Trump Tower Is Now One of NYC’s Least-Desirable Luxury Buildings

Trump Tower, once the crown jewel in Donald Trump’s property empire, now ranks as one of the least desirable luxury properties in Manhattan. Trump Tower Is Now One of NYC’s Least-Desirable Luxury Buildings

The 36-year-old building has been turned into a fortress since Trump won the presidency, ringed with concrete barriers and the two main entrances partially blocked off. It hasn’t been substantially updated in years. And Trump’s name has been a huge turnoff in liberal New York City.

For anyone who owns a unit in the tower, the past two years have been brutal. Most condo sales have led to a loss after adjusting for inflation, property records show. Several sold at more than a 20% loss. By contrast, across Manhattan, just 0.23% of homes over the past two years sold at a loss, according to real-estate data provider PropertyShark, although the firm doesn’t adjust for inflation.

It’s all a far cry from the days when the New York landmark attracted the likes of Michael Jackson, Johnny Carson and Steven Spielberg. These days, it’s better known for a Trump campaign meeting with a Russian lawyer documented in Robert Mueller’s Russia report.

While some corners of Trump’s business empire have thrived, such as his Washington D.C. hotel, others have suffered from his high unpopularity. Rounds of golf are down at his public course in New York, a clutch of once Trump-branded buildings have torn his name off their fronts, and an ambitious plan to launch a new mid-tier hotel chain across the country fizzled.

Read more: Trump’s Company Shelves Hotel Plan, Citing Political Climate

Trump is scheduled to provide an updated snapshot of his net worth this week, with his annual financial disclosures due Wednesday. The documents won’t go into detail about the Trump Organization’s revenues, but it’s clear that Trump Tower is suffering, based on securities filings, property records, real estate listings, and interviews with industry insiders.

The commercial portion of the building has been struggling for months to find tenants for more than 42,000 square feet of vacant office space, despite advertising rents well below the area’s average, listings and data from real estate brokers show.

On any given midweek afternoon, the number of government and Trump Organization security personnel rivaled the number of other people inside the building’s atrium.

Occupancy Rate Plunged

Trump Tower’s occupancy rate has plunged over the last seven years to 83% from 99%, giving it a vacancy rate that’s about twice Manhattan’s average.

“If I were looking for office space, that would be a building I’d want to avoid,” said Edward Son, until recently a market analyst for CoStar Group Inc.

Net income slightly rose last year, boosted by the tenancy of his 2020 campaign committee, which has spent more than $890,000 over the last two years to rent space in Trump Tower, according to Federal Election Commission records.

The building’s net income is still about 26% lower than what bankers expected when they evaluated Trump’s fitness for a $100 million loan in 2012. Even so, Trump Tower regularly produces an annual profit for its namesake. Last year, the building generated $10 million in net cash flow, after taking into account its annual $4.3 million interest payment on the loan, according to Trump Organization disclosures.

The Trump Organization didn’t respond to requests for comment.

Condo owners hoping to run into the president on occasion have been disappointed. While Trump ran his presidential campaign out of the high-rise, he’s only visited 13 times since his inauguration, according to a count from NBC News.

Name ‘Became A Problem’

Michael Sklar sold his parents’ 57th floor unit for $1.83 million in October after they spent $400,000 to remodel the property. His family purchased it for $1.4 million in 2004, which comes out to $1.84 million after adjusting for inflation.

“No one wants in that building,” Sklar said.

After Trump’s election, living in his tower became a hassle, Sklar said. His mother, who was battling cancer, took cabs to the building from the airport, and she used to be dropped off right in front of the entrance. After the election, security would force her cab driver to drop her off a few hundred feet from the front door, requiring a long and painful walk home.

“The name on the building became a problem,” Sklar said.

At least 13 condos in the tower have sold since Trump’s 2016 election, property records show. For the nine transactions where New York City records show what the seller originally paid for the property, eight sold at an inflation-adjusted loss.

By contrast, just 57 homes in Manhattan sold over the past two years at a loss, out of 24,871 third-party sales, according to PropertyShark, although the firm doesn’t adjust for inflation.

