Peak Shipping Season Runs Aground As Ocean Lines Pull Capacity

Ultimate Resource For Shipping Industry Impact (or Lack Of Shipping Activity) On Global Economy. Peak Shipping Season Runs Aground As Ocean Lines Pull Capacity

Bloated inventory levels and low import expectations have container lines canceling sailings when carriers and retailers are usually bulking up for the fall.

Related:

Cold War Games: U.S. Is Unprepared To Test The Waters In Icy Arctic

Ocean container lines are bracing for muted demand during the usual peak shipping season heading into the fall, with supply chains still rattled by the coronavirus pandemic and retailers in the U.S. and Europe reining in restocking plans.

Shipping lines that move the vast majority of the world’s manufactured goods have canceled more than a quarter of all sailings on Asia-to-Europe and trans-Pacific lanes, the world’s biggest trade routes, since the beginning of March, according to maritime data providers.

Copenhagen-based research group SeaIntelligence Consulting says the cancellations equate to the withdrawal of more than 4 million containers of capacity and that carriers have continued to drop departures scheduled for the third quarter, signaling expectations of continued weak demand by major Western importers.

“Fears of a virus resurgence means retailers will bring in only what they know they can sell,” said Lars Jensen, ” chief executive of SeaIntelligence. “There is a muted run-up to Black Friday in the U.S. that kicks off the holiday shopping and we expect container volumes to be down 10% overall this year. There is no peak season, just fleet management to cut costs.”

The summer months are typically when shipping activity picks up steam as retailers begin to bulk up inventories for an expected pickup in consumer demand later in the year, starting with back-to-school sales and leading into the year-end holidays.

But widespread store closings under coronavirus lockdowns have battered demand and crashed traditional planning for the fall. The 17.7% month-to-month increase in retail sales in the U.S. in May still left overall sales below pre-pandemic levels, and the retail inventories-to-sales ratio in April soared to 1.68, the highest level since 1996 and an indication that warehouses across the country were bursting with merchandise.

In the European Union, retail trade fell 11.1% in April from March, according to official statistics agency Eurostat.

As well as weak demand, retailers are dealing with supply chains that have been scrambled by the coronavirus. Some deliveries have been delayed by up to two months because factories in China and elsewhere were mostly closed in March and April.

“We’ve just opened after three months and we are getting deliveries of spring apparel,” said Varvara Petridi, who owns two high-end fashion shops in Athens, Greece. “We’ve got lots of unsold light suits and dresses, but no bathing suits, sandals and towels. They’ll come in August, if we are still in business. It’s a disaster.”

Seaborne import figures since the lockdowns began suggest retailers are hunkering down.

Major U.S. ports handled 1.61 million container imports in April, according to the Global Port Tracker report prepared by the National Retail Federation and Hackett Associates, down 7.8% from a year ago. T

he retail group forecasts annual declines for May, June and July of 14.6%, 12.9% and 17.4%, respectively, with volumes remaining well below last year’s levels for the rest of 2020.

The falling demand has pushed ocean shipping lines to sharply retrench their operations, a departure from previous downturns that have seen carriers fight for diminishing container volumes by offering lower prices, sending ships out with freight rates that barely covered operational costs.

Now, carriers are holding back ship orders as well as dropping services as they focus on managing capacity. New liner orders are at multiyear lows, according to London-based Braemar ACM Shipbroking.

“There are about 300 container ships on order, which is the lowest in at least 20 years,” Braemar’s container analyst Jonathan Roach said.

Updated: 6-23-2020

Ocean Carrier MOL To Cut Fleet On Shrinking Trade

Japan’s biggest ship owner expects a ‘significant decline’ in global cargo will persist over the next three years.

Mitsui OSK Lines, Japan’s largest ship owner, is cutting its fleet by 5% over the next three years on expectations of a deep decline in trade volumes as a result of the coronavirus pandemic.

The cuts will involve 40 vessels, including container ships, dry-bulk carriers, tankers and car carriers. MOL, as the carrier is known, currently operates 800 ships and is one of the world’s biggest seaborne operators.

“As a result of our forecasts we concluded that a significant decline in ocean transport volume and a restrained stance on customers’ investments will be unavoidable in the foreseeable future,” MOL said in a statement. “Based on the idea that we need defensive measures, we will immediately reduce our market exposure and review investment plans.”

MOL’s move is the latest in a series of cuts taken by ocean carriers in recent months to deal with a steep decline in shipping demand because of the lockdowns aimed at stemming the spread of the coronavirus.

Container sailings from Asia to Europe and across the Pacific are down at least 25% so far this year, according to Copenhagen-based research group SeaIntelligence Consulting, and several carriers are lined up for government bailouts or preferential loans.

MOL expects “a lower-mobility society” with less movement of people and products and a world-wide review of corporate supply chains that will rein in sprawling global supply chains.

The company is also looking to sell other assets, including real estate, as it goes through what it calls one of the most challenging periods in the company’s 130-year history.

Global trade is expected to plunge around 18.5% in the second quarter from a year ago, according to a new forecast by the World Trade Organization.

MOL expects car-carrier volumes, which have declined significantly since automotive factories largely shut down in March, to return to last year’s levels only in 2023. Many vehicle makers and parts suppliers in North America and Europe have reopened plants in recent weeks but face difficulties in ramping up output.

Shipping executives expect volumes to bottom out in the third quarter this year but to remain below 2019 levels until 2022. Tanker volumes will also take two years to recover, but commodities moved by dry bulkers are faring better as China’s economy expands and factory owners push for more raw materials.

People with knowledge of MOL’s plans said the company will initially return chartered ships back to its owners but it is also looking to offload older ships that it owns.

Updated: 7-24-2020

Shipyards’ Rebound Hopes Are Coming Up Empty

Vessel owners are putting off new orders amid faltering trade demand and uncertainty over future ship-power technology.

Shipbuilding demand is sinking, and there’s no rescue on the horizon.

Orders for new oceangoing ships are at record lows as carriers sit on the sidelines amid clouds of uncertainty. The blow to the global trading economy from the coronavirus pandemic has left cargo carriers’ demand forecasts in tatters. Perhaps more important, there’s no consensus on what kind of fuels a new generation of environmentally friendly ships would use in the coming years.

Operators need to order new ships to comply with an industry target to cut greenhouse-gas emissions by half by 2050, compared with 2008 levels. Ships contribute around 3% of the world’s greenhouse-gas emissions, according to the United Nations Conference on Trade and Development.

Research on whether carbon-free fuels like ammonia, hydrogen, batteries or biofuels can propel giant commercial vessels is still under way, and it may take a decade for the maritime sector to settle on a single fuel type.

“Ships last for 25 years, so we have to start thinking about gradually replacing our fleet, but there is nothing out there,” said a Greek owner of two dozen vessels who asked not to be named.

Making choices now is all but impossible, this owner said. “We can’t even fly to China to check on two retrofits that were to be delivered in February because of the pandemic. You can’t run a business like this,” he said.

Shipyard executives in China, South Korea and Japan are now in high-stakes competition to attract the limited prospects for orders.

Much of that attention is focused on the tanker and bulk-commodities business, while interest in vessel types like big container ships that have long been seen as fundamental to growing global trade is close to zero.

Earlier plans by big operators like Germany’s Hapag-Lloyd AG and Singapore-based Ocean Network Express to invest hundreds of millions of dollars in giant container ships that can move up to 20,000 containers now are shelved.

“For the past five months we had only two inquiries about boxships, but there were no orders. The business is in steep decline,” said an executive at the state-run China State Shipbuilding Corp. who asked not to be named because he isn’t permitted to speak to the press.

Some owners are looking to order large tankers as demand to move crude and petroleum products has shot up since a nosedive in oil prices early this spring. But many remain cautious until the industry narrows its search for the new fuels that could require radically new hull designs.

Hopes for new orders were pinned before the pandemic to demand to move natural gas.

At $175 million each, liquefied natural gas carriers are more expensive than other ship types. But many shipowners believe over the long term the gas market could create the most profitable new trade in shipping since the 1960s, when crude-oil tankers began powering global maritime fortunes.

LNG demand has withered as industrial demand has waned under the pandemic, however. Energy giant Saudi Aramco put on hold an order of a dozen ships worth around $2.5 billion to next year, and a massive, 40-ship order by Qatar, the world’s largest LNG exporter, that was expected to be signed this year, is no longer certain.

The clouds over that market go beyond the impact of the new coronavirus.

Warm winters in recent years in a world coping with climate change raise questions over potentially diminishing demand for the fuel as a heating source. And renewed tensions between the U.S. and China have led to uncertainty about the direction of trade flows.

The order drought is far more serious than what the industry went through in the wake of the 2008-09 financial crisis.

London-based maritime data provider Clarksons said new ship orders were down 53% from a year ago in the first half of the year. In terms of tonnage, orders over the six-month period were down 66% compared with the post-2009 average.

Activity at yards this year is extremely limited, Clarksons said in a report this month. It said the pandemic had seriously hurt sentiment among investors and amplified concerns over new fuels and ship designs and that around 30% of new ship deliveries this year may be pushed into 2021.

Danish Ship Finance said in a May report that more than 200 yards may close down in the coming months and years. It said half of all active yards haven’t seen any new orders since 2018.

Shipbuilding is a major source of industrial manufacturing employment in several countries. But without answers to major questions over ship power and trade demand, the sector will provide a drag rather than a boost for several national economies.

Updated: 8-5-2020

Growth In Container Port Capacity To Contract As Trade Declines

A new report says port operators are reviewing investment plans as shipping volumes wane during the coronavirus pandemic.

Container capacity growth at ports from channel-deepening projects to cargo terminal construction is expected to shrink at least 40% over the next five years as port operators reconsider expansion amid the pandemic-driven slump in global trade.

Drewry Shipping Consultants Ltd. said in a new report issued Tuesday that it expects boxship terminal capacity to grow by an average 25 million containers a year, well below the annual average increase of more than 40 million containers that was added over the past decade.

The forecast could be cut even further if there is a resurgence of coronavirus infections and forces another round of lockdowns around the world, the London-based maritime consultancy said.

“Our five-year forecast for global container port handling has been cut back drastically due to the Covid-19 pandemic, and the risks remain heavily weighted to the downside,“ said Eleanor Hadland, Drewry’s senior analyst for ports and terminals.

She said port operators are actively reviewing scheduled projects as a result of falling global economic growth and uncertainty over the short to medium term.

While big port works commissioned for this and next year may be delayed, Ms. Hadland said “projects which are currently at an earlier stage of planning, particularly where construction contracts and equipment orders have not yet been tendered, suspension or cancellation is more likely if market conditions remain poor.”

The report comes after container operators have cut sailings by around 30% over the past five months as demand for consumer goods like clothing, automobiles, electronic goods and home appliances has fallen back.

London-based maritime data provider Clarksons PLC said new orders for all varieties of ocean-going vessels, including container ships, were down 53% from a year ago in the first half of the year.

Global trade is expected to fall by between 13% and 32% in 2020 as the pandemic continues to disrupt normal economic activity, according to the World Trade Organization, which estimates that global merchandise trade volume declined 18.5% from a year ago in the second quarter.

Updated: 8-10-2020

As Inventories Swell, Companies Turn To Novel Strategies To Get Through Coronavirus Crisis

Logistics specialists that buy and hold goods for clients are increasingly in-demand as companies look to reduce costs.

Companies that have stockpiled more goods during the coronavirus pandemic are turning to creative strategies to put inventory to work and generate cash.

The tactics include tapping firms that specialize in buying and holding inventory for other businesses, as well as more traditional measures such as borrowing against inventory to stay afloat.

Companies “want to get as much liquidity as they can to get through this period and beyond,” said Steve Box, a senior adviser to Channel Capital Advisors LLP.

Inventories for retailers, manufacturers and distributors ballooned as factories and stores shut down and consumers stayed home during the extensive lockdowns in the early weeks of the pandemic.

Adding to inventories, companies stocked up on goods and raw materials to ward against shortages caused by snarled transportation routes and other supply-chain difficulties.

Some stockpiles have thinned out, but many companies say they expect to keep more goods on hand as they navigate an uncertain economic recovery.

A second-quarter survey of supply-chain executives by consulting firm McKinsey & Co. found that nearly half of respondents said they would increase their inventory of critical products owing to weaknesses laid bare by the pandemic.

Mei Yee Pang, who leads the global supply-chain practice at DHL Consulting, said transportation constraints have helped push companies to add more inventory.

Companies are moving more goods by ocean as flight capacity has shrunk, adding to transport costs. Because it takes longer for goods to arrive by sea, companies need to order more per batch and store more products, she said.

The cost concerns have businesses looking at a variety of techniques aimed at turning the carrying cost of goods into cash until demand is more certain, stoking interest in firms that buy and hold inventory on behalf of their clients.

One such outfit, Falcon Group, says it is signing up more clients for that service this year as companies adopt “just-in-case” supply-chain strategies that require more buffer stock and move away from lean, just-in-time principles aimed at paring inventory costs.

Executive Chairman Kamel Alzarka said companies showing interest recently include telecommunications and technology firms that tend to use high-value parts.

Falcon, which has its main office in London, places the inventory on its own balance sheet, taking on the cost—as well as the risk that clients may abandon the goods. In 2013, for example, Falcon was left holding 749 cars that it had to offload to second-tier auto-dealers.

Companies like Falcon typically buy the inventory at one price and then sell it to clients, adding a charge that includes storage and transportation costs, supply-chain experts say, as well as a fee meant to offset the risk they take on with the inventory.

Oliver Chapman, chief executive of OCI Ltd., said the British trading company has seen a 42% increase in inventory requests from six months ago.

In one instance, Mr. Chapman said, a private-health firm approached OCI in April, in the early days of the pandemic, looking to store personal protective equipment without knowing when or where it would need the gear.

OCI bought £100 million ($126 million) worth of PPE, predominantly masks and gloves and mostly from China, and stored the supplies in the U.K.

Some inventory holdings are being turned into investment mechanisms. U.K.-based Supply@ME Capital PLC said it sets up a special-purpose vehicle that buys goods and raw materials from a client, using money from outside investors who receive bondlike securities in return.

