A Debt-Collection Machine That’s Chewing Up Small Businesses Across America (#GotBitcoin)

Look out, the stranger on the phone warned. They’re coming for you. A Debt-Collection Machine That’s Chewing Up Small Businesses Across America (#GotBitcoin)

The caller had Janelle Duncan’s attention. Perpetually peppy at 53, with sparkly jewelry and a glittery manicure, Duncan was running a struggling Florida real estate agency with her husband, Doug. She began each day in prayer, a vanilla latte in her hand and her Maltese Shih Tzu, Coco, on her lap, asking God for business to pick up. She’d answered the phone that Friday morning in January hoping it would be a new client looking for a home in the Tampa suburbs.

The man identified himself as a debt counselor. He described a bizarre legal proceeding that he said was targeting Duncan without her knowledge. A lender called ABC had filed a court judgment against her in the state of New York and was planning to seize her possessions. “I’m not sure if they already froze your bank accounts, but they are RIGHT NOW moving to do just that,” he’d written in an email earlier that day. He described the lender as “EXTREMLY AGGRESSIVE.” Her only hope, the man said, was to pull all her money out of the bank immediately.

His story sounded fishy to the Duncans. They had borrowed $36,762 from a company called ABC Merchant Solutions LLC, but as far as they knew they were paying the money back on schedule. Doug dialed his contact there and was assured all was well. They checked with a lawyer; he was skeptical, too. What kind of legal system would allow all that to happen 1,000 miles away without notice or a hearing? They shrugged off the warning as a scam.

But the caller was who he said he was, and everything he predicted came true. The following Monday, Doug logged in at the office to discover he no longer had access to his bank accounts. A few days on, $52,886.93 disappeared from one of them. The loss set off a chain of events that culminated a month later in financial ruin. Not long after her agency went bankrupt, Janelle collapsed and was rushed to the hospital, vomiting bile.

As the Duncans soon learned, tens of thousands of contractors, florists, and other small-business owners nationwide were being chewed up by the same legal process. Behind it all was a group of financiers who lend money at interest rates higher than those once demanded by Mafia loan sharks. Rather than breaking legs, these lenders have co-opted New York’s court system and turned it into a high-speed debt-collection machine. Government officials enable the whole scheme. A few are even getting rich doing it.

“Somebody Just Comes In And Rips Everything Out. It’s Cannibalized Our Whole Life”

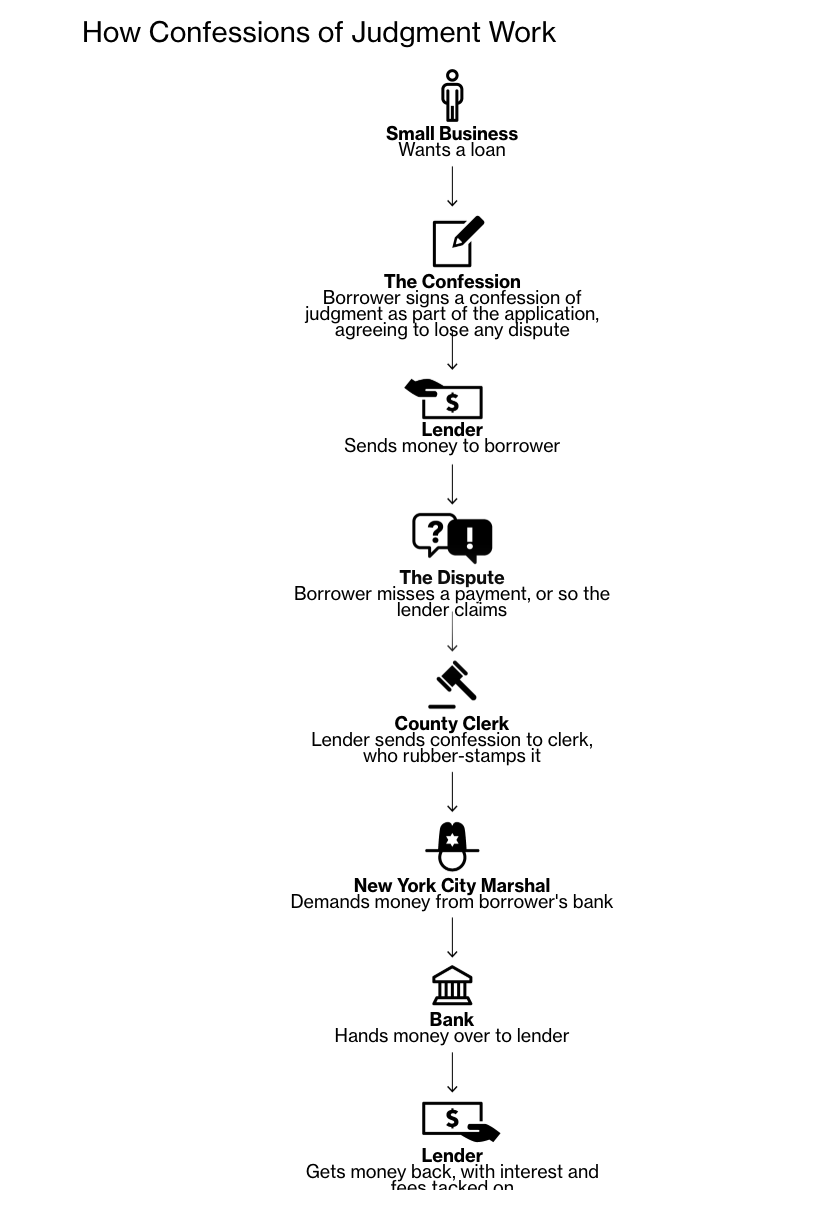

The lenders’ weapon of choice is an arcane legal document called a confession of judgment. Before borrowers get a loan, they have to sign a statement giving up their right to defend themselves if the lender takes them to court. It’s like an arbitration agreement, except the borrower always loses. Armed with a confession, a lender can, without proof, accuse borrowers of not paying and legally seize their assets before they know what’s happened. Not surprisingly, some lenders have abused this power. In dozens of interviews and court pleadings, borrowers describe lenders who’ve forged documents, lied about how much they were owed, or fabricated defaults out of thin air.

“Somebody just comes in and rips everything out,” Doug said one evening in August, pulling up a stool at a Starbucks and recounting the events that killed the Duncans’ business. After a long day spent selling houses for another company, the name tag pinned to his shirt had flipped upside down like a distress signal. “It’s cannibalized our whole life.”

Confessions of judgment have been part of English common law since the Middle Ages, intended as a way to enforce debts without the fuss and expense of trial. Concerns about their potential abuse are almost as old. In Charles Dickens’s 1837 novel The Pickwick Papers, a landlady who’s tricked into signing one ends up in debtors’ prison. Some U.S. states outlawed confessions in the middle of the 20th century, and federal regulators banned them for consumer loans in 1985. But New York still allows them for business loans.

For David Glass, they were the solution to a problem: People were stealing his money. Among the hustlers and con men who work the bottom rungs of Wall Street, Glass is a legend. Before he was 30, he’d inspired the stock-scam movie Boiler Room. Later busted by the FBI for insider trading, he avoided prison by recording incriminating tapes of his old colleagues. Even his enemies say Glass, who declined to comment for this story, is one of the sharpest operators they’ve ever dealt with.

In 2009, while still on probation, Glass and a friend named Isaac Stern started a company called Yellowstone Capital LLC. (ABC, the firm that wiped out the Duncans, is one of more than a dozen corporate names used by Yellowstone’s sales force.) Operating out of a red-walled office above an Irish bar in New York’s financial district, these salespeople phoned bodegas and pizzerias and pitched their owners on loans. The rates sometimes exceeded 400 percent a year, and daily payments were required, but borrowers were desperate.

In the aftermath of the financial crisis, banks were cutting back on lending just when small businesses most needed cash. Companies such as Yellowstone stepped in. They got around lending regulations by calling what they did “merchant cash advances,” not loans—a distinction judges recognize though there’s little practical difference. The same people who’d pushed stock swindles in the 1990s and subprime mortgages a decade later started talking small businesses into taking on costly debt. The profits were huge, and the industry grew. Last year it extended about $15 billion in credit, according to an estimate by investment bank Bryant Park Capital.

Yellowstone would hire anyone who could sell. A nightclub bouncer sat next to ultra-Orthodox Jews fresh out of religious school. The best brokers earned tens of thousands of dollars a month, former employees say; others slept at the office, fought, sold loose cigarettes, and stole from each other. A video posted on YouTube shows Glass firing an employee. “Get the f— out of my firm,” he yells. “Why are you still sitting there, fat ass? Get out of my company!” To keep the troops focused, management would stack a pile of cash on a table and hold a drawing for closers.

Glass’s problem was that some borrowers took Yellowstone’s money with no intention of paying it back. Lawsuits against deadbeats proved pointless, dragging on for months or years. Then a lawyer who worked for Yellowstone and other cash-advance outfits came up with the idea of requiring borrowers to sign confessions of judgment before receiving their loans. That way, at the first sign of trouble, lenders could start seizing assets, catching borrowers unawares.

In May 2012, Yellowstone became what appears to be the first company in the industry to file a confession in court. Others copied the trick. The innovation didn’t just make collections easier; it upended the industry’s economics. Now, even if a borrower defaulted, a company stood a chance of making a full recovery. By tacking on extra fees, it might even make more money, and faster, than if the borrower had never missed a payment. In some cases, the collections process became a profit engine.

