Global Investment In Wind And Solar Energy Is Outshining Fossil Fuels

In 2016, about $297 billion was spent on renewables—compared with $143 billion on new nuclear, coal, gas and fuel-oil power plants. Global Investment In Wind And Solar Energy Is Outshining Fossil Fuels

Global spending on renewable energy is outpacing investment in electricity from coal, natural gas and nuclear power plants, driven by falling costs of producing wind and solar power.

More than half of the power-generating capacity added around the world in recent years has been in renewable sources such as wind and solar, according to the International Energy Agency.

In 2016, the latest year for which data is available, about $297 billion was spent on renewables—more than twice the $143 billion spent on new nuclear, coal, gas and fuel oil power plants, according to the IEA. The Paris-based organization projects renewables will make up 56% of net generating capacity added through 2025.

Once supported overwhelmingly by cash-back incentives, tax credits and other government incentives, wind- and solar-generation costs have fallen consistently for a decade, making renewable-power investment more competitive.

Renewable costs have fallen so far in the past few years that “wind and solar now represent the lowest-cost option for generating electricity,” said Francis O’Sullivan, research director of the Massachusetts Institute of Technology’s Energy Initiative.

This is beginning to disrupt the business of making electricity and manufacturing generating equipment.

Both General Electric Co. and Siemens AG are grappling with diminished demand for large gas-burning turbines and have announced layoffs. Meanwhile, mostly Asian-based manufacturers of solar panels are flourishing.

In many places, opting for renewables “is a purely economic choice,” said Danielle Merfeld, the chief technology officer of GE’s renewable energy unit.

“In most places, it is cheaper and other technologies have become more expensive.”

Sustained government support in Europe and other developed economies spurred the development of renewable energy. But costs have fallen for other reasons. China invested heavily in a domestic solar-manufacturing industry, creating a glut of inexpensive solar panels. Innovation helped manufacturers build longer wind-turbine blades, creating machines able to generate substantially more power at a lower cost.

Renewable-energy plants also face fewer challenges than traditional power plants. Nuclear-power plants have been troubled by mostly technical delays, while plants burning fossil fuels face regulatory uncertainties due to concerns about climate change. And pension funds, seeking long-term stable returns, have invested heavily in wind farms and solar parks, allowing developers to get cheaper financing.

“It is just easier to get renewables built,” said Tony Clark, a former member of the Federal Energy Regulatory Commission. “There is that much less opposition to it.”

The sustained investment is reshaping how the world’s homes and industries are powered. Last year, the percentage of electricity from renewable sources reached 12.1%, more than double that of a decade earlier, according to a joint report by the Frankfurt School of Finance & Management and the United Nations Environmental Program. These figures don’t include electricity from large hydroelectric dams.

The rise of renewable power generation is raising concerns and sparking a political backlash in the U.S.

The Trump administration is weighing actions to subsidize the operation of coal and nuclear plants, arguing that these units are needed for the reliable operation of the power grid.

The proposal, which follows a request for relief by First Energy Corp., an Ohio-based owner of coal and nuclear plants, would hurt renewables and natural gas-fired plants, which have boomed in recent years as the fuel has become cheaper and more plentiful thanks to fracking. An unusual alliance, including renewable-energy groups and the oil-and-gas-industry’s American Petroleum Institute, have challenged whether any government aid is really needed.

In the U.S., more than two decades of government tax credits, some of which will soon go away, have propelled renewables. About 17% of the country’s electricity last year came from renewable sources, including wind, solar and hydroelectric dams, according to federal data. The government said that just under half of large-scale power generation added was renewable last year.

Last week, Xcel Energy Inc. announced a $2.5 billion plan to add 1,800 megawatts of new wind and solar generation, plus a substantial amount of batteries to store the power. The plan, which needs to be approved by state regulators, would retire 660 megawatts of coal-burning generation and result in savings for consumers, the Minneapolis-based utility said.

“I think, across the nation, you could get to 40% renewable energy,” said Xcel Chief Executive Ben Fowke. “Ten years ago, I would have told you 20% was the max.”

Renewable-energy prices are now competitive with fossil-fuel generation in many places. In 2017, the global average cost of electricity from onshore wind was $60 per megawatt hour and $100 for solar, toward the lower end of the $50 to $170 range for new fossil-fuel facilities in developed nations, according to the International Renewable Energy Agency.

The combination of falling costs and large pools of available capital is also spurring renewables growth in developing countries.

In November, Italy’s Enel SpA, a global energy company, won a bid to build power plants in Chile in an auction open to both renewable and fossil-fuel generators. Enel will build wind, solar and geothermal facilities and sell power from the facilities at about $32.50 per megawatt hour, an unsubsidized rate that is lower than the cost of natural gas or coal to burn in existing plants.

Recent power auctions have suggested that renewable energy prices have further to fall. Earlier this year, an auction in Saudi Arabia awarded a contract to build a 300-megawatt solar facility for $17.90 a megawatt hour. Very low labor costs in the Middle East and India are resulting in record-breaking low bids for solar.

A Mexican auction last year drew international bids for power at an unsubsidized price of below $21 per megawatt hour. That was substantially below the spot market price for electricity, which averaged around $70 per megawatt hour last year, said Veronica Irastorza, an associate director of economic consulting firm NERA and a former Mexican undersecretary of energy planning.

“Renewables are going to be able to compete with thermal plants. They will be incorporated into the system faster than I thought five years ago,” she said.

In Canada, an auction in Alberta in December awarded four wind contracts for an average of $37 a megawatt hour, subsidy-free. The Albertan government planned to award contracts for only 400 megawatts, but bumped it up to 600 megawatts when it saw the prices offered, which were slightly below the average price for electricity on the province’s grid in 2018.

In India, the push into solar has been driven partly by a desire for cleaner energy sources, but also because there is more financing available for solar than for coal, said Rahul Tongia, a fellow at Fellow at Brookings India in New Delhi.

Renewable output varies, based on when the sun is shining and wind is blowing, and cannot always be dispatched when needed like a coal or gas plant. That can pose a challenge to grid operators.

But industry observers say that is now a concern only in certain markets, such as California, where renewable penetration is at its highest.

“We could see aggressive build rates for several years to come before we see issues in many markets,” said Tom Heggarty, an analyst with energy consultant Wood Mackenzie. “Ten, 20 years down the line, it might be a different story.”

Updated: 11-1-2017

These 5 U.S. Towns Are Powered Entirely By Renewable Energy

“For too long, dirty fuels have jeopardized the health of our communities and put our children’s future at risk.”

As President Donald Trump stands his ground on fossil fuels and works to roll back America’s climate and clean energy policies, cities around the country are committing to renewable energy ― and a handful already get all their power from sources such as wind and solar.

Over the past decade, five locations ― Aspen, Colorado; Greensburg, Kansas; Burlington, Vermont; Kodiak Island, Alaska; and Rock Port, Missouri ― have successfully made the switch to 100 percent renewables.

Since Trump was elected in November, the number of cities and towns that have committed to using only clean power sources has more than doubled, with 46 cities, including Atlanta and San Diego, promising a move in that direction, said Jodie Van Horn, campaign director for the Sierra Club’s Ready for 100 initiative. The campaign, which launched in 2016, is challenging 100 U.S. cities to commit to 100 percent clean energy.

“For too long, dirty fuels have jeopardized the health of our communities and put our children’s future at risk,” said Van Horn. “Now cities are not only our best offense, they’re also our best defense against Trump’s destructive policies.”

Cities play a key role in reducing carbon emissions, since they account for roughly 75 percent of global C0₂ emissions. It’s becoming easier for cities to clean their air as renewable energy continues to become more affordable. Once extremely costly, wind and solar will become the cheapest sources of electricity globally by 2030, according to research firm Bloomberg New Energy Finance.

While cities’ pursuit of 100 percent renewable energy is an “admirable goal,” the feasibility of every city achieving this target depends partly on the city government’s mandates and how they define what “100 percent renewable” means, said Michelle Davis, senior solar analyst at GTM Research.

Even the five towns that have already made the transition had different ideas about how to reach this target, Davis said. So one city’s path to 100 percent renewable energy could look very different from another’s.

“It’s one of the main areas of criticisms of most of these renewable energy targets and policies ― it is not consistent from state to state and city to city exactly how an entity claims they are meeting certain renewable energy goals,” Davis said.

Another challenge lies in who runs a city’s electric grid, she said. Some grids are run by municipal utilities, which means the city can decide whether it wants to integrate cleaner energy options. However, other cities have grids that are run by a statewide monopoly utility. These cities don’t have jurisdiction to make those decisions.

But as clean energy technologies continue to become more affordable and efficient, a 100 percent renewable power target should be within reach for most cities.

“Right now the cities that are doing it are ones where ‘the right conditions’ ― already a good energy mix, rich ― are in place, but this doesn’t need to persist,” said Dan Kammen, a professor of energy at the University of California, Berkeley. “Cities can all essentially source green energy and use offsets to fill gaps until more clean generation comes online.”

