Federal Reserve Money-Printing Results In $14Tril. Of U.S. Consumer Debt (#GotBitcoin)

U.S. Consumer Debt Is Now Breaching Levels Last Reached During The 2008 Financial Crisis. Federal Reserve Money-Printing Results In $14Tril. Of U.S. Consumer Debt (#GotBitcoin)

U.S. Consumer Debt Hit $14 Trillion In The First Quarter Of 2019

Consumer debt is growing to worrisome levels.

Ben Mohr, senior research analyst of fixed income at investment consultant Marquette Associates, calculated that total U.S. consumer debt hit $14 trillion in the first quarter of 2019, surpassing the roughly $13 trillion of leverage accumulated in credit cards, auto loans and mortgages and other debt back in 2008, when those souring loans and securities pegged to them helped to send global markets into a tailspin (see chart below):

Mohr told MarketWatch that the increase in student loans — often cited as a source of consternation for economists and strategists — saw a notable increase. At the end of the first three months of 2019, student loan debt hit $1.486 trillion, according to credit data from the New York Federal Reserve. By comparison, student loan at the height of the financial crisis was $611 billion and has been mostly rising since, Mohr said. “It has ballooned and that’s a dramatic increase,” the fixed-income analyst said of the student-debt expansion.

Analyzing growing consumer leverage another way, Mohr said the ratio of debt compared against the U.S. population estimated at 327 million, according to U.S. Census Bureau data, translates to a record per-person debt ratio at $41.77, surpassing the ratio of $41.68 back in 2008.

Concerns about ballooning debt come as U.S. equity markets have been drifting toward records, with the Dow Jones Industrial Average DJIA, and the S&P 500 index within about 1.5% of all-time highs, while the benchmark 10-year Treasury note is hovering not far from its lowest levels in months at 2.09%.

Those market moves come against a backdrop of a Federal Reserve that is considering reducing borrowing costs for individuals and corporations from an already relatively benign range of 2.25%-2.50%.

So, should we be worried about rising consumer debt?

Mohr says there are some mitigating factors. Gross domestic product, the official scorecard of the U.S. economy, demonstrates an economy in far better shape than it was during the financial crisis. GDP, which includes all goods and services produced, expanded 3.1% in the first quarter of 2019, compared against 2008 when the overall economy contracted at an annual rate of 6.3%, according to the Bureau of Economic Analysis.

The Marquette analyst also noted that defaults on debt are tame, suggesting that investors aren’t being overwhelmed by the growing obligations. A pickup in loan delinquencies was a telltale sign that the economy was beginning to crack under the weight of debt, but Mohr said consumer delinquencies today are trending near historic lows.

Defaults on first-mortgage loans also are lower than pre-2008 financial crisis.

Historically low interest rates have helped consumers to manage debt and the Fed may further help that cause soon by complying with market wishes for yet-lower borrowing costs.

That said, if the economy does begin to contract into recession as some economists fear, the debt load could be a more pressing matter. “We are starting to see some chinks in the armor,” Mohr said.

Updated: 2-15-2020

1 In 5 People Making More Than $100,000 A Year Are Still Living Paycheck To Paycheck

And that doesn’t bode well for their retirement savings.

Making bank doesn’t mean you have money in the bank.

Fully 18% of people who earn more than $100,000 say they live paycheck to paycheck, according to a survey of 8,000 workers by global advisory firm Willis Towers Watson.

“There’s a high correlation between high pay — and living in a high-cost area and having an advanced degree,” Shane Bartling, the senior director for retirement for the firm, explains of why so many people making a chunk of change say they’re still living paycheck to paycheck.

Indeed, an analysis by personal finance site MagnifyMoney found that in some pricey cities it’s particularly hard to make it on $100,000. “The worst metro area for a family earning $100,000 includes Washington, D.C. and neighboring cities Arlington and Alexandria, Va.

After factoring in monthly expenses, families would be $315 in the red,” MagnifyMoney reported. “Stamford, Conn., San Jose, Calif., San Francisco, and the New York City area round out the five worst areas for affordability.”

Others may be facing a pile of student loan debt that makes it difficult for them to get out of the paycheck-to-paycheck lifestyle. Currently, Americans have a total of roughly $1.5 trillion in student loan debt — and graduate degrees are responsible for a chunk of that debt.