The company’s client roster swelled in the second quarter to 100 from 60. Some were doing business in Italy and were seeking new sources of cash, fearing the country’s coronavirus outbreak could trigger a credit crunch in its rickety banking system, said Chief Executive Alessandro Zamboni.

Another method companies are turning to is asset-based lending, in which firms use inventory as collateral to secure loans. It shows up as debt on the balance sheet, but allows access to immediate funding.

Asset-based lending is a longstanding tool, with volumes totaling around $95 billion in the U.S. last year, according to Refinitiv LPC. Large banks including Wells Fargo & Co. and Bank of America Corp. are active players in the market.

Macy’s Inc., which closed its stores from mid-March to early May, in June set up a $3.15 billion asset-based borrowing facility for which it posted almost all its inventory as collateral. Douglas Sesler, who led the retailer’s refinancing, said the use of inventory was essential to making lenders comfortable with a larger facility.

The pandemic raised a challenge: Banks couldn’t make sure all the inventory they were lending against was in place. They applied a small discount to the stock Macy’s has on paper, which will be reduced when the lenders are able to check stores and warehouses.

One New York-based lawyer said he is fielding more requests for asset-based lending from investment-grade companies that ordinarily would tap bank loans or the bond market but now can’t get those deals done.

Updated: 8-31-2020

Shipping Stocks Weather The Pandemic Storm

Quick capacity adjustments and surprisingly robust demand have sent freight rates surging.

Investors in container-shipping companies are having an unexpectedly good year as freight rates surge despite the pandemic, thanks to quick capacity adjustments and surprisingly robust demand.

Shares in several major operators have rebounded sharply. A.P. Moeller-Maersk A/S’s nonvoting stock, which at its low point in March was down by almost half for the year, is now roughly flat. The Danish company owns Maersk Line, the world’s biggest ocean carrier.

Hong Kong-listed Cosco Shipping Holdings Co., which controls the world’s third-largest container carrier by capacity, and Taiwan’s Evergreen Marine Corp. are up about 23% and 32% for the year, respectively, after also recovering from steep selloffs.

“Ocean carriers got out ahead of the pandemic,” said Simon Heaney, senior manager for container research at Drewry Shipping Consultants Ltd. “It’s a good year for carriers in terms of profits.”

Drewry now expects the global industry to earn around $9 billion before interest and taxes this year, up 41% from 2019. It had earlier forecast a $3.7 billion loss. If shipping rates stay high, Mr. Heaney said, he might lift his forecast further.

Container-shipping companies play a vital role in global trade by moving clothes, food, furniture, electronics and much else around the world.

As the coronavirus pandemic unfolded, investors and analysts say, shippers were quick to idle vessels and cancel sailings, buoying freight rates and lifting profits. When demand proved more resilient than expected, they were equally quick to add back capacity—without crossing the line into oversupply.

The overall picture for trade is tough, but improving. The Geneva-based World Trade Organization now forecasts global volumes will fall 13% this year, after previously warning they could crash by a third.

Many shipping companies and their corporate clients expected a much steeper drop-off in demand than actually occurred, said Dave Perrett, co-head of Asian investment at M&G Investments: “They thought it would be absolutely catastrophic, and it wasn’t.” M&G funds hold stakes in shipping companies including A.P. Moeller-Maersk, FactSet data shows.

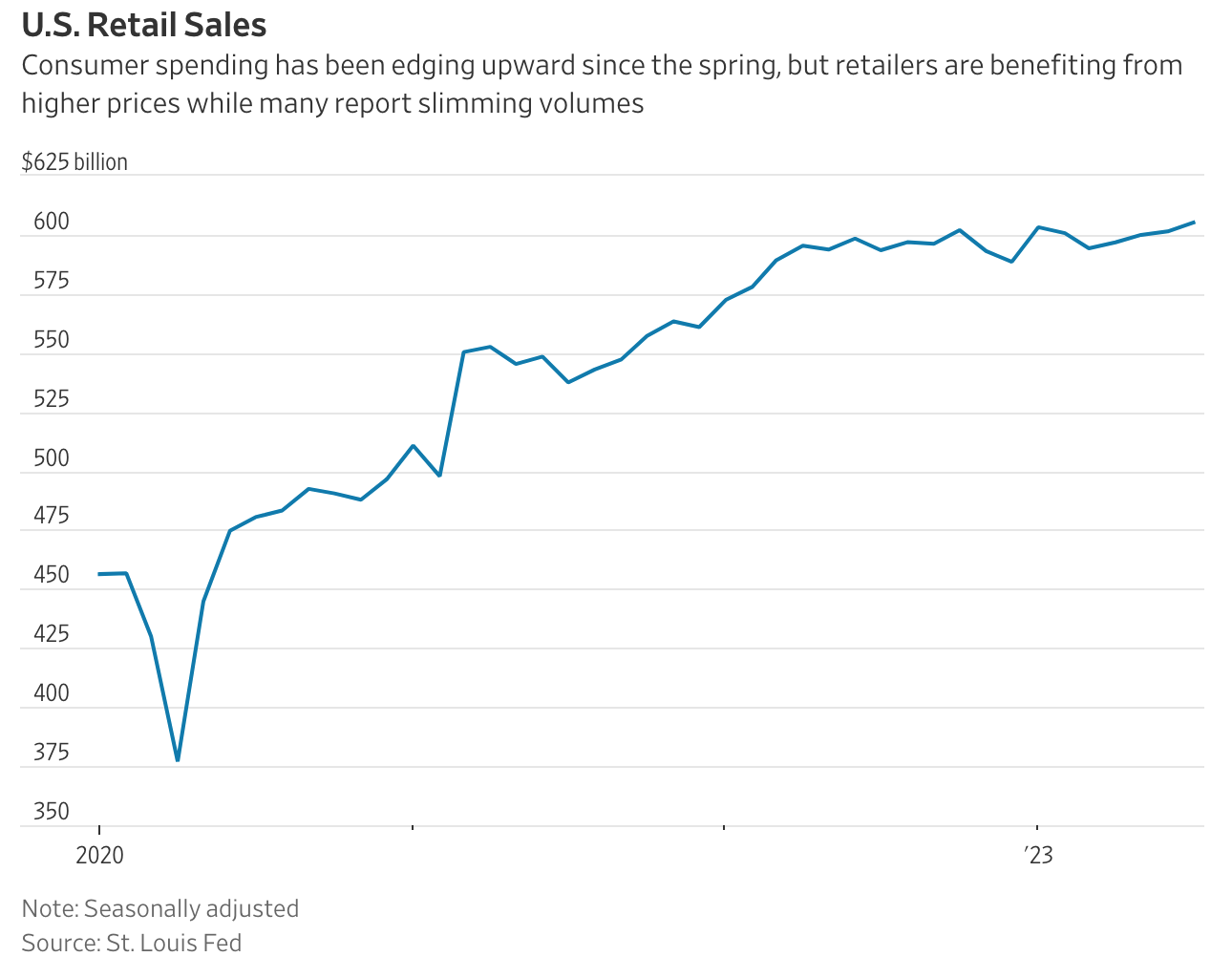

In the U.S., retail sales topped prepandemic levels in July. Andrian Dacy, head of the global transportation group at J.P. Morgan Asset Management, said retail spending in the U.S. and Europe had been buoyed by government financial assistance to households.

Plus there is the e-commerce boom, he said: Many people stayed home and spent money they would otherwise have used on movies, travel or meals. “They’re online, they’re ordering things, and those things are being delivered and moved to the supply chain,” he said. Trade in medical supplies also surged, Mr. Dacy added.

In the week ending Aug. 28, the spot rate to ship a 40-foot container from Shanghai to the U.S. West Coast hit $3,639, the highest in over a decade, according to the Shanghai Shipping Exchange. A Drewry composite index of rates for eight east-west routes hit $2,251 in the week to Aug. 27, up 60% from a year earlier.

Not all shippers’ share prices have benefited. Germany’s Hapag-Lloyd AG, the world’s fifth-largest container shipper by capacity, spiked to a record in May but is now down 35% for the year. Japan’s Mitsui O.S.K. Lines 9104 1.19% is down by a similar amount.

The industry is partly reaping the benefit of its distress over the past decade, when low profits spurred takeovers, partnerships and investment in bigger, more-efficient ships.

Five players control 64% of the global fleet now, versus 47% in 2008, according to Parash Jain, global head of shipping and ports equity research at HSBC. Greater concentration makes cutting capacity easier, investors and analysts said.

And there is little risk that new ships will flood the market, pressuring freight rates. Outstanding orders stand at about 9% of existing fleet capacity, versus more than 50% during the global financial crisis, Mr. Jain said.

M&G’s Mr. Perrett said tighter environmental regulations would also damp demand for new vessels. Overall, he said, the industry would avoid a return to its earlier, damaging focus on growth.

“There’s no need for one player to be disruptive,” he said. “The focus here would be more about profitability as opposed to market share.”

Updated: 9-19-2020

Maersk Prepares Job Cuts As It Extends Reorganization

The Danish shipping giant is preparing a shake-up that could eliminate scores of jobs.

AP Moller-Maersk A/S is undertaking a shake-up that could cut scores of jobs as the Danish shipping giant moves to control costs and simplify its business.

A Maersk spokesman said up to 27,000 jobs, or nearly a third of its global workforce, could be affected but didn’t say how many of its 80,000 staffers world-wide could be laid off. People with knowledge of the matter said the job reductions could involve employees at Damco and Safmarine, operating units the company said earlier this month would be integrated into the wider group.

“The reorganization is in process and we want to make sure that our employees are informed first,” the Maersk spokesman said.

Damco, which specializes in freight forwarding and logistics, employs around 2,000 people and Safmarine, a container operator that mostly serves Africa, employs about 1,000.

The people said there may also be redundancies at Hamburg Süd, the German container line that Maersk bought in 2017 for $4 billion and that employs 4,500 people.

“Some will experience big changes, others small. Some are moving to new jobs, and a smaller number will unfortunately become redundant, which we take very seriously,” Vincent Clerc, head of Maersk’s main ocean and logistics business, said in a statement.

The shake-up was previously reported by Reuters.

Maersk is the world’s biggest ocean container line, with about 17% of the world’s oceangoing capacity, according to maritime research group Alphaliner.

The company has been under pressure by shareholders to complete a reorganization that began in 2016 and split its shipping and logistics operations from the company’s energy business.

Maersk Line, like other container companies, sharply curtailed its shipping capacity at the onset of the coronavirus pandemic as global trade pulled back under widespread community lockdowns instituted to slow the virus’s spread.

Maersk tripled its second-quarter net profit to $427 million from $141 million a year earlier, strongly exceeding expectations.

Updated: 10-14-2020

Maersk Lifts Guidance, Will Cut 2,000 Jobs in Restructuring

Danish shipping giant will book a $100 million charge related to layoffs, but increased its full-year guidance on booming freight rates.

A.P. Moeller-Maersk A/S lifted its full-year guidance Tuesday after noting a faster-than-expected rebound in shipping volumes and freight rates, but cautioned that it will take a $100 million restructuring charge in the third quarter to cover the costs of cutting 2,000 jobs.

Maersk said full-year earnings before interest, tax, depreciation and amortization is now expected to be between $7.5 billion and $8 billion before restructuring and integration costs, from previous guidance of $6 billion to $7 billion.

The Danish shipping company prereleased third-quarter revenue of $9.9 billion and Ebitda before restructuring and integration costs of $2.4 billion. Analysts polled by FactSet had expected revenue of $9.87 billion.

Volumes in the company’s main ocean unit declined by around 3% in the third quarter compared with the previous year, which is slightly better than the mid-single-digit contraction Maersk had earlier projected.

“Volumes have rebounded faster than expected, our cost have remained well under control, freight rates have increased due to strong demand and we are growing earnings rapidly in Logistics & Services,” said Chief Executive Soren Skou.

“The outlook for [the fourth quarter] is solid for the same reasons, and we are therefore able to upgrade our expectations for the full year.”

Maersk’s shares jumped on the news, trading up 1.8% at 10,865 Danish kroner on the Copenhagen Stock Exchange.

The company is the world’s biggest ocean container line, with about 17% of the world’s capacity, according to maritime research group Alphaliner. The company has been under pressure from shareholders to complete a reorganization that began in 2016, when it split its shipping and logistics operations from its energy business.

Maersk didn’t give details about the job cuts Tuesday. It said last month that up to 27,000 staff, nearly a third of its global workforce of 80,000, could be affected by the restructuring.

The Wall Street Journal reported, citing people familiar with the matter, that the job reductions could involve employees at Damco and Safmarine, operating units the company said last month would be integrated into the wider group.

Damco, which specializes in freight forwarding and logistics, employs around 2,000 people and Safmarine, a container operator that mostly serves Africa, employs about 1,000. The Journal reported that there may also be redundancies at Hamburg Süd, the German container line that Maersk bought in 2017 for $4 billion and that employs 4,500 people.

Maersk Line and other container ship operators sharply curtailed capacity at the onset of the coronavirus pandemic as widespread lockdowns aimed at slowing the spread of the virus weighed on trade.

Volumes began recovering in late May as lockdowns in many countries began easing and freight rates started surging as shipping demand began to outpace capacity.

London-based Drewry Shipping Consultants Ltd. said its index of world-wide container freight rates for the week ending Oct. 8 was double the level of a year ago, and spot-market prices from Shanghai to Los Angeles had more than tripled from the same period last year.

Maersk said in August it tripled its second-quarter net profit to $427 million from $141 million a year earlier, strongly exceeding expectations.

Mr. Skou warned that prospects for next year are uncertain because of a potential resurgence in Covid-19 cases during the winter.

“The positive impact from stimulus packages may be less strong in 2021, potential new lockdowns will impact demand and the timing and the effectiveness of a potential vaccine will impact 2021,” he said.

Norway-based Fearnley Securities said in a report that Maersk’s outlook is favorable over the next two years, with current freight rates almost double what they were a year ago.

Maersk’s full third quarter results will be published Nov. 18.

Updated: 11-12-2020

Cargo Vessels And Cruise Ships Line Up For Scrapping

The fallout from the Covid-19 pandemic is pushing shipping companies to sell vessels in growing numbers to bring in cash.

Cargo ships and cruise liners are being scrapped in growing numbers as operators hit by the fallout from the coronavirus pandemic look to turn their unemployed vessels into cash in the recycling market.

