Ultimate Resource On Countless Store Closings (#GotBitcoin)

More store closings coming: An estimated 12,000 shops could close by the end of 2019. Ultimate Resource On Countless Store Closings (#GotBitcoin)

The retail apocalypse isn’t showing any signs of slowing down.

Eight months into 2019, there have already been 29% more store closings announced than in all of 2018, according to a new report from global marketing research firm Coresight Research.

More Than 9,100 Stores Are Closing In 2019 As The Retail Apocalypse Drags On — Here’s The Full List

Based on Coresight Research’s figures, retailers’ earnings reports, bankruptcy filings and other records, more than 7,600 stores are slated to shutter this year and thousands of locations already gone.

Bankrupt footwear company Payless ShoeSource, which closed its remaining U.S. stores in late June, accounts for about 37% of the closings.

The “going-out-of-business” sales and liquidation of other brands is expected to continue. Coresight estimates closures could reach 12,000 by the end of the year, the report said.

Coresight, which has offices in Manhattan, London and Hong Kong, tracked the 5,864 closings in 2018, which included all Toys R Us stores and hundreds of Kmart and Sears locations.

Plus-Sized Retailer Avenue Will Be Closing All 222 Stores

Another Plus-Sized Women’s Retailer Will Be Closing Its Doors

Avenue Stores LLC, owned by private-equity firm Versa Capital Management, has decided to shutter all 222 of its retail locations, Hilco Merchant Resources said in a statement announcing the closures. The company, which operates in 33 states, has hired Hilco and Gordon Brothers to oversee inventory sales.

Versa, Avenue, Gordon and Hilco didn’t reply to requests for comment. Calls to stores in New Jersey, New York and Florida directed Bloomberg to the corporate office in Rochelle Park, N.J., where calls weren’t answered.

Retail Dive And Dow Jones Reported On The Closures Earlier

The specialty plus-sized apparel industry has been under pressure as online rivals like Amazon.com Inc. and big-box retailers from Walmart Inc. to Target Corp. increasingly compete in the space. Plus-sized women’s retailer Fullbeauty Brands Inc. filed for Chapter 11 earlier this year before winning court approval for its plan to restructure the company in less than 24 hours.

Sears and Kmart Store Closings List: 21 Sears and 5 Kmart locations to close in October

Walgreens Store Closings: Drugstore chain plans to close 200 U.S. stores, according to new SEC filing:

The record year for closings was 2017, with 8,139 shuttered stores, Coresight found. This included an earlier round of Payless closings, the entire HHGregg electronics and appliance chain, and hundreds of Sears and Kmart stores.

The pain is expected to continue into future years, according to an April report from UBS Securities.

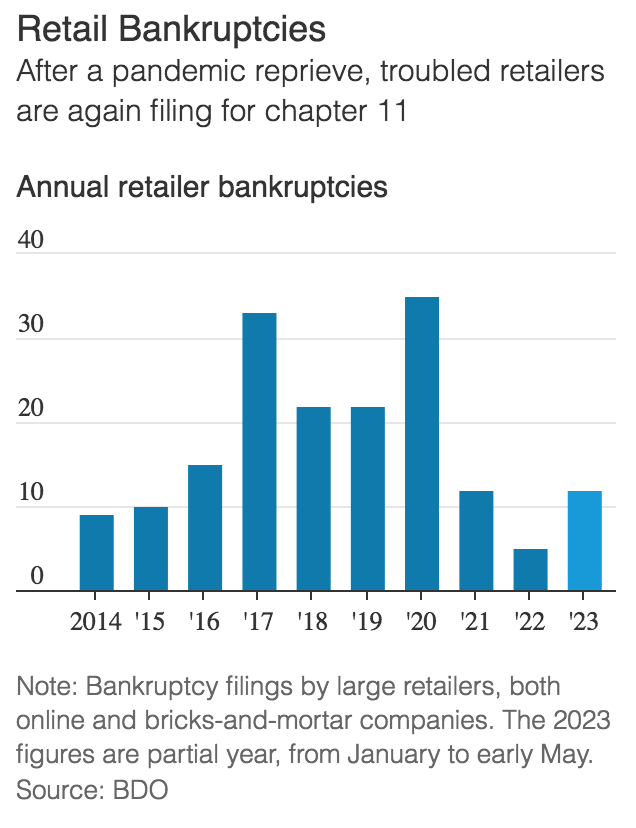

Retail Bankruptcies Rise, Store Closures Skyrocket In First Half of 2019

Store closures in the first six months of the year have already exceeded the number of bricks-and-mortar stores closed in all of 2018.

The pace of retail bankruptcies and store closures in the U.S. has accelerated so far this year compared with 2018, due in part to last year’s lackluster holiday shopping season, a new report finds.

More retail bankruptcy filings are expected in the second half of the year, and bricks-and-mortar stores will continue to close at a higher rate, according to a report released Wednesday by professional services firm BDO USA LLP.

“We’re going to see this trend continue,” said David Berliner, who leads the business restructuring and turnaround services practice of BDO, which provides assurance, tax and advisory services. While retailers are expected to keep falling in the second half of the year, the torrid pace should slow, Mr. Berliner said.

“I don’t think the pace of the bankruptcy filings will be as large as it was in the first half,” he said.

Talk of a retail apocalypse has echoed throughout the industry for years as shoppers abandon the nation’s malls and flock to online sellers. But the expected increase in bankruptcies and closures means the industry’s recent pain shows little sign of easing.

Retailers continue to grapple with excessive debt, over expansion, private equity-ownership pressures and changing consumer behavior. On top of that, retailers were hurt by the 2018 holiday season, which failed to meet expectations, resulting in the weakest retail sales performance since December 2009, BDO found.

Retail sales in the first half of the year were also hit by smaller tax refunds for the average taxpayer, trade tariffs, the longest government shutdown in U.S. history and inclement weather, which led some retailers to offer deep discounts to move merchandise, according to BDO.

In the first half of 2019, 14 retailers with 25 or more stores filed for bankruptcy, including Payless ShoeSource Inc., Gymboree Group Inc. and Charlotte Russe Holdings Corp., BDO found. That is up slightly from 13 retailers with 20 or more stores during the same period in 2018.

Over the summer, several more retailers—including Charming Charlie Holdings Inc., Barneys New York Inc., A’Gaci LLC and Avenue Stores LLC—filed for bankruptcy.

The number of store closures from January to June has already exceeded the number of bricks-and-mortar stores closed in all of 2018. About 19 retailers announced they would close a total of more than 7,000 stores so far this year, already topping all previous full years, BDO found.

Many of those closures were due to companies filing for bankruptcy, including ShopKo, Charming Charlie and Things Remembered. The bankruptcies of Payless, Gymboree and Charlotte Russe alone led to the closure of about 3,700 stores, according to BDO.

To reduce the expense of maintaining a physical presence, some retailers are dropping their flagship stores and opting for smaller locations in prime urban areas.

For the full year, Coresight Research predicts more than 12,000 stores will close, compared with a total of under 6,000 in 2018. Behind the closures are some retailers going out of business, while others are just reducing their physical footprint.

But it isn’t all bad news. Despite the large number of bankruptcy filings and store closures, overall retail sales in the first six months of the year remained solid because of a strong economy, low unemployment and rising wages, BDO said.

The risk of a significant downturn in the retail sector is slim for the remainder of the year, but retailers should still remain cautious heading into 2020 because of the trade dispute with China and record consumer debt, the report said.

“If the economy does stumble a little bit, things can get painful,” Mr. Berliner said. “That can have a devastating effect on the weak retailers who can’t afford that sales dip in the holiday season.”

UBS analysts said 75,000 more stores would need to be shuttered by 2026 if e-commerce penetration rises to 25% from its current level of 16%.

A separate analysis by UBS said tariffs on Chinese imports could put $40 billion of sales and 12,000 stores at risk.

“The market is not realizing how much brick & mortar retail is incrementally struggling and how new 25% tariffs could force widespread store closures,” UBS analyst Jay Sole wrote in the May report. “We think potential 25% tariffs on Chinese imports could accelerate pressure on these company’s profit margins to the point where major store closures become a real possibility.”

Charming Charlie Store Closings: Retailer going out of business, will close all 261 stores in Chapter 11 bankruptcy

Closing All Locations:

Thousands of locations have already closed this year with the final Payless stores finishing their liquidation sales in June. All Charlotte Russe stores closed in April.

Payless ShoeSource: 2,589 (includes 248 Canada locations and 114 smaller-format stores in Shopko Hometown locations).

Gymboree/Crazy 8: 749

Dressbarn: 649. Here are the locations closing in July and August.

Charlotte Russe: 494;

Shopko: 371

Charming Charlie: 261

LifeWay Christian Resources: 170

Henri Bendel: 23

E.L.F. Beauty: 22

Topshop: All 11 U.S. stores

Barneys New York Bankruptcy: Luxury retailer files for bankruptcy and announces 15 closing stores.

Perkins, Marie Callender’s Bankruptcy: Restaurant chain filed for bankruptcy after closing 29 locations

More Closings

Some of the announced closures may carryover into 2020, which was the case with several closings announced in late 2018 such as Lowe’s, Sears and Kmart. Gap Inc. announced Feb. 28 it would close roughly 230 stores over two years. Some retailers also are opening new stores while closing locations including Bath & Body Works and Abercrombie & Fitch.

GNC: 192 stores closed in first six months of year; up to 900 over the next three years.

Family Dollar: As many as 390 stores

Fred’s: 442; the company said July 12 it would close another 129 stores.

