Crypto Market Is Closer To A Bottom Than Stocks (#GotBitcoin)

Mike Novogratz, the founder and chief executive officer of Galaxy Digital Holdings Ltd., said that cryptocurrencies are closer to a “bottom” than the U.S. equity market. Crypto Market Is Closer To A Bottom Than Stocks (#GotBitcoin)

* Galaxy Founder Makes Comment At Morgan Stanley Conference

* Ether To Hold Around $1,000, Bitcoin At $20,000 Level, He Says

Both sectors tumbled Monday as investors brace for a more hawkish Federal Reserve to ratchet up interest rates, raising the risk of a US recession. Crypto has been especially hit hard with the lending platform Celsius halting withdrawals on Monday.

Related:

$35 TRILLION Global Stock Market Meltdown!!! (#GotBitcoin)

When World’s Central Banks Get It Wrong, Guess Who Pays The Price😂😹🤣 (#GotBitcoin)

Ultimate Resource On Insider Trading

A Comprehensive Analysis of The Jeffrey Epstein Case

Ultimate Resource For Money Laundering, Spoofing, Market-Rigging, Etc. In Banking Industry

Bitcoin, the largest digital asset, fell as much as 17% to $22,603, while smaller rival Ether dropped as much as 21% to $1,165. They’ve slumped 67% and 74% respectively since hitting record highs in early November.

“Ethereum should hold around $1,000 and it’s $1,200 right now. Bitcoin is around $20,000, $21,000 and it is $23,000, so you are much closer to the bottom in crypto than you are where I think, stocks, are going to have another 15% to 20%” decline, Novogratz said at the Morgan Stanley Financials Conference.

The benchmark S&P 500 Index has declined about 22% from its record high in early January.

“Until I see the Fed flinch, until I really think, OK the economy is so bad, and the Fed is going to have to stop hiking and even think about cutting, I don’t think it is time to really deploy lots of capital,” Novogratz said.

Updated: 6-10-2022

Crypto Washout Sends Major Coins to Lowest Levels of the Year

* Ether Drops Below Low Set After Collapse Of Terra Blockchain

* Solana, Cordano Tumble As ‘Crypto Winter’ Carries Into Spring

Losses in cryptocurrencies deepened Friday, with everything from Bitcoin to Ether to Solana either setting or approaching their lowest levels of the year.

The MVIS CryptoCompare Digital Assets 100 Index, a market cap-weighted measure which tracks the performance of the 100 largest tokens, declined 4.9%, bringing the drawdown for the year to almost 50%.

Bitcoin, which accounts for almost half the index, slumped for a fourth day. Ether, which makes up about 18%, breached an earlier low set at the start of May after the collapse of the Terra blockchain. Popular DeFi tokens such as Solana and Cardano fell even more.

“We are entering into a crypto winter,” said Paul Veradittakit, a partner at Pantera Capital Management. “Capital is going to consolidate with the larger cap coins like BTC and ETH for the time being.”

Investors are increasingly saying the market is in the midst of crypto winter, as extended period of declines have become known over the years.

Last week, Gemini Trust, run by the Winklevoss brothers, laid off 10% of employees citing worsening market conditions. Coinbase Global Inc., the biggest US cryptocurrency exchange, froze hiring and rescinded some job offers.

While crypto prices have been dropping since early November, when Bitcoin reached its all-time high, the declines accelerated after the collapse of the TerraUSD (UST) stablecoin and related Luna cryptocurrency that resulted in losses of tens of billions in market value.

The market is also digesting bad economic news, which had hit tech stocks — which many coins have shown correlation to — particularly hard. Data released Friday on US consumer prices showed inflation continues to accelerate.

“The only event that mattered for markets this week was CPI, and the data yet again proved inflation is far from under control, which leads to higher interest rates, stronger dollar, lower stock and digital asset prices as investors continue to increase the probability of more rate hikes and a hard landing leading to recession,” said Jeff Dorman, chief investment officer at Arca.

Updated: 6-12-2022

Who Pays For Crypto’s Collapse?

The more than $500 billion in non-bitcoin investor losses will attract lawsuits.

Is anyone liable for the $1.5 trillion in recent crypto losses? Maybe so. After every market downturn, the class-action crowd canvasses the carnage looking for whom to blame—and then sues the pants off them. With so many stocks down 80% to 90%, such as Carvana and Robinhood, the pickings are plentiful.

But most public companies have smart lawyers who sprinkle protective legalese like “safe harbors” and pad their registration statements’ risk section. Most securities suits are settled, basically to pay lawyers to go away.

But this cycle had something new: crypto craziness. The Federal Trade Commission reports that 46,000 people have reported losing $1 billion in crypto to scams since January 2021. Bitcoin is down more than 50% since its 2021 peak, Ethereum is down 65%, XRP 78%.

And of course, the Luna token is down from $116 on April 5 to essentially zero. Is anyone liable? Binance, FTX, Coinbase, Kraken, Bitfinex and Crypto.com are some of the largest exchanges for crypto trading.

Class actions will follow the money. Kim Kardashian and boxer Floyd “Money” Mayweather Jr. are being sued for false statements promoting crypto. But that’s nothing! The trillion-and-a-half-dollar question is: Are cryptocurrencies securities or not?

Selling unregistered securities can be a felony, with up to five years in jail, and damages could include the dollar amount of an investors’ losses or more.

A 1946 Supreme Court case, Securities and Exchange Commission v. W.J. Howey Co., established the test that determines whether something is a security under the Securities Act of 1933 and subject to registration and reporting requirements.

It is a four-criteria test, summarized as: A security requires an investment in a common enterprise with expectations of profit via efforts by others.

I don’t think any cryptocurrencies have registered as securities. But crypto creators can’t say they weren’t warned.

In 2017 then-SEC Chairman Jay Clayton cautioned “market participants against promoting or touting the offer and sale of coins without first determining whether the securities laws apply to those actions.”

In 2019 the SEC ruled in a letter that bitcoin specifically failed the Howey test, meeting only the “investment” criteria. I see it differently, but no matter—the rest of crypto is still in flux.

In 2018, before his tenure as SEC chairman, Gary Gensler told a Massachusetts Institute of Technology class that Ethereum would pass the Howey test but has since waffled.

In January he told CNBC that many cryptocurrency projects “are investment contracts, they are securities, and they should register.”

Some early lawsuits have failed. A suit against Binance was dismissed in March for “untimeliness” and “extraterritoriality.” In November 2021, a Connecticut jury found that four small cryptocurrencies failed the Howey test, ending a class-action suit.

Meanwhile, the SEC has sued Ripple Labs, claiming its XRP digital assets are securities. The case is pending. Ripple has disputed the SEC’s allegations and noted the importance of the case for the whole industry.

But in March, Underwood v. Coinbase Global was filed, claiming 79 different digital assets on the platform, including XRP, were securities that pass the Howey test. The plaintiffs argue that Coinbase, as an exchange under Section 3(a)(1) of the Securities Act and a broker-dealer, is liable for trading “unregistered securities.”

My spreadsheet isn’t big enough to add up the total decline in value of all 79 digital assets since their peaks, but XRP alone represents around $65 billion lost. My guess is the total loss is $100 billion for all assets, although not all of it traded on Coinbase on the way up.

Once worth $100 billion, Coinbase is currently worth $13 billion with about $6 billion in cash on hand. Losing could seriously hurt.

So is Ethereum or XRP or Luna an unregistered security? Unlike bitcoin, which is a decentralized dream, the others are the works of known enterprises that pitch the use of their products for payments and smart contracts.

XRP claims: “Our proven technology and global network enable remittances, SME payments, disbursements and treasury flows.” It charges fees to enable these services. My sense is that XRP’s value is derived from enterprise profits resulting from the work of others. Howey wowie!

Ethereum claims: “Smart contracts are a type of Ethereum account. This means they have a balance and they can send transactions over the network. However they’re not controlled by a user, instead they are deployed to the network and run as programmed.”

If an entity promotes its assets as products to do payment transfers or smart contracts, doesn’t that make those assets part of a profit-seeking entity run by others?

Ethereum claims its fees, known as “gas,” are “essential to the Ethereum network. It is the fuel that allows it to operate.”

Luna similarly claims that its “gas is a small computational fee that covers the cost of processing a transaction.” This is a key point. Unlike a commodity such as gold or oil, only Howey-passing entities can charge fees.

A jury will decide, but if it looks like a duck and quacks like a duck, then it’s a security. More than $500 billion in non-bitcoin investor losses will likely attract a lot of class-action lawsuits. Lawyers, not coders, might determine the future of crypto.