1. Rock Port, Missouri

In 2008, Rock Port, a small farm town in northwest Missouri, became the first community in America to be powered entirely by wind energy. Four large wind turbines are connected to the power grid and provide Rock Port’s 1,300 residents with more electricity than they can use.

2. Greensburg, Kansas

A rural hamlet in south-central Kansas, Greensburg is the little town that could. When a tornado devastated Greensburg in 2007, half the town’s population of 1,400 left. Those who stayed decided to rebuild their community with sustainability at its core. Greensburg met its 100 percent renewable energy goal in 2013, harnessing the very thing that decimated it: wind. They also used solar and geothermal technologies. The city buys its electricity from a 12.5 megawatt wind farm just outside of town, which provides more energy than the town needs, allowing it to sell the excess.

“The wind that destroyed Greensburg is also the wind that would make us energy sustainable,” said Mayor Bob Dixson.

A big hurdle was cost. Rebuilding with an eye on going green would set the town back 20 percent more than if it had stuck with conventional energy sources and building materials. But the investment is paying off in the long term: Greensburg now saves $200,000 annually in energy costs for its largest buildings, which are all LEED certified.

3. Kodiak Island, Alaska

Since 2014, Kodiak Island in southern Alaska has been 99 percent powered by wind and hydro. A decade ago, Kodiak got the majority of its power from hydro, but it was still burning 2.8 million gallons of diesel a year to make up the energy shortfall, at a cost of $7 million annually. So the island’s electric utility company set an ambitious goal that 95 percent of the community’s power would come from renewable energy sources by 2020. Kodiak succeeded in meeting its target six years ahead of schedule. It was a steep learning curve. The city bought three 1.5 MW wind turbines in 2009, but installing them was a challenge. “There was not a lot of information back then on how to keep the grid frequency and voltage steady with an influx of variable wind power,” Kodiak Electric Association CEO Darron Scott told the nonprofit Rocky Mountain Institute. “It was uncharted territory.”

4. Burlington, Vermont

Vermont’s largest city, Burlington, achieved 100 percent renewable electricity in 2014 when it bought a hydropower facility on its outskirts. Burlington, which once relied heavily on coal, is now powered by a combination of energy from burning wood chips, wind, solar, landfill methane and hydropower. During times of high demand, Burlington might use a small amount of power that comes from fossil fuels, but it generates and trades enough renewable energy during the year to effectively cancel out that usage. The city estimates it will save $20 million over the next two decades.

5. Aspen, Colorado

Aspen is a winter ski destination for the mega-rich, and it’s also one of the greenest towns in America. Ski resort towns have been hit hard in recent years as warmer winters mean less snow, so they’ve been ahead of the curve in tackling the effects of climate change. Aspen committed to a 100 percent renewable energy target in 2007 and achieved its goal in 2015 using primarily wind and hydropower. It wasn’t an easy road getting there. The city already had two hydroplants – built in the 1980s – to draw power from, and by 2014 it was using around 80 percent renewable energy. To close the final gap, Aspen decided to buy wind power from other states rather than resurrect a third hydroplant, which would be too costly.

Updated: 5-22-2019

14 Of The Most Impressive Solar Projects Powering Our World

The sun’s limitless energy is all around us. We just need to harness it.

While the U.S. moves forward with a new infrastructure plan, we need some forward-thinking ways to power the future. While wind and hydroelectric power will have their place, solar must also play a big part. Here are few incredible projects to provide some inspiration.

Benban Solar Park, Benban, Egypt

Benban is a solar park under construction in eastern Egypt that, when completed, will become the largest solar installation in the world, producing 1.8GW of energy. It’s planned to begin operations later this year though parts are already online.

Longyangxia Dam Solar Park, China

Located in China’s Qinghai province, this is one of the largest solar parks in the world, stretching to about 27 square kilometers (or about 10 square miles). This park outputs a whooping 850MW of power, though planned solar farms in India will surpass that number as well as China’s own Tengger Desert Solar Park.

This solar park shows that it can capture enough clean energy from the sun to power nearly 200,000 homes.

This Indian airport, the seventh busiest in the country, is the first airport in the world to run completely off solar power. In fact, it’s not only 100 percent clean energy, its solar farm actually gives back energy to the electrical grid. The solar project, located near one of the airport’s terminals, has been a years long project. Looks like this solar investment is finally paying off.

Chernobyl Solar Plant

The site of the world’s most devastating nuclear disasters is now looking for a new image with a brand new solar farm. This one-megawatt solar plant isn’t the biggest project in the world, but it’s perhaps one of the most poignant.

Sungrow Solar Farm, Huainan, China

Much like the Chernobyl plant, this solar farm also has a story to tell. It’s the world’s largest floating solar array—and it also sits on top of a collapsed coal mine. The installation produces 40 MW of energy, and is just another sign that the world’s biggest polluter is trying to clean up its reputation.

Solar Star, California

The Solar Star photovoltaic power station near Rosemund, California, isn’t just the largest capacity solar park in the United States (and also the western hemisphere), it’s also the largest solar installation in the country. It’s spread over 13 square kilometers (or 5 square miles) and produces 579MW. The second largest U.S. solar farm, the Topaz Solar Farm, produces 550MW.

Solar Panel Bike Path, Krommenie, Netherlands

When the Netherlands installed the first solar powered bike path in 2014, it became a huge success. So much so that France has a plan to build entire solar roads that could provide up to 8 percent of the energy needs of the entire country. Japan is taking a similar approach, but instead applying the idea to water and creating the world’s largest floating solar panel. It just goes to show that a small green energy project can have a huge impact.

Solar “Tindo” Bus, Adelaide , Australia

In 2013, the city of Adelaide in South Australia put the first fully solar-powered public transit bus into commission. Called the “Tindo,” which is aboriginal for Sun, the bus can travel 125 miles before needing to recharge, which is does at a base station at the Adelaide Central Bus station. It also provides free wi-fi and A/C for up to 40 passengers.

Canal Solar Power Project, Gujarat, India

This solar project ingeniously kills two birds with one stone. Beginning as a pilot project, these strategically placed solar panels placed over canals not only provide much needed electricity but also keeps millions of gallons of water from evaporating annually. With water shortages and erratic access to reliable energy being two major problems for India, this inventive project seems like a doubly fantastic idea.

The World’s First Photovoltaic Road, Jinan, China

One December 28, 2017, a new road opened in Jinan, China. But unlike your usual asphalt construction, this 1km stretch of road was built with photovoltaic solar panels, able to bear the weight of small trucks. According to The New York Times in June last year, said that China’s road costs $11 a square foot. Expensive compared to asphalt but inexpensive compared to solar panel construction costs overall, and the company says, the road could pay for itself in energy after 15 years.

Tokelau Renewable Energy Project, Tokelau

The pacific island of Tokelau, a relative speck of a country, is the first in the world to be completely solar powered. Built in 2012, this solar project provides all of the country’s energy needs for its 1,500 residents spread across three atolls. The country was once 100 percent dependent on diesel fuel, but this solar project makes Tokelau completely diesel free. In fact, the project was so successful that the neighboring island of Ta’u, in the American Samoa, completed a similar project with SolarCity in 2016, preventing 2.5 million pounds of carbon dioxide from entering the atmosphere. These tiny islands will be the first major benefactors of a sun-only existence.

