Millions of Credit-Card Customers Can’t Pay Their Bills. Lenders Are Bracing For Impact (#GotBitcoin?)

Credit-card debt kept many consumers afloat. Now that the debt bubble is bursting, lenders and borrowers alike are preparing for pain. Millions of Credit-Card Customers Can’t Pay Their Bills. Lenders Are Bracing For Impact (#GotBitcoin?)

Robert Rodriguez and Migdalia Wharton, a married couple in Orlando, Fla., have been out of work for more than a month and can’t afford to pay their credit-card bills.

When they called Capital One Financial Corp. to explain, the bank told them they could skip their April payments. But they doubt they will have money in May. Ms. Wharton, a school-bus driver, was told she wouldn’t get paid until school reopens. Mr. Rodriguez, a cancer survivor, is worried for his health and has stopped driving for Uber.

“We don’t know what we’re going to do,” Mr. Rodriguez said.

Millions of Americans are skipping their credit-card payments as the coronavirus pandemic puts them out of work. Banks and other lenders that for years relied on heavy consumer spending to create big profits are preparing to struggle alongside their customers.

As the economy spirals, credit-card payments are one of the first places where the effects will show up. They are often the first loans people stop paying when money is tight. They are usually unsecured, which means lenders have little recourse if a borrower stops paying.

Many large card issuers, including Capital One, Discover Financial Services and Synchrony Financial, are letting borrowers pause their credit-card payments for a month or longer. Some are lowering or waiving late fees and interest charges, or even forgiving portions of customers’ balances.

Those suspensions will allow some borrowers to stay afloat, but only temporarily. Companies and analysts expect delinquencies and charge-offs to soar later this year. Banks and other lenders can only shoulder the unpaid loans for so long before they face a reckoning too.

Shares of Discover and Synchrony have lost more than half their value so far this year. That is far worse than the broader market, which has declined about 12%, and sectors less exposed to unemployment worries, such as technology, health care and consumer staples.

Discover and Synchrony said this week that they have allowed hundreds of thousands of borrowers to defer their payments, including many credit-card customers. Capital One, which has roughly 120 million credit-card accounts in the U.S., according to the Nilson Report, said it enrolled 1% of its active card accounts into deferral programs. The three banks are a good gauge of the financial health of a swath of American consumers. Discover and Synchrony generally don’t market to affluent customers, and Capital One has a large number of customers with less-than-pristine credit scores.

Banks hope that delaying payments will buy time for the economy to recover and consumers to get back on track. But for people who have no idea when they will be back at work, that likely won’t be enough. Many Americans were already overstretched even before the pandemic, tapping credit cards and other debt at record levels to keep up with soaring costs for college, health care, housing and other expenses.

Marena Owens called Synchrony in March to ask about deferring payments on her T.J. Maxx, American Eagle Outfitters Inc. and J.C. Penney Co. cards. She accepted an offer to skip the April payments on two of the cards, and to erase the roughly $50 balance on her J.C. Penney card. Ms. Owens lost her job at an Ohio car dealership the same week.

Unsure of when she might return to work, Ms. Owens called Synchrony again this week, and was told she could defer her T.J. Maxx payment due in early May for another month. She is planning to ask for the same reprieve on her American Eagle card.

“I probably won’t pay if they’re not willing to work with me,” she said.

A Synchrony spokeswoman said the bank “is here to assist our customers…who are experiencing financial hardship as a result of this crisis.”

Discover, Capital One, American Express Co., JPMorgan Chase & Co. and other card issuers have together socked away billions of extra dollars to prepare for big potential loan losses.

“We clearly have already had significant deterioration,” said Roger Hochschild, Discover’s chief executive, in an interview. “This was very quick and cataclysmic.”

Some lenders are also tightening the credit available to new applicants or existing customers.

Banks including Citigroup Inc., Discover and Synchrony are shutting down credit cards that haven’t been used in a while or lowering spending limits. The companies say they were taking these measures before the pandemic as a way to lessen risk. But those moves could also leave some borrowers without access to credit just when they need it most.

Missed payments, though, aren’t the only problem for card issuers.

