The Ultimate Resource For The Bitcoin Miner And The Mining Industry (Page#2) #GotBitcoin

Crypto Miners Exempt From IRS Reporting Rules, US Treasury Affirms. The Ultimate Resource For The Bitcoin Miner And The Mining Industry (Page#2) #GotBitcoin

The U.S. Treasury affirmed that crypto miners and wallet operators are exempt from the IRS reporting rules, preparing appropriate regulations.

Related:

The Ultimate Resource For The Bitcoin Miner And The Mining Industry (#GotBitcoin)

The Weaponization of Bitcoin And Global Finance

Weaponizing Blockchain — Vast Potential, But Projects Are Kept Secret

Bitcoin Developer Amir Taaki, “We Can Crash National Economies”

Bitcoin Has Lost Its Way: Here’s How To Return To Crypto’s Subversive Roots

OnlyFans To Net $1.2 Billion This Year And $2.5 Billion In 2022 Off Sex Workers’ Hard Labor

In a letter to a group of senators on Friday, the U.S. Treasury indicated that it plans to exempt crypto miners, stakers and other market participants from rules that would require crypto brokers to share data on their clients’ transactions with the Internal Revenue Service.

“Appreciate the Treasury Department affirming that crypto miners, stakers and those who sell hardware and software for wallets are not subject to tax reporting obligations,” Senator Rob Portman said, announcing the news on Twitter.

In the letter, Treasury Assistant Secretary for Legislative Affairs Jonathan Davidson said that the department’s position is that “ancillary parties who cannot get access to information that is useful to the IRS are not intended to be captured by the reporting requirements for brokers.”

Davidson also emphasized crypto validators are “not likely to know whether a transaction is part of a sale,” while entities involved in offering services related to hardware or software crypto wallets “are not carrying out broker activities.”

The Treasury will also consider “the extent to which other parties in the digital asset market, such as centralized exchanges and those often described as decentralized exchanges and peer-to-peer exchanges, should be treated as brokers,” the letter notes.

Bloomberg reported that the Treasury is planning to issue proposed regulations to include its stance on the broker definition.

As previously reported, U.S. President Joe Biden signed the $1-trillion infrastructure bill in mid-November 2021, requiring crypto market participants to report all digital asset transactions worth more than $10,000 to the IRS.

Several senators, including Pat Toomey, Ron Wyden and Cynthia Lummis, subsequently urged the Treasury to clarify the definition of broker in the infrastructure law in December, planning to offer related legislation. A group of House Democrats also backed a similar initiative in November.

Updated: 3-6-2023

TeraWulf Starts Nuclear-Powered Bitcoin Mining With Nearly 8,000 Rigs At Nautilus Facility

The miner also said it expects to reach 5.5 EH/s of computing power across its two sites by early in the second quarter.

TeraWulf (WULF) has begun operations at its Nautilus Cryptomine facility – the first nuclear-powered bitcoin mining facility in the U.S. – with nearly 8,000 mining rigs online representing computing power, or hashrate, of about 1.0 exahash per seond (EH/s).

The company expects to have about another 8,000 rigs energized in coming weeks, bringing capacity at the Pennsylvania-based Nautilus facility to 1.9 EH/s by May, according to a Monday press release.

Nautilus will significantly lower TeraWulf’s energy costs, with the company having secured a power agreement for 2 cents per kilowatt hour (kWh) of power for five years, which will bring its average energy cost down to about 4 cents/kWh across its two facilities.

That’s much lower than the U.S. industrial average of 9 cents/kWh that the Energy Information Administration reported in December 2022, as well as the variable rate TeraWulf pays at its New York site, which averages 5 cents/kWh.

Along with its mining peers, TeraWulf has struggled mightily during the crypto winter as declining bitcoin prices teamed with rising energy costs.

The Maryland-based company had to embark on a series of cost-cutting initatives in November and raised $10 million in new capital in December to repay some of its debt.

However, both crypto and energy markets have improved somewhat in early 2023, and the mining industry is showing early signs of recovery.

The Nautilus mine is “the first behind-the-meter bitcoin mining facility of its kind, directly sourcing reliable, carbon free, and 24×7 baseload power from the 2.5GW Susquehanna nuclear generation station in Pennsylvania,” according to TeraWulf.

It is a joint venture with Texas energy producer Talen Energy, in which TeraWulf has a 25% interest.

The company said Monday it expects to reach 5.5 EH/s of computing power by early in the second quarter.

Updated: 3-13-2023

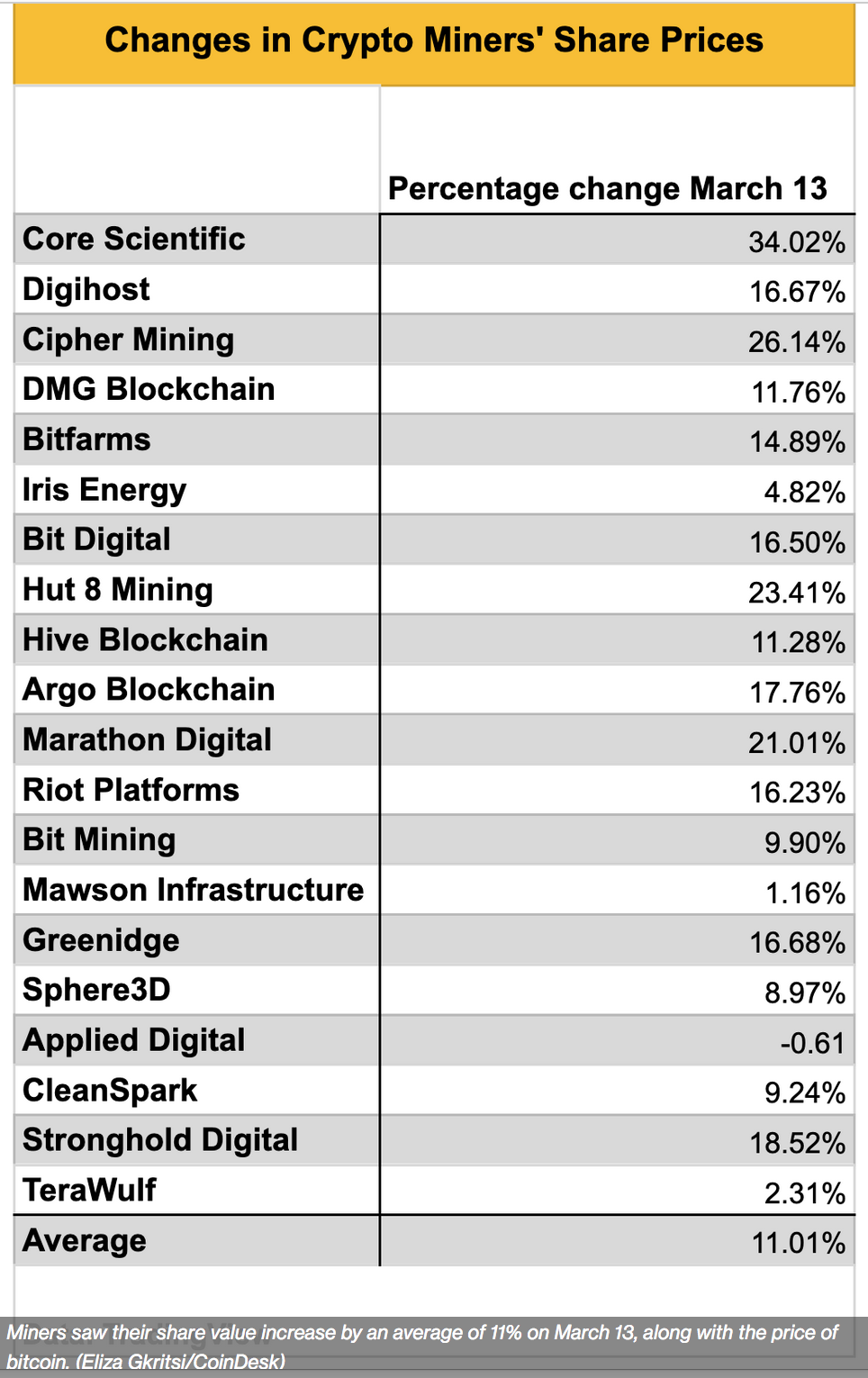

Bitcoin Miner Stocks Surge Amid Banking Meltdown

Mining equities were up about 11% on average on Monday alongside big gains for bitcoin.

Cipher Mining (CIFR), Hut 8 (HUT) and Stronghold Digital (SDIG) are among the crypto miners seeing the largest gains in Monday trading after the U.S. government late Sunday moved to protect all depositors at collapsed lenders Silicon Valley Bank (SVB) and Signature Bank.

The miners are moving in step with bitcoin (BTC), which is higher by 17% over the past 24 hours to $26,100.

“I’m actually surprised [the miners] didn’t get pumped more,” said Wolfie Zhao, head of research at TheMinerMag. “Many even didn’t surge more than bitcoin.”

The extent of the mining sector’s exposure to crypto-friendly Signature Bank is unclear. Marathon Digital Holdings (MARA) on Monday said it still had access to $142 million in deposits the now-shuttered lender.

CleanSpark (CLSK), Bitfarms (BITF) and Argo Blockchain (ARBK) said on Monday they have no exposure to either Signature or the other collapsed banks, Silvergate and SVB.

An Argo subsidiary, however, does hold operating funds in Signature deposits, the firm said.

Updated: 3-31-2023

MIT Space Force Major Proposes Bitcoin Mining As Cybersecurity Tool

An active-duty United States Space Force astronautical engineer is proposing a new cybersecurity tool to the Pentagon: Bitcoin.