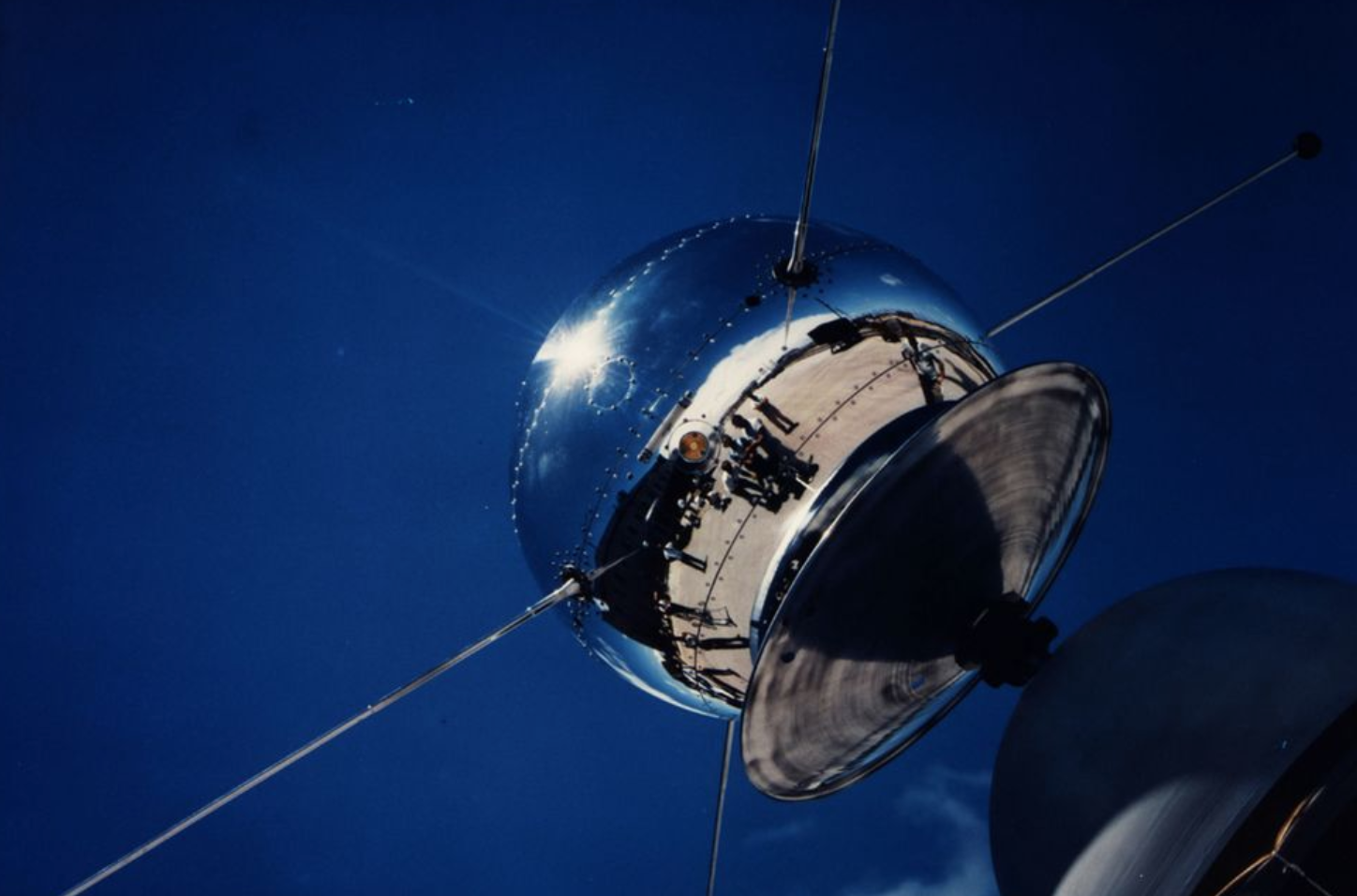

Vanguard 1

Of course not every solar revolution is a 21st century creation. The first satellite powered completely by solar cells was NASA’s Vanguard 1 launched in 1958. To this day, it remains in orbit as the oldest man-made object in space. This small achievement sparked a trend of using solar energy for space vehicles, many of which have been solar powered for nearly 60 years.

Solar Impulse

Solar Impulse is the brainchild of Swiss engineer Andre Borschberg and Swiss aeronaut Bertrand Piccard. Its first flight began in December 2009, and the subsequent Solar Impulse 2 completed an entire journey around the world using just solar power in July 2016. Of course, the plane is little more than a proof of concept, but it shows that air travel is possible using just the power of the sun, leading to a possible future where airlines no longer pollute the skies.

Of course, Solar Impulse owes much of its legacy to other solar experiments like the MacCready Solar Challenger, which flew on solar power from France to England in 1981, as well as NASA’s Helios project.