Chico’s: 74, but 250 over the next three years.

Gap: Roughly 230 in next two years

Walgreens: 200

Foot Locker: 165, total includes closings outside of the U.S.

Signet Jewelers: The parent company of Kay, Zales and Jared said it would close another 150 stores.

Pier 1 Imports: 57, but up to 145 could close.

Ascena Retail: 120

Destination Maternity: 117

Sears: 21 more stores will close in October; 72 stores closed earlier this year

Victoria’s Secret: 53

Vera Bradley: 50

Office Depot: 50

Kmart: Five more stores will close in October; 48 stores closed earlier this year

CVS: 46

Party City: 45

Sears Hometown and Outlet Stores: 45

The Children’s Place: Up to 45

Z Gallerie: 44

DKNY: 41

Stage Stores: 40 to 60

Bed Bath & Beyond: 40

Abercrombie & Fitch: 40

Francesca’s: At least 30 stores

Build-A-Bear: Up to 30 over two years

Williams-Sonoma: 30

J.C. Penney: 27

Bath & Body Works: 24

Southeastern Grocers: 22

Saks Off 5th: 20

Lowe’s: 20

J. Crew: 20

Barneys New York: 15

Macy’s: 8

Nordstrom: 7

Target: 6

J.Crew: 5

Kohl’s: 4

Whole Foods: 1

Calvin Klein: 1

Pottery Barn: 1

Source: Coresight Research; staff research

Pier 1 Imports Store Closings: Retailer plans to close 57 stores, and more closures could be coming, interim CEO says

Updated: 11-11-2019

Adidas To Close Sneaker Factory In The U.S., Move Production To Asia

The footwear maker’s move reverses an effort to make products closer to shoppers in the West.

Adidas AG plans to close its only sneaker factories in the U.S. and Germany, shifting cutting-edge automated footwear production to Asia and reversing an effort to make products closer to shoppers in the West.

The German company, the world’s second-largest athletic gear maker by revenue after Nike Inc., said Monday it would move technology developed at its so-called “Speedfactories” to two suppliers in Vietnam and China.

The closure of the facilities in Ansbach, Germany, and suburban Atlanta—both opened within the past three years—raises questions about the feasibility of bringing manufacturing jobs back to developed markets.

Adidas said the move would result in the “better utilization of existing production capacity and more flexibility in product design.” A spokeswoman said the decision wasn’t related to the continuing trade dispute between the U.S. and China.

The closure of the two factories, which will cease production by April, will together affect some 200 jobs.

The decision marks an abrupt shift in strategy for Adidas, which has been gaining market share in the U.S. and has reported lagging sales in its home market of Western Europe in recent months.

The Atlanta facility was announced in 2016 and began production in late 2017. It was touted as part of a broader effort to be closer to U.S. consumers, while innovating production processes meant to cut time to market and competing with fast-fashion retail. Earlier this year, Adidas promoted limited-edition shoes made at the Georgia factory for the Atlanta-hosted Super Bowl.

Like industry leader Nike, Adidas sources the vast majority of its footwear production from contracted manufacturers in Asia. Each of the big three sportswear makers—Nike, Adidas and Under Armour Inc. —have invested in or begun testing automated production technology for footwear in recent years to diversify their manufacturing strategy. Nike doesn’t manufacture footwear in the U.S., according to its manufacturing map. Under Armour in 2016 opened a facility for automated and 3-D product prototyping near its headquarters in Baltimore.

Still, the volume of footwear produced at the Ansbach and Atlanta factories was expected to be just a fraction of Adidas’s annual output. In 2016, the company anticipated some 500,000 pairs of shoes would be made annually in Ansbach, and some 50,000 pairs in Atlanta, each less than 1% of its 300 million pairs produced overall.

Updated: 11-12-2019

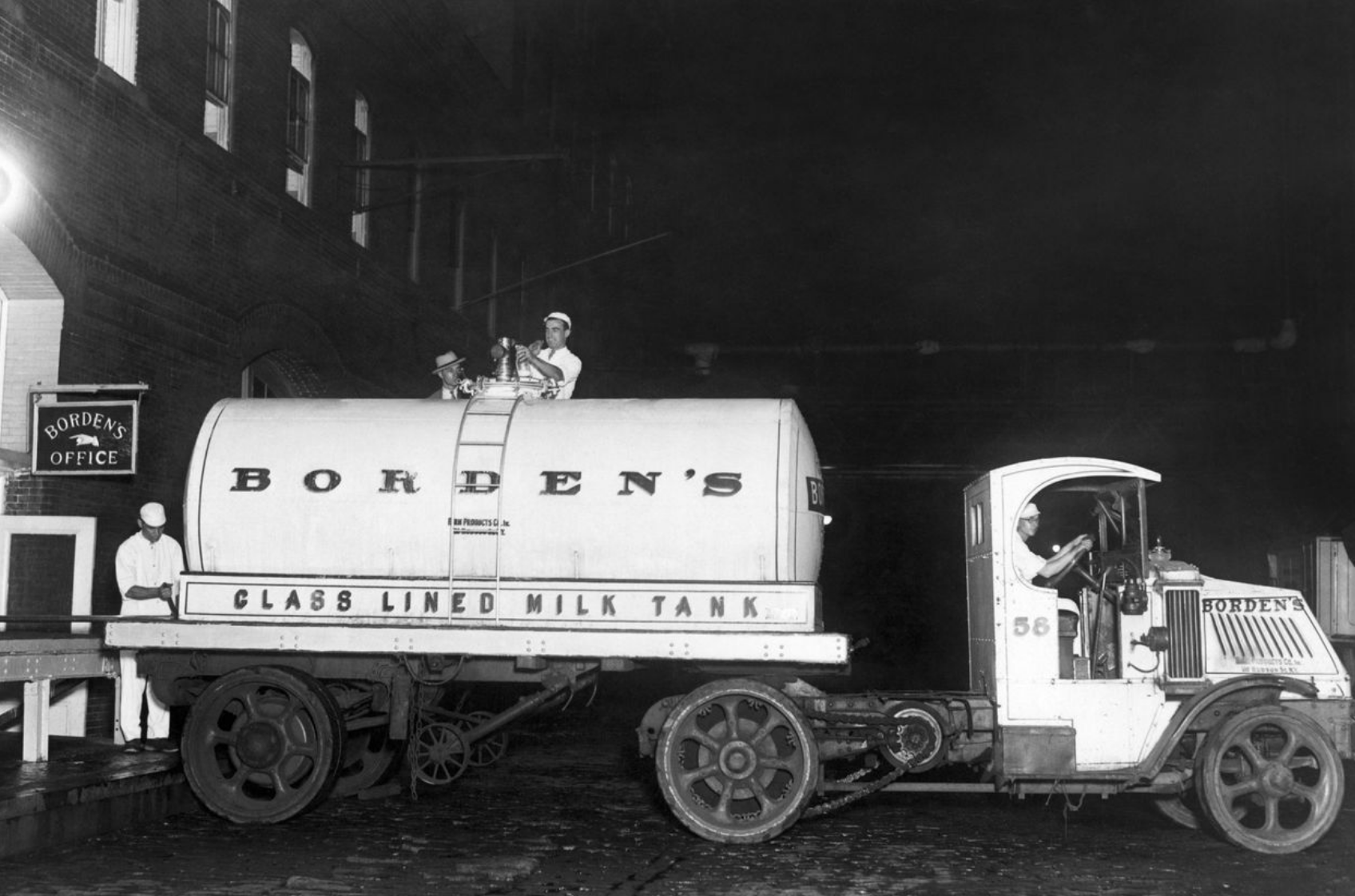

America’s Largest Milk Producer Files For Bankruptcy

Dean Foods, America’s largest milk producer, is filing for bankruptcy.

The 94-year-old company has struggled in recent years because Americans are drinking less cows milk. 2019 has been particularly brutal: the company’s sales tumbled 7% in the first half of the year, and profit fell 14%. Dean Foods stock has lost 80% this year

The company, which makes some of the country’s most recognizable milk and dairy products, including Dairy Pure, Organic Valley and Land O’Lakes, has blamed its struggles on the “accelerated decline in the conventional white milk category.”

The company is saddled with debt and has been unable to fund all of its workers’ pensions. So on Tuesday, Dean Foods filed for Chapter 11 bankruptcy protection to keep the business operating, reorganize its debt and help fund the pensions while it looks to sell the company.

Dean Foods said in a statement that it is working with the Dairy Farmers of America cooperative on a potential deal, in which the cooperative would buy almost all of the company.

As part of the bankruptcy process, the company secured $850 million in financing from its existing lenders, including Rabobank, to keep the company running.

Once a staple of the American refrigerator, milk has slowly fallen out of favor with consumers as they seek less-sugary or plant-based alternatives.

The global market for milk alternatives is expected to top $18 billion this year, up 3.5% from 2018, according to Euromonitor. That’s still a fraction of the traditional milk market which will come in at just under $120 billion globally this year.

Sales for cow’s milk has been declining for the past four years. Sales for the past 52 weeks, ending on October 26, was around $12 billion, according to data Nielsen provided to CNN Business. That’s a decline from $15 billion during a similar time period in 2015. All types of cow’s milk, such as 1%, 2%, skim and fat-free milk sales have all declined.

In contrast, and while still much smaller, sales of oat milk has jumped 636% to $53 million over the past year.

That’s not the only problem Dean Foods has faced. Walmart, which was one of Dean Food’s biggest customers, dropped them last year after building its own dairy plant.