Car-carrying vessels and iron-ore haulers lead the burgeoning fleet heading for demolition. Cruise ships, still idled by the restrictions imposed at the start of the pandemic, are joining the lineup at ship-breaking yards, where the vessels are pulled apart for their steel.

The ship operators are trying to repair balance sheets that were battered by the global industrial downturn earlier this year, when factory shutdowns—starting in China and spreading throughout large parts of the world—brought a swath of shipping activity to a halt.

Vehicle sales crashed last spring along with the commodities market as China, the biggest raw-materials importer, closed down to fight the illness. Continuing bans on cruises has left dozens of luxury liners idle as storage costs have mounted.

Manufacturing activity around the world has recovered this fall and automotive sales have rebounded. But global vehicle sales are still expected to fall below last year’s 75-million tally to around 62 million this year, according to data provider Statista.

Shipowners say the damage to their finances from the earlier shutdowns remains.

“Last spring was a very difficult period for car movers,” said Emanuele Grimaldi, a co-owner of Italy’s Grimaldi Group SpA, which operates a fleet of car carriers and heavy equipment movers. “I returned six chartered ships back to their owners and scrapped two of our own.”

Overall ship demolitions through October stood at 557, compared with 889 in all of 2019, according to U.K.-based maritime data provider VesselsValue.

This year’s figure is far below the 1,996 vessels recycled in 2012, when a huge overhang of shipping capacity was taken out following the 2008 financial crisis. Scrap sites were closed for three months this year, however, and ships began heading to the demolition process known as breaking as the yards reopened.

“In the second quarter, you had too many ships chasing too little cargo,” said Anil Sharma, the chief executive of U.S and Dubai-based Global Marketing Systems, which buys more than half of all ships heading for recycling yards. “Although the new-ship order book is pretty balanced, demand for shipping services fell off a cliff during the period.”

Rising prices for steel in scrap markets this fall have also shifted economic calculations for some ship operators.

“India is offering around $370 per ton of steel, up around 30% from the second quarter, but cruise shipowners are getting clobbered, with offers as low as $100 per ton, because of high demand,” Mr. Sharma said. “The ships are docked in Greece waiting for a slot [at a yard] in Turkey that can take months.”

Vessel operators can typically get about 20% of the original purchase price for a 25-year old ship by selling it to recycling companies. With lending markets tight, owners see the scrap market as a potential source of cash for a shipping industry that will need to invest billions in coming years to develop a new generation of environmentally friendly ships.

VesselsValue says 22 ore carriers have been sold for scrapping this year compared with a dozen last year and two in 2018. Ten cruise ships were sent to recycling this year after nine were demolished over the previous two years combined. Car carrier demolitions stood at 28 this year, matching a 2016 high in records dating to 2012.

Shipping executives said those three ship types represented roughly half the overall recycled tonnage this year. Several container ships were also contracted to be scrapped, but were pulled back as demand to move goods surged starting in late summer thanks to rebounding manufacturing and consumer economies.

Updated: 7-23-2023

Shipping Companies Are On a Spending Spree

* Capacity Will Grow More Than Trade, CMA CGM Finance Chief Says

* Too Many Large Container Ships Ordered, DSF CEO Says

The world’s biggest shipping companies are plowing their pandemic windfalls into orders for new vessels on an unprecedented scale, making an industry known for hair-raising cycles of boom and bust more vulnerable in the latest downturn.

Container carriers like MSC Mediterranean Shipping Co., A.P. Moller-Maersk A/S, CMA CGM SA and Hapag-Lloyd AG — all backed by European billionaires — are spending record profits gleaned during the health crisis to splash out on new models mostly from Korean and Chinese shipyards. This has pushed the global order pipeline to a historic level — almost $90 billion by one estimate.

But the tide has turned in the notoriously cyclical sector as freight rates flirt with below-breakeven levels and fears about overcapacity re-emerge.

“Too many large container ships have been ordered,” said Erik I. Lassen, chief executive officer of Danish Ship Finance A/S, a company providing vessel financing.

He noted that deliveries are now starting at a time when supply chains are running more smoothly and demand for freight transport is back to pre-pandemic levels.

“There will be shipowners — tonnage providers — out there that will have stretched themselves,” he said in an interview. “Although the last couple of years have been profitable for shipping, the accumulated earnings are far from enough to fund the investment in new technology and ships in the coming decade.”

Cloudier Outlook

The outlook has grown cloudier for the tycoons, whose companies have begun a chorus of negative forecasts for the coming months.

On Friday, France’s CMA CGM, controlled by billionaire Rodolphe Saade and his family, warned about deteriorated market conditions and said new vessel capacity “is likely to weigh on freight rates.”

Earlier this month, Zim Integrated Shipping Services Ltd. cut its 2023 financial outlook on lower-than-expected volume growth and weak rates.

Danish shipping giant Maersk has forecast global container transport volumes may shrink as much as 2.5% this year and has also warned of an emerging supply-side risk in the second half.

Germany’s Hapag-Lloyd has said supply will likely outpace demand this year and next.

Matson Inc. — a smaller competitor and a bellwether for goods flowing from China to North America — said on July 20 it expects a “muted peak season” in the months ahead as “retailers continue to carefully manage inventory levels in the face of lower consumer demand.”

Honolulu-based Matson announced plans last November to purchase three new vessels for about $1 billion.

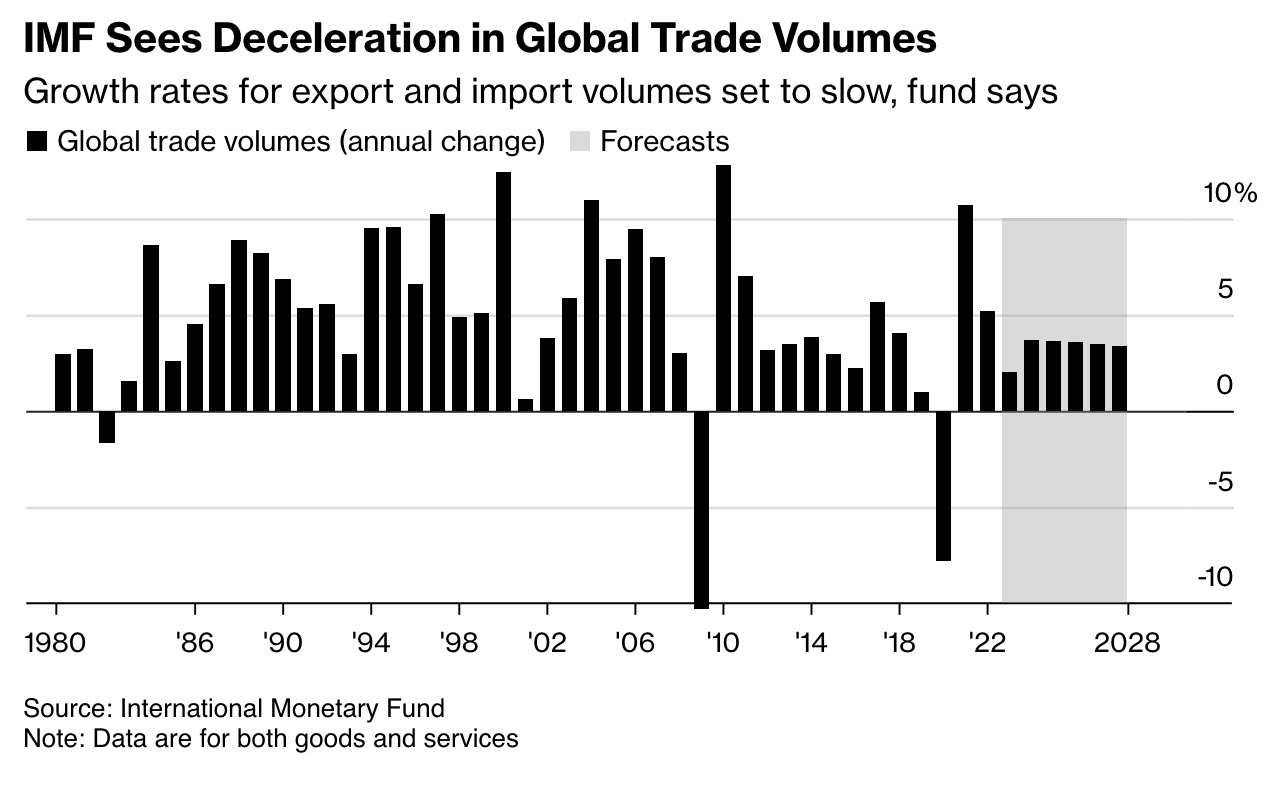

Overall, the International Monetary Fund is predicting trade volumes will grow by just 2% this year, a sharp deceleration from the estimated 5.2% in 2022.

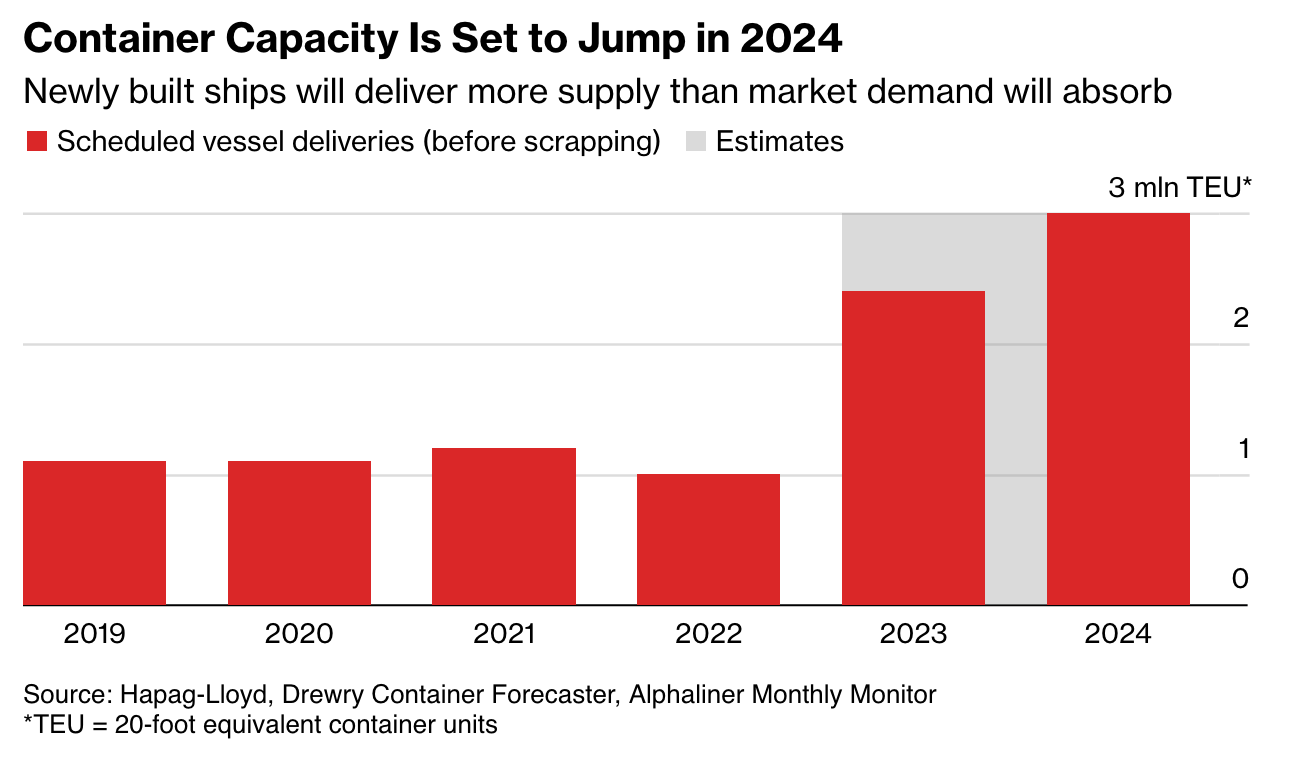

Against this backdrop looms an order book for new container vessels that Drewry Maritime Research put at 890 ships as of July 1, or 28% of the current global capacity worldwide measured in 20-foot equivalent container units.

Deliveries this year alone are expected to add 1.75 million TEUs, or about 6.6% of the total fleet before adjusting for demolitions, according to Drewry’s latest Container Forecaster.

Net new capacity is expected to increase by a record 1.82 million TEUs next year and 1.4 million in 2025 to reach 30.5 million, up almost 55% from a decade earlier.

“We’re looking at the biggest order book in container shipping history,” said industry veteran John McCown, the founder of Blue Alpha Capital.

“They have cleaned up their balance sheets and are now reinvesting.”

He estimates the pipeline of new vessels will set shipowners back some $89.5 billion based on the cost to build ships of an average size range.

A clutch of European billionaires control some of the world’s biggest container lines including the Saade clan.

There’s Switzerland-based Gianluigi Aponte, founder of MSC; Klaus-Michael Kuehne, who has a 30% stake in Hapag-Lloyd; and the family of Maersk Chairman Robert Maersk Uggla, the great-grandson of the founder.

Kuehne is Germany’s richest individual with a net worth of $46 billion, according to the Bloomberg Billionaires Index, while Saade and his family have $23 billion and Aponte $21 billion.

One motivating factor to order new vessels and upgrade the engines of existing ones is to mitigate climate change.

The International Maritime Organization wants the industry to be net-zero greenhouse gas emissions by 2050, with checkpoints in 2030 and 2040. The availability of emission-free fuels is virtually zero right now.

Maersk last month ordered six methanol-powered container vessels, bringing the total to 25. At the end of last year, Hapag-Lloyd had an order book of 15 new builds with deliveries over the 2023-2025 period.

CMA CGM has built up the world’s second-largest order book at 1.24 million TEUs, putting the French company in a position to get close or even overtake Maersk in 2026, according to industry analyst Alphaliner.

“In recent years, the Marseille-based shipping line has been ultra-aggressive when it comes to placing new-building orders,” Alphaliner said this month in a report, putting the pipeline at 122 vessels and 1.24 million TEUs.

No. 1 ranked MSC’s fleet expansion is partly due to purchases of second-hand vessels, it says.