Crypto Market Sinks Below $1 Trillion After Latest DeFi Blowup

* Selloff Comes As Traders Boost Bets For Fed Tightening

* Celsius Paused Withdrawals, Swaps And Transfers On Platform

Bitcoin plunged to the lowest in about 18 months after the freezing of withdrawals by the Celsius lending platform added to concern that systemic risk in the crypto ecosystem will accelerate the digital-asset market meltdown.

The world’s largest digital token tumbled as much as 17% to $22,603 — its lowest since December 2020. Other cryptocurrencies also declined as a broader sell-off continued.

The MVIS CryptoCompare Digital Assets 100 Index, which measures 100 of the top tokens, dropped as much as 17%. And the total market value, which topped $3 trillion in November, dropped below $1 trillion during New York trading hours on Monday, according to CoinGecko.

“The fundamentals to support stabilization and recovery just aren’t there,” said Steven McClurg, co-founder and CIO at crypto fund manager Valkyrie Investments. “Things can and likely will get worse before they get better.”

The shares of companies that have embraced crypto also tumbled. MicroStrategy Inc., the software company that made buying Bitcoin as part of its corporate strategy, fell 25%. Jack Dorsey’s Block Inc. dropped 13%. Bitcoin miners Marathon Digital Holdings Inc. and Riot Blockchain Inc. slumped 12% and 10%, respectively.

Binance, the largest crypto trading platform, temporarily suspended withdrawals of the Bitcoin network because of an transaction processing issue. Withdrawals were later resumed.

The selloff comes as traders are boosting bets for a more aggressive pace of Federal Reserve tightening after data Friday showed US inflation jumped to a fresh 40-year high in May.

Cryptocurrencies, which have struggled amid the Fed’s policy in recent months, have been hit particularly hard. The collapse of the Terra/Luna ecosystem last month, and lender Celsius pausing withdrawals Monday morning Asia time, have further eroded confidence in the space.

“If you do get long, perhaps think about doing so with either a long call spread or short put spread to limit risk” on Bitcoin futures, said Rick Bensignor, president of Bensignor Investment Strategies and a former strategist at Morgan Stanley. “If this dives, there’s no reliable support nearby.”

Traders speculated that Celsius could face further risks if the broader market selloff deepens. A loan worth more than $278 million, one of the biggest single loans on decentralized lending platform MakerDAO, is labeled as a loan made by Celsius, according to data tracker Block Analitica.

If Bitcoin falls below $22,534.89, the position will be liquidated, adding more sell pressure for Bitcoin, the analytics firm said.

Data shows that the address used 17,919 wrapped Bitcoin, a version of Bitcoin that can be used in decentralized finance, as collateral for a loan worth $278,490,419 in the decentralized stablecoin DAI.

While the blockchain explorer Etherescan didn’t labeled the wallet as Celsius, a wallet from Celsius sent additional 2,000 wrapped Bitcoin to support the position. Celsius did not immediately respond to a request for comment on the wallets.

Ether declined as much as 21% to its lowest level since January 2021. Avalanche dropped as much as 20%, Solana up to 19% and Dogecoin as much as 21%.

Mike Novogratz, the founder and chief executive officer of Galaxy Digital Holdings Ltd., said that cryptocurrencies are closer to a “bottom” than the U.S. equity market. Bitcoin is down around 67%, while Ether has slumped 74%, respectively, since hitting record highs in early November. The S&P 500 is down around 21% this year.

“Ethereum should hold around $1,000 and it’s $1,200 right now. Bitcoin is around $20,000, $21,000 and it is $23,000, so you are much closer to the bottom in crypto than you are where I think, stocks, are going to have another 15% to 20%” decline, Novogratz said at the Morgan Stanley Financials Conference.

Crypto Billionaire Fortunes Vanish As Quickly As They Were Made

Seven of the world’s richest crypto founders have lost a combined $114 billion since November as digital-asset values crumble.

One built a massive fortune that rivaled the wealthiest US tech titans. Another amassed a war chest that he vowed would change politics and philanthropy. Some were given a second chance at riches after past ventures flamed out.

The cryptocurrency craze turned Changpeng Zhao, Sam Bankman-Fried, Mike Novogratz and a handful of other digital-asset evangelists into billionaires several times over. But just as quickly as they became the new faces of global wealth, they’re now seeing their fortunes vanish at an astonishing rate.

Worth as much as $145 billion on Nov. 9, when Bitcoin reached a record high of almost $69,000, seven billionaires with fortunes tied to crypto have since lost a combined $114 billion, according to the Bloomberg Billionaires Index.

Many others who have bet big on Bitcoin, from Microstrategy Inc. Chief Executive Officer Michael Saylor to El Salvador President Nayib Bukele, are also feeling the pinch as the price of the world’s largest digital token slumped below $23,000 on Monday, the lowest since December 2020.

Once seen as ushering in a new era of decentralized finance, crypto has been rocked by two high-profile implosions in the span of weeks.

Celsius, one of the largest crypto lending platforms, announced Sunday that it was freezing all transactions on its network following speculation it would be unable to meet returns promised on some of its products.

That followed the collapse in May of so-called stablecoin TerraUSD and its sister token, Luna — which is memorialized as a tattoo on the left arm of Novogratz, the founder of Galaxy Digital Holdings Ltd.

While global markets are in turmoil as the Federal Reserve and other central banks plan to aggressively raise interest rates to fight the highest inflation in decades, the speed at which crypto has plunged in recent weeks stands out.

And while there’s little evidence of cracks so far in the broader US labor market, the losses in digital assets have led some crypto billionaires to resort to job cuts.

Zhao, founder of Binance, the world’s largest cryptocurrency exchange, said his firm has “a very healthy war chest” and is expanding hiring.

Still, the 44-year-old has seen his personal fortune, once the world’s 11th-largest, tumble 89% to $10.2 billion since he debuted on the Bloomberg wealth index in January. His firm has also become a focal point for US investigators seeking to rein in the crypto industry.

Bankman-Fried, the 30-year-old CEO of crypto trading platform FTX, is down 66% since his fortune peaked at $26 billion. That could dent his plans to give away his money and spend big in politics.

He poured $16 million into super PACs in April, making him one of the top donors to outside groups, and has said he expects to give more than $100 million during the next presidential election to support Democrats.

Novogratz, 57, whose macro fund at Fortress Investment Group was liquidated in 2015 following two years of losses, has staked his comeback on crypto, recently calling Terra a “big idea that failed.”

His fortune fell on Monday to $2.1 billion, lower than when he debuted on the Bloomberg Billionaires Index in December 2020, when Bitcoin traded around $29,000.

Meanwhile, Cameron and Tyler Winklevoss saw their fortunes sag to $3 billion each, from as high as $5.9 billion apiece. The 40-year-old twin founders of crypto exchange Gemini, which announced this month that it would cut about 10% of its workforce, are currently touring with their rock band, Mars Junction.

Coinbase Global Inc., the largest US crypto exchange, rescinded employment offers as crypto prices kept plunging. Founders Brian Armstrong, 39, and Fred Ehrsam, 34, once worth a combined $18.1 billion, have seen their fortunes shrink to $2.1 billion each as shares of the company have tumbled 79% since their initial public offering.

As for Saylor, 57, he’s keeping the faith: He tweeted “In Bitcoin We Trust” on Monday, along with a new picture of himself surrounded by lightning. Microstrategy, the software company he founded that plunged in value during the dot-com bubble in 2000, began buying Bitcoin in 2020.

Its shares closed at a peak of $1,272 in February 2021, when the 2.36 million shares Saylor currently owns would have been worth $3 billion. They’ve since plummeted about 88%.

Bukele, El Salvador’s 40-year-old president, hadn’t tweeted about Monday’s plunge in crypto as of 4:45 p.m. in New York. About a week ago was the one-year anniversary of his push to make Bitcoin legal tender. At the time, it traded at about $36,000.

Updated: 6-13-2022

S&P 500 Tumbles Into Bear Market For First Time Since March 2020

* Equities Benchmark Closes Down 22% From January Record High

* Prospect Of Bolder Fed Hikes Raise Concerns On Growth Outlook

The S&P 500 Index sank into a bear market on Monday with investors fearing that the Federal Reserve will need to hike interest rates more aggressively to fight inflation, even at the risk of sending the US economy into recession.

The broad equities benchmark closed down 3.9%, with all 11 major industry groups declining more than 2%.

The index has now fallen 22% from its Jan. 3 peak, meeting the technical definition of a bear market for the first time since the onset of the pandemic in March 2020.

Big technology companies Apple Inc., Microsoft Corp. and Amazon.com Inc. were the biggest drags on the S&P 500 for the session. Breadth was particularly weak, with just five of the index’s 504 stocks gaining.

At one point in the day, every S&P 500 stock was in the red at the same time. The tech-heavy Nasdaq 100 Index ended lower by 4.7%, while the Russell 2000 index plunged 4.8%.