Updated: 2-17-2020

Dairy Farmers of America Strikes $425 Million Deal for Dean Foods Assets

Deal, requiring Justice Department and bankruptcy court approval, would maintain farmers’ market for milk, cooperative has said.

The biggest U.S. dairy farming cooperative struck a $425 million deal to buy dozens of plants from bankrupt milk processor Dean Foods Co., DFODQ 2.29% in a deal executives said would preserve jobs and markets for farmers’ milk.

The deal, which was proposed by Dairy Farmers of America, would see the Kansas City, Kan., agricultural cooperative take over the bulk of Dean’s plants, following the top U.S. milk company’s bankruptcy filing in November.

The deal requires approval of the bankruptcy court and the U.S. Department of Justice.

Dean’s bankruptcy followed a yearslong decline in sales of fluid milk, the Dallas company’s main business. Bottled water, fruit juices and plant-based milk alternatives have crowded out milk cartons in grocery store beverage cases, pressuring the milk business. Dean also struggled as grocery sellers like Walmart Inc. WMT 0.38% and Kroger Co. opened their own milk-bottling plants, expanding sales of store-brand milk that is often priced far below branded milk from processors like Dean.

Pressures are mounting on the U.S. milk sector beyond Dean. Borden Dairy Co., another Texas dairy company, filed for bankruptcy in January, also blaming falling milk consumption and retailers’ investment in bargain-priced milk. Battling low prices, thousands of dairy farmers have closed their milking parlors in recent years, according to the U.S. Department of Agriculture.

Dean is a huge presence in the U.S. dairy sector, operating 57 plants in about 30 states, and both farmers and supermarket operators have fretted over the prospect of the company’s collapse. The company’s role as a major milk buyer, purchasing about 10% of U.S. farmers’ production, prompted the dairy farmers cooperative last October to begin discussing a deal to acquire plants and other assets from Dean.

In addition to the dairy farmers’ offer, Dean evaluated nearly 100 other potential buyers after seeking bankruptcy protection and provided details about its business to 38 of those, according to bankruptcy-court documents filed Monday.

The dairy cooperative’s bid will serve as the floor for the sale of those Dean assets, according to a company filing ahead of an April 13 deadline for bids for Dean’s business and a potential auction April 20. “We have had a relationship with DFA over the past 20 years, and we are confident in their ability to succeed in the current market and serve our customers with the same commitment to quality and service they have come to expect,” said Eric Beringause, Dean’s chief executive.

“As Dean is the largest dairy processor in the country and a significant customer of DFA, it is important to ensure continued secure markets for our members’ milk and minimal disruption to the U.S. dairy industry,” Rick Smith, the cooperative’s CEO, said.

Dairy Farmers of America, the largest U.S. dairy-farming cooperative by membership, markets nearly one-third of milk in the U.S. and operates its own milk-processing plants and dairy facilities.

Some dairy farmers, wary of a potential conflict of interest between the cooperative’s role as a marketer of farmers’ milk and its own processing operations, have voiced worries about its expanding further by acquiring much of Dean. The Justice Department has been probing the deal’s potential impact on farmers and regional milk markets.

In addition to plants from Dean, the dairy farmers’ proposal would include Dean’s Mexican subsidiaries and its ownership interest in a distribution venture with organic dairy cooperative Organic Valley. As part of the agreement, Dean committed to pay the cooperative a $15 million breakup fee if Dean ends up accepting a rival proposal.

Updated: 1-6-2020

Borden Dairy Files for Bankruptcy

The 163-year-old milk producer becomes second major industry player in two months to seek protection from creditors.

Borden Dairy Co., a 163-year-old milk producer known for its spokes-cow Elsie, has filed for bankruptcy with plans to erase millions of dollars in debt from its books, becoming the second major player in the industry to seek protection from creditors in two months.

The Dallas-based company filed its chapter 11 petition Sunday in the U.S. Bankruptcy Court in Wilmington, Del., blaming falling milk consumption, rising raw-milk costs, increasing freight costs due to driver shortages pressuring wages, and the growing clout of retailers consolidating with other merchants or beginning to develop their own milk-processing operations.

Borden, with $1.18 billion in 2018 sales, is one of the U.S.’s largest milk producers. The nation’s largest, Dean Foods Co. , filed for bankruptcy in November.

The company’s debts include $255.8 million in secured loans and a $33.2 million settlement with a pension fund. Borden’s majority owners are Acon Investments LLC and Laguna Dairy, S. de R.L. de C.V., court papers say.

The company had been in talks with creditors on a restructuring deal, but a forbearance agreement the company struck with its lenders expired Monday.

“Unfortunately, the parties were unable to finalize an out-of-court restructuring by the forbearance termination date,” Borden Chief Financial Officer Jason Monaco said Monday in a court filing.

Borden said that in July 2017 it arranged a $275 million credit facility that consisted of a $30 million term loan held by PNC Financial Services Group Inc. ; a $175 million term loan now held by lenders that include KKR & Co.; and a $70 million revolving credit facility provided by PNC.

Besides milk, Borden makes or markets products that include dips and sour cream, as well as juice. It has 12 manufacturing plants and more than 75 distribution centers nationwide.

Borden, founded in 1857 by Gail Borden Jr., said it plans to continue its normal operations.

It is seeking court permission to continue to use its cash, as well as to pay its taxes, its 3,264 employees, and its insurance and utility bills. It also wants to maintain customer programs and bank accounts. More than one-fifth of its employees are covered by a collective bargaining agreement.

The company is also seeking permission to pay vendors that it believes are critical to its operations. Nearly $25.1 million is owed to milk suppliers.

Borden buys more than one-third of its raw milk from 262 family dairy farms of various sizes and the rest from farmers’ cooperatives. Customers include Walmart Inc. stores and Sam’s Club, Starbucks Corp. , Food Lion LLC, Kroger Co. and school districts.

“Despite Borden’s best efforts, its current obligations under the credit agreement have severely limited its ability” to make money, Mr. Monaco said. Borden has paid $21 million a year in cash interest over the past several years, “a burden that can no longer be serviced by the company’s underlying earnings and cash flow,” he said.

Borden Chief Executive Tony Sarsam told The Wall Street Journal that he believes Acon, which took a major stake in the company in 2017, will be the primary owner of the business after the bankruptcy. He declined to say how much debt Borden would erase as part of its bankruptcy restructuring.

Acon would be willing to play a constructive role in Borden’s reorganization, said a person familiar with the private-equity firm’s strategy.

Borden’s biggest unsecured debt is nearly $33.2 million owed to Central States Health and Welfare pension funds over a settlement reached after Borden withdrew from the plan in 2014. A fund representative couldn’t be reached for immediate comment.

The bankruptcy of Borden Dairy and 17 affiliated companies has been consolidated under case number 20-10010. The company has hired law firm Arnold & Porter Kaye Scholer LLP to handle its restructuring. Judge Christopher S. Sontchi is overseeing the case.

Updated: 12-1-2019

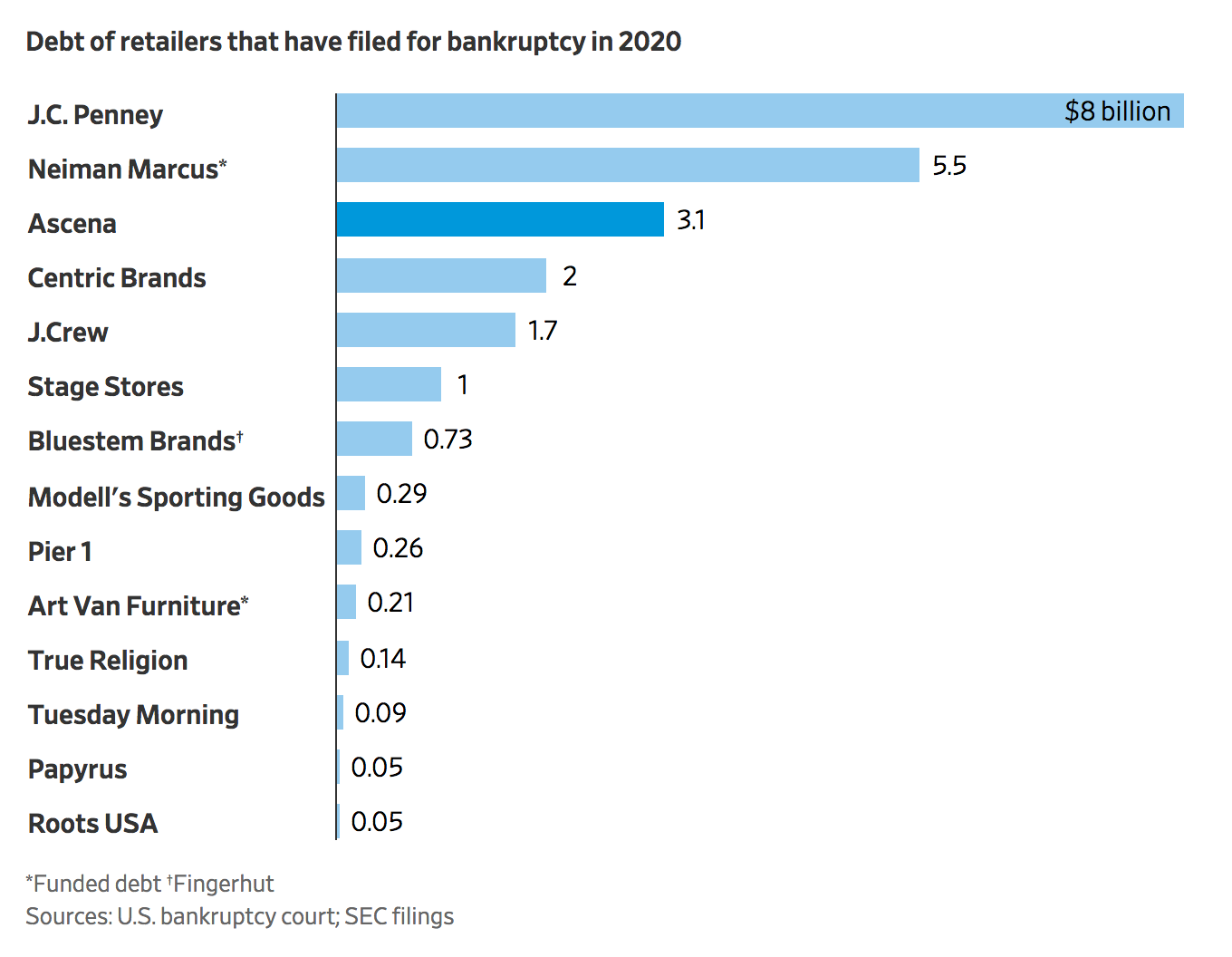

Investors Bet On More Pain For Retailers

Short sellers line up against retail stocks.