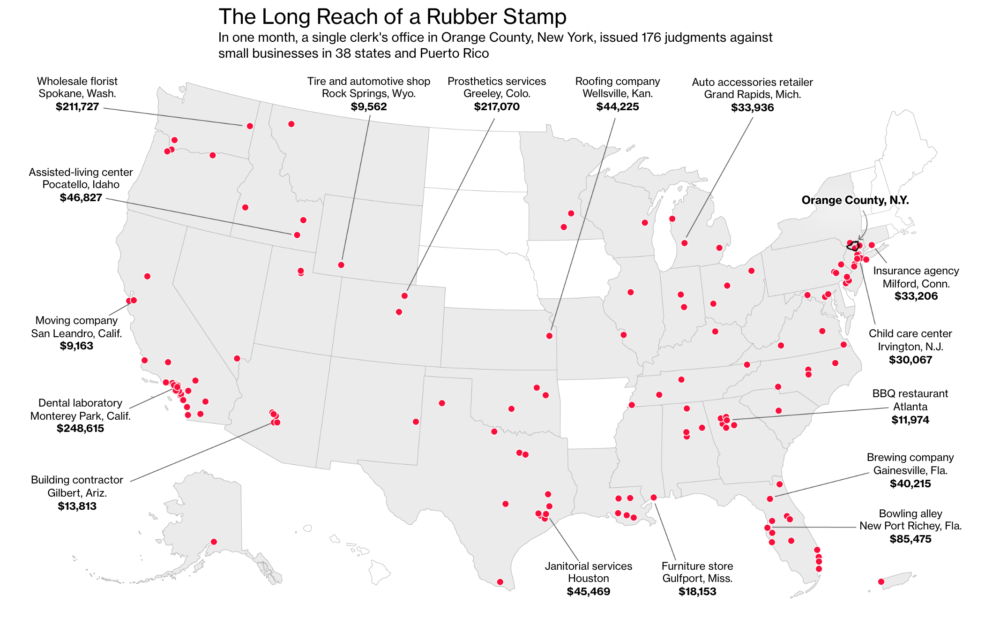

Confessions aren’t enforceable in Florida, where the Duncans signed theirs. But New York’s courts are especially friendly to confessions and will accept them from anywhere, so lenders require customers to sign documents allowing them to file there. That’s turned the state into the industry’s collections department. Cash-advance companies have secured more than 25,000 judgments in New York since 2012, mostly in the past two years, according to data on more than 350 lenders compiled by Bloomberg Businessweek. Those judgments are worth an estimated $1.5 billion. The biggest filer by far, with a quarter of the cases: Yellowstone Capital.

The Duncans’ ordeal began in November 2017 with an unsolicited fax from a broker promising term loans of as much as $1 million at a cheap rate. The couple had owned their agency, a Re/Max franchise, for three years and now had 50 employees, but they still weren’t turning a profit. A planned entry into the mortgage business was proving more expensive than expected. Doing some quick math, Doug figured he could borrow $800,000 to fund the expansion, pay off some debt, and come out with a lower monthly payment. The spam fax felt like a gift from God.

On the phone, the broker said that to qualify for a big loan, Doug would first have to accept a smaller amount and make a few payments as a tryout. He sent over the paperwork for a cash advance, not a term loan—and included confessions for both Doug and Janelle to sign. Without talking to a lawyer, they did. Why not? Doug thought. They intended to pay the money back on time.

The advance turned out to be for $36,762, repaid in $800 daily debits from their bank account starting the day after they got the money. This would continue for about three months, until they’d repaid $59,960, amounting to an annualized interest rate of more than 350 percent. A small price to pay, Doug figured—soon he’d have all the money he needed in cheaper, longer-term debt. But when he followed up the next month to inquire about the status of the bigger loan, he got no response. The trouble started soon after.

A few hours after learning that their bank accounts had been frozen, the Duncans met with a local attorney, Jeffrey Dowd, in a law office squeezed between a nail salon and a transmission shop. Their bank, SunTrust, refused to tell them who was behind the freeze. It wasn’t clear why Yellowstone would target them. Their contact there was still pleading ignorance; the lender had collected its $800 payment as recently as the previous business day. Janelle was on the verge of tears.

A broad-shouldered man with a white goatee, Dowd handles everything from wills to lawsuits for small-business owners in the Tampa suburbs. After assuring the Duncans he’d get to the bottom of it, he logged on to his computer. He soon found a legal website showing that Yellowstone had won a judgment against the Duncans a few hours after Janelle received the warning phone call. The lender had gone to a court in the village of Goshen, 60 miles north of New York City.

“I hereby confess judgment,” read the documents Doug and Janelle had signed. Attached was a statement signed by the same person at Yellowstone who’d assured Doug everything was fine. It said the Duncans had stopped making payments.

That wasn’t true. The Duncans’ bank records show that Yellowstone had continued to get its daily $800 even after going to court. The company’s sworn statement also inflated the size of the couple’s debt. But by the time Dowd found the case, it was already over. A clerk had approved the judgment less than a day after Yellowstone’s lawyer asked for it. No proof was demanded, no judge was involved, and the Duncans didn’t have a chance to present their side in court.

Beau Phillips, a Yellowstone spokesman, said in an email to Businessweek that the company was within its rights, because the Duncans had blocked one payment and never made up for it. The Duncans respond that if a block had taken place, it must have been a computer error. Why stop paying and then resume the next day?

The court papers revealed the name of Yellowstone’s lawyer, and on a whim, Dowd searched for her other cases and found more than 1,500 results. The Duncans’ predicament was no aberration. “It was like a rabbit hole,” Dowd says. He dove in, clicking on case after case after case.

The Long Reach of a Rubber Stamp

In one month, a single clerk’s office in Orange County, New York, issued 176 judgments against small businesses in 38 states and Puerto Rico.

Goshen, N.Y., is a bucolic stop on the harness-racing circuit, just west of the Hudson River. Not far from the track, in the Orange County Clerk’s office, women with ID lanyards around their necks sit behind Plexiglas windows, processing pistol permits and recording deeds. One clerk prints out proposed judgments sent electronically by cash-advance companies and makes them official with three rubber stamps.

Orange is one of a handful of counties in upstate New York that together handle an outsize share of the nation’s cash-advance collections. Industry lawyers pick offices known to sign judgments quickly; there’s no need for the borrower or lender to have a connection to the area. In even smaller Ontario County, cash-advance filings make up about three-quarters of the civil caseload. No matter how abusive the confessions might be, clerks have no choice but to continue processing them, says Kelly Eskew, a deputy clerk in Orange County.

To obtain a judgment, a lawyer for a cash-advance company must send in the confession along with a sworn affidavit explaining the default and how much is still owed. The clerk accepts the statement as fact and enters a judgment without additional review. Once signed, this judgment is almost impossible to overturn. Borrowers rarely try. Few lawyers will take on a client whose money is already gone, and getting a ruling can take months—too long to save a desperate business. It’s a trap with no escape.

Clicking around a database of New York state court records, Dowd did find some cases in which cash-advance borrowers had sought to overturn judgments. They’d almost always failed. New York judges took the view that debtors waived their rights when they signed the papers. Dowd concluded it would probably cost the Duncans $5,000 to retain a lawyer to travel to Orange County. He advised them not to bother.

It’s possible that if the Duncans had tried to overturn the judgment, they would have discovered that the confessions they’d signed were later altered. The signed originals contain an apparent drafting error, failing to identify the Duncans’ company as subject to the judgment, a flaw that might have prevented Yellowstone from seizing their money. In the version filed in court, someone had replaced the first two pages of each confession with the mistake corrected. Asked by Businessweek about the discrepancy, Phillips didn’t provide an explanation.

Altered Documents

The confession of judgment signed by the Duncans (top) and the one filed by Yellowstone in court

Borrowers have accused Yellowstone of forgery before. Just in the past year, a Georgia contractor presented evidence in court that a confession used against him was a complete fabrication, and a Maryland trucker complained to Yellowstone that a key term in his confession had been changed after the fact, as had happened with the Duncans. The company backed off from those borrowers but faced no further consequences. Phillips declined to comment on the accusations.

While Dowd didn’t challenge the ruling against the Duncans in court, he did think he could get SunTrust to help them. He told the bank that one of the couple’s accounts held funds that didn’t belong to them because it was used to collect rent on behalf of landlords. Dowd says a banker at the local branch wanted to help but was overruled by higher-ups. The account remained frozen. A spokesman for SunTrust declined to comment.

When Dowd finally reached Yellowstone’s lawyer, she referred him to a marshal who she said was handling the case. Dowd was confused. Why would a U.S. marshal be involved? His clients weren’t fugitives. He called the phone number, and somebody with a Russian accent answered.

The person on the phone wasn’t a federal official. Dowd had reached the Brooklyn office of Vadim Barbarovich, who holds the title of New York City marshal. He’d stumbled onto an arcane feature of the city’s government that’s become another powerful tool for cash-advance companies.

New York’s 35 marshals are government officers, appointed by the mayor, who collect private debts. They evict tenants and tow cars, city badges dangling from their necks. When they recover money, they get a fee of 5 percent. The office dates to Dutch colonial days, formed by a decree of Peter Stuyvesant’s council. Fees for the biggest jobs were initially set at a dozen stivers, less than one-tenth the price of a beaver pelt.

Barbarovich’s office is in the immigrant enclave of Sheepshead Bay. Before he was appointed in 2013, he’d tracked inventory at a Brooklyn hospital and volunteered as a Russian translator. He’s now the go-to marshal for the cash-advance business and has gotten rich in the process. Last year, city records show, he cleared $1.7 million after expenses.

As soon as Yellowstone had obtained its judgment against the Duncans, it had sent a copy to Barbarovich, who issued legal orders demanding money from Atlanta-based SunTrust and another bank in Alabama where the couple kept their personal funds. By law, New York marshals’ authority is limited to the city’s five boroughs, but a loophole vastly extends their reach: They’re allowed to demand out-of-state funds as long as the bank has an office in the city, as SunTrust does. A few big banks refuse to comply with the orders, but most just hand over their customers’ money.

SunTrust proved accommodating. Three days after freezing the Duncans’ accounts, it took $52,886.93 and mailed a check to Barbarovich, enough to satisfy the judgment plus the 5 percent marshal’s fee. Almost all of it was rent money the Duncans were holding for landlords, not their own funds. Barbarovich didn’t respond to questions about the couple’s case but said in an email that he follows the rules when issuing a demand for money. Phillips, the Yellowstone spokesman, said no one told the company that the money belonged to third parties until seven weeks after it was seized. Even then, Yellowstone refused to return it.

