Scamming Grandma: Financial Abuse of Seniors Hits Record (#GotBitcoin?)

A federal law enacted in May allows bank employees to report suspected cases of elder financial abuse to police and adult protective services. Scamming Grandma: Financial Abuse of Seniors Hits Record (#GotBitcoin?)

Banks report 12% increase of suspected cases as they step up efforts to detect and stop fraud. Scamming Grandma: Financial Abuse of Seniors Hits Record

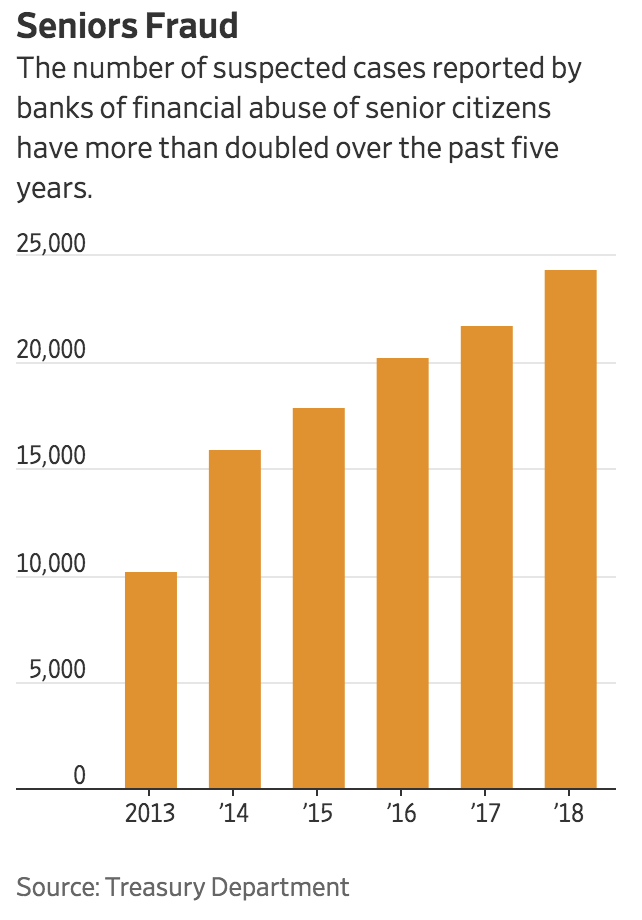

U.S. banks reported a record 24,454 suspected cases of elder financial abuse to the Treasury Department last year, more than double the amount five years earlier, according to government data.

The increase occurred as new federal and state laws are prompting banks to take a more active role in trying to address frauds and scams that target older customers. For their part, banks are beefing up training programs for employees on how to detect, stop and report issues without violating a customer’s privacy. Employees are even learning to recognize early signs of cognitive decline.

The issue of elder financial abuse is likely to grow even more pronounced. An average of 10,000 Americans turn 65 a day, a pace expected to continue through 2030. In that year, one in every five people will be 65 or older, according to the U.S. Census Bureau.

Meanwhile, people over 50 represent one-third of the population but account for 61% of bank accounts and 70% of bank deposits, according to 2017 research by the American Bankers Association.

“Anything having to do with elder financial abuse or exploitation affects a huge part of our customer base,” said Rob Rowe, associate chief counsel at the American Bankers Association.

The 24,454 suspected cases reported in 2018 is up 12% from 21,839 cases in 2017, the previous record, and more than double the number in 2013, according to Treasury Department data.

Last February, a customer in her late 70s walked into a New Canaan, Conn. branch of People’s United Bank, asking to wire $30,000 to her grandson. The customer said he had been in a car accident while vacationing in Mexico.

Where She Recently Has Been Looking Out For Scams Affecting Elderly Customers.

Suspecting what is known as a “grandchild scam,” Rebecca Reed, an assistant manager, instead suggested the customer call her grandson. It turned out he had been at school all day—not in Mexico.

“We can see it when something is not right,” said Ms. Reed, who has received a Fraud Fighter award from the bank.

Yet elder financial abuse isn’t always so obvious and can raise privacy issues, or risk alienating customers. The delaying or canceling of transactions also could result in customers missing out on legitimate opportunities such as timely investments.

Legislators have tried to address some of these issues. A federal law enacted in May called the Senior Safe Act allows bank employees to report suspected cases of elder financial abuse to police and adult protective services. Some states have gone further: Tennessee and Texas, for instance, allow bank employees to refuse or delay transactions, or notify family members when elderly customers request suspicious money transfers.

Daughter Erika, Lost Over $80,000 In A ‘Grandchild Scam’ Last Year.

