Is The $349 Billion Small Business Relief Package Another Big Bank Bail-out Fund? (#GotBitcoin?)

Big banks may have just killed the government’s $349 billion relief effort to save America’s devastated small businesses. Is The $349 Billion Small Business Package Another Big Bank Bail-out Fund? (#GotBitcoin?)

- Applications for forgivable loans for small businesses opened on April 3, but last-minute changes have thrown the program into chaos.

- Banks, fintechs, and other financial institutions were expected to perform a critical function in processing and disbursing funds for the $349 billion small business relief program.

- But a combination of high demand, conflicting information, and changing guidance are causing significant uncertainty for lenders and borrowers.

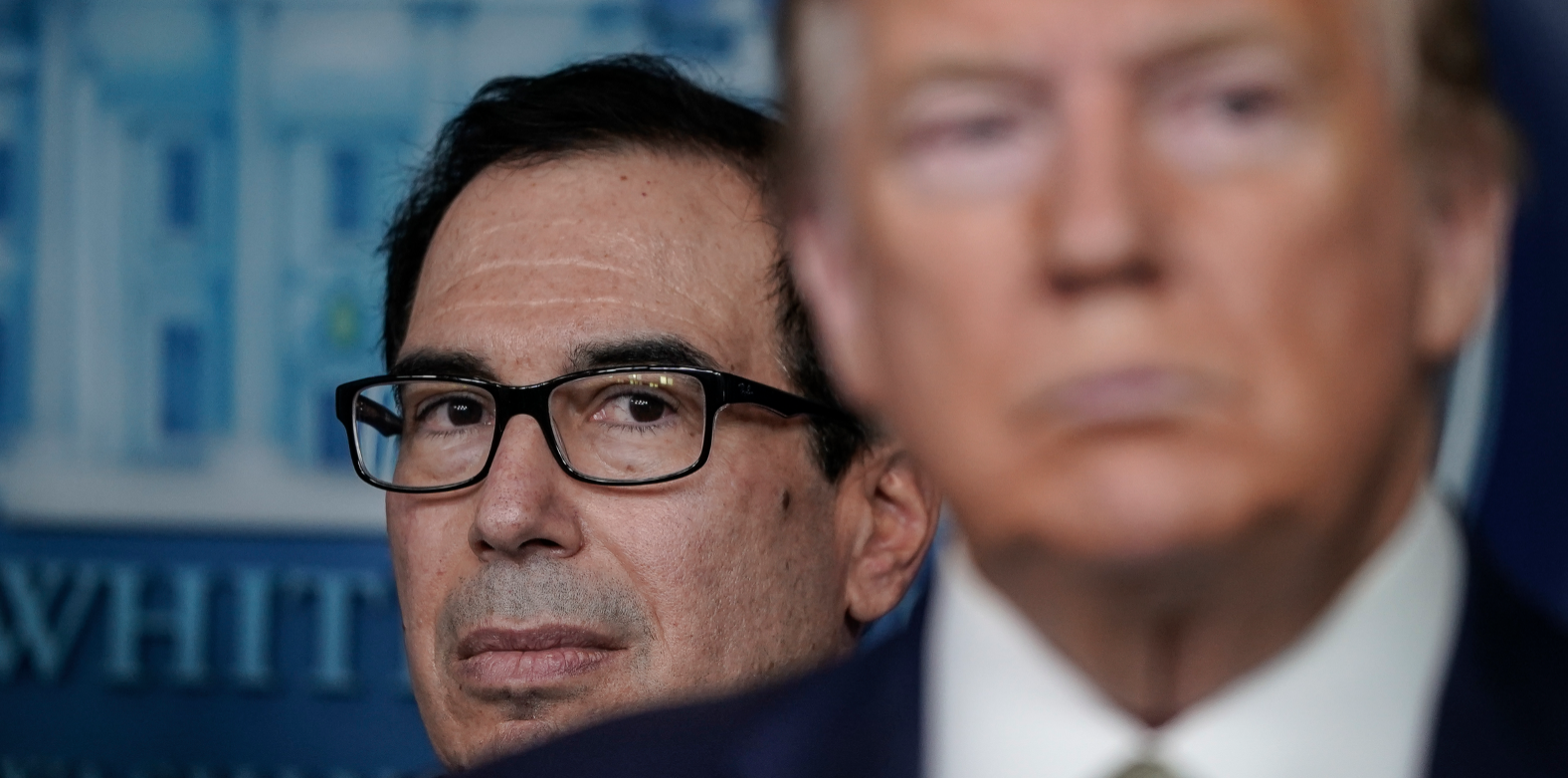

- On Friday afternoon, Treasury Secretary Steven Mnuchin tweeted that $1.8 billion in Payroll Protection Loans had been processed, “mostly all from community banks. Big banks taking in large amounts but not yet submitted in these numbers.”

- “This will be dead on arrival” if the problems aren’t fixed, said the CEO of a nonbank SBA lender in an interview with American Banker on Thursday before the launch.

Money that was authorized for small business relief in the $2 trillion coronavirus stimulus package may face significant delays in reaching its intended recipients due to a chaotic rollout of the application process.

Just hours before loan applications were scheduled to open on April 3, media reports show a rocky start to the $349 billion initiative to extend much-needed financial support to US small businesses.

“If they don’t get this fixed, they can launch the program tomorrow and have all the publicity – it won’t matter because this will be dead on arrival,” said Chris Hurn, the CEO of a nonbank SBA lender in Lake Mary, Florida, in an interview with American Banker on Thursday. “It will be a spectacular failure.”

That is unwelcome news for small businesses, who have been left treading water since the economic disruptions from the public-health emergency accelerated last month. Most small businesses lack the cash reserves to weather a month-long shutdown, and the clock is ticking.

The program was lauded by many for its simplicity when it was originally outlined by Congress in March, but in the intervening weeks, a combination of high demand, conflicting information, and changing guidance are causing significant uncertainty for lenders and borrowers.