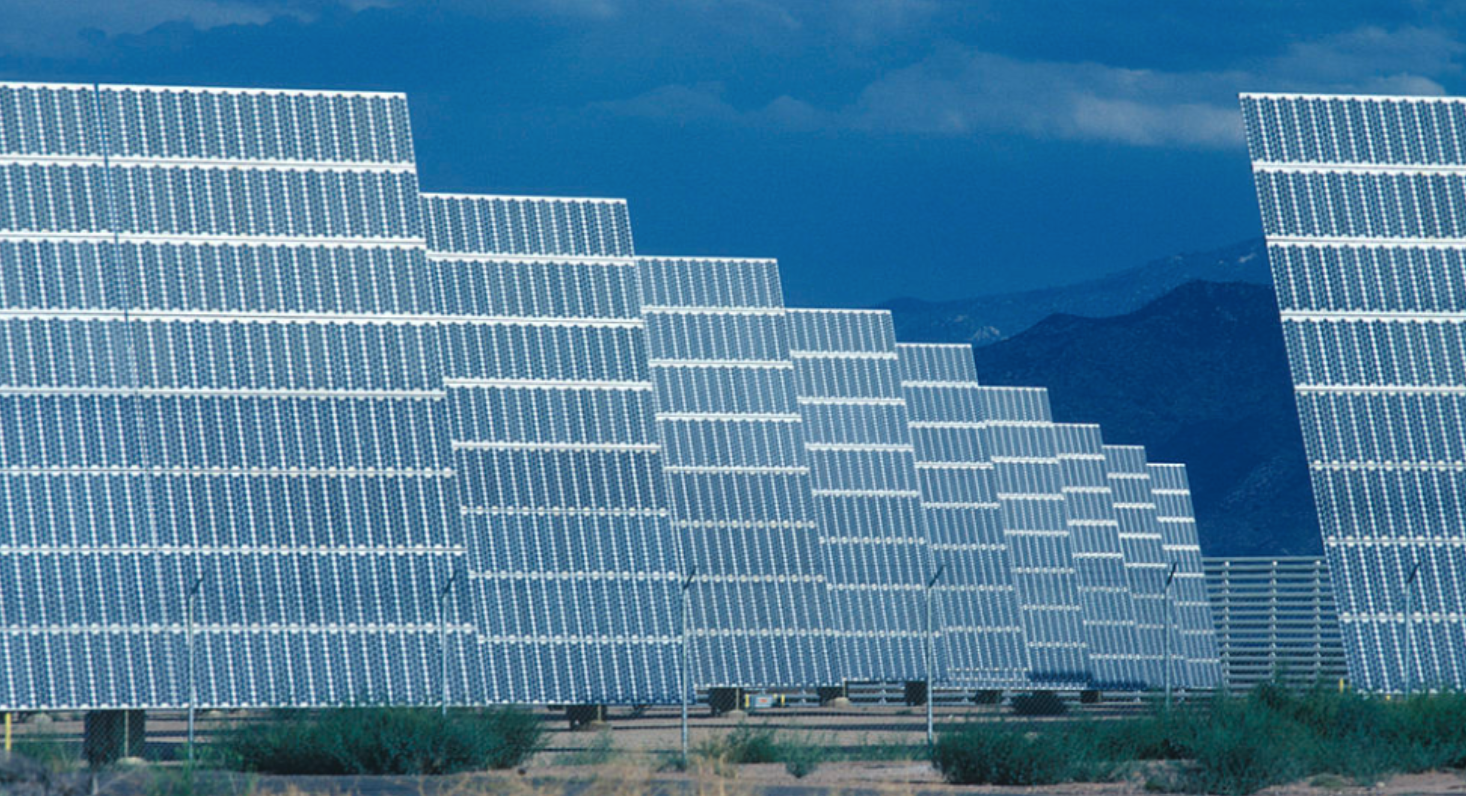

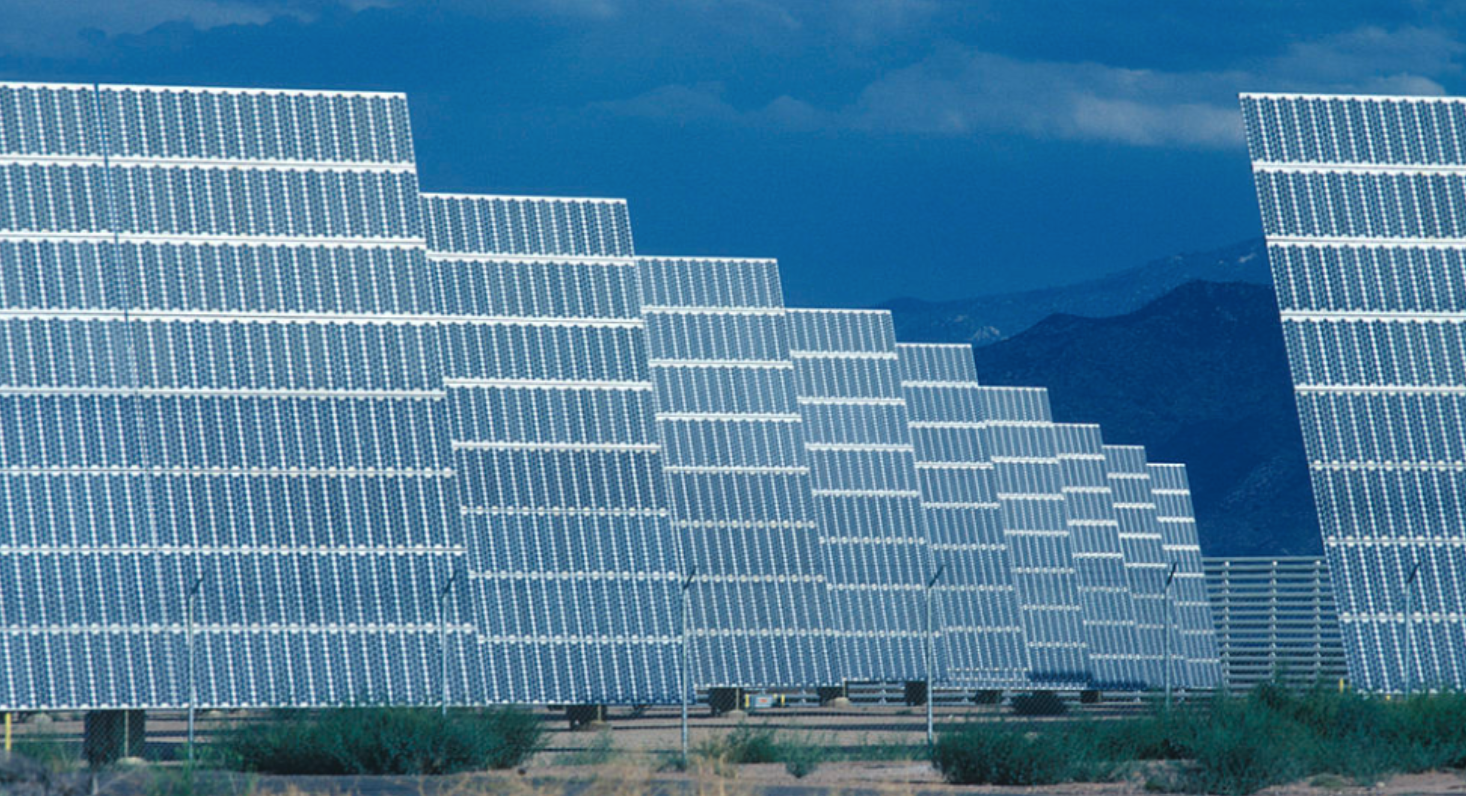

Arco Solar, California

This solar power station, created in the rush of increased research into alternative fuels after the 1973 oil crisis, was the world’s first photovoltaic system to reach a 1-megawatt capacity in 1982. Although the first, it certainly wasn’t the best, with Arco selling off the money-losing plants in 1990.

However, these early plants were just the beginning of bigger and better solar farms that are slowly dotting the globe. It’s a kind of alternative energy science race among nations, a race toward a goal that everyone can get behind.

Updated: 11-2-2019

The Next Frontier for Electric Vehicles: Deep Underground

To improve air quality and reduce emissions, mining companies aim to shift away from diesel equipment.

The next boom in electric vehicles could be the world’s mining fleet.

From rural Canada to Australia’s dusty Outback, companies are swapping out diesel-fueled drills, loaders and utility vehicles for equipment powered by lithium-ion batteries. They are looking to reduce emissions and eliminate the exhaust fumes that foul the underground air and risk miners’ health.

Around 35 electric vehicles are at work at Newmont Goldcorp Corp. ’s Borden mine near Chapleau, Ontario, unearthing ore or ferrying workers around the site, which began producing commercial volumes in October. Newmont wants the mine to go all-electric. An electric production drill will arrive early next year, a spokesman said, and diesel haul trucks are likely to be phased out.

“The Holy Grail is a haul truck,” said Kirsten Rose, who oversees low-emission technologies at BHP Group Ltd. , the world’s largest mining company by market value. These heavy-duty trucks carry tons of ore out of the bottom of pits, and with current technology, matching the power of their diesel engines would require an enormous battery pack.

BHP has been testing a light electric vehicle over the past year at Olympic Dam, Australia’s largest underground mine, and this month it will add another. The company intends to expand the trial to other Australian mines. In Canada, workers planning BHP’s Jansen potash project are assessing how many electric vehicles could be deployed if it goes ahead.

The aim is one day to eliminate all diesel-powered machines from mine sites, Ms. Rose said.

Smaller rivals are also stepping up efforts to go green. Among them, Nouveau Monde Graphite Inc. is planning an all-electric open-pit graphite mine in Quebec.

At Fortescue Metals Group Ltd. , one of the world’s top suppliers of iron ore, CEO Elizabeth Gaines said, “We’re always looking at opportunities to replace diesel.” But “the technology—the battery life—isn’t quite there yet for our operations,” she said.

The technology is advancing rapidly, but that can present another challenge: “It’s like laptops,” said Drew O’Sullivan, who is leading BHP’s trial at Olympic Dam. “By the time you get it home, it’s outdated.”

The purchase price is a further hurdle. Electric vehicles for use in mines cost from 40% more than to three times as much as diesel-powered ones, experts say.

Proponents counter that running costs are lower. Borden’s annual energy expenses should be lower by roughly US$9 million—possibly more—than a traditional mine’s, the Newmont spokesman said. One factor in that: As much as 40% of an underground mine’s energy costs are tied to powering giant ventilation systems to extract pollutants from tunnels.

Customers and investors are pushing for global resources companies to clean up their act. With a growing focus on the social impact of investments, many big pension funds and asset managers, as well as project financiers, are pressing miners to disclose and reduce their carbon footprints. Diesel is a ripe target: It accounts for more than one-third of BHP’s direct operational emissions, Ms. Rose said.

Regulators may soon join in the push. In July, the mines department of Western Australia state raised fresh concerns about the health of workers who spend up to 12 hours a day guiding heavy machinery around subterranean labyrinths.

“Diesel-engine exhaust is a known hazard for mining operations, especially in underground mines,” said Andrew Chaplyn, the department’s director of mines safety. A government committee is drawing up recommendations for the state’s mines minister.

Within a few years, diesel machinery will likely no longer be used at new underground mines in Australia, while being phased out at others, said Sherif Andrawes, global head of natural resources at accounting and advisory firm BDO.

“I think what we are seeing now is the start of something quite big,” he said.

Rio Tinto PLC, the world’s second-biggest miner by market value, is even studying the potential for hybrid engines on its heavy-haul railway trains. Ian Vella, who oversees rail services for Rio Tinto, is excited about the regenerative-braking aspect.

“Imagine a giant battery on one of those locomotives that is taking energy from the train as it is braking, storing it, and then it can use it when it needs power on the network,” he said.

Still, electrifying mine fleets won’t do much to cut the industry’s overall emissions without a shift away from fossil fuels to renewable power for generating electricity.

Some miners are moving in that direction. Last month, Fortescue struck an agreement with electricity generator Alinta Energy to help power its Chichester iron-ore production hub with solar energy, displacing roughly 100 million liters of diesel annually.

Updated: 1-4-2020

Warren Buffett Is Making A Big Bet On Solar Power

Warren Buffett is betting on solar power, with one of Berkshire Hathaway’s (BRK.B) companies behind a project to build the largest solar power plant in the U.S.

Berkshire subsidiary NV Energy will be using the electricity generated by a 690-megawatt solar-energy plant to be built on federal land in Nevada. The current record for a solar plant is 579 megawatts.

On Monday, the Bureau of Land Management released an environmental-impact statement about the project, indicating that it would approve the project after a 90-day period for public comment, as first reported by the Los Angeles Times. While the Trump administration hasn’t been friendly to solar power, opposing a plan last year to extend tax incentives, a federal official praised the Berkshire project as being part of an “America First Energy Plan,” echoing nationalist rhetoric the president has used to describe other parts of his agenda.

The so-called Gemini project, which will generate power for NV Energy companies but will be developed by third parties, will be 25 miles from Las Vegas. That project and two others will create 1.19 gigawatts of new power for NV, enough to provide electricity to 230,000 homes. The projects also come with 590 megawatts of battery-storage capacity, meaning the power generated by solar panels can be stored for times when the sun isn’t shining.

Buffett said in a 2016 investor letter that he was convinced renewable sources would grow in importance, which is why the company’s Berkshire Hathaway Energy subsidiary was investing in them. “Last year, BHE made major commitments to the future development of renewables in support of the Paris Climate Change Conference,” he wrote. “Our fulfilling those promises will make great sense, both for the environment and for Berkshire’s economics.”

Buffett’s commitment to environmental goals has been challenged in the past. Berkshire Hathaway Energy was previously criticized for opposing “net metering” rules that pay rooftop solar generators for the power they send back into the grid. Without net metering, rooftop-generated solar energy is less cost-competitive in many states. Some environmentalists have also criticized the Gemini project because of its impact on wildlife, including tortoises in the area.

Regardless of the environmental debates, Berkshire’s embrace of solar energy makes it clear that the technology is becoming progressively more cost-competitive with fossil-fuel-driven power. The Gemini project will cost $38.44 per megawatt hour under a 25-year contract, the L.A. Times reported, while Lazard has calculated that the average national cost of a new natural-gas plant ranges from $44 to $68.