The Duncans scrambled to make up the shortfall. Doug got another, larger cash advance from a different company to keep afloat. The daily payments on that loan were too much for them to handle, though, and they were soon short of cash again. Sensing trouble, employees fled.

One evening, Janelle thought she was having a heart attack. Her pulse raced, her limbs went numb, and she grew nauseous. An ambulance rushed her to the hospital. Her heart was fine. Her insurance claim was denied.

Unlike the Duncans, most of the dozens of borrowers interviewed by Businessweek really did fall behind on their debt payments. Their experiences were no less wrenching. They spoke of divorce, of lost friendships, of unpaid medical bills.

“You can’t defend yourself,” says Richard Schilg, the owner of a human resources company in Ohio who borrowed hundreds of thousands of dollars with at least six advances. “As long as you still have a business, as long you have a personal checking account, they’re going to hound you. Your life is ruined by their contract.” Schilg says he always tried to honor his debts. But his access to money has been so restricted by cash-advance judgments that he’s had to sell furniture to buy food.

He’s one of many borrowers who’ve received nasty threats from debt collectors. “I will make this my personal business to f— you,” a Yellowstone executive named Steve Davis told Schilg on a voicemail heard by Businessweek. Davis texted another: “I will watch you crash and burn.” Asked about the messages, Davis says, “People defraud us. When that happens we have to do what’s best for us.”

Jerry Bush, who ran a plumbing business with his father in Roanoke, Va., signed confessions for at least six cash advances from companies including Yellowstone, taking one loan after another as his payments mounted to $18,000 a day. In January, Davis called him while he was accompanying his wife to a chemotherapy appointment and threatened him with the confession in a dispute over payment terms. Davis denies menacing Bush, but according to Bush’s account of their conversation, Davis said he would pursue Bush until his death and take all of his money, leaving nothing to pay for his wife’s treatment. Bush also says Davis then offered to send flowers to Bush’s wife.

“I Wake Up Every Morning Afraid What Else They Will Take. And Every Morning I Throw Up Blood”

In August, Bush closed his business, laid off his 20 employees, and stopped making payments on his loans. Yellowstone never filed its signed confession in court, but other lenders went after him over theirs. One sunny day that month, he walked to a wooded area near his home, swallowed a bottle of an oxycodone painkiller, and began streaming video to Facebook. To anyone who might have been watching, he explained that he’d taken out cash advances in a failed attempt to save his business. Now the lenders had seized his accounts, Bush said, his voice wavering. One had even grabbed his father’s retirement money.

“I signed ’em, I take the blame for it,” he said. “This will be my last video. I am taking this on me.” He asked his friends to take care of his family, then sobbed as he told his wife and teenage son he loved them.

Someone who saw the video alerted the police. They found Bush unconscious in the woods a few hours later—he credits them with saving his life. But the pressure from his confessions of judgment hasn’t relented. “I wake up every morning afraid what else they will take,” he says. “And every morning I throw up blood.”

Bush’s contracts with Yellowstone show that the company advanced him a total of about $250,000 and that he paid them back more than $600,000. Davis, who parted ways with Yellowstone in August, says he didn’t mistreat Bush or other borrowers and always followed the company’s protocols. “You know why people put the blame on me is because I’m successful,” he says. “It’s just haters.”

As for the Duncans, each morning at their house still begins with a prayer and a Bible verse. Their retirement savings evaporated with their agency, but they’ve been able to keep their house. They continue to believe God has a plan for every one of his children, but they’ve learned to trust some of those children less. “If we don’t have peace from God, and we live in outrage, it destroys us,” Janelle says. “So I’m choosing to have hope to start again, and we’re relying on the Lord to replace what the enemy has stolen and turn it around for good.”

By seizing their bank deposits, Yellowstone had managed to collect its money ahead of schedule and tack on $9,990 in extra legal fees, payable to a law firm in which it owns a stake. In about three months, the company and its affiliates almost doubled their money. At that rate of return, one dollar could be turned into 10 in less than a year.

Everyone else involved in the collection process got a slice, too. SunTrust got a $100 processing fee. Barbarovich’s office got approximately $2,700, with about $120 of that passed along to the city. The Orange County Clerk’s office got $41 for its rubber stamps. The New York state court system got $184.

To date, no state or federal regulator has tried to police the merchant-cash-advance industry. Its lawyers designed it to avoid scrutiny, sidestepping usury laws and state licensing requirements by keeping the word “loan” out of paperwork and describing the deals as cash advances against future revenue. And because the customers are technically businesses, not individuals, consumer protection laws don’t apply, either.

With regulators sidelined and lawmakers oblivious, Yellowstone and its peers keep growing. After Glass stepped back a couple of years ago from day-to-day operations—his criminal record was making it harder to find investors—Wall Street investment bankers arranged a $120 million line of credit to finance more advances. In 2016 the company moved from its grimy downtown Manhattan offices to a shiny building in Jersey City, pocketing $3 million in state tax incentives. On Instagram, a top salesman shows off flights on private jets, a diamond-encrusted watch, and a Lamborghini. Yellowstone advanced $553 million last year, its highest total ever.

In April, on the same day Janelle Duncan was selling the last of her office furniture, Yellowstone executives marked the company’s ninth anniversary with a luncheon in Jersey City. In a celebratory email marking the occasion, Stern, the co-founder, wrote, “I am continually blown away at the success and achievements we continue to have.”

Updated: 2-9-2022

Sign This Agreement And Your Bank Account Might Be Frozen

Predatory lenders are turning to Connecticut to help collect their debts, using a legal trick to bypass judicial review.

Jared Alfin has powers that many of his fellow debt collectors can only dream of.

Alfin, a lawyer in Simsbury, Conn., can order someone’s bank account frozen without warning. He doesn’t need a judge’s say-so. He simply drafts some boilerplate legal papers and has them dropped off at the bank.

His clients are so-called merchant cash-advance companies that make costly, short-term loans to small businesses. Alfin gets involved when one of these loans goes sour. The borrower could be a restaurateur in San Diego or a self-employed trucker in Nashville. They might need that cash for employee paychecks or to pay the fuel bill.

No matter. Until Alfin relents or a judge intervenes, the money is untouchable—no withdrawals, no checks, no transfers. Last year, court records show, he pursued more than 180 small-business owners this way.

Alfin’s power flows from a feature of Connecticut law that plays normal court procedure in reverse. Typically, if you sue someone for money, a court has to rule in your favor before a defendant must hand over assets. Alfin uses what’s known as a prejudgment attachment to lock up people’s money first, before he’s won his case—in fact, before defendants even know they’re being sued.

His biggest client for these services is a group of a half-dozen related companies that use names such as Matrix Advance, Gofund Advance, and Bridge Funding Cap, court records show. These companies are managed from an office in the Borough Park neighborhood of Brooklyn, overseen by Jonathan Braun, according to people with knowledge of the matter. Braun is notorious in the world of high-interest lending.

New York’s attorney general has called him a “modern-day loan shark” and is suing him for ripping off customers and threatening violence at his previous cash-advance company.

Released from prison last year after President Donald Trump commuted an unrelated drug-trafficking sentence, Braun denies any wrongdoing in his cash-advance dealings and says he isn’t involved in the Borough Park operation.

Alfin, a partner at Hassett & George PC, wouldn’t discuss specific clients or say whether he’s had any contact with Braun, but he says cash-advance collections represent only part of his practice. And he says prejudgment attachment is a normal and appropriate part of commercial litigation. “I just simply file papers for different clients,” he says. “I don’t think I am doing anything improper.”

Last summer, Alfin locked up about $14,600 in two bank accounts belonging to Lucy Barrachina, who employs four people at a pharmacy in Dickinson, Texas, a city near Houston, court records show. Barrachina had missed payments on a loan from Matrix, and a representative there demanded immediate cash to have the funds released. “I told him, ‘But we have payroll, we have to pay our employees, we cannot do that,’ ” Barrachina says.

Instead, she agreed to add an extra $10,000 onto a loan balance that was already costing her more than 700% annualized. Her bank account was unfrozen, but she was in debt even deeper than before. “I regret it so much that we got in touch with them,” she says.

Not long ago, cash-advance companies often relied on a different legal instrument to raid customers’ bank accounts, a confession of judgment filed in a New York court.

A 2018 Bloomberg News series highlighted abuses of that tactic, finding that confessions were sometimes forged, altered, or deployed against borrowers who hadn’t missed payments and that they helped destroy thousands of small businesses nationwide. Braun was one of the most aggressive users.

After New York lawmakers curtailed the use of confessions in 2019, the industry, concentrated in Manhattan and Brooklyn, explored alternatives. Some lenders turned to courts in Utah or Texas, where confessions or similar instruments can still be used. Some tried their own arbitration schemes in which hand-picked arbitrators quickly ruled in favor of lenders.

Others turned to Connecticut, where long-standing state law allows courts to restrain a defendant’s property at the start of a case to prevent that person from moving assets out of reach. Ordinarily, that kind of restraint is granted by a judge after a hearing attended by both parties, and the plaintiff must demonstrate he’s likely to prevail.

But Alfin—the only lawyer in the state routinely seeking prejudgment attachments on behalf of the cash-advance industry, according to a review of court records—doesn’t need to bother with pretrial hearings.

Buried in the fine print of his clients’ loan agreements is a clause that specifically waives the borrowers’ right to such a hearing. That means that whenever a client wants, Alfin can freeze a borrower’s property, as long as he obtains a written affidavit from the client stating that money is owed.

Alfin says this type of waiver is common in commercial lending in Connecticut and isn’t as onerous as the New York tactic that came under criticism from lawmakers there. By itself, a Connecticut prejudgment attachment cannot be used to drain bank accounts, only freeze them temporarily, and defendants can demand a hearing to free them up.