CMA CGM Chief Financial Officer Ramon Fernandez said the company has about 100 vessels on order, with most of them to be fueled by LNG or methanol.

He declined to be more specific, but acknowledged the possibility of overcapacity.

“The supply-demand balance for the next period will likely be under pressure because capacity will grow more than trade,” he said, adding that the scrapping and pulling from service of older, more polluting vessels could dampen the effects, along with a move to slow engine speeds to curb emissions.

The plans to build ships hark back to the lead-up to past declines in the sector.

CMA CGM was on the brink of default in 2009 when the global financial crisis brought trading to its knees. This time around, though, their coffers are fuller. This is reflected by muted demand for credit, so far.

Bank lending, traditionally one of the main sources of funding for the industry, didn’t increase in line with the order book last year and could remain flat in 2023, Petrofin Research said in its annual report on global ship financing.

Furthermore, a two-tier credit market has emerged with lenders offering better terms for vessels with lower emissions.

“Ship owners are becoming more and more like banks and use the risk mindsets you see at banks,” Lassen said.

“They are becoming a lot more sophisticated than the general picture you might have of the old days of ‘buy cheap and sell expensive’.”

Updated: 8-29-2023

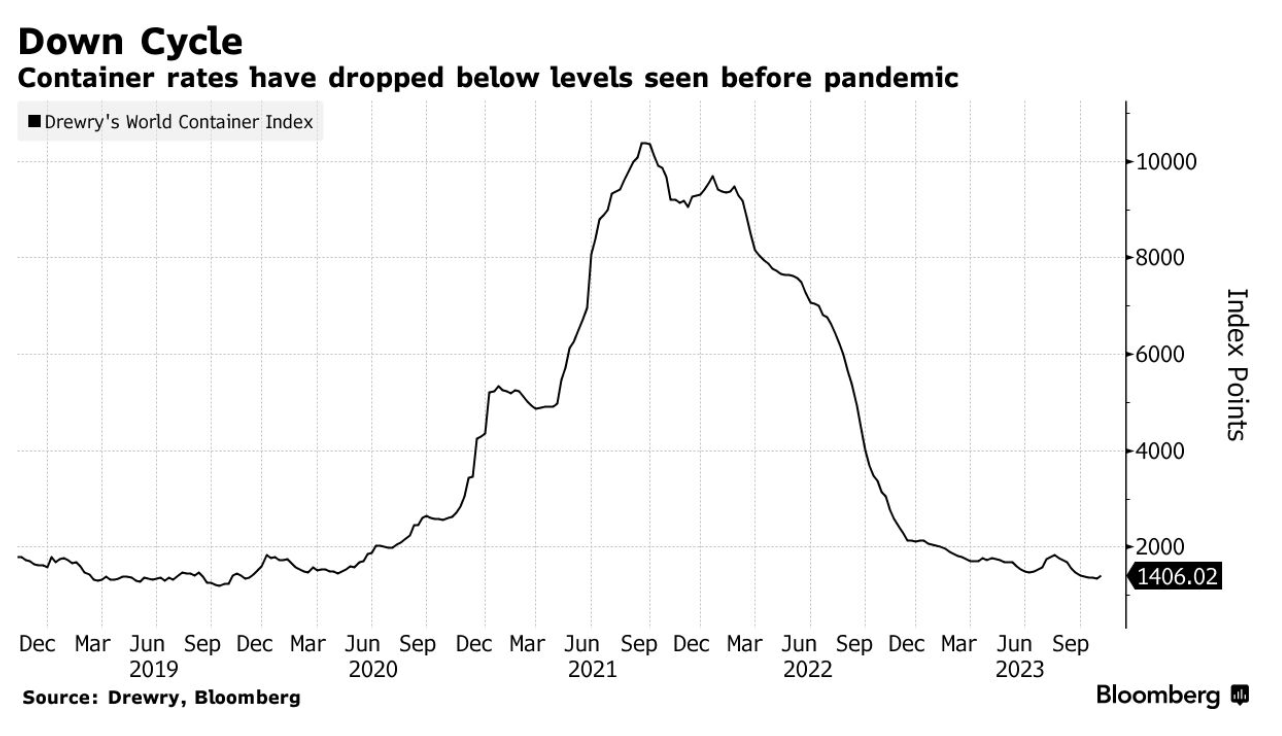

Where Peak-Season Shipping Is Headed, In Charts

The busiest period for supply chains is arriving with a whimper, providing little optimism for a rebound in freight demand.

The period from late summer into fall is usually the busiest time of year in supply chains, as retailers rush clothing, electronics and holiday-season decorations to consumer markets and freight operators look to boost profits on the surging demand.

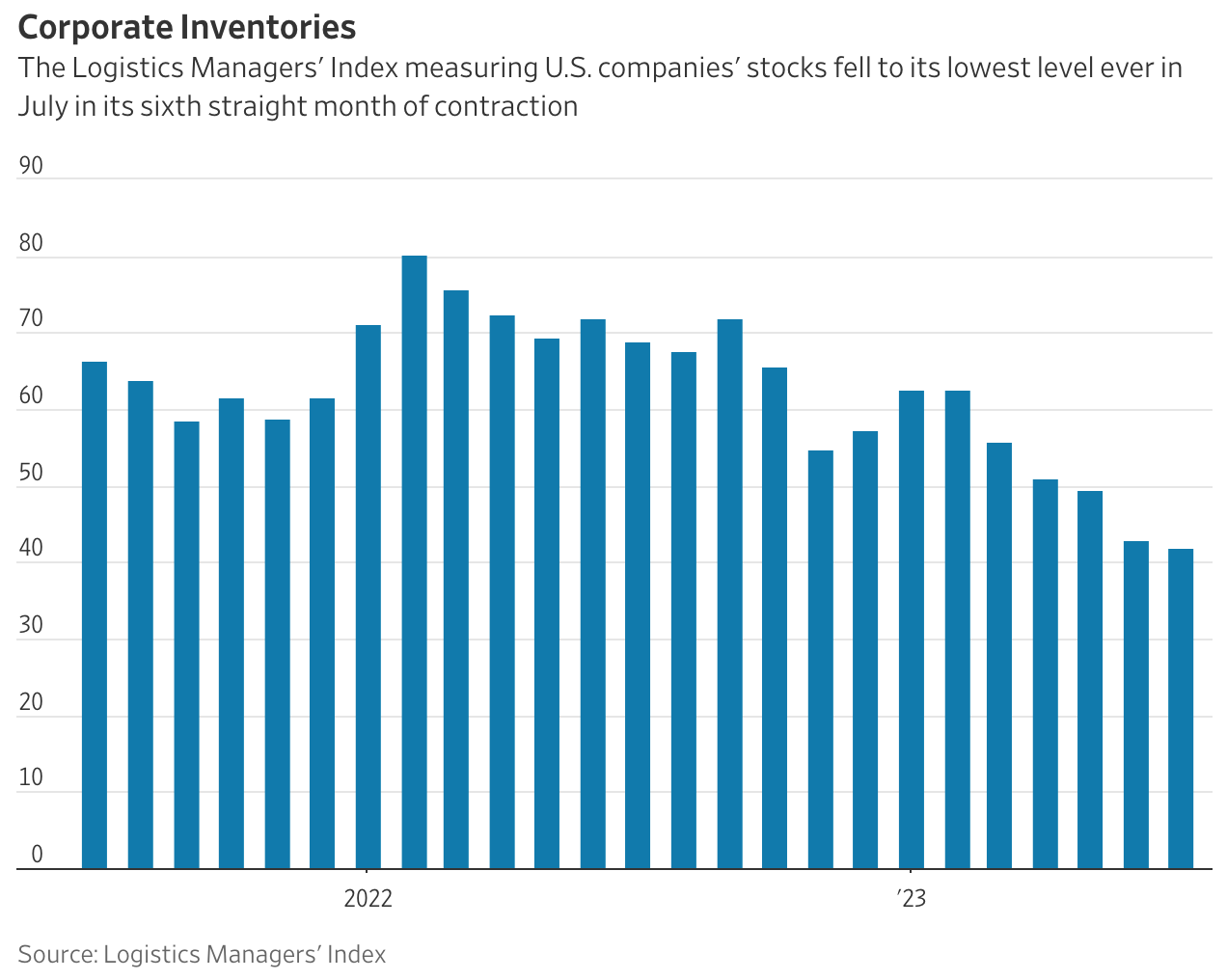

This year’s peak shipping season is arriving with a whimper, however, as merchants and consumer-goods suppliers continue to burn off excess inventories built up during the Covid-19 pandemic and logistics companies cope with tepid volume and freight rates far below year-ago levels.

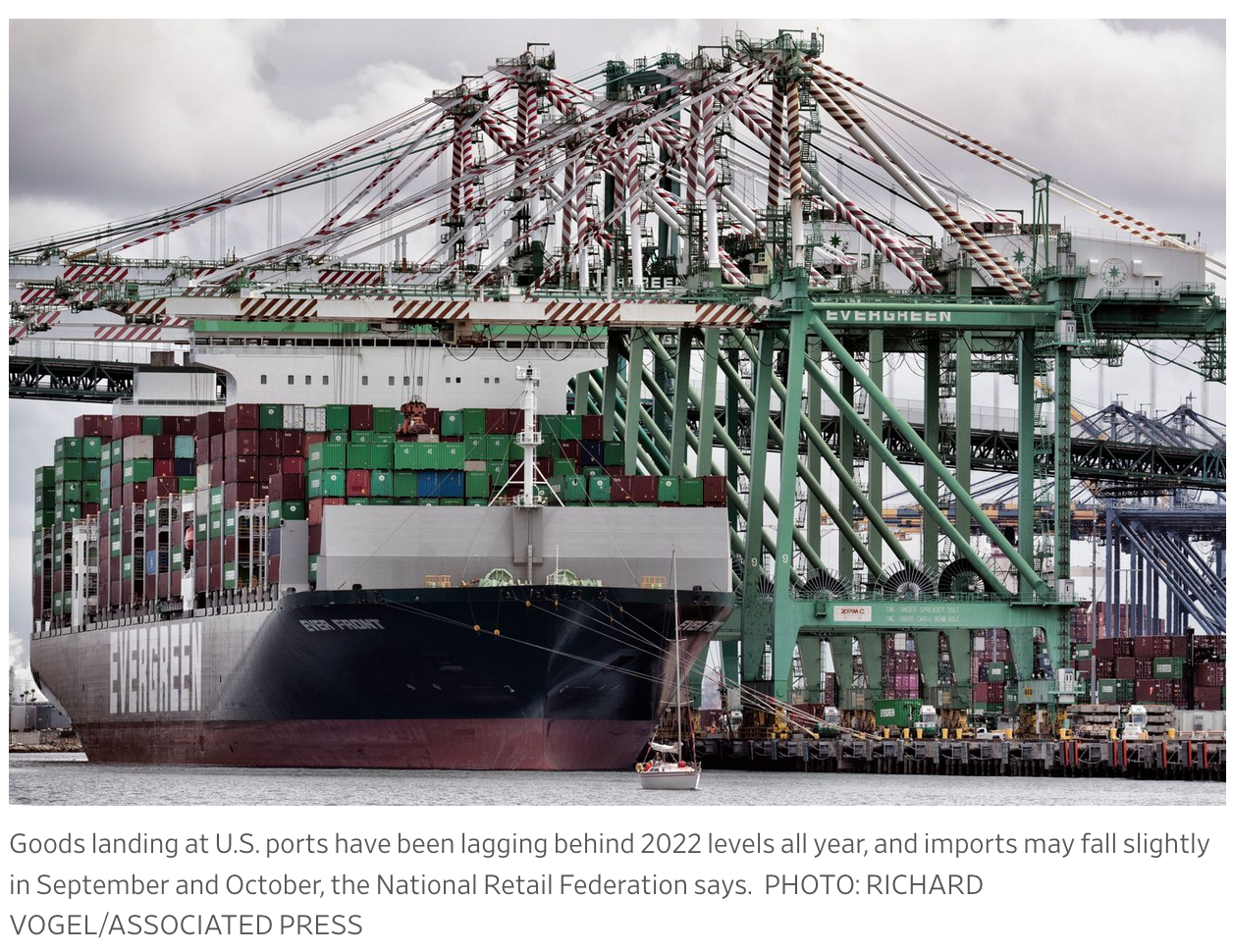

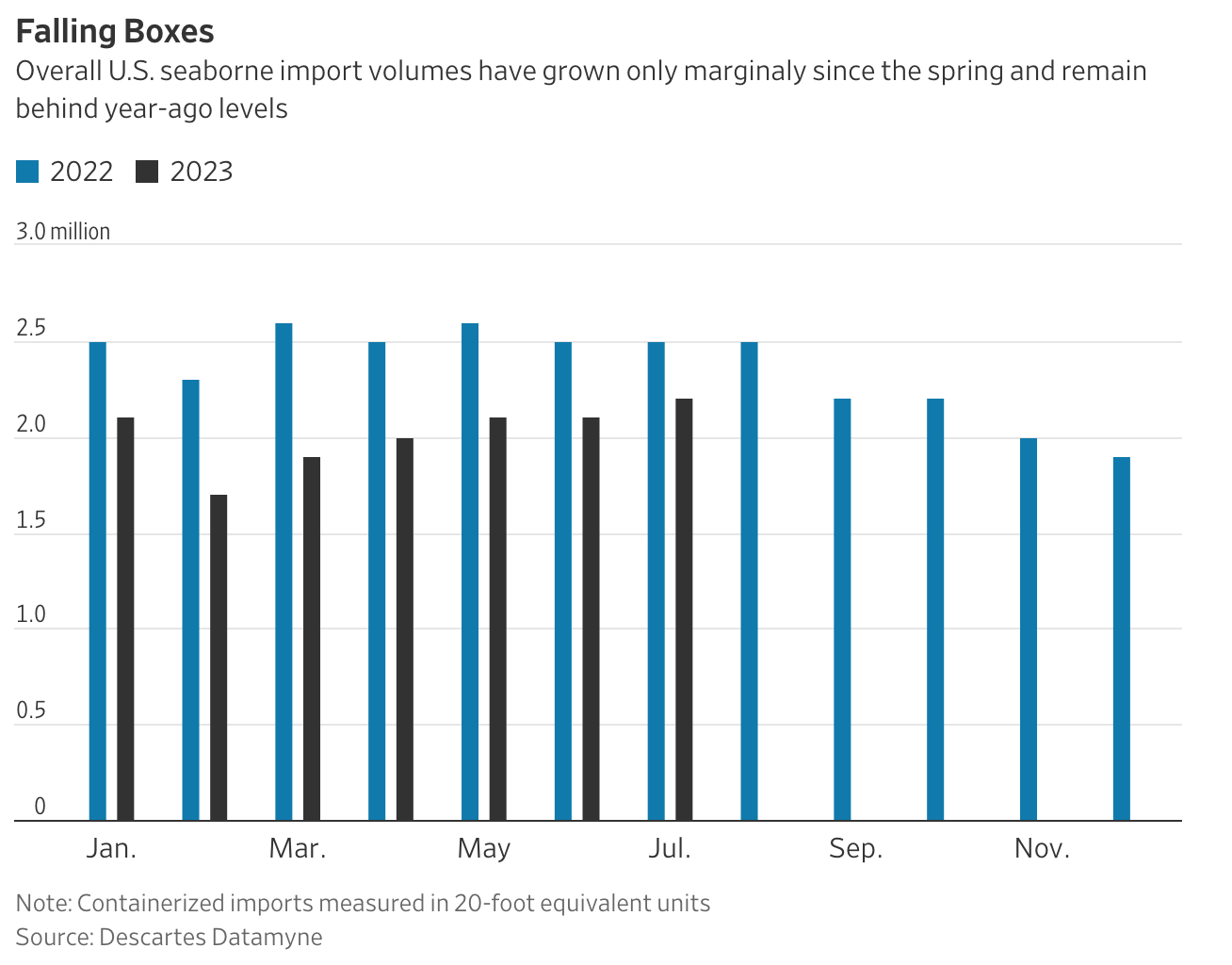

Goods landing at U.S. ports, which cascade across trucking and rail networks heading to distribution centers and stores, have been lagging behind 2022 levels all year and the National Retail Federation forecasts that imports may fall slightly in September and October.