The bears are circling retailers ahead of the holiday season.

Short sellers have revived their bets against bricks-and-mortar retailers in recent weeks, taking their most aggressive positions in months. Short positions against the SPDR S&P Retail fund, one of the biggest retail exchange-traded funds, last week hit 441% of the fund’s available shares, due to multiple borrowings by bearish speculators, according to financial-data firm S3 Partners.

That was twice the percentage of shares investors shorted at the same time last year and the highest level in roughly eight months.

Short sellers—who have wagered $7.7 billion against retailers including Macy’s Inc., Kohl’s Corp. and Nordstrom Inc. —borrow shares and sell them, expecting to repurchase them at lower prices and collect the difference as profit. Mall owners are also being targeted, with billionaire investor Carl Icahn among their biggest detractors in recent months.

Despite expectations for a solid holiday shopping season, several investors said their bearish bets are based on retailers’ struggles in a highly competitive landscape and consumers’ growing preference for digital shopping. And investors say they will closely watch the results from Dollar General Corp. , Big Lots Inc. and Lululemon Athletica Inc., which are due to report results this week.

The wagers against retailers stand in contrast to investors’ more bullish take on the stock market. Bets against the SPDR S&P 500 Trust, the biggest ETF tracking the broad index, stand at just 15% of available shares, near the lowest levels of the year, according to S3. The S&P 500 has surged 25% this year.

“Everyone talks about the holiday season and how retailers are doing better,” said Seth Golden, a 43-year-old consultant for the consumer-packaged goods industry in Ocala, Fla. “But retailers are fighting an uphill battle. It doesn’t matter what many of them do at this point. Their structure is a storefront, which is only decreasing year after year.”

Mr. Golden, who also runs a trading website that issues alerts on trades he completes to 3,000 members, said he has been shorting shares of Kohl’s for most of the year. The trade got a big boost last month after the department-store chain reported lower-than-expected sales and cut its profit forecast for the year, sending shares down nearly 20% on Nov. 19. That was the stock’s largest-ever single-day decline and helped extend its pullback for the year to 27%.

Mr. Golden isn’t finished with the trade. “I don’t see growth,” he added. “I see only further share-price deterioration.”

Kohl’s is the second-most profitable retail short this year. S3 estimates that short sellers have netted $556.5 million on the stock this year. Macy’s tops the list, giving investors who had bet against the stock a cumulative payday of $597.1 million.

The retail short trade has been popular in recent years as shares of department stores and specialty retailers have withered under the shadow of Amazon.com Inc. Macy’s shares have lost 76% of their value over the past five years. And some investors have bet shares will fall further after disappointing earnings reports over the past two quarters.

Short positions against the department-store operator have jumped to 31% of its total share count, significantly higher than the 13% of shares that were held short in early August, according to S3.

Macy’s representatives didn’t respond to a request for comment. A Kohl’s spokeswoman declined to address the company’s short sellers.

Despite the big paydays generated by a handful of stocks, retail hasn’t been a uniform trade for investors this year. Several short sellers described a tougher environment for picking shorts. Some shorts have gone the wrong way, saddling investors with massive losses, while others, such as Macy’s, appear so beaten down that some investors say there may be little upside left for bears.

After spiking earlier this year, short interest on the SPDR S&P Retail ETF has grown exceptionally large again relative to the fund’s total shares outstanding, which is due to multiple borrowings by bearish speculators.

Target Corp. , for example, has defied most expectations, rising 89% in 2019 after four consecutive years of single-digit gains and losses. Unlike many of its rivals, Target has continued to attract more shoppers, and the company reported last month its 10th consecutive quarter of rising sales.

Short sellers have hemorrhaged $1.3 billion on Target this year, forcing many out of the trade altogether. Discount retailers, such as Dollar General Corp. and TJX Co s., have also been resilient.

Even struggling retailers have had periods of strength, forcing short sellers to cover their positions. Shares of Nordstrom have struggled for most of the year. But some investors had to scramble to cover their positions on Nov. 22 after the stock rose nearly 11% on stronger-than-expected earnings.

Short bets have crept higher since then, with positions standing at 29% of Nordstrom’s share count.

“There was a tremendous amount of carnage in this area 18 months ago,” said Brad Lamensdorf, portfolio manager for AdvisorShares Ranger Equity Bear ETF. “Since then, it’s been bifurcated.”

Mr. Lamensdorf, who had shorted retailers including Macy’s in the past, said he has avoided traditional retailers in recent months. Instead, he has been shorting mall operator Macerich Co. , which has been hurting from the raft of bankruptcies of mall-based stores. The latest bankruptcy, Forever 21 Inc., is expected to dent Macerich’s annual earnings, the mall operator warned in late October.

Macerich shares are down 38% this year.

Carl Icahn has also been wagering against mall owners in recent months. The billionaire investor stands to gain $400 million or more if mall owners run into problems servicing their debt.

Besides that, retail shorts have been costly, contributing to why investors such as Mr. Lamensdorf have looked past the traditional trades. Crowded shorts tend to carry higher borrowing costs for short sellers. Also, several retailers pay rich dividends, forcing short sellers to pass that back to their share lender. Macy’s has a 9.8% dividend yield, while Kohl’s stands at 5.6%.

“Macy’s may go lower, but having to pay that dividend yield right now can be painful,” Mr. Lamensdorf said.

Other retail bears remain undeterred.

Michael Rooks, a 31-year-old director of digital media in Virginia Beach, Va., who invests on the side, has been shorting shares of Target, Lululemon Athletica Inc. and Ulta Beauty Inc. on a day-to-day basis, never holding a position past the market’s 4 p.m. close.

He says he has made money off his Lululemon and Ulta shorts but admits Target has been tougher.

“The bears have been squeezed to the damn bone,” Mr. Rooks said. “But I’ve been focusing on little windows.”

Updated: 12-1-2019

Bankrupt Retailer Destination Maternity Corp. To Close 235 Retail Stores

Neuberger Berman-backed firm agrees to acquire retailer’s brand name, e-commerce business, subject to a higher bid at bankruptcy auction.

Bankrupt retailer Destination Maternity Corp. will shut down its remaining 235 retail stores under a deal that would see a licensing firm buy the company’s brand name and other assets for $50 million.

A licensing platform backed by Neuberger Berman Group LLC has agreed to acquire the e-commerce business, brand name and intellectual property of bankrupt retailer, according to a filing in U.S. Bankruptcy Court in Wilmington, Del.

New York-based Marquee Brands will also be able to designate the sale of some inventory and other assets, court documents show. Marquee Brands is owned by investor funds managed by the private-equity arm of Neuberger Berman, an employee-owned investment manager.

Under the deal, a joint venture composed of liquidators Hilco Merchant Resources LLC and Gordon Brothers Retail Partners LLC would sell inventory, fixtures and equipment, and other assets through store-closing sales at the 235 stores where liquidation sales aren’t already in process.

Hilco and Gordon Brothers will also be in charge of winding down Destination Maternity’s leased department-store business.

Marquee Brands agreed to serve as the stalking horse bidder in exchange for bid protections. Under the agreement, Destination Maternity would reimburse Marquee up to $750,000 for its expenses and costs incurred in negotiating the deal, and a breakup fee of $1.75 million if a transaction is closed with another bidder, court documents show.

A bankruptcy lawyer for Destination Maternity declined to comment Saturday.

Destination Maternity operated about 435 stores when it filed for bankruptcy in October. It initially had planned to close about 210 underperforming locations while looking for a buyer to operate some of its remaining 235 stores. The retailer also operated more than 420 leased locations within department stores and baby specialty stores.

Earlier this year, Marquee Brands acquired the Martha Stewart and Emeril Lagasse brands and all related intellectual property from Sequential Brands Group. The licensing company also owns stakes in Ben Sherman menswear, BCBGeneration women’s apparel and Dakine outdoor-clothing brands.

Destination Maternity is requesting that Judge Brendan Linehan Shannon schedule an expedited hearing to approve the stalking horse bid on Tuesday, according to court documents. Rival bids are due Thursday and an auction, if necessary, is set for Dec. 9. A sale hearing is slated for Dec. 12, with a deal expected to close by the end of the year.

Destination Maternity, based in Moorestown, N.J, has said it was looking for a buyer that would want to keep many of its stores open and would value the name recognition of the band.