That would, of course, require a small-business owner in Texas or Minnesota to swiftly hire a lawyer in Connecticut while lacking access to a bank account. Asked if any of his cash-advance cases had resulted in such a hearing, Alfin says he can’t recall one.

The Borough Park crew operates out of a second-story office on 13th Avenue. Braun, 38, joined up not long after Trump let him out of prison last year, people with knowledge of the matter say. They say that although his name doesn’t appear on paperwork, he’s the boss.

The group began using the Connecticut tactic shortly before Braun’s release from prison and has sought more than $10 million from more than 100 small businesses this way, court records show. The typical deal involves interest amounting to more than 500% annualized. To get access to the state’s legal system, the group’s companies claim a “place of business” at a rented mailbox in a strip mall in Avon, Conn.

Alfin said in an email that Braun “is not a member or employee” of any of these companies. “I am also not aware of any instances where Mr. Braun spoke to a merchant that one of my clients sued” in the state, he added.

In Barrachina’s case, court records show she agreed to borrow $50,000 from Matrix in August, though she said she actually received far less after fees were deducted. She agreed to pay back $2,500 a day, starting immediately, until she’d paid $74,950.

Barrachina says she had trouble keeping up and asked her contact at Matrix for a lower daily payment, but the company refused. Within days of the first missed payment, Alfin drafted some legal papers and sent them to a Connecticut marshal, a state-appointed officer who serves legal documents and is compensated by the lawyers who hire her.

The marshal, Elizabeth Ostrowski, in turn delivered copies to local branches or agents of two banks that Barrachina used. Soon, accounts at both banks were frozen. Ostrowski declined to comment.

Barrachina says she learned what was going on only when she discovered she didn’t have access to her bank accounts. She says she was left with no other option and agreed to take on more debt to have her accounts unfrozen.

But her trouble didn’t end there. About $1,900 remained frozen for months after she settled. Alfin attributes that to a mix-up by one of the banks. After inquiries from Bloomberg Businessweek, he took further steps to get the money released, and Barrachina received a check on Feb. 1.

The industry is using Connecticut law in a way that was never intended by the legislature, says Shane Heskin, a Philadelphia-based lawyer with White & Williams LLP who represents small-business owners. Cash-advance companies are using it to strong-arm people into a settlement, regardless of the merits of their cases, he says. “It effectively makes them negotiate with a gun to their head.”

Alfin disagrees. “The purpose of the prejudgment remedy is to secure assets so that the assets are not dissipated,” he says. That’s exactly what happens in his cases, he says.

Connecticut law trusts private lenders to do the right thing, letting them freeze bank accounts without anyone checking beforehand to see if they doctored contracts, inflated the size of debts, or fabricated defaults—the kind of abuses cash-advance customers have complained about for years.

Some of those complaints have involved Braun. In 2018, a New York judge found that Braun’s previous lending operation, Richmond Capital Group LLC, ripped off a plumber and then lied about it when seeking a court judgment against him.

“The record is replete with evidence that [Richmond] made false statements and misrepresentations to the court,” the judge wrote, and “essentially made the court an unwilling participant in its fraud.” Later, both the Federal Trade Commission and the New York attorney general’s office filed lawsuits alleging that Braun and Richmond systematically abused the New York courts.

Braun and his then-business partners “file false affidavits in which they misrepresent to courts the nature of their loans and often the amounts paid and still due,” an assistant attorney general wrote. Braun has denied the allegations in court, and the cases are pending.

So far, the cash-advance industry’s use of Connecticut law hasn’t attracted notice from officials there. The office of the state’s chief court administrator referred questions to the attorney general’s office, which said it hadn’t received any complaints about the matter.

In an email, Steve Stafstrom, chairman of the state House Judiciary Committee, said he hadn’t heard anything either. “It may be something we should look into,” he wrote.

Updated: 4-14-2022

The ‘Hell or High Water Clause’ Is Tormenting Small-Business Owners

Many entrepreneurs lease their equipment. Then, if hurt by the pandemic, they face years of payments, even if the gear is faulty.

Small-business owners often rely on leasing for the equipment they need, from trucks to restaurant ovens. It’s a way to get set up without having to pour in a lot of cash.

The pandemic upended many of those small businesses’ plans. In the process, it has fueled bitter clashes between owners and leasing companies.

The culprit is a provision in most lease and finance contracts that binds owners to make years of monthly payments, no matter what happens to their business and even if the equipment doesn’t work or is returned. The industry calls it the “hell or high water clause.”

Nicole Carranza and her husband leased $59,000 worth of equipment for a restaurant they planned to open in La Habra, Calif., just before the pandemic. After it began, they couldn’t finance additional equipment, so they dropped their plan and canceled the order.

Only one item had shipped. The vendor returned the money paid for the rest of the equipment to the leasing company, Pawnee Leasing Corp.

Pawnee told the Carranzas they still had a lease contract. It said that after a deduction for the returned funds, they owed it nearly $70,000 in payments that they would have made over the 55-month lease if they had received and kept the equipment.

The Carranzas in turn filed for personal bankruptcy, mainly due to debt to the leasing company, Ms. Carranza said. “With the rest of the debt, we would have probably looked at something more like a debt restructuring,” she said.

Pawnee declined to comment on a specific customer. “We provided substantial support to very large number of our customers to help and provide them time to adjust their business operations to the new COVID-world,” President Gary Souverein said in an email. Deferrals typically averaged one to three months, according to securities filings by Pawnee’s parent, Toronto-based Chesswood Group Ltd.

Without addressing specifics, Mr. Souverein called Wall Street Journal descriptions of the Carranzas’ lease matter and another one “either insufficient, inaccurate or misleading and generally out of context.”

Leasing equipment can be an attractive option for entrepreneurs and business owners who have limited cash, can’t get bank financing or worry about purchasing equipment that might grow outdated.

Stephen Martin and his partners chose that route when they opened a facilities-management company in late 2019 and needed scrubbers and other gear. “We couldn’t afford to buy,” he said, and “banks don’t really pay attention to you until you have crossed over two years” of experience.

Mr. Martin said leasing has worked well for their ACESA Cleaning Service in Duluth, Ga. He added that an owner needs to be careful, because “the fine print is often on the back in really minute lettering.”

Equipment and vehicle leases totaled about $160 billion in outstanding balances in 2019, the newest available number, according to the U.S. Consumer Financial Protection Bureau.

The volume of leases and finance transactions under $250,000 increased by nearly 15% in 2021 from a year earlier after dipping slightly in 2020, according to the Equipment Leasing and Finance Association, an industry group. Many leasing and finance companies are arms of equipment makers such as Deere & Co. and Caterpillar Inc. or of big banks.

Although federal and state laws provide an array of protections to individuals who borrow, such as required disclosure of borrowing costs, they generally don’t extend these to small businesses. Unlike leases to individuals, those to small businesses don’t have to spell out the total amount to be paid over the life of the lease or the value of the equipment being financed.

Leasing and finance companies are pretty careful to explain the terms of contracts, said Ralph Petta, chief executive of the Equipment Leasing and Finance Association. It is in their interest to work with customers affected by the pandemic, he said, adding that the financial strains “are not unique to equipment financing.”

As of June 2020, about three months after the start of the pandemic, leasing and finance companies had deferred payments on 15% of their equipment-finance portfolio, according to an analysis of data collected by the Equipment Leasing & Finance Foundation. By September they had an average of just 4% of their portfolios in deferral, said the analysis, done by consultant Tom Ware.

Comparable figures for bank lending are hard to come by, but many small-business owners say their banks showed more flexibility, as federal bank regulators urged. Bank of America Corp., for one, deferred payments on 20% of small-business credit-card balances and 14% of other small-business loan balances.

Pattera Newsome said when he shut down his Denham Springs, La., landscaping and maintenance firm after revenue dried up in the pandemic, all of his lenders except an equipment finance company agreed to work with him by writing off some debt or deferring payments while he tried to restart his business. The company, Ascentium Capital, sued for payments for an ice vending machine and related hardware, plus interest, attorney’s fees and other costs.

A court granted Ascentium a default judgment for more than $60,000 in 2021. A spokeswoman for Ascentium’s parent company, Regions Financial Corp., declined to discuss a specific client but said: “Ascentium Capital has a strong track record of working in support of clients if their business experiences financial difficulty.”

The “hell or high water” provision that leaves customers responsible for all payments regardless of circumstances is based on the notion that the leasing company just provides financing and isn’t making or selling equipment, said James Schallheim, a finance professor at the University of Utah. “A lot of courts have upheld it even in situations where I would say it doesn’t seem right,” he said.

“On the other hand,” he said, the arrangement “does allow for a lot of low-credit-type lessees to get a lease when they otherwise wouldn’t be able to get financing.”

Industry officials defend the provision on the grounds that companies assume significant risk when they buy equipment and lease it out, such as that the equipment loses value over time.

“A lease is a non-cancellable lease. At the end of the day, the customer is obligated for the entire amount,” said Tom Meredith, chief commercial officer of leasing company De Lage Landen Financial Services Inc. He said DLL, a subsidiary of the Netherlands’ Rabobank, granted three-month extensions to many customers struggling during the pandemic and gave some a second deferral.

Bobby Clements, owner of Limitless Powder Coating in Modesto, Calif., said he is stuck with a lease on an oven convection system. The oven, for melting powder, is smaller than what he ordered, Mr. Clements said, and it lacks a burner, control box and other key components, making it unusable.

The lease contract he signed in October 2019 said he “unconditionally and irrevocably” guaranteed 60 months of payments and accepted the equipment as-is. If he missed a payment, the company had a right to all future payments plus other costs, the contract said.

Mr. Clements said he has made about two dozen payments to Financial Pacific Leasing Inc. but didn’t make several. In February, he signed a contract addendum that increased his monthly payments by a little under $150 and required him to resume making them.