Logistics companies base expectations for shipping demand on how much inventory retailers are holding and how quickly they expect to replenish their stocks.

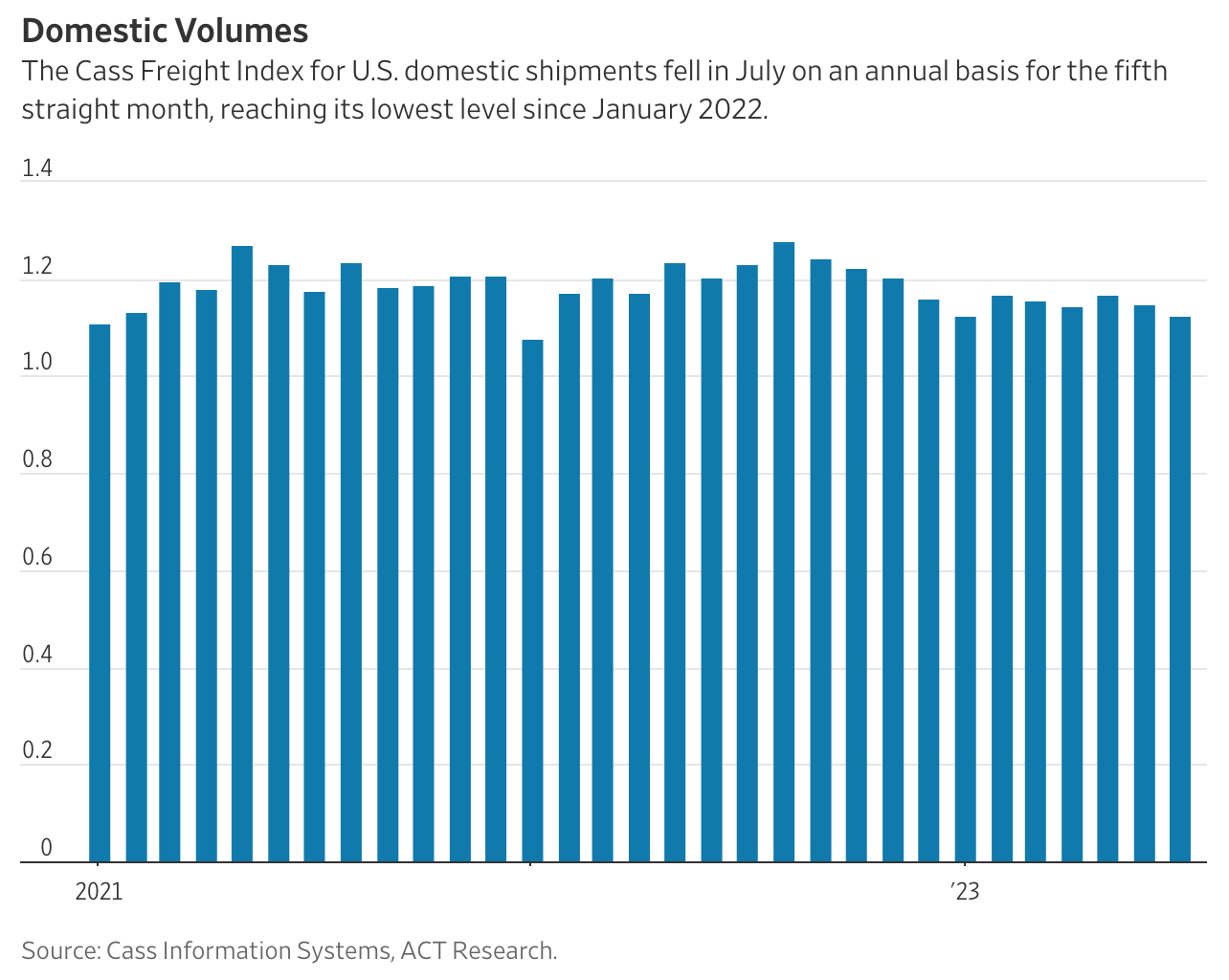

The Logistics Managers Index in July reached its lowest point in the six-and-a-half year history of the measure while inventories were in contraction.

Retailers including Walmart, Target and Home Depot say they have made progress in destocking but that they aren’t looking to rush goods to market without clear indications of demand from consumers.

Target Chief Financial Officer Michael Fiddelke said on an Aug. 16 earnings call that the big-box retailer remains cautious as it benefits from “our efficiency efforts and lean inventory position.”

Jason Miller, interim chair of Michigan State University’s supply-chain management department, said inventories for retailers remain elevated, especially for items such as clothes, household appliances and smartphones.

“There’s no doubt right now we are in for a weak peak season,” Miller said.

Americans are spending more on services and experiences, like vacations and dining out, while pulling back spending on a wide array of goods.

Large retailers like Walmart also are seeing shoppers focus more on basics such as groceries rather than the consumer goods that fill the vessels, trains and trucks serving peak-season demand.

The shift in spending and uncertainty is prompting retailers like Macy’s and Dick’s Sporting Goods to pull back on orders.

“Consumers still have good savings, but they are being more judicious in how they spend,” Macy’s Chief Executive Jeff Gennette said this month.

Freight executives had hoped that this year’s peak season would prove to be a turning point after a year of lackluster import volumes.

But inbound trade this summer has expanded only marginally, leading some ocean carriers to cancel trans-Pacific sailings and revise down their expectations for 2023.

Vincent Clerc, chief executive of one of the biggest container-shipping companies in the world, Denmark-based A.P. Moller-Maersk, said on a recent earnings conference call that retail and lifestyle shipments are down double-digits compared with prior years.

”We do not see any sign of an expected volume rebound in the second part of the year,” Clerc said.

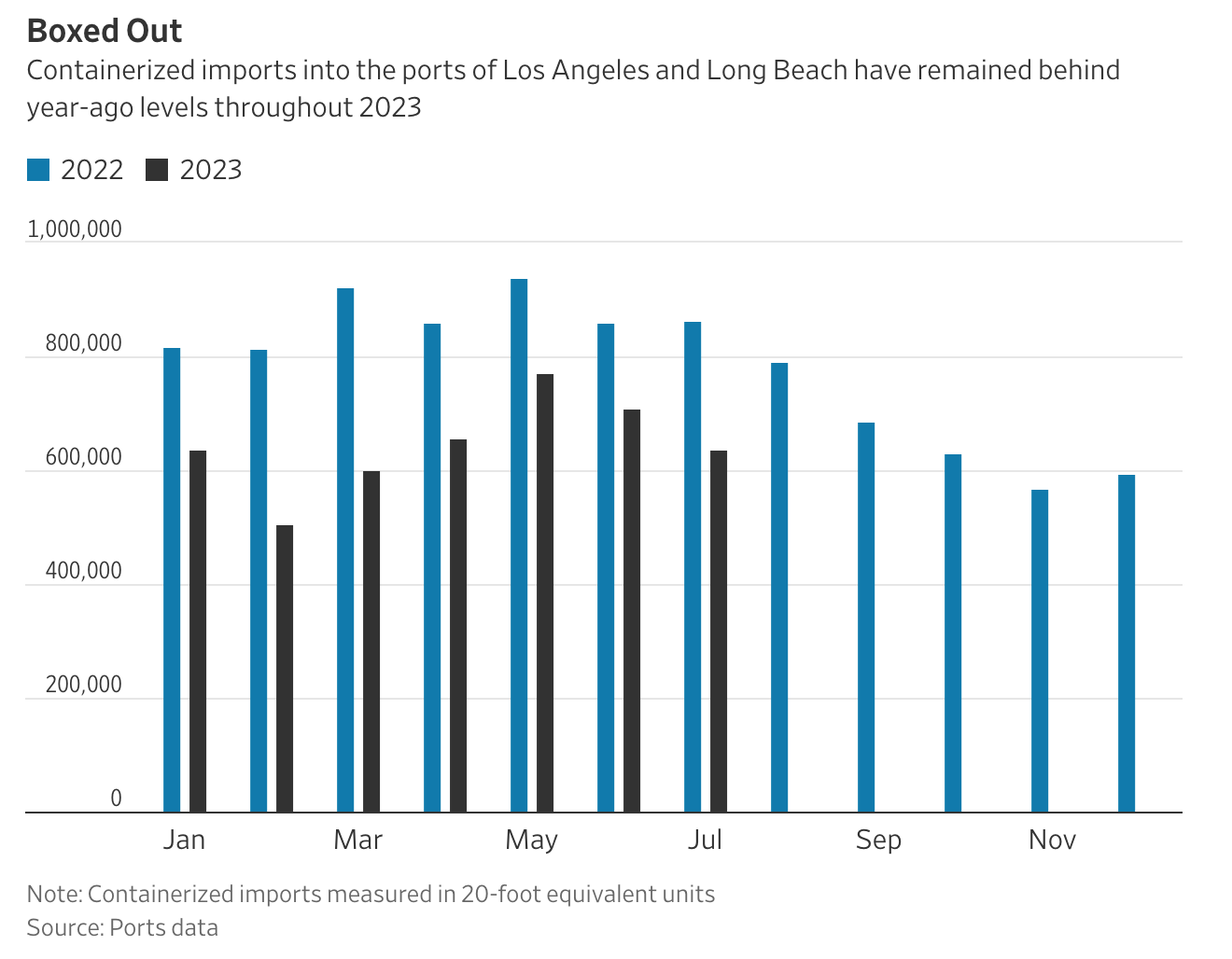

The peak season usually lands strongest at Southern California’s neighboring ports of Los Angeles and Long Beach, where trucks and trains ferry goods from Asia to nearby warehouses and into distribution networks fanning out across the U.S.

But the country’s busiest container port complex is seeing no peak this summer. Combined import volumes there fell more than 10% between June and July, to their lowest levels since December 2022, just as business should have been heating up.

In one potentially ominous sign for future volume, the ports are also sending fewer empty containers back over the Pacific because of weak demand from factories in Asia. Exports of empty boxes at the Port of Los Angeles in July fell 39% compared with the same month last year.

Fewer containers flowing into the country means fewer loads for truckers to haul from ports and rail yards to warehouses and distribution centers. The cautious optimism that some truckers had at the start of this year has given way to a sense that a recovery could be months away.

“While we’re not ruling out a market inflection in the next few months, we’re not calling for such a turning point,” David Jackson, chief executive of trucker Knight-Swift Transportation, said on a July 20 earnings conference call. “Our base case is for a modest seasonal uplift in the fourth quarter.”