State mandates are helping drive wider adoption of renewable energy. Nevada has mandated that utilities get at least half their power from renewables by 2030. Companies that have embraced renewables have seen their stock prices rise. NextEra Energy (NEE), a utility company that has taken a lead role in developing renewable projects, trades at 27 times 2020 earnings expectations, while competitors trade at less than 20 times. Utilities that aren’t investing as heavily in renewables are likely to continue to be left behind.

Updated: 2-17-2020

Can Solar Power Compete With Coal? In India, It’s Gaining Ground

Electricity from sunlight costs less, a hopeful sign for developing nations building out their power grids.

In a dusty northwest India desert dotted with cows and the occasional camel, a solar-power plant is producing some of the world’s cheapest energy.

Built in 2018 by India’s Acme Solar Holdings Ltd., it can generate 200 megawatts of electricity, enough to power all the homes in a middle-size U.S. town. Acme sells the electricity to distributors for 2.44 rupees (3.4 cents) a kilowatt-hour, a record low for solar power in India, a country that data trackers say has the world’s cheapest solar energy.

More remarkable, the power costs less to generate in India than the cheapest competing fossil fuel—coal—even with subsidies removed and the cost of construction and financing figured in, according to the Indian government and industry trackers.

Price-conscious Indian utilities are eager to snap up that power. “We are infamous for low cost,” says Sandeep Kashyap, Acme’s president.

Solar power has entered a new global era. The industry was long dependent on subsidies and regulatory promotions. Now, technological innovation and falling solar-panel prices have made solar power inexpensive enough to compete on its own with other fuel sources in some regions, when it comes to newly built plants.

That could turbocharge growth of renewables in the global energy industry, especially in fast-growing Asian markets where much of the world’s energy infrastructure expansion will take place.

Governments in many solar markets—including China, the biggest—are phasing out or reducing supports. Solar-plant development is going mainstream, with finance provided by global investors like Goldman Sachs Group Inc., Singaporean sovereign-wealth fund GIC and huge Western pension and private-equity funds.

So far, the renewable-energy push hasn’t halted the growth of global energy emissions. But the success of countries like India in feeding their rising power demands with clean energy will still be key to blunting the growth of global challenges like pollution and climate change.

The price declines in solar panels and the power they produce are jolting the industry. In the past decade, solar has grown from less than 1% of the world’s electric-power capacity to an estimated 9% by the end of this year, according to the International Energy Agency, an intergovernmental organization focused on energy policy.

By 2040, the IEA expects that to grow to 24%, which would make solar the largest single energy source.

India is at the forefront of the trend, with a cost of building solar capacity that has dropped 84% in eight years, according to the International Renewable Energy Agency, an intergovernmental organization focused on renewable energy. Other countries are close behind, with costs falling fast in Australia and China.

India has increased the amount of solar power it has installed 10-fold in the past five years, to 32 gigawatts, and the government is hoping to triple that in the next few years—one of the fastest paces of growth anywhere. India’s prime minister last year said he wants 450 gigawatts of renewable energy including solar installed by 2030.

If India manages that, which many analysts say is a real stretch, it would account for nearly all the additional electric capacity the country’s Central Electricity Authority has projected it would add by then, and more than the country’s total from all power sources now.

India has pledged as a climate goal that 40% of its electric capacity will come from non-fossil fuels by 2030; the latest renewable targets would likely put that percentage at over half.

Cheaper Than Coal

In 2018, India’s “levelized” cost of solar-power generation—an analysis removing the impact of direct subsidies and figuring in the costs of construction and financing for a new plant—fell to 14% below that of coal, the first time anywhere in the world that generating solar was cheaper than coal on that basis, according to international energy consulting firm Wood Mackenzie.

India’s national energy plan doesn’t anticipate construction of new coal power plants for at least several years. Even state-controlled Coal India, one of the world’s largest coal-producing companies, in November said it planned a pilot solar project as it navigated a future with less coal.

Across Asia, a region expected to account for two-thirds of the world’s new power demand during the next two decades, price declines will make wind and solar combined 17% cheaper than coal by 2030 on a levelized basis, says Wood Mackenzie. In India, solar generation will be almost 50% cheaper, it projects.

“This is a revolution in power generation costs,” says Wood Mackenzie analyst Alex Whitmore. “What it means is there will be a lot more solar investment in India, and in countries like India.”

Solar’s big problem: It generates power only when the sun shines. Wind power, similarly, works only with wind. So displacing fossil fuels could require cheaper ways to store energy. And the more renewables in the power-transmission grid, the more the grid will need to be rebuilt to accommodate those special characteristics.

That inefficiency is why the IEA forecasts the amount of power solar generates to rise to only 11% of the world’s total by 2040, around half that of coal or natural gas.

In India, which has some of the world’s best conditions for generating solar power, the mismatch is pronounced because demand for electricity swells after people go home and switch on air conditioners in the evening, when solar plants aren’t working.

Meanwhile, countries like India have made massive investments in coal-fired plants they can’t afford to simply scrap. Coal still provides two-thirds of India’s power. Coal shipments also underpin profits at the nation’s biggest employer, the railways.

As Indian solar developers push prices down, the thin margins for many are being pummeled by challenges ranging from an economic slowdown and tighter domestic financing conditions to power distributors that aren’t paying bills and squatters refusing to move off land slated for development.

During the past two years, the pace of solar development in India slowed. Although installations are expected to pick back up this year, many analysts and industry leaders now expect India won’t hit its aggressive solar goals.

‘Low-Hanging Fruit’

Challenges will likely multiply when solar power in India’s grid rises from the current 9% to around 20% or 30%—a level at which it may start replacing conventional power plants, say experts like Rahul Tongia, a fellow at the India arm of think tank Brookings Institution.

“What happens after that point when the low-hanging fruit is done?” says Mr. Tongia.

India’s solar push started in 2010, when its government outlined plans for a modest boost in capacity during the next decade. Solar was a good fit for India’s growing energy needs.

Plants are easy to build—essentially solar panels lined up in racks—and labor is inexpensive. India has big stretches of sparsely populated land and intense sun, good for vast spreads cranking out power.

In 2015, Prime Minister Narendra Modi quintupled the country’s solar target, aiming to install 100 gigawatts of capacity by 2022—roughly half of the world’s 2015 total. At the time, India had less than 3 gigawatts of solar power installed and the plan seemed crazy.

“It was a leap of faith,” says Anand Kumar, a top official in India’s Ministry of New and Renewable Energy. “We got very lucky that the price of solar panels fell.”

China had been cranking out solar panels in massive numbers in a government-subsidized effort to dominate the industry globally. Panel prices, which can account for around half the cost of a solar plant in India, plummeted.

Globally, solar-panel prices fell more than 90% during the past decade, according to the International Renewable Energy Agency.

The Indian government’s system of auctioning out solar projects to developers that offered the cheapest electricity reduced prices there further. Aggressive entrepreneurs elbowed in, figuring the government’s eagerness to boost solar capacity coupled with ever-cheaper panels offered a profit opportunity.

Japan’s SoftBank Group Corp., whose chief executive, Masayoshi Son, is a solar proponent, set up an energy unit in Delhi around the same time Mr. Modi announced his ambitious goals. SoftBank snagged its first solar project in half a year.

Acme switched its focus to solar from telecom equipment, figuring the industry was poised to repeat telecom’s rapid growth. ReNew Power Ltd., founded in 2011, enlisted a roster of blue-chip investors including Goldman, the Canada Pension Plan Investment Board and the Abu Dhabi Investment Authority.

As the government tendered hundreds of megawatts of solar capacity, the price at which solar developers were offering to sell their electricity roughly halved between 2015 and this year, according to Bridge to India, a data tracker.

Developers pushed to squeeze all the profit they could from projects. In the Bhadla solar park, where the Acme plant producing the cheap electricity is located, one problem is dust.

The plant has 927,180 panels stretched over desert where sandstorms are common and temperatures can swing from over 120 degrees Fahrenheit in summer to nearly freezing in winter. If panels aren’t cleaned regularly, dust collects and electricity production declines.

Acme had used sprinklers on tractors driven by contractors to wash down the panels, a method letting them clean all panels three times a month. Last year, it rolled out robots that brush the panels down, doubling the monthly cleaning and boosting the maximum amount of energy the plant could produce.

Bottlenecks

As solar prices sank, some projects were delayed by a lack of transmission lines to ship the electricity. Others fell behind because of tussles between villagers, developers and local governments over land—issues dogging development in other countries as well.

Acme and other developers have been hamstrung by a delay in tax and tariff refunds they had counted on. “A lot of equity got stuck, which was planned for new projects,” says Mr. Kashyap, Acme’s president.

ReNew and other companies have been hit by payment delays from India’s struggling power distributors, mainly state-owned companies that buy electricity from producers and sell it to households. India’s Central Electricity Authority estimated that as of Nov. 30, renewable-energy companies were owed some $1.3 billion in overdue bills.