“I am stuck in a Catch-22. If I don’t do it, my credit gets ruined. If I do do it, I’m throwing money out the window,” said Mr. Clements, who has filed a suit against the equipment provider in state court in Stanislaus County, Calif. An attorney for the provider, who has denied responsibility in court filings, declined to comment.

Financial Pacific said when customers ask to finance equipment before it has been delivered, as in this case, it takes special care to be sure they understand they are “asking to assume all liability and accountability for the equipment and the vendor relationship.” Financial Pacific works with customers when disputes arise, said Kurt Heath, a spokesman for the firm, which is owned by Umpqua Holdings Corp.

“In the case of Limitless Coating, lease modifications were requested and granted that have allowed for six-months of deferred payments in total,” Mr. Heath said in an email.

If there’s a dispute, many lease and finance contracts permit a suit to be brought in a court far from a small-business customer’s location.

Sky Properties Inc., a Los Angeles property manager, faced a suit in Linn County, Iowa, more than 1,800 miles away, over a spat with leasing company GreatAmerica Financial Services Corp.

Sky balked at making payments on leased telecommunications equipment it said didn’t work. Sky owner Kari Negri asked the vendor to take back the equipment, but it refused, she said.

The contract called for Sky to make 60 monthly lease payments of $336.40. “We will still need to be paid whole,” a GreatAmerica portfolio manager told Ms. Negri by email.

The suit was one of more than 300 that the leasing company, based in Cedar Rapids, Iowa, has filed in local Linn County since the start of the pandemic, according to court records. GreatAmerica CEO Stan Herkelman said if the firm sued in every jurisdiction where it has customers, that would be an added expense borne by customers who pay on time.

Support of leased equipment “is driven by the equipment vendor,” he said. “That’s why you find the hell or high water language in there.”

GreatAmerica said it provided deferrals or extensions to 95% of customers who requested them. It thinks of itself as a pretty strong ally of small and medium sized businesses, Mr. Herkelman said.

Sky’s Ms. Negri didn’t fight the suit. “To travel all that way, for a small company, the expense is really not worth it,” she said.

Instead, she filed a claim of her own against the vendor of the equipment she said didn’t work, then used a $5,000 small-claims-court award plus company funds to pay GreatAmerica’s roughly $12,000 claim.

Ms. Carranza, the restaurateur who with her husband filed for bankruptcy largely over a lease debt, said she didn’t know the leasing company’s name, Pawnee, until her first payment was due. A broker had arranged the transaction.

The broker was Kingswood Leasing. Maura Bragg, an attorney with its parent company, TimePayment Corp., said it is standard for leasing companies to introduce themselves after a lease is signed. She said Ms. Carranza came across as a sophisticated business owner.

In late 2020, Pawnee offered to settle the debt for $29,000 if paid soon. “We don’t have that kind of financial capital,” Ms. Carranza said. “We put everything into the business. It was all gone.”

Related Articles:

Bitcoin Information & Resources (#GotBitcoin?)

‘I Cry Every Day’: Olympic Athletes Slam Food, COVID Tests And Conditions In Beijing

Ultimate Resource On Myanmar’s Involvement With Crypto-Currencies

Bitcoin For Corporations | Michael Saylor | Bitcoin Corporate Strategy

Japan’s $1 Trillion Crypto Market May Ease Onerous Listing Rules

How Bitcoin Contributions Funded A $1.4M Solar Installation In Zimbabwe

BREAKING: Arizona State Senator Introduces Bill To Make Bitcoin Legal Tender

Vast Troves of Classified Info Undermine National Security, Spy Chief Says

Inflation And A Tale of Cantillionaires

America COMPETES Act Would Be Disastrous For Bitcoin Cryptocurrency And More

Petition Calling For Resignation Of U.S. Securities/Exchange Commission Chair Gary Gensler

McDonald’s Jumps On Bitcoin Memewagon, Crypto Twitter Responds

Smart Money Is Buying Bitcoin Dip. Stocks, Not So Much

Henrietta Lacks And Her Remarkable Cells Will Finally See Some Payback

Stealing The Blood Of The Young May Make You More Youthful

Doctors Show Implicit Bias Towards Black Patients

Indexing Is Coming To Crypto Funds Via Decentralized Exchanges

Imagine There’s No Bitcoin. If You Can, Then We Haven’t Done Our Jobs

US Stocks Historically Deliver Strong Gains In Fed Hike Cycles (GotBitcoin)

Federal Regulator Says Credit Unions Can Partner With Crypto Providers

Jack Dorsey Announces Bitcoin Legal Defense Fund

Four Ways Black Families Can Fight Against Rising Inflation (#GotBitcoin)

Bitcoin’s Dominance of Crypto Payments Is Starting To Erode

Walmart Filings Reveal Plans To Create Cryptocurrency, NFTs

Ultimate Resource On Duke of York’s Prince Andrew And His Sex Scandal

FDA Approves First-Ever Arthritis Pain Management Drug For Cats

Is Art Therapy The Path To Mental Well-Being?

Arkansas Tries A New Strategy To Lure Tech Workers: Free Bitcoin

Wordle Is The New Lingo Turning Fans Into Argumentative Strategy Nerds

Nas Selling Rights To Two Songs Via Crypto Music Startup Royal

Teen Cyber Prodigy Stumbled Onto Flaw Letting Him Hijack Teslas

Joe Rogan: I Have A Lot Of Hope For Bitcoin

How Black Businesses Can Prosper From Targeting A Trillion-Dollar Black Culture Market (#GotBitcoin)

‘Yellowstone’ Is A Huge Hit That Started With Small-Town Fans

Sidney Poitier, Actor Who Made Oscars History, Dies At 94

How Jessica Simpson Almost Lost Her Name And Her Billion Dollar Empire

Ultimate Resource On Solana Outages And DDoS Attacks

Ultimate Resource On Kazakhstan As Second In Bitcoin Mining Hash Rate In The World After US

Nasdaq-Listed Blockchain Firm BTCS To Offer Dividend In Bitcoin; Shares Surge

Bitcoin Enthusiast And CEO Brian Armstrong Buys Los Angeles Home For $133 Million

Ultimate Resource On A Strong Dollar’s Impact On Bitcoin

Ultimate Resource On Bitcoin Unit Bias

Yosemite Is Forcing Native American Homeowners To Leave Without Compensation. Here’s Why

Raoul Pal Believes Institutions Have Finished Taking Profits As Year Winds Up

10 Women Who Used Crypto To Make A Difference In 2021

Disposable Masks That Don’t Pollute

Move Over, Tennis And Golf. Networks And Brands Are Cashing In On Pickleball

Athletes Unlimited Signs Big Sponsor In Boost For Women’s Sports

Grounded By The Pandemic? Donate Your Unused Points And Miles

Crypto And Its Many Fees: What To Know About The Hidden Costs Of Digital Currency

Deputizing Blockchain To Fight Corrupt Governments. Also America Blows It’s Tokenization Advantage

Crypto Attracts More Money In 2021 Than All Previous Years Combined

The US Shouldn’t Be Afraid of China

Ultimate Resource On Donald J. Trump

Ubiquitous Surveillance And Security

Finding Your Superpower In A Higher-Priced World With On-The-Spot Comparison Shopping

How remanufacturing is combating global warming

Shoppers Lined Up At Dawn For The ‘Open Run’ On $9,500 Chanel Bags

How Banks Win When Interest Rates Rise (#GotBitcoin)

Crypto, NFTs And Tungsten Cubes: A Guide To Giving Cash In 2021

Tech Giants Apple, Microsoft, Amazon And Others Warn of Widespread Software Flaw

Ultimate Resource On Web3 And Crypto’s Attempt To Reinvent The Internet

Bitcoin Core Developer Samuel Dobson Decides It Is ‘Time To Go’

The Biden Economy Is Actually Pretty Good

Live: House Memo Details Congress’ Priorities Ahead Of Crypto CEO Hearing

Verizon is Tracking iPhone Users by Default And There’s Nothing Apple Can Do. How to Turn It Off

A Plant-based Pet Food Frenzy Is On The Horizon

What Is Cryptocurrency, And How Does It Work?

One Of The Weirdest Reports: Investors React To 12-3-2021 Jobs Data (#GotBitcoin)

Ultimate Resource On China’s ‘Common Prosperity’ Drive How It Plans To Redistribute The Wealth

Note To Brands: Crypto Isn’t Funny Money. It’s Community

How Crypto Vigilantes Are Hunting Scams In A $100 Billion Market

6 Questions For Lyn Alden Schwartzer Of Lyn Alden Investment Strategy

Bitcoin Offers Little Refuge From Covid Market Rout

The Anti-Work Brigade Targets Amazon On Black Friday

Reddit’s Latest Money-Making Obsession Is An Obscure Fed Facility (Reverse Repo or RRP)

Federal Reserve To Taper Money Printing That Fueled Bitcoin Rally

Apple Sues NSO Group To Curb The Abuse Of State-Sponsored Spyware

Did You Buy Your Cat or Dog A Christmas Present? Join The Club

Gen Z Has $360 Billion To Spend, Trick Is Getting Them To Buy (#GotBitcoin)

10 Fundamental Rights For All Crypto Users Including Responsibilities For The Industry

Texas Plans To Become The Bitcoin Capital, Vulnerable Power Grid And All

Bitcoin Caught Between Longer-Term Buyers, Leveraged Speculators

Outcry Grows As China Breaks Silence On Missing Tennis Star

China Left In Shock Following Brutal Killing Of Corgi During Covid-19 Disinfection

Biden Orders Feds To Tackle ‘Epidemic’ Of Missing Or Murdered Indigenous People

An Antidote To Inflation? ‘Buy Nothing’ Groups Gain Popularity

Ultimate Resource For Cooks, Chefs And The Latest Food Trends

Open Enrollment Gameplan: How To Compare Your Partner’s Health Insurance With Yours

Millions Of Americans Are Skipping The Dentist. Lenders See A Financing Niche

Matt Damon To Promote Crypto.Com In Race To Lure New Users

US General Likens China’s Hypersonic Missile Test To A ‘Sputnik Moment’

The Key To Tracking Corona And Other Any Virus Could Be Your Poo

How To Evade A Chinese Bitcoin Ban

US Government Failed To Spot Pedophile At Indian Health Service Hospitals

Netflix Defends Dave Chappelle While Seeing “Squid Game” Become It’s Biggest Hit Ever

Ultimate Resource On Various Countries Adopting Bitcoin

Ultimate Resource On Bitcoin Billionaires

Stripe Re-Enters Processing Payments Using Cryptos 3 Years After Dropping Bitcoin

Why Is My Cat Rubbing His Face In Ants?