As the economy spirals, credit-card payments are one of the first places where the effects will show up. They are often the first loans people stop paying when money is tight. They are usually unsecured, which means lenders have little recourse if a borrower stops paying.

Many large card issuers, including Capital One, Discover Financial Services and Synchrony Financial, are letting borrowers pause their credit-card payments for a month or longer. Some are lowering or waiving late fees and interest charges, or even forgiving portions of customers’ balances.

Those suspensions will allow some borrowers to stay afloat, but only temporarily. Companies and analysts expect delinquencies and charge-offs to soar later this year. Banks and other lenders can only shoulder the unpaid loans for so long before they face a reckoning too.

Shares of Discover and Synchrony have lost more than half their value so far this year. That is far worse than the broader market, which has declined about 12%, and sectors less exposed to unemployment worries, such as technology, health care and consumer staples.

Marena Owens contacted Synchrony to ask about deferring her credit-card payments. ‘I probably won’t pay if they’re not willing to work with me,’ she said.

Discover and Synchrony said this week that they have allowed hundreds of thousands of borrowers to defer their payments, including many credit-card customers. Capital One, which has roughly 120 million credit-card accounts in the U.S., according to the Nilson Report, said it enrolled 1% of its active card accounts into deferral programs. The three banks are a good gauge of the financial health of a swath of American consumers. Discover and Synchrony generally don’t market to affluent customers, and Capital One has a large number of customers with less-than-pristine credit scores.

Banks hope that delaying payments will buy time for the economy to recover and consumers to get back on track. But for people who have no idea when they will be back at work, that likely won’t be enough. Many Americans were already overstretched even before the pandemic, tapping credit cards and other debt at record levels to keep up with soaring costs for college, health care, housing and other expenses.

Marena Owens called Synchrony in March to ask about deferring payments on her T.J. Maxx, American Eagle Outfitters Inc. and J.C. Penney Co. cards. She accepted an offer to skip the April payments on two of the cards, and to erase the roughly $50 balance on her J.C. Penney card. Ms. Owens lost her job at an Ohio car dealership the same week.

Unsure of when she might return to work, Ms. Owens called Synchrony again this week, and was told she could defer her T.J. Maxx payment due in early May for another month. She is planning to ask for the same reprieve on her American Eagle card.

“I probably won’t pay if they’re not willing to work with me,” she said.

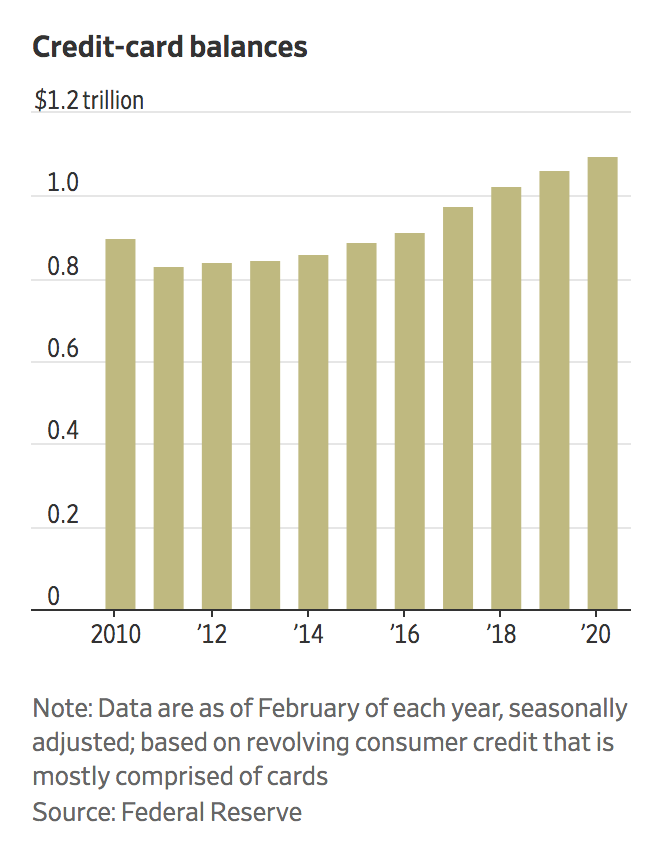

Credit-card balancesSource: Federal ReserveNote: Data are as of February of each year, seasonallyadjusted; based on revolving consumer credit that ismostly comprised of cards

.trillion

2010’12’14’16’18’200.00.20.40.60.81.0$1.2

A Synchrony spokeswoman said the bank “is here to assist our customers…who are experiencing financial hardship as a result of this crisis.”

