of the information of the general public,” he added.

Other attempts to digitize previously cash-based transactions have met with much criticism. In India, where the government is conversely attempting to limit cash usage since 2016, spectators have voiced alarm at a scheme to tie replacement digital transactions to consumers’ real identities.

Updated: 11-14-2019

Julian Gordon’s WeChat ‘Hasn’t Stopped Buzzing’ Since Xi Jinping Went Pro-Blockchain

Speaking at BlockShow Asia 2019, Hyperledger Vice President APAC Julian Gordon described the personal impact that the Chinese president’s pro-blockchain remarks have had on him:

“Xi Jinping made that announcement 10 days ago. The reason I know that is because my phone is sitting on my desk — my WeChat started buzzing and hasn’t stopped since.”

Hosted by the Linux Foundation, Hyperledger is an open-source blockchain project aiming to be a hub for open blockchain development across industries. It has gathered companies from different backgrounds such as IBM, Airbu, and J.P.Morgan to further advance cross-industry blockchain technologies.

Hyperledger is also collaborating with Chinese companies in areas like trade finance, letters of credit (L/C), and e-visibility. For example, they are working with top Chinese banks like China Minsheng Bank and China CITIC Bank to remove the need for SWIFT in China’s domestic L/C settlement.

Expectations for the Chinese blockchain market are quite high. Referring to big Chinese tech companies like Alibaba and Tencent, Gordon said that they were always amazed by Chinese entrepreneurship.

Hyperledger is a permissioned blockchain project, which is different from a permissionless technology with anonymous participants. Yet Gordon claims that the two different ecosystems can coexist. Last June, the Ethereum Foundation joined Hyperledger.

Updated: 11-15-2015

Binance CEO: It’ll Be Hard for Nations to Outrun China on Blockchain

Changpeng Zhao, founder and CEO of crypto exchange Binance, says the Chinese President’s endorsement of blockchain will inevitably drive mass adoption of crypto.

In an interview with Bloomberg Markets: Asia on Nov. 15, Zhao — better known by his industry moniker “CZ” — gave his perspective on the likely global impact of the recent intervention by President Xi Jinping.

“We’re going to see a race”

As reported, President Xi Jinping had called this October for China to accelerate its adoption of blockchain technologies to drive innovation and industrial transformation.

Reflecting on the likely consequences of this high-profile endorsement and explicit declaration of a pro-blockchain strategy by the world’s second-largest economy, CZ said:

“It’s super positive. China’s very pro-technology, so China will invest very heavily in blockchain technology and on the educational front as well. Given that China has now made that move, every other country in the world will have no choice but to follow or move faster. But it’s going to be pretty hard to move faster than China to be honest.”

Hinting at states’ competing geopolitical aspirations to monopolize technology, CZ added: “I think we’re going to see a race there.”

The CEO saw the impact of the pro-blockchain stance going much further, arguing that while the president may have confined his comments to the underlying technology”

“You can’t learn just about blockchain without learning about cryptocurrencies. so I think we’ll see a lot more people who understand Bitcoin, Ether and other cryptocurrencies. So we’ll see very strong adoption there.”

Approaching The Great Wall

When quizzed on Binance’s China strategy, CZ struck an implicit note of caution — perhaps unsurprisingly, given the exchange had been forced to leave the country in the wake of China’s Sept. 2017 crackdown on crypto exchanges, relocating its headquarters to Malta. He said:

‘We want to follow the recommendations very closely and to promote blockchain technology research and development. We’re looking at a number of initiatives in that area. We want to help wherever we can.”

In Sept. 2018, Binance had made its first strategic Chinese investment since leaving the country in the wake of the crackdown, participating in a $200 million funding round for a Beijing-based crypto and blockchain publication.

Earlier this month, Binance launched peer-to-peer trading for Bitcoin (BTC), Ether (ETH) and Tether (USDT) against the Chinese yuan. As noted in today’s Bloomberg interview, the exchange has also been involved in over-the-counter cryptocurrency trading in the country, which raked in solid profits earlier this year.

Speaking yesterday at BlockShow Asia 2019, CZ predicted — in contrast to other industry figures — that the digital currency in development by the People’s Bank of China will be based on blockchain.

Updated: 11-22-2019

US Deputy Treasury Secretary: Crypto Raises Questions on Self-Government

The United States Deputy Treasury Secretary argued that decentralized privately-issued digital currencies can shift some functions from the state to the private sector.

Deputy Secretary of the Treasury Justin Muzinich presented his view on the emerging ecosystem of financial intermediation and digital currencies at an annual banking and payments conference in New York on Nov. 21.

The keynote by Muzinich was published on the official website of the United States Department of the Treasury.

The recent conference was co-hosted by the U.S. Clearing House and Bank Policy Institute.

Illicit uses of crypto are “one of the issues at the top of Treasury’s mind”

Speaking at the conference, Muzinich addressed issues associated with digital currencies alongside regulatory and tax reform and the intersection of economic policy and national security. In his statement, Muzinich continued a common Treasury narrative on concerns that cryptocurrencies can be used for illicit practices such as money laundering.

The Deputy Secretary Emphasized That These Concerns Remain One Of The Top Issues Concerning The Authority:

“One of the issues at the top of Treasury’s mind is that digital currencies can potentially be used to evade existing legal frameworks — like those governing taxation, anti-money laundering, and countering the financing of terrorism.”