An active-duty United States Space Force astronautical engineer is proposing a cybersecurity tool to the Pentagon that is capable of transforming the country’s national security and the base-layer architecture of the internet: Bitcoin

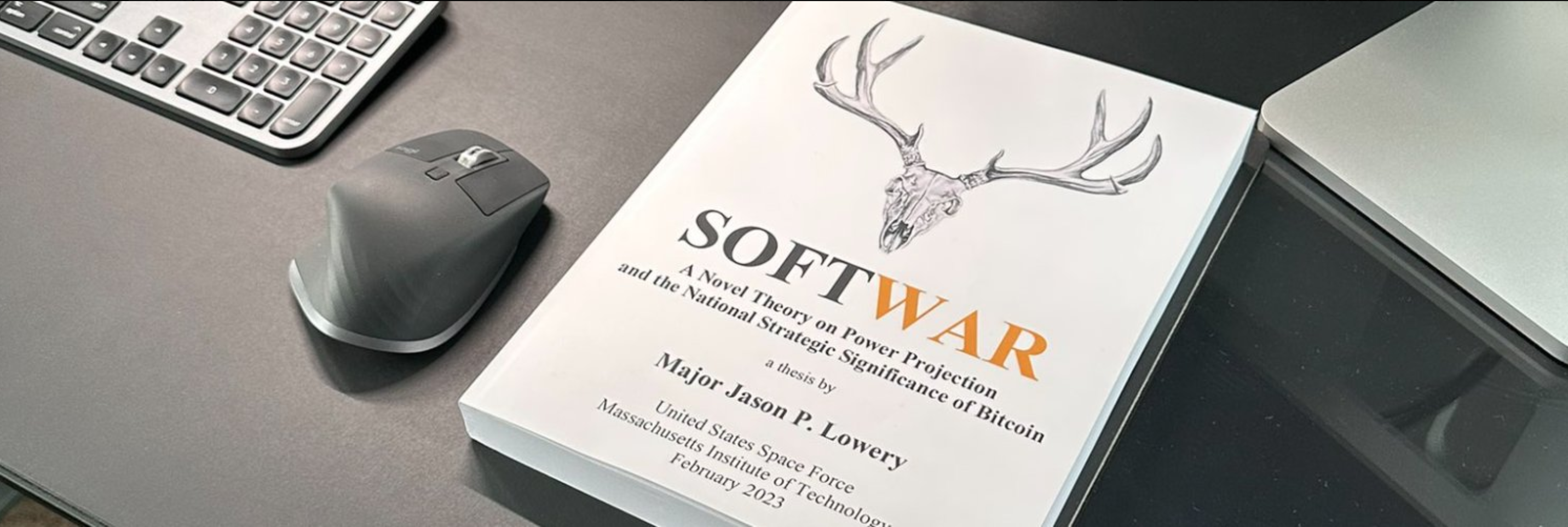

In an academic thesis, Major Jason Lowery, who is also a national defense fellow at Massachusetts Institute of Technology (MIT), presented a new theory to the U.S. Department of Defense that Bitcoin is not just a peer-to-peer payment system but a new form of “digital-age warfare,” arguing that proof-of-work technologies will change the way humans compete globally, according to Ben Schreckinger’s review of the book in Politico.

Published in February, Lowery’s master’s degree thesis dubbed “Softwar” sits in third position on Amazon’s list of best-selling technology books at the time of writing. According to his Amazon bio, Lowery has a decade of experience serving as a weapon system developer and technical adviser for U.S. senior officials, including Bitcoin-related policies.

Lowery’s research argues that the U.S. military could use Bitcoin to stop certain types of attacks, such as denial-of-service attacks, which overload servers with too many requests.

The concept involves creating software programs that only respond to signals from large transactions recorded on the Bitcoin network. This would make it harder for attackers to flood servers with fake signals and cause damage.

THESIS PUBLISHED!!!

Announcing the public debut of SOFTWAR, a theory presented to OPOTUS, OSECDEF, & the Joint Chiefs about the national strategic significance of #Bitcoin

LET THE HASH WARS BEGIN

High-quality physical copies available now: https://t.co/WaNo7y8avl pic.twitter.com/vWF24ze9EA

— Jason Lowery (@JasonPLowery) February 20, 2023

Lowery also suggests that the Bitcoin network is like maritime trade routes, which means it’s suited for economic exchange.

Consequently, it’s crucial to protect freedom of navigation on the network, just as we protect trade routes.

By designing software programs that only respond to external signals if they come with a large enough Bitcoin transaction recorded on the network, Lowery argues they would prevent adversaries from gaining control over them.

According to the author, the U.S. should also stockpile Bitcoin, build a domestic Bitcoin mining industry and extend legal protections to the technology. In his view, Bitcoin is a self-defense weapon, and the country should protect it as it does other rights.

Updated: 4-8-2023

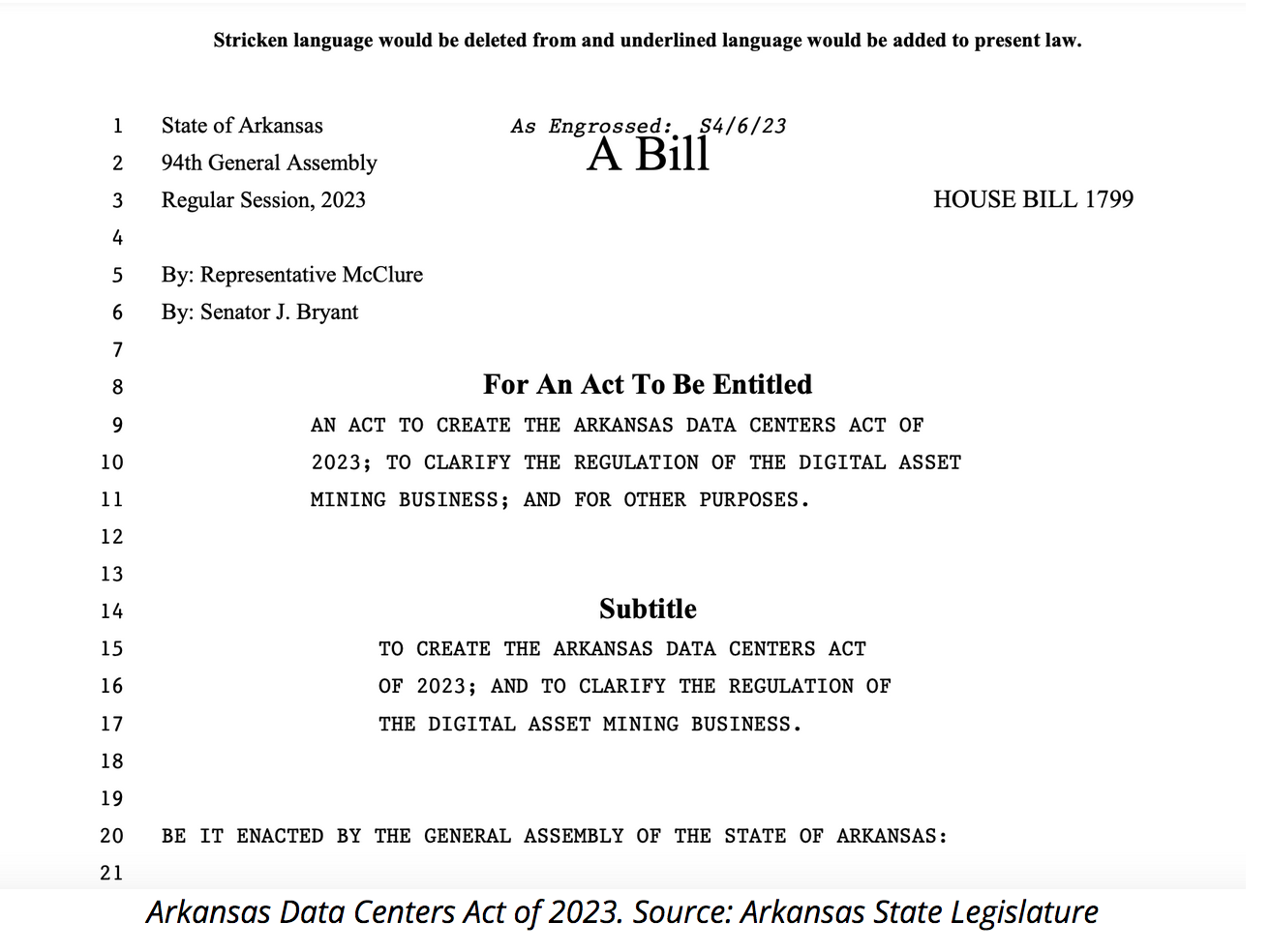

Bill Protecting Bitcoin Mining Rights Passes In Arkansas Senate And House

The Arkansas Data Centers Act is now moving to the governor’s office for approval. It grants crypto miners in the state the same rights as data centers.

A bill seeking to regulate Bitcoin mining activity in Arkansas has passed in the state’s House of Representatives and Senate. The bill will now move to the governor’s office for approval.

According to the bill, the Arkansas Data Centers Act of 2023 intends to regulate the Bitcoin mining industry in the American state, creating guidelines for miners and protecting them from discriminatory regulations and taxes.

Arkansas’ state legislators quickly passed the bill after it was proposed on March 30 by Senator Joshua Bryant.

The document recognizes “that data centers create jobs, pay taxes, and provide general economic value to local communities.“

As per the approved bill, a digital asset miner is required “to pay applicable taxes and government fees in acceptable forms of currency and operate in a manner that causes no stress on an electric public utility’s generation capabilities or transmission network.“

Under the legislation, crypto miners will also have the same rights as data centers. The bill outlines that Arkansas’ government should not “impose a different requirement for a digital asset mining business than is applicable to any requirement for a data center.“

Arkansas’ move follows a similar initiative in the state of Montana. In late March, the Montana Senate passed a bill to protect crypto miners operating within the state.

The bill intends to protect miners against taxes on digital assets used for payments, and to eliminate energy rates discriminating against home crypto miners and digital assets businesses.

The state of Texas went in a different direction. Its Senate Committee on Business and Commerce passed legislation on April 4 that would essentially remove incentives for miners operating under the state’s crypto-friendly regulatory environment, Cointelegraph reported.

An even more decisive move came from New York in November 2022 when Governor Kathy Hochul signed the proof-of-work mining moratorium into law, banning crypto-mining activities in the state for two years.

On a federal level, crypto miners in the United States could eventually be subject to a 30% tax on electricity costs under a budget proposal introduced on March 9 by President Joe Biden aimed to “reduce mining activity.”

Updated: 4-11-2023

Bitcoin Miner CleanSpark Purchases 45,000 ASICs For $145M

The BTC mining firm projects its mining power will reach 16 EH/s by the end of the year.

On April 11, American Bitcoin miner CleanSpark announced that it purchased 45,000 Antminer S19 XP application-specific integrated circuit (ASIC) mining rigs for $144.9 million.

CleanSpark said all the units will be ready for delivery by Antminer before the end of September. The purchase is expected to add 6.3 exahashes per second (EH/s) of mining power to its rig, which currently possesses a capacity of 6.7 EH/s.

After the purchase, the firm’s expected hash rate will account for an estimated 3.8% of the entire Bitcoin network. Zach Bradford, CEO of CleanSpark, commented:

“The Antminer S19 XP is the most power-efficient bitcoin mining machine available in the market today, and a key component in our continuing work to build some of the most efficient bitcoin mining facilities in the country.”

25,000 of the 45,000 ASICs will be delivered in August, while the remaining 20,000 units are expected to be ready in September.

CleanSpark said it plans to deploy all the acquired units at its Bitcoin mining facility in Sandersville, Georgia, which is currently undergoing a 150-megawatt power expansion.

“This bear market has continued to provide us with opportunities to maximize ROI, including the opportunity to purchase the industry’s best miner at an industry-leading price.”

CleanSpark has set a goal of reaching 16 EH/s in hash rate by the end of 2023. In February, the firm purchased 20,000 ASICs scheduled for operations this quarter.

CleanSpark claimed that over 90% of its mining electricity stems from “low-carbon energy sources.” At the end of 2022, the firm possessed $486.8 million in total assets and $59.8 million in total liabilities.

Updated: 4-28-2023

Jack Dorsey’s Block Snaps Up Bitcoin Mining Chip As Intel Winds Down Production

The payments company could start selling bitcoin mining hardware as early as next year.