Wherever they live and no matter their debt levels, one thing is clear: Most Americans don’t feel prepared for retirement. Fully 58% of workers with pay of more than $100,000 indicated they are not saving enough for retirement; that goes up to 69% across income levels.

Frankly, they probably aren’t saving enough: The Employee Benefit Research Institute projects that more than four in 10 U.S. households where the head of the household is between 35 and 64 will likely run short of money in retirement.

Experts say there are ways to up your retirement savings, even if you’re feeling financially stretched. First, look for ways to slash your current spending to free up extra cash or consider a side gig to earn more.

You also shouldn’t beat yourself up if you can’t immediately max out your retirement contributions. Try to get at least up to what your employer matches and then gradually increase contributions as you can.

Ideally, you will “maximize contributions to your IRA, 401(k), or 403(b). You can contribute up to $19,500 in 2020 to your 401(k) or 403(b) plan, and if you’re 50 or older, you can contribute an extra $6,500,” explains Kimberly Foss, the founder of Empyrion Wealth Management in Roseville, Calif. .

She adds: “And don’t forget IRAs; the maximum contribution for 2020 is $6,000, with an extra $1,000 catch-up provision in you’re 50 or older. The tax-free compounding of these retirement accounts is strong magic for your income at retirement time.”

Updated: 6-11-2020

Total U.S. Debt Surges To $55.9 Trillion Amid Big Increases In Corporate And Government Borrowing

* Debt Surged And Household Net Worth Tumbled In The First Three Months Of The Year As The Initial Impact Of The Coronavirus Pandemic Hit, According To The Fed.

* Total Domestic Nonfinancial Debt Jumped By 11.7% To $55.9 Trillion, The Report Said.

* Debt Had Increased By 3.2% In The Previous Quarter.

Debt surged and household net worth tumbled in the first three months of the year as the initial impact of the coronavirus pandemic hit, according to Federal Reserve data released Thursday.

Total domestic nonfinancial debt jumped by 11.7% to $55.9 trillion, the Fed said in its quarterly statement on domestic financial accounts. Debt had increased by 3.2% in Q4 of 2019.

At the same time, plunging stock market values took a bite out of net worth, which fell $7.4 trillion to $110.8 trillion. Wall Street, however, staged a sharp recovery off its March lows, so much of that loss likely has been made up. Equity values fell by $7.8 trillion, while real estate value increased by $400 billion in the first quarter.

The biggest debt gain come on the business side, rising 18.8%, while federal government debt also jumped 14.3%. Total federal debt recently passed $26 trillion.

Household debt rose 3.9% due in large part to an increase on the mortgage side of 3.2%. Consumer debt rose 1.6%.

The increases in debt and decrease in household worth came as the longest expansion in U.S. history came to an end.

Earlier this week, the National Bureau of Economic Research declared that a recession started in February, following an 11-year expansion. The bull market in stocks ended the same month but turned around on March 23 due to excessive Federal Reserve liquidity injections.

Updated: 11-9-2021

Americans Ramp Up Credit-Card Spending In Return To Old Habits

Americans are racking up bills on credit cards, returning to pre-pandemic habits after emergency relief programs ended and the economy reopened.

Credit card balances increased by $17 billion to $800 billion in the third quarter, the second gain in a row after a year of declines, the Federal Reserve Bank of New York said Tuesday. While the total number is $123 billion lower than at the end of 2019, the past two quarters mark a return to relative normalcy.

“We are beginning to see the reversal of some of the credit-card balance trends seen during the pandemic, namely reduced consumption and the paying down of balances,” Donghoon Lee, research officer at the New York Fed, wrote in a report. “As pandemic restrictions are lifted and consumption normalizes, credit card usage and balances are resuming their pre-pandemic trends.”

Americans hold a record 520 million credit card accounts, with a massive $3.2 trillion in credit available.

Overall, U.S. household debt increased by $286 billion to $15.2 trillion last quarter — $1.1 trillion higher than at the end of 2019.

Most of the increase came in mortgage balances, the largest component of household debt. With the average 30-year rate holding to a relatively tight and historically low range during the period, millions of Americans with good credit took the opportunity to refinance and cut their monthly payments.

A surge in home prices during the pandemic has improved the equity position for millions of home owners. Still, banks remain cautious about who they lend to, the report shows. Of the $1.11 trillion in newly originated mortgage debt last quarter, 69% was for borrowers with credit scores over 760 — a high level.