Treasury Respects Innovation, But Digital Currencies Need A “Very Hard Look”

Muzinich stated that the Treasury values innovation and welcomes efficiency improvements, but stressed that innovation powered by digital currencies needs a “very hard look.” He added that decentralized, privately-issued digital currencies are not simply a means of payment, but also tools that can shift functions traditionally performed by the government to the private sector. He said:

“Digital currencies at scale raise not only concrete questions about money laundering, monetary policy, and other topics, but also very abstract questions about self-government. Those engaged in digital currency markets should therefore expect that policymakers, in pursuing the public interest, will take a very hard look at these issues.”

Muzinich Extends Mnuchin’s Warnings About Bitcoin

The fresh remarks from Muzinich, who assumed office as Deputy Secretary of the Treasury in late 2018, are a logical extension from some previous statements delivered by Treasury Secretary Steven Mnuchin.

In July 2019, Mnuchin criticized the major cryptocurrency Bitcoin (BTC), saying that it can be used for money laundering, and the authority will be preventing it from becoming an “equivalent of Swiss-numbered bank accounts.” Notably, Mnuchin declared that cash is not laundered like Bitcoin.

In mid-October, the Treasury agreed to the need for an investigation into Facebook’s forthcoming Libra stablecoin following a letter from Representative Emanuel Cleaver.

Updated: 11-22-2019

CFTC Chair On Crypto Regulation: We Don’t Want To Snuff Out Innovation

The chairman of the United States Commodity Futures Trading Commission (CFTC) has called for “principles-based regulation” for cryptocurrencies.

Heath Tarbert, who assumed his post following former Chairman J. Christopher Giancarlo in July 2019, stated that taking such an approach in regulating digital assets would allow a period of development and observation before it may be appropriate to adopt more targeted rules. Tarbert delivered his remarks on crypto regulation in an op-ed published on the CFTC website Nov. 19.

In the statement, Tarbert emphasized that the term “principles-based regulation” does not imply a light-touch approach or deregulation, stating that it is actually “far from it.” The chairman elaborated that such an approach involves moving away from detailed rules to relying more on high-level and “broadly-stated principles” to define standards for regulated firms and products.

“If You Make 10,000 Regulations, You Destroy All Respect For The Law”

To make his point, Tarbert quoted former British Prime Minister Winston Churchill’s statement, “If you make 10,000 regulations, you destroy all respect for the law.”

According to the chairman, regulators should first fully understand the outcomes and potential risks of digital assets before enforcing their rules. “What we don’t want to do is take a heavy hand and snuff out innovation altogether,” Tarbert argued, explaining:

“Given the rapid pace of innovation and the markets supporting it, taking a principles-based approach to regulating digital assets and other fintech products would permit a period of development and observation.

After we fully understand the outcomes and potential risks of digital assets, it may be appropriate to adopt more tailored and targeted rules, or a more balanced combination of principles and rules.”

Willingness To Allow Innovation Should Not Be Confused With Fraud Tolerance

While expressing a supportive stance to the development of the nascent technology, Tarbert still devoted considerable attention to the risks associated with the industry. “Our willingness to allow innovation to develop should not be confused with a tolerance of fraudulent behavior or a so-called light-touch approach,” the executive stated. According to Tarbert, digital assets face unique operational risks such as fraud and hacks that could lead to theft or losses.

He added that the CFTC is now considering how the basic aspects of principles-based regulation can be applied to crypto exchanges and clearinghouses.

Former CFTC Chairman Supported A “No Harm” Approach To Crypto

Tarbert’s new pro-industry remarks echo those of his predecessor, former Chairman Giancarlo. In September 2018, Commodity argued that crypto needs a “do no harm” approach from regulators to flourish, comparing the industry with the early days of the Internet.

In late October 2019, the commission granted its fintech research unit LabCFTC status as an independent operating office. Following the elevation, the CFTC’s fintech hub started reporting directly to Tarbert.

Updated: 11-22-2019

US Think Tank Releases Report on Investigation Into Illicit Transactions On The Dark Web

United States think tank The Rand Corporation has taken a closer look at the dark web, where criminal activities are difficult to discover, monitor, and investigate for law enforcement.

On Nov. 20, The Rand Corporation, the Police Executive Research Forum, and the University of Denver on behalf of the National Institute of Justice released a report that dives into a variety of criminal aspects of the so-called dark web.

Dark Web Provides Level Of Anonymity By Using Crypto

The report was compiled during a workshop where law enforcement practitioners and researchers identified 46 potential solutions that include the improvement of training for law enforcement, sharing information across jurisdictions, and investigating the gaps and shortcomings in current laws.

In regards to cryptocurrencies, the think tank found that the anonymity of the dark web is presenting law enforcement with significant challenges, as users with malintent are able to achieve a high level of anonymity by using cryptocurrencies, with the report singling out Bitcoin (BTC), Litecoin (LTC), or Monero (XMR).

The report further points out that due to the large number of legitimate cryptocurrency users, especially for BTC, the difficulty increases for law enforcement agencies to properly identify and police the trading of illicit goods and services.

During the workshop, participants recognized that current methods used to identify suspects on the dark web largely rely on traditional techniques to which most officers already are accustomed.

According to the report, the two main findings were that increased investment is needed in training and in the efforts which are aimed at improving information sharing across agencies, both within the U.S. and across international borders.

Dark Web Drug Dealer Ordered To Forfeit $150,000 In Bitcoin

At the end of October, a U.S. court ordered Christopher Bania, who pleaded guilty to drug distribution, to give up almost 17 Bitcoin — worth roughly $150,000 at the time. Bania’s plea was to the single charge of possession of controlled substances with intent to distribute on the dark web, which carries a maximum sentence of 20 years in jail.

Updated: 11-29-2019

US And China Battle For Blockchain Dominance