Pets Score Company Perks As The ‘New Dependents’

What Pet Owners Should Know About Chronic Kidney Disease In Dogs And Cats

The Facebook Whistleblower, Frances Haugen, Says She Wants To Fix The Company, Not Harm It

Walk-in Cryptocurrency Exchanges Emerge Amid Bitcoin Boom

Europe’s Giant Job-Saving Experiment Pays Off In Pandemic

To Survive The Pandemic, Entrepreneurs Might Try Learning From Nature

Rise of The FinFluencer And How They Target Young And Inexperienced Investors

Hyperinflation Concerns Top The Worry List For UBS Clients

Sotheby’s Opens First-Ever Exhibition of Black Jewelry Designers

America And Europe Face Bleak Winter As Energy Prices Surge To Record Levels

Ultimate Resource On Vaccine Boosters

Unvaccinated COVID-19 Hospitalizations Cost The U.S. Health System Billions Of Dollars

Wallets Are Over. Your Phone Is Your Everything Now

Crypto Mining Demand Soars In Vietnam Amid Bitcoin Rally

How The Supreme Court Texas Abortion Ruling Spurred A Wave Of ‘Rage Giving’

Ultimate Resource On Global Inflation And Rising Interest Rates (#GotBitcoin)

Presearch Decentralized Crypto-Powered Search Engine

How To Make Vietnam A Powerful Trade Ally For The U.S.

Banking Could Go The Way of News Publishing (#GotBitcoin)

Operation “Choke Point”: An Aggressive FTC And The Response of The Payment Systems Industry

Bezos-Backed Fusion Startup Picks U.K. To Build First Plant

TikTok Is The Place To Go For Financial Advice If You’re A Young Adult

More Companies Weigh Penalizing Employees Without Covid-19 Vaccinations

Crypto Firms Want Fed Payment Systems Access—And Banks Are Resisting

Travel Expert Oneika Raymond’s Favorite Movies And Shows

How To Travel Luxuriously In The Summer Of Covid-19, From Private Jets To Hotel Buyouts

Nurses Travel From Coronavirus Hot Spot To Hot Spot, From New York To Texas

Travel Is Bouncing Back From Coronavirus, But Tourists Told To Stick Close To Home

Tricks For Making A Vacation Feel Longer—And More Fulfilling

Who Is A Perpetual Traveler (AKA Digital Nomad) Under The US Tax Code

Four Stories Of How People Traveled During Covid

Director Barry Jenkins Is The Travel Nerd’s Travel Nerd

Why Is My Cat Rubbing His Face In Ants?

Natural Cure For Hyperthyroidism In Cats Including How To Switch Him/Her To A Raw Food Diet

A Paycheck In Crypto? There Might Be Some Headaches

About 46 Million Americans Or 17% Now Own Bitcoin vs 50% Who Own Stocks

Josephine Baker Is 1st Black Woman Given Paris Burial Honor

Cryptocurrency’s Surge Leaves Global Watchdogs Trying To Catch Up

It Could Just Be The U.S. Is Not The Center Of The Crypto Universe

Blue Turmeric Is The Latest Super Spice To Shake Up Pantry Shelves

Vice President Kamala Harris To Focus On Countering China On Southeast Asia Trip

The Vaccinated Are Worried And Scientists Don’t Have Answers

Silver Lining of Coronavirus, Return of Animals, Clear Skies, Quiet Streets And Tranquil Shores

Cocoa Cartel Stirs Up Global Chocolate Market With Increased Use Of Child Labor

Killer Whale Dies Suddenly At SeaWorld San Diego

Does Getting Stoned Help You Get Toned? Gym Rats Embrace Marijuana

Hope Wiseman Is The Youngest Black Woman Dispensary Owner In The United States

What Sex Workers Want To Do With Bitcoin

How A Video Résumé Can Get You Hired In The Covid-19 Job Market

US Lawmakers Urge CFTC And SEC To Form Joint Working Group On Digital Assets

Bitcoin’s Surge Lacks Extreme Leverage That Powered Past Rallies

JP Morgan Says, “Proof-Of-Stake Will Eat Proof-Of-Work For Breakfast — Here’s Why

Ranking The Currencies That Could Unseat The Dollar (#GotBitcoin)

The Botanist Daring To Ask: What If Plants Have Intelligence?

After A Year Without Rowdy Tourists, European Cities Want To Keep It That Way

Prospering In The Pandemic, Some Feel Financial Guilt And Gratitude

The Secret Club For Billionaires Who Care About Climate Change

A List Of Relief Funds For Restaurants, Bars, And Food Service Workers

Bill And Melinda Gates Welcome The Philanthropists Of The Future

CO2-Capture Plan Using Old Oil Reservoirs In Denmark Moves Ahead

Could This Be The Digital Nose Of The Future?

Bitcoin Fans Are Suddenly A Political Force

Walmart Seeks Crypto Product Lead To Drive Digital Currency Strategy

Music Distributor DistroKid Raises Money At $1.3 Billion Valuation

Books To Read, Foods To Eat, Movies To Watch, Exercises To Do And More During Covid19 Lockdown

Hacker Claims To Steal Data Of 100 Million T-Mobile Customers

Is The Cryptocurrency Epicenter Moving Away From East Asia?

Vietnam Leads Crypto Adoption In Finder’s 27-Country Survey

Bitcoin’s Latest Surge Lacks Extreme Leverage That Powered Past Rallies

Creatine Supplementation And Brain Health

Nigerian State Says 337 Students Missing After Gunmen Attack

America’s 690 Mile-Long Yard Sale Entices A Nation of Deal Hunters

Russian Economy Grew (10.3% GDP) Fastest Since 2000 On Lockdown Rebound

US Troops Going Hungry (Food Insecurity) Is A National Disgrace

Overheated, Unprepared And Under-protected: Climate Change Is Killing People, Pets And Crops

Accenture Confirms Hack After LockBit Ransomware Data Leak Threats

Climate Change Prompts These Six Pests To Come And Eat Your Crops

Leaked EU Plan To Green Its Timber Industry Sparks Firestorm

Students Take To The Streets For Day Of Action On Climate Change

Living In Puerto Rico, Where The Taxes Are Low And Crypto Thrives

Bitcoin Community Leaders Join Longevity Movement

Some Climate Change Effects May Be Irreversible, U.N. Panel Says

Israel’s Mossad Intelligence Agency Is Seeking To Hire A Crypto Expert

What You Should Know About ‘529’ Education-Savings Accounts

Bitcoin Doesn’t Need Presidents, But Presidents Need Bitcoin

Plant-Based Fish Is Rattling The Multibillion-Dollar Seafood Industry

The Scientific Thrill Of The Charcoal Grill

Escaping The Efficiency Trap—and Finding Some Peace of Mind

Sotheby’s Selling Exhibition Celebrates 21 Black Jewelry Designers

Marketers Plan Giveaways For Covid-19 Vaccine Recipients

Haiti’s President Moise Assassinated In Night Attack On His Home

The Argentine River That Carries Soybeans To World Is Drying Up

A Harvard Deal Tries To Break The Charmed Circle Of White Wealth

China Three-Child Policy Aims To Rejuvenate Aging Population

California Wants Its Salton Sea Located In The Imperial Valley To Be ‘Lithium Valley’

Who Will Win The Metaverse? Not Mark Zuckerberg or Facebook

The Biggest Challenge For Crypto Exchanges Is Global Price Fragmentation

London Block Exchange – LBX Buy, Sell & Trade Cryptocurrencies?

Chicago World’s Fair Of Money To Unveil A Private Coin Collection Worth Millions of Dollars

Bitcoin Dominance On The Rise Once Again As Crypto Market Rallies

Uruguayan Senator Introduces Bill To Enable Use Of Crypto For Payments

Talen Energy Investors Await Update From The Top After Pivot To Crypto

Ultimate Resource On Hydrogen And Green Hydrogen As Alternative Energy

Covid Made The Chief Medical Officer A C-Suite Must

When Will Stocks Drop? Watch Profit Margins (And Get Nervous)

Behind The Rise Of U.S. Solar Power, A Mountain of Chinese Coal

‘Buy Now, Pay Later’ Installment Plans Are Having A Moment AgainUS Crypto Traders Evade Offshore Exchange Bans

5 Easy Ways Crypto Investors Can Make Money Without Needing To Trade

What’s A ‘Pingdemic’ And Why Is The U.K. Having One?

“Crypto-Property:” Ohio Court Says Crypto-Currency Is Personal Property Under Homeowners’ Policy

Retinal And/Or Brain Photon Emissions

Antibiotic Makers Concede In The War On Superbugs (#GotColloidalSilver)

What It Takes To Reconnect Black Communities Torn Apart by Highways

Those Probiotics May Actually Be Hurting Your ‘Gut Health’ We’re Not Prepared To Live In This Surveillance Society

How To Create NFTs On The Bitcoin Blockchain

World Health Organization Forced Valium Into Israeli And Palestinian Water Supply

Blockchain Fail-Safes In Space: Spacechain, Blockstream And Cryptosat

What Is A Digital Nomad And How Do You Become One?