Only 2% went to subprime borrowers, a sharp contrast to the 12% average seen between 2003 and 2007, before the Great Recession, according to the Fed. Last quarter there were 80.8 million mortgage accounts, down from more than 98 million accounts in early 2008.

Another finding from the report is that younger Americans are jumping into housing. A record amount in mortgage originations came from people aged 18 to 29 last quarter, almost double the amount from two years earlier.

Student-loan debt, the second-largest component of debt in American households, rose $14 billion last quarter. About 45 million Americans with student debt will resume payments in February after almost two years of a pandemic freeze.

Student debt has loomed large over President Joe Biden, who has enacted several targeted loan forgiveness programs — including most recently forgiving federal debt for Americans with severe disabilities — but fallen short so far of the sweeping action he promised on the campaign trail.

Americans owe a collective $1.8 trillion in student-loan debt, according to a separate measure by the Federal Reserve, a result of what critics call a broken system that cripples economic mobility, and one that cements the racial wealth gap, and affects women worse.

Updated: 11-18-2021

Banks Sending Out More Credit-Card Offers To Get Consumers Back Into Debt

Americans paid down credit-card debt during the pandemic. Credit-card issuers are spending big to get them borrowing again.

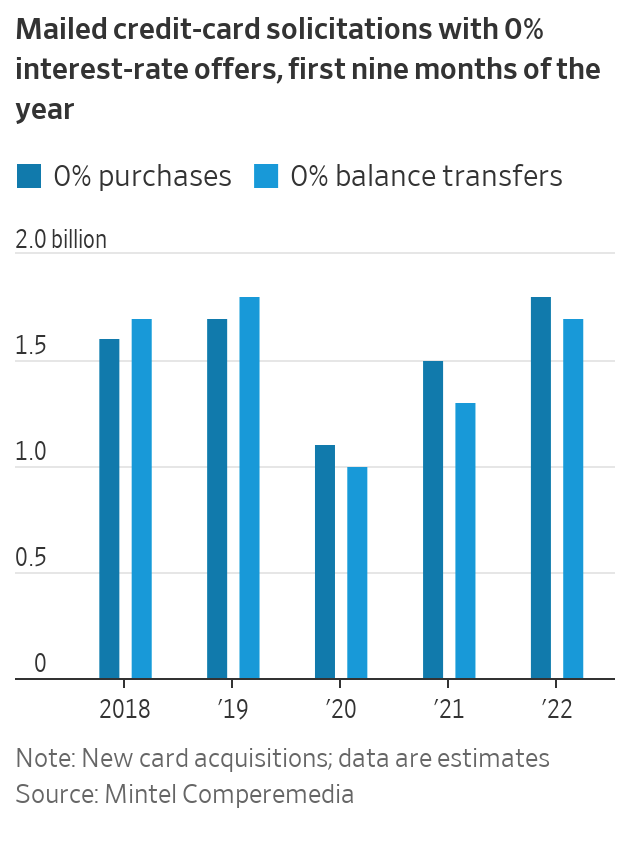

Banks’ credit-card marketing costs surged last quarter, and there is little evidence the multibillion-dollar spending spree will stop soon. Mailed credit-card solicitations are back above pre-pandemic levels. Issuers are making cash-back offers and other rewards more generous.

During the past two quarters, cash-back cards offered an average 1.11% per dollar spent, up from 1.08% in the beginning of the year and the highest level since at least 2010, according to WalletHub.com. Miles or points offered have reached their highest level in over a decade, at 1.2 miles or points per dollar spent.

Banks are venturing in new directions to appeal to a broader set of consumers. Capital One Financial Corp., known for subprime and travel-rewards credit cards with modest annual fees, launched Venture X, a $395-a-year card that comes with access to its first airport lounge. American Express Co. recently added a benefit for Walmart Inc. shoppers to its Platinum card that has a $695 annual fee.

Nearly every card issuer has the same goal: to find cardholders with good credit scores who will carry balances. These customers are among the most lucrative for banks, and their absence is keenly felt. Big banks’ credit-card profitability fell last year to the lowest level since 2009, according to the Federal Reserve.

Credit-card spending declined sharply in the early days of the pandemic, when travel was off limits and restaurants were closed.