Investors are bracing for the Fed’s interest rate decision on Wednesday, with most economists expecting policy makers to lift borrowing costs by 50 basis points.

Some firms including Barclays Plc and Jefferies are projecting a 75-basis-point increase amid a pickup in inflation, with others saying a full-percentage hike cannot be ruled out.

While Fed Chair Jerome Powell “has been clear in his desire to guide expectations rather than surprise expectations, this may be the meeting where we get a bit of a jolt,” said Art Hogan, chief strategist at National Securities.

A 75 or 100 basis-point hike “would send a strong message that this Fed is willing to do what needs to be done to get inflation moving in the right direction.”

US inflation unexpectedly accelerated to the highest in 40 years last month, while consumer sentiment plunged in early June.

Economic indicators that arrive later this week will also be key to assessing the state of the economy, since any sharp drops in growth could spur stagflation concerns and further weigh on stocks, according to Tom Essaye, founder of the “Sevens Report” newsletter.

The Empire Manufacturing survey is set to be released Wednesday, while the Philadelphia Fed Business Outlook comes out on Thursday.

The MSCI All Country World Index also closed in bear market, falling 21% from its November closing high. As companies grapple with persistently high inflation, upward earnings revisions momentum in the index, which includes stocks in both developed and emerging markets, has declined to 6.7% from its July peak of 48.6%.

According to Goldman Sachs Group Inc. and Morgan Stanley strategists, the risks to economic activity are yet to be fully priced in by equity markets.

“If Wall Street begins to price in much more aggressive Fed tightening, technical selling could drag the S&P 500 towards the 3,500 level,” said Ed Moya, a senior market analyst at Oanda.

Updated: 1-9-2023

Crypto Beats Stocks, Gold On Best Bitcoin Streak In Nearly A Year

A cryptocurrency sector battered by turmoil last year is showing some signs of life early in 2023, posting bigger gains than other asset classes like stocks, bonds and gold.

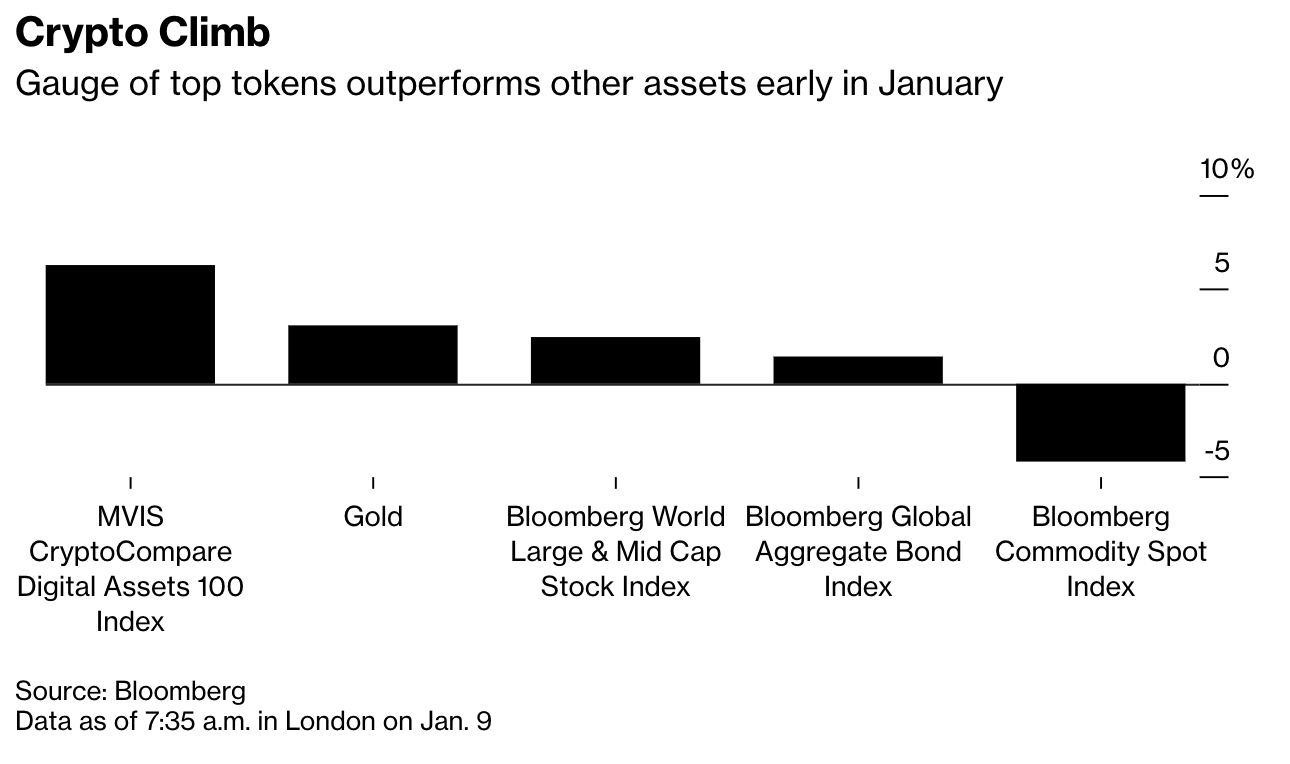

The MVIS CryptoCompare Digital Assets 100 Index of top tokens is up some 7% so far this month, exceeding advances of about 2% in global stocks, 1% in bonds and 3% from gold, according to data compiled by Bloomberg.

Global markets are taking heart from the possibility that central banks are closer to calling time on rapid interest-rate hikes as inflation eases from very high levels.

Some of that tentative relief has spilled over into crypto, even as the threat of further bankruptcies hangs over the industry after FTX’s collapse.

“There’s a faint heartbeat — the patient’s not dead,” said Tony Sycamore, a market analyst at IG Australia, referring to six straight days of increases in the Bitcoin price, the best streak since February 2022.

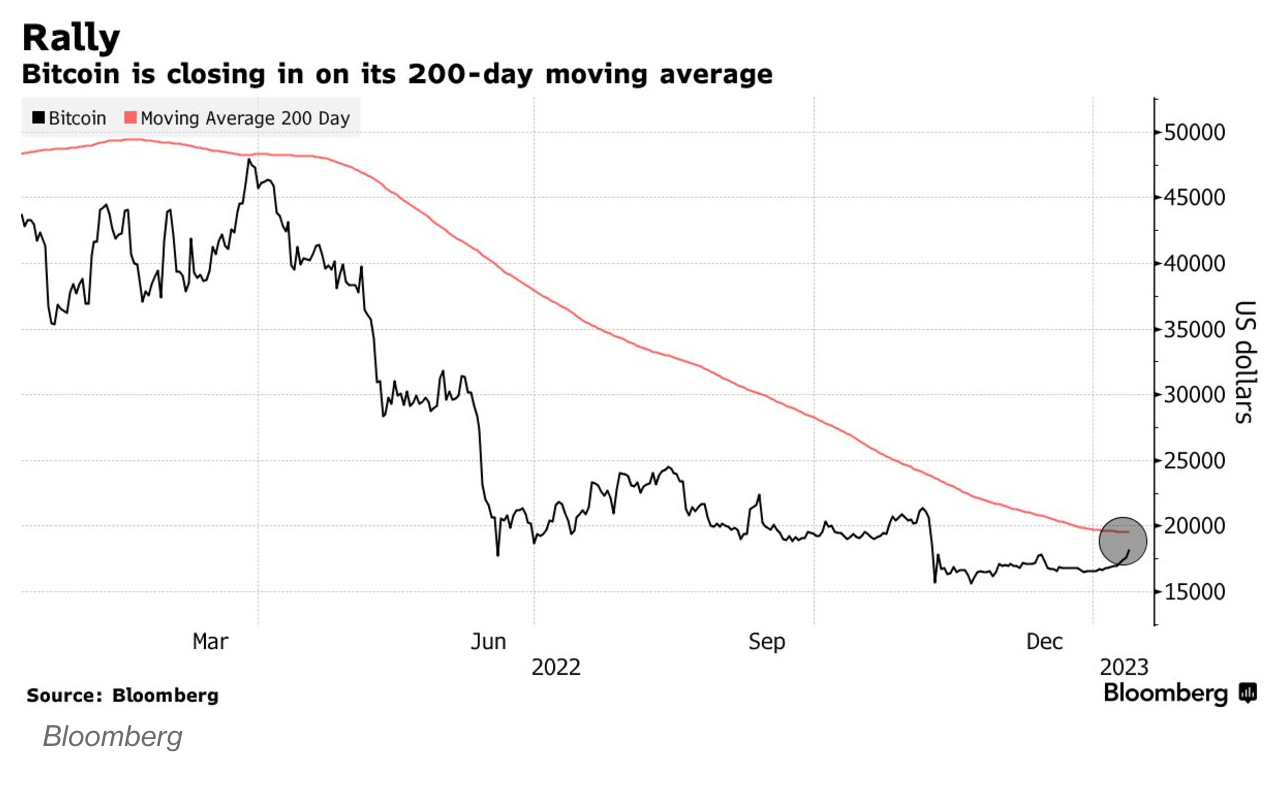

“Selling momentum looks exhausted and there’s a better macro environment” but the token needs to scale key technical levels like the 200-day moving average to trigger greater investor interest, Sycamore added.