Flying Private Is Cheaper Than You Think — Here Are 6 Airlines To Consider For Your Next Flight

What Hackers Can Learn About You From Your Social-Media Profile

How To Protect Your Online Privacy While Working From Home

Rising Diaper Prices Prompt States To Get Behind Push To Pay

Want To Invest In Cybersecurity? Here Are Some ETFs To Consider

US Drops Visa Fraud Cases Against Five Chinese Researchers

Risks To Great Barrier Reef Could Thwart Tycoon’s Coal Plans

The Super Rich Are Choosing Singapore As The World’s Safest Haven

Jack Dorsey Advocates Ending Police Brutality In Nigeria Through Bitcoin

Psychedelics Replace Pot As The New Favorite Edgy Investment

Who Gets How Much: Big Questions About Reparations For Slavery

US City To Pay Reparations To African-American Community With Tax On Marijuana Sales

Crypto-Friendly Investment Search Engine Vincent Raises $6M

Trading Firm Of Richest Crypto Billionaire Reveals Buying ‘A Lot More’ Bitcoin Below $30K

Bitcoin Security Still A Concern For Some Institutional Investors

Weaponizing Blockchain — Vast Potential, But Projects Are Kept Secret

China Is Pumping Money Out Of The US With Bitcoin

Tennessee City Wants To Accept Property Tax Payments In Bitcoin

Currency Experts Say Cryptonotes, Smart Banknotes And Cryptobanknotes Are In Our Future

Housing Insecurity Is Now A Concern In Addition To Food Insecurity

Food Insecurity Driven By Climate Change Has Central Americans Fleeing To The U.S.

Eco Wave Power Global (“EWPG”) Is A Leading Onshore Wave Energy Technology Company

How And Why To Stimulate Your Vagus Nerve!

Green Finance Isn’t Going Where It’s Needed

Shedding Some Light On The Murky World Of ESG Metrics

SEC Targets Greenwashers To Bring Law And Order To ESG

Spike Lee’s TV Ad For Crypto Touts It As New Money For A Diverse World

Bitcoin Network Node Count Sets New All-Time High

Tesla Needs The Bitcoin Lightning Network For Its Autonomous ‘Robotaxi’ Fleet

How To Buy Bitcoin: A Guide To Investing In The Cryptocurrency

How Crypto is Primed To Transform Movie Financing

Paraguayan Lawmakers To Present Bitcoin Bill On July 14

Bitcoin’s Biggest Hack In History: 184.4 Billion Bitcoin From Thin Air

Paul Sztorc On Measuring Decentralization Of Nodes And Blind Merge Mining

Reality Show Is Casting Crypto Users Locked Out Of Their Wallets

EA, Other Videogame Companies Target Mobile Gaming As Pandemic Wanes

Strike To Offer ‘No Fee’ Bitcoin Trading, Taking Aim At Coinbase And Square

Coinbase Reveals Plans For Crypto App Store Amid Global Refocus

Mexico May Not Be Following El Salvador’s Example On Bitcoin… Yet

What The Crypto Crowd Doesn’t Understand About Economics

My Local Crypto Space Just Got Raided By The Feds. You Know The Feds Scared Of Crypto

My Local Crypto Space Just Got Raided By The Feds. You Know The Feds Scared Of Crypto

Bitcoin Slumps Toward Another ‘Crypto Winter’

NYC’s Mayoral Frontrunner Pledges To Turn City Into Bitcoin Hub

Lyn Alden On Bitcoin, Inflation And The Potential Coming Energy Shock

$71B In Crypto Has Reportedly Passed Through ‘Blockchain Island’ Malta Since 2017

Startups Race Microsoft To Find Better Ways To Cool Data Centers

Why PCs Are Turning Into Giant Phones

Panama To Present Crypto-Related Bill In July

Hawaii Had Largest Increase In Demand For Crypto Out Of US States This Year

What To Expect From Bitcoin As A Legal Tender

Petition: Satoshi Nakamoto Should Receive The Nobel Peace Prize

Can Bitcoin Turbo-Charge The Asset Management Industry?

Bitcoin Interest Drops In China Amid Crackdown On Social Media And Miners

Multi-trillion Asset Manager State Street Launches Digital Currency Division

Wall Street’s Crypto Embrace Shows In Crowd At Miami Conference

MIT Bitcoin Experiment Nets 13,000% Windfall For Students Who Held On

Petition: Let’s Make Bitcoin Legal Tender For United States of America

El Salvador Plans Bill To Adopt Bitcoin As Legal Tender

What Is Dollar Cost Averaging Bitcoin?

Paxful Launches Tool Allowing Businesses To Receive Payment In Bitcoin

CEOs Of Top Russian Banks Sberbank And VTB Blast Bitcoin

President of El Salvador Says He’s Submitting Bill To Make Bitcoin Legal Tender

Bitcoin Falls As Weibo Appears To Suspend Some Crypto Accounts

Israel-Gaza Conflict Spurs Bitcoin Donations To Hamas

Bitcoin Bond Launch Brings Digital Currency Step Closer To ‘World Of High Finance’

Worst Month For BTC Price In 10 Years: 5 Things To Watch In Bitcoin

Bitcoin Card Game Bitopoly Launches

Carbon-Neutral Bitcoin Funds Gain Traction As Investors Seek Greener Crypto

Ultimate Resource On The Bitcoin Mining Council

Libertarian Activists Launch Bitcoin Embassy In New Hampshire

Why The Bitcoin Crash Was A Big Win For Cryptocurrencies

Treasury Calls For Crypto Transfers Over $10,000 To Be Reported To IRS

Crypto Traders Can Automate Legal Requests With New DoNotPay Services

Bitcoin Marches Away From Crypto Pack In Show of Resiliency

NBA Top Shot Lawsuit Says Dapper’s NFTs Need SEC Clampdown

Maximalists At The Movies: Bitcoiners Crowdfunding Anti-FUD Documentary Film

Caitlin Long Reveals The ‘Real Reason’ People Are Selling Crypto

Microsoft Quietly Closing Down Azure Blockchain In September

How Much Energy Does Bitcoin Actually Consume?

Bitcoin Should Be Priced In Sats And How Do We Deliver This Message

Bitcoin Loses 6% In An Hour After Tesla Drops Payments Over Carbon Concerns

Crypto Twitter Decodes Why Zuck Really Named His Goats ‘Max’ And ‘Bitcoin’

Bitcoin Pullback Risk Rises As Whales Resume Selling

Thiel-Backed Block.one Injects Billions In Crypto Exchange

Sequoia, Tiger Global Boost Crypto Bet With Start-up Lender Babel

Here’s How To Tell The Difference Between Bitcoin And Ethereum

In Crypto, Sometimes The Best Thing You Can Do Is Nothing

Crypto Community Remembers Hal Finney’s Contributions To Blockchain On His 65Th Birthday

DJ Khaled ft. Nas, JAY-Z & James Fauntleroy And Harmonies Rap Bitcoin Wealth

The Two Big Themes In The Crypto Market Right Now

Crypto Could Still Be In Its Infancy, Says T. Rowe Price’s CEO

Governing Body Of Louisiana Gives Bitcoin Its Nod Of Approval

Sports Athletes Getting Rich From Bitcoin

Behind Bitcoin’s Recent Slide: Imploding Bets And Forced Liquidations

Bad Omen? US Dollar And Bitcoin Are Both Slumping In A Rare Trend

Wall Street Starts To See Weakness Emerge In Bitcoin Charts

Crypto For The Long Term: What’s The Outlook?

Mix of Old, Wrong And Dubious ‘News/FUD’ Scares Rookie Investors, Fuels Crypto Selloff

Wall Street Pays Attention As Bitcoin Market Cap Nears The Valuation Of Google

Bitcoin Price Drops To $52K, Liquidating Almost $10B In Over-Leveraged Longs

Bitcoin Funding Rates Crash To Lowest Levels In 7 Months, Peak Fear?

Investors’ On-Chain Activity Hints At Bitcoin Price Cycle Top Above $166,000

This Vegan Billionaire Disrupted The Crypto Markets. Now He Wants To Tokenize Stocks

Black Americans Are Embracing Bitcoin To Make Up For Stolen Time

Rap Icon Nas Could Net $100M When Coinbase Lists on Nasdaq

The First Truly Native Cross-Chain DEX Is About To Go Live

Reminiscing On Past ‘Bitcoin Faucet’ Website That Gave Away 19,700 BTC For Free

3X As Many Crypto Figures Make It Onto Forbes 2021 Billionaires List As Last Year

Bubble Or A Drop In The Ocean? Putting Bitcoin’s $1 Trillion Milestone Into Perspective

Pension Funds And Insurance Firms Alive To Bitcoin Investment Proposal

Here’s Why April May Be The Best Month Yet For Bitcoin Price

Blockchain-Based Renewable Energy Marketplaces Gain Traction In 2021

Crypto Firms Got More Funding Last Quarter Than In All of 2020

Government-Backed Bitcoin Hash Wars Will Be The New Space Race

Lars Wood On Enhanced SAT Solvers Based Hashing Method For Bitcoin Mining

Morgan Stanley Adds Bitcoin Exposure To 12 Investment Funds

One BTC Will Be Worth A Lambo By 2022, And A Bugatti By 2023: Kraken CEO

Rocketing Bitcoin Price Provides Refuge For The Brave

Bitcoin Is 3rd Largest World Currency

Does BlockFi’s Risk Justify The Reward?

Crypto Media Runs With The Bulls As New Entrants Compete Against Established Brands

Bitcoin’s Never-Ending Bubble And Other Mysteries

The Last Dip Is The Deepest As Wife Leaves Husband For Buying More Bitcoin

Blockchain.com Raises $300 Million As Investors Find Other Ways Into Bitcoin

What Is BitClout? The Social Media Experiment Sparking Controversy On Twitter

Bitcoin Searches In Turkey Spike 566% After Turkish Lira Drops 14%

Crypto Is Banned In Morocco, But Bitcoin Purchases Are Soaring

Bitcoin Can Be Sent With A Tweet As Bottlepay Twitter App Goes Live

Rise of Crypto Market’s Quiet Giants Has Big Market Implications

Canadian Property Firm Buys Bitcoin In Hopes Of Eventually Scrapping Condo Fees

Bitcoin Price Gets Fed Boost But Bond Yields Could Play Spoilsport: Analysts

Bank of America Claims It Costs Just $93 Million To Move Bitcoin’s Price By 1%

Would A US Wealth Tax Push Millionaires To Bitcoin Adoption?