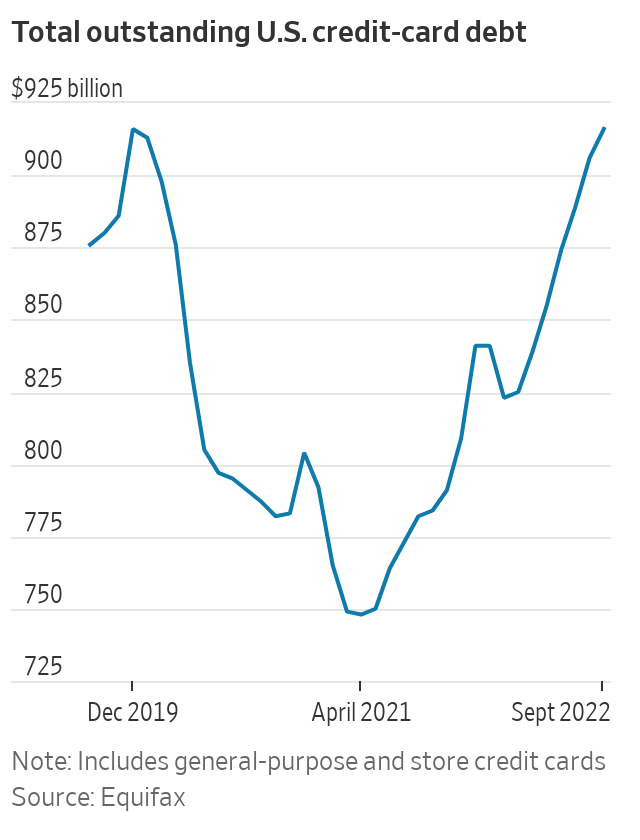

Balances on general-purpose and store credit cards went in the same direction, falling by $166 billion from January 2020 through April 2021, according to credit-reporting firm Equifax Inc.

Many cardholders closed their accounts altogether. The total number of open credit cards in the U.S. fell 7% from January 2020 to March 2021.

Credit-card spending has since rebounded to pre-pandemic levels. Balances have not.

Visa said spending on its U.S. credit cards increased 20% to $622 billion during the last quarter compared with a year prior. Some 40.4 million general-purpose credit cards were issued during the first seven months of this year, an 83% increase from last year, according to Equifax.

Credit-card balances on general-purpose and store credit cards in the U.S. increased 5% to $784 billion from this past April, when they bottomed out, to September, according to Equifax. Balances continued to rise in October, card issuers said.

America’s two biggest banks— JPMorgan Chase & Co. and Bank of America Corp. —said credit-card purchase volume during the third quarter increased 30% and 26%, respectively, from a year earlier. Card balances increased by about 2% at JPMorgan and fell 4% at Bank of America.

A decline in credit-card debt is, of course, a good thing for consumers. Smaller balances mean lower interest payments and less risk of credit-damaging defaults. Missed payments on credit cards remain near record-low levels.

Banks say many people have the ability to pay their card bills in full because of their higher-than-usual savings. They expect that to decline as stimulus money runs out and people revert to their pre-pandemic spending habits.

Banks, meanwhile, hope spending now will pay off in the future. There tends to be a lag between account openings and rising balances, issuers say, and pent-up demand means consumers are primed to spend.

AmEx marketing spending increased 26% in the third quarter from a year prior to $1.4 billion. Earlier this year, the company said it expected to spend more than $5 billion on marketing in 2021. The company says a small portion of its revenue comes from interest charges.

Capital One’s marketing spending soared 165% in the third quarter from a year earlier, with card marketing being “the biggest driver of total company marketing trends,” Chief Executive Richard Fairbank said on the bank’s most recent earnings call.

Marketing expenses at Discover Financial Services rose 50% in the third quarter from a year earlier. New credit-card account openings in the first nine months of this year rose 27% from the same period a year earlier, but balances were up only about 1%.

“The efforts we’re putting towards getting new accounts are close to entirely offset by elevated payment rates,” said Discover Chief Executive Roger Hochschild. The company expects cardholder-payment rates to fall to pre-pandemic levels in 2023.

Updated: 10-28-2022

Credit-Card Debt Returns To Levels Before Covid-19 Pandemic

Record card issuance and increased spending helped push total card balances to $916 billion last month.

Credit-card debt recently reached a new milestone: It returned to where it was before the pandemic.

Total card balances in the U.S. hit $916 billion in September, nearly identical to December 2019 levels, according to the credit-reporting firm Equifax Inc.

Balances are up 9% from January and about 23% higher than their pandemic low in April 2021.