On Friday afternoon, Treasury Secretary Steven Mnuchin tweeted that $1.8 billion in Payroll Protection Program loans had been processed, “mostly all from community banks. Big banks taking in large amounts but not yet submitted in these numbers.”

While Bank of America was the first major bank to open it’s PPP loan portal, the bank sparked a social media backlash for its decision to restrict applications to customers who had existing “small business” accounts. (The bank was itself the recipient of massive bailouts in 2009).

Banks, fintechs, and other financial institutions were supposed to perform a critical function in processing and disbursing funds, but reporting from Reuters indicates that thousands of banks – including several of the country’s largest lenders – do not intend to participate.

Banks initially mobilized behind a plan that called for federally guaranteed, forgivable loans with low interest rates, long deferral periods, and a 10-year amortization schedule.

But in the days running up to the program’s launch, the US Treasury issued new rules that dramatically altered those calculations by further lowering rates, shortening the deferral period, and accelerating the amortization.

As a result, many established lenders are reportedly reconsidering their participation, saying the new rules don’t make economic sense for their businesses, according to Reuters reporting of an executive conference call of a trade group whose members include JPMorgan Chase, Bank of America, Wells Fargo, and Citigroup.

The current interest rate of 0.5% “would create unacceptable losses for lenders, which have a duty to preserve their financial strength for the sake of their communities,” the Independent Community Bankers of America, a trade group that represents approximately 5,000 small and mid-sized financial institutions, wrote in a letter to Trump administration officials.

One justification offered by the Treasury for the rule changes is that demand for the program is expected to outstrip the funding level authorized by Congress.

But demand on financial institutions is also shaping up to prove problematic. In another interview with the Orlando Sentinel, Hurn said his office received more than 2,500 loan applications in less than a week.

“We don’t see 2,500 loan submissions in 2½ years time,” he said.

Fintech companies have also been jockeying for a position to process and serve loans, but only received confirmation that they would be eligible to participate when Secretary Mnuchin gave a press interview last Sunday.

Even so, at $349 billion, the small business relief program is at least ten-times greater than all fintech small business lending since 2017.