At any one time, distributors in roughly a quarter of the eight or nine states that ReNew Power operates in are behind on payments, says CEO Sumant Sinha. Although ReNew and other developers factor such payment delays into electricity prices they offer when bidding for projects, a miscalculation could hit profits. “Everyone sees delays in payments,” he says.

Some Indian state agencies, hoping solar prices fall lower, have canceled solar auctions when they thought developers were offering to sell power at too high a price.

Last year, the southern state of Andra Pradesh —which has one of the highest levels of renewable-energy consumption as well as one of the largest unpaid bills—threatened to cancel old solar contracts and renegotiate them at lower prices, sending the industry into an uproar.

The Andra Pradesh government says paying those higher prices has left its electricity distributors in financial distress, and that it is trying to “persuade” renewable-energy generators to supply power “at a mutually beneficial rate.”

By early 2019, many developers were starting to pass on solar auctions, threatening the country’s aggressive development timetable. Many developers and analysts now say India is likely to fall behind in achieving its renewable-energy goals.

India is working to remove roadblocks, building more transmission lines and tweaking rules governing auction, development deadlines and solar parks to make it easier to build plants. It is holding auctions for projects bundling solar with wind power and electricity-storage capacity to help even out solar generation’s peaks and troughs. ReNew recently won one such contract.

And India is considering projects that bundle existing coal plants with renewable-energy sources, to help smooth the transition from fossil fuels, says Mr. Kumar, the renewable-energy official.

Experts like ReNew’s Mr. Sinha say it will likely be several years before India builds so much solar capacity that the technology’s daytime power surges and nighttime plunges could affect the country’s overall electricity supply. By that time, says Mr. Sinha, other new technologies such as batteries and systems for shipping electricity may be available to smooth out irregularities.

India has already shown it can expand its solar capacity far faster than anyone would have expected, he says: “That is not an achievement to be scoffed at.”

Updated: 5-11-2020

U.S. Approves Giant Solar Project In Nevada

Gemini project will have capacity to power all Las Vegas homes.

The Interior Department has given final approval for what it says will be the largest solar-power project in the U.S., a $1 billion installation in Nevada that could power about 260,000 households—enough to cover the residential population of Las Vegas.

The project has financial backing from NV Energy Inc., a unit of Warren Buffett’s Berkshire Hathaway Inc., and Quinbrook Infrastructure Partners, a private-equity firm. The two firms signed a 25-year deal last year to take the solar farm’s output of 690 megawatts.

Major business consumers have been clamoring for more wind and solar power to help slow climate change and lower bills. Nevada last year joined several states that have passed laws committing to emissions-free power, mandating that half of its electricity must come from renewables by 2030.

Interior Secretary David Bernhardt signed approval Monday for what is called the Gemini Solar Project to go forward on 7,000 acres of federal land in the desert 33 miles northeast of Las Vegas, the Interior Department said.

It touts the project as a boon to the economy and the environment, with the potential to employ up to 900 construction workers and produce emissions-free power to offset the greenhouse-gas output of 83,000 cars.

“That project would be a major producer of energy,” Mr. Bernhardt said. “I’m glad that we’re getting this out, and it’s really part of our effort to foster jobs.”

Construction was originally set begin one month after final approval, with the first phase expected to be completed within a year, and full operation by 2023. Mr. Bernhardt warned, however, that the coronavirus pandemic might delay that timeline.

While President Trump has shrugged off dire scientific warnings about global warming, the administration has also proposed cutting red tape on environmental reviews and says Gemini fits with its priority of facilitating investment in important infrastructure projects.

Gemini is unique among the country’s largest solar projects in that it includes major battery capacity to keep feeding the grid overnight, an emerging trend among new solar projects, according to an arm of energy-consulting firm Wood Mackenzie.

“It’s just a monstrous project,” said Colin Smith, an analyst at Wood Mackenzie. “I see it as the next step. We’re going to keep seeing bigger and bigger solar.”

Berkshire is also invested in the biggest operating U.S. solar farm, Solar Star, a 586-megawatt project outside Los Angeles. Its offtake partner on Gemini, Quinbrook, focuses on lower carbon and renewable-energy infrastructure, with offices in Houston, the U.K. and Australia.

Updated: 8-11-2020

World’s Largest Wind Turbine Maker Vestas Hits Record High As U.S. Demand Drives Sales

Vestas Wind Systems’s stock hit record highs on Tuesday, as strong U.S. demand for wind turbines drove surging sales in the second quarter.

The world’s largest wind turbine manufacturer restored its full-year guidance as sales rose to €3.5 billion—a 67% increase compared with the same period in 2019—driven by a higher volume of wind turbine deliveries in the U.S.

The company’s combined order backlog—for wind turbines and service contracts—climbed to record highs of €35.1 billion at the end of June, as high demand for renewable energy continued. Chief Executive Henrik Andersen said its service segment “played a key role in ensuring stable and renewable energy supply during lockdowns across the globe,” growing 6% with high margins in the quarter.

The Danish company restored the full-year guidance it scrapped at the height of the pandemic in April, expecting revenue of €14 billion to €15 billion. However, it expected an earnings before interest and taxes margin of 5-7%, down from a previous forecast of 7-9%, and total investments would now be lower than the initial €700 million target in 2020.

Vestas swung to a quarterly net loss of €7 million, from a profit of €90 million a year earlier, and below the FactSet consensus of a €75 million profit. Earnings were hit by a one-off cost of €175 million to repair and upgrade older wind turbine blades, while logistical costs were also increased by the coronavirus pandemic.

Despite the loss, the soaring sales and reintroduction of unchanged full-year guidance buoyed investors as the stock climbed 8.4% to 918.6 Danish krone – it is now 36% up year-to-date.

Looking ahead. Reinstating unchanged full-year guidance is an impressive feat, given the disruption caused by the coronavirus pandemic. What is more impressive, though, is the sales performance and record order backlog of €35 billion. Looking longer term, the global movement toward a lower-carbon economy appears to be gathering pace, with governments factoring it into the Covid-19 recovery, which also bodes well for the company.

Analysts at Danish bank Sydbank said that Vestas’ strength and the fact that sustainable investments were high on the wish list for investors, meant that despite the strained valuation the stock had room to move higher.

Updated: 9-15-2020

The East River Becomes A New Energy Source For New York City

Three small tidal turbines will be installed off Roosevelt Island this fall and connect to ConEd’s power grid.

Wouldn’t it be fun to have your refrigerator powered by the East River?

That’s the idea behind a private company’s plan to install three small tidal turbines off Roosevelt Island this fall. The underwater system will be hooked up to Con Edison’s power grid.

I asked John Banigan, CEO of Verdant Power, the New York City-based company behind the project, whether I’d notice a difference in my apartment.

“No,” he said. “Power is power. But when you look out your window, you’ll see a cleaner sky.”

Make that a tiny, tiny, tiny bit cleaner.

The $8 million project will generate enough electricity to power the equivalent of roughly 100 homes.

And it’s taken two decades to reach this milestone, Verdant’s co-founder and chief commercial officer, Trey Taylor, says.

The company was launched in 2000 when Mr. Taylor, who already had a long career in public relations and advertising, came across promising new tidal turbine technology developed by folks at New York University.

The technology’s first test came in 2007, when Verdant installed a prototype turbine in the East River to power a Roosevelt Island Gristedes supermarket and the nearby Motorgate parking garage. It operated successfully for nearly two years.

Next step: a license from the Federal Energy Regulatory Commission to install a larger system in the same spot, which required 23 permits from 14 different agencies. The application was four phone books thick, Mr. Taylor recalls. Permission was granted in 2012.

Since then, Verdant has been busy refining its turbine technology—and doing a lot of fundraising. Mr. Taylor estimates his company so far has received $46 million, largely from Department of Energy and New York State Energy Research and Development Authority grants, along with funding from private investors including friends and family.

“We mortgaged our homes, but we’re having fun,” he said.

I asked Mr. Taylor if Con Edison will pay for Verdant’s power feed.

“I don’t know,” he said.

“You might want to find out!” I suggested.

When I checked with ConEd—the company that supplies electricity to 3.5 million residential and commercial customers in New York City and Westchester—it said it would indeed pay Verdant as it would pay for any power sent to its distribution system.

“We want to eliminate barriers to renewable energy wherever possible, and this is a unique opportunity to do so,” ConEd spokesman Jamie McShane said.

Not that the project will come close to paying for itself. “It’s to showcase it for the world,” Mr. Taylor says.

Verdant’s experience thus far is roughly in line with efforts taken to develop renewable energy of other types over the decades, says Robi Robichaud, a renewable energy expert with the World Resources Institute, a research nonprofit focusing on several global issues including energy.

Tidal turbine power has some advantages over wind and solar, he says. It’s more predictable. And because much of the world’s population is clustered near deep rivers and ocean ports, plants can be located close to consumers, which cuts infrastructure and transmission costs.

It’s also early days for tidal power development, Mr. Robichaud says. Electricity generated by wind power has been around since the 1800s, and solar since the 1950s. Costs for both have dropped enough in the past few decades to make them commercially viable.