Thomas Flavin, a 76-year-old retiree in Watertown, N.Y., was a victim of a grandchild scam last year where a man posing as a lawyer said Mr. Flavin’s grandson needed money to cover bail, legal fees and vehicle repairs after causing a DUI accident in Tennessee, according to his daughter Erika Flavin. He got cash from his bank and sent it by FedEx to New York and Pennsylvania addresses, losing more than $80,000, most of his life savings.

Only later did he find out that there was no DUI and his grandson hadn’t been in an accident. “In a way, it feels like a sad death in the family,” he said in a statement, adding that his banker later said he thought something was fishy but wasn’t allowed to intervene. “If that banker had offered him information about these scams that were going on, things would have turned out very differently,” Ms. Flavin said.

Bankers and senior-citizen advocates say many cases of elder abuse involve family members or caregivers. Other scams use phone calls and emails to trick vulnerable seniors into making irreversible money transfers. Besides the grandchild scam, there are romance or online dating schemes in which victims are deceived into online relationships before being swindled out of their savings.

Bankers attribute an increase in social media use by older Americans for a surge in fraud cases targeting seniors. Others say seniors still have landline numbers listed in phone books, making them an easier target for telephone scammers.

“They might be lonely. They are willing to talk while most of us just have a cellphone or screen out calls,” said Laurel Sykes, senior vice president for Montecito Bank & Trust in California.

Coastal Credit Union in North Carolina now reports an average of one case of elder abuse to the Treasury Department every month, compared with one or two cases a year earlier this decade, says Arlene Babwah, vice president in charge of risk management. The credit union has conducted annual training on senior banking in recent years, and added more sessions this year based on employees’ job functions.

“You might want to train an underwriter or a loan officer to ask, ‘If you are 90 years old, why are you buying a Corvette?’” said Ms. Babwah. “If you notice that an ATM card was used after midnight and you have an 85-year-old customer, that’s a red flag.”

Bankers in some states have more powerful tools than others. A branch employee at First Farmers and Merchants Bank in Tennessee successfully intervened in a theft targeting a customer in her 90s, whose granddaughter was siphoning cash from the woman’s account to cover her drug habit, according to Sam Wantland, the bank’s corporate counsel.

The employee did so by refusing—as permitted by a Tennessee law—to honor a power of attorney the granddaughter produced, freezing the account and notifying another relative. “A lot of times, we know their sons and their daughters. We know who to reach out to and that’s been very helpful,” Mr. Wantland said.

Updated: 1-24-2021

How To Protect Seniors From Online Fraud And Phone Scams

Stay ahead of scammers by blocking their calls, sending their emails to spam and monitoring assets.

Scams targeting older adults take many forms, ranging from callers posing as grandchildren in need of financial assistance to emails directing people to fake bank websites where cons collect login credentials. The techniques evolve every year but the outcome is always the same: Many seniors end up losing money.

The isolation many older adults are experiencing during the pandemic has exacerbated the problem. Technology helps seniors stay connected with loved ones during a time of limited social interactions but it also opens new doors to scammers. Online puppy scams and romance scams are on the rise as bad actors seek to take advantage of people’s loneliness, according to the National Adult Protective Services Association.

Scammers initiated contact with older adults online more often than they did by phone for the first time ever in the second quarter of 2020, according to an October report from the Federal Trade Commission. Phone scams, though, still resulted in the highest monetary losses.

Older adults, defined by the FTC as those age 60 and over, were nearly six times as likely as younger ones to report losing money on tech-support scams. In all, older Americans reported fraud losses totaling $388 million through the third quarter of 2020, the latest data available from the FTC, up 23% from the same period a year earlier.

There are ways to safeguard assets and to prevent such scams from occurring in the first place. Here are some tips, based on interviews with several elder-care experts.

Block Unwanted Phone Calls

In addition to adding a land line or mobile phone number to the National Do Not Call Registry, people also can check with their phone company or mobile provider about call-blocking services. AT&T, T-Mobile and Verizon all offer features for blocking robocalls.

People also can block unwanted calls on the mobile phones themselves: Apple devices running iOS 13 or later can silence unknown callers as can Android devices running Android 6.0 and newer. There are also a number of third-party apps that block robocalls, available on the Apple and Google app stores.

Reduce Electronic And Physical Junk Mail

If you receive something that looks like junk mail in your inbox, it’s best to mark it as spam so your email service’s spam filter recognizes it next time.

Even if an email looks legitimate, it’s always best to check the email address it came from before opening it or clicking on anything in the message. Emails sent from scammers usually contain various numbers or symbols rather than the simple email address of a legitimate institution.