Greenhill & Co., the retailer’s investment bank, contacted more than 180 potential buyers. There are at least 21 active potential buyers conducting due diligence, with three submitting written proposals for a stalking horse bid that contemplated an acquisition of certain portions of the Destination Maternity’s business. But so far, only negotiations with Marquee led to a definitive agreement, according to court documents.

Destination Maternity, founded in 1982, has faced declining sales brought on by online competition, changing consumer behaviors, falling pregnancy rates in the U.S., high rents and a revolving door of executives. The company operates stores under the brands Motherhood Maternity, A Pea in the Pod and Destination Maternity.

Updated: 1-3-2020

Record Pace of Shut Stores Fuels Business For ‘The Closers’

Part sales guru, part therapist, a new breed of retail worker travels the U.S. shuttering locations and liquidating merchandise.

In the hollowed-out retail economy, Jerry Robertson finds himself almost continuously in demand. He specializes in closing stores.

Mr. Robertson travels the U.S., winding down one dying storefront after the next, from a gift shop in Kentucky to an Ace Hardware in New York.

Part sales guru, part therapist, Mr. Robertson has deployed to 28 states, from Amish country in Indiana to West Hollywood, slashing prices for deal-hungry customers while consoling longtime employees and managers who are often working the final days of their jobs.

“It’s just really tough” in retail, said the 60-year-old Mr. Robertson, who managed stores for Walgreens in Texas and Florida before stumbling into his store-closing career in 2003 after reading a Craigslist ad. “You get work all the time.”

He and others doing such jobs are part of a nomadic segment of workers thriving amid industry chaos. Last year, retailers announced plans to shutter more than 9,300 U.S. stores, a record, according to Coresight Research. Liquidation companies that help close stores report that they are busier than ever. As consumers shift more of their spending online and Amazon.com Inc. continues to reshape the landscape, many expect more fallout.

On a recent earnings call of B. Riley Financial, the parent company of liquidation giant Great American Group, Chairman Bryant Riley told investors that the liquidator was experiencing “one of the busiest periods in its history.”

Great American has closed more than 6,800 stores since 2013, including recent liquidations for Barneys New York, Toys R Us, Payless ShoeSource, and Gymboree.

Mr. Robertson has closed 90 stores since 2003, including four in 2019. He is currently liquidating an Ace Hardware in Brooklyn’s Dyker Heights neighborhood. On a recent December afternoon, standing near a wall of artificial Christmas trees and half-price Santa figurines, he repeatedly answered questions from confused shoppers and kept watch over the store. Mr. Robertson works alone and typically spends seven weeks winding down each location, working six days a week. He tends to stay at budget motels, like Rodeway Inn, or a guest room in an Airbnb. Since many closings overlap with the holidays, he often misses Christmas with his wife and children at his home in San Antonio.

Sometimes, even he can’t resist the deals. He renovated his family’s home with deeply discounted items he spotted in closings. He bought 20 gallons of paint at 70% off, or about $10 a gallon, in one hardware store closing. He also has picked up faucets, ceiling fans, a garbage disposal and many lawn tools, transporting them in his wife’s old van. “I could load that sucker up,” he said.

Closings can vary by retailer. Some consultants work directly for a liquidation company brought in as part of a bankruptcy filing. Other retailers hire extra hourly workers to shut stores.

In late December, Sears and Kmart had more than 50 open job postings online for cashiers, stockers and loss-prevention associates, among others, at stores slated to close soon. A spokesman for Transformco, the retailers’ parent company, declined to comment.

One reason stores turn to outside help is that closing a location is a “very involved process,” said Gary Wright, president at G.A. Wright Sales, a Denver-based marketing company that works on liquidation sales. “It’s very different than doing business as usual.”

Stores that had been dead typically become mobbed during a closing, Mr. Wright said. Executing a massive sale takes operational know-how.

The magic discount: 13% off, said Mr. Robertson, an independent contractor for DWS Retail Sales, which helps liquidate stores. He can’t explain why, but in the early days of a store’s slow wind down, that relatively low discount is surprisingly effective, he and colleagues have found.

Mr. Robertson usually gets paid a base fee for his work along with a portion of sales, so he has an incentive to sell as much merchandise at the highest price possible. A strong closing can bring him $20,000 after expenses, though he typically makes less.

As a closing date approaches, steeper discounts are called for. At small independent stores, dropping prices can irk managers who may be reluctant to sell an item below cost, Mr. Robertson said. He tries to reason with them, telling them it could fetch $10 now, or nothing in a few weeks and then end up in the trash.

While closing a model-train shop in St. Louis, Mr. Robertson asked to see the owner’s mailing list so he could send postcards to longtime customers, inviting them to the closing sale. A problem soon emerged: Many of the customers were no longer living.

“I go look at it, and he says, ‘Oh he’s dead, he’s dead, he’s dead,’ or ’They’re in bad health,’” Mr. Robertson said of his conversation with the owner.

While Mr. Robertson said closing stores can become emotional, he’s happy to have a job he sees as largely recession proof.

“You know a recession is going to happen sooner or later. That’s more stores,” he said. “Especially now, because Amazon is bigger.”

Tracy Ray, 58, spent decades managing big-box stores, repeatedly changing locations as the stores shut down. In 2013, she decided she had had enough and switched sides. Ms. Ray now works as a store closer for Great American, traveling around the U.S. and Australia.

Based near Louisville, Ky., Ms. Ray often doesn’t know where she is being deployed until a week before an assignment begins. “I’ve been here and there and everywhere,” she said.

She keeps a bag packed in a spare bedroom of her home with a dress shirt and pants for early in a closing, when she introduces herself to workers, and jeans for an inevitable cleanup at the end.

In 2019, she closed about 10 locations. She is currently on assignment in North Carolina, closing an office-supply store. She keeps up with friends she’s met around the world on Instagram and Facebook, and her retired husband sometimes joins her on the road.

Ms. Ray said she empathizes with shellshocked employees because she, too, has worked for a retailer going under.

“I think I’m fortunate and unfortunate that I went through it so many times myself that I know what the feeling is,” she said. “That takes away a lot of fear from employees.”

Updated: 1-8-2020

Macy’s To Close 29 Locations

Department store giant says comparable sales fell 0.6% in November and December, less than feared.

Macy’s Inc. said sales fell in the critical holiday quarter and it would close about 29 stores, but the sales decline wasn’t as sharp as investors had feared amid mounting competition and a shift to online shopping.

The department store giant said comparable-store sales for November and December fell 0.6% from a year ago for its owned plus licensed merchandise. On that basis, sales fell 3.5% in the fall quarter. Comparable sales include stores open at least a year.

Analysts are predicting that Macy’s same-store sales will fall 2.5% for the fourth quarter, according to FactSet. The quarter also includes January.

The retailer said its performance during the holiday season “reflected a strong trend improvement from the third quarter.” Macy’s said its digital business and core stores performed well and customers responded to its marketing, particularly in the 10 days before Christmas.

Macy’s shares were up 3.6% to $18.31 in early trading. The stock was one of the worst performing in the S&P 500 last year, losing more than 30% of its value.

The company is also closing 28 Macy’s stores and one Bloomingdale’s store, according to a company spokeswoman. She said the closures were part of the normal annual review of the company’s store portfolio. The company operates about 680 department stores and 190 specialty stores.

Macy’s has been struggling to turn itself around under Chief Executive Officer Jeff Gennette. He has upgraded the chain’s most promising stores and is shrinking the rest. He has also rolled out new concepts, including Backstage, which sells items at deep discounts, and Story, a boutique that changes its themed merchandise every few months.

While sales initially rebounded under Mr. Gennette, a longtime Macy’s executive, who took the helm in 2017, recent results have disappointed. After a weak fall quarter, the company lowered its guidance for the year.

In December, Macy’s President Hal Lawton left the company to become the CEO of Tractor Supply Co. Mr. Lawton, a former eBay Inc. executive, had spearheaded many of the changes at Macy’s and was highly regarded by industry executives.

Overall, the strong economy and consumer spending boosted retail sales last year, with forecasts calling for year-over-year growth both in stores and online. Department stores from J.C. Penney Co. to Kohl’s Corp. have had difficulty holding on to shoppers, who are buying more from online competitors, fast fashion chains and discounters such as T.J. Maxx.

Updated: 3-30-2020

Macy’s to Furlough Most Workers as Stores Stay Shut During Pandemic

Retailer to keep some of its 130,000 employees on the job and continue paying health benefits.

Macy’s Inc. will furlough the majority of its employees beginning this week as sales have evaporated while its stores remain closed due to the coronavirus.

The department store operator, which employs roughly 130,000 people, told staff on Monday that it would continue to pay health benefits and cover 100% of premiums at least through May. It will keep on some staffers to support its e-commerce operations, distribution and call centers.

The company, which operates the Macy’s, Bloomingdale’s and Bluemercury chains, closed its stores effective March 18; and although it has continued to sell online, the retailer said it has lost most of its sales.

Macy’s first tried other measures to conserve cash, including suspending its dividend, drawing down its credit line, delaying the time it takes to pay suppliers and canceling some orders. The company told employees that those measures weren’t enough.

Macy’s, like other department store chains, was struggling with sluggish sales before the health pandemic hit. Before Monday’s announcement, analysts at Cowan & Co. estimated that retailer had enough cash to last five months, assuming stores remain closed for that entire time, which is unlikely.

Macy’s on Monday said it plans to bring employees back on a staggered basis once business resumes.

Other chains, including the parent of Men’s Warehouse, the Cheesecake Factory Inc. and SeaWorld Entertainment Inc., have furloughed employees, as they scramble to conserve cash during the pandemic.