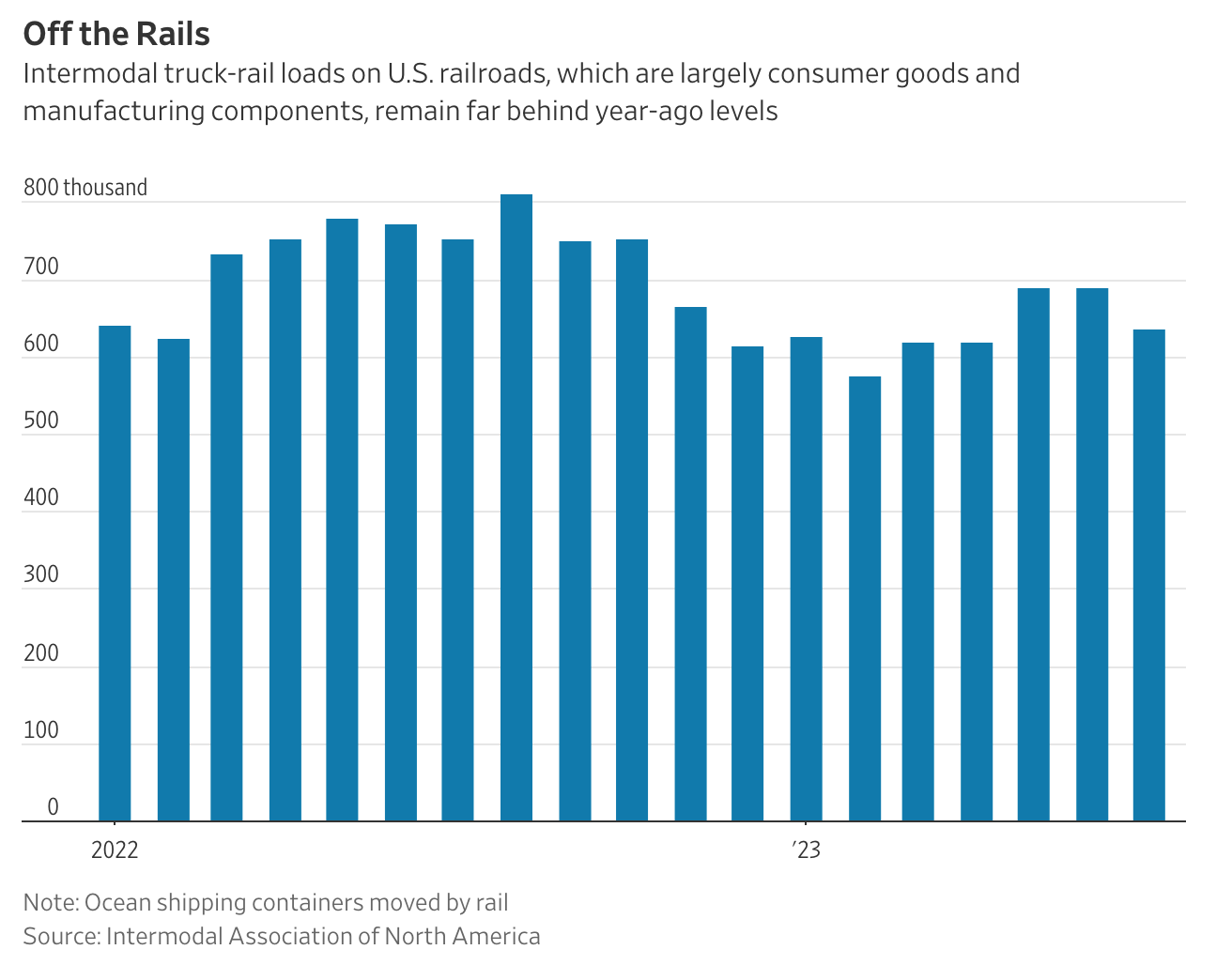

Intermodal rail transport, in which railroads carry containers and truck trailers, often grows as importers and logistics companies load imported boxes for distribution from ports to inland destinations. This year, that circulatory system for supply chains is thinning.

Intermodal volumes have slipped this year to their lowest levels in several years and the Intermodal Association of North America says the business in July was barely ahead of levels this spring, providing no signals that more freight was in the pipeline.

”I don’t have any customers really predicting a significant peak season,” Darren Field, president of intermodal at J.B. Hunt Transport Services, said this month at a Deutsche Bank transportation conference. “I think it’s still just a wait-and-see on the economy in general.”

Updated: 10-19-2023

Union Pacific Profit Falls On Weaker Freight Demand

The railroad beat expectations on earnings but signaled dimming strength in industrial, intermodal businesses.

Union Pacific’s profit fell 19% in the third quarter to $1.5 billion, beating expectations, while the company reported declining freight rail volumes and revenue across key industrial commodities.

Earnings slid to $2.51 a share from $3.05 a share in the year-ago quarter. Analysts polled by FactSet had been expecting $2.41 a share.

Overall quarterly revenue at $5.94 billion was down 10% from $6.57 billion last year and below FactSet’s consensus forecast of $5.96 billion.

The Omaha, Neb.-based freight railroad, a bellwether of the industrial economy, saw revenues fall back from the third quarter of 2022 in industrial commodities, including coal, metals, industrial chemicals and energy products.

Carloads of forest products fell 13%, a likely result of the weak U.S. housing market.

Home sales have trended sharply lower this year as mortgage rates rose to the highest level since 2000.

“We faced many challenges in the quarter, including continued inflationary pressures and a drop in carloads,” said Chief Executive Jim Vena.

The railroad also saw business demand deteriorate in its intermodal operations, which have been hit by inventory destocking and sagging consumer demand for goods.

Union Pacific’s volumes in that business segment, which hauls sea containers and truck trailers, fell 6% from the same quarter a year ago and revenue fell at an even steeper pace as average revenue per car, a measure of pricing strength, declined 13%.

Pricing and volume in that segment also declined from the second quarter, a sign of the muted peak season that freight industry executives have forecast for a period when volumes typically increase ahead of the end-of-year holidays.

Union Pacific shares closed up 2.14% at $210.33 Thursday.

J.B. Hunt Transport Services, a major rail customer in intermodal operations, said this week that its intermodal revenue and average revenue per load both fell at a double-digit pace in the quarter ended Sept. 30.

Separately, freight railroad CSX’s profit sank in the third quarter on lower volumes.

The Jacksonville, Fla.-based carrier posted a profit of $846 million, or 42 cents a share, in the third quarter, compared with $1.11 billion, or 52 cents a share, a year earlier. Analysts polled by FactSet expected per-share earnings of 43 cents.

Revenue fell 8% to $3.57 billion, beating the $3.55 billion expected by analysts polled by FactSet.

Updated: 10-20-2023

CMA CGM’s Saadé Urges Calm As Ocean Carrier Profits Plummet

The head of the world’s No. 3 container line expects little change next year in a faltering shipping market marked by sagging demand, falling freight rates and overcapacity.

Rodolphe Saadé, the billionaire chief executive of French container line CMA CGM, says the shipping industry shouldn’t panic over a sharp retreat in earnings.

The head of the world’s third-largest liner company said in an interview that he expects the weak growth in global trade to continue through 2024.

But Saadé said the tumbling profits from record highs during the Covid-19 pandemic essentially bring the business back to prepandemic levels.

“Most probably 2024 will be pretty much the same as the second half of ’23, provided [there is] no exceptional crisis,” Saadé said.

“We expect more tension in the months to come,” he said. “We see that the demand is not as strong as before, we see crisis around the world, and this is having an impact on the shipping business.”

Some of the world’s largest ocean carriers made tens of billions of dollars during the pandemic, when shipping demand soared and freight rates skyrocketed.

Some carriers like CMA CGM plowed those profits into seaport terminals and air cargo, trucking and warehousing operations.

They also leaned on their big cash stockpiles to order a record number of new containerships that now are headed to sea after the red-hot Covid-era demand has evaporated.

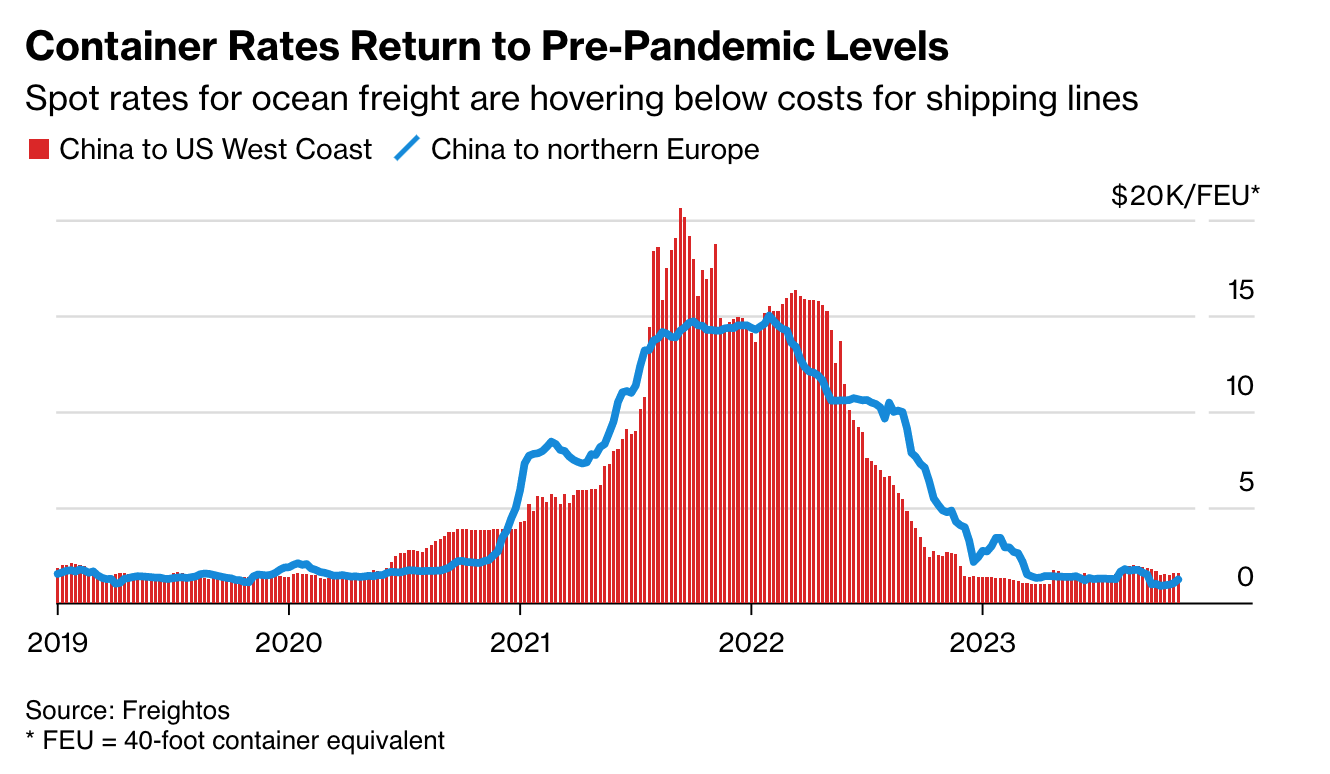

Combined net profits for container shipping lines in the second quarter fell to $8.9 billion, down $54 billion from the industrywide earnings the same quarter last year, according to industry analyst John McCown. Denmark-based marine data company Sea-Intelligence said freight rates are down between 48% to 67% from a year ago.

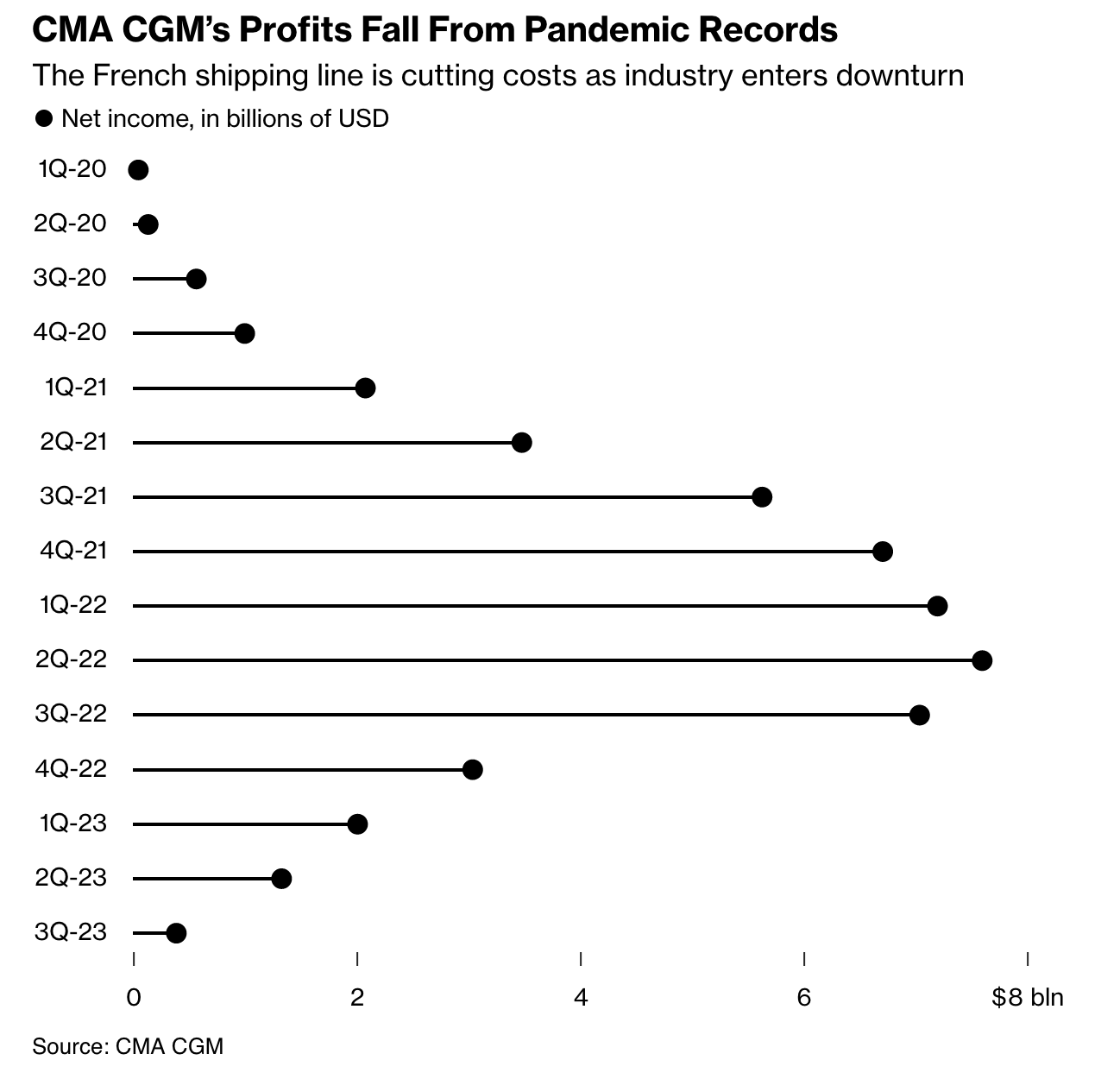

CMA CGM has been among those feeling the impact. Its second-quarter profits of $1.3 billion were down 83% compared with 2022.

Saadé said he expects the second half of 2023 will be weaker than the first half of the year and that the company faces headwinds through 2024 as ocean carriers deploy a record number of new containerships at a time of geopolitical instability and flagging freight demand.

CMA’s struggles are in line with its competitors. Denmark-based A.P. Moller-Maersk in August posted a second-quarter profit of $2.9 billion, down from $10.3 billion in the same period last year.

Orient Overseas Container Line, a Hong Kong-based unit of China’s Cosco Shipping Holdings, reported operating profit for the first half of this year of $1.1 billion, down 81% from the same period in 2022.