“The luxury market is softening,” said Matthew D. Hughes, a Manhattan-based broker at Brown Harris Stevens. “But it’s rare that someone owns an apartment here for 10 years and takes a loss.”

One New York real estate agent, who didn’t want to be identified discussing Trump, said that clients have repeatedly told him not to show them units in Trump buildings.

These days, gawkers sometimes outnumber the customers of the building’s remaining retail stores.

60-Foot Waterfall

“It’s totally a tourist trap,” said Barbara Res, a former Trump Organization executive who oversaw the building’s construction.

Res remembers the building fondly, and said that when it was built Trump recruited celebrities to purchase its condos and prominent brands to fill its retail space. “It’s dated but it’s a building worthy of respect,” Res said.

Located just two blocks from Central Park, Trump built his namesake tower in 1983, complete with a 60-foot waterfall and mounds of pink Italian marble.

Advertised as having 68 stories — it’s actually 58, city records show — the building was ahead of its time, Trump’s lawyer, George Ross, wrote in his 2005 book, Trump Strategies for Real Estate. “He single-handedly created the market for high-end luxury residences in New York City,” Ross wrote.

The Apprentice, Trump’s reality show on NBC, was filmed in Trump Tower. Its launch in 2004 gave the building a new prominence and helped Trump revive his personal and corporate brands. In 2013 Trump pegged the value of his brand at $4 billion, according to unaudited statements of financial condition provided by his former personal lawyer, Michael Cohen.

By most measures, Trump Tower should be doing well these days. It’s in a part of Manhattan known as the Plaza District, named after the Plaza Hotel right off Central Park, that many real estate experts consider to be the nation’s premier office area. Offices with views of Central Park easily fetch more than $100 per square foot, said Craig Leibowitz, New York research director for JLL.

The office portion of Trump Tower is advertising five vacancies spread across five floors. In January, prices for the open space ranged from $72 to $85 per square foot annually. A month earlier, the Trump Organization posted to its YouTube channel a glossy marketing video that referred to the tower as “one of New York’s most iconic trophy buildings.”

Read more: Why the Infamous Trump Tower Meeting Didn’t Take Down Trump

Now the prices are listed as negotiable.

A commercial real estate broker said that his firm’s surveys show that prospective tenants won’t consider a Trump building until he’s out of office.

One of the building’s other problems is that Trump hasn’t spent much money updating the tower in recent years, according to disclosures to investors.

“I don’t think I would want an office in Trump Tower,” Res said. “Why would you go there? It’s a wonder he doesn’t have 50% vacancy.”

President Trump’s Onetime Greenwich Estate Relists For 29% Less

The Connecticut property where Donald Trump and his ex-wife Ivana Trump lived after getting married is asking $38.5 million.

A Greenwich, Conn., estate where President Donald Trump and his ex-wife Ivana Trump lived is returning to market for $38.5 million—almost 29% less than its onetime $54 million asking price.

The Trumps bought the property after they were married in the early 1980s for about $4 million. When they divorced in the early 1990s, Ms. Trump kept the house. She sold it to the current owners, financier Robert Steinberg and his wife Suzanne Steinberg, for $15 million in 1998.

The Steinbergs have been trying to sell the home on and off since 2009, when they listed it for $50 million, according to listings website Zillow. The property returned to market for $54 million in 2014, and was last listed for $45 million in March.

The nearly 6-acre property dates back to the 1930s and has panoramic views of the Long Island Sound, according to the listing agent. The roughly 20,000-square-foot Georgian-style mansion has a triple-height entryway with twin curved staircases, eight bedrooms, a movie theater and a gym. The old-leaf décor favored by the Trumps was removed by the Steinbergs, The Wall Street Journal previously reported. The Steinbergs declined to comment.

The land comprises three almost 2-acre parcels, each of which could be developed separately, according to the listing agent.

Outside, there is also a tennis court, a private dock, a putting green and a guesthouse with an indoor swimming pool.

Listing agent Joseph Barbieri of Sotheby’s International Realty said he believes the property is now priced close to its land value. The softness in the Greenwich market has prompted sellers to reduce prices on some of the area’s most prominent homes, he said. The market has suffered from a decline in banking bonuses and a general shift towards city living.