Updated: 4-8-2020

Congress Already Prepares To Pass CARES 2 Act Economic Aid

Lawmakers rush to approve more funding for small-business paycheck protection loans, put off infrastructure and other stimulus ideas.

Congress moved fast. The coronavirus crisis moved faster.

After quickly passing a $2.2 trillion aid package designed to tide over American households and businesses until the worst of the pandemic had passed, Republicans and Democrats were hoping to start working on a stimulus package to rebuild the economy, potentially including long-sought infrastructure spending and tax cuts.

Instead, less than two weeks since President Trump signed the bill, lawmakers find themselves racing to shore up the relief measures already in law, rather than formulating new ones.

“I don’t think anyone two weeks ago imagined that we would need to move so quickly to augment” the last package, said Rep. Jared Huffman (D., Calif.). “Everyone assumed we would be moving on to the broader economic package, including infrastructure. But this crisis is just a lot more acute than we previously imagined.”

The shift in legislative targets underscores the challenge Congress has faced trying to keep up with the twin public health and economic crises, which have only continued to deepen as the number of people in the U.S. who have tested positive for the virus tops 400,000 and stay-at-home orders have crippled businesses nationwide.

Senate Majority Leader Mitch McConnell (R., Ky.) said Tuesday he wants the Senate to approve additional assistance for small businesses this week in response to the Trump administration’s request for $251 billion more for the program, aimed to keep workers on payrolls.

That set a rapid timeline that will require an agreement with Senate Democrats. Mr. McConnell had previously cautioned against taking any immediate additional legislative action, calling on lawmakers to wait and see how the bill, dubbed the CARES Act, turned out.

“Even as the CARES Act continues to come online, one such need is already clear: The small-business Paycheck Protection Program needs more funding,” Mr. McConnell said.

House Speaker Nancy Pelosi (D., Calif.) and Senate Minority Leader Chuck Schumer (D., N.Y.) said Wednesday that assistance to small businesses must also include an additional $100 billion for health care providers, $150 billion for state and local governments, and increased food assistance benefits.

The top Democrats on Capitol Hill said that a bill this week must still be followed by an additional round of relief legislation dubbed CARES 2.

“After we pass this interim emergency legislation, Congress will move to pass a CARES 2 Act that will extend and expand the bipartisan CARES Act to meet the needs of the American people,” the two wrote.

Mr. McConnell said he wanted to hold a Senate vote this week on expanded small business aid and then send it to the House, but the parties’ differing stances could muddle the timing for passage. Also, both chambers need to keep lawmakers in line, as they are aiming to pass the legislation without requiring in-person roll call votes, as Congress is currently in recess.

Last week, Mrs. Pelosi had held a number of conference calls with House Democrats looking at various new initiatives, including infrastructure and housing assistance, for the next bill. Mr. Trump had also lent his support to tackling a major infrastructure package as part of the next set of legislation.

But House Democrats are now juggling two bills both aimed at bolstering elements of the last package. Mrs. Pelosi told House Democrats on Monday that a CARES 2 bill could run to more than $1 trillion and would provide an additional round of direct payments, further bolster unemployment benefits, and assist first responders.

For a Congress divided between a Democratic-controlled House and GOP-led Senate, the legislative response has been unusually quick. The $2.2 trillion package was the third in a series of bills aimed at responding to the coronavirus crisis Congress passed in March alone, each several times as large as the last.

The first was an $8.3 billion bill that funded efforts to find a vaccine to the new disease, and the second provided more than $100 billion in further relief efforts, including expanding paid leave.

For a disease that has forced a large part of the U.S. economy to shut down, that pace hasn’t been fast enough. Former Federal Reserve Chairwoman Janet Yellen warned House Democrats on Monday that initial weekly unemployment claims, which totaled a record-shattering 10 million in the past two readings, will only continue to grow.

“The circumstances are just overtaking us here in terms of the depth and scope of the economic fallout of this public health crisis,” said Sen. Josh Hawley (R., Mo.), who has been pushing a plan to restore workers’ paychecks by having the government cover 80% of employers’ payroll costs, up to the national median wage, at all firms affected by the crisis, and provide incentives for rehiring workers laid off last month.