Discover, Capital One, American Express Co., JPMorgan Chase & Co. and other card issuers have together socked away billions of extra dollars to prepare for big potential loan losses.

“We clearly have already had significant deterioration,” said Roger Hochschild, Discover’s chief executive, in an interview. “This was very quick and cataclysmic.”

Some lenders are also tightening the credit available to new applicants or existing customers.

Banks including Citigroup Inc., Discover and Synchrony are shutting down credit cards that haven’t been used in a while or lowering spending limits. The companies say they were taking these measures before the pandemic as a way to lessen risk. But those moves could also leave some borrowers without access to credit just when they need it most.

Missed payments, though, aren’t the only problem for card issuers.

Share Your Thoughts

How is the crisis affecting your finances? Join the conversation below.

Card spending in travel and other categories is plummeting, which means banks won’t get as much revenue from the swipe fees they collect when consumers pay with cards. And since people under stay-at-home orders aren’t out shopping, many of them are spending less on the store credit cards they have. That is a problem for issuers that specialize in store cards, including Synchrony and Alliance Data Systems.

“For the next two years or so until everything settles, [credit cards] will be much less profitable and more risky,” said Brian Riley, director of credit advisory services at Mercator Advisory Group.

In Orlando, Mr. Rodriguez and Ms. Wharton used their Capital One credit cards to buy groceries, toilet paper and medicine for several weeks after they found themselves out of work. They recently were approved for food stamps.

They told Capital One they might not be able to pay their bills in May, either. They said they were told to call back at the end of April if they are still in financial distress.

Updated: 8-25-2020

Before Making Loans, Some Mortgage Lenders Ask, Do You Really Plan To Pay This?

New forms are showing up in some borrowers’ paperwork when they close on their home loan. Lenders are asking them to confirm that they don’t plan to skip their payments, at least not right away.

Some mortgage lenders are asking customers taking out a mortgage to confirm they don’t intend to seek forbearance, a move meant to keep losses low during a pandemic that has put millions of Americans on shaky financial footing.

The unusual requirement comes in the form of a new document included in many borrowers’ closing paperwork. While the language varies, the forms generally tell borrowers that they won’t be allowed to skip payments until their loans are backed by the government, according to forms reviewed by The Wall Street Journal.

The forms, known among lenders as “Covid-19 borrower certifications,” often ask home buyers to confirm that they don’t expect changes to their income. Some warn of potential penalties if any of the certifications are later proven to be false.

The $2 trillion coronavirus stimulus package Congress passed in the pandemic’s early days allows struggling homeowners to request up to 12 months of forbearance on federally backed home loans, meaning they can temporarily pause their payments and make them up later. But it can take days, weeks or sometimes even months for a newly made loan to get government backing.

Lenders can still unload loans that are already in forbearance. Government-backed mortgage companies Fannie Mae and Freddie Mac said this spring they would begin to buy loans in forbearance, but at a discount of either 5% or 7% of the loan’s value, depending on whether the borrower is a first-time homebuyer. The Federal Housing Administration said it would insure loans in forbearance but could charge the lender a 20% fee if the loan goes into foreclosure.

Together, Fannie Mae, Freddie Mac and the government-owned mortgage company, Ginnie Mae, back more than 70% of outstanding U.S. mortgages, according to the Urban Institute, a nonpartisan policy research group in Washington, D.C.

Lenders are struggling to figure out which borrowers will be able to pay back their loans. The current recession has made it particularly hard to determine who is creditworthy: Millions of Americans are behind on their debts, but their missed payments aren’t reflected in their credit scores or uniformly recorded on their credit reports because of protections in the stimulus law.