A Failed Trump Golf Course Turned Into a Dilapidated New York State Park

When Donald Trump bought 436 acres in upstate New York two decades ago, he envisioned adding two new championship golf courses to his collection.

He bought the wet, overgrown, tree-tangled parcels that sit miles off a state parkway beginning in 1998 for less than the current price of a two-bedroom condo in Trump Tower.

But local leaders nixed the golf-course plans and his subsequent efforts to sell it to a homebuilding company faltered. So he gave it away.

“This is my way of trying to give back,” he said at the time.

Like most deals involving Trump, there was more to it than goodwill. He was unloading what experts say was useless land, but not before working local officials to see if they could reappraise it at more than five times the assessed value, according to documents seen by Bloomberg and interviews with people involved — and using a grossly inflated figure on later presidential campaign documents to show, falsely, the depth of his philanthropy.

Despite the purchase price of $2.75 million, and a county assessment of $5.5 million at the time of the donation, Trump’s 2016 campaign said in a list of charitable donations published by The Washington Post that the land was worth $26.1 million.

IRS Audits

It’s impossible to tell if Trump did anything improper, since he has never released his tax returns. And there’s no law against inflating the value of property on campaign press releases. But the law does require taxpayers to accurately report the value of all charitable donations for deduction purposes and Trump could face a penalty or fine from the IRS if he exaggerated the value of the land on his tax returns. The IRS routinely audits all modern U.S presidents and vice presidents annually, including Trump.

The donation took shape around the same time that Trump was struggling, ultimately in vain, to turn around his three struggling casinos in Atlantic City, New Jersey. In March 2006, one month before his gift was announced, his casino empire — Trump Entertainment Resorts — lost $22.1 million in its fourth quarter.

An hour’s drive north of Manhattan, Donald J. Trump State Park is what New York euphemistically calls a “passive park,” meaning it has no trails, picnic tables or other amenities. The state stopped maintaining it in 2010, and the land lies covered in brambles, mud and rocks. A bill pending before the state legislature would change the name of the park to honor the folk singer Pete Seeger instead of the current president.

County Rejects Golf Courses

Trump bought the first parcel, 282 acres known as Indian Hill that straddle Westchester and Putnam counties, from an estate sale for $1.75 million in 1998. He also bought 154 acres in Westchester County known as French Hill, also part of an estate sale, for $750,000. In 2000, he bought 58 acres of a nearby “surplus” stretch of the Taconic State Parkway from the New York State Department of Transportation for $250,000.

Trump Donation To New York Followed Series of Failures

Donald J. Trump State Park comprises 436 acres of unmaintained land that the state calls a “passive park.” Trump donated the land after development plans failed.

But by 2002, local authorities had rejected his plans for two 18-hole championship golf courses on Indian Hill and French Hill on the grounds that the courses would drain the area’s water supply as well as affect the water supply of New York City downstream.