Some of the sharpest crypto gains lie outside of the largest token Bitcoin. Second-ranked Ether is up 10% so far this month. Solana, a token that shed almost all its value last year because of a link to FTX’s fallen founder Sam Bankman-Fried, has added over 60% in the early days of January.

An upgrade of the Ethereum blockchain, crypto’s major commercial highway, is also engendering optimism. The upgrade, called Shanghai, may materialize in March. It will allow investors to withdraw Ether they locked up to help operate the network. The latter process is known as staking and earns rewards.

Staking Tokens

Some crypto protocols seek to provide easier and more flexible access to staking rewards, and coins linked to them have surged. Examples of such so-called liquid staking tokens include StakeWise’s SWISE, Lido DAO and Rocket Pool’s RPL, which are up 113%, 107% and 21% respectively in January, according to data from CoinGecko.

Bitcoin rose as much as 1.9% on Monday and was trading at $17,260 as of 10:56 a.m. in London, a three-week high. Solana added about 20% and Cardano 12%.

Coinbase Global Inc. and Riot Platforms Inc. led cryptocurrency-exposed stocks higher in US premarket trading amid the digital-asset bounce.

Bitcoin and the gauge of top 100 digital assets sank over 60% in 2022, hurt by sharply tightening monetary policy and a series of blowups culminating in the unraveling of the FTX exchange, which owes billions of dollars to customers.

Trading volumes crashed and volatility ebbed as investors fled, highlighting lingering worries about the risk of further bankruptcies in the contagion from the alleged fraud at FTX.

Updated: 1-11-2023

Bitcoin Extends Its Longest Winning Streak Since Pandemic Days

* Bitcoin, Ether And Other Riskier Assets Have Rallied Recently

* Optimism About Cooling Inflation, Slower Fed Hikes Aiding Mood

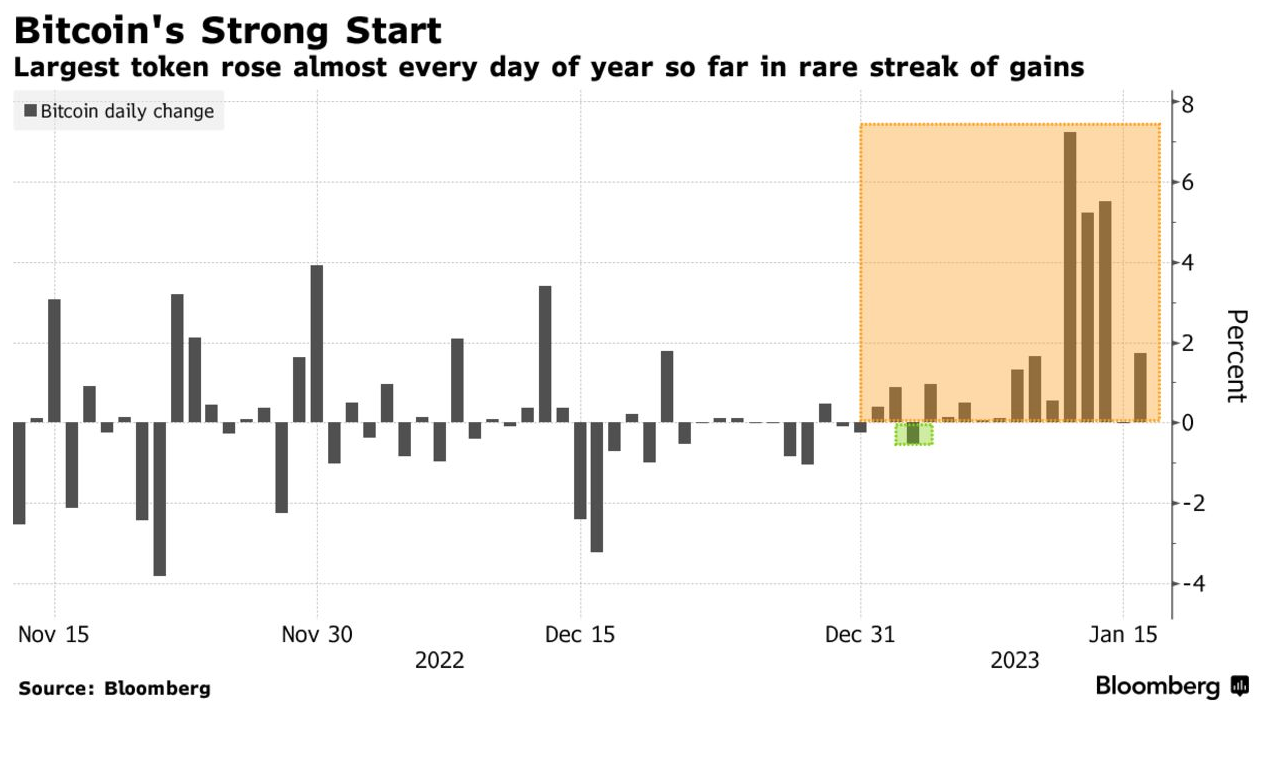

A prolonged rally in Bitcoin is giving crypto enthusiasts a smidgen of something to be happy about during a dark period for the industry.

The world’s largest token has advanced for nine straight days, the longest such streak since 2020, according to data compiled by Bloomberg. Bitcoin has added almost 10% this month and second-largest token Ether about 17%. They both fell more than 60% last year.

Bitcoin was up 3.6% to about $18,194 as of 6:53 a.m. in New York. Ether and Avalanche both gained about 4%.

Bets that inflation is cooling and that the Federal Reserve will slow the pace of interest-rate hikes have helped all manner of assets at the start of 2023. For Bitcoin, the recent gains are a stark contrast to last year’s slump of 64% amid a series of crypto blowups, including the fall of the FTX exchange.

“Risk assets have been rallying, I think, for the reason that the terminal rate is coming slowly but surely into the foreground and positioning has been bearish and transitioning, which means bullish near-term price action,” said Michael Purves, founder of Tallbacken Capital Advisors.

Institutions may make a comeback once the issues overhanging the digital-asset market clear up, according to Noelle Acheson, author of the “Crypto Is Macro Now” newsletter.

“There is little doubt that large players will come back into the market when the outlook is less murky, pushing up transactions and also price,” she wrote in a note this week.

Updated: 1-12-2023

Bitcoin Surges Above $18K To Cap 8-Day Winning Streak

The last time Bitcoin saw such a long streak of green candles was July 2021, during the height of the pandemic.

Bitcoin has clocked eight straight days of increasing prices and has surged back above $18,000 for the first time since mid-December.

The cryptocurrency hadn’t recorded such a prolonged winning streak since July 2021, at the height of the COVID-19 pandemic.

Over the last seven days, the price of BTC has increased nearly 8%, with a 4.1% surge in the last 24 hours at the time of writing.

Cointelegraph analysts predicted on Jan. 11 that Bitcoin could rally to $18,000 and that its upward price movement put pressure on $275 million worth of weekly options expiring Jan. 13 with bets placed at $16,500 and lower.

Hedge fund Moskovski Capital’s CEO, Lex Moskovski, tweeted an image on Jan. 11 showing $86 million worth of Bitcoin shorts were “getting smoked royally.”

Shorts are getting smoked royally.

$86M in the last 4h. pic.twitter.com/hNPwn4C53M

— Lex Moskovski (@mskvsk) January 11, 2023

BTC’s price fell nearly 65% over 2022. The wider crypto market also faced headwinds resulting from numerous bankruptcies and collapses in the space in the same year including crypto exchange FTX, the second-largest exchange at the time of its bankruptcy.

It seems that #Bitcoin likes to remind us that it doesn’t give a shit about exchanges, investor letters, open letters, and ponzi schemes: pic.twitter.com/OfmmdWeUvz

— Andrew (@AP_Abacus) January 12, 2023

On Jan. 11, FTX said it had recovered $5 billion in cash and cryptocurrencies which it may sell in order to repay its creditors, a move that some say could form a bullish narrative if FTX customers are repaid.

yup my sense is that is and always has been the best recovery scenario for customers. I think that them being made substantially whole is a real possibility; I think we were possibly a few weeks away from getting there in November. (US is solvent, should make everyone whole.)