The same goes for web addresses, which also can be spoofed. You can google the name of the bank website where you’ve supposedly been directed to see if it matches.

You can unsubscribe from marketing emails. Cyber safety firm NortonLifeLock shows how to do so on every major email service. When in doubt about an email, ask a trusted loved one, call the Senior Planet tech hotline at 920-666-1959 or call the AARP fraud watch helpline at 877-908-3360.

People also can request not to receive certain kinds of U.S. mail, as well as unwanted commercial email, through a service called DMAchoice. You can opt out of receiving prescreened credit and insurance offers by visiting http://www.optoutprescreen.com.

Elder-care experts suggest that people who receive in-home care switch to electronic bank statements or have their mail forwarded to a trusted loved one to avoid having mail containing account information available for caregivers and others to see.

While technology has invited new scams, most fraud against seniors is still perpetrated by caregivers and family members, according to the Justice Department.

Monitor Your Money

Seniors can safeguard their money by setting up direct deposits for income from Social Security, pensions and dividends so that physical checks aren’t sent to their home, where a caregiver or others could get a hold of them.

People should also keep an eye on spending activity by asking their bank and credit-card companies to send them—or trusted loved ones—alerts of suspicious activity or charges that exceed a certain amount. Most banks allow customers to create custom alerts. You can also lower the credit limit on credit cards to reduce the risk of loss, or use only prepaid cards such as a True Link Visa.

Some financial institutions recommend an app called EverSafe, which monitors bank and investment accounts across institutions and uses an algorithm that analyzes an individual’s spending history to detect changes in behavior, such as late bill payments, changes in interest rates and missed deposits.

It also monitors real-estate assets for title changes and lien filings. The hard part might be preparing yourself to allow a third party access to so much financial information—or persuading an aging parent to do so. The subscription-based service says it doesn’t store account information or enable money transfers through the app.

The app was created by Howard Tischler, a former executive at financial-services and background-check firms whose mother lost her life savings to scammers, and Elizabeth Loewy, former head of the elder-abuse unit in the Manhattan district attorney’s office. Seniors can designate trusted family members, accountants, lawyers and others also to receive alerts without giving them access to account numbers or balances.

Ms. Loewy said it isn’t enough for seniors to monitor their credit reports. “Most cases we saw in the DA’s office did not start in a credit report and, in some cases, the financial abuse never showed up in the credit report,” she said. “For example, if a dormant credit card is stolen and used, that won’t show up in your credit report.”

Consider Hiring A Care Manager

If your aging parents require in-home care and have cognitive problems—especially if you don’t live close enough to check in on them regularly—it’s a good idea to hire a care manager to oversee all aspects of their care.

Care managers are independent of the agency that provides the actual caregiving and act as a liaison between the care recipient, family members and anyone providing help, whether it’s a nurse, the person mowing the lawn or the estate attorney.

Care managers can also advise families on additional steps that should be taken to guard against fraud, such as locking up or removing valuable items from the home.

“The bottom line is to be proactive instead of reactive when it comes to fraud,” said Connie McKenzie, board president of the Aging Life Care Association.

If you suspect that you or a loved one has been the victim of fraud, you can call the National Elder Fraud hotline at 833-372-8311 and report it to the FTC by visiting the agency’s website or calling 877-382-4357.

Scamming Grandma: Financial Abuse,Scamming Grandma: Financial Abuse,Scamming Grandma: Financial Abuse,Scamming Grandma: Financial Abuse,Scamming Grandma: Financial Abuse,Scamming Grandma: Financial Abuse,Scamming Grandma: Financial Abuse,Scamming Grandma: Financial Abuse,

Related Articles:

A Retirement Wealth Gap Adds A New Indignity To Old Age (#GotBitcoin?)

Even A Booming Job Market Can’t Fill Retirement Shortfall For Older Workers (#GotBitcoin?)

Three Steps To Take If You’re Behind In Retirement Savings (#GotBitcoin?)

The New Retirement Plan: Save Almost Everything, Spend Virtually Nothing (#GotBitcoin?)

A Retirement Wealth Gap Adds A New Indignity To Old Age (#GotBitcoin?)

401(k) or ATM? Automated Retirement Savings Prove Easy to Pluck Prematurely (#GotBitcoin?)

How Aging Japan Defied Demographics And Revived Its Economy (#GotBitcoin?)

Your questions and comments are greatly appreciated.

Monty H. & Carolyn A.

Go back

Leave a Reply

You must be logged in to post a comment.