Jack Dorsey’s fintech-payments company Block (SQ) recently bought a large number of bitcoin (BTC) mining chips from Intel (INTC), which will accelerate its plans to enter the mining hardware market just as the chipmaker winds down production.

The purchase will help it bring mining machines to the market as it focuses on developing its cutting-edge 3-nanometer chips.

Intel announced in February a last date for the production of its bitcoin mining application-specific integrated circuits (ASIC) in April 2024 as it discontinues the chip.

Block recently jumped on the opportunity to buy a large quantity of these ASICs from Intel, it said in a Friday blog post.

The firm was planning on finalizing its design of a 5-nanometer chip for bitcoin mining this quarter and build machines based on that.

The purchase means that the team can focus exclusively on the 3-nanometer design, the post said.

Nanometers in chip design refer to the size of each transistor, millions of which are packed together make up a chip. The smaller the transistors, the more that can fit on a chip so it can run more calculations, making for a more powerful chip.

Block’s first-party products will come early next year, said Thomas Templeton, Block’s hardware lead, in an interview with CoinDesk.

Asked about the quantity of chips the company bought, he said it is enough to bridge the time until Block can design and productize its own 3-nanometer chips.

Block said it aims to improve the decentralization of the Bitcoin network. When it comes to mining, “the main problem” is “the diversity of manufacturing and supply chain,” said Templeton.

“We want to make more more tools for more people to build and use. When you dig into mining, the ASIC is at the center of mining.”

The mining manufacturing industry is dominated by two players: Bitmain and MicroBT.

In March, Block announced it was working on a mining development kit, which will allow other engineers to create products using Block’s chips.

This will provide developers with a suite of tools to unlock innovation in bitcoin mining hardware, the firm said.

Block is open sourcing this technology and wants the community to contribute to its development, which is why it announced the kit, Templeton said.

Amid Bankruptcy, Core Scientific Signs Bitcoin Mining Hosting Contracts For Almost 18,000 Machines

The miner signed deals with three firms to host rigs at sites where the Celsius Mining fleet was recently unplugged.

Core Scientific (CORZQ) has signed contracts to host almost 18,000 bitcoin (BTC) mining rigs with three firms as it negotiates its way through Chapter 11 bankruptcy, it said in a Friday press release.

The contracts are the latest indication the prospects for the largest publicly listed miner by computing power, or hashrate, might be improving after it started bankruptcy proceedings in December 2022.

The change in market conditions since then led a group of the firm’s equity holders to point out in March that the firm’s financial position had improved significantly.

Core Scientific will host 6,914 mining rigs for Greenidge Generation Holdings (GREE), 10,000 units for Ault Alliance (AULT) and 1,021 for LM Funding (LMFA).

Once fully installed in May, they will bring the total number of machines the firm is hosting to about 70,000.

That’s on top of the 155,000 machines it uses to mine for itself as of March-end. The contracts are a mix of variable pricing and proceeds-sharing deals, the firm said.

The 18,000 machines will be hosted in Core Scientific’s sites in Dalton, Georgia; Calvert City, Kentucky; and Denton, Texas – all sites where Celsius Mining had rigs.

After the Chapter 11 filing, Core Scientific shut down 37,000 rigs belonging to Celsius Network’s mining arm, which is also in bankruptcy proceedings, as the two are quarreling over their services agreement.

Core Scientific’s equity, traded over-the-counter, has gained 887% since the start of the year, TradingView data shows. The shares are now at 40 cents.

The miner has 175 megawatts (MW) of available hosting capacity in its Denton, Texas, facility, and is developing another 915 MW in west Texas and Oklahoma.

Updated: 5-3-2023

Bitcoin Miners Have Earned $50B From BTC Block Rewards, Fees Since 2010

They may have seen some hard times, but overall, estimates conclude that Bitcoin miners are up 37% from their activities.

Bitcoin miners have profited roughly 37% from mining Bitcoin since its inception, new data reveals.

Calculations from on-chain analytics firm Glassnode suggest that since 2010, fees and block reward subsidies have netted miners over $50 billion.

Bitcoin Miner Revenue Passes $50 Billion Mark

Amid an ongoing debate over miner costs and susceptibility to Bitcoin price dips, new figures suggest that miners are firmly in the black in the long term.

According to Glassnode, miners’ total all-time income is almost 40% higher than their estimated costs, coming in at $50.2 billion versus $36.6 billion, respectively.

Researchers generated the numbers using two metrics: thermocap and transaction fees, which are “the cumulative sum of issuance multiplied by spot price in addition to all-time generated fee revenue” and difficulty production cost.

In a dedicated report in late March, Glassnode explained the nuances behind the calculations while arriving at the 37% profit margin still in place today.

“In this model, the Thermocap and Transaction Fees can be considered the realized revenue by miners, whilst the Difficulty Production Cost is considered the aggregate mining input expense,” the report explains.

The results counter fears that too low a BTC/USD price could spark mass capitulation across the mining industry, which continues to grow.

Bitcoin network fundamentals support the argument, with difficulty and hash rate both hitting new all-time highs throughout 2023.

Current estimates from BTC.com, however, predict that this week’s difficulty adjustment will be the first negative one for Bitcoin since mid-February, 2023.

Bitcoin Transaction Fees Spike Higher

Meanwhile, an influx of newly-created unspent transaction outputs (UTXOs) thanks to ordinals is rapidly making on-chain transactions less appealing this month.

Glassnode shows these created UTXOs spiking to their highest levels since 2015 in May, with fees rising accordingly.

Blockchain.com has the 1-day moving average transaction fee rate at $6.91 for May 2 — more than at any time since July 2021.

Updated: 5-4-2023

Stronghold Digital To Add 400 PH/s Capacity Via 4K Bitcoin Miners From Canaan Subsidiary

The machines will be installed in two tranches, one my mid-May and the second by mid-June.

Bitcoin miner Stronghold Digital (SDIG) is to host 4,000 mining machines supplied by Cantaloupe Digital, a subsidiary of rig maker Canaan (CAN).

The 2,000 A1246 and 2,000 A1346 miners will provide a total capacity of 400 petahash per second (PH/S), according to an emailed announcement on Thursday.

The A1246 miners will be installed by May 15, while the A1346 miners will be installed by a month later.

Stronghold has procured around 22,000 miners since August with capacity of 2.2 exahash per second (EH/s) at a cost of $15 million, CEO Greg Beard said.

“We achieved this through opportunistic purchases of Bitcoin miners in a distressed market and through unique hosting agreements where we retain exposure to Bitcoin mining economics and power upside,” Beard said.

As part of the two-year hosting agreement with Canaan, Stronghold will receive 50% of the bitcoin mined and retain any upside of selling power back to the grid, should the company elect to curtail the usage of the machines to do so.

Like its peers across the mining industry, Stronghold spent 2022 in a squeeze between falling bitcoin prices and exorbitant energy costs.

Stronghold was able to organize restructuring deals to fend off the bankruptcies that befell Compute North and Core Scientific (CORZ). Its latest restructuring deal allowed it to postpone payments on $55 million worth of debt until June 2024.

Montana Governor Signs Pro-Cryptocurrency Mining Bill Into Law

The legislation includes revisions to laws aimed at prohibiting discriminatory electrical rates for mining firms and not allowing taxation for crypto used as a method of payment.

Greg Gianforte, the governor of Montana, has signed into law a bill largely preventing local governments in the state from passing laws prohibiting cryptocurrency mining.

According to records with the Montana legislature, Gianforte signed S.B. 178 into law on May 2 after the bill had passed both the state House and Senate.

The legislation effectively enshrines crypto miners’ rights in the state by revising existing laws, prohibiting discriminatory electrical rates for mining firms and not allowing taxation for crypto used as a method of payment.

The latest version of the bill suggested that the legislation was introduced partly as a preventive measure in response to certain proposals in other states — i.e. “digital asset mining has often faced difficulty with regulations at the state and local level.”

For example, in April, lawmakers in the Texas state Senate introduced a bill aimed at limiting incentives for crypto miners through participation in a program intended to compensate them for load reductions on the state’s power grid.

BREAKING: The State of Montana has officially signed the ‘Right to Mine’ #Bitcoin bill into law. pic.twitter.com/f3PD1WgTOW

— Satoshi Action Fund (@SatoshiActFund) May 4, 2023

Crypto advocacy group Satoshi Action Fund has supported pro-mining legislation in certain states.

Lawmakers in the Arkansas state House and Senate passed a bill similar to Montana’s S.B. 178 — “to clarify the regulation of the digital asset mining business” — with Governor Sarah Huckabee Sanders signing it into law on April 13.

“At the state level, we can have a lot of progress, we can move things forward, and there isn’t a whole lot the federal government can do in the meantime,” said Porter.

Similar pro-mining legislation had been moving forward in the Mississippi state legislature, but the bill “died” in March.

Porter said a Missouri bill was “a further little behind in the process” but still progressing in the legislature.

At the federal level, the Biden administration recently renewed a push for a 30% tax on cryptocurrency miners as part of an FY2024 budget proposal. The tax would potentially target miners’ electricity usage.

Updated: 5-9-2023

Cipher Mining Buys 11,000 Crypto Mining Rigs From Canaan, Reaches 6 EH/s Hashrate

Cipher has an eye on hashrate of 8.2 EH/s by the end of the year.

Cipher Mining (CIFR) announced the purchase of 11,000 bitcoin mining rigs from Canaan Inc. (CAN) after reaching 6 exahash/second (EH/s) of computing power, the firm said Tuesday.

The new Canaan model A1346 rigs will boost its computing power to 7.2 EH/s when installed, with energization expected by the end of Q3. Cipher says it has the potential reach 8.2 EH/s by the end of the year.

At the time of writing, Cipher’s stock was up over 6% at $2.07 in pre-market trading.

The miner slightly overshot its previously stated hashrate target of 5.7 EH/s for the end of Q1. Meanwhile, its net loss per share fell by more than half in Q1 2023 compared to the same period last year; to $0.03 from $0.07.

The miner expects an average price of $0.027 per kilowatt hour (kWh) of electricity across its portfolio, with 96% of its capacity secured by fixed price agreements.

Other miners without fixed price agreements saw soaring costs in 2022 due to the energy crisis.

Canaan saw its sales dwindle throughout the year, outcompeted by other manufacturers while the market overall was depressed.

Marathon Digital Announces Immersion Crypto Mining Operations In Abu Dhabi

The mining firm expects the two facilities to be online by 2024 and produce a combined hash rate of roughly 7 EH/s.

Crypto mining firm Marathon Digital Holdings announced it has partnered with digital assets infrastructure company Zero Two to create a large-scale immersion Bitcoin-mining facility in Abu Dhabi.

In a May 9 notice, Marathon Digital said the joint venture will be based in Mina Zayed and Masdar City in the United Arab Emirates, comprising two mining sites with a combined 250-megawatt capacity.

According to the firm, Marathon and Zero Two plan to power the facilities with excess energy from Abu Dhabi’s grid, claiming it will increase its base load and sustainability.

Crypto mining in the desert climate of Abu Dhabi — where the average annual temperature is roughly 28 degrees Celsius (82 degree Fahrenheit) — was often “infeasible,” according to Marathon Digital.