— SBF (@SBF_FTX) January 12, 2023

The exchange also found a number of cryptocurrencies it says will be harder to sell as the markets for those assets are illiquid.

However, some have urged caution on the price, saying a BTC price rally is typical before the release of United States Consumer Price Index (CPI) data.

Never fails. This is third pre-cpi ramps.

— Bill Noble (@crypto_noble) January 12, 2023

CPI data is due on Jan. 12 and many seemingly expect it to show that inflation is dwindling and the Federal Reserve may pump the brakes on hiking interest rates.

The sentiment has also seen the price of stocks rally, with the S&P 500 up 4% over the past five days, according to Google Finance.

U.S. Treasury yields have also seen a slight fall recently, according to Bloomberg data.

Updated: 1-15-2023

FOMO Stirs Again In Bitcoin’s Best Start Since Before Pandemic

* The World’s Largest Token Has Risen Over 28% So Far In January

* Bets That Rate Hikes Will Soon End Are Aiding Market Sentiment

Bitcoin has bolted out of January’s starting gates with a climb of more than 26%, turning up the heat on bears who anticipated more challenges for riskier investments after sharp selloffs in 2022.

The token’s advance so far is the best for the opening month of a year since a 31% rally in 2020 before the pandemic hit. The surge has helped to lift the overall value of digital assets past $1 trillion, a level that gave way in November when the FTX exchange imploded, CoinGecko data shows.

The largest cryptocurrency rose as much as 2.5% on Monday and was trading at $20,860 as of 12:18 p.m. in London, down slightly for the session along with tokens like Ether, Avalanche and Algorand.

The crypto climb is partly a bet on an end to punishing interest-rate hikes, a prospect that’s also boosted the likes of stocks, bonds and gold.

Even so, investors are wondering if all these assets have moved too far, too fast given that central banks like the Federal Reserve are pledging to keep policy rates elevated until still-high inflation is vanquished.

While plenty of uncertainty hangs over digital assets, including whether a short squeeze is driving up prices and will peter out, “FOMO is likely to play a role in how the market evolves from here,” Noelle Acheson wrote in her “Crypto Is Macro Now” newsletter, using the acronym for “fear of missing out.”

A jump in the average size of trades indicates “whales” are driving the rally, researcher Kaiko said on Twitter, referring to large crypto holders. Trade sizes have increased to $1,100 from $700 for the Bitcoin-US dollar pair on the Binance exchange since Jan. 8, Kaiko said.

At the same time, market depth — a measure of how one big trade could impact the price of Bitcoin — lingers near the lowest level since since FTX went bankrupt, according to Kaiko.

The crypto industry continues to brace for further fallout from the bankruptcy of FTX and ensuing fraud charges against co-founder Sam Bankman-Fried. Crypto brokerage Genesis and its parent firm Digital Currency Group are seeking to resolve debt woes, a process that could spark market upheavals.

Meanwhile, some technical indicators suggest Bitcoin’s jump is becoming stretched. The token’s 14-day relative-strength index — a measure of momentum — has scaled 90. That’s far above the 70 level viewed as “overbought” and the highest in about two years.

This year’s Bitcoin surge is among the signs that “there’s still a lot of froth in the marketplace” and that “investors continue to ‘act’ in a much less bearish way than they ‘speak,’” Matt Maley, chief market strategist at Miller Tabak + Co., wrote in note on Sunday.

Both Bitcoin and a gauge of the top 100 digital assets sank more than 60% in 2022, a painful year that raised questions about what kind of future they have.

Updated: 4-6-2023

Stocks Haven’t Looked This Unattractive Since 2007

The allure of shares dimmed when bond yields surged and the corporate-earnings picture continued to darken.

The reward for owning stocks over bonds hasn’t been this slim since before the 2008 financial crisis.

The equity risk premium—the gap between the S&P 500’s earnings yield and that of 10-year Treasurys—sits around 1.59 percentage points, a low not seen since October 2007.

That is well below the average gap of around 3.5 points since 2008. The reduction is a challenge for stocks going forward. Equities need to promise a higher reward than bonds over the long term. Otherwise, the safety of Treasurys would outweigh the risks of stocks losing some, if not all, of investors’ money.

The allure of stocks dimmed recently when bond yields shot higher and the corporate-earnings picture continued to darken. The Federal Reserve now faces the dual challenge of raising interest rates to cool inflation while reaching into its toolbox to prevent a full-blown banking crisis from erupting—both of which cloud the outlook for stocks.

The S&P 500 has clawed back some of last year’s 19% decline, rising 6.5% in 2023. The Bloomberg U.S. Aggregate Bond index has jumped 3.9%, boosted by an early-year rally and higher yields.

Bonds are offering a “once in a generation opportunity, but not once in a lifetime,” said Tony DeSpirito, BlackRock Inc.’s chief investment officer of U.S. fundamental equities.

The current equity risk premium is closer to the longer-term norm: The average premium since 1957 is around 1.62 points, BlackRock research shows. That means stocks should still offer a better return than bonds given their historical outperformance, Mr. DeSpirito added.

The equity risk premium falls when bond yields rise, or a stock’s price/earnings ratio jumps—either due to weaker earnings or higher stock prices. The earnings yield, meanwhile, is the ratio of profits from the past year to current stock prices.

October 2007 would turn out to mark a precarious time in markets. Stocks had recently hit their highest level on record, and the federal-funds rate was near its current level at around 4.8%.

Over the following year, the S&P 500 would go on to drop roughly 45%, and the Fed would cut rates to near zero. Bloated stock valuations reset; bond yields cratered.

By March 2009 when the stock market bottomed, stocks’ premium over Treasurys had risen above 7 points and a new bull market was born.

Stocks look pricey again today, and markets and the economy are facing a new host of challenges. By at least one valuation measure, U.S. stocks are currently more expensive than those of any other country or region, Research Affiliates’ data show.

That is based on the S&P 500’s price level relative to inflation-adjusted corporate earnings over the past 10 years, or the CAPE ratio.

Although well off prior peaks seen in the late 1990s and during the exuberance that followed the onset of Covid-19, the U.S. stock benchmark now trades at a multiple of 28.3, pricier than it has been more than 90% of the time since 1881.

Valuations have historically plummeted during economic recessions, though some analysts say lofty valuations won’t prevent stock prices from continuing to rise.

“We have seen the peak for stock-market valuations, but that doesn’t necessarily mean we’ve seen peak prices yet in this cycle,” said Jawad Mian, founder of macro-advisory firm Stray Reflections.

The economy is much more resilient to high interest rates than it has been in the past, said Mr. Mian. High nominal growth—boosted by inflation—will continue to support earnings more than Wall Street’s consensus currently sees, preventing a significant drop in stock prices, he said.

Analysts expect earnings among companies in the S&P 500 to edge up roughly 1.6% in 2023, according to FactSet. At the end of last year, they were calling for a 5% increase.

Since 1957, equities have beaten out fixed income more than two-thirds of the time when they were held for at least a year, BlackRock research shows. Stocks’ favorability improves as holding periods lengthen.

Focusing on stocks’ slim risk premium misses part of the picture, Mr. DeSpirito of BlackRock says. Fed intervention—suppressing short-term rates and buying up long-term bonds—created an abnormal risk-reward profile for stocks after the 2008 financial crisis.

He encourages investors to seek stocks with resilient margins and strong earnings growth, while avoiding overvalued companies.

Some investors say frothy valuations mean value stocks—those trading at a discount to their book value, or net worth—warrant consideration.

Value stocks are “dirt cheap” relative to growth, now more discounted than they have been four-fifths of the time in U.S. stock-market history, according to Rob Arnott, founder and chairman of Research Affiliates.

Although value stocks trumped their growth-oriented peers during last year’s rout, growth stocks are back in the lead. The Russell 3000 Growth Index has jumped 12% in 2023 while the Russell 3000 Value Index has remained relatively flat.

When inflation has run between 4% to 8% a year, value stocks have outperformed their growth peers by 6 to 8 percentage points annually, Mr. Arnott said. Consumer prices rose 6% in February from the year before, the smallest increase since September 2021.

“Inflation is wonderful for value,” he added.