Six Flags Entertainment Corp. on Monday said it is cutting full-time employee pay by 25% and reducing hourly workers’ scheduled time by 25% as its parks remain closed until at least mid-May. Executives will also have their base pay reduced by 25%.

The moves will swell the ranks of the U.S. unemployed, which included a record 3.28 million people who filed for unemployment benefits in the week ended March 21.

The furloughs also show the limits of the $2 trillion rescue package passed by Congress last week, as many consumer-oriented businesses have been cut off from their customers.

Tailored Brands Inc., which owns the Men’s Wearhouse and Jos. A Bank chains, said last week that it would furlough all U.S. store employees as well as a significant portion of employees in its distribution network and offices. SeaWorld said more than 90% of its employees would be idled effective April 1, and Cheesecake Factory closed 27 of its locations, affecting 41,000 hourly workers.

L Brands Inc., which owns Victoria’s Secret and Bath & Body works, furloughed most store associates, as well as anyone not involved in e-commerce or who can’t work from home, as of April 5.

Several hotel chains including Marriott International Inc., Hilton Worldwide Holdings Inc. and Hyatt Hotels Corp. have furloughed tens of thousands of workers, as most travel plans world-wide grind to a halt.

Updated: 1-9-2020

J.C. Penney, Kohl’s Post Lower Holiday Sales

Woes continue for department stores and mall chains that struggled heading into holidays.

A strong U.S. economy and robust consumer spending weren’t enough to boost holiday sales at many department stores and mall-based chains, as Americans continue to shift their purchases online and to other retailers.

J.C. Penney Co., Kohl’s Corp. and Victoria’s Secret parent L Brands Inc. all reported lower sales in the critical months of November and December. All three companies entered the holiday season on weak footing, with falling sales as they lost orders to Amazon.com Inc. as well as traditional rivals such as T.J. Maxx and Target Corp.

“Our customer data shows that a chunk of clothing spend from Kohl’s customers has migrated to other retailers, most notably to Target and various off-price players,” said Neil Saunders, managing director of research firm GlobalData Retail. “This is reflective of the weaker proposition at Kohl’s but also underlines the success Target has had in improving its own offer.”

The sales updates came a day after Macy’s Inc. reported its comparable sales fell 0.6% in the holiday period and said it would close 29 stores. Bed Bath & Beyond Inc. also reported a drop in comparable sales for the third quarter. Comparable sales generally include online sales and reflect stores open at least a year.

Not all traditional retailers are struggling. Walmart Inc. and Target have reported rising sales and store traffic for much of the past year, as they ramp up online ordering and in-store pickup services. Off-price chains such as TJX Cos. have also logged healthy sales.

Warehouse club operator Costco Wholesale Corp. reported comparable sales jumped 9% in the five weeks ended Jan. 5. The results include e-commerce sales and international stores. Costco shares rose 2% Thursday morning and, like shares of Walmart and Target, are trading near all-time highs.

J.C. Penney’s comparable-store sales fell 7.5% during the nine-week stretch that ended Jan. 4. Excluding appliances and furniture, categories it exited last year, comparable sales fell 5.3% in the period. The retailer maintained its financial targets for the fiscal year, which includes January.

Penney’s shares, which have hovered around $1 apiece, slipped 4% in premarket trading.

Chuck Grom, an analyst with Gordon Haskett Research Advisors, said the continued decline in Penney’s sales gives him little hope the company will be able to turn things around this year.

Kohl’s said its comparable sales for November and December slipped 0.2%, citing weakness in its women’s apparel business. It also warned that profits would be at the low end of its prior target range. Shares were down 8% to $45.45 premarket.

“We are managing the business with discipline and we expect to deliver on our earnings guidance for the full year,” Chief Executive Michelle Gass said.

L Brands said comparable sales, which include sales from company-owned stores in North America open at least a year and digital sales, fell 3% for the nine weeks ended Jan. 4.

The company, which also owns Pink and Bath & Body Works, said it now expects fourth-quarter earnings of $1.85 a share. It had previously guided for earnings of $2.00 a share.

Shares fell 2% in premarket trading.

1-15-2020

Target Says Holiday Sales Missed Its Forecasts

Retailer cites weak demand for toys, electronics in crucial shopping season.

Holiday sales were sluggish at Target Corp., raising questions about the strength of the retailer’s turnaround plans and the health of the U.S. consumer.

Target’s sales rose 1.4% between Nov. 1 and Dec. 31 in stores and through digital channels operating for at least 12 months, the company said. It warned that growth for the full quarter, which includes January, would likely come in less than half the 3% to 4% growth it had predicted.

“We faced challenges throughout November and December in key seasonal merchandise categories and our holiday sales did not meet our expectations,” Chief Executive Brian Cornell said.

Fresh government data—the Census Bureau’s report for December retail sales expected Thursday—will provide a better picture of whether the shortfall reflects missteps at Target or evidence of a broader pullback by U.S. consumers. Investors are also waiting to hear from Walmart Inc., the country’s biggest retailer, which is slated to report results next month.

Market researcher NPD Group on Tuesday said holiday results were lackluster, estimating that total sales rose 0.2% compared with the previous year. The National Retail Federation is expected to provide an update Thursday. The group had predicted more than 3% growth in holiday sales, including in stores and online.

Target cited weak sales of toys and electronics, two categories that are big sellers during the gift-giving season. The Minneapolis-based chain also said Wednesday it was appointing a new executive to oversee its fleet of roughly 1,800 stores.

Shares of Target fell 6.7% in Wednesday morning trading. The shares nearly doubled last year and closed Tuesday at $125.26, near all-time highs. While other traditional retailers reported lackluster holiday results, Target had been held up as one of the chains that adapted to shifting consumer habits by ramping up its e-commerce operations and remodeling its stores.

Digital sales rose 19% in November and December compared with a year ago, down from 31% growth in the third quarter. The company has tried to drive such growth by offering free shipping on all orders placed on its website during the holidays and rolling out a variety of home-delivery and store-pickup services.

Some analysts said the results didn’t necessarily signal weakness in the company’s strategy. They pointed to a holiday season that had six fewer days between Thanksgiving and Christmas versus last year, which pressured e-commerce delivery efforts and perhaps impulse buying, and the lack of new electronics devices that might have enticed gift buyers.

“Some of the shortfall can be explained away,” Chuck Grom, of Gordon Haskett, wrote in a note.

Sales at Target have been robust in recent quarters, aided by a turnaround plan that included adding more in-house brands, remodeling stores and cutting prices while spending more to grow online and offer fast home delivery. Mr. Cornell announced the turnaround plan in 2017 after reporting weak holiday sales that season.

The company had boasted a streak of eight consecutive quarters of at least 3% sales growth, including a 4.5% jump in the quarter ended Nov. 3. In November, Mr. Cornell said the company was gaining market share in the apparel, home and beauty categories. “We are starting to see the bifurcation of winners and losers” in retail, he told analysts a week before Black Friday.

Target said Wednesday it continued to post strong sales growth in most of those categories, but they weren’t enough to offset flat toys sales and a 6% drop in electronics sales as well as weak sales in some home categories.

The company is maintaining its profit targets, in part because the categories with stronger sales earn high margins. For the fourth quarter, Target expects adjusted earnings per share of $1.54 to $1.74 and full-year adjusted earnings per share of $6.25 to $6.45.

Some analysts say they had been expecting sluggish toy sales given the big sales lift many retailers reported last year after Toys ‘R’ Us closed all stores, sending toy shoppers elsewhere.

Target’s “holiday sales were not terrible,” in light of expected flat toy sales and slowing holiday sales overall, said Simeon Gutman, retail analyst at Morgan Stanley. “Target’s ability to manage the business well through weaker sales is the silver lining.”

Several other retailers have reported sluggish holiday sales recently, but those have mostly included department stores and specialty chains that entered the holiday season on weak footing. Macy’s Inc., J.C. Penney Co., Kohl’s Corp. and Victoria’s Secret parent L Brands Inc. all reported lower sales in the critical months of November and December.

Thus far Costco Wholesale Corp. is a lone bright spot, reporting comparable sales up 9% in the five weeks ended Jan. 5, including e-commerce and international sales.

Two big U.S. retailers, Walmart and Amazon.com Inc., haven’t detailed their holiday results. Amazon said the day after Christmas that it set a record for orders in the season and noted strong demand for toys, fashion and electronics but didn’t provide sales data.

Overall, the strong U.S. economy, low unemployment and rising wages boosted retail sales last year, government data show. But much of the growth is coming from e-commerce, not store visits. Online sales rose 18.8% from Nov. 1 through Christmas Eve, compared with growth of 1.2% for in-store sales, according to Mastercard SpendingPulse.

The string of weak holiday-sales reports so far leaves a muddled picture of the health of the economy, but there aren’t specific signs of consumer spending weakness, said Rod Sides, vice chairman of retail at Deloitte LLP. “Once we get the other data points in a week or so, we will know,” he said.

Target also said its chief stores officer, Janna Potts, 52 years old, will retire and be succeeded immediately by another company veteran, Mark Schindele, 50.

Ms. Potts, a 30-year Target employee, took over as stores chief in January 2016. She will stay in an advisory role until May 1.

Mr. Schindele, who has worked at the company for nearly 20 years, was most recently responsible for remodeling stores and rolling out smaller-format stores in urban areas.

The company also promoted two executives to permanently fill the role vacated in early November when Mark Tritton resigned as chief merchant to take over as CEO of Bed Bath & Beyond Inc. Christina Hennington and Jill Sando will serve as chief merchandising officers.