The firm said it had helped develop a “custom-built immersion solution” to cool mining rigs at the proposed facilities, suggesting a liquid-cooling solution.

“For this project, our team successfully co-developed and implemented a full immersion solution, as well as developed proprietary mining software from the ground up to provide flexibility, resilience, and optimization,” said Marathon Digital chair and CEO Fred Thiel.

We are excited to share details of our new #Bitcoin mining sites in the UAE. Owned and operated via a joint venture with Zero Two, this initiative marks the first large-scale immersion Bitcoin mining operations in the Middle East. Learn more: https://t.co/vFROdM6urR

— Marathon Digital Holdings (NASDAQ: MARA) (@MarathonDH) May 9, 2023

Ownership of the project, called the Abu Dhabi Global Markets JV Entity, will be split between Zero Two and Marathon Digital, with the two companies controlling 80% and 20%, respectively.

The two firms expect both Abu Dhabi facilities to be online by 2024 and produce a combined hash rate of roughly 7 EH/s.

The report of the planned mining operation came amid executives from United States-based crypto exchange Coinbase visiting the UAE to test the potential of the region as a “strategic hub” for its international operations.

Coinbase CEO Brian Armstrong met with policymakers and spoke at the Dubai FinTech Summit.

Updated: 5-15-2023

Bitcoin Miner Bitfarms Accelerates 6 EH/s Hashrate Target As Quarterly Loss Per Share Narrows

In Q1 2023, the bitcoin miner’s net loss per share narrowed to 1 cent, from 8 cents the previous quarter.

Bitcoin miner Bitfarms (BITF) accelerated its stated timeframe for reaching 6 exahash/second (EH/s) of computing power, as its per-share loss narrowed significantly quarter-on-quarter, according to a press release on Monday.

The miner said that it expects to hit the 6 EH/s goal by the end of the third quarter, as opposed to its previous goal of 2023-end. Its hashrate stood at 5 EH/s at the end of Q1. However, the firm had previously said it would reach 6 EH/s at the end of 2022.

At the time of writing, the miner’s shares were up 7% in pre-market trading.

Bitfarms saw its net loss per share narrowed significantly to 1 cent, from 8 cents the quarter before, while its gross mining margin improved to 42%, from 33% the previous quarter. Its mining margin was 76% in Q1 2022.

The miner reported revenue of $30 million in the first quarter in 2023, compared with $27 million the quarter before and $40 million the year prior.

The Canadian firm has been working to deleverage its balance sheet for several months, along with other miners, by selling bitcoin and paying down its loans. In January, it warned it might default on some of its debt.

Updated: 5-18-2023

Bitcoin Mining Rig Maker MicroBT Unveils Most Powerful Machine Yet

The Chinese rig maker’s new model can deliver 320 TH/s, outperforming competitor Bitmain’s equivalent machine lineup.

Bitcoin mining machine manufacturer, MicroBT, unveiled three new mining rigs today at Bitcoin2023 conference in Miami, one of them being the most powerful currently available on the market.

One of the new models, WhatsMiner M53S++, delivers 320 terahash per second (TH/s) of computing power with efficiency of 22 joules per terahash (J/T).

It is more powerful than rival Bitmain’s equivalent, the Antminer S19 XP Hydro, which delivers up to 257 TH/s, but less efficient that the Bitmain model, which can run at 20.8 J/T, the company’s founder and CEO Zuoxing Yang said.

The other two models were the M50S++, designed for air-cooling and with computing power of 150 TH/s, and the M56S++, designed for immersion cooling, which can deliver up to 230 TH/s. Both machines have an efficiency of 22 J/TH.

The rig maker’s motivation for the new machines were mainly to utilize sustainable source of energy, amid heated debate over enormous power usage by the miners.

“Faced with the energy crisis and global warming, Dr. Yang believes that the power source for bitcoin mining needs to be upgraded by finding better solutions like green energy,” the firm said in a press release.

On that front, MicroBT is also working on adjusting the voltage and frequency of the WhatsMiner so that it can be better suited for solar power use, a source of energy that Yang thinks is a match for the decentralization of the bitcoin network.

He also pointed out that over 90% of the heat generated from the mining machines can be collected which then can be used for various other uses, including space heating, steam for industry and fish hatchery.

Updated: 5-23-2023

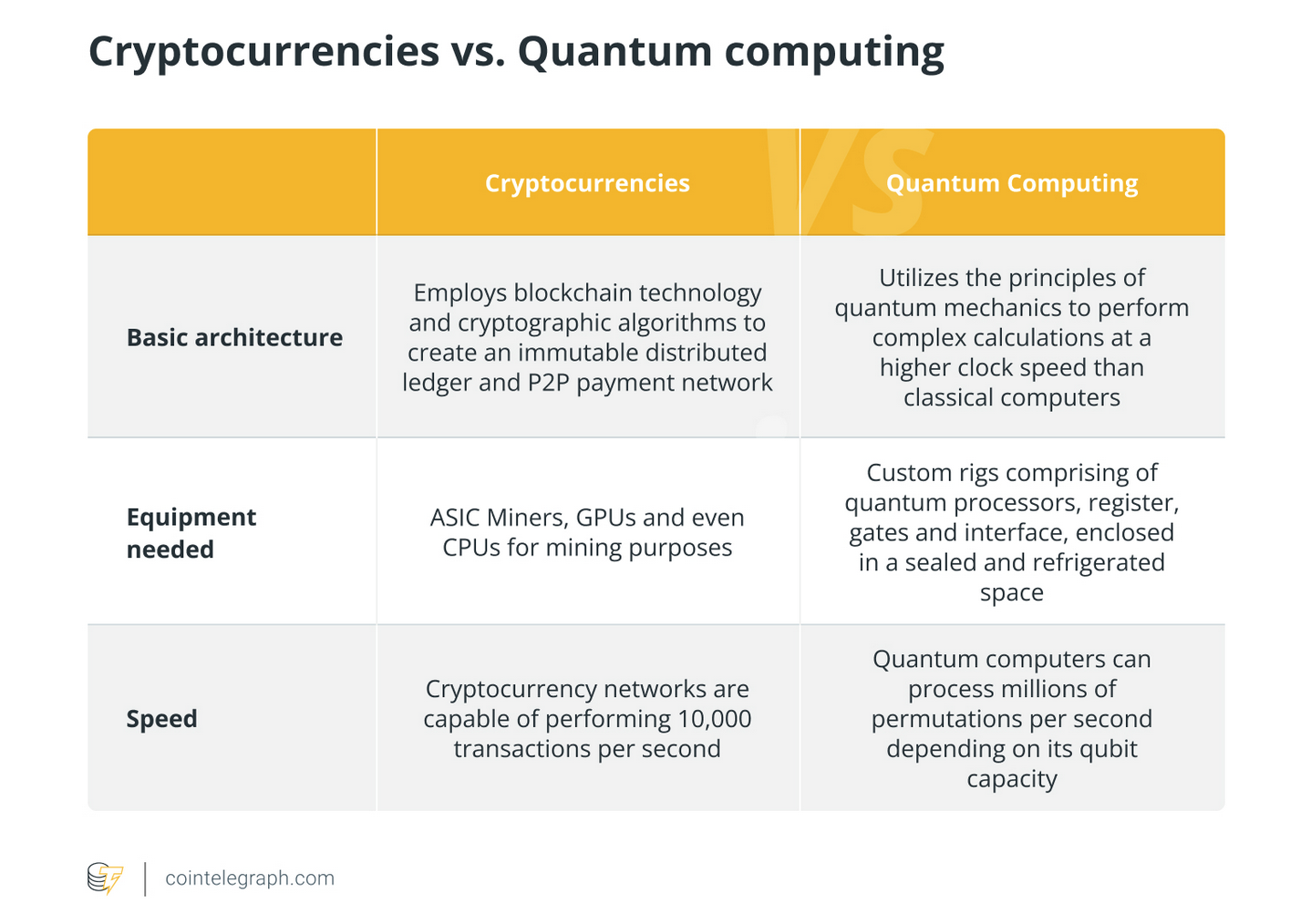

Can Quantum Computers Mine Bitcoin Faster?

1. Quantum Computing, Explained

Quantum computing is an emerging technology that leverages the principles of quantum mechanics to process information.

Quantum mechanics is the foundation for quantum computing, allowing for the special qualities of superposition and entanglement that could make quantum computers more powerful than conventional computers.

Quantum computers use quantum bits, or qubits, which can exist in numerous states simultaneously, as opposed to classical computers, which use bits to represent information as either a 0 or a 1. As a result, they can carry out some computations far more quickly than traditional computers.

Quantum computing may have a significant influence on cryptography. Today’s encryption techniques frequently rely on the difficulties of factoring huge numbers or resolving other challenging mathematical puzzles for conventional computers.

However, the speed at which quantum computers could solve these puzzles might make current encryption techniques attackable.

Another area where quantum computing could have an impact is in Bitcoin mining. Bitcoin mining involves complex arithmetic problems that must be solved to validate transactions and add them to the blockchain.

However, mining Bitcoin (BTC) demands a lot of processing power, which is why specialist equipment and software are needed. Quantum computers might be able to handle these issues considerably more quickly than traditional computers, which might make mining BTC more efficient.

Nonetheless, it is crucial to remember that quantum computers are not always superior to classical computers in all situations.

For instance, certain operations that require sifting through a lot of data, like looking for a particular record in a database, are still better suited for classical computers.

Additionally, the impact of quantum computing on cryptography and Bitcoin mining remains to be seen, with researchers still exploring the potential of this emerging technology.

2. How Efficient Are Quantum Computers In Bitcoin Mining?

Complex mathematical problems must be solved throughout the Bitcoin mining process, which can be accomplished significantly more quickly using quantum computers than with classical ones.

Yet, it is currently unclear how quantum computing may affect Bitcoin mining.

While quantum computers may increase mining productivity, they may also increase the risk of quantum hacking on the Bitcoin network.

This is because many public key cryptography-based encryption techniques used to protect Bitcoin are susceptible to attack by quantum computers.

Quantum hacking is a cyberattack that uses quantum computing to break through cryptographic systems.

Public key cryptography is a mathematical algorithm allowing two parties to communicate securely without exchanging a secret key beforehand.

The approach is based on the complexity of some mathematical tasks, such as computing discrete logarithms or factoring huge integers, which are thought to be challenging for traditional computers to tackle well.

Researchers are investigating using quantum cryptography and quantum-resistant algorithms to address this issue.

These techniques could help safeguard the Bitcoin network in the future since they are more resistant to attacks from quantum computers.

Furthermore, there are currently no quantum computers that can mine Bitcoin more effectively than conventional computers.

But, as quantum technology develops further, it is conceivable that quantum Bitcoin mining may become a reality in the future.

3. Can A Quantum Computer Hack Bitcoin?

By exploiting its higher processing capacity to defeat the encryption that safeguards private keys and transactions on the Bitcoin network, a quantum computer could theoretically hack Bitcoin.

However, the current state of quantum technology is not yet advanced enough to pose a significant threat to Bitcoin’s security.