Many lenders have responded by tightening credit. Credit-card issuers are closing accounts and lowering credit limits. The Mortgage Bankers Association’s Mortgage Credit Availability Index, designed to gauge access to a variety of mortgage products, shows consumer access to home loans fell about 17% between March and July.

For mortgage lenders, the forbearance penalty is an added concern. “The hit more than wipes out your margin—over something you have no control over,” said Esther Phillips, senior vice president of sales at Key Mortgage Services Inc.

“You can’t control what customers do after you close.” Key’s form asks borrowers to certify they haven’t applied for forbearance from any mortgage payments and have no plans to ask for it.

Adrian Leal was surprised when one of the mortgage lenders he was considering asked him to sign such an agreement in the late spring. The form, from LoanPeople LLC, asked him to confirm that he had no plans to request a forbearance.

At first, Mr. Leal thought it meant his home loan would never be eligible for forbearance. He now believes the letter meant he wouldn’t be eligible for forbearance until a government agency agreed to buy or insure his mortgage.

He is still employed as a software engineer but said he would turn to forbearance if he lost his job.

“I’ve never bought a home before, so I needed to be careful,” Mr. Leal said.

The share of mortgages in forbearance, 7.2%, has declined for 10 straight weeks, according to the Mortgage Bankers Association, but is still far above pre-pandemic levels. The Urban Institute has estimated that just 3,750 loans will be subject to the forbearance penalty.

But lenders are still doing everything they can to avoid it, including tightening credit, with wide-ranging effects. Many have raised minimum credit scores and lowered maximum debt-to-income ratios.

Bernadette Kogler, chief executive of RiskSpan, a mortgage analytics firm, said lenders are going to pull back on credit and “make fewer loans that might go into forbearance.”

The resulting credit pullback will limit purchase and refinance opportunities for up to 255,000 consumers, the Urban Institute said. The share of consumers with credit scores below 700 who purchased or refinanced a home fell in the first half of the year.

Verifying that mortgage applicants have a job, a typical part of the lending process, has become a major concern for lenders during a time of high unemployment.

Dustin Adair said his credit union called his office to make sure he still worked there six times between his loan’s approval and the closing on his Austin, Texas-area home this month.

Mr. Adair, a legal assistant, understands the rigorous vetting. He was furloughed for about two months in early spring when the lawyers at his office began working from home, delaying his quest for mortgage preapproval.

“Every day I go into work, I think, ‘Well, what’s going to happen if we go back into quarantine for another three months?’” Mr. Adair said.

Updated: 5-11-2021

Credit-Card Debt Keeps Falling. Banks Are On Edge

Americans are paying off their credit cards at the fastest rates in years. Banks are responding with generous card solicitations and looser underwriting standards.

Americans are paying down their credit-card debt at levels not seen in years. That is good news for everyone but credit-card issuers.

Large card issuers that cater to borrowers ranging from the affluent to the subprime say that overall card balances—and thus the firms’ interest income—are falling. To make up for it, issuers are spending more on marketing and loosening their underwriting standards.

Discover Financial Services said on its earnings call last month that the share of card balances that were paid off at the end of the first quarter was at the highest level since 2000. Capital One Financial Corp. said that nearly half of the credit-card balances it had at the beginning of March were paid off by the end of the month, which the company described as historically high. The companies’ calculations are based on the credit-card balances that they packaged into securities and sold to investors.

Synchrony Financial, the largest issuer of store credit cards in the U.S., said payment rates have been higher than they averaged before the pandemic.

Card balances at the three companies were down 9%, 17% and 7% in the first quarter from a year prior, respectively.

The results reflect the pandemic’s topsy-turvy effect on consumer finances. A year ago, lenders expected delinquencies to surge and many borrowers to turn to credit cards to make ends meet. But then the government stepped in, issuing stimulus checks, expanding unemployment benefits and making it easy for borrowers to pause payments on many mortgages and student loans, and the expected jump in delinquencies didn’t happen.