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

When World’s Central Banks Get It Wrong, Guess Who Pays The Price😂😹🤣 (#GotBitcoin)

“Better Days Ahead With Crypto Deleveraging Coming To An End” — Joker

Crypto Funds Have Seen Record Investment Inflow In Recent Weeks

Bitcoin’s Epic Run Is Winning More Attention On Wall Street

Ultimate Resource For Crypto Mergers And Acquisitions (M&A) (#GotBitcoin)

Why Wall Street Is Literally Salivating Over Bitcoin

Nasdaq-Listed MicroStrategy And Others Wary Of Looming Dollar Inflation, Turns To Bitcoin And Gold

Bitcoin For Corporations | Michael Saylor | Bitcoin Corporate Strategy

Ultimate Resource On Myanmar’s Involvement With Crypto-Currencies

‘I Cry Every Day’: Olympic Athletes Slam Food, COVID Tests And Conditions In Beijing

Does Your Baby’s Food Contain Toxic Metals? Here’s What Our Investigation Found

Ultimate Resource For Pro-Crypto Lobbying And Non-Profit Organizations

Ultimate Resource On BlockFi, Celsius And Nexo

Petition Calling For Resignation Of U.S. Securities/Exchange Commission Chair Gary Gensler

100 Million Americans Can Legally Bet on the Super Bowl. A Spot Bitcoin ETF? Forget About it!

Green Finance Isn’t Going Where It’s Needed

Shedding Some Light On The Murky World Of ESG Metrics

SEC Targets Greenwashers To Bring Law And Order To ESG

BlackRock (Assets Under Management $7.4 Trillion) CEO: Bitcoin Has Caught Our Attention

Canada’s Major Banks Go Offline In Mysterious (Bank Run?) Hours-Long Outage (#GotBitcoin)

On-Chain Data: A Framework To Evaluate Bitcoin

On Its 14th Birthday, Bitcoin’s 1,690,706,971% Gain Looks Kind of… Well Insane

The Most Important Health Metric Is Now At Your Fingertips

American Bargain Hunters Flock To A New Online Platform Forged In China

Why We Should Welcome Another Crypto Winter

Traders Prefer Gold, Fiat Safe Havens Over Bitcoin As Russia Goes To War

Music Distributor DistroKid Raises Money At $1.3 Billion Valuation

Nas Selling Rights To Two Songs Via Crypto Music Startup Royal

Ultimate Resource On Music Catalog Deals

Ultimate Resource On Music And NFTs And The Implications For The Entertainment Industry

Lead And Cadmium Could Be In Your Dark Chocolate

Catawba, Native-American Tribe Approves First Digital Economic Zone In The United States

The Miracle Of Blockchain’s Triple Entry Accounting

How And Why To Stimulate Your Vagus Nerve!

Housing Boom Brings A Shortage Of Land To Build New Homes

Biden Lays Out His Blueprint For Fair Housing

No Grave Dancing For Sam Zell Now. He’s Paying Up For Hot Properties

Cracks In The Housing Market Are Starting To Show

Ever-Growing Needs Strain U.S. Food Bank Operations

Food Pantry Helps Columbia Students Struggling To Pay Bills

Food Insecurity Driven By Climate Change Has Central Americans Fleeing To The U.S.

Housing Insecurity Is Now A Concern In Addition To Food Insecurity

Families Face Massive Food Insecurity Levels

US Troops Going Hungry (Food Insecurity) Is A National Disgrace

Everything You Should Know About Community Fridges, From Volunteering To Starting Your Own

Russia’s Independent Journalists Including Those Who Revealed The Pandora Papers Need Your Help

10 Women Who Used Crypto To Make A Difference In 2021

Happy International Women’s Day! Leaders Share Their Experiences In Crypto

Dollar On Course For Worst Performance In Over A Decade (#GotBitcoin)

Juice The Stock Market And Destroy The Dollar!! (#GotBitcoin)

Unusual Side Hustles You May Not Have Thought Of

Ultimate Resource On Global Inflation And Rising Interest Rates (#GotBitcoin)

The Fed Is Setting The Stage For Hyper-Inflation Of The Dollar (#GotBitcoin)

An Antidote To Inflation? ‘Buy Nothing’ Groups Gain Popularity

Why Is Bitcoin Dropping If It’s An ‘Inflation Hedge’?

Lyn Alden Talks Bitcoin, Inflation And The Potential Coming Energy Shock

Ultimate Resource On How Black Families Can Fight Against Rising Inflation (#GotBitcoin)

What The Fed’s Rate Hike Means For Inflation, Housing, Crypto And Stocks

Egyptians Buy Bitcoin Despite Prohibitive New Banking Laws

Archaeologists Uncover Five Tombs In Egypt’s Saqqara Necropolis

History of Alchemy From Ancient Egypt To Modern Times

Former World Bank Chief Didn’t Act On Warnings Of Sexual Harassment

Does Your Hospital or Doctor Have A Financial Relationship With Big Pharma?

Ultimate Resource Covering The Crisis Taking Place In The Nickel Market

Apple Along With Meta And Secret Service Agents Fooled By Law Enforcement Impersonators

Handy Tech That Can Support Your Fitness Goals

How To Naturally Increase Your White Blood Cell Count

Ultimate Source For Russians Oligarchs And The Impact Of Sanctions On Them

Ultimate Source For Bitcoin Price Manipulation By Wall Street

Russia, Sri Lanka And Lebanon’s Defaults Could Be The First Of Many (#GotBitcoin)

Will Community Group Buying Work In The US?

Building And Running Businesses In The ‘Spirit Of Bitcoin’

What Is The Mysterious Liver Disease Hurting (And Killing) Children?

Citigroup Trader Is Scapegoat For Flash Crash In European Stocks (#GotBitcoin)

Bird Flu Outbreak Approaches Worst Ever In U.S. With 37 Million Animals Dead

Financial Inequality Grouped By Race For Blacks, Whites And Hispanics

How Black Businesses Can Prosper From Targeting A Trillion-Dollar Black Culture Market (#GotBitcoin)

Ultimate Resource For Central Bank Digital Currencies (#GotBitcoin) Page#2

Meet The Crypto Angel Investor Running For Congress In Nevada (#GotBitcoin?)

Introducing BTCPay Vault – Use Any Hardware Wallet With BTCPay And Its Full Node (#GotBitcoin?)

How Not To Lose Your Coins In 2020: Alternative Recovery Methods (#GotBitcoin?)

H.R.5635 – Virtual Currency Tax Fairness Act of 2020 ($200.00 Limit) 116th Congress (2019-2020)

Adam Back On Satoshi Emails, Privacy Concerns And Bitcoin’s Early Days

The Prospect of Using Bitcoin To Build A New International Monetary System Is Getting Real

How To Raise Funds For Australia Wildfire Relief Efforts (Using Bitcoin And/Or Fiat )

Former Regulator Known As ‘Crypto Dad’ To Launch Digital-Dollar Think Tank (#GotBitcoin?)

Currency ‘Cold War’ Takes Center Stage At Pre-Davos Crypto Confab (#GotBitcoin?)

A Blockchain-Secured Home Security Camera Won Innovation Awards At CES 2020 Las Vegas

Bitcoin’s Had A Sensational 11 Years (#GotBitcoin?)

Sergey Nazarov And The Creation Of A Decentralized Network Of Oracles

Google Suspends MetaMask From Its Play App Store, Citing “Deceptive Services”

Christmas Shopping: Where To Buy With Crypto This Festive Season

At 8,990,000% Gains, Bitcoin Dwarfs All Other Investments This Decade

Coinbase CEO Armstrong Wins Patent For Tech Allowing Users To Email Bitcoin

Bitcoin Has Got Society To Think About The Nature Of Money

How DeFi Goes Mainstream In 2020: Focus On Usability (#GotBitcoin?)

Dissidents And Activists Have A Lot To Gain From Bitcoin, If Only They Knew It (#GotBitcoin?)

At A Refugee Camp In Iraq, A 16-Year-Old Syrian Is Teaching Crypto Basics

Bitclub Scheme Busted In The US, Promising High Returns From Mining

Bitcoin Advertised On French National TV

Germany: New Proposed Law Would Legalize Banks Holding Bitcoin

How To Earn And Spend Bitcoin On Black Friday 2019

The Ultimate List of Bitcoin Developments And Accomplishments

Charities Put A Bitcoin Twist On Giving Tuesday

Family Offices Finally Accept The Benefits of Investing In Bitcoin

An Army Of Bitcoin Devs Is Battle-Testing Upgrades To Privacy And Scaling

Bitcoin ‘Carry Trade’ Can Net Annual Gains With Little Risk, Says PlanB

Max Keiser: Bitcoin’s ‘Self-Settlement’ Is A Revolution Against Dollar

Blockchain Can And Will Replace The IRS

China Seizes The Blockchain Opportunity. How Should The US Respond? (#GotBitcoin?)

Jack Dorsey: You Can Buy A Fraction Of Berkshire Stock Or ‘Stack Sats’

Bitcoin Price Skyrockets $500 In Minutes As Bakkt BTC Contracts Hit Highs

Bitcoin’s Irreversibility Challenges International Private Law: Legal Scholar

Bitcoin Has Already Reached 40% Of Average Fiat Currency Lifespan

Yes, Even Bitcoin HODLers Can Lose Money In The Long-Term: Here’s How (#GotBitcoin?)