The carrier’s chairman, Wan Min, said in an August company report that the decline “has certainly been spectacular in terms of both absolute dollar value and in terms of percentage, but this is simply a reflection of just how high the freight market had risen.”

Investors have punished the carriers over the declining earnings. Shares in Maersk have fallen 45% and those of German container line Hapag-Lloyd have fallen more than 60% from their 2022 highs.

Saadé said carriers should accept that the industry is returning to normal cycles that include long periods when profits are tight.

He said that despite war in Ukraine, instability in the Middle East and an economic slowdown among some of the world’s largest economies, he expects the global economy to grow between 1% and 3% in 2024.

“We see a soft market,” he said, but “there is still demand.”

The U.S. remains a big importer, he said. “Maybe less than during the Covid years, that is for sure, but there will still be growth. Moderate growth, but there will still be growth. This is the way we see 2024.”

The challenge for carriers is the record number of containerships that are being delivered over the next couple of years. CMA CGM has 116 new vessels on order, according to data provider Alphaliner, second only to the world’s largest carrier, Switzerland-based Mediterranean Shipping.

“The issue we have in our industry is supply and demand,” Saadé said.

Saadé said the new ships are needed to replace older vessels, to handle future trade growth and to meet CMA’s goal of becoming carbon neutral by 2050.

The carrier has already deployed ships powered by liquefied natural gas and is anticipating future ships powered by cleaner fuels, such as methanol and biomethanol.

Updated: 10-24-2023

CN Railway Misses Estimates As Consumer Goods Shipments Drop

Canadian National Railway Co. spelled out a challenging picture for the North American economy as earnings fell short of expectations in the third quarter, partly due to falling demand for consumer goods.

Revenue dropped 12% from last year to C$3.99 billion ($2.9 billion), missing analyst estimates of C$4.05 billion. On an adjusted basis, the railway’s earnings came in at C$1.69 per share, missing Bloomberg consensus estimates by 3 Canadian cents.

Intermodal shipments were down 34% from the same period last year.

“Our consumer-related business — particularly the intermodal business — continues to be murky,” Chief Executive Officer Tracy Robinson told analysts, adding that summer port strikes in British Columbia hurt the business.

Still, Canadian National reiterated the guidance it gave investors in July for a “flat to slightly negative” change in earnings per share this year.

The Montreal-based freight operator is sticking with its target of 10% to 15% earnings growth per year over the next three years. “I believe we’ve seen the bottom on volumes,” Robinson said.

The railway’s revenue from shipments of forest products and chemicals and petroleum fell by double-digit percentages in the quarter.

But grain and fertilizer revenue was up 16%, and automotive rose 14%. The United Auto Workers strike, which began in September, had little impact.

In addition to a slowing economy, Canadian railways are also contending with the hangover from the port strikes, which forced some traffic to reroute to US west coast ports.

It’s unclear if the volume shift to the US is temporary or if it will be a challenge for Canadian railways over the longer term, RBC Capital Markets analyst Walter Spracklin said in a note prior to the earnings.

Fuel surcharges were down because of lower energy costs, crimping revenue. The company’s operating ratio, which measures expenses against revenues, was 62% on an adjusted basis, above its 60% target.

The board approved a 13% boost in the budget for share buybacks, to C$4.5 billion.

Updated: 10-25-2023

Canadian Pacific Cuts 2023 Outlook On Cooling Economy, Port Strike

Railway operator Canadian Pacific Kansas City Ltd. unveiled a more muted full-year outlook, saying a weakening economy and spate of labor disruptions weighed on freight volumes in the third quarter more than management had anticipated.

CPKC revised its 2023 outlook to say that earnings per share will be “flat to slightly positive” compared with last year on an adjusted basis. Previously, it said it would have mid-single-digit growth this year.

Chief Executive Officer Keith Creel called it a “challenging quarter” with softening consumer demand and supply chain snarls resulting from a dockworkers’ strike in British Columbia.

“Certainly not the outcome we had planned, but it’s the prudent thing to do at this point,” Creel told analysts. “That said, it’s not the challenges that define us, but rather how we respond.”

Earnings fell to 92 Canadian cents a share on a combined adjusted basis, a 9% decline from a year earlier. Revenue grew 44% to C$3.3 billion because of the acquisition of Kansas City Southern, which received regulatory approval earlier this year.

“We’re a little over six months in this combination into our forever story,” Creel said on a conference call with analysts. The growth opportunities “remain unchanged. We’re successfully integrating this network.”

Updated: 10-29-2023

How Digital Freight Darling Convoy Ran off The Road

The Seattle-based freight broker went from a $3.8 billion valuation to a shutdown in just 18 months.

Convoy had smart technology, a star-studded lineup of investors and a shiny valuation that spoke to its big ambitions.

But the backing that investors sent the business in early 2022, at the peak of pandemic-driven shipping demand and venture-capital fervor for new supply chain tech, also helped accelerate the undoing of one of the brightest of a long lineup of digital startups.

The funding round in April 2022 brought Convoy, a Seattle-based freight business with early backing from Jeff Bezos and Bill Gates, $160 million along with $100 million in venture loans that gave the business a value of $3.8 billion.

Industry experts and people familiar with Convoy say the debt was one factor in the rapid downfall of a company focused mostly on high-volume, low-margin freight that was ill-equipped to handle the sharp downturn in demand that has hobbled shipping markets over the past year.

By this year, Convoy was losing $10 million a month, according to a person familiar with the company. Its executives spent several months aggressively seeking new investors or outright buyers, including package-delivery giant United Parcel Service and C.H. Robinson Worldwide, the nation’s largest freight broker, according to people familiar with the discussions.

The company came so close to clinching a deal that its executives began mapping out an integration strategy, the person familiar with the company said.

But the deals fell through, and with about $40 million left at Convoy, venture firm Hercules Capital stepped in to recoup some of the money it was owed under the lending.

Convoy, founded in 2015 by two former Amazon.com veterans, effectively gave up its efforts earlier this month, shuttering the business, laying off more than 400 employees and keeping on only a core group of workers as it tries to sell the company’s technology.

Hercules is now overseeing the sale of Convoy’s assets including its software, the person said. The Wall Street Journal reported Friday that another digital-focused startup, freight forwarder Flexport, was in talks to buy the technology.

Benjamin Gordon, managing partner at private-equity firm Cambridge Capital LLC, said venture debt is attractive to startups because it is cheaper than equity as long as the company maintains rapid growth.

“The problem with leverage is it multiplies the upside, but also the downside,” Gordon said. “So if you miss your targets, venture debt can accelerate your demise. This is exactly what happened at Convoy.”

A spokesman for Hercules Capital declined to comment.

The abrupt end to a business that attracted such lofty backing and high profile support—its investors included Bono and The Edge of the band U2—highlights a sudden downturn in shipping demand that has also chilled the once-hot market for venture investment in the logistics sector.

Venture capital deals in the sector totaled $5.7 billion in the first half of 2023, down from $22.7 billion in the first half of 2022, according to PitchBook Data.

Convoy aimed to disrupt freight brokerage, a fiercely competitive corner of the trucking industry in which middlemen match loads from retailers and manufacturers to available trucks, many operated by small companies and independent truckers.

It is a fast-paced business, with profits for brokers coming in the space between the money they charge shipping customers and the rates that truckers charge to haul loads.

Convoy founders Dan Lewis and Grant Goodale believed that by automating the transactions, similar to the way ride-sharing companies link drivers and passengers, they could take costs out of the process and speed up supply chains.

The business drew major customers that included brewer Anheuser-Busch InBev, home-improvement retailer Home Depot and consumer-products suppliers Procter & Gamble and Unilever.

Similar startups including Transfix and the Uber Freight business at ride-sharing app Uber Technologies, also have targeted the market.

A digital freight startup in China, Full Truck Alliance, also known as Manbang, raised $1.6 billion in a U.S. public stock offering in 2021 after attracting early investment from SoftBank Group’s Vision Fund and China’s Tencent.

But Convoy couldn’t figure out how to turn that business into sustained profits.

Jeff Tucker, chief executive of New Jersey-based freight broker Tucker Company Worldwide, said Convoy’s technology was best suited to so-called transactional business—shipments owned by customers that will switch between brokers and carriers for relatively small differences in price.

“It’s trying to make money in the least profitable freight,” Tucker said. ”There’s zero margin in that and a lot of headaches.”

Convoy’s business was designed to operate similar to commodity trading, but using an algorithm to buy and sell freight loads and trucking capacity.

The person familiar with the company said the costs to develop and maintain the technology required revenue that Convoy never achieved, even at the peak of shipping demand during the Covid-19 pandemic.

The company “didn’t get big enough, fast enough,” the person said.

Industry executives say the effort to take the passenger ride-matching business into shipping faces major hurdles.

The vast majority of freight moves under contracts rather than the spot market that the digital startups are focused on, executives said, and industrial freight can be complicated, carries high stakes for its owners and demands human intervention when shipments go off track or are delayed.

Evan Armstrong, chief executive of research group Armstrong & Associates, said advances by the startups have helped spur technology investments at traditional brokerages such as C.H. Robinson.

That also has provided greater competition to the startups from freight brokers with large lists of customers and trucking companies that have been built up over time.

Convoy had attracted funding from an investment arm of Google parent Alphabet and its board included tech luminary Reid Hoffman, a Silicon Valley venture capitalist and co-founder of LinkedIn.

The company raised $1.1 billion in several funding rounds. Its peak valuation in April 2022 of $3.8 billion followed a round that raised $160 million led by investment firm Baillie Gifford and $100 million in venture-debt from Hercules.

Convoy hoped the funding would buy the company time to find a strategic investor or buyer. But the round last year came just as investors were tightening spending amid rising interest rates and economic uncertainty.

At the same time, freight demand slowed and shipping rates fell, sending earnings across the freight sector into a tailspin.

C.H. Robinson saw second-quarter profit this year fall 72% compared with a year ago. J.B. Hunt Transport Services, a freight bellwether that has a large brokerage unit, reported earlier this month that its profit tumbled more than 30% in the three months ended Sept. 30.

Most big transport operators have broad revenue streams, however, that may range from global forwarding and contract logistics to dedicated fleet operations for retailers.

Uber Freight expanded its revenue stream in 2021 by buying transportation-management provider Transplace in a $2.25 billion deal.

Convoy passed up opportunities to diversify. Lewis, the company’s co-founder who also served as chief executive, said in 2021 that the company was in no rush to merge with another company or to sell itself.

The company sought to branch out, including by launching a service for other brokers to book freight through Convoy’s platform.

When the freight downturn hit, Convoy undertook several rounds of layoffs that slashed its workforce to roughly 500 workers from a peak of around 1,500 employees.

Lewis, in an Oct. 19 email to staff announcing the last round of layoffs as the business wound down, told employees their work to advance technology in brokerage would leave its mark on the freight industry.

“You guys rock,” Lewis signed off the email: “#TruckYeah, Dan.”

Updated: 11-3-2023

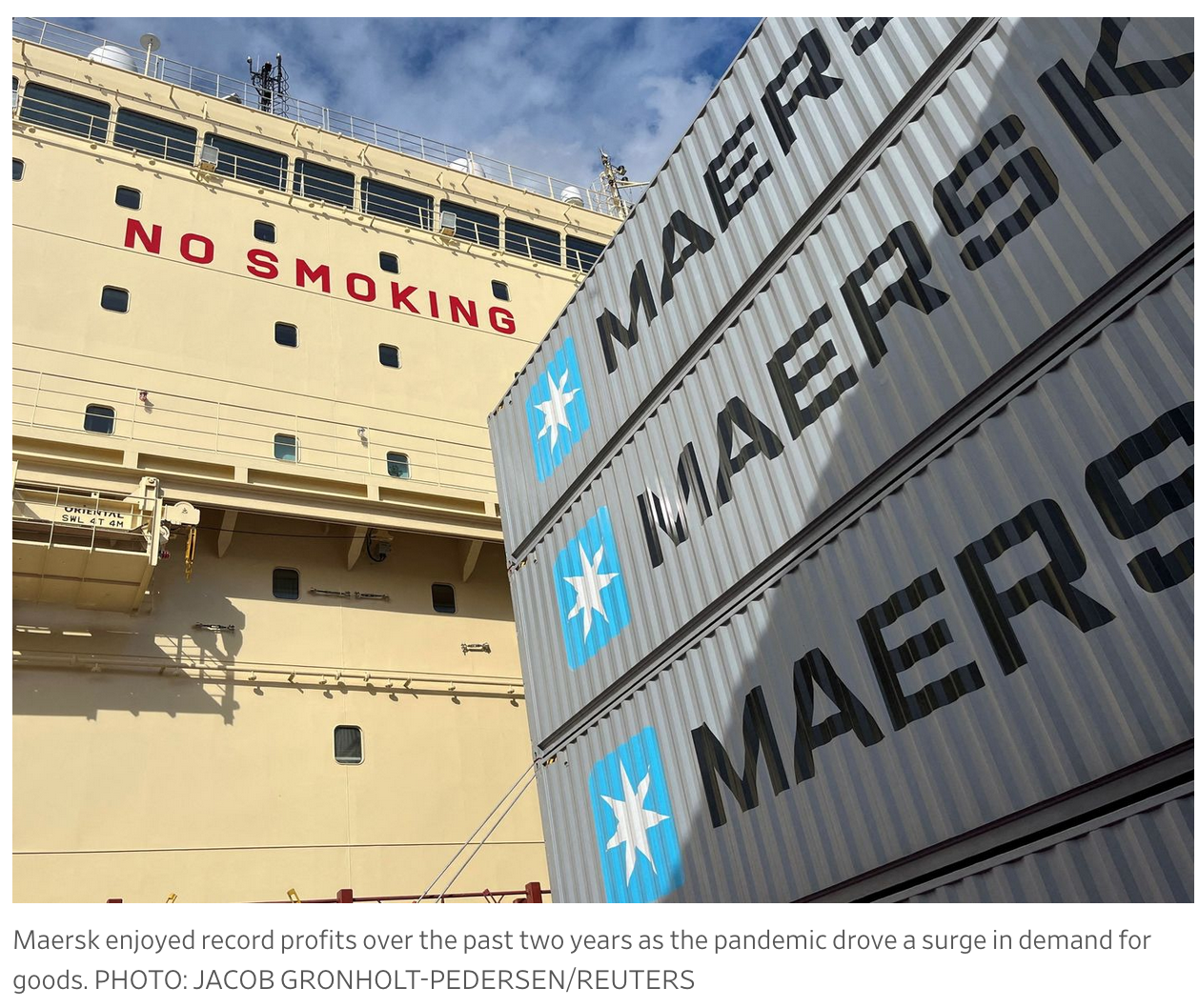

Maersk To Cut 10,000 Jobs As Cargo Boom Ends

Shipping giant swings from bumper profits to layoffs as demand for seaborne trade weakens.