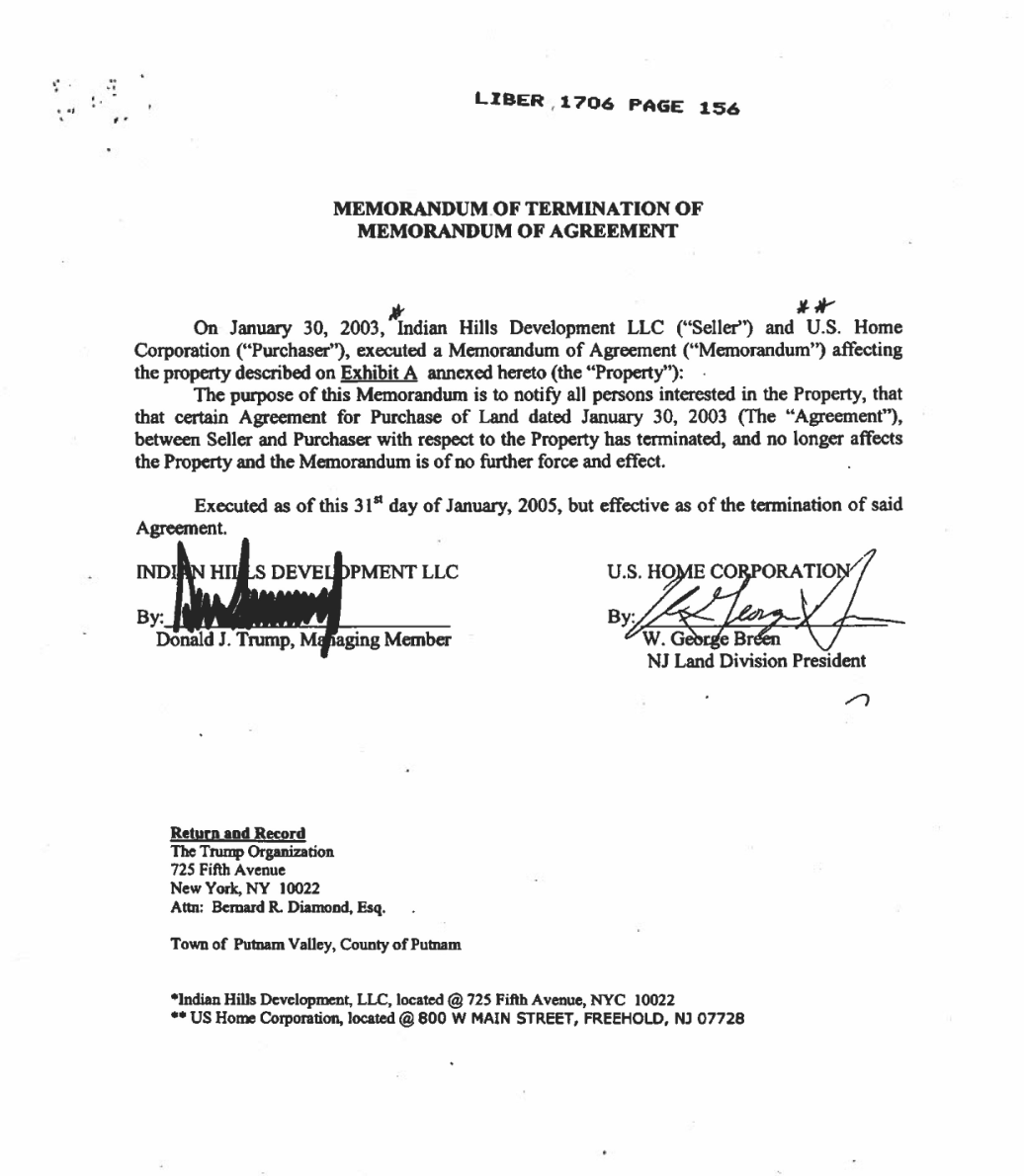

So in 2003, Trump tried to sell U.S. Home Corp. an option to build houses on the tracts. But the giant home-builder got cold feet about the costs of environmental and engineering challenges, according to a person familiar with the deal. The option agreement was terminated in April 2005, according to a memorandum filed in Putnam County.

Aaron Curtiss, a spokesman for Lennar Corp., which bought U.S. Home Corp. in 2000, declined to comment on the company’s dealing with Trump.

Tim Miller, an environmental consultant who worked on the plans, said Trump made no improvements to the land, so the value likely stayed the same. “What he paid was its value, that’s what I would expect,” he said.

Miller added that he billed the Trump Organization a seven-figure sum for his work on the land as well as his work on Trump National Golf Club Westchester in Briarcliff Manor, New York. Trump’s company paid him all but $140,000, and after fighting for several months to get the balance, Miller said he finally accepted Trump’s personal offer of a discounted membership at the Briarcliff Manor club in lieu of payment.

“It was either accept it or go to court,” Miller said.

The Trump Organization didn’t respond to emails and phone calls seeking comments about any aspect of the park deal.

Maximizing Value

Once Trump decided to donate the lands, his aides worked hard to maximize their value. Apparently, Trump wanted a bigger write-off than what the county said the land was worth.

Henry DeCotis, then the assistant state attorney general, said Trump fixer Michael Cohen called him in 2005 to inquire about donating lands to the state. DeCotis said the official fair market value of $5.5 million “might be in the ballpark.”