Unicef To Accept Donations In Bitcoin (#GotBitcoin?)

Former Prosecutor Asked To “Shut Down Bitcoin” And Is Now Face Of Crypto VC Investing (#GotBitcoin?)

Switzerland’s ‘Crypto Valley’ Is Bringing Blockchain To Zurich

Next Bitcoin Halving May Not Lead To Bull Market, Says Bitmain CEO

Bitcoin Developer Amir Taaki, “We Can Crash National Economies” (#GotBitcoin?)

Veteran Crypto And Stocks Trader Shares 6 Ways To Invest And Get Rich

Is Chainlink Blazing A Trail Independent Of Bitcoin?

Nearly $10 Billion In BTC Is Held In Wallets Of 8 Crypto Exchanges (#GotBitcoin?)

SEC Enters Settlement Talks With Alleged Fraudulent Firm Veritaseum (#GotBitcoin?)

Blockstream’s Samson Mow: Bitcoin’s Block Size Already ‘Too Big’

Attorneys Seek Bank Of Ireland Execs’ Testimony Against OneCoin Scammer (#GotBitcoin?)

OpenLibra Plans To Launch Permissionless Fork Of Facebook’s Stablecoin (#GotBitcoin?)

Tiny $217 Options Trade On Bitcoin Blockchain Could Be Wall Street’s Death Knell (#GotBitcoin?)

Class Action Accuses Tether And Bitfinex Of Market Manipulation (#GotBitcoin?)

Sharia Goldbugs: How ISIS Created A Currency For World Domination (#GotBitcoin?)

Bitcoin Eyes Demand As Hong Kong Protestors Announce Bank Run (#GotBitcoin?)

How To Securely Transfer Crypto To Your Heirs

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

Crypto News From The Spanish-Speaking World (#GotBitcoin?)

Financial Services Giant Morningstar To Offer Ratings For Crypto Assets (#GotBitcoin?)

‘Gold-Backed’ Crypto Token Promoter Karatbars Investigated By Florida Regulators (#GotBitcoin?)

The Original Sins Of Cryptocurrencies (#GotBitcoin?)

Bitcoin Is The Fraud? JPMorgan Metals Desk Fixed Gold Prices For Years (#GotBitcoin?)

Israeli Startup That Allows Offline Crypto Transactions Secures $4M (#GotBitcoin?)

[PSA] Non-genuine Trezor One Devices Spotted (#GotBitcoin?)

Bitcoin Stronger Than Ever But No One Seems To Care: Google Trends (#GotBitcoin?)

First-Ever SEC-Qualified Token Offering In US Raises $23 Million (#GotBitcoin?)

You Can Now Prove A Whole Blockchain With One Math Problem – Really

Crypto Mining Supply Fails To Meet Market Demand In Q2: TokenInsight

$2 Billion Lost In Mt. Gox Bitcoin Hack Can Be Recovered, Lawyer Claims (#GotBitcoin?)

Fed Chair Says Agency Monitoring Crypto But Not Developing Its Own (#GotBitcoin?)

Wesley Snipes Is Launching A Tokenized $25 Million Movie Fund (#GotBitcoin?)

Mystery 94K BTC Transaction Becomes Richest Non-Exchange Address (#GotBitcoin?)

A Crypto Fix For A Broken International Monetary System (#GotBitcoin?)

Four Out Of Five Top Bitcoin QR Code Generators Are Scams: Report (#GotBitcoin?)

Waves Platform And The Abyss To Jointly Launch Blockchain-Based Games Marketplace (#GotBitcoin?)

Bitmain Ramps Up Power And Efficiency With New Bitcoin Mining Machine (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Miss Finland: Bitcoin’s Risk Keeps Most Women Away From Cryptocurrency (#GotBitcoin?)

Artist Akon Loves BTC And Says, “It’s Controlled By The People” (#GotBitcoin?)

Ledger Live Now Supports Over 1,250 Ethereum-Based ERC-20 Tokens (#GotBitcoin?)

Co-Founder Of LinkedIn Presents Crypto Rap Video: Hamilton Vs. Satoshi (#GotBitcoin?)

Crypto Insurance Market To Grow, Lloyd’s Of London And Aon To Lead (#GotBitcoin?)

No ‘AltSeason’ Until Bitcoin Breaks $20K, Says Hedge Fund Manager (#GotBitcoin?)

NSA Working To Develop Quantum-Resistant Cryptocurrency: Report (#GotBitcoin?)

Custody Provider Legacy Trust Launches Crypto Pension Plan (#GotBitcoin?)

Vaneck, SolidX To Offer Limited Bitcoin ETF For Institutions Via Exemption (#GotBitcoin?)

Russell Okung: From NFL Superstar To Bitcoin Educator In 2 Years (#GotBitcoin?)

Bitcoin Miners Made $14 Billion To Date Securing The Network (#GotBitcoin?)

Why Does Amazon Want To Hire Blockchain Experts For Its Ads Division?

Argentina’s Economy Is In A Technical Default (#GotBitcoin?)

Blockchain-Based Fractional Ownership Used To Sell High-End Art (#GotBitcoin?)

Portugal Tax Authority: Bitcoin Trading And Payments Are Tax-Free (#GotBitcoin?)

Bitcoin ‘Failed Safe Haven Test’ After 7% Drop, Peter Schiff Gloats (#GotBitcoin?)

Bitcoin Dev Reveals Multisig UI Teaser For Hardware Wallets, Full Nodes (#GotBitcoin?)

Bitcoin Price: $10K Holds For Now As 50% Of CME Futures Set To Expire (#GotBitcoin?)

Bitcoin Realized Market Cap Hits $100 Billion For The First Time (#GotBitcoin?)

Stablecoins Begin To Look Beyond The Dollar (#GotBitcoin?)

Bank Of England Governor: Libra-Like Currency Could Replace US Dollar (#GotBitcoin?)

Binance Reveals ‘Venus’ — Its Own Project To Rival Facebook’s Libra (#GotBitcoin?)

The Real Benefits Of Blockchain Are Here. They’re Being Ignored (#GotBitcoin?)

CommBank Develops Blockchain Market To Boost Biodiversity (#GotBitcoin?)

SEC Approves Blockchain Tech Startup Securitize To Record Stock Transfers (#GotBitcoin?)

SegWit Creator Introduces New Language For Bitcoin Smart Contracts (#GotBitcoin?)

You Can Now Earn Bitcoin Rewards For Postmates Purchases (#GotBitcoin?)

Bitcoin Price ‘Will Struggle’ In Big Financial Crisis, Says Investor (#GotBitcoin?)

Fidelity Charitable Received Over $100M In Crypto Donations Since 2015 (#GotBitcoin?)

Would Blockchain Better Protect User Data Than FaceApp? Experts Answer (#GotBitcoin?)

Just The Existence Of Bitcoin Impacts Monetary Policy (#GotBitcoin?)

What Are The Biggest Alleged Crypto Heists And How Much Was Stolen? (#GotBitcoin?)

IRS To Cryptocurrency Owners: Come Clean, Or Else!

Coinbase Accidentally Saves Unencrypted Passwords Of 3,420 Customers (#GotBitcoin?)

Bitcoin Is A ‘Chaos Hedge, Or Schmuck Insurance‘ (#GotBitcoin?)

Bakkt Announces September 23 Launch Of Futures And Custody

Coinbase CEO: Institutions Depositing $200-400M Into Crypto Per Week (#GotBitcoin?)

Researchers Find Monero Mining Malware That Hides From Task Manager (#GotBitcoin?)

Crypto Dusting Attack Affects Nearly 300,000 Addresses (#GotBitcoin?)

A Case For Bitcoin As Recession Hedge In A Diversified Investment Portfolio (#GotBitcoin?)

SEC Guidance Gives Ammo To Lawsuit Claiming XRP Is Unregistered Security (#GotBitcoin?)

15 Countries To Develop Crypto Transaction Tracking System: Report (#GotBitcoin?)

US Department Of Commerce Offering 6-Figure Salary To Crypto Expert (#GotBitcoin?)

Mastercard Is Building A Team To Develop Crypto, Wallet Projects (#GotBitcoin?)

Canadian Bitcoin Educator Scams The Scammer And Donates Proceeds (#GotBitcoin?)

Amazon Wants To Build A Blockchain For Ads, New Job Listing Shows (#GotBitcoin?)

Shield Bitcoin Wallets From Theft Via Time Delay (#GotBitcoin?)

Blockstream Launches Bitcoin Mining Farm With Fidelity As Early Customer (#GotBitcoin?)

Commerzbank Tests Blockchain Machine To Machine Payments With Daimler (#GotBitcoin?)

Man Takes Bitcoin Miner Seller To Tribunal Over Electricity Bill And Wins (#GotBitcoin?)