Quantum computers might make public-key cryptography less secure because of their capacity to answer some mathematical problems far more quickly than classical computers.

For example, Shor’s algorithm — a quantum algorithm — can factor large integers exponentially faster than classical algorithms.

Factoring large integers is the basis of many public key encryption schemes, including the one used in Bitcoin.

The public-key cryptography employed in Bitcoin and other cryptocurrencies might hypothetically be cracked if a quantum computer had the processing capability to carry out Shor’s algorithm.

An attacker with a quantum computer could potentially steal BTC by computing the private key corresponding to a public key used to receive Bitcoin.

The big prime numbers used to generate the public-private key combination could be factored in to achieve this.

However, it is crucial to remember that quantum computing is still in its infancy and lacks the power to carry out Shor’s algorithm at the scale necessary to decrypt Bitcoin.

Although small-scale quantum computers have been shown to factor in small numbers, there is still a long way to go before a large-scale quantum computer that breaks Bitcoin’s encryption can be built.

In addition, the Bitcoin network is constantly developing to counter possible security risks, such as the risk presented by quantum computers.

For instance, a hash-based signature system like the Lamport signature method might make Bitcoin more resilient against quantum attacks.

Researchers are also investigating the use of post-quantum cryptography, which was created to be resistant to quantum computers.

The Lamport signature method is considered one of the post-quantum cryptographic methods that can be used to secure digital signatures from potential threats from quantum computers.

This technique generates several pairs of public and private keys to verify digital signatures using a one-time hash function.

The communication is protected against efforts at quantum hacking since each pair is used to sign a distinct section of the message.

Due to the one-time nature of the hash function, even if an attacker gets hold of one of the private keys, they cannot use it to forge other signatures or find the other private keys.

4. Can Quantum Computing Help Reduce Bitcoin’s Energy Consumption?

While quantum computing could potentially reduce Bitcoin’s energy consumption and improve mining efficiency, it’s important to consider the potential security risks and continue to develop quantum-resistant algorithms to ensure the integrity of the Bitcoin network.

Quantum computing has the potential to significantly reduce Bitcoin’s energy consumption by improving the efficiency of Bitcoin mining.

Quantum annealing, a type of quantum computing, can speed up the process of solving the hash function needed to mine BTC.

Quantum annealing is a technique used to solve optimization problems using quantum mechanics.

Miners may be able to solve the hash function significantly more quickly and efficiently than existing ASIC miners by using quantum annealing.

However, the Bitcoin network’s security mainly relies on cryptography, which may be subject to attacks by quantum computers. This has raised questions regarding the quantum resilience of the encryption techniques used by Bitcoin.

Some encryption algorithms used in Bitcoin mining, such as SHA-256, are considered quantum-resistant. Still, others, like the public key cryptography used for wallet addresses, could be vulnerable to quantum hacking.

Despite the potential advantages of using quantum computing for Bitcoin mining, ensuring the network’s security is not jeopardized is critical.

To keep the network safe from quantum hacking, researchers focus on creating quantum-resistant algorithms that can be utilized in Bitcoin mining.

It is also important to remember that not all hash functions can be solved by quantum annealing; some may still require classical computing techniques.

For instance, the National Institute of Standards and Technology developed SHA-3 (Secure Hash Algorithm 3), which is considered quantum-resistant because it uses a sponge construction and a permutation-based architecture. However, there is no mathematical evidence of this.

Updated: 5-25-2023

USBTC Aims To Become Bitcoin Mining Giant After Deal To Buy Celsius Assets

The miner could get as much as $75 million in management fees for the Celsius mining rigs over five years.

US Bitcoin Corp. (USBTC) is looking to be one of the largest miners in the U.S. by increasing its computing power by 12.2 exahash/second (EH/s), following a deal to buy mining assets from bankrupt lender Celsius, according to a press release.

The miner is part of a consortium, named Fahrenheit, that won a bankruptcy auction for the Celsius assets, which include a lending portfolio, crypto assets and 121,800 mining machines.

Once it brings all the mining rigs online, its fleet will total at least 270,000 mining rigs, the miner told CoinDesk.

This will raise its computing power to the ranks of mining giants such as Riot Platforms (RIOT), Core Scientific (CORZ) and Marathon Digital Holdings (MARA).

Under the Celsius deal, USBTC will enter into one or more operating and services agreements to be the “exclusive operator” of the Celsius mining fleet, the miner said.

On top of that, USBTC will receive a $15 million annual management fee for the mining assets, net of operating expenses, for the five years it will manage the rigs, the firm added.

That’s $75 million on top of expenses, provided that USBTC fulfills certain operational requirements.

Another $20 million in management fees will go to the Fahrenheit consortium, court filings show. The consortium will also receive stock incentives in the new company that will house the Celsius assets.

USBTC also has to build a 100 megawatts (MW) of infrastructure to house the Celsius rigs, and provide a plan for the buildout of another 240 MW of capacity in a behind-the-meter site.

The Miami-based firm has managed to massively increase its operational capabilities in the past few months, taking advantage of opportunities born out of bankruptcies.

It started from a single site in Niagara Falls, New York, but has now taken control of three sites formerly operated by Compute North, which filed for Chapter 11 in September 2022.

Two of those are owned by energy investment firm Generate Capital, while the third is a joint venture between USBTC and energy firm NextEra Energy.

USBTC has managed to secure hosting deals for 150,000 machines in its facilities. It is also undergoing a merger with Canada’s Hut 8 Mining (HUT).

Other members of the consortium that will be managing the Celsius assets are Arrington Capital, Proof Group Capital Management, Steven Kokinos, and Ravi Kaza.

Updated: 6-1-2023

Scientists Propose Quantum Proof-Of-Work Consensus For Bitcoin Mining

“Whereas classical PoW schemes such as Bitcoin’s are notoriously energy inefficient, our boson sampling-based PoW scheme offers a far more energy efficient alternative when implemented on quantum hardware.”

Boson sampling was once considered a problem looking for a solution. Now, it might be the bridge that brings quantum computing to the mining Bitcoin.

A team of researchers from universities in Australia and the United States, working in collaboration with quantum technology company BTQ, recently published research proposing a novel proof-of-work (PoW) scheme for blockchain consensus that relies on quantum computing techniques to validate consensus.

Our new paper on using NISQ-era quantum sampling problems in proof-of-work blockchain consensus algorithms. In collaboration with @BTQ_Tech.https://t.co/MKAB2czqSk

— Peter Rohde (@drpeterrohde) June 1, 2023

Dubbed “Proof-of-work consensus by quantum sampling,” the preprint research paper details a system that the authors claim “provides dramatic speedup and energy savings relative to computation by classical hardware.”

According to the researchers, current algorithms for solving PoW consensus puzzles are slow and require a significant amount of computation resources to process.

According to the paper, the quantum advantage provided by this scheme would also increase the difficulty of mining, thus making it possible to “maintain consistent block mining time” as the number of miners increases, further incentivizing continuing participation of “quantum miners.”

The sampling process the researchers refer to, boson sampling, isn’t a new one, but its application to blockchain technology appears novel. Boson sampling has shown promise in numerous quantum computing applications.

Still, as a non-universal quantum computing solution (it has to be used in a system built for a specific task), its potential has been limited to a select few domains, such as chemistry.

However, according to the researchers, it may be the perfect solution for future-proofing blockchain applications and, potentially, lowering the environmental impact of mining on the Bitcoin blockchain and similar chains.

Aside from quantum advantage, quantum hardware also has a leg up on old school computers due to the nature of how blockchain mining works.

One of the current advantages of classical supercomputers over their new quantum cousins is the ability to “precompute” when handling the same class of problem regularly. But, when it comes to blockchain, such precompute is essentially wasted.

Mining is, as the researchers put it, a problem that is “progress-free.” No matter how many times a blockchain puzzle is solved to provide proof-of-work, the computer and algorithms processing the challenges don’t ever get any better at solving the problem.

This means that quantum computers, despite being notoriously challenging to develop and expensive to build and maintain, would ultimately be capable of validating consensus more efficiently than state-of-the-art classical systems.

Updated: 7-26-2023

Thirsty Data Centers Are Making Hot Summers Even Scarier

For more than a year, Spain has been struggling with drought that has sent water levels in dams below historical averages, prompting local officials to tell residents not to water their gardens and to turn off taps at night to guarantee supply during the day.

The situation is particularly hard for farmers. The central region of Castilla La Mancha, which produces a quarter of all Spanish grain, is expected to lose 80% to 90% of this year’s harvest, and water restrictions loom large.

Yet in Talavera de la Reina, a small city tucked among the region’s yellowing barley and wheat fields, Meta Platforms Inc. is planning to build a €1 billion ($1.1 billion) data center.

Meta expects the facility to use about 665 million liters (176 million gallons) of water a year, and up to 195 liters per second during “peak water flow,” according to a technical report. Enthusiasm about the jobs the project is expected to create (1,000 in total, about 250 of which will be permanent) is now being weighed against heightened concerns over water.

“People don’t realize that ‘the cloud’ is real, that it is part of an ecosystem that consumes many resources,” says Aurora Gómez, a spokesperson for Tu Nube Seca Mi Río (“Your Cloud Dries Up My River” in Spanish), a group created to fight the construction. “People are not aware of the amount of water that goes into watching a kitten meme.”

We tend to think of the internet as immaterial, but websites exist in the real world as rows of servers that never turn off, filling data centers that need to be cooled to prevent technical failures.

Operators such as Amazon, Google, Meta and Microsoft use a wide array of systems to do this; the most energy-efficient ones—such as cooling towers—typically evaporate water to chill the air circulating in the buildings.

With drought spreading around the globe, battles are emerging between data center operators and adjacent communities over local water supplies in places such as Chile, Uruguay and parts of the southwestern US.

In the northern Netherlands, public outrage erupted last year when a local news outlet reported that a Microsoft Inc. data center complex was consuming more than four times as much water as the company had previously disclosed.

Some of the cooler, wetter hubs in northern Europe, such as Ireland and the Netherlands, have blocked the development of new data centers because of concerns about energy consumption, leading companies to start looking farther afield.

Operators of hyperscale data centers, those with more than 5,000 servers, are migrating to places where water is plentiful, such as Norway, but also to drought-prone places like Italy and Spain where energy is cheaper—and where extreme heat is becoming the norm.

While data centers have faced scrutiny over their electricity use, little is known about their water consumption—including by tech companies themselves. A survey conducted last year by the Uptime Institute, a consulting firm, found that only 39% of data centers even tracked their water use, a 12 percentage-point drop from 2021.

Tech companies in the past have refused to disclose information about individual centers’ energy and water consumption, claiming that such data was a trade secret.

Over the last couple of years, Google, Meta and Microsoft have started publishing their total water use across their operations, but they don’t break the number down by business unit nor use standardized metrics. Bluefield Research has estimated data centers use more than a billion liters of water per day, including water used in energy generation.

Governments are beginning to demand more information. Beginning in March 2024, the European Commission will require operators to report wide-ranging data about their energy and water use to the public.