House Democrats have been eyeing releasing a CARES 2 bill next week, according to people familiar with the efforts, and voting on it after April 20. The current small business program is aimed at helping firms cover payroll and other essential expenses for roughly two months, and lawmakers had been looking at providing support for a longer period.

Mrs. Pelosi is likely to face pressure from House Democrats’ left wing to fight for other measures, including direct assistance to a broader range of people, expanded health care coverage and funding for voting by mail in November. Mr. Schumer (D., N.Y.) said Senate Democrats would push for the next bill to include increased pay for essential workers, a broad category that would include health care workers, grocery store clerks and transit employees, among others.

Whether those measures would be enough is uncertain.

“It’s hard to prescribe the appropriate amount of resources to address the financial crisis when the health crisis is very much blazing,” Rep. Andy Kim (D., N.J.), a member of the House Small Business Committee. “In the absence of clarity on the health side we’re constantly just trying to fill a hole that keeps getting deeper.”

Even after the next relief package or packages, lawmakers still anticipate they will turn to a broad stimulus bill that would include elements like infrastructure investments.

“You’re going to have a need for far more than what is done,” Sen. Cory Gardner (R., Colo.) said. “What we’ve done is a good start, it claws us back to the starting line, by no means does it get to where we were.”

Updated: 4-13-2020

US Gov Opens Door For Fintechs To Become Lenders In COVID-19 Relief Plan

Main Street businesses hit by the COVID-19 crisis now have access to a lifeline from fintech lenders.

On April 9, the United States Small Business Administration released its application form for nonbanks to sign on as lenders under the federal Paycheck Protection Program.

Speaking to Cointelegraph on April 10, John Pitts, head of policy at San Francisco-based fintech Plaid, said the development was “a critical step” that would broaden the reach of the relief program and ensure that as many firms as possible get access to the help they urgently need.

Fintech In The Spotlight

The PPP — first announced as part of the U.S. government’s $2 trillion relief package on April 3 — aims to support small businesses hit by the COVID-19 pandemic by providing them with access to low-interest, forgivable loans.

While Treasury Secretary Steve Mnuchin had indicated early on that nontraditional financial services firms would be eligible to participate in the program, rollout had at first been slow for nonbanks, Pitts noted.

The administration first certified already-approved SBA lenders, which extended loan applications to their existing clients — this being “the easiest solution under a tight timeframe.”

A host of fintechs have already ostensibly signed on after just a few days, while reports state that some banks are stalling with loan approvals, leaving small firms in limbo. This conjuncture could do much to demonstrate the benefits that new actors in finance can offer. Pitts noted:

“One of the biggest advantages that fintechs have over traditional lenders is their ability to be more agile. Fintech lenders are digital-first and can process loans quickly — a matter of hours versus days compared to traditional lenders.”

Many banks have reportedly already revealed they will only extend loans to existing small business customers. For firms that may have never needed a small business loan before — as well as for those perhaps too small to qualify for a loan from a traditional bank — “fintech lenders will become a life-line,” he said.

The situation is not entirely resolved, however. While the SBA has finally made applications for fintechs accessible, “the Fed has to also do its part.” Pitts added:

“The Fed previously announced they would open a lending facility for all depositories participating in the PPP program and would extend the facility to fintechs ‘in the near future.’ Small businesses, and the lenders that support them, need access now.”

Is The $349 Billion,Is The $349 Billion,Is The $349 Billion,Is The $349 Billion,Is The $349 Billion,Is The $349 Billion,Is The $349 Billion,Is The $349 Billion,Is The $349 Billion,Is The $349 Billion,Is The $349 Billion,Is The $349 Billion,Is The $349 Billion,Is The $349 Billion,Is The $349 Billion,Is The $349 Billion,Is The $349 Billion,Is The $349 Billion,Is The $349 Billion,Is The $349 Billion,Is The $349 Billion,

Go back

Leave a Reply

You must be logged in to post a comment.