Shipping and logistics giant A.P. Moller-Maersk said it would cut more than 10,000 jobs, as a pandemic-fueled cargo boom has ended, leaving the industry with a surplus of ships and sharply lower freight rates.

Maersk, a bellwether for global trade, saw its third-quarter profit plummet to $521 million from $8.88 billion last year. Its main Ocean division posted a quarterly loss for the first time in many years.

The company’s shares slumped in Copenhagen by about 11%. Shares of rival Hapag Lloyd in Frankfurt fell by 8%.

Maersk and its rivals enjoyed record profits over the past two years as the pandemic drove a surge in demand for goods, which coupled with port congestion, drove freight rates sharply higher.

But many sailings across the big ocean trade are now becoming loss-making.

Freight rates fell 58% on year in the third quarter and are down 90% from their peak during the pandemic. Revenue in Maersk’s main shipping business fell 56% on year to $7.9 billion.

Container lines dug themselves into a hole by ordering too many ships during the pandemic to move record amounts of cargo and are now looking at a weaker market.

Americans are back spending but are buying fewer big-ticket items like cars, home improvements or tech gear that move in boxes across the seas.

Chief Executive Vincent Clerc said shipping is facing a new normal with subdued demand and inflationary pressure. “Since the summer, we have seen overcapacity across most regions triggering price drops,” Clerc said.

Maersk expects the market to remain volatile and will cut its workforce below 100,000, from 110,000 at the start of the year. This will result in savings of $600 million next year.

Given the uncertainty ahead, it will also cut capital expenditure this year and next while placing its share buyback program under review.

Maersk expects full-year underlying earnings before interest and tax of $3.5 billion to $5 billion, with the company guiding toward the lower end of the range.

Analysts say the industry imbalance will take time to clear. “This year is one of transition, but 2024 will most definitely be tough,” said Peter Sand, chief analyst at Xeneta, a Norway-based shipping-data provider.

“We expect container demand next year at around 2% and fleet growth at 6%, meaning a glut of ships into the water well into 2025.”

Maersk Cuts 10,000 Jobs On Weakening Global Trade; Shares Tumble

* Shipping Giant’s Shares Fall More Than 18% In Copenhagen

* Company Is Cutting 9% Of Workforce As It Accelerates Savings

A.P. Moller-Maersk A/S, a bellwether for global trade, fell after saying it’s cutting at least 10,000 jobs to shield its profitability in a shipping market that is set to remain weak until about 2026.

Maersk shares extended declines to more than 18%, bringing the destruction of market value to about 36 billion kroner ($5.1 billion), at 1:08 p.m. in Copenhagen.

“If you look at the order book and what is going to come over the next couple of years, I think we’re probably settling in for a very subdued and pressured environment for two to three years ahead,” Chief Executive Officer Vincent Clerc said in an interview with Bloomberg TV’s Mark Cudmore and Tom MacKenzie.

The personnel reductions, equivalent to 9% of headcount, are prompted by lower freight rates and increased competition in marine transport. About 6,500 of those positions have already been eliminated, Clerc said.

Maersk expects to save $600 million through the job cost measures, according to a statement on Friday. The Copenhagen-based company will also put its 2024 share buyback program under review and reduced its estimate for capital expenditure in 2023 and 2024.

Container lines are facing an abrupt drop in earnings after record profits in 2021 and 2022 when high demand for consumer goods during the pandemic, coupled with limited vessel supply, drove freight prices higher.

This year, global economic growth has lost steam and companies are working through existing inventories instead of transporting new goods to Europe and the US. At the same time, an oversupply of vessels is building up on the market.

Maersk’s earnings before interest, tax, depreciation and amortization fell more than 80% to $1.88 billion in the third quarter, meeting analyst estimates.

Global container trade will probably decline 0.5% to 2% this year, Maersk said, compared with its previous prediction of a contraction of 1% to 4%.

Maersk said it now sees 2023 underlying Ebitda “toward the lower end” of a previously given range of $9.5 billion to $11 billion.

Its reduced capital expenditure plans and review of its planned share buybacks “will likely be taken negatively,” analysts at Citigroup Inc. led by Sathish Sivakumar said in a note to clients.

Analysts are likely to trim their full-year earnings estimates for the company by mid-single digits, they added.

The downturn in the industry is set to be deeper and longer than the market expects, Goldman Sachs analysts warned in a research note last month, repeating a recommendation to sell Maersk stock.

According to Bloomberg Intelligence, Maersk may have to wait until 2025 before earnings will grow, amid weak rates.

Maersk, which transports about one-sixth of the world’s containers, prepared for things to sour, seeking to lock in many of its big customers on long-term contracts back when rates where higher to ease the impact of freight-rate volatility.

The Danish company is also spreading its focus to cover land-based container logistics, where profit margins traditionally have been higher than at sea.

Updated: 11-6-2023

Fedex Suggests Pilots To Fly For American Airlines As Cargo Demand Slows

FedEx said on Monday it is encouraging pilots to seek work flying for a unit of American Airlines Group

as the U.S. parcel giant grapples with a slowdown in e-commerce demand.

The global shipping downturn has been a margin drag for most operators in the logistics sector and FedEx too was met with a daunting task of matching costs to lower demand after the e-commerce bubble burst with customers returning to their pre-pandemic lifestyles.

“Given the softness in air cargo demand across the industry and current FedEx flight operations staffing levels, we shared information about this unique opportunity with our pilots,” FedEx said in a statement.

FreightWaves was the first to report on the development.

FedEx in the last year has slashed jobs, retired planes, shuttered offices and pared back profit-sapping Sunday deliveries to cut $4 billion in permanent costs by the end of its 2025 financial year.

Meanwhile, the U.S. airline industry has also been struggling with industry-wide pilot shortage, worsened by pandemic layoffs and retirements as pent-up demand for travel remains unabated.

Regional carrier PSA Airlines, a subsidiary of American Airlines, is now recruiting experienced FedEx pilots for entry-level captain’s position.

American Airlines last month said its regional carriers do not have enough pilots with 1,000 hours of flight time to be able to upgrade to captain.

“Their recognition of the quality had of our crew force is clear in this recruitment initiative that provides FedEx pilots an additional career path opportunity,” FedEx said in the statement.

Updated: 11-10-2023

World’s No. 3 Container Carrier Warns Against Price War

* French Transporter Reports Third-Quarter Net Drops 94%

* Marseille-Based Company Has About 100 Vessels On Order

CMA CGM SA, the world’s No. 3 container carrier, urged the industry to avoid a price war as the delivery of new vessels threatens to push global shipping to a protracted slump.

“New capacity expected on the market in 2024 will likely continue to pull down freight rates,” the French company controlled by billionaire Rodolphe Saade and his family said in an earnings statement Friday. “The slowdown in the global economy is expected to continue weighing on our industry in the period ahead.”

The closely held company’s third-quarter net income fell 94% to $388 million from $7.04 billion in the same three months a year earlier. The profit margin narrowed to 17.5% from 46%.

CMA CGM follows rivals A.P. Moller-Maersk A/S, the second-biggest container line, and No. 5 Hapag-Lloyd AG in painting a gloomy outlook for the notoriously cyclical industry.

Maersk said last week it’s cutting at least 10,000 jobs to protect profitability.

Marseille-based CMA CGM said it’s also reducing costs, but declined to specify whether jobs are being eliminated.

The industry’s reversal of fortunes began in the second half of 2022, after an unprecedented boom in demand during the pandemic sent cargo rates soaring and profits to record highs.

The windfall led CMA CGM and others to order vessels that are now entering service. Global capacity is rising 5% in the last half of this year and is expected to gain 9% in 2024, the company said.

At the same time, two wars, elevated inflation and high borrowing costs are weighing on consumer purchases and business confidence.

“There is a risk of imbalance because demand is weak and supply is high, and in this case what happens is that rates fall,” CMA CGM Chief Financial Officer Ramon Fernandez told reporters Friday.

In the decade before the pandemic, container companies struggled to make money in an environment where available capacity outstripped the demand to move goods, leading to rock-bottom prices often set below costs in a battle for market share.

While Fernandez stopped short of saying there’s currently a price war going on and said rates have more or less stabilized around 2019 levels, he called for discipline.

“It’s impossible to say what will happen in 2024, this will depend on the behavior of the players,” he said. “With 9% capacity growth we would expect vessel scrapping to replace aging fleets.”

CMA CGM has about 100 new vessels on order that will be added to a fleet that now stands at 621, Fernandez said.

“Each actor will have to be responsible to ensure that the market remains reasonable amid rates that are relatively low,” he said. “Price wars after a while hurt not only those who start them but everyone, even customers because they get erratic behavior from their partners.”

Surging profits over the previous two years filled the coffers of the Saades and rival European shipping tycoons like Gianluigi Aponte, founder of Mediterranean Shipping Co., and Klaus-Michael Kuehne, who has stakes in logistics and shipping companies.

CMA CGM went on a buying spree, most recently bolstering its media assets like La Tribune newspaper. The company is also working to close its biggest purchase to date: Bollore SE’s logistics arm for an enterprise value of €5 billion ($5.3 billion).

The Saade family is worth about $19 billion, according to the Bloomberg Billionaires Index. That compares with $33 billion in April.

Updated: 11-12-2023

Shipping Shifts From Jackpot To Job Cuts After $364 Billion Boom

* Container Carriers Head For 2-3 Year Slump On Excess Supply

* Price Wars Will Hurt Everyone, CMA CGM Executive Says

Consumers gearing up to buy the latest imported appliances, clothes or electronic gadgets this holiday season might want to spare a thought for the companies that will struggle to make money for the next few years hauling products across the ocean.

That’s because the container shipping industry, cast as the Grinch that spoiled Christmas over the past two years with record-high freight rates and slow deliveries, is returning to its pre-pandemic place in the corporate world: perennial underachiever Charlie Brown.

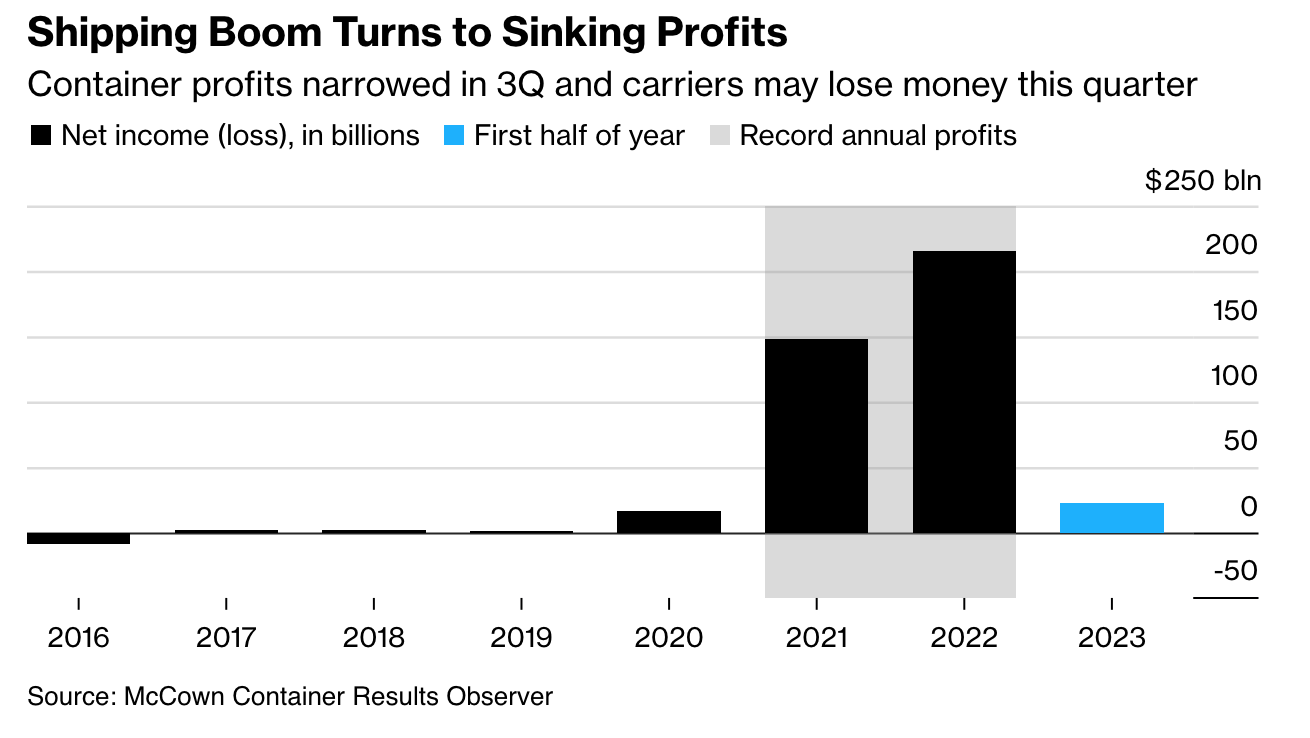

The biggest carriers posted net income totaling $364 billion in 2021 and 2022, according to figures compiled by industry veteran John McCown, after a decade of scant profits.

They’ll likely drift back into the red this quarter as the rates they charge fall below costs and look to stay there for the foreseeable future.

Booms-turned-busts have been more abrupt and sensational, but rarely has an established industry so tied to the global economy lurched from historic profits to below break-even levels more directly than the shipping lines that move 80% of the world’s merchandise trade have this year. After Covid’s massive demand shock, the culprit now is too much supply.

“I’m certainly concerned about the next 24 to 36 months,” Rolf Habben Jansen, chief executive officer of Hamburg-based Hapag-Lloyd AG, said in an interview last week. “We are going to see a downturn.”