Tidal technology got a later start. And in part because it’s difficult to install and repair things underwater, tidal systems currently cost three-to-four times more than solar and wind systems to build and operate. “But the economies of scale will come,” Mr. Robichaud says.

Last week, I met Mr. Banigan at a scruffy port facility in Perth Amboy, N.J.—across the Outerbridge Crossing from Staten Island—where the Verdant system was assembled this summer. It was only his third time seeing the turbines in person.

“It makes it real!” said Mr. Banigan, who left a four-decade banking career to join Verdant in 2014.

The five-meter (16-foot) diameter turbines look like propeller rockets drawn by a kid in the 1950s. They are mounted on a steel triangular foundation with 15-meter connecting arms. The entire assembly weighs about 100 tons.

On the big day, barges and tugboats will transport the system across New York Harbor and arrive at Roosevelt Island during the 7 a.m. slack tide—the point at which the river stands still before reversing.

While New York City might sound like a crazy place to attempt this sort of project, the East River is actually an ideal demonstration site, Verdant says. It’s the right depth, and the core current is a relatively swift 2.25 meters per second—faster than its rival on the other side of Manhattan. Sorry Hudson!

Going forward, the 10-person company has big plans. First, a $25 million fundraising effort. It hopes to hire another 35-to-40 employees to design and build a larger turbine that will operate more efficiently in deeper waters.

Next: Assembly plants around the globe along with, of course, maintenance and consulting services.

As for New York City and tidal power? It’s not likely the East River will be lighting up the five boroughs anytime soon. But Mr. Taylor has some fun ideas. Roosevelt Island could be fueled entirely with a combination of wind, solar and tidal power on its own self-contained smart grid, he says. And that includes a return to the Motorgate parking garage.

“Wouldn’t it be cool,” he says, “for NYC to have tidal-powered cars zipping around on the streets?”

Updated: 2-11-2021

Making Wind Turbines Greener Could Also Make Them More Expensive

Carbon-neutral turbines might raise prices in the short term as companies try to make zero-emission production more cost effective.

The world’s biggest wind turbine manufacturers have committed to eliminating their net emissions of greenhouse gases, but reducing the carbon footprint of their production process may mean customers have to bear some of the cost.

Global players such as Denmark’s Vestas Wind Systems A/S and Siemens Gamesa Renewable Energy SA, its German-Spanish rival, aim to hit an array of sustainability targets in the next decade. These range from building zero-waste turbines to reducing the emissions of their supply chain, posing the challenge of rising costs in a market where margins are already lean.

Unlike coal or natural gas power plants, wind energy does not emit the greenhouse gases that are responsible for global warming. But making the turbines needed to generate that power does. Wind turbine blades are made from a combination of fiberglass and resins that can’t yet be recycled in a cost-effective way.

Steel, another key component of the turbines, needs to be made at temperatures so high that at the moment they can only be achieved by burning fossil fuels. All of that that might lead to a market premium on carbon-neutral turbines, said Lisa Ekstrand, head of sustainability at Vestas, the world’s top turbine manufacturer.

“There will be a number of companies that will probably take the lead and will be willing to accept a bit of a higher cost for a more sustainable product in the short term, with the view of the costs coming down in the medium and long run,” she said, adding that sustainability programs ultimately aim to achieve costs “on par with today’s, or even lower.”

Major turbine producers are launching pilot programs to develop new technology and come up with cost-effective ways to make low-emissions wind turbines. Some initiatives underway include recycling components of decommissioned turbines as feedstock for cement production, redesigning the logistics network and switching to cleaner energy sources.

Towers are particularly problematic, because of the large amount of steel they contain. Siemens Gamesa has been running a pilot program with its suppliers for about two years to assess and improve its production progress of the component, said Jonas Pagh Jensen, an executive who focuses on health, safety and environment issues.

The program has cut CO2 emissions by 20,000 metric tons in Europe, the Middle East and Africa and has now been rolled out globally. “We’re trying to find out how fast can we move while remaining competitive, and the best way to do it is having an open dialog with our costumers to understand the pressure they’re also exposed to,” he said.

The company, based in Zamudio, Spain, is also working on projects to separate and reuse turbine blade materials. Although the process is not cost-efficient at the moment, “progress has been made, but whether we’ll get to a 100% recyclability is still to be seen,” said Jensen.

This approach can help wind turbine makers improve their potential waste recycling rate already north of 80% while lowering their emissions and boosting profitability, said Adeline Diab, head of ESG and thematic investing at Bloomberg Intelligence. “If you don’t have to recreate 80% of a turbine, it won’t be a like-for-like carbon savings, but it may contribute to a good portion of it, helping carbon neutrality targets.”

Solar And Wind Are Reaching For The Last 90% Of The U.S. Power Market

They’ve both grown exponentially over the last 30 years. Now there’s just one more decimal place to go.

Three decades ago, the U.S. passed an infinitesimal milestone: solar and wind power generated one-tenth of one percent of the country’s electricity. It took 18 years, until 2008, for solar and wind to reach 1% of U.S. electricity. It took 12 years for solar and wind to increase by another factor of 10. In 2020, wind and solar generated 10.5% of U.S. electricity.

If this sounds a bit like a math exercise, that’s because it is. Anything growing at a compounded rate of nearly 18%, as U.S. wind and solar have done for the past three decades, will double in four years, then double again four years after that, then again four years after that, and so on.

It gets confusing to think in so many successive doublings, especially when they occur more than twice a decade. Better, then, to think in orders of magnitude—10ˣ.

There are a number of reasons why exponential consideration matters. The first is that U.S. power demand isn’t growing, and hasn’t since wind and solar reached that 1% milestone in the late 2000s. That means that the growth of wind and solar—and that of natural gas-fired power—have come entirely at the expense of coal-fired power.

That replacement of coal with either natural gas (half the emissions of coal) or with wind and solar (zero emissions) is certainly an environmental achievement. Coupled with last year’s massive drop in emissions, that power shift also makes it much easier for the U.S. to meet its Paris Agreement obligations.

But it also means that challenges lie ahead for any power generation technology that isn’t wind or solar. BloombergNEF analyzed the future of major power systems extending out to 2050, which for the U.S. shows a renewed increase in electricity demand. Total generation will increase about 30% in the next three decades, BNEF predicts. During that time, wind power generation will increase 195% and solar power generation will increase 753%.

That means a few things. Even with a growing electricity system, solar and wind will continue to crowd out every other generation technology while also competing with each other. It also means that the electricity grid—and the businesses and services that use it—will need to become both more supple and more innovative to integrate so much renewable power.

That suppleness will have to come from a more robust grid, able to send more renewable energy from places where generation is surging to demand centers. It will also have to come from energy storage, both short term (a matter of hours) and potentially long term (a matter of weeks or more).

Innovation, on the other hand, will come down to the speed at which businesses realize that zero-carbon electrons are becoming ever more abundant and less expensive. As I wrote last week, we already have moments in some grids when solar power supply exceeds total demand. That’s a challenge, but it’s also an opportunity, which I hope entrepreneurs and big enterprises alike are ready to capitalize on.

My final thought is a return to exponents. There’s only one left for wind and solar in the U.S. power system. The next order of magnitude takes us from 10% to 100%, when the entirety of U.S. power generation comes from panels and turbines.

Wind and solar are now playing for the remaining 90% of the U.S. power mix. They won’t ever reach 100%, but they will force every other energy source—including natural gas—into whatever corner of the market they haven’t filled. In doing so, wind and solar will also compete with each other. That will create a country-sized opportunity to experiment with innovative ways to use all those new electrons.

Updated: 9-9-2021

Solar Startup Born In A Garage Is Beating China To Cheaper Panels

Australia-based SunDrive has made a materials breakthrough that promises to increase the efficiency and lower the cost of solar panels.

About seven years ago, Vince Allen barged into the garage he shared with some flatmates in a Sydney suburb and set about trying to shake up the solar industry. He was at the time a PhD candidate at the University of New South Wales, and he had an idea for making solar panels much cheaper: replace the expensive silver typically used to pull electricity out of the devices with plentiful, cheap copper.

Labs and well-funded giants had already struggled with this same attempt to ditch silver. Allen remained undeterred and built his own equipment to test one idea after another at a quick clip, until he found a technique that worked. SunDrive Solar, the company he co-founded in 2015 based on this research, proved this week that it has produced one of the most efficient solar cells of all time, according to a leading independent testing laboratory. And SunDrive did so with copper as the metal at the core.

If SunDrive can mass produce its technology — and that’s a big if — the Australian startup could reduce the cost of solar panels and make the industry far less dependent on silver. “The thing about copper is that it’s very abundant and usually about 100 times cheaper than silver,” said Allen, now 32.