In the UK, the Thames Water utility is investigating the amount of water that data centers are using in London and may adjust its pricing model for water-intensive businesses depending on the findings.

Identifying which water-intensive clients are data centers hasn’t been easy, says John Hernon, who’s heading up the probe. Operators often use shell companies to apply for planning permissions, and a data center can look like any large warehouse or factory from the outside.

Arman Shehabi, a researcher at the Lawrence Berkeley National Laboratory in California best known for a landmark paper on energy consumption at data centers, thinks the facilities could contribute to scarcity as droughts become longer and more intense.

Part of the problem, he says, is that data center operators “are generally the last ones to the table to ask,” straining the system by asking for access to scarce water after agricultural interests and local communities have already come up with a plan. “Everybody is going to feel that,” he says.

Companies say data centers are getting more energy-efficient, but the increase in overall demand for computing power is outpacing such gains. The race to build large language models used in generative AI has created a surge in demand for more powerful processors.

The specialized chips required for AI—broadly known as accelerators—emit so much more heat than general-purpose chips do that data center operators are having to rethink their cooling systems entirely, says Colm Shorten, a data center sustainability expert at real estate investment firm JLL.

Shaolei Ren, associate professor of electrical and computer engineering at University of California, Riverside, has conducted research estimating that training GPT-3 in Microsoft’s US data centers directly consumed 700,000 liters of water in about a month—not including the indirect water use associated with electricity generation.

The team has also calculated that every short conversation of 20 to 50 questions and answers with ChatGPT represents about 500 milliliters of water.

“Microsoft is investing in research to make large systems more sustainable and efficient, in both training and application,” said a Microsoft spokesperson in an emailed statement.

“Climate change is a real and urgent challenge, with increasingly severe impact on our businesses, our communities, and the ecosystems that sustain them.” OpenAI did not respond to requests for comment.

Shorten says that over time data centers will need to radically change the way they dissipate heat. The gold standard, he says, is a process called immersive cooling, in which servers are bathed in a special fluid that transfers heat from the chips.

For now, operators are likely to opt for a hybrid model, wherein a high-performance section of the data center will be liquid-cooled while the rest will continue to use air conditioning, he says.

Amazon Web Services, Google and Microsoft have all made water stewardship pledges, promising to use more nonpotable and recycled water and to replenish more water than they consume operationally by 2030.

This is the equivalent to offsetting carbon by planting trees—something that looks good on paper but may not directly benefit the communities affected by data centers, because water may be replenished only in places where it’s easy to do so.

In Spain, Meta has pledged to “restore more volume of water than is consumed at the facility, through hydrological restoration projects,” but it hasn’t yet determined whether water restoration efforts will affect Talavera.

It says it recycles water used in its facilities and has reduced the controlled humidity level in data halls where it uses direct evaporative cooling, cutting water consumption by 10% to 65% across those facilities.

As authorities experiment with provisional measures such as covering one of the town’s central streets with a canopy of umbrellas to protect locals from the sun, Gómez from Tu Nube Seca Mi Río is skeptical that tech’s promises to help will have any positive effect on Talavera.

The water replenishment plans fulfill two objectives, she said: “to look good in the eyes of the general public, and to win over a local environmental group.”

Updated: 12-04-2023

Bitcoin Is Of ‘National Strategic Importance’ Says US Space Force officer

U.S. Space Force Major Jason Lowery wants the U.S. military to prioritize the investigation of proof-of-work systems like Bitcoin for the country’s defense.

The United States needs to formally investigate using proof-of-work networks such as Bitcoin (BTC) to protect the country from cyber-inflicted warfare, according to Jason Lowery, a member of the United States Space Force.

In a four-page letter to the U.S. Defense Innovation Board on Dec. 2, Lowery explained that while Bitcoin is mostly seen as a “monetary system” to secure funds, few know that Bitcoin can be used to secure “all forms of data, messages or command signals.”

“As a result, this misconception underplays the technology’s broad strategic significance for cybersecurity, and consequently, national security.”

The Defense Innovation Board is an independent advisory board set up to bring the technological innovation and best practices of Silicon Valley to the U.S. Military. Lowery used the letter to urge the board to advise the Secretary of Defense to investigate the “national strategic importance” of PoW systems like Bitcoin.

Lowery used the letter to urge the board to advise the Secretary of Defense to investigate the “national strategic importance” of PoW systems like Bitcoin.

In his letter, Lowery explained that a proof-of-work system like Bitcoin could work to deter adversaries from cyberattacks due to the “steep costs” of a physically resource-intensive computer in the same way military assets help to deter military attacks against the country.

“Proof-of-work mirrors the physical security and deterrence strategies utilized in other domains like land, sea, air, and space,” but instead, it does it in the digital domain, Lowery explained.

BREAKING: US Space Force Major, Jason Lowery sends open letter about #Bitcoin to DOD’s Defense Innovation Board.

“I contend that reusable proof-of-work networks like #Bitcoin represent an offset strategy for the 21st century.” pic.twitter.com/qiLZ71S5MN

— Dennis Porter (@Dennis_Porter_) December 3, 2023

Bitcoin’s potential cybersecurity applications are huge, according to Lowery, and could play an important role in the U.S. maintaining its position as the world leader.

“Addressing this could be vital for the US to maintain its positions as a global superpower and leader among nations, especially in an increasingly digital and interconnected world plagued by security vulnerabilities.”

Lowery says it has the potential to kickstart the “cybersecurity revolution” too.

“[It is] the beginning of a cybersecurity revolution. It converts the global electric power grid into a large, physically costly computer, or ‘macrochip,’ and uses it to physically constrain malicious actors and safeguard a wide range of data and messages traversing the internet.”

Lowery concluded Bitcoin’s cybersecurity application aligns “perfectly with a strategic offset” and that the U.S. Department of Defense may have already “lost valuable time” by not implementing it into its arsenal.

Lowery is also a national defense fellow at Massachusetts Institute of Technology (MIT) and previously proposed a cybersecurity tool on the Bitcoin base layer in March, which he claims is capable of transforming the country’s national security.

Bitcoin “Best Defender” of U.S. interests: Coinbase CEO

Meanwhile, in a separate thread on X, Coinbase CEO Brian Armstrong argued that Bitcoin and cryptocurrencies could play a pivotal role in helping the United States maintain its dominance with the U.S. dollar, according to Coinbase CEO Brian Armstrong.

“One idea I’ve been contemplating is that Bitcoin may be the key to extending western civilization,” said Armstrong in a Dec. 3 post, explaining that cryptocurrencies can work in tandem with the U.S. dollar instead of dethroning it.

“I think it will be a natural check and balance that will complement the dollar and be the best defender of long term American interests,” Armstrong added.

One idea I’ve been contemplating is that Bitcoin may be the key to extending western civilization.

The natural trend of whichever country has the reserve currency is to inflate the money supply and increase deficit spending until it loses that advantage. The U.S. is somewhere on…

— Brian Armstrong ️ (@brian_armstrong) December 3, 2023

He explained that world leaders often fail to retain the reserve currency by inflating its money supply and increasing its deficit spending.

“The U.S. is somewhere on this journey,” Armstrong explained but stressed the Chinese yuan and Euro aren’t viable alternatives at the moment as they have issues of their own.

Instead, cryptocurrencies have the potential to be the alternative currency in the event of a U.S. dollar downfall:

“What I think many haven’t considered is that people have an alternative now with crypto. They may start moving fiat into crypto, as an antidote to inflation.”

Armstrong stressed it’s better to move from dollars to cryptocurrencies than another country’s fiat currency if the U.S. dollar loses its dominance.

He added that U.S. dollar-backed stablecoins like USD Coin (USDC) and the emergence of flat coins will play a “major role in unifying these worlds.”

Updated: 1-24-2024

Global Emissions From Electricity Set To Fall Even As Power Demand Climbs, IEA Predicts

Starting this year, record generation from renewables and nuclear will cover rising power demand from growth in emerging markets, AI and data centers, the agency says.

Global demand for electricity is set to grow at a faster rate over the next three years, but with record power generation from renewables and nuclear expected to cover the surge, emissions will likely go into structural decline, according to the International Energy Agency.

Electricity demand is on track to rise by an average of 3.4% a year through 2026, driven by robust growth in emerging economies, AI, cryptocurrencies and data centers, according to the Paris-based organization’s latest report.

However, global carbon-dioxide emissions from power generation are expected to fall, as low-emission energy sources—wind, solar, hydro and nuclear, among others—are likely to account for almost half of the world’s electricity generation by 2026, up from just under 40% last year.

“It’s encouraging that the rapid growth of renewables and a steady expansion of nuclear power are together on course to match all the increase in global electricity demand over the next three years,” IEA’s executive director Fatih Birol said on Wednesday.

“This is largely thanks to the huge momentum behind renewables, with ever cheaper solar leading the way, and support from the important comeback of nuclear power, whose generation is set to reach a historic high by 2025.”

In 2023, global CO2 emissions from electricity generation increased by 1%, but the IEA predicts a fall of more than 2% this year and smaller decreases in the next two years.

Generation from cleaner energy sources is expected to rise at twice the annual growth rate seen between 2018 and 2023, while coal-fired generation is forecast to fall by an average of 1.7% annually through 2026, the IEA said.

Rapid growth of renewables will be supported by nuclear power. According to the report, nuclear generation is set to rise by roughly 3% a year on average to the end of 2026, despite a number of countries phasing out nuclear power or closing plants early.

France and Japan will restart several plants while new reactors begin operating in Europe, China, India and Korea. Asia will likely remain the main driver of growth, reaching a 30% share of global nuclear generation in 2026, the IEA said.

For years, nuclear power has been at the center of the clean-energy debate. Proponents including France argue that it is a reliable, low-carbon alternative to fossil fuels, while opponents such as Germany say costs and risks from reactor accidents and waste are too high.

At the United Nations’ COP28 climate summit last year, the U.S. and 21 other nations pledged to triple nuclear power capacity by the middle of the century.

Most of the increase in electricity demand forecast by the IEA is set to come from emerging markets. China is expected to be the largest contributor to growth—with consumption boosted by the production of solar PV modules, electric vehicles and the processing of raw materials—while India is forecast to grow the fastest among major economies.

Rapid expansion of artificial intelligence, data centers and cryptocurrencies will also be a driver of growth, according to the agency, which predicts their power demand could double to roughly the equivalent of electricity consumption in Japan.

Last year, electricity demand growth slowed to 2.2% from 2.4% in 2022, as advanced economies suffered the impact of high inflation and lower industrial output, the IEA said.

Demand in the U.S. decreased by 1.6% after rising 2.6% in 2022, mainly because milder weather reduced the use of heaters and coolers, but demand is expected to recover this year to 2026. European Union power demand declined for the second consecutive year in 2023—despite a fall in energy prices—and isn’t expected to return to high levels until 2026 at the earliest, the IEA said.