NYDIG Head Says Major Firms Will Announce Bitcoin ‘Milestones’ Next Week

Signal Encrypted Messenger Now Accepts Donations In Bitcoin

Bitcoin Is Now Worth More Than Visa And Mastercard Combined

Retail Bitcoin Customers Rival Wall Street Buyers As Mania Builds

Crypto’s Rising. So Are The Stakes For Governments Everywhere

Bitcoin Falls After Weekend Rally Pushes Token To Fresh Record

Oakland A’s Major League Baseball Team Now Accepts Bitcoin For Suites

Students In Georgia Set To Be Taught About Crypto At High School

What You Need To Know About Bitcoin Now

Bitcoin Winning Streak Now At 7 Days As Fresh Stimulus Keeps Inflation Bet Alive

Bitcoin Intraday Trading Pattern Emerges As Institutions Pile In

If 60/40 Recipe Sours, Maybe Stir In Some Bitcoin

Explaining Bitcoin’s Speculative Attack On The Dollar

VIX-Like Gauge For Bitcoin Sees Its First-Ever Options Trade

A Utopian Vision Gets A Blockchain Twist In Nevada

Crypto Influencers Scramble To Recover Twitter Accounts After Suspensions

Bitcoin Breaks Through $57,000 As Risk Appetite Revives

Analyzing Bitcoin’s Network Effect

US Government To Sell 0.7501 Bitcoin Worth $38,000 At Current Prices

Pro Traders Avoid Bitcoin Longs While Cautiously Watching DXY Strengthen

Bitcoin Hits Highest Level In Two Weeks As Big-Money Bets Flow

OG Status In Crypto Is A Liability

Bridging The Bitcoin Gender Gap: Crypto Lets Everyone Access Wealth

HODLing Early Leads To Relationship Troubles? Redditors Share Their Stories

Want To Be Rich? Bitcoin’s Limited Supply Cap Means You Only Need 0.01 BTC

You Can Earn 6%, 8%, Even 12% On A Bitcoin ‘Savings Account’—Yeah, Right

Egyptians Are Buying Bitcoin Despite Prohibitive New Banking Laws

Is March Historically A Bad Month For Bitcoin?

Bitcoin Falls 4% As Fed’s Powell Sees ‘Concern’ Over Rising Bond Yields

US Retailers See Millions In Lost Sales Due To Port Congestion, Shortage Of Containers

Pandemic-Relief Aid Boosts Household Income Which Causes Artificial Economic Stimulus

YouTube Suspends CoinDesk’s Channel Over Unspecified Violations

It’s Gates Versus Musk As World’s Richest Spar Over Bitcoin

Charlie Munger Is Sure Bitcoin Will Fail To Become A Global Medium Of Exchange

Bitcoin Is Minting Thousands Of Crypto ‘Diamond Hands’ Millionaires Complete W/Laser Eyes

Dubai’s IBC Group Pledges 100,000 Bitcoin ($4.8 Billion) 20% Of All Bitcoin, Largest So Far

Bitcoin’s Value Is All In The Eye Of The ‘Bithodler’

Bitcoin Is Hitting Record Highs. Why It’s Not Too Late To Dig For Digital Gold

$56.3K Bitcoin Price And $1Trillion Market Cap Signal BTC Is Here To Stay

Christie’s Auction House Will Now Accept Cryptocurrency

Why A Chinese New Year Bitcoin Sell-Off Did Not Happen This Year

The US Federal Reserve Will Adopt Bitcoin As A Reserve Asset

Motley Fool Adding $5M In Bitcoin To Its ‘10X Portfolio’ — Has A $500K Price Target

German Cannabis Company Hedges With Bitcoin In Case Euro Crashes

Bitcoin: What To Know Before Investing

China’s Cryptocurrency Stocks Left Behind In Bitcoin Frenzy

Bitcoin’s Epic Run Is Winning More Attention On Wall Street

Bitcoin Jumps To $50,000 As Record-Breaking Rally Accelerates

Bitcoin’s Volatility Should Burn Investors. It Hasn’t

Bitcoin’s Latest Record Run Is Less Volatile Than The 2017 Boom

Blockchain As A Replacement To The MERS (Mortgage Electronic Registration System)

The Ultimate Resource On “PriFi” Or Private Finance

Deutsche Bank To Offer Bitcoin Custody Services

BeanCoin Currency Casts Lifeline To Closed New Orleans Bars

Bitcoin Could Enter ‘Supercycle’ As Fed Balance Sheet Hits New Record High

Crypto Mogul Bets On ‘Meme Investing’ With Millions In GameStop

Iran’s Central Banks Acquires Bitcoin Even Though Lagarde Says Central Banks Will Not Hold Bitcoin

Bitcoin To Come To America’s Oldest Bank, BNY Mellon

Tesla’s Bitcoin-Equals-Cash View Isn’t Shared By All Crypto Owners

How A Lawsuit Against The IRS Is Trying To Expand Privacy For Crypto Users

Apple Should Launch Own Crypto Exchange, RBC Analyst Says

Bitcoin Hits $43K All-Time High As Tesla Invests $1.5 Billion In BTC

Bitcoin Bounces Off Top of Recent Price Range

Top Fiat Currencies By Market Capitalization VS Bitcoin

Bitcoin Eyes $50K Less Than A Month After BTC Price Broke Its 2017 All-Time High

Investors Piling Into Overvalued Crypto Funds Risk A Painful Exit

Parents Should Be Aware Of Their Children’s Crypto Tax Liabilities

Miami Mayor Says City Employees Should Be Able To Take Their Salaries In Bitcoin

Bitcoiners Get Last Laugh As IBM’s “Blockchain Not Bitcoin” Effort Goes Belly-up

Bitcoin Accounts Offer 3-12% Rates In A Low-Interest World

Analyst Says Bitcoin Price Sell-Off May Occur As Chinese New Year Approaches

Why The Crypto World Needs To Build An Amazon Of Its Own

Tor Project’s Crypto Donations Increased 23% In 2020

Social Trading Platform eToro Ended 2020 With $600M In Revenue

Bitcoin Billionaire Set To Run For California Governor

GameStop Investing Craze ‘Proof of Concept’ For Bitcoin Success

Bitcoin Entrepreneurs Install Mining Rigs In Cars. Will Trucks And Tractor Trailers Be Next?

Harvard, Yale, Brown Endowments Have Been Buying Bitcoin For At Least A Year

Bitcoin Return To $40,000 In Doubt As Flows To Key Fund Slow

Ultimate Resource For Leading Non-Profits Focused On Policy Issues Facing Cryptocurrencies

Regulate Cryptocurrencies? Not Yet

Check Out These Cryptocurrency Clubs And Bitcoin Groups!

Blockchain Brings Unicorns To Millennials

Crypto-Industry Prepares For Onslaught Of Public Listings

Bitcoin Core Lead Maintainer Steps Back, Encourages Decentralization

Here Are Very Bitcoiny Ways To Get Bitcoin Exposure

To Understand Bitcoin, Just Think of It As A Faith-Based Asset

Cryptos Won’t Work As Actual Currencies, UBS Economist Says

Older Investors Are Getting Into Crypto, New Survey Finds

Access Denied: Banks Seem Prone To Cryptophobia Despite Growing Adoption

Pro Traders Buy The Dip As Bulls Address A Trifecta Of FUD News Announcements

Andreas Antonopoulos And Others Debunk Bitcoin Double-Spend FUD

New Bitcoin Investors Explain Why They’re Buying At Record Prices

When Crypto And Traditional Investors Forget Fundamentals, The Market Is Broken

First Hyperledger-based Cryptocurrency Explodes 486% Overnight On Bittrex BTC Listing

Bitcoin Steady As Analysts Say Getting Back To $40,000 Is Key

Coinbase, MEVP Invest In Crypto-Asset Startup Rain

Synthetic Dreams: Wrapped Crypto Assets Gain Traction Amid Surging Market

Secure Bitcoin Self-Custody: Balancing Safety And Ease Of Use

UBS (A Totally Corrupt And Criminal Bank) Warns Clients Crypto Prices Can Actually Go To Zero

Bitcoin Swings Undermine CFO Case For Converting Cash To Crypto

CoinLab Cuts Deal With Mt. Gox Trustee Over Bitcoin Claims

Bitcoin Slides Under $35K Despite Biden Unveiling $1.9 Trillion Stimulus

Bitcoin Refuses To ‘Die’ As BTC Price Hits $40K Just Three Days After Crash

Ex-Ripple CTO Can’t Remember Password To Access $240M In Bitcoin

Financial Advisers Are Betting On Bitcoin As A Hedge

ECB President Christine Lagarde (French Convict) Says, Bitcoin Enables “Funny Business.”

German Police Shut Down Darknet Marketplace That Traded Bitcoin

Bitcoin Miner That’s Risen 1,400% Says More Regulation Is Needed

Bitcoin Rebounds While Leaving Everyone In Dark On True Worth

UK Treasury Calls For Feedback On Approach To Cryptocurrency And Stablecoin Regulation

What Crypto Users Need Know About Changes At The SEC

Where Does This 28% Bitcoin Price Drop Rank In History? Not Even In The Top 5

Seven Times That US Regulators Stepped Into Crypto In 2020

Retail Has Arrived As Paypal Clears $242M In Crypto Sales Nearly Double The Previous Record

Bitcoin’s Slide Dents Price Momentum That Dwarfed Everything

Does Bitcoin Boom Mean ‘Better Gold’ Or Bigger Bubble?