Now, even as Americans return to spending on their credit cards, they are continuing to pay down their card balances. That signals many borrowers are faring well even during the pandemic. But many card issuers rely on growing card usage and balances for their revenue, and they are wondering if the pandemic trends will turn into a long-term shift.

“We are very focused on returning to growing loans,” Discover Chief Executive Roger Hochschild said. “Delinquencies can’t get much lower than where they are now, but if your loans keep shrinking, your revenues come down [and] margins will get worse.”

Some consumers curbed their credit-card use because the things they normally spent money on, like travel and dining at restaurants, weren’t an option last year. Others shifted to debit cards because they didn’t want to take on new debt in an uncertain economy.

Carolina Ixta Navarro-Gutiérrez had about $2,800 in credit-card debt when the pandemic began, and was making small payments on her Wells Fargo & Co. card. But then the government paused payments on federal student loans, and she started diverting the $500 she used to spend each month on those loans to pay down her card instead.

Ms. Navarro-Gutiérrez, a 24-year-old elementary school teacher who lives in Berkeley, Calif., continues to use her card but now pays it off each month.

Credit-reporting firm Equifax Inc. said U.S. credit-card balances totaled $749 billion in March for general-purpose and store-only cards, down 2% from February and down 14.5% from a year prior. Consumers’ credit-card balances on average equaled 18% of their spending limits on general-purpose credit cards in March, compared to approximately 21% a year prior and the lowest level since Equifax began tracking this metric in 2009.

Credit-card spending in the U.S. totaled nearly $3.9 trillion on general-purpose and store cards last year, down 9% from 2019, according to the Nilson Report, an industry publication.

Spending is picking up as the U.S. emerges from the pandemic, according to card issuers. Even so, people are still paying down their balances. At JPMorgan Chase & Co, the total dollar amount of credit-card purchases in the first quarter increased 3% from the prior year. But card balances were down 14% for the same period.

Matthew Fraser said he had about $30,000 of credit-card debt when the pandemic hit, and he was behind on some of his cards.

Mr. Fraser then lost his part-time job in guest services for a sports team. He had already moved back in with his parents, and he used his stimulus checks and unemployment benefits to start paying down his debt. In August, Mr. Fraser got a job in mortgage sales. In February, he said, he paid off all his card debt.

“I said, ‘I need to get my finances in order where if I lose my job again…I can stay away from having to fall back on my parents,’ ” said Mr. Fraser, who is 30 and lives in the Atlanta area. “I’m not a kid anymore.”

He now makes all his purchases with a debit card.

Card issuers are trying to recruit new customers, particularly those with good credit scores who are likely to use the cards often and carry balances. American Express Co. , which often caters to wealthier customers, said it spent $1 billion in marketing expenses in the first quarter, up 21% from a year earlier. The company’s card balances in the U.S. were down 11% in the first quarter from the year before.

Issuers mailed out an estimated 260 million credit-card solicitations in March, up 23% from February and the highest since March 2020 when they totaled roughly 309 million, according to Mintel Comperemedia. The number of open credit-card accounts fell for the first time last year after at least seven years of consecutive increases, according to Mercator Advisory Group, a payments research and consulting firm.

Capital One, which tightened its underwriting standards when the pandemic hit, said it has been gradually increasing credit-card spending limits in recent months. Discover said on its earnings call that it has “begun to migrate [its] credit standards back to pre-pandemic levels.”

Millions of Credit-Card Customers, Millions of Credit-Card Customers, Millions of Credit-Card Customers, Millions of Credit-Card Customers, Millions of Credit-Card Customers, Millions of Credit-Card Customers, Millions of Credit-Card Customers, Millions of Credit-Card Customers, Millions of Credit-Card Customers,Millions of Credit-Card Customers, Millions of Credit-Card Customers, Millions of Credit-Card Customers, Millions of Credit-Card Customers, Millions of Credit-Card Customers, Millions of Credit-Card Customers, Millions of Credit-Card Customers, Millions of Credit-Card Customers, Millions of Credit-Card Customers,

Go back

Leave a Reply

You must be logged in to post a comment.