Bitcoin’s Computing Power Sets Record As Over 100K New Miners Go Online (#GotBitcoin?)

Walmart Coin And Libra Perform Major Public Relations For Bitcoin (#GotBitcoin?)

Judge Says Buying Bitcoin Via Credit Card Not Necessarily A Cash Advance (#GotBitcoin?)

Poll: If You’re A Stockowner Or Crypto-Currency Holder. What Will You Do When The Recession Comes?

1 In 5 Crypto Holders Are Women, New Report Reveals (#GotBitcoin?)

Beating Bakkt, Ledgerx Is First To Launch ‘Physical’ Bitcoin Futures In Us (#GotBitcoin?)

Facebook Warns Investors That Libra Stablecoin May Never Launch (#GotBitcoin?)

Government Money Printing Is ‘Rocket Fuel’ For Bitcoin (#GotBitcoin?)

Bitcoin-Friendly Square Cash App Stock Price Up 56% In 2019 (#GotBitcoin?)

Safeway Shoppers Can Now Get Bitcoin Back As Change At 894 US Stores (#GotBitcoin?)

TD Ameritrade CEO: There’s ‘Heightened Interest Again’ With Bitcoin (#GotBitcoin?)

Venezuela Sets New Bitcoin Volume Record Thanks To 10,000,000% Inflation (#GotBitcoin?)

Newegg Adds Bitcoin Payment Option To 73 More Countries (#GotBitcoin?)

China’s Schizophrenic Relationship With Bitcoin (#GotBitcoin?)

More Companies Build Products Around Crypto Hardware Wallets (#GotBitcoin?)

Bakkt Is Scheduled To Start Testing Its Bitcoin Futures Contracts Today (#GotBitcoin?)

Bitcoin Network Now 8 Times More Powerful Than It Was At $20K Price (#GotBitcoin?)

Crypto Exchange BitMEX Under Investigation By CFTC: Bloomberg (#GotBitcoin?)

“Bitcoin An ‘Unstoppable Force,” Says US Congressman At Crypto Hearing (#GotBitcoin?)

Bitcoin Network Is Moving $3 Billion Daily, Up 210% Since April (#GotBitcoin?)

Cryptocurrency Startups Get Partial Green Light From Washington

Fundstrat’s Tom Lee: Bitcoin Pullback Is Healthy, Fewer Searches Аre Good (#GotBitcoin?)

Bitcoin Lightning Nodes Are Snatching Funds From Bad Actors (#GotBitcoin?)

The Provident Bank Now Offers Deposit Services For Crypto-Related Entities (#GotBitcoin?)

Bitcoin Could Help Stop News Censorship From Space (#GotBitcoin?)

US Sanctions On Iran Crypto Mining — Inevitable Or Impossible? (#GotBitcoin?)

US Lawmaker Reintroduces ‘Safe Harbor’ Crypto Tax Bill In Congress (#GotBitcoin?)

EU Central Bank Won’t Add Bitcoin To Reserves — Says It’s Not A Currency (#GotBitcoin?)

The Miami Dolphins Now Accept Bitcoin And Litecoin Crypt-Currency Payments (#GotBitcoin?)

Trump Bashes Bitcoin And Alt-Right Is Mad As Hell (#GotBitcoin?)

Goldman Sachs Ramps Up Development Of New Secret Crypto Project (#GotBitcoin?)

Blockchain And AI Bond, Explained (#GotBitcoin?)

Grayscale Bitcoin Trust Outperformed Indexes In First Half Of 2019 (#GotBitcoin?)

XRP Is The Worst Performing Major Crypto Of 2019 (GotBitcoin?)

Bitcoin Back Near $12K As BTC Shorters Lose $44 Million In One Morning (#GotBitcoin?)

As Deutsche Bank Axes 18K Jobs, Bitcoin Offers A ‘Plan ฿”: VanEck Exec (#GotBitcoin?)

Argentina Drives Global LocalBitcoins Volume To Highest Since November (#GotBitcoin?)

‘I Would Buy’ Bitcoin If Growth Continues — Investment Legend Mobius (#GotBitcoin?)

Lawmakers Push For New Bitcoin Rules (#GotBitcoin?)

Facebook’s Libra Is Bad For African Americans (#GotBitcoin?)

Crypto Firm Charity Announces Alliance To Support Feminine Health (#GotBitcoin?)

Canadian Startup Wants To Upgrade Millions Of ATMs To Sell Bitcoin (#GotBitcoin?)

Trump Says US ‘Should Match’ China’s Money Printing Game (#GotBitcoin?)

Casa Launches Lightning Node Mobile App For Bitcoin Newbies (#GotBitcoin?)

Bitcoin Rally Fuels Market In Crypto Derivatives (#GotBitcoin?)

World’s First Zero-Fiat ‘Bitcoin Bond’ Now Available On Bloomberg Terminal (#GotBitcoin?)

Buying Bitcoin Has Been Profitable 98.2% Of The Days Since Creation (#GotBitcoin?)

Another Crypto Exchange Receives License For Crypto Futures

From ‘Ponzi’ To ‘We’re Working On It’ — BIS Chief Reverses Stance On Crypto (#GotBitcoin?)

These Are The Cities Googling ‘Bitcoin’ As Interest Hits 17-Month High (#GotBitcoin?)

Venezuelan Explains How Bitcoin Saves His Family (#GotBitcoin?)

Quantum Computing Vs. Blockchain: Impact On Cryptography

This Fund Is Riding Bitcoin To Top (#GotBitcoin?)

Bitcoin’s Surge Leaves Smaller Digital Currencies In The Dust (#GotBitcoin?)

Bitcoin Exchange Hits $1 Trillion In Trading Volume (#GotBitcoin?)

Bitcoin Breaks $200 Billion Market Cap For The First Time In 17 Months (#GotBitcoin?)

You Can Now Make State Tax Payments In Bitcoin (#GotBitcoin?)

Religious Organizations Make Ideal Places To Mine Bitcoin (#GotBitcoin?)

Goldman Sacs And JP Morgan Chase Finally Concede To Crypto-Currencies (#GotBitcoin?)

Bitcoin Heading For Fifth Month Of Gains Despite Price Correction (#GotBitcoin?)

Breez Reveals Lightning-Powered Bitcoin Payments App For IPhone (#GotBitcoin?)

Big Four Auditing Firm PwC Releases Cryptocurrency Auditing Software (#GotBitcoin?)

Amazon-Owned Twitch Quietly Brings Back Bitcoin Payments (#GotBitcoin?)

JPMorgan Will Pilot ‘JPM Coin’ Stablecoin By End Of 2019: Report (#GotBitcoin?)

Is There A Big Short In Bitcoin? (#GotBitcoin?)

Coinbase Hit With Outage As Bitcoin Price Drops $1.8K In 15 Minutes

Samourai Wallet Releases Privacy-Enhancing CoinJoin Feature (#GotBitcoin?)

There Are Now More Than 5,000 Bitcoin ATMs Around The World (#GotBitcoin?)

You Can Now Get Bitcoin Rewards When Booking At Hotels.Com (#GotBitcoin?)

North America’s Largest Solar Bitcoin Mining Farm Coming To California (#GotBitcoin?)

Bitcoin On Track For Best Second Quarter Price Gain On Record (#GotBitcoin?)

Bitcoin Hash Rate Climbs To New Record High Boosting Network Security (#GotBitcoin?)

Bitcoin Exceeds 1Million Active Addresses While Coinbase Custodies $1.3B In Assets

Why Bitcoin’s Price Suddenly Surged Back $5K (#GotBitcoin?)

Zebpay Becomes First Exchange To Add Lightning Payments For All Users (#GotBitcoin?)

Coinbase’s New Customer Incentive: Interest Payments, With A Crypto Twist (#GotBitcoin?)

The Best Bitcoin Debit (Cashback) Cards Of 2019 (#GotBitcoin?)

Real Estate Brokerages Now Accepting Bitcoin (#GotBitcoin?)

Ernst & Young Introduces Tax Tool For Reporting Cryptocurrencies (#GotBitcoin?)

Recession Is Looming, or Not. Here’s How To Know (#GotBitcoin?)

How Will Bitcoin Behave During A Recession? (#GotBitcoin?)

Many U.S. Financial Officers Think a Recession Will Hit Next Year (#GotBitcoin?)

Definite Signs of An Imminent Recession (#GotBitcoin?)

What A Recession Could Mean for Women’s Unemployment (#GotBitcoin?)

Investors Run Out of Options As Bitcoin, Stocks, Bonds, Oil Cave To Recession Fears (#GotBitcoin?)

Goldman Is Looking To Reduce “Marcus” Lending Goal On Credit (Recession) Caution (#GotBitcoin?)

Leave a Reply

You must be logged in to post a comment.