Updated: 1-23-2020

After Bankruptcy, Nearly Half of Retailers Close All Stores

Liquidations are more prevalent in retail bankruptcies while top lenders recover on average 91 cents on the dollar, according to research by Fitch Ratings.

Secured creditors are recovering all or most of their investments when retailers file for bankruptcy protection, even as nearly half these companies don’t survive with a physical presence, according to Fitch Ratings research.

Among large retail and supermarket chains that filed for bankruptcy protection over the past 15 years, 45% closed all of their stores, the ratings firm said in a new report. Fitch found that the bankruptcies of 25 out of 55 retail and supermarket companies ended in liquidations.

Retailers tend to go out of business for good “if they’ve lost their place in the marketplace,” said Sharon Bonelli, a Fitch senior director and head of the bankruptcy group. Bankruptcies spanning all U.S. corporate sectors ended in liquidation an average of 13% of the time.

“Retail liquidation has been a common theme throughout retail history,” Ms. Bonelli said. “Nobody wants to reinvest in the business and they tend to end up in liquidation when that happens.”

High debt balances and lease and interest payments are some of the headwinds driving retailers into bankruptcy, Fitch said. They can also suffer from insufficient investments in operations and problems with cash flows and liquidity.

At the same time, some troubled big retailers had a hard time accessing trade credit, such as Sears Holdings Corp., Toys “R” Us Inc. and Gordmans Stores Inc. Inventory suppliers demanded cash on delivery, cash in advance or a letter of credit to guarantee payment for goods.

As a result, “inventory starts to shrink because the suppliers have stopped shipping as much product, then that causes the borrowing base to also shrink,” Ms. Bonelli said. “It creates a downward spiral.”

Suppliers that stocked the old Sears’s shelves during the retailer’s bankruptcy had to swallow losses, The Wall Street Journal reported, even as law firms are guaranteed full payment under the law on more than $200 million for their work on the chapter 11 case.

On top of those challenges, retailers faced loss of market share to competitors, such as discounters and online-only companies, as well as declining store traffic, changing consumer tastes that put pressure on sales and pricing power at bricks-and-mortar retailers.

For example, Sears, Shopko and Fred’s Inc. couldn’t compete against discount peers such as Walmart Inc. and Kohl’s Corp.

“A retailer goes into distress because it has lost its competitive edge, either due to price or real estate location, or missed execution of its operations,” said David Silverman, a Fitch senior director and retail analyst. “There’s very little unique or proprietary about a given retailer that sells products that a number of other retailers sell.”

Currently, nine retailers are on Fitch’s watch list for being at risk of default, including bankruptcy, based on concerns over their loans and bonds. The ratings agency included J.C. Penney Co., Fresh Market Inc., J.Crew Group Inc., Fairway Market, Serta Simmons Bedding LLC, as well as Ascena Retail Group Inc., which owns Ann Taylor, Lane Bryant, and Catherines.

New York supermarket chain Fairway Market filed for bankruptcy protection Thursday with a proposal to sell its Manhattan stores to the Village Super Market Inc., a member of the Wakefern Food Corp. cooperative, for $70 million.

Fairway previously filed for chapter 11 protection in 2016, emerging soon after with a restructuring plan to cut its debt by more than half.

Lenders with collateral rights over retailer assets generally recovered in full on at least one first-lien bank loan or secured bond issue claim in the capital structures with more than one first-lien claim, Fitch said. First-lien lenders’ average recovery rate was 91%, including for asset-backed loans, cash-flow revolvers, term loans and secured bonds, the ratings firm found.

Asset-backed loans were often repaid shortly after the bankruptcy filings through a roll up into debtor-in-possession financing, a special loan provided for companies under bankruptcy protection, or with inventory sales proceeds.

Second-lien creditors had a median recovery of 41%, while those with unsecured note claims realized mostly poor recoveries of less than 10% of par value.

Updated: 1-23-2020

Greeting Cards Retailer Papyrus Files for Bankruptcy, Plans to Close Stores

Company behind Papyrus and sister retail chains said it filed for bankruptcy after running out of time to find a buyer for the business.

Greeting cards and stationery retailer Papyrus filed for bankruptcy Thursday with a plan to close all its stores in the U.S. and Canada after it was unable to find a buyer to keep its stores and sister outlets, American Greetings, Carlton Cards and Paper Destiny, in business.

Schurman Fine Papers, which runs the greetings cards business, operates 254 retail stores and employs about 1,100 salaried and hourly workers in the U.S. The Tennessee-based business expects to finish store-closing sales by the end of February, according to papers filed in the U.S. Bankruptcy Court in Wilmington, Del.

The parent company was attempting to sell or recapitalize the business, but in December its supplier terminated its agreements with Papyrus claiming it was in default under the deal. At that point, Schurman Fine Paper pivoted to preparing a bankruptcy filing, court papers said.

Papyrus’s operator blamed its bankruptcy on the industry downturn that for years has roiled bricks-and-mortar retailers as well as what it described as unique operational and performance problems which eroded its profits.

Schurman Fine Papers said it has assets of about $39.4 million compared with outstanding liabilities of about $54.9 million. The company’s Chief Executive Dominique Schurman owns the business, according to its chapter 11 petition.

The retailer said it faced higher product costs, which have eaten into its revenue and incurred additional capital costs refurbishing and closing “a large number of old and underperforming stores” it acquired in 2009.

Craig Boucher, Schurman Fine Papers’ co-restructuring chief, said in a declaration filed in the bankruptcy court that the store closings and proposed liquidation “will provide the best process under the circumstances to maximize value for all of their stakeholders.”

The company has an agreement with liquidators Gordon Brothers Retail Partners LLC and Hilco Merchant Resources LLC to conduct the store closing sales at Papyrus, American Greetings, Carlton Cards and Paper Destiny.

The business traces its roots back 80-years to Schurman Retail Group, which imported greeting cards and stationery, later evolving into a retailer. The first Papyrus store opened in 1973 in Berkeley, Calif., court papers said. At its height, the company ran more than 500 stores in the U.S. and Canada following a 2009 transaction with American Greetings Corp.

Schurman Fine Papers is scheduled to debut in bankruptcy court on Friday.

U.S. Bankruptcy Judge John T. Dorsey has been assigned to the case, number 20-10134.

Schurman Fine Papers is being represented in bankruptcy by the law firm Landis Rath & Cobb LLP.

Updated: 1-27-2020

Village Inn, Bakers Square Restaurant Chains File For Bankruptcy

Family-friendly restaurant chains blamed chapter 11 filing on competition from newer and larger dining operators.

The operator of the Village Inn and Bakers Square restaurant chains has filed for bankruptcy after years of losses as it faces ongoing pressure from new casual dining brands and larger competitors.

Restaurant operator American Blue Ribbon Holdings LLC filed for chapter 11 protection on Monday in the U.S. Bankruptcy Court in Wilmington, Del. The bankruptcy filing comes after Blue Ribbon said it closed 33 underperforming restaurant locations and laid off about 1,100 employees.

The Nashville, Tenn.-based company’s chapter 11 filing follows the bankruptcies of several family-friendly and casual-dining chains over the last several months including Marie Callender’s and Houlihan’s Restaurant + Bar.

Blue Ribbon said it would seek to reorganize in chapter 11 and “will explore a variety of strategic and structural initiatives to best position the Company for success in the future.”

The company said it still runs 97 restaurants in 13 states and franchises another 84 Village Inn outlets. At the time of the chapter 11 filing, Blue Ribbon said it employed about 1,500 full-time workers and more than 3,000 part-time workers.

In addition to pressure from newer restaurant competitors, Blue Ribbon says it has struggled with increased labor costs in a number of states where it operates and a number of unprofitable locations with high occupancy costs.

Blue Ribbon said it sustained operating losses of $11 million in fiscal year 2018 and $7 million last year. The company said it has been funded by a corporate parent and other affiliates that aren’t part of the bankruptcy. However, the restaurant operator said its other affiliates were no longer willing to fund the business based on financial projections for the 2020 fiscal year indicating further losses.

Blue Ribbon has lined up a $20 million bankruptcy loan from public investment holding company Cannae Holdings Inc., the majority owner of the restaurant business, according to court papers. Affiliates of Blue Ribbon also run the dining brands O’Charley’s Restaurant and Bar and Ninety Nine Restaurant and Pub, both of which aren’t part of the bankruptcy.

Kurt Schnaubelt, Blue Ribbon’s chief financial officer, said in a declaration filed in court that the company solicited chapter 11 loans from other lenders but said no other parties they discussed financing with were interested in funding the bankruptcy even though the company had no secured debt encumbering its assets. Blue Ribbon has about $14 million in unsecured debt, court papers say.

Instead, Mr. Schnaubelt said potential lenders cited Blue Ribbons’ losses and the relatively small size of the so-called debtor-in-possession financing the company was seeking as reasons why they weren’t interested in funding the chapter 11 case.

The proposed funding from Cannae, which must be approved by a judge, is necessary to keep Blue Ribbon afloat as it explores its options for restructuring in chapter 11 “and will send a strong positive signal to vendors, employees, customers and other parties critical to maintaining the debtors’ viability as a going concern,” Mr. Schnaubelt said.

Village Red was founded in 1958 and Bakers Square was founded in 1969 as family-friendly and affordable full-service restaurants. The average check per guest is between $10 and $11, the company said. Aside from the restaurant chains, Blue Ribbon also owns a pie-making business that provides the desserts to Village Inn and Bakers Square locations and sells them to other restaurant brands, court papers say.