Updated: 1-25-2024

AI Needs So Much Power That Old Coal Plants Are Sticking Around

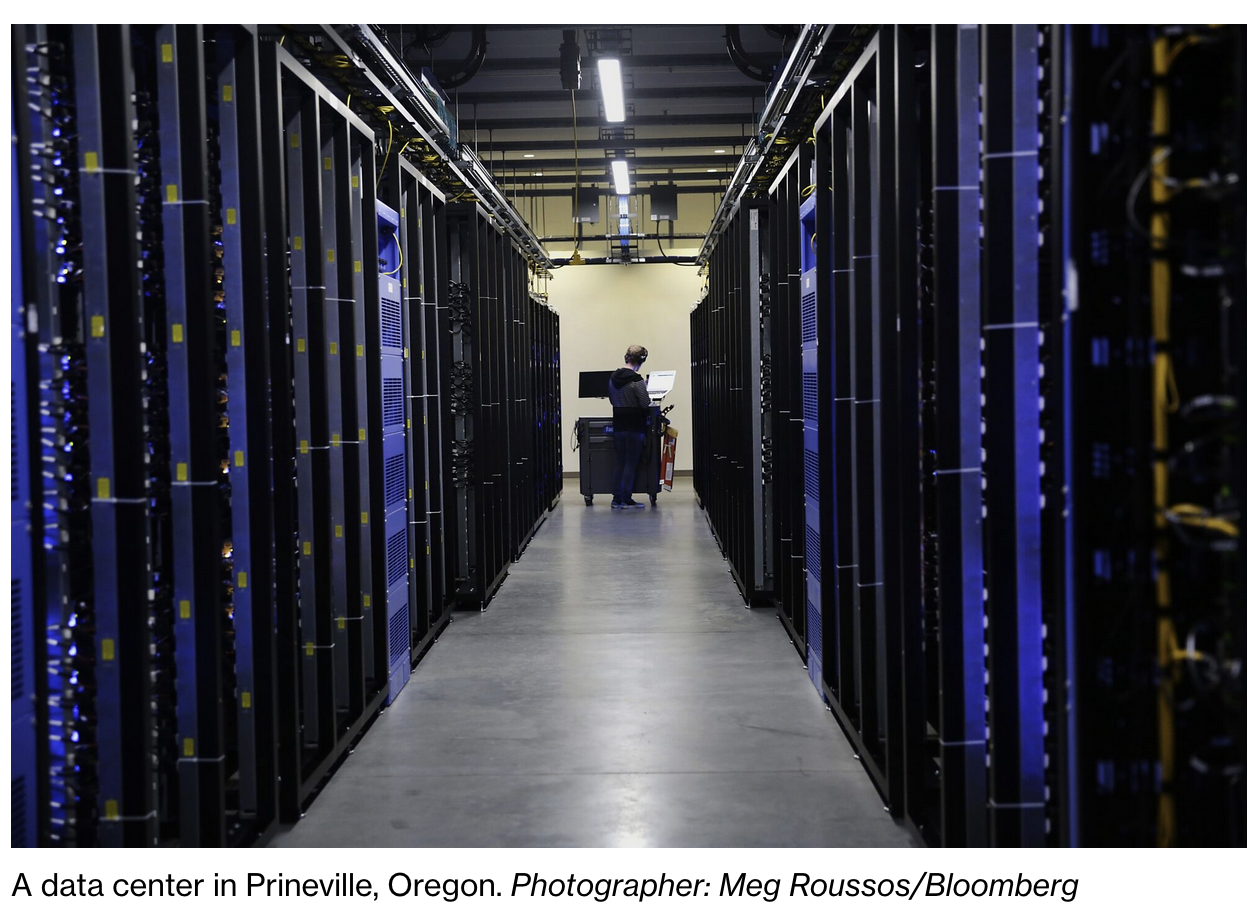

Power companies are scrambling to satisfy the needs of data centers and new factories in a country where the grid is already strained.

In a 30-square-mile patch of northern Virginia that’s been dubbed “data center alley,” the boom in artificial intelligence is turbocharging electricity use. Struggling to keep up, the power company that serves the area temporarily paused new data center connections at one point in 2022.

Virginia’s environmental regulators considered a plan to allow data centers to run diesel generators during power shortages, but backed off after it drew strong community opposition.

In the Kansas City area, a data center along with a factory for electric-vehicle batteries that are under construction will need so much energy the local provider put off plans to close a coal-fired power plant.

This is how it is in much of the US, where electric utilities and regulators have been caught off guard by the biggest jump in demand in a generation. One of the things they didn’t properly plan for is AI, an immensely power-hungry technology that uses specialized microchips to process mountains of data.

Electricity consumption at US data centers alone is poised to triple from 2022 levels, to as much as 390 terawatt hours by the end of the decade, according to Boston Consulting Group.

That’s equal to about 7.5% of the nation’s projected electricity demand. “We do need way more energy in the world than we thought we needed before,” Sam Altman, chief executive officer of OpenAI, whose ChatGPT tool has become a global phenomenon, said at the World Economic Forum in Davos, Switzerland last week. “We still don’t appreciate the energy needs of this technology.”

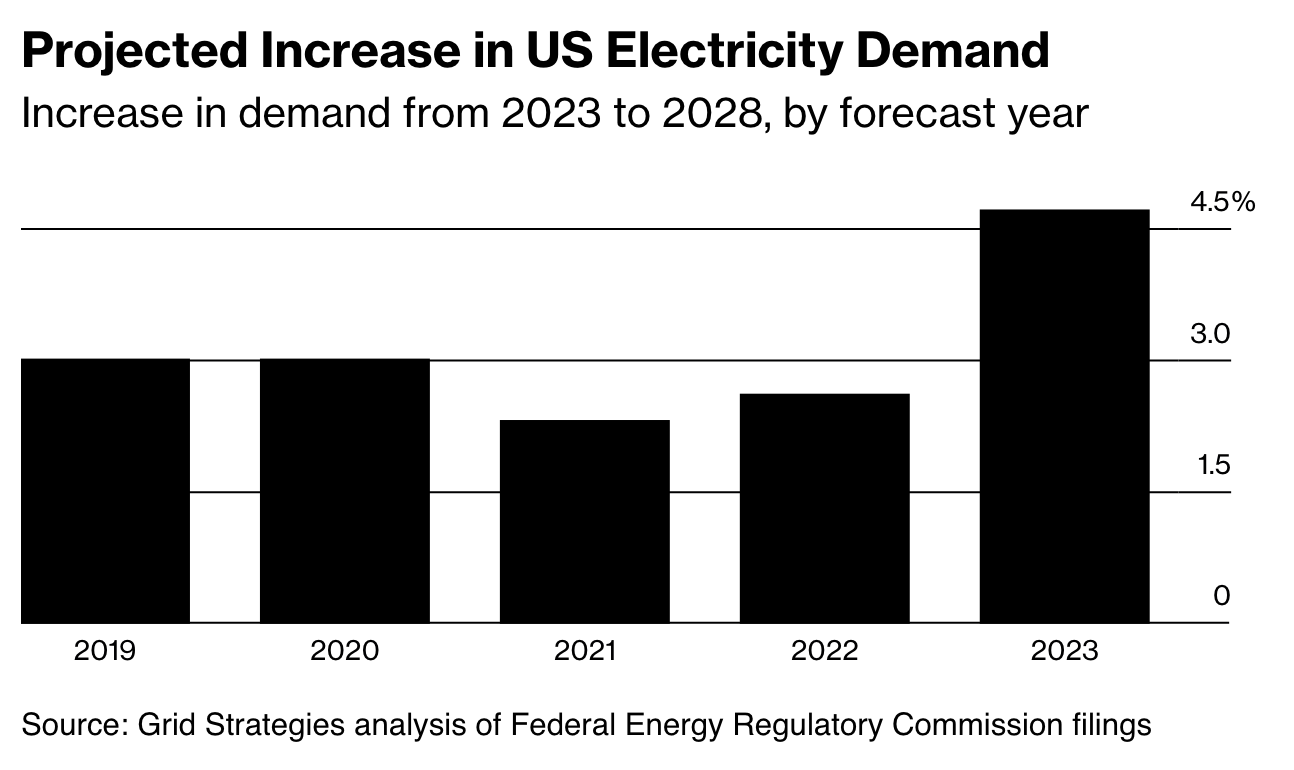

For decades, US electricity demand rose by less than 1% annually. But utilities and grid operators have doubled their annual forecasts for the next five years to about 1.5%, according to Grid Strategies, a consulting firm that based its analysis on regulatory filings.

That’s the highest since the 1990s, before the US stepped up efforts to make homes and businesses more energy efficient.

It’s not just the explosion in data centers that has power companies scrambling to revise their projections. The Biden administration’s drive to seed the country with new factories that make electric cars, batteries and semiconductors is straining the nation’s already stressed electricity grid.

What’s often referred to as the biggest machine in the world is in reality a patchwork of regional networks with not enough transmission lines in places, complicating the job of bringing in new power from wind and solar farms.

To cope with the surge, some power companies are reconsidering plans to mothball plants that burn fossil fuels, while a few have petitioned regulators for permission to build new gas-powered ones. That means President Joe Biden’s push to bolster environmentally friendly industries could end up contributing to an increase in emissions, at least in the near term.

Unless utilities start to boost generation and make it easier for independent wind and solar farms to connect to their transmission lines, the situation could get dire, says Ari Peskoe, director of the Electricity Law Initiative at Harvard Law School. “New loads are delayed, factories can’t come online, our economic growth potential is diminished,” he says.

“The worst-case scenario is utilities don’t adapt and keep old fossil-fuel capacity online and they don’t evolve past that.”

Rob Gramlich, founder of Grid Strategies, says that based on his firm’s projections for peak usage during the summer months, the US could soon be facing a future of rolling blackouts if infrastructure improvements keep getting delayed.

“That’s the ultimate concern everybody has: that we’ll be short on power,” he says. At least $20 billion annually needs to be invested in new long-distance transmission lines, but virtually nothing is being spent on them now, he adds.