Card balances fell sharply in the early months of the pandemic after Americans, out of work and stuck at home, cut back on spending. Stimulus checks later padded savings accounts and allowed many to pay down costly debt.

When the economy reopened and people went back to work, credit-card issuers launched a big push to get people borrowing again. Many loosened underwriting standards, making it easier for people with lower credit scores to get cards.

Now, Americans are spending and borrowing, despite fears that a recession is on the horizon. Missed payments on credit cards, while rising, remain below prepandemic levels.

Still, rising card balances could be an early sign of financial pain. Consumers are still paying a higher share of their balances than they were before Covid-19 hit, according to card issuers, but that figure at some lenders is starting to decline.

The rising cost of food, gasoline and housing, meanwhile, has strained household budgets, forcing some Americans to use their credit cards to make ends meet.

The trillions of dollars in rainy-day funds Americans built up during the pandemic are dwindling. The personal saving rate as a share of disposable personal income fell to 3.3% in the third quarter, one of the lowest readings going back to the late 1940s and down from 26.4% in the second quarter of 2020, according to the Bureau of Economic Analysis.

“You have an increasing number of people running out of that excess savings, but it’s small,” said Mark Zandi, chief economist at Moody’s Analytics. “The folks who are the most pressed are starting to turn to debt to supplement their income to maintain their spending.”

Some card issuers have begun pulling back on lending to consumers they deem to be the most vulnerable in a recession. Nearly all set aside money to cover loan losses in a potential recession.

Consumers had credit-card debt of $5,529 on average in September. That figure has been rising but remains below its prepandemic peak, according to the credit-score provider VantageScore Solutions LLC.

At JPMorgan Chase & Co., credit-card balances that are carried from month to month increased 15% in the third quarter from a year prior, but they remain slightly below prepandemic levels.

“Credit-card borrowing is normalizing, not getting worse,” Chief Executive Jamie Dimon said on a call with analysts earlier this month.

At Citigroup Inc. and Bank of America Corp., general-purpose credit-card spending fell slightly from the second to the third quarter while balances increased, evidence that people who are carrying debt from month to month are contributing to rising loan balances.

Interest-earning balances on Citigroup general-purpose cards grew 9% in the third quarter from the same period last year. The bank said it expects those balances to continue to grow in the fourth quarter.

The increases follow a period of record card issuance for borrowers of all stripes. Lenders issued nearly 47 million general-purpose credit cards during the first seven months of the year, up 17% from a year earlier and the highest level for the period, according to data from Equifax that goes back to 2011. Nearly 9.6 million of those cards were issued to people with credit scores below 620, the highest for the period and up 8% from a year earlier.

Prime and subprime consumers who received a new general-purpose card in July were given average spending limits of $5,115 and $892, respectively, up about 15% from a year prior and nearly back to prepandemic levels.

Despite rising interest rates, issuers have ramped up offers for cards that don’t charge interest on purchases or balance transfers for a period. That could be contributing to the increase in balances, because borrowers have less incentive to pay down their debt during the promotional period.

Costly car repairs and higher housing costs led Sarah Shah to start racking up credit-card debt last year. This summer, she transferred about $10,000 of the roughly $13,000 she owes to a new card with a temporary 0% rate.

“It just creeps up on you when you have a bunch of things that go wrong,” she said.

There are early signs of caution. Some 2.2% of banks eased credit standards for credit-card approvals in the second quarter, according to a Federal Reserve survey of senior loan officers, down from 14.6% in the first quarter and 39.3% a year prior.

Discover Financial Services began tightening underwriting in the third quarter for new card approvals for “segments that will be most volatile in a downturn” such as people who are on the “lower end of prime,” Chief Executive Roger Hochschild said on an earnings call.

Still, he said, credit cards remain an attractive area for banks.

“I’d say overall, a very good environment,” Mr. Hochschild said in an interview. “And that’s part of why you’re seeing such strong growth.”

Related Articles:

Trump Calls On Fed To Cut Interest Rates, Resume Bond-Buying To Stimulate Growth (#GotBitcoin?)

Fake News: A Perfectly Good Retail Sales Report (#GotBitcoin?)

Anticipating A Recession, Trump Points Fingers At Fed Chairman Powell (#GotBitcoin?)

Affordable Housing Crisis Spreads Throughout World (#GotBitcoin?) (#GotBitcoin?)

Los Angeles And Other Cities Stash Money To Prepare For A Recession (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.