A spokeswoman for Cohen’s lawyer Lanny Davis declined to comment, and declined to arrange an interview with Cohen, who is serving time in Otisville prison in New York for lying to Congress about Trump’s business and campaign dealings.

By early 2006, Hal Goldman, who until 2011 was a Trump Organization vice president for development, said that he was in talks with the New York state Department of Parks, Recreation and Historic Preservation about donating the land — and branding it Trump.

‘Opinion’ Sought

The person familiar with the donation said he received a call from a Trump Organization employee — whose name he couldn’t remember — asking for a “zoning opinion” that would justify a $27.5 million value for the land. The person said he told the Trump Organization that that figure could not be justified.

Trump’s donation nevertheless was finalized and in April 2006, Republican Governor George Pataki held a ceremony at the park to announce the gift and naming, with Trump saying in an official statement issued by the governor’s office that “this is my way of trying to give back” and that he hoped the lands “will turn into one of the most beautiful parks anywhere in the world.”

The Internal Revenue Service requires filers claiming a charitable deduction worth more than $5,000 to attach to their returns a “qualified appraisal” of the contribution.

Goldman said he was “unaware” of Trump having conducted any independent appraisal of the parcels of land.

“Let me put it this way,” Goldman said. “Would you go out and get an appraisal, or would you declare what you wanted it to be worth” and then have someone justify it. “I think that’s your answer,” he said.

Michael Grace, a former town attorney for Yorktown, New York, where some of the land sits, said the tracts might not have been worth even the $2.75 million Trump paid for it.

“There’s a reason they remained undeveloped,” Grace said, noting the land’s hills, mud and rocks.

In 2016, the Trump campaign released to The Associated Press and the Post a 93-page list of his charitable contributions, listing “Land Donated to NY Office of Parks – Yorktown, N.Y. – 436 acres” at “$26,100,000.00.”

Appraisal Process

The only way to know if Trump actually claimed a deduction of $26.1 million would be if congressional committees get his federal tax returns they have subpoenaed from the Treasury Department.

Bernadette Castro, the former state parks commissioner who oversaw the donation and attended the ceremony, said through a spokesman, John Rice, that she “does not recall the exact appraisal process.” At the formal donation ceremony, Castro said Trump’s “incredible gift will have a lasting impact on our parklands, opening up public access to additional outdoor recreation and helping preserve the rich array of natural resources found in the Hudson Valley,” according to a state press release from the time.

Dan Keefe, a spokesman for the state Parks department, said the donation “happened a long time ago” and declined to state whether the agency had done its own appraisal. Former Putnam County clerk Dennis Sant referred Bloomberg to the documents involved in the sale and subsequent donation. White House spokesman Hogan Gidley declined repeated requests for comment.

Fred Koelsch, the director of realty investments at Camarda Realty Investments, said that if Trump took a $26.1 million deduction for the donation, “that’s an awfully large number.” Koelsch, who did some work for the Trump Organization while at his former law firm, Shamberg Marwell Hollis Andreycak & Laidlaw PC, explained that because both Trump and U.S. Home had failed to develop the lands, they had neither increased in value nor held much extra value on top of their purchase price. “This is back-of-the-napkin math, but the deduction should have been low.”

Still, Koelsch said it’s very difficult to put value on undeveloped land. As such, said, “we have the seller tell us what they think it’s worth.”

Related Articles:

Ship Orders Fall To Lowest Level In 15 Years Indicating Trumponomics Is Not Working (#GotBitcoin?)

Black Workers See Record-Low Unemployment In Addition To Smallest Wage Gains (#GotBitcoin?)

Trump Calls On Fed To Cut Interest Rates, Resume Bond-Buying To Stimulate Growth (#GotBitcoin?)

Fake News: A Perfectly Good Retail Sales Report (#GotBitcoin?)

Anticipating A Recession, Trump Points Fingers At Fed Chairman Powell (#GotBitcoin?)

Affordable Housing Crisis Spreads Throughout World (#GotBitcoin?) (#GotBitcoin?)

Los Angeles And Other Cities Stash Money To Prepare For A Recession (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.