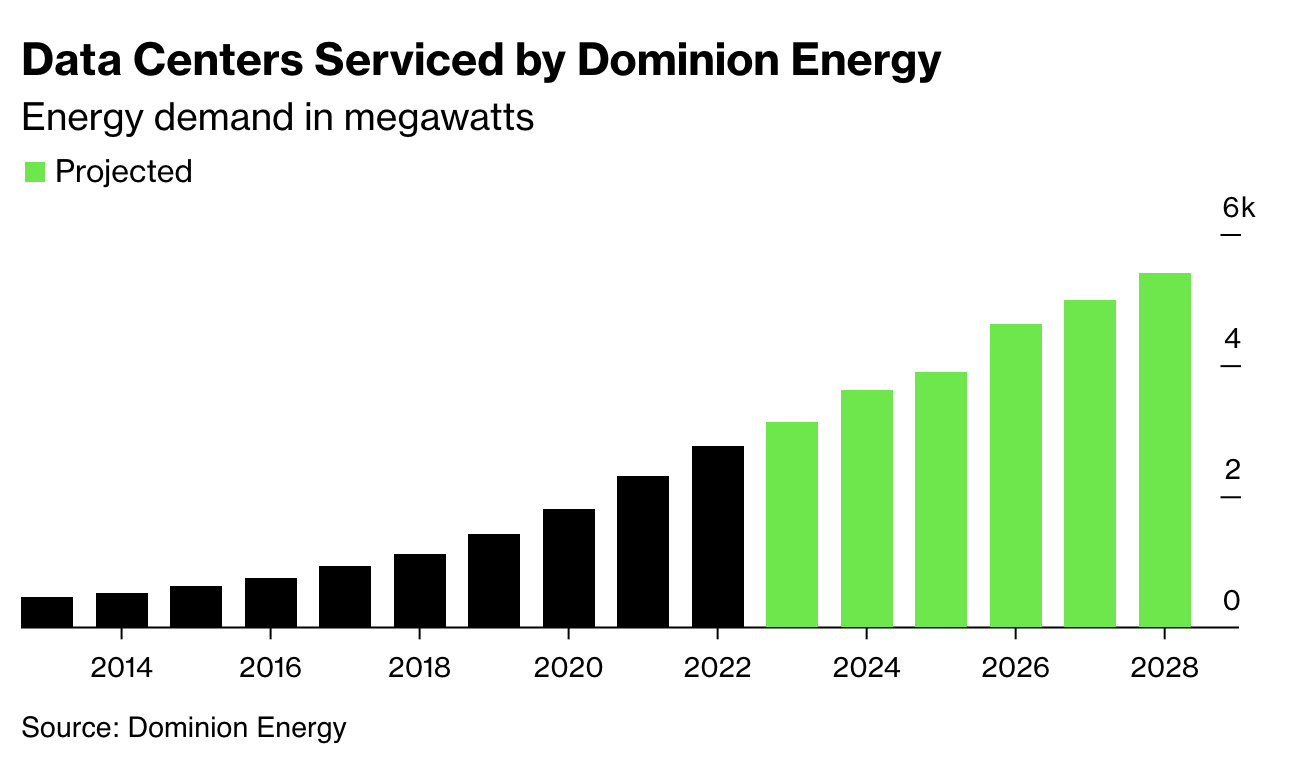

In Virginia, which bills itself as the world’s biggest hub for data centers, about 80 facilities have opened in Loudoun County since 2019 as the pandemic accelerated the shift online for shopping, office work, doctor visits and more.

Electricity demand was so great that Dominion Energy Inc. was forced to halt connections to new data centers for about three months in 2022.

That same year, the head of data center company Digital Realty said on an earnings call that Dominion had warned its big customers about a “pinch point” that could prevent it from supplying new projects until 2026.

A Dominion representative says this is inaccurate. The pause on new data center connections lasted just a few months, affected only a small area of Loudoun County and had no impact on customers outside of “data center alley,” spokesperson Aaron Ruby said in an email.

“After accelerating several new transmission projects, we were able to fully resume service connections and have since connected 27 new data centers in eastern Loudoun.”

Dominion says it expects demand in its service territory to grow by nearly 5% annually over the next 15 years, which would almost double the total amount of electricity it generates and sells. To prepare, the company is building the biggest offshore wind farm in the US some 25 miles off Virginia Beach and is adding solar energy and battery storage.

It has also proposed investing in new gas generation and is weighing whether to delay retiring some natural gas plants and one large coal plant.

Utilities are having to contend with other power hogs, besides data centers. There’s about $465 billion worth of semiconductor, EV and battery factories announced since Biden took office, according to White House data, many of them spurred by laws Congress passed in 2022 that give incentives to invest in clean tech and chip fabs.

In Kansas City, construction is underway on a data center run by Meta Platforms Inc., while on the city’s outskirts, Panasonic Holdings Corp. is building a factory where energy-intensive robots will help assemble EV batteries.

Both projects, as well as overall economic development in the region, are fueling some of the “most robust electricity demand growth in decades,” said David Campbell, chief executive officer of Evergy, the utility that serves the area, in a June 15 press release.

In the same communication, the company said it would delay retiring a coal plant that’s been operational since the 1960s by five years, to 2028.

Soaring electricity demand is slowing the closure of coal plants elsewhere. Almost two dozen facilities from Kentucky to North Dakota that were set to retire between 2022 and 2028 have been delayed, according to America’s Power, a coal-power trade group.

Many tech companies and clean tech manufacturers prefer their plants to be powered exclusively by renewable energy. But those aspirations are running up against reality, says Mark Nelson, managing director of energy consultancy Radiant Energy Group: “Factories say, ‘We want clean energy. At this point we’ll take anything.’”

Some corporations are now being forced to consider locations they had initially overlooked to secure energy within the timeframe they need, such as rural areas in Mississippi, says Didi Caldwell, who’s spent more than two decades helping companies find sites for their facilities and runs a consulting firm in South Carolina.

In Arizona, historic demand prompted the state’s largest utility to temporarily stop accepting new business in the fall from very large data centers that need power around the clock, according to people with knowledge of the matter.

Arizona Public Service needed to do in-depth studies on things such as how many transmission lines are needed and where substations will be located before signing contracts, one of the people said.

“The number and the size of requests kept coming,” says Tony Tewelis, who works in APS’s transmission and distribution group, adding that some customers had asked for almost 2 gigawatts of power. “We wanted to make sure that we did our due diligence before we said yes.”

APS says it will roll out a new process this year where it will perform case-by-case studies before taking on very large data centers as customers.

Other parts of the world are also seeing big increases in power demand. China’s electricity need is forecast to grow about 6% this year, driven by the manufacturing of things like EVs and solar equipment; in India it’s set to almost double in the decade through to 2032. And London’s aging electricity grid is struggling to add more data centers.

A big power company with operations in six states, Duke Energy has seen unprecedented demand growth, spurred by data centers, factories and EVs—including both manufacturing and charging. It plans to ask regulators for permission to build more gas-fired and solar power projects by the early 2030s.

But Glen Snider, who heads resource planning, warns that even with that additional capacity, the company might have to keep some customers waiting if future demand growth outpaced its ability to add new generation and transmission.

“There’s not an infinite ability for resources to be added to the grid,” he says. “So if growth accelerated even further, we might have to delay the timing at which new large loads are added.”

Updated: 2-1-2024

Biden Administration Unveils ‘Emergency’ Bitcoin Mining Survey

US miners must disclose the number of ASIC miners, the models, and the ages of those machines.

The Biden administration is launching an emergency data collection initiative targeting cryptocurrency mining operations in the United States, the US Energy Information Administration (EIA) announced yesterday, according to the EIA’s press release.

The EIA, the statistical agency within the Department of Energy, said it is “initiating a provisional survey of electricity consumption information from identified cryptocurrency mining companies” starting next week.

The mining companies will have to comply with the data request, which was authorized as an “emergency collection” by the White House Office of Management and Budget.

The Survey Is Titled “Proposed Emergency Survey – Cryptocurrency Mining Facilities.”

Based on the specific information being requested, the EIA appears to be creating a detailed registry of mining operations nationwide. The agency is asking for data such as the make-up of mining fleets and hashrate information.

Biden has declared a Federal “emergency” because #bitcoin is winning pic.twitter.com/NwxLxHynQ9

— Pierre Rochard (@BitcoinPierre) January 31, 2024

Mining companies will be required to provide extensive data about their firms and the locations of their mining centers, including geographic coordinates. They must disclose the total electricity consumption at each facility, regardless of whether the miner controls all the energy use.

Additionally, miners must reveal the percentage of the facility’s power that goes specifically to crypto mining and identify their electric utility provider.

The EIA also wants specifics on mining equipment. For each facility, miners will have to disclose the number of ASIC miners, the models and ages of those machines to determine energy needs, and the maximum hashrate performance during the reporting period.

The Biden administration’s interest in closely monitoring Bitcoin mining energy usage comes on the heels of reiterating last year that it wants to impose a federal 30% tax on electricity costs for all mining operations.

Updated: 2-25-2024

AI Is Exploding Data Center Energy Use. And Google Leans On Bitcoin Miners For Answers

Data center operators are shifting computing power to locations where the cleanest electrons are, in an effort to reduce tech’s carbon footprint.

Tech giants are racing to ward off a carbon time bomb caused by the massive data centers they’re building around the world.

A technique pioneered by the Bitcoin Mining industry and copied by Google is gaining currency as more power-hungry artificial intelligence comes online: Using software to hunt for clean electricity in parts of the world with excess sun and wind on the grid, then ramping up data center operations there. Doing so could cut carbon and costs.

There’s an urgent need to figure out how to run data centers in ways that maximize renewable energy usage, said Chris Noble, co-founder and chief executive officer of Cirrus Nexus, a cloud-computing manager tapping data centers owned by Google, Microsoft and Amazon.

The climate risks sparked by AI-driven computing are far-reaching — and will worsen without a big shift from fossil fuel-based electricity to clean power. Nvidia Corp. Chief Executive Officer Jensen Huang has said AI has hit a “tipping point.” He has also said that the cost of data centers will double within five years to power the rise of new software.

Already, data centers and transmission networks each account for up to 1.5% of global consumption, according to the International Energy Agency. Together, they’re responsible for emitting about as much carbon dioxide as Brazil annually.

Hyperscalers — as the biggest data center owners like Google, Microsoft and Amazon are known — have all set climate goals and are facing internal and external pressure to deliver on them. Those lofty targets include decarbonizing their operations.

But the rise of AI is already wreaking havoc on those goals. Graphics processing units have been key to the rise of large language models and use more electricity than central processing units used in other forms of computing. Training an AI model uses the more power than 100 households in a year, according to IEA estimates.

“The growth in AI is far outstripping the ability to produce clean power for it,” he said.

Moreover, AI’s energy consumption is volatile and more akin to a sawtooth graph than a smooth line that most data center operators are used to. That makes decarbonization a challenge, to say nothing of ensuring grid stability.

AI’s growth is being driven by North American companies, keeping computing power — and energy usage — concentrated there, said Dave Sterlace, account director for global data centers at Hitachi Energy. That’s a trend he didn’t expect two years ago.

To lower data center CO2 emissions, hyperscalers and other data center providers have financed massive amounts of solar or wind farms and used credits to offset emissions. (In the case of credits, some have failed to have a meaningful impact on emissions.)

But that alone won’t be enough, especially as AI use ticks up. That’s why operators are turning to the strategy employed by Alphabet Inc. unit Google called load shifting. The idea: Lower emissions by upending the way data centers function.

Today, most data centers seek to operate in a “steady state,” such that their energy consumption is fairly stable. That leaves them at the mercy of the grid they’re connected to and whatever the day’s mix of natural gas, nuclear and renewable power generation is given the lack of transmission lines between regions.

To break their reliance on dirtier grids, tech giants are looking for opportunities to shift daily or even hourly data center operations around the world in an effort to soak up excess renewable energy production.

Google launched the first effort to match its power usage at certain data centers with zero-carbon power on an hourly basis in a bid to get its machines running on clean energy 24/7. No one has fully achieved that goal yet.

And, to be sure, the strategy of shifting loads around the world might be complicated by countries pushing for data sovereignty policies that attempt to restrict and safeguard the flow of data across borders.