Blue Ribbon has filed a number of customary motions in bankruptcy court to pay taxes, wages and other ordinary business expenses to keep the lights on as the company transitions to operating in chapter 11.

Cannae didn’t immediately return a message seeking comment.

Blue Ribbon has hired the law firms Young Conaway Stargatt & Taylor LLP and KTBS Law LLP to handle the chapter 11 case

Judge Laurie Selber Silverstein has been assigned to the bankruptcy case, number 20-10161.

Updated: 2-9-2020

Mattel Closes Factories, as Toy Slump Weighs on Supply Chain

Toy maker to close Mega Bloks factory in Montreal, affecting 580 jobs, following the industry’s gloomy holiday season.

Mattel Inc. said it has closed two factories in Asia and plans to close one in Canada, as it reduces its sprawling manufacturing footprint to cut costs.

The maker of Barbie dolls and Hot Wheels cars shut manufacturing sites in China and Indonesia last year, and it said it would close a facility in Montreal sometime this year. Mattel had previously announced plans to close and sell a factory in Mexico.

Unlike Hasbro Inc., a rival that has outsourced most of its production, Mattel until recently still owned 13 factories and employed thousands of production staff across the globe.

Closing the Montreal plant, which makes Mega Bloks, will affect about 580 workers, a spokeswoman said. She declined to say how many jobs were affected by the Asia closures. Mattel employs about 35,000 workers during peak manufacturing periods.

The manufacturing overhaul is part of Chief Executive Ynon Kreiz’s plan to turn around and stabilize Mattel, one of the world’s largest toy companies, which has struggled in recent years, from both weak sales in large divisions like Fisher-Price preschool toys and American Girl dolls and the industry upheaval caused by the liquidation of Toys “R” Us.

Weak sales have exposed inefficiencies in Mattel’s manufacturing network and led to some factories being underutilized. Mattel has sought to tackle various problems in the supply chain, from drastically reducing the number of products it makes to culling the number of colors available to designers.

Roberto Isais, Mattel’s chief supply chain officer, said the changes have turned its supply chain into a competitive advantage.

“We are continuing to optimize our manufacturing footprint, increase the productivity of our manufacturing infrastructure and achieve efficiencies across our global supply chain,” he said.

Mattel plans to retain some factories, like those that make Hot Wheels and Barbie, where the company would have an advantage over outsourcing to a third party. Executives say such a structure would allow Mattel to move more quickly to capitalize faster on trends.

The China factory made finished goods, while the Indonesia plant made tooling equipment used in other factories. The manufacturing will be moved to other Mattel facilities.

Mattel and Hasbro are scheduled this week to report earnings for the key holiday shopping period.

Already, there have been signs of caution. Research firm NPD Group Inc. said U.S. toy sales fell in the fourth quarter, which had six fewer shopping days between Thanksgiving and Christmas, leading to a 4% decline for the industry for 2019.

Target Corp. blamed soft toy sales for its weaker-than-expected holiday season. Other toy companies, like Spin Master Corp. and Funko Inc., have warned of a weak holiday period.

Some toy companies have expressed concerns that the coronavirus outbreak in China could disrupt the toy supply chain. Isaac Larian, CEO of MGA Entertainment Inc., a Mattel competitor and maker of L.O.L. Dolls and other toys, said a large Chinese toy factory is remaining closed for another week.

“The coronavirus is not solely China’s problem,” Mr. Larian said. “It will impact the global economy.”

Updated: 2-13-2020

Newspaper Publisher McClatchy Files For Chapter 11 Bankruptcy

McClatchy obtained $50 million in debtor-in-possession financing from Encina Business Credit.

McClatchy Co., MNI 9.43% the second-largest U.S. newspaper group by circulation, filed for bankruptcy protection, a move that comes as the nation’s newspaper industry is struggling to cope with a sharp decline in print advertising and the challenges of building a robust digital business.

The move is expected to put an end to the McClatchy family’s 163-yearlong control over the publisher, and turn the hedge fund behind the current owner of the National Enquirer into its top shareholder.

McClatchy, the publisher of the Miami Herald, Sacramento Bee, Kansas City Star and other well-known newspapers, has struggled under a heavy debt load since its ill-timed $4.5 billion acquisition of Knight Ridder in 2006—a stretch during which its stock price plunged from $496 to 75 cents.

McClatchy on Thursday said it initiated a chapter 11 restructuring in the U.S. Bankruptcy Court in New York. If a tentative agreement with creditors is approved by the court, the McClatchy family would lose control of the business it founded in 1857, while its main debtholder, Chatham Asset Management LLC, would become its primary shareholder.

A Chatham representative said the hedge fund “is committed to preserving independent journalism and newsroom jobs.”

McClatchy said its 30 newsrooms would continue to operate as usual as the bankruptcy proceeds. The company has obtained $50 million in financing from bankruptcy lender Encina Business Credit to maintain operations during the bankruptcy, and said it aims to emerge from the bankruptcy process in the next few months.

Chatham, a New Jersey-based hedge fund, is also the primary stakeholder in tabloid publisher American Media LLC, which is in the process of selling the scandal-scarred National Enquirer. The fund also holds a large piece of Postmedia Network Canada Corp., a publisher of dozens of newspapers in Canada, and several big newspaper and magazine distribution companies.

McClatchy’s existing share structure will be canceled and it will likely emerge from bankruptcy as a closely held concern, the company said.

The News Guild, which represents 150 McClatchy employees at six of its publications, warned that the growth of hedge-fund and private-equity control of American newspapers would do little to save them.

“Continued financialization of local news will destroy our democracy,” said guild president Jon Schleuss. “It’s time for communities across America to stand up and fight to save local news.”

The U.S. newspaper industry is struggling to cope with the collapse of print advertising. McClatchy Chief Executive Craig Forman has said the collapse of print advertising has drained some $35 billion in revenue from the industry as a whole.

That has led to increasing consolidation as some companies turn to greater scale as a possible solution. Last year, the two largest companies by circulation, USA Today-owner Gannett Co. and GateHouse Media, merged to create a giant publishing 261 dailies, amounting to about 30% of the newspapers sold every day in the U.S.

MNG Enterprises Inc., which publishes more than 60 daily papers and is majority-owned by New York hedge fund Alden Global Capital LLC, failed in an earlier attempt to merge with Gannett. It has since taken a big stake in Tribune Publishing Co., owner of the Chicago Tribune and the New York Daily News, and is now its largest shareholder.

A person familiar with the matter said Mr. Forman was unlikely to remain with the company following the bankruptcy, but that Kevin McClatchy, the great-great grandson of the company’s founder, would likely stay on the board.

“McClatchy remains a strong operating company with an enduring commitment to independent journalism that spans five generations of my family,’’ Mr. McClatchy, who is currently the company’s chairman, said. “We are privileged to serve the 30 communities across the country that together make McClatchy and are ever grateful to all of our stakeholders—subscribers, readers, advertisers, vendors, investors and employees—who have enabled our legacy to date.”

Mr. Forman said it was too soon to comment on his future role but noted that he serves “at the pleasure of the board.”

While many publishers—including Tribune and GateHouse—filed for bankruptcy protection in the wake of the 2008 economic crisis, McClatchy had avoided that fate until now, but sees it as the only way to get through its severe liquidity crunch.

Despite its financial struggles, McClatchy has won accolades for its papers’ coverage, including numerous Pulitzer Prizes in recent years. The Miami Herald published a series of stories in 2018 and 2019 on how the late financier Jeffrey Epstein avoided serious charges on allegations of running an underage sex ring.

If approved by the bankruptcy court, McClatchy’s restructuring proposal would cut the company’s $703 million in funded debt by 55%.

The company has pointed to its unfunded pension obligations as a significant challenge and reported its largest unsecured creditor in bankruptcy papers as the federal Pension Benefit Guaranty Corp. with a $530 million claim.

On Thursday, McClatchy said the plan held assets of about $1.39 billion. The company said it would ask the bankruptcy court to terminate its pension plan and appoint the PBGC as trustee.

McClatchy said it has offered a settlement to the PBGC of $3.3 million in annual payments for 10 years and 3% ownership in the restructured company. The PBGC hasn’t agreed and wants “a materially larger stream of cash payments over ten years” and a larger equity stake, McClatchy said.

“PBGC and McClatchy continue to engage in discussions to find the best path forward for the people covered under the company’s pension plan, as well as the millions of people in the other plans PBGC insures,” a PBGC spokesman said. “As always, our goal is to protect the retirement security of workers and retirees.”

Creditors including Chatham would receive a controlling 97% stake in McClatchy in exchange for the forgiveness of debt. Chatham, the company’s largest debtholder, has agreed to provide $30 million in exit financing to ease McClatchy’s path out of bankruptcy, subject to court approval.

Some 1,800 U.S. newspapers were closed between 2004 and 2018, leaving roughly half the counties in the country with only one newspaper, and 200 with none, a University of North Carolina study found.

McClatchy has been trying to gain traction with digital initiatives. The Sacramento-based company has been cutting costs and working to build up digital subscribers. It said it reduced operating expenses by $187 million between 2017 and last year, and built up its digital-only subscriber base to more than 200,000.

McClatchy said revenue in the fourth quarter declined 14% from a year earlier and that full-year revenue in 2019 had dropped 12% to $709.5 million. The company reported a net loss in nine of its previous 12 quarters.

Updated: 2-17-2020

Pier 1 Imports Files For Chapter 11 Bankruptcy

Home furnishings chain in discussions with several potential buyers.