SunDrive has raised about $7.5 million to date from Blackbird Ventures and other big-name investors. Mike Cannon-Brookes, one of Australia’s wealthiest people, has backed the startup through his Grok Ventures; so has former Suntech Power Holdings Co. chief Shi Zhengrong, sometimes called the “Sun King” for his outsized role in the solar-panel industry.

The company also received more than $2 million via a grant from the Australian Renewable Energy Agency, a government body tasked with boosting green technology.

About 95% of solar panels are constructed out of photovoltaic cells made from wafers of silicon. To pull electrical current from the cells, you typically need to fuse them with metal contacts. Silver has long been the metal of choice because it’s easy to work with and very stable.

Solar-panel manufacturers rely on a screen printing process similar to that used to place designs on T-shirts, pushing a thick silver paste through a mesh and onto their silicon cells in a fixed pattern. If you’ve ever seen a solar cell up close, the faint, thin lines running across it are the metal electrodes.

Solar panel makers now consume as much as 20% the world’s industrial silver each year. When silver prices are high, the metal alone can account for 15% of a solar cell’s price. Even after a big rally this year, copper trades for a little more than $9,000 a ton in London. That same amount of silver would cost nearly $770,000.

The solar industry will need more and more silver as it continues to boom and, at some point, SunDrive’s backers believe, it’s likely demand for the metal will constrain the spread of solar electricity needed to bring down greenhouse gas emissions.

The issue preventing solar-panel manufacturers from ditching silver has been that copper doesn’t lend itself to the standard manufacturing techniques, in part because it doesn’t stick well to solar cells. Copper also oxidizes more easily, which impacts its ability to conduct current.

The University of New South Wales has a long history of solar technology breakthroughs, and Allen zeroed in on this copper conundrum as the heart of his graduate studies. Instead of working at the school’s labs, however, Allen thought he could conduct experiments more quickly by building an R&D setup in a garage. He spent a couple years assembling machines that held a liquid copper concoction of his own creation and that could deposit the slurry onto a solar cell in a controlled fashion.

“I always wanted to follow my own curiosity and try out a bunch of random, crazy ideas,” Allen said. “It required some discretion since there were neighbors, and I was walking around in a lab coat with all these chemicals.”

It took hundreds of experiments, but he eventually developed technology that makes it possible to securely adhere thin lines of copper on solar cells. He started SunDrive with his former flatmate, David Hu, 33, in a bid to commercialize the technology. The company now has about a dozen employees. Hu, who grew up in China and moved to Australia at 16, handles the business affairs, while Allen sticks to the science.

Just this week SunDrive received official word that it had set a record for the efficiency at which its particular design of solar cells convert light to electricity. The result came from analysis by the Institute for Solar Energy Research Hamelin (ISFH), a German organization known for conducing such tests. The efficiency figure — 25.54% — will mean little to people outside of the solar industry. But it’s is one of the key metics by which cells are compared.

Large Chinese solar cell makers have topped the efficiency records for years. Longi Green Energy Technology Co., which sold $8.4 billion of solar technology last year and is one of the world’s biggest manufacturers, held the previous top mark of 25.26%.

Startups in this part of the solar market are rare because of the daunting prospect of competing against giant companies that produce solar cells by the millions at large, expensive factories. Chinese companies dominate, with collective control of the majority of global capacity for the supply chain.

“The capital required to a start a new company is huge, and even then it’s not a terribly profitable business,” said Zachary Holman, a professor who studies solar materials at Arizona State University. Still, he said, there are a handful of companies like SunDrive that are aiming for technical breakthroughs that might give them a shot. SunDrive “would need something new like that in order to compete.”

The next step for SunDrive will be proving it can mass produce solar cells reliably and cheaply. “What they have shown so far is high performance on one cell,” Holman said. “They did not show 10,000 high performance cells coming off a several-hour manufacturing run.”

Allen and Hu said they’ve yet to decide on the exact path they will take moving forward. It’s likely that they will try to form a partnership with one or more of the large manufacturers rather than attempting to build an entire solar panel business from scratch. “We might purchase partially complete solar cells and then finish them with our copper process,” Hu said.

Shi, the SunDrive investor nicknamed “Sun King,” said it will be hard to find enough affordable silver if the solar business grows as predicted. Over the next decade, he expects to see manufacturers move to a 50-50 split between silver and copper in the solar cells. “The shift to copper is something that we’ve long desired but has been very hard to do,” he said.

He recalled visiting Allen at his homemade lab and being surprised by what the PhD student had accomplished. “He had all these simple tools and things he’d bought off Amazon,” Shi said. “Innovation really is related to the individual and sometimes the right moment, and not to being at a big company with lots of resources.”

Updated: 5-31-2022

A Billionaire’s Windmill Tilt Is Breaking An Investment Drought

Shareholder activism — and the election of a new government — has forced Australia’s largest emitter to consider a faster exit from coal.

If you live by politics, you end up dying by politics.

Such is the fate of AGL Energy Ltd., Australia’s oldest utility and biggest polluter. The company Monday abandoned plans to de-merge its coal power plants and said its chairman and chief executive officer would both leave amid a review of its strategic direction.

That brings an end to a sorry episode that’s seen AGL lose nearly half its value since confirming the demerger program in June 2020.

Part of the impetus for the change has been the shareholder activism of software billionaire Mike Cannon-Brookes, Australia’s fourth-richest man, who launched a A$7.9 billion ($5.7 billion) takeover offer for the company in February to push it to decarbonize faster.

Though that bid was rejected, an 11.3% stake held by Cannon-Brookes’s Grok Ventures meant the de-merger won’t pass shareholder approval, AGL said.

More important, however, has been the political shift ushered in by Australia’s election May 21, that brought the center-left Labor Party to power after nine years in opposition.

Governing with a slim majority, new Prime Minister Anthony Albanese is just two parliamentary votes away from needing climate-focused independents and Greens to pass legislation.

Despite being privately held, utilities are deeply dependent on the government to run their heavily regulated monopolies. AGL’s shares doubled in less than three years after the previous Labor government’s emissions pricing scheme was repealed in 2014.

Its former Chief Executive Andy Vesey left abruptly in 2018 after clashing with politicians in the then-ruling conservative Liberal-National Coalition government about his plans to close an aging coal generator.

Before the election, AGL was lobbying the country’s energy regulator to water down forecasts the industry uses to plan its future needs, arguing they were too bullish on the pace of energy transition.

Now, the strategic review will be looking at how to create value “in an environment where pressure on decarbonization and energy affordability is accelerating.”

The pro-fossil fuel policies of the previous government — led by Scott Morrison, who once brandished a lump of coal on the floor of parliament to taunt his opponents — left Australia’s utilities in an impossible position.

The country’s vast landmass, long coastlines and bright sunlight make it one of the world’s best locations for renewable power, with costs for wind and solar well below even the lowest-priced gas and coal-fired generation.

In a situation where almost the entire grid is renewable-powered in 2030, even the most expensive wind-and-solar plants backed up with batteries and transmission will be cheaper than all but the very cheapest gas plants in a low-renewables network, according to a government review last year.

As a result, there’s been no investment case to build anything except renewable power and the transmission networks to support it as existing plants gradually wear out — but poorly designed regulations have been driving investors away.

Spending on new large-scale renewables generation fell for the third consecutive year in 2021 to $2.2 billion, according to BloombergNEF — barely more than a third of 2018’s peak level. Wind power, the backbone of any future zero-carbon grid in Australia, saw not a cent of investment in the fourth quarter of last year.

A government that’s not at war with the technology and economics of the 21st-century power sector ought to make a difference.

Transmission spending, essential to providing the grid infrastructure that renewable projects need to obtain predictable pricing, fell by about half after 2015, with no more than about 16% of expenditure going to the growth that the network needs.

Unblocking that bottleneck — especially in New South Wales state, where Brett Redman, a former AGL chief executive who developed the junked de-merger plan, now runs the closely held grid operator — ought to unleash a fresh wave of zero-carbon generation projects.

Cannon-Brookes’s presence as AGL’s biggest investor is the last push that was needed to accelerate this transition. His proposal to close the company’s coal fleet by 2030 sounds radical, given that AGL accounts for nearly a tenth of Australia’s emissions — but in truth, its largest divergence from existing plans will be closing a single plant east of Melbourne when it’s been operating for four decades, rather than six decades.

Australia’s power sector has been stymied for too long by governments that held back the tide of energy transition. AGL’s now-abandoned de-merger program was the perfect embodiment of that era, a shift modest enough to prevent howls of complaint from Canberra, but insufficiently ambitious to convince investors it represented a workable plan.

Its valuation, just 5.8 times forecast earnings before interest, tax, depreciation and amortization, is now at some of the lowest levels it’s ever plumbed. With the prospect of a viable future ahead at last, that low estimate is due for a re-rating.

Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,Global Investment In Wind,

Related Articles:

Giant Batteries Supercharge Wind And Solar Plans (#GotBitcoin?)

North America’s Largest Solar Bitcoin Mining